Global Food Leavening Agent Market By Type (Biological Leavening Agents, Chemical Leavening Agents, Physical Leavening Agents), By Form (Powder, Liquid, Granules), By Source (Natural, Synthetic), By End-use (Food and Beverages, Pharmaceuticals, Cosmetics, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148201

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

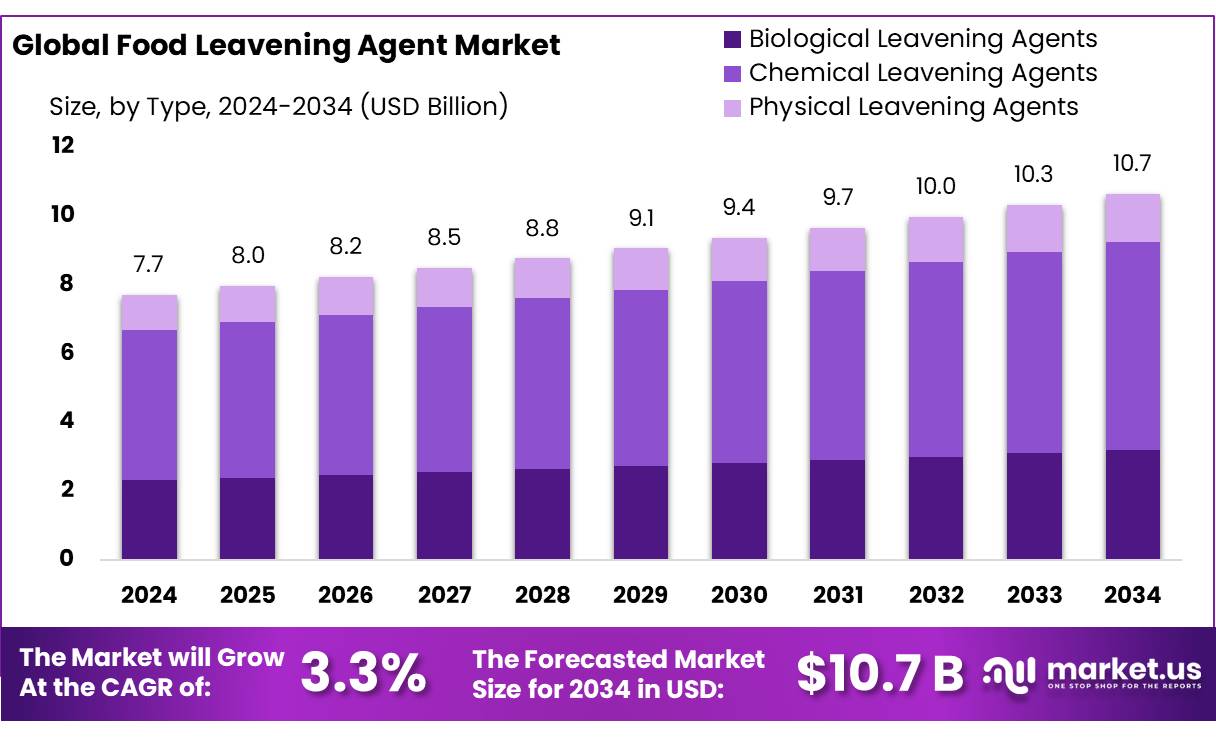

The Global Food Leavening Agent Market size is expected to be worth around USD 10.7 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 3.3% from 2025 to 2034.

Food leavening agents are crucial in the baking and processed food industries, facilitating the expansion of doughs and batters by releasing gases that create a porous structure in baked goods. These agents, encompassing chemical (e.g., sodium bicarbonate), biological (e.g., yeast), and physical (e.g., steam) types, are integral to producing a variety of bakery products, fried foods, and other processed items. Their role is pivotal in ensuring the desired texture and volume in end products, making them indispensable in both artisanal and industrial food production.

In India, the food processing sector has emerged as a significant contributor to the economy, with a Gross Value Added (GVA) increasing from ₹1.30 lakh crore in 2013-14 to ₹2.08 lakh crore in 2021-22, growing at an average annual growth rate of approximately 7.26%. This growth underscores the rising demand for food ingredients, including leavening agents, as the industry scales up to meet both domestic and international demands.

Government initiatives have played a pivotal role in bolstering the food processing industry in India. The Ministry of Food Processing Industries (MoFPI) has implemented schemes like the Mega Food Parks, aiming to establish a direct linkage from farm to processing and then to consumer markets. Each Mega Food Park is expected to house 30-35 food processing units, with a collective investment of at least ₹250 crore, generating employment for approximately 30,000 individuals. These initiatives are designed to enhance the processing of perishables and increase India’s share in global food trade.

Key Takeaways

- Food Leavening Agent Market size is expected to be worth around USD 10.7 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 3.3%.

- Chemical Leavening Agents held a dominant market position, capturing more than a 56.8% share in the Food Leavening Agent Market.

- Powder held a dominant market position, capturing more than a 75.9% share in the Food Leavening Agent Market.

- Synthetic held a dominant market position, capturing more than a 65.2% share in the Food Leavening Agent Market.

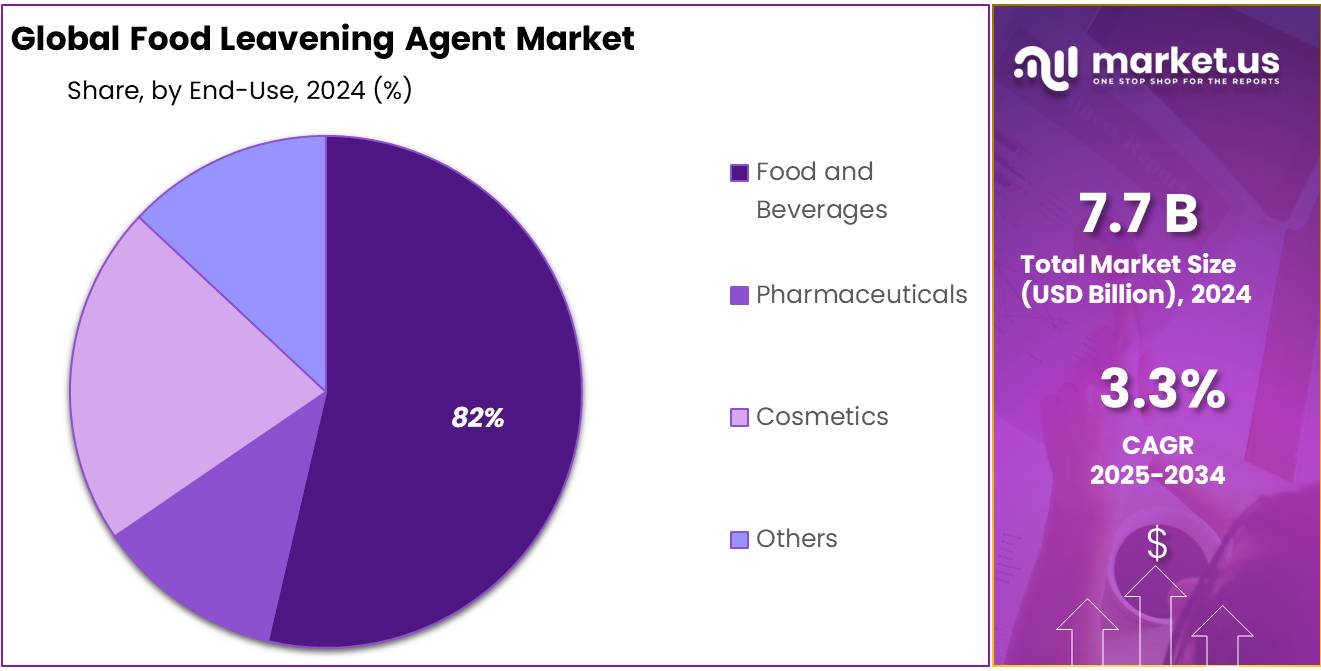

- Foodservice (HoReCa) held a dominant market position, capturing more than an 82.3% share in the Food Leavening Agent Market.

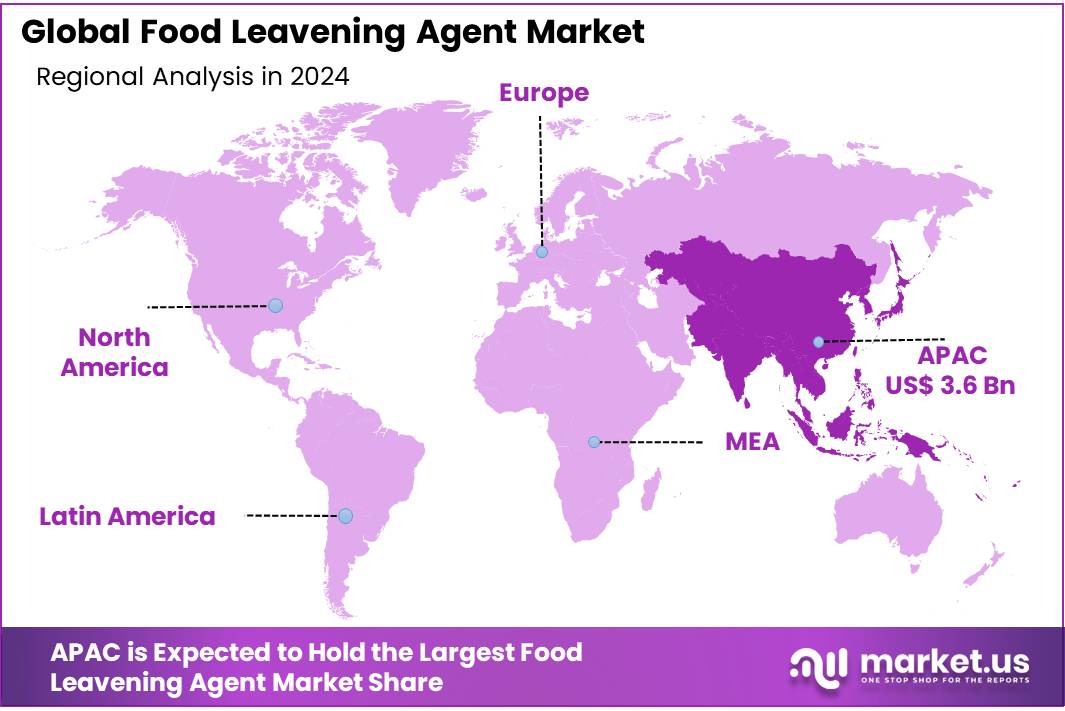

- Asia-Pacific (APAC) region held a dominant share of the global food leavening agent market, accounting for 46.8% of the market, valued at approximately US$ 3.6 billion.

By Type

Chemical Leavening Agents Lead with 56.8% Market Share in 2024

In 2024, Chemical Leavening Agents held a dominant market position, capturing more than a 56.8% share in the Food Leavening Agent Market. The increasing usage of chemical leavening agents in bakery products, such as cakes, cookies, and bread, contributed significantly to this dominance. The extensive application of baking soda and baking powder in the food processing sector drove the demand upward.

Additionally, the affordability and longer shelf life of chemical leavening agents compared to natural leaveners further supported their substantial market share. The trend is expected to persist in 2025 as food manufacturers increasingly adopt chemical leavening agents to enhance product texture and volume efficiently.

By Form

Powder Leavening Agents Command 75.9% Market Share in 2024

In 2024, Powder held a dominant market position, capturing more than a 75.9% share in the Food Leavening Agent Market. The preference for powdered leavening agents, such as baking powder and baking soda, was largely driven by their ease of handling and consistent efficacy in baked goods. Powder forms are widely utilized in the bakery sector due to their superior mixing capabilities, ensuring even distribution throughout doughs and batters.

The rising consumption of baked products globally further bolstered the demand for powdered leavening agents, positioning them as the preferred form in the leavening agent market. The trend is anticipated to continue through 2025 as food manufacturers emphasize product consistency and extended shelf life.

By Source

Synthetic Leavening Agents Secure 65.2% Market Share in 2024

In 2024, Synthetic held a dominant market position, capturing more than a 65.2% share in the Food Leavening Agent Market. The extensive use of synthetic leavening agents, including sodium bicarbonate and ammonium carbonate, was propelled by their predictable performance and cost-effective nature. The demand for synthetic leavening agents surged as food manufacturers prioritized consistency in product quality, particularly in the mass production of bakery and confectionery items.

Additionally, the longer shelf life and readily available supply of synthetic leaveners further supported their market dominance. The trend is expected to maintain momentum in 2025, driven by expanding processed food sectors and rising consumption of packaged baked goods.

By End-use

Foodservice (HoReCa) Dominates with 82.3% Market Share in 2024

In 2024, Foodservice (HoReCa) held a dominant market position, capturing more than an 82.3% share in the Food Leavening Agent Market. The substantial share was primarily driven by the increasing demand for baked goods and confectioneries across hotels, restaurants, and catering services. The rapid expansion of the foodservice sector, particularly in urban areas, led to a heightened reliance on leavening agents to maintain product consistency and texture in high-volume production.

Additionally, the growing trend of dine-in and takeaway baked products significantly fueled the demand for food leavening agents in commercial kitchens. The trend is expected to persist in 2025, as the foodservice sector continues to expand, emphasizing product quality and quick service delivery.

Key Market Segments

By Type

- Biological Leavening Agents

- Chemical Leavening Agents

- Physical Leavening Agents

By Form

- Powder

- Liquid

- Granules

By Source

- Natural

- Synthetic

By End-use

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

Drivers

Rising Consumer Demand for Processed and Ready-to-Eat Foods

One of the key driving factors for the food leavening agent market is the growing consumer demand for processed and ready-to-eat foods. As modern lifestyles become busier, consumers are increasingly seeking convenient meal options that require minimal preparation time. Leavening agents play a crucial role in the production of these food products, as they help achieve the desired texture and volume, making processed foods more palatable and appealing.

In 2023, the global market for processed foods was valued at approximately US$ 3.8 trillion, with a significant portion of this growth driven by the demand for quick, easy-to-prepare foods such as baked goods, snacks, and convenience meals. According to the Food and Agriculture Organization (FAO), food processing is a significant part of the global food industry, and it continues to grow as consumer preferences shift toward more convenient food options.

Governments around the world are also supporting the growth of the processed food sector, which indirectly boosts the demand for leavening agents. For instance, in India, the government’s push for “Make in India” and the promotion of food processing industries has resulted in increased investment in food manufacturing facilities. This initiative has helped enhance the availability of processed and packaged foods, driving demand for ingredients like leavening agents.

Moreover, companies are focusing on the innovation of their products by incorporating new food additives and leavening agents that improve texture, shelf-life, and nutritional content. This not only caters to consumer needs but also aligns with global trends toward healthier, more sustainable food options. With the continuous growth in demand for processed foods, the food leavening agent market is poised for significant expansion in the coming years.

Restraints

Concerns Over Health Impacts and Consumer Preferences for Natural Ingredients

A significant restraining factor for the food leavening agent market is the growing consumer preference for natural and clean-label ingredients. As more people become health-conscious, there has been an increased demand for foods that are free from artificial additives and chemicals. Traditional leavening agents, which often contain artificial compounds or chemicals, face criticism from consumers who are wary of their potential health impacts. This trend toward natural ingredients poses a challenge for manufacturers who rely on synthetic leavening agents.

According to the World Health Organization (WHO), nearly one in three adults worldwide suffer from health issues related to poor diet, which has led to an increasing focus on healthier eating habits. As a result, consumers are gravitating towards foods with fewer additives, preservatives, and artificial ingredients. This shift has prompted many food manufacturers to reformulate their products, often choosing natural alternatives like baking soda or yeast-based leavening agents.

Governments are also playing a role in this trend. For example, the European Union (EU) has set stricter regulations on food labeling, requiring manufacturers to disclose all ingredients and additives used in food products. This has increased consumer awareness about what is in their food and has led to growing demand for cleaner labels and transparency. In the U.S., the Food and Drug Administration (FDA) continues to monitor food additives, making it clear that consumers have the right to know about potentially harmful ingredients in their food.

As this trend towards clean-label products continues, the demand for synthetic leavening agents is likely to decline, creating a challenge for the market. Food manufacturers are increasingly focusing on natural alternatives to meet consumer expectations and government regulations, making it harder for traditional leavening agents to maintain their market share.

Opportunity

Expansion of the Organic and Gluten-Free Food Market

One of the major growth opportunities for the food leavening agent market lies in the expanding demand for organic and gluten-free food products. As more consumers turn towards healthier and dietary-specific options, there is an increasing need for leavening agents that cater to these segments. Organic and gluten-free foods require specific leavening agents that can maintain texture and volume without compromising the product’s natural or allergen-free status.

The global gluten-free market was valued at US$ 7.6 billion in 2022 and is expected to grow significantly over the next few years. This trend is not only driven by those with gluten sensitivities but also by health-conscious consumers who prefer gluten-free diets for various health benefits. The Gluten Intolerance Group (GIG) reports that over 3 million people in the United States have celiac disease, a condition that requires a strict gluten-free diet, further propelling demand for gluten-free food products and, by extension, the leavening agents that make them possible.

Government support for organic food products is also fueling this growth. The U.S. Department of Agriculture (USDA) has committed to increasing the availability of organic food in the market. Their initiatives, such as the National Organic Program (NOP), help set high standards for organic production and certification, boosting consumer confidence in organic food products. In Europe, the European Union’s Common Agricultural Policy (CAP) has encouraged organic farming practices, which has translated into increased availability of organic food and ingredients.

With consumers increasingly seeking cleaner, healthier food options, the demand for organic and gluten-free leavening agents is projected to rise. Manufacturers are investing in research and development to create alternative leavening agents that meet the growing demand for organic certifications and gluten-free products, making this an exciting opportunity for growth in the food leavening agent market.

Trends

Emergence of Clean-Label and Natural Leavening Agents

A significant trend shaping the food leavening agent market is the growing consumer preference for clean-label and natural ingredients. As health consciousness rises, consumers are increasingly seeking products that are free from artificial additives and preservatives. This shift is prompting manufacturers to innovate and develop leavening agents that align with these preferences.

This growth is driven by consumer demand for transparency and natural ingredients in food products. In response, companies are introducing clean-label leavening agents that are free from synthetic chemicals and allergens, catering to the needs of health-conscious consumers.

For instance, Innophos introduced Levair Select, an aluminum-free leavening agent that not only meets clean-label requirements but also offers reduced sodium content and increased calcium levels. This innovation addresses consumer concerns about additives and aligns with the clean-label trend.

Additionally, advancements in fermentation and encapsulation technologies are enabling the development of natural leavening agents that maintain product quality and shelf life without relying on artificial substances. These technologies contribute to the creation of leavening agents that are both effective and aligned with natural food trends.

Governments and regulatory bodies are also supporting this trend by establishing standards and guidelines for clean-label products. For example, the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) provide regulations that help ensure the safety and transparency of food ingredients, including leavening agents.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant share of the global food leavening agent market, accounting for 46.8% of the market, valued at approximately US$ 3.6 billion. The region’s robust market performance is driven by the rapid growth of the food processing industry, particularly in countries like China, India, Japan, and South Korea. These nations have witnessed a surge in the demand for processed, ready-to-eat, and convenience foods, which heavily rely on leavening agents to enhance texture and volume.

Additionally, government initiatives such as India’s “Make in India” program, which encourages local manufacturing and food processing, have further bolstered the food leavening agent market. The APAC region is also benefiting from increasing investments in food safety standards and the adoption of international regulations, ensuring the production of high-quality food products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lesaffre, a global leader in yeast and fermentation products, offers a wide range of leavening agents for the food industry. With a strong presence in over 50 countries, the company focuses on innovation in baking solutions and fermentation technologies. Their product offerings are aimed at enhancing texture, flavor, and volume in baked goods. Lesaffre’s commitment to sustainable practices further strengthens its market position.

AB Mauri, a division of Associated British Foods, is a major player in the food leavening agent market. The company specializes in yeast and bakery ingredients, providing a comprehensive range of leavening agents for various food applications. AB Mauri focuses on innovation, quality, and sustainability, catering to both large-scale food manufacturers and smaller, regional players. Their global presence and extensive research and development capabilities help them meet the diverse needs of the food industry.

Lallemand, a leading yeast and bacteria producer, offers innovative leavening agents that cater to the food and beverage sectors. With over 100 years of experience, the company provides a variety of products designed to improve dough properties, enhance fermentation, and reduce production costs. Lallemand’s focus on biotechnology and sustainable practices has positioned it as a key supplier of clean-label ingredients, meeting the rising demand for natural and non-GMO solutions.

Top Key Players in the Market

- Lesaffre

- AB Mauri

- Lallemand

- Kraft

- Church & Dwight

- Solvay

Recent Developments

In 2024, Church & Dwight Co., Inc. (NYSE: CHD), renowned for its Arm & Hammer brand, reported net sales of $6.1 billion, marking a 4.1% increase from the previous year. This growth was driven by a 3.3% rise in volume and a 1.3% improvement in pricing and product mix. The company’s organic sales grew by 4.6%, and adjusted earnings per share reached $3.44.

In 2024, Lallemand achieved a turnover of €113.8 million, reflecting its strong position in the industry . The company’s extensive expertise in fermentation and microbiology supports its role in meeting the growing demand for high-quality leavening agents globally.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 10.7 Bn CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Biological Leavening Agents, Chemical Leavening Agents, Physical Leavening Agents), By Form (Powder, Liquid, Granules), By Source (Natural, Synthetic), By End-use (Food and Beverages, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lesaffre, AB Mauri, Lallemand, Kraft, Church & Dwight, Solvay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Leavening Agent MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Food Leavening Agent MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lesaffre

- AB Mauri

- Lallemand

- Kraft

- Church & Dwight

- Solvay