Global Food Flavour Market Size, Share, And Business Benefits By Source (Natural (Essential Oil, Natural Essence, Others), Synthetic (Artificial flavors, Nature-identical flavor)), By Form (Liquid and Gel, Dry), By Flavor (Chocolate, Fruit and Nut, Vanilla, Spices and Savory, Others), By Application (Bakery, Beverages, Confectionery, Dairy, Convenience Foods, Snacks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150812

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

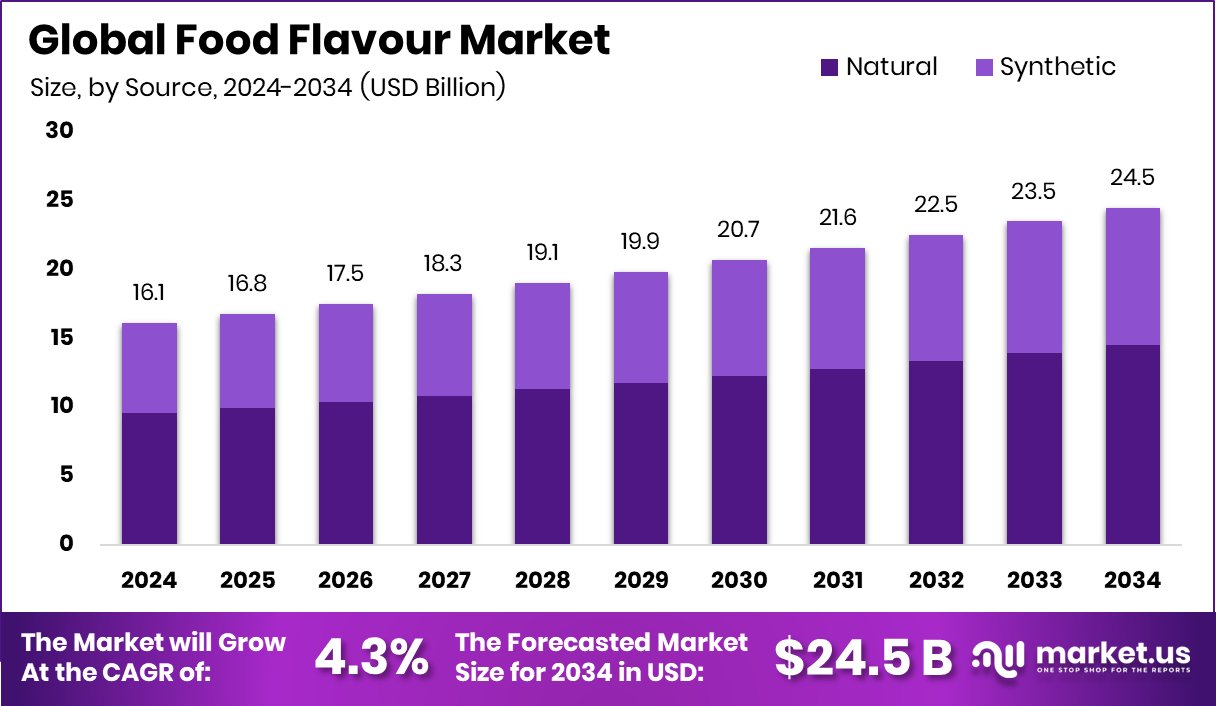

Global Food Flavour Market is expected to be worth around USD 24.5 billion by 2034, up from USD 16.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. Strong regional demand makes Asia-Pacific key in the USD 7.2 billion market.

Food flavour refers to the sensory impression of food or other substances, primarily determined by the chemical senses of taste and smell. It’s what gives food its unique identity—whether it’s the citrusy sharpness of lemon or the deep umami of cooked meat. Flavours can be naturally derived from ingredients like herbs, fruits, and spices, or they can be synthetically created to replicate those tastes.

The food flavour market involves the development, production, and distribution of flavouring agents used across various food and beverage products. These flavourings are used in everything from snacks and bakery goods to beverages and ready meals. This market exists to meet consumer demand for tasty, innovative, and diverse food experiences. It plays a critical role in how food is perceived, particularly as processed and packaged foods become more prevalent.

Rising global demand for processed and convenience foods is a key driver for the growth of the food flavour market. As lifestyles become busier, people lean towards ready-to-eat meals that still offer a rich and satisfying taste experience. Innovation in flavouring technology also contributes to market expansion, enabling longer shelf life and improved taste. According to an industry report, KisaanSay secures $2 million to promote sustainable and fair food sourcing in India.

There is a growing consumer interest in natural and clean-label flavours, pushing the market to move away from artificial additives. Health-conscious individuals are seeking foods that are both nutritious and flavorful, creating a higher demand for plant-based and organic flavour options. Ethnic and global cuisines are also influencing demand, as consumers explore more diverse flavour profiles. According to an industry report, Naagin, a flavour-focused food brand, raises ₹18 crore in a pre-Series A round led by 360 ONE Asset.

Key Takeaways

- Global Food Flavour Market is expected to be worth around USD 24.5 billion by 2034, up from USD 16.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Natural sources dominate the Food Flavour Market, contributing 59.3% due to rising health-conscious consumer trends.

- Liquid and gel forms lead the Food Flavour Market, holding 69.1% share for easier blending applications.

- Chocolate flavour is the most preferred in the Food Flavour Market, accounting for a 28.9% share.

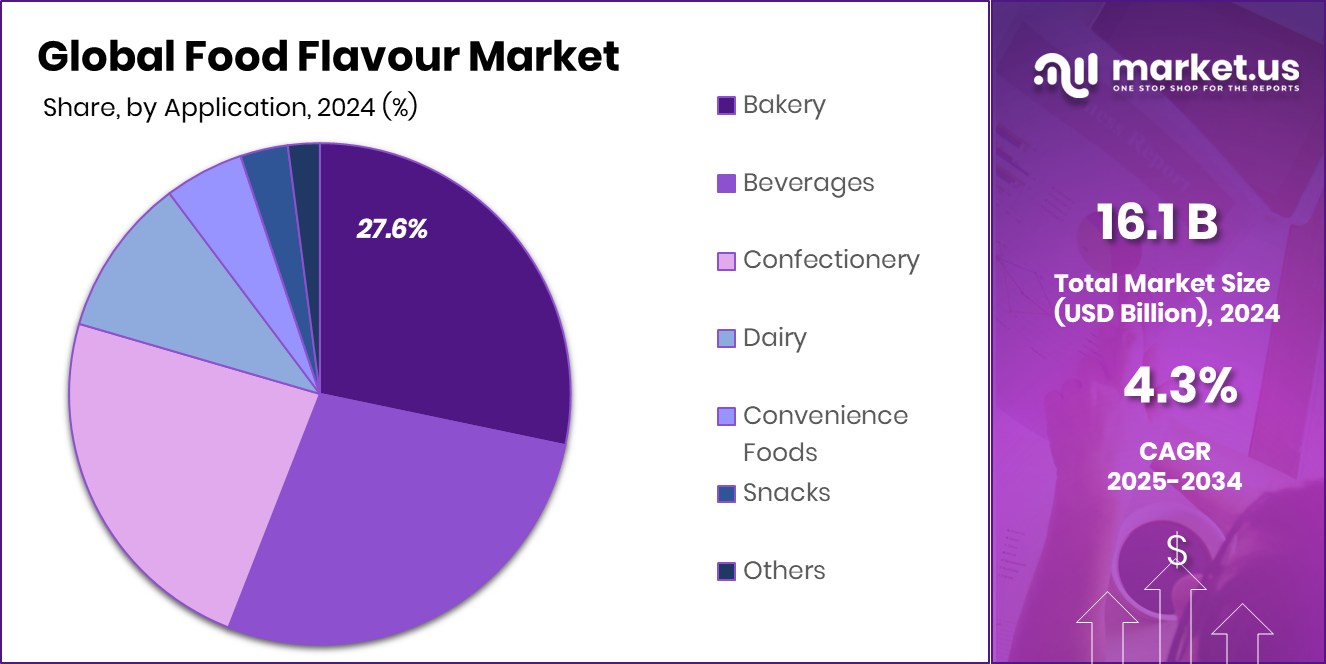

- The bakery segment drives food flavour market demand, representing 27.6% due to evolving snacking and dessert habits.

- Asia-Pacific held a dominant 45.3% share in the global food flavour market.

By Source Analysis

Natural sources dominate the Food Flavour Market, accounting for 59.3% due to rising clean-label preferences.

In 2024, Natural held a dominant market position in the By Source segment of the Food Flavour Market, with a 59.3% share. This strong foothold reflects the rising consumer inclination toward clean-label products and natural ingredients. As awareness around health and wellness continues to grow, more consumers are actively reading product labels and preferring items that contain recognisable and plant-based ingredients.

The dominance of natural flavours is also driven by the increasing popularity of organic and minimally processed food products, especially among younger, health-conscious demographics. Food producers are responding by reformulating products to include natural flavourings without compromising on taste. Additionally, the trend toward sustainable sourcing has further propelled the natural segment, as many natural flavours are derived from renewable resources and align with environmental values.

With consumers becoming more selective about what they eat and how it’s made, the demand for natural flavours is expected to remain strong. Their wide applicability across food and beverage categories, combined with evolving consumer preferences, has firmly positioned natural flavours as the leading choice in the market’s source-based segmentation.

By Form Analysis

Liquid and gel formats lead the Food Flavour Market with 69.1%, offering ease in mixing and application.

In 2024, Liquid and Gel held a dominant market position in the By Form segment of the Food Flavour Market, with a 69.1% share. This leadership can be attributed to their ease of application, versatility, and superior blending properties in a wide range of food and beverage products. Liquid and gel forms are widely preferred in industrial food production due to their ability to distribute flavour uniformly, ensuring consistency in taste and quality across batches.

Their functional advantage in both hot and cold processing makes them suitable for use in beverages, sauces, dairy products, and baked goods. Manufacturers also favour liquid and gel flavours for their efficiency in dosing and measuring, which streamlines production processes and minimises waste. Additionally, they allow for quicker absorption and integration into food matrices, which is particularly beneficial in high-speed manufacturing environments.

The dominant share held by this form also reflects a shift in consumer preference toward products with intense and well-balanced flavour profiles. Liquid and gel flavours offer better solubility and stability, enhancing the sensory experience of finished products.

By Flavor Analysis

Chocolate remains the most popular flavour in the Food Flavour Market, capturing 28.9% of total demand.

In 2024, Chocolate held a dominant market position in the By Flavour segment of the Food Flavour Market, with a 28.9% share. This strong market presence highlights the enduring popularity and universal appeal of chocolate as a flavour across various food and beverage categories. Known for its rich, indulgent taste, chocolate continues to be a preferred choice among consumers of all age groups, making it a staple in product development for manufacturers.

Its widespread use in confectionery, bakery, dairy, and beverage products contributes significantly to its market dominance. Chocolate flavour offers a familiar and comforting profile that resonates well with both traditional and modern palates. Moreover, the versatility of chocolate – whether dark, milk, or white – allows it to be adapted in multiple formats, meeting a range of consumer preferences and seasonal trends.

The 28.9% share also reflects its strong emotional and sensory connection with consumers, often associated with pleasure and reward. As a result, brands consistently innovate around chocolate-based offerings to maintain customer interest and loyalty.

By Application Analysis

The bakery segment holds 27.6% of the Food Flavour Market, driven by growing consumption of baked goods.

In 2024, Bakery held a dominant market position in the By Application segment of the Food Flavour Market, with a 27.6% share. This leading share reflects the consistent global demand for baked goods, where flavour plays a crucial role in product appeal and consumer satisfaction. Bakery products such as cakes, pastries, cookies, and breads rely heavily on flavouring to enhance taste, mask processing notes, and create variety in offerings.

Flavours in bakery applications are used not only to deliver traditional tastes like vanilla and chocolate but also to introduce seasonal or novelty items that keep consumers engaged. The flexibility of bakery products to incorporate both classic and innovative flavours contributes to their popularity, supporting a high rate of product launches and consistent consumer interest.

The 27.6% market share also highlights the strength of the bakery industry in adapting to evolving preferences, with food flavouring used to cater to indulgent, nostalgic, or even health-oriented trends. Flavour remains a key differentiator in bakery products, influencing both initial trial and repeat purchases.

Key Market Segments

By Source

- Natural

- Essential Oil

- Natural Essence

- Others

- Synthetic

- Artificial flavors

- Nature-identical flavor

By Form

- Liquid and Gel

- Dry

By Flavor

- Chocolate

- Fruit and Nut

- Vanilla

- Spices and Savoury

- Others

By Application

- Bakery

- Beverages

- Confectionery

- Dairy

- Convenience Foods

- Snacks

- Others

Driving Factors

Growing Demand for Tasty and Convenient Foods

One of the top driving factors of the food flavour market is the rising demand for tasty and convenient foods. As people lead busier lives, they often look for quick meal solutions that don’t compromise on flavour. Ready-to-eat meals, packaged snacks, and frozen foods have become part of everyday diets in many parts of the world. To keep these foods appealing, manufacturers rely heavily on food flavours to improve taste and variety.

Consumers want meals that are easy to prepare but still offer a satisfying and enjoyable eating experience. This growing demand encourages continuous innovation in flavours, helping companies create exciting food products that match consumer expectations for both convenience and taste.

Restraining Factors

Health Concerns Over Artificial Food Flavours Growing

A major restraining factor in the food flavour market is the increasing concern about artificial ingredients, especially synthetic flavours. Many consumers are becoming more health-conscious and are paying close attention to product labels. When they see artificial or chemical-sounding flavour names, they may choose to avoid those products.

This shift in preference puts pressure on food companies to move away from artificial flavours, which can be more affordable and easier to produce. Replacing them with natural alternatives can raise production costs and lead to more complex sourcing and manufacturing processes.

Growth Opportunity

Rising Popularity of Natural and Organic Flavours

A major growth opportunity in the food flavour market is the rising popularity of natural and organic flavours. More consumers today are choosing food products that are made with clean, simple, and recognisable ingredients. This trend is especially strong among health-conscious individuals and younger generations who prefer products free from artificial additives. As a result, food companies are investing more in natural flavour development, using fruits, herbs, spices, and plant extracts.

This shift opens new doors for innovation and product launches that meet clean-label standards. Natural flavours also align well with the growing demand for organic and sustainable food choices, making them a key area of opportunity for manufacturers looking to expand and stay competitive in the market.

Latest Trends

Bold & Sour Pickle-Inspired Flavour Trend Rises

A major recent trend in the food flavour market is the rise of bold and sour pickle-inspired flavours. Younger consumers, particularly Gen Z and Millennials, are drawn to adventurous taste experiences that break from the ordinary. This trend is manifesting in unexpected places—ranging from instant noodles to beverages—where tangy dill pickle or fermented profiles are being infused to surprise and excite the palate.

These bold flavours create memorable taste moments and encourage social sharing, especially across TikTok and Pinterest platforms. As a result, brands are experimenting with sour, fermented notes to offer novelty and stand out in crowded aisles. With consumers actively seeking unique sensory adventures, pickle-like flavours stand poised to shape future product developments and flavour innovation strategies.

Regional Analysis

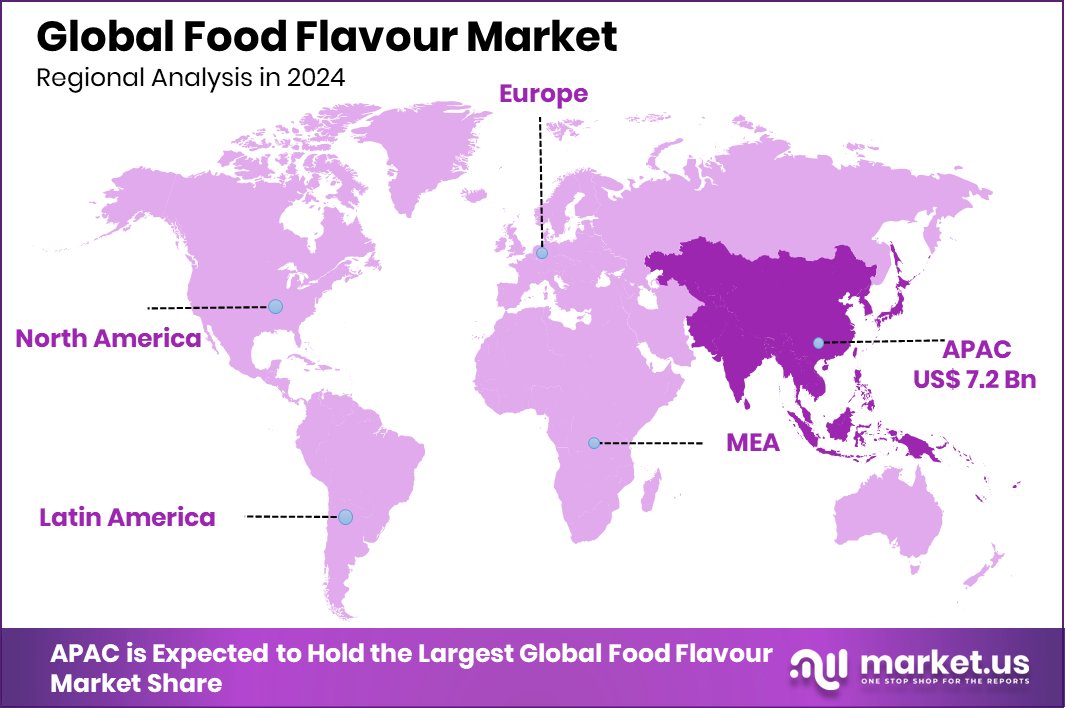

In Asia-Pacific, the food flavour market reached USD 7.2 billion in 2024.

In 2024, the Food Flavour Market showed notable regional variation, with Asia-Pacific emerging as the dominant region, accounting for 45.3% of the global market share and reaching a value of USD 7.2 billion. This strong presence is driven by the region’s large population base, growing urbanisation, and rising demand for packaged and processed foods.

The popularity of diverse local cuisines, along with increasing consumer preference for flavoured snacks and ready-to-eat products, has further boosted flavour consumption across countries such as China, India, and Southeast Asia.

North America and Europe remain significant contributors to the market, supported by high demand for premium and clean-label flavour products. These regions are also characterised by a mature food processing industry and advanced flavouring technologies.

Meanwhile, Latin America and the Middle East & Africa are witnessing steady growth, fueled by changing dietary habits, expanding food sectors, and a growing interest in global cuisine trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global food flavour market has seen steady strategic movement from key players such as Bell Flavours and Fragrances, Corbion NV, and DuPont, each carving their influence through focused innovation and product development.

Bell Flavours and Fragrances continues to build on its longstanding expertise in natural and botanical flavour solutions. The company’s strong emphasis on creating clean-label and culturally diverse flavour profiles resonates well with evolving consumer demands. Its ability to localise flavour offerings across regions gives it a competitive edge in global flavour customisation and responsiveness to taste trends.

Corbion NV, known for its focus on sustainable and functional ingredients, remains a crucial player by combining flavour innovation with food preservation. The company’s drive toward natural and plant-based flavour systems fits well into the current demand for health-forward food products. Corbion’s integration of flavour enhancement within shelf-life solutions is particularly valuable in processed and convenience food categories.

DuPont, leveraging its extensive scientific and technical capabilities, continues to deliver performance-based flavour ingredients. Its role in advancing taste modulation, especially in sugar and salt reduction, positions the company strongly in the wellness-driven product space. DuPont’s flavour development is tightly connected to its broader food solutions portfolio, allowing it to deliver integrated offerings across a variety of applications.

Top Key Players in the Market

- Archer Daniels Midland

- BASF SE

- Bell Flavours and Fragrances

- Corbion NV

- DuPont

- Firmenich

- Givaudan

- International Flavours and Fragrances

- Kerry Group

- MANE

- McCormick & Company

- Sensient Technologies Corp

- Symrise AG

- Synergy Flavors

- T. Hasegawa

- Taiyo International

Recent Developments

- In March 2025, BASF’s Isobionics® launched beta‑Sinensal 20 (a citrus‑aldehydic note) and alpha‑Humulene 90 (a pure woody flavour), both made by fermentation. Debuted at FlavourTalk 2025 in London, they offer clean-label, weather-independent alternatives for beverage, savoury, and essential oil applications.

- In October 2024, Bell introduced its “Herbaceous Alchemy” flavour lineup at regional IFT supplier expos. The collection features blends of botanicals, florals, herbs, and spices—think hibiscus, lavender, hojicha tea, and marigold. It targets food and beverage makers seeking natural, wellness-driven flavour solutions.

Report Scope

Report Features Description Market Value (2024) USD 16.1 Billion Forecast Revenue (2034) USD 24.5 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural (Essential Oil, Natural Essence, Others), Synthetic (Artificial flavors, Nature-identical flavor)), By Form (Liquid and Gel, Dry), By Flavor (Chocolate, Fruit and Nut, Vanilla, Spices and Savory, Others), By Application (Bakery, Beverages, Confectionery, Dairy, Convenience Foods, Snacks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland, BASF SE, Bell Flavors and Fragrances, Corbion NV, DuPont, Firmenich, Givaudan, International Flavors and Fragrances, Kerry Group, MANE, McCormick & Company, Sensient Technologies Corp, Symrise AG, Synergy Flavors, T. Hasegawa, Taiyo International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland

- BASF SE

- Bell Flavours and Fragrances

- Corbion NV

- DuPont

- Firmenich

- Givaudan

- International Flavours and Fragrances

- Kerry Group

- MANE

- McCormick & Company

- Sensient Technologies Corp

- Symrise AG

- Synergy Flavors

- T. Hasegawa

- Taiyo International