Global Fermented Beverages Market Size, Share Analysis Report By Type (Alcoholic Beverages, Non-alcoholic Beverages), By Packaging (Bottles, Cans, Sachets, Cartons, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152900

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

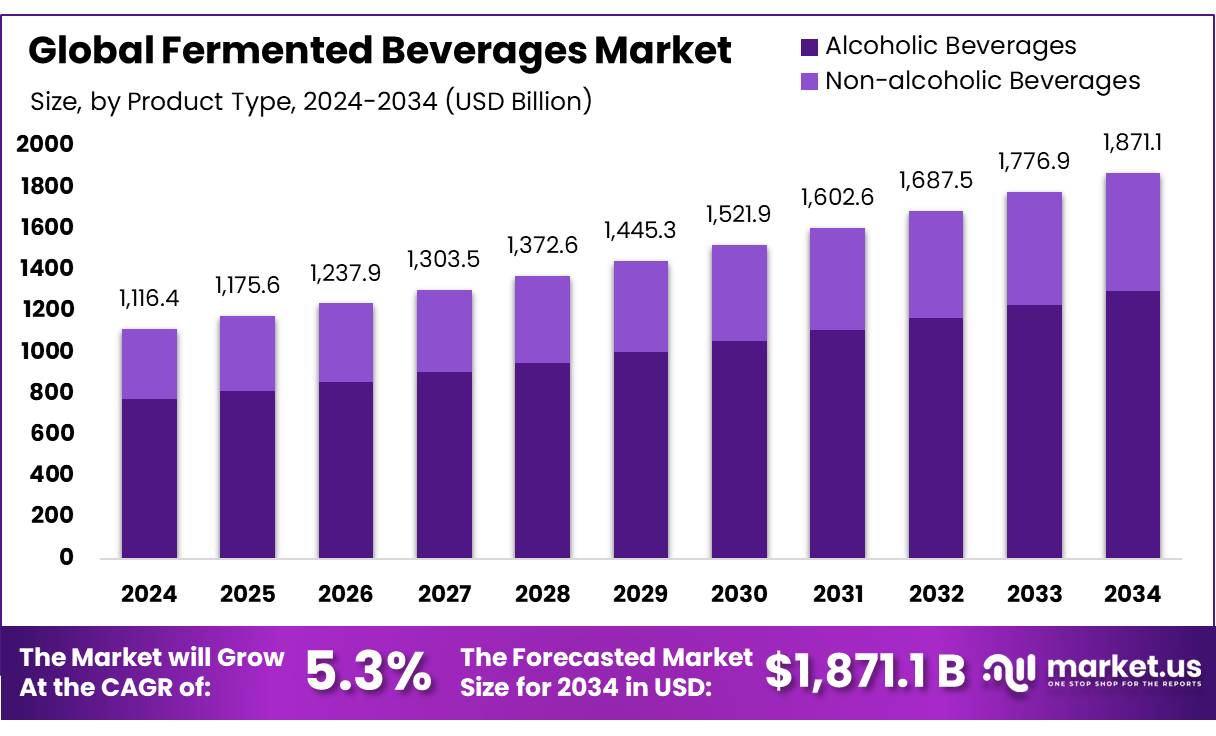

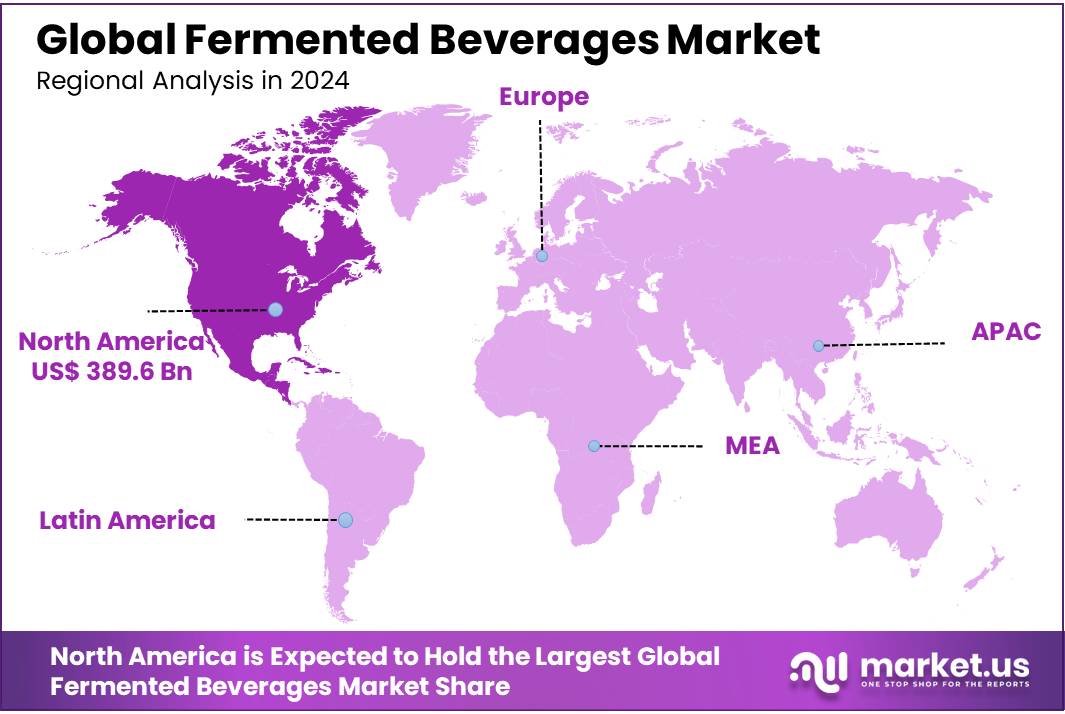

The Global Fermented Beverages Market size is expected to be worth around USD 1871.1 Billion by 2034, from USD 1116.4 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 34.9% share, holding USD 389.6 Billion revenue.

The fermented beverage concentrates market is witnessing substantial growth due to increasing consumer demand for healthier beverage options, especially in the wake of the growing awareness surrounding health and wellness. Fermented beverages such as kombucha, kefir, and other probiotic-rich drinks have gained popularity due to their potential health benefits, including improved digestion, boosted immunity, and better gut health. This shift in consumer preferences is significantly influencing the market’s expansion.

The industrial scenario is further strengthened by significant public-sector backing. In the U.S., for example, a federally backed USD 25 million loan issued in November 2023 supported the construction of a commercial-scale fermentation plant (600,000 L capacity) to bolster the bioeconomy.

Meanwhile, in India, the Ethanol Blended Petrol (EBP) programme for the 2021/22 ethanol sugar year (ESY) yielded approximately USD 289 million (INR 2.3 billion) in foreign-exchange savings and reduced greenhouse gas emissions by over 2.7 million tonnes. This biofuel-focused policy has indirect spillover benefits for fermentation-based ingredients, including beverage concentrates.

Key drivers include escalating health consciousness linked to probiotics, digestive health, and immunity. Functional beverage demand has been supported by credible nutritional research. Kombucha, for example, generated USD 400 million in US bottled sales in 2014, with growth of 37% in 2017.

Government initiatives are playing a pivotal role in supporting the growth of the fermented beverages industry. The Ministry of Food Processing Industries received a budget allocation of Rs. 3,290 crore in 2024-25, marking a 13% increase from the previous year. Programs like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Production-Linked Incentive Scheme for Food Processing Industry (PLISFPI) received Rs. 2,173 crore, aimed at enhancing food processing infrastructure and promoting innovation in the sector.

Key Takeaways

- Fermented Beverages Market size is expected to be worth around USD 1871.1 Billion by 2034, from USD 1116.4 Billion in 2024, growing at a CAGR of 5.3%.

- Alcoholic Beverages held a dominant market position, capturing more than a 69.3% share of the overall fermented beverages market.

- Bottles held a dominant market position, capturing more than a 47.8% share in the global fermented beverages market.

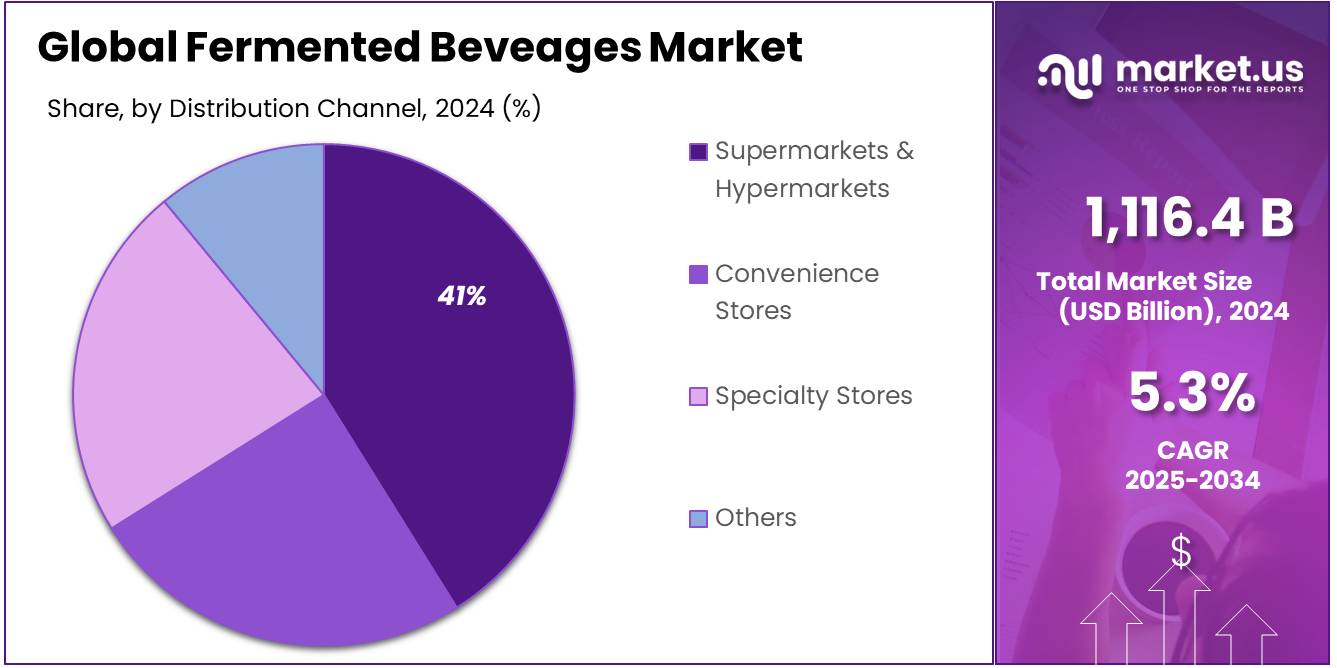

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.2% share in the global fermented beverages market

- North America emerged as the leading regional market for fermented beverages, holding a commanding 34.9% share, which translates to a market value of approximately USD 389.6 billion.

By Type Analysis

Alcoholic Beverages dominate with 69.3% share due to strong cultural integration and global demand.

In 2024, Alcoholic Beverages held a dominant market position, capturing more than a 69.3% share of the overall fermented beverages market. This large portion reflects the deeply rooted cultural presence and global acceptance of products such as beer, wine, cider, and spirits across various demographics. The steady demand in both developed and emerging economies continues to fuel growth, with beer remaining the most consumed alcoholic fermented beverage worldwide. Traditional consumption patterns, expanding nightlife economies, and the introduction of craft variations have further strengthened the appeal of alcoholic fermented drinks. Additionally, increased disposable incomes in regions such as Asia-Pacific and Latin America are driving consumption, especially among the younger population.

By Packaging Analysis

Bottles dominate with 47.8% share owing to their strong consumer preference and retail appeal.

In 2024, Bottles held a dominant market position, capturing more than a 47.8% share in the global fermented beverages market by packaging. This dominance is mainly driven by the widespread use of glass and PET bottles in packaging both alcoholic and non-alcoholic fermented drinks. Bottles are favored for their ability to preserve flavor, carbonation, and shelf life, which is especially important for products like kombucha, kefir, beer, and wine.

Their transparency also allows consumers to visually assess the product, which enhances trust and buying confidence. In retail environments, bottled fermented beverages continue to outperform other formats due to their convenience, portability, and premium image. Furthermore, many craft and small-batch producers prefer bottles for branding and label customization.

By Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 41.2% share due to high product visibility and consumer access.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.2% share in the global fermented beverages market by distribution channel. This segment’s leadership can be credited to its wide network, strong retail presence, and ability to offer a broad range of fermented beverage options under one roof.

Consumers prefer shopping from these outlets because of the convenience of comparing brands, access to promotional deals, and the assurance of product quality and freshness. Supermarkets and hypermarkets also support impulse buying, especially for newer products like flavored kombuchas or fermented plant-based drinks.

Key Market Segments

By Type

- Alcoholic Beverages

- Beer

- Wine

- Cider

- Wine coolers

- Alcopops

- Others

- Non-alcoholic Beverages

- Fermented Tea Drinks

- Fermented Dairy-Based Drinks

- Fermented Fruit-Based Drinks

- Fermented Cereal-Based Drinks

- Others

By Packaging

- Bottles

- Cans

- Sachets

- Cartons

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

Emerging Trends

Rise of Functional Fermented Beverages Among Gen Z

A significant trend in the fermented beverages market is the increasing preference for functional drinks among Generation Z consumers. These beverages, enriched with probiotics, vitamins, and adaptogens, are gaining popularity as health-conscious alternatives to traditional sugary or caffeinated drinks.

The TimesRecent data from Ocado Retail indicates a 54% year-on-year increase in sales of health drinks, with specific products like kefir and matcha tea experiencing notable growth. Sales of kefir rose by 30%, while matcha tea sales grew by 67% over the past year. Additionally, a survey by Savanta and Ocado revealed that two-thirds of Gen Z consumers frequently purchase functional drinks, and half have replaced alcohol and sugary beverages with options like kombucha. This shift reflects a broader movement towards beverages that offer more than just taste, aligning with wellness and self-care trends.

This growing demand is not only consumer-driven but also supported by industry innovations. Brands are introducing new products such as mushroom-infused coffees and performance teas, catering to the desire for functional beverages that promote mental clarity, stress reduction, and overall well-being. The popularity of these drinks is further evidenced by the surge in online searches and retail offerings, indicating a robust market expansion.

In response to this trend, retailers like Marks & Spencer and companies like Mission are launching products like mushroom shots and performance teas to meet the evolving preferences of health-conscious consumers. This indicates a significant opportunity for brands to innovate and align with the growing demand for functional fermented beverages.

Drivers

Increasing Health Consciousness and Preference for Natural Ingredients Drives Fermented Beverages Market Growth

In recent years, there has been a significant rise in consumer interest toward health-conscious choices, particularly in the food and beverage industry. This trend is notably impacting the demand for fermented beverages, as consumers increasingly seek products that offer functional benefits like improved gut health, enhanced immunity, and better digestion. Fermented beverages such as kombucha, kefir, and probiotic drinks are recognized for their potential health benefits due to the presence of live cultures, probiotics, and enzymes that support the digestive system.

A key factor driving this market shift is the growing consumer awareness about the link between gut health and overall well-being. According to the World Health Organization (WHO), an estimated 70% of the immune system is housed in the gut, emphasizing the importance of maintaining a healthy gut microbiome. As a result, the global shift toward natural, probiotic-rich products has increased the demand for fermented beverages.

In the U.S., the National Institutes of Health (NIH) highlights that over 60 million Americans suffer from digestive disorders, fueling the demand for probiotic beverages as a natural remedy. Additionally, the trend towards plant-based diets is further boosting the popularity of plant-based fermented drinks like kombucha and water kefir. A report from the Food and Agriculture Organization (FAO) also supports this growth, stating that fermented food consumption is growing globally as people seek more nutrient-dense, plant-forward products.

Government initiatives are also playing a role in this surge. The U.S. Department of Agriculture (USDA) has been actively promoting fermented foods as part of healthy eating programs, acknowledging the nutritional and digestive benefits of such products. The growing support from health bodies and the increasing focus on healthy lifestyle choices are expected to continue fueling the growth of the fermented beverages market in the coming years.

Restraints

High Sugar Content and Its Impact on Consumer Preferences Restraints Fermented Beverages Market

One of the significant factors restraining the growth of the fermented beverages market is the high sugar content often found in these drinks. While fermented beverages like kombucha, kefir, and others are marketed as healthy alternatives to sugary sodas, many still contain added sugars, which can negatively affect health, especially in populations that are already health-conscious or those managing conditions like diabetes. This sugar content becomes a concern as more consumers are becoming increasingly aware of the health risks associated with excessive sugar intake.

According to the American Heart Association (AHA), the average American consumes about 77 grams of sugar daily, which is well above the recommended limit of 36 grams for men and 25 grams for women. This high sugar intake is linked to various chronic diseases such as obesity, type 2 diabetes, and heart disease. As consumers continue to shift toward healthier, lower-sugar options, the high sugar levels in many fermented beverages are turning potential buyers away from these drinks.

Additionally, the U.S. Food and Drug Administration (FDA) has been focusing on regulating and reducing the sugar content in food and beverages. In 2021, the FDA mandated clearer labeling of added sugars on product packaging, encouraging consumers to make informed decisions about their sugar intake. This has placed pressure on fermented beverage producers to reformulate their products by either reducing the sugar content or finding alternative sweeteners that meet health standards.

Opportunity

Growing Popularity of Plant-Based Fermented Beverages Presents Significant Market Opportunity

One of the most promising growth opportunities for the fermented beverages market lies in the increasing consumer shift towards plant-based products. As more people adopt vegetarian, vegan, and plant-forward diets, the demand for plant-based fermented beverages, such as kombucha, water kefir, and plant-based kefirs, is rising. This shift is driven by the growing awareness of the health benefits of plant-based nutrition, including improved digestion, better gut health, and overall wellness.

The plant-based movement has seen rapid growth in recent years. According to the Plant Based Foods Association, the plant-based food market in the United States alone was valued at US$7 billion in 2021 and is projected to continue expanding. Fermented beverages, particularly kombucha, have become a central part of this trend, as they not only provide probiotic benefits but also cater to the increasing demand for plant-based, dairy-free alternatives. This surge in consumer interest is anticipated to continue, especially as younger generations, who are more health-conscious, become the largest demographic group in the market.

Government initiatives are also helping to fuel this growth. The U.S. Department of Agriculture (USDA) has been encouraging plant-based food consumption through its dietary guidelines and healthy eating programs. These initiatives promote the benefits of plant-based eating, which include a reduced risk of chronic diseases such as heart disease and diabetes. As plant-based diets gain traction, more food and beverage manufacturers are developing innovative, plant-based fermented products that align with these government-supported health trends.

Regional Insights

North America reigns with 34.9% share, reaching USD 389.6 billion in 2024.

In 2024, North America emerged as the leading regional market for fermented beverages, holding a commanding 34.9% share, which translates to a market value of approximately USD 389.6 billion. This dominant position reflects strong consumer demand for both functional and traditional fermented drinks within the United States, Canada, and Mexico.

The North American market is driven by evolving consumer preferences toward healthier, low-sugar alternatives, such as kombucha, kefir, and probiotic beverages. In 2024, fermented drinks such as kombucha and kefir benefited from increasing retail shelf presence and growing consumer education about gut health. This trend is supported by investments in point-of-sale refrigeration and premium storefronts throughout supermarkets and convenience chains.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Döhler is a global specialist in natural ingredients and ingredient systems, operating in over 130 countries with 23 production and 24 application centres. Its fermentation-focused portfolio includes natural solutions for beverage applications, such as functional ingredients and flavor systems. With a foundation dating back to 1838, Döhler leverages technological innovation and sustainability to support customers in the fermented beverages sector. Its integrated offerings range from concept to realization, empowering both large-scale manufacturers and craft producers to deliver consistent quality and sensory profiles in fermented drinks.

Biotiful Dairy offers a compelling presence in the fermented dairy beverage market, emphasizing kefir rich in live cultures. Their organic kefir, made in Britain, contains billions of gut-friendly bacteria, is high in protein, and has no added sugar. Certified by the Soil Association and rooted in traditional fermentation methods, Biotiful has successfully elevated kefir into mainstream retail. The brand’s focus on gut health and clean ingredients has resonated with consumers seeking functional wellness beverages, fueling category expansion and innovation in flavored kefir variants.

Danone is a leading consumer goods company with deep roots in fermented dairy and plant-based beverages. In 2024, its fermentation-based brands contributed to total group sales of approximately €27.6 billion (USD ~$29.5 billion). Danone is actively investing in precision fermentation, committing €16 million (~USD 17.1 million) in 2025 to build demo-scale production capabilities and supporting scale-up platforms in partnership with Michelin, DMC Technologies, and Crédit Agricole.

Top Key Players Outlook

- Dohler

- Biotiful Dairy

- Novonesis Group

- Danone

- Diageo

- Heineken

- Kirin Holdings

- Lifeway Foods

- PepsiCo

- Sula Vineyards

- Suntory Holdings Limited

- The Coca-Cola Company

- Yakult Honsha

Recent Industry Developments

In 2024, Diageo reported net revenue of USD 20.269 billion, supported by its diversified fermented beverages portfolio that spans beer, stout, and non-alcoholic options.

In 2024, Danone achieved €27,376 million in consolidated sales, growing +4.3% like-for-like—with +3.0% driven by volume/mix—reflecting robust demand in its core segments, including fermentation-based drinks and waters.

Report Scope

Report Features Description Market Value (2024) USD 1116.4 Bn Forecast Revenue (2034) USD 1871.1 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Alcoholic Beverages, Non-alcoholic Beverages), By Packaging (Bottles, Cans, Sachets, Cartons, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dohler, Biotiful Dairy, Novonesis Group, Danone, Diageo, Heineken, Kirin Holdings, Lifeway Foods, PepsiCo, Sula Vineyards, Suntory Holdings Limited, The Coca-Cola Company, Yakult Honsha Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fermented Beverages MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Fermented Beverages MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dohler

- Biotiful Dairy

- Novonesis Group

- Danone

- Diageo

- Heineken

- Kirin Holdings

- Lifeway Foods

- PepsiCo

- Sula Vineyards

- Suntory Holdings Limited

- The Coca-Cola Company

- Yakult Honsha