Global E-Bike Lithium Battery Market Size, Share Analysis Report By Battery Type (Lithium-ion, Lithium Polymer, Lithium Iron Phosphate, Others), By Application (Mountain E-Bikes, Road E-Bikes, Hybrid E-Bikes, Cargo E-Bikes, Others), By Distribution Channel (Online Retail, Offline Retail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170256

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

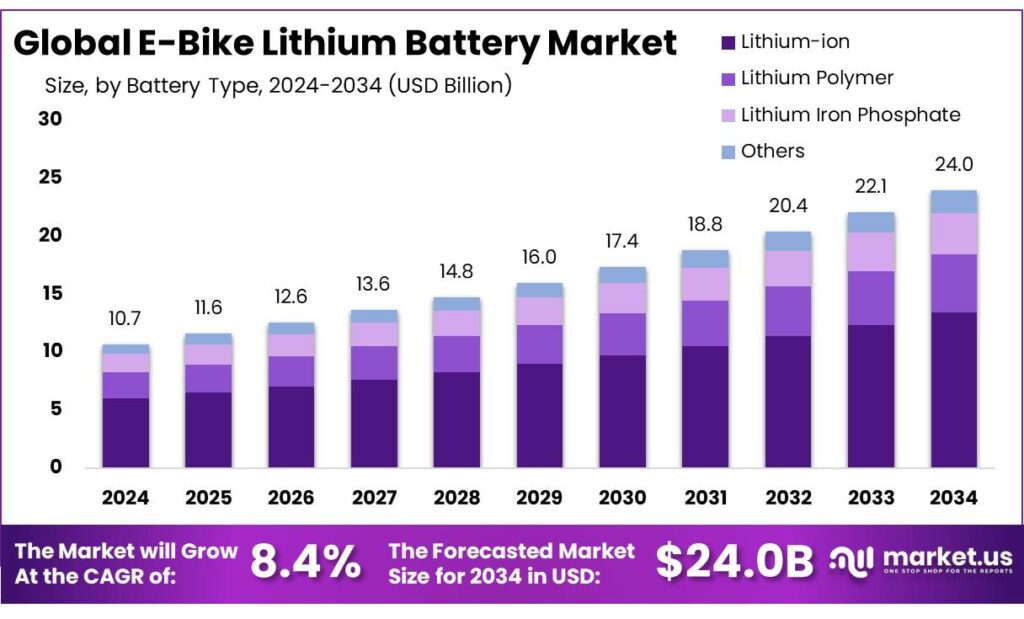

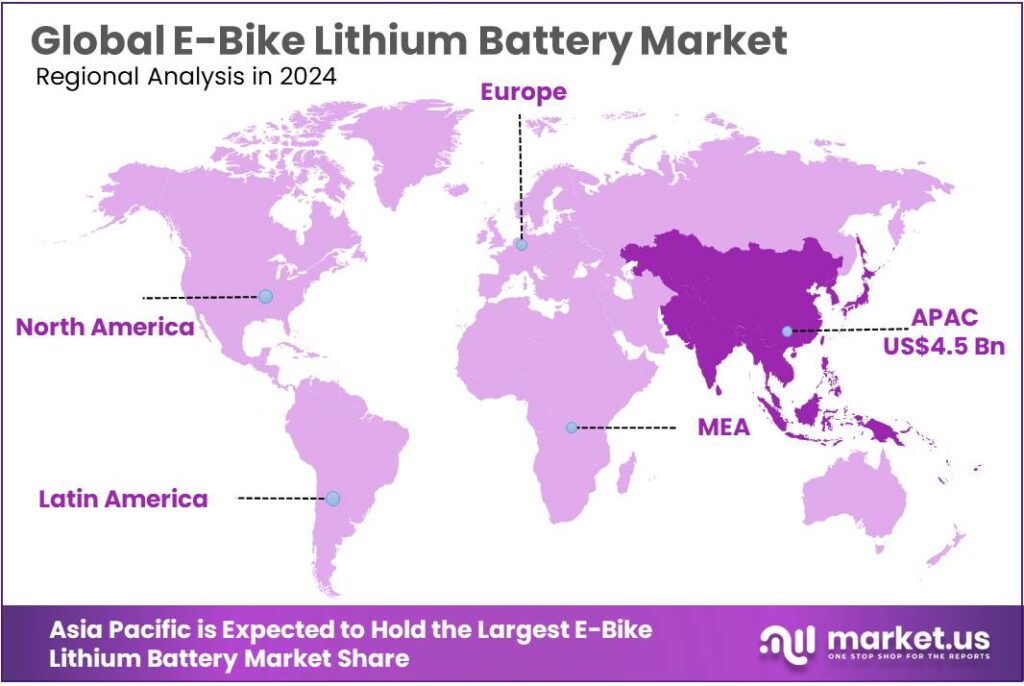

The Global E-Bike Lithium Battery Market size is expected to be worth around USD 24.0 Billion by 2034, from USD 10.7 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 39.20% share, holding USD 1.2 Billion revenue.

Industrial momentum is tied to the wider battery supply chain scaling up. The International Energy Agency (IEA) reports global battery manufacturing reached about 2.5 TWh in 2023, adding 780 GWh of capacity in a single year—evidence that cell, pack, and component ecosystems are expanding rapidly. Even though this figure includes all road-transport batteries, it directly benefits e-bike packs via greater availability of cells, improved manufacturing automation, and broader standardization in battery testing and quality systems.

Demand drivers for e-bike batteries are no longer only “green commuting.” Food and restaurant delivery has become structurally more off-premises, pushing fleet usage of e-bikes and swappable packs in dense cities. The U.S. National Restaurant Association notes off-premises traffic at full-service restaurants rose from 19% in 2019 to 30% in 2024, while limited-service locations reached 83% in 2024. In its consumer trends work, the same organization also reports 47% of adults pick up takeout at least weekly and 37% order delivery weekly—supporting sustained utilization for delivery e-bikes and therefore recurring battery replacement demand.

- Policy is another anchor. In India, the Ministry of Heavy Industries’ PM E-DRIVE scheme is scheduled from 1 Oct 2024 to 31 Mar 2026, signalling continued central support for electric mobility categories that sit close to the e-bike ecosystem. Separately, India’s FAME-II program carried an outlay of ₹10,000 crore and targeted support including 10 lakh e-two-wheelers, reinforcing supplier investment and localization across cells, packs, and charging hardware.

Government initiatives and regulation are shaping the next phase of the battery value chain. In China, an official update on an e-bike trade-in/subsidy program reported about 8.4 million buyers receiving subsidies, with a total sales value of about 24.77 billion yuan in the first half of 2025—a direct policy lever that stimulates new vehicle and battery turnover.

- In the EU, Regulation (EU) 2023/1542 raises expectations around sustainability and end-of-life handling; reporting around the regulation highlights recycled-content targets by 2031, including 6% recycled lithium and nickel and 16% cobalt—signals that will increasingly reward battery makers who design for recycling and documented material recovery.

Key Takeaways

- E-Bike Lithium Battery Market size is expected to be worth around USD 24.0 Billion by 2034, from USD 10.7 Billion in 2024, growing at a CAGR of 8.4%.

- Lithium-ion held a dominant market position, capturing more than a 56.2% share.

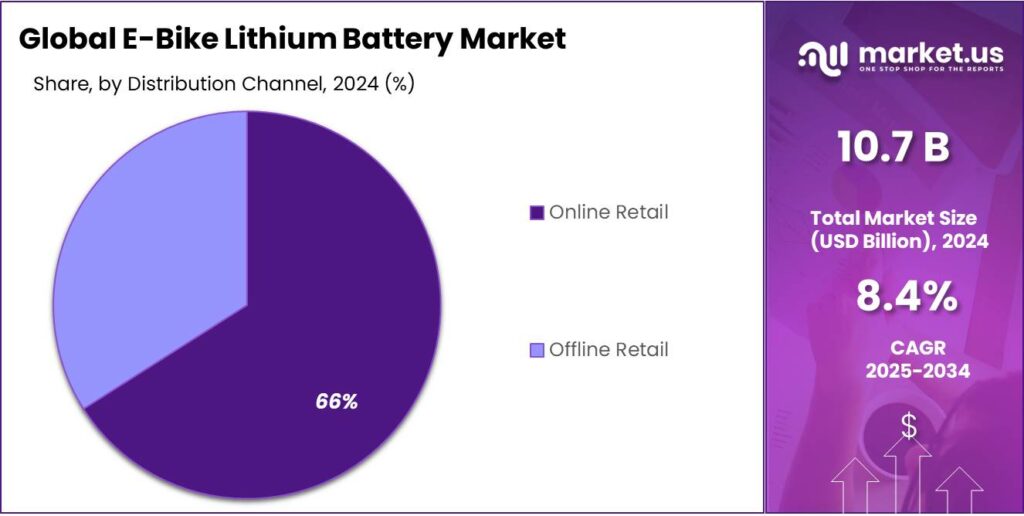

- Online Retail held a dominant market position, capturing more than a 66.1% share.

- Mountain E-Bikes held a dominant market position, capturing more than a 33.8% share.

- Asia Pacific held a dominant regional position, capturing 42.70% of the market and generating approximately USD 4.5 billion.

By Battery Type Analysis

Lithium-ion leads with 56.2% as energy density and cycle life favour electric bicycles.

In 2024, Lithium-ion held a dominant market position, capturing more than a 56.2% share. This outcome was driven by the technology’s superior energy density, longer cycle life and falling pack costs, which together made lithium-ion the preferred choice for commuter and performance e-bikes. Adoption was supported by improvements in battery management systems and faster charging capabilities, which increased user confidence and reduced total cost of ownership.

Procurement decisions in 2024 favoured lithium-ion suppliers that could provide safe, certified packs with clear thermal management and warranty terms. The segment also benefited from growing aftermarket replacement demand and expanded OEM partnerships. Into 2025, lithium-ion is expected to maintain its leading role as manufacturers continue to optimise cell chemistry and pack design for weight, range and safety, while evolving regulations and recycling programmes shape longer-term supply-chain resilience.

By Application Analysis

Online Retail dominates with 66.1% thanks to convenience and wide product selection.

In 2024, Online Retail held a dominant market position, capturing more than a 66.1% share. This strength can be attributed to the convenience of direct-to-consumer purchase flows, broader product assortments and improved logistics that simplified battery selection, delivery and returns for e-bike owners. The channel benefited from clearer product information, user reviews and bundled services such as warranty registration and doorstep support, which reduced purchase friction compared with traditional retail.

Price transparency and frequent promotional activity further encouraged buyers to choose online platforms for both OEM packs and aftermarket replacements. Distribution and fulfilment systems were adapted in 2024 to handle larger, packaged battery shipments while preserving safety and regulatory compliance during transit. The preference for online purchase pathways was expected to remain pronounced into 2025 as retailers and marketplaces continued to enhance product presentation, technical guidance and after-sales service for lithium battery buyers.

By Distribution Channel Analysis

Mountain E-Bikes dominate with 33.8% as riders demand higher-capacity packs for off-road performance.

In 2024, Mountain E-Bikes held a dominant market position, capturing more than a 33.8% share. This strength was supported by the need for higher energy and power delivery in off-road conditions, which led manufacturers to specify larger, higher-discharge lithium battery packs with robust thermal management and strengthened housings. The segment benefitted from advances in battery management systems and cell chemistry that improved range and safety under heavy load, making electric mountain bikes more reliable for longer rides and steeper terrain.

Procurement choices in 2024 were influenced by a preference for proven pack designs, warranty terms and serviceability, while aftermarket demand for replacement and upgrade packs grew alongside OEM sales. The segment’s leadership was reinforced by product innovation in lightweight pack construction and integration with motor control systems; this position was expected to remain strong into 2025 as off-road e-cycling continued to attract both recreational and performance-focused buyers.

Key Market Segments

By Battery Type

- Lithium-ion

- Lithium Polymer

- Lithium Iron Phosphate

- Others

By Application

- Mountain E-Bikes

- Road E-Bikes

- Hybrid E-Bikes

- Cargo E-Bikes

- Others

By Distribution Channel

- Online Retail

- Offline Retail

Emerging Trends

Standardized, Swappable Batteries for High-Usage Riders

One of the most visible latest trends in e-bike lithium batteries is the shift toward standardized and swappable battery systems—especially for riders who use their bikes every day for work, like food delivery couriers. In the past, riders often bought the cheapest battery they could find and hoped it lasted. But as delivery has become a big part of the urban economy, riders and fleet managers are looking for safer, easier-to-handle batteries that they can swap quickly between shifts.

- Governments and cities are also encouraging practices that support this trend, though sometimes indirectly. For example, China’s e-bike trade-in program showed strong activity in the first half of 2025, with about 8.4 million buyers receiving subsidies and total reported sales of around 24.77 billion yuan. These incentives push people toward newer, safer vehicles—and batteries—because older batteries are more likely to fail or cause fire hazards.

Standardization and swap-friendly designs also respond to safety regulation trends. For example, European battery rules under Regulation (EU) 2023/1542 are pushing for better traceability and recycling from 18 August 2031, with specific minimum recycled contents. Although these rules are not only about swap systems, they create an environment where well-documented, certified, and traceable battery packs are the default choice. Riders and operators prefer batteries that meet high compliance levels rather than facing surprises during inspections or at borders.

Drivers

Food Delivery Boom Pushes Battery Demand

A major driver for e-bike lithium battery demand is the fast rise of urban delivery—especially food—and the way delivery work “uses up” batteries much faster than casual riding. When an e-bike is used for multiple short trips all day, the battery sees frequent charge–discharge cycles, higher heat, and more time spent near full charge. That combination increases wear, which means fleets and riders replace packs sooner, buy backup batteries, and prefer safer, better-managed packs with reliable BMS protection.

The scale of food delivery activity is large enough to move the needle for battery demand. DoorDash reported 685 million total orders in Q4 2024 and Marketplace GOV of $21.3 billion in the same quarter. Those aren’t “nice-to-have” numbers—they show how constant and high-frequency last-mile delivery has become in real life, every day, across cities. High order volumes translate into more rider hours, more daily kilometers, and more charging events, all of which directly increase battery throughput and replacement needs.

The broader platform ecosystem reinforces the same story. Uber reported that trips on its platform grew to 3.1 billion in Q4 2024. Even though not all trips are food delivery, this figure signals how massive app-based mobility and delivery networks have become. Where e-bikes are part of the mix (either owned by couriers or provided by fleets), operators push for quick charging, predictable range, and fewer failures—so higher-quality lithium packs become a business necessity, not a luxury.

- Government policy is also strengthening this driver by speeding up replacement cycles and raising compliance expectations. China’s official reporting on the e-bike trade-in program said about 8.4 million buyers received subsidies in the first half of 2025, with total sales value around 24.77 billion yuan, and output of the top 10 brands up 27.6% year over year in the same period.

- Meanwhile, the EU’s Batteries Regulation (EU) 2023/1542 is pushing sustainability and traceability requirements, including recycled-content thresholds that kick in from 18 August 2031, which encourages formal, higher-standard battery supply chains.

Restraints

Safety Fears and Compliance Costs Slow Adoption

One of the biggest restraints on the e-bike lithium battery industry is simple: people worry about fires, and cities are starting to treat unsafe batteries as a public safety issue. When a battery problem makes the news—especially when it happens indoors—it can quickly damage trust. For everyday riders it becomes “Is this safe to charge at home?” For delivery fleets it becomes “Will this create liability for our riders and restaurants?” That fear doesn’t just reduce new sales; it also pushes buyers to delay replacements or keep older packs longer than they should.

- Regulators are backing that concern with hard action. In the U.S., the Consumer Product Safety Commission (CPSC) issued a warning about certain Rad Power Bikes e-bike batteries, saying it was aware of 31 reported fires and 12 property-damage reports totaling about $734,500. The same notice mentions replacement batteries sold for about $550, which shows the “real-world” cost of fixing a safety issue for a consumer.

Governments are also tightening the rulebook—and that creates a second restraint: compliance cost and supply disruption. New York City moved to require third-party certification for e-mobility devices and battery packs, with the goal of keeping uncertified products out of the market. From an industry perspective, this is good for safety, but it adds testing time, documentation work, and higher bill-of-materials cost. Smaller importers and low-cost assemblers struggle to keep up, which can shrink “cheap supply” and raise average prices in the short term.

Enforcement is not theoretical. A fire-safety write-up based on FDNY learnings notes that in 2024 a city task force inspected nearly 600 e-bike shops and issued 426 summons, 138 violation orders, and 32 stop-work orders. Those numbers show active policing of the battery ecosystem—shops, repairs, storage, and sales. For the battery market, this kind of enforcement can temporarily reduce availability and slows down informal refurbishment channels that many riders depend on for low-cost replacements.

Opportunity

Fleet-Grade, Swappable Batteries for Food Delivery Networks

A big growth opportunity in e-bike lithium batteries is building “fleet-first” battery systems for food delivery and other last-mile work. Delivery riders don’t use an e-bike like a weekend cyclist. They ride for hours, stop often, carry weight, and charge more than once a day. That creates a clear need for batteries that are safer, easier to swap, and backed by service—because downtime means lost income. This shift opens the door for battery makers and assemblers to sell not only packs, but also charging cabinets, swap stations, spare-battery subscriptions, and maintenance programs.

The opportunity is large because the delivery economy is already huge and still growing. DoorDash reported 685 million total orders in Q4 2024, with Marketplace GOV of $21.3 billion for the quarter. Those numbers reflect a steady, daily flow of short trips—exactly the type of driving pattern that pushes high battery throughput and faster pack replacement. When riders and fleets need dependable range every day, the market starts valuing warranties, verified safety, and predictable cycle life rather than the cheapest pack available.

Uber’s scale points in the same direction. Uber reported 3.1 billion trips in Q4 2024, averaging about 33 million trips per day. Even though e-bikes are not the only vehicle used, these trip volumes show how large app-based mobility and delivery systems have become. As platforms expand and cities push for cleaner transport, fleets will keep looking for battery solutions that reduce charging time, reduce theft risk (lockable docks), and cut fire exposure through better cells and smarter battery management.

Government policy is making the “replacement and upgrade” cycle even more important—another reason swap-ready and service-ready batteries can grow faster than basic packs. China’s official reporting on its e-bike trade-in program said the first half of 2025 reached about 24.77 billion yuan in sales value, with about 8.4 million buyers receiving subsidies, and output of the top 10 e-bike brands up 27.6% year over year. Programs like this speed up turnover of older bikes and older batteries, creating a steady lane for compliant, higher-quality batteries and standardized designs that can be serviced at scale.

Regional Insights

Asia Pacific leads with 42.70% share and about USD 4.5 billion in 2024

In 2024, Asia Pacific held a dominant regional position, capturing 42.70% of the market and generating approximately USD 4.5 billion in revenues. This leadership can be attributed to rapid electrification of personal mobility, strong OEM activity, and dense urban markets that accelerated e-bike adoption and corresponding battery demand. Large manufacturing clusters in the region enabled scale production of lithium battery cells and packs, which supported competitive pricing and rapid time-to-market for new models.

Procurement patterns in 2024 were influenced by robust domestic demand in major markets, complemented by substantial export volumes to Europe and North America; supply-chain integration from cell manufacturers through pack assemblers reduced logistics friction and supported high fill-rates for retailers and OEMs. Regulatory frameworks and incentive programmes for sustainable urban transport in several countries encouraged fleet electrification and stimulated aftermarket replacement purchases, increasing overall battery throughput. Technical capabilities for thermal management, BMS calibration and safety certification were concentrated in regional hubs, enabling faster iteration of higher-energy and higher-power pack designs for commuter and performance segments.

Channel dynamics also favoured online and specialist distributors that could handle regulated shipping and warranty workflows for lithium packs. In 2025, the region’s leading position in absolute value is expected to be sustained as product diversification, improved cell energy density and continued urbanisation maintain elevated battery consumption; however, attention to recycling, second-life applications and stricter safety oversight will be required to preserve long-term growth and supply-chain resilience.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hydrofarm supplies lighting, nutrient and controlled-environment equipment to horticulture and aquaculture markets. In 2024 the business reported aggregate net sales on the order of ~USD 226.6 million, reflecting channel distribution and seasonal demand cycles; quarterly trends showed Q4 net sales of USD 37.3 million. The company supports growers with a broad product range and logistics capability.

Practical Cyclopentanone operates as a regional supplier in the cyclopentanone value chain; company financials are not publicly reported. For context, the global cyclopentanone market was estimated at ~USD 260.0 million in 2024, highlighting the addressable market for producers and distributors. Practical Cyclopentanone’s role is primarily in local supply and specialty-chemical distribution.

Greenlife Cyclopentanone is identified in trade and supplier lists as a producer/distributor of cyclopentanone grades for industrial use. Public revenue figures are not available; the broader market measured about USD 260.0 million in 2024, which frames the scale for specialist suppliers. The company serves formulators in pharmaceuticals and fine chemicals where product grade and supply reliability matter.

Top Key Players Outlook

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Bosch Group

- Shimano Inc.

- Yamaha Motor Co., Ltd.

- Trek Bicycle Corporation

- Specialized Bicycle Components, Inc.

- Accell Group N.V.

- BMZ Group

Recent Industry Developments

In 2024, Panasonic (through Panasonic Holdings and its Panasonic Energy business) was a significant player in lithium-ion cell and pack supply relevant to e-bike manufacturers, backed by consolidated sales of ¥8,496.4 billion for the fiscal year ended March 31, 2024 and a global workforce of ~228,000; these numerical indicators reflect the company’s capacity for large-scale cell production, technical support and quality assurance.

In 2024, Samsung SDI reported consolidated revenue of KRW 16.59 trillion and an operating profit of KRW 363.3 billion, figures that show the company’s financial scale in battery cell and pack production.

Report Scope

Report Features Description Market Value (2024) USD 10.7 Bn Forecast Revenue (2034) USD 24.0 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-ion, Lithium Polymer, Lithium Iron Phosphate, Others), By Application (Mountain E-Bikes, Road E-Bikes, Hybrid E-Bikes, Cargo E-Bikes, Others), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Panasonic Corporation, Samsung SDI Co., Ltd., LG Chem Ltd., Bosch Group, Shimano Inc., Yamaha Motor Co., Ltd., Trek Bicycle Corporation, Specialized Bicycle Components, Inc., Accell Group N.V., BMZ Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Bike Lithium Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

E-Bike Lithium Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Bosch Group

- Shimano Inc.

- Yamaha Motor Co., Ltd.

- Trek Bicycle Corporation

- Specialized Bicycle Components, Inc.

- Accell Group N.V.

- BMZ Group