Dental Impression Systems Market By Product Type (Impression Materials, Impression Trays, Intraoral Scanners, and Others), By Application (Restorative & Prosthodontics Dentistry and Orthodontics), By End-user (Hospitals, Dental Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154540

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

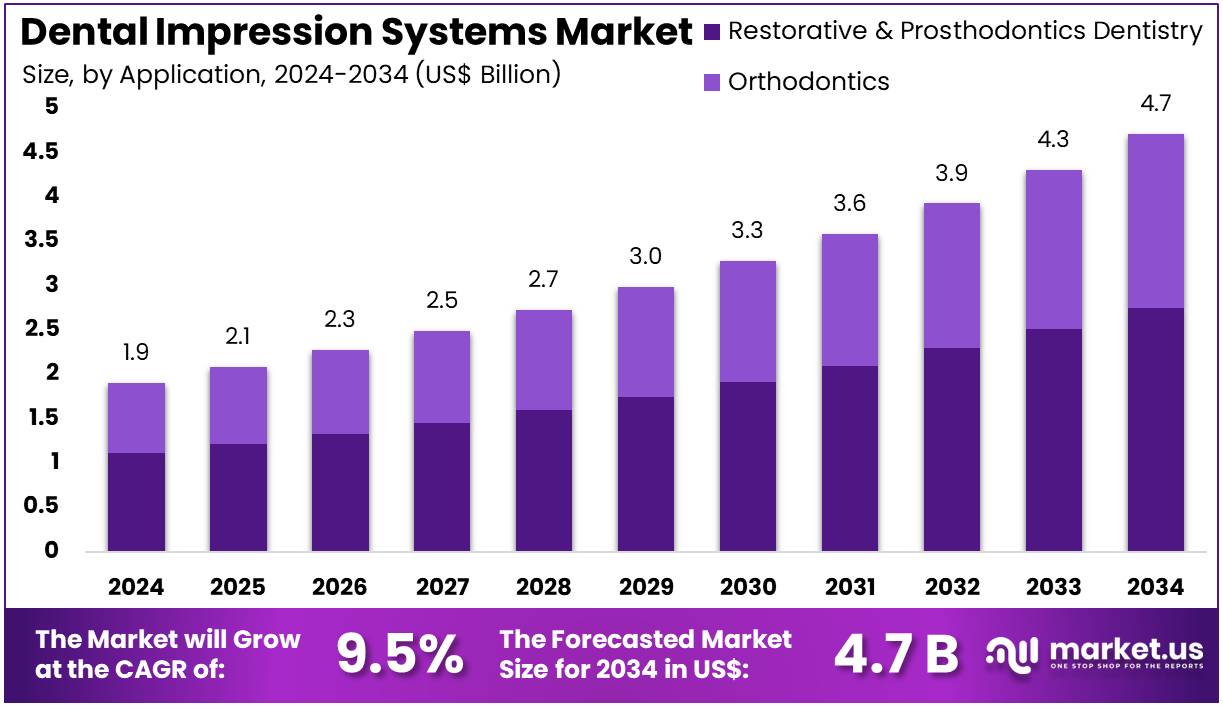

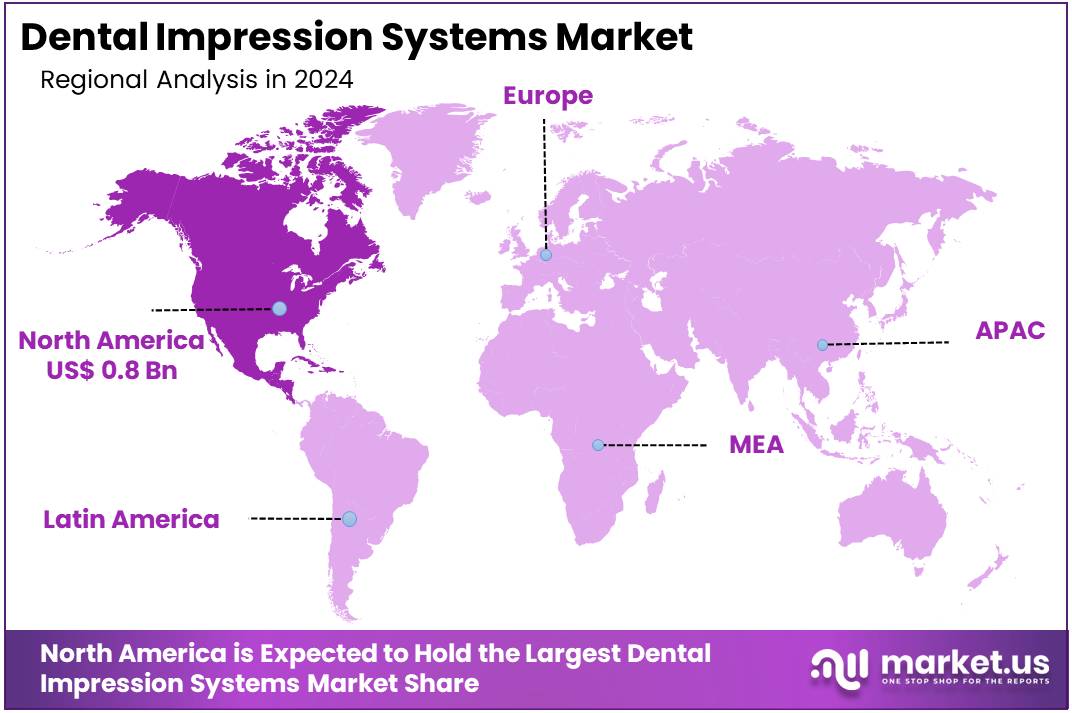

The Global Dental Impression Systems Market Size is expected to be worth around US$ 4.7 Billion by 2034, from US$ 1.9 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.7% share and holds US$ 0.8 Billion market value for the year.

The dental impression systems market is currently experiencing significant growth, driven by a combination of demographic shifts and technological advancements. The increasing demand for dental restorations and orthodontic treatments, particularly from an expanding geriatric population, is a primary catalyst. This trend is exacerbated by the rising prevalence of dental disorders, which creates a constant need for diagnostic and restorative procedures.

The adoption of advanced digital impression technologies and CAD/CAM systems is also playing a crucial role, promising enhanced accuracy, efficiency, and patient comfort. For example, the Centers for Disease Control and Prevention (CDC) reported that 13.2% of US adults aged 65 and older experienced complete tooth loss between 2017 and 2020, highlighting the persistent need for the prosthetic and restorative dental services that modern impression systems support.

The transition to digital solutions is fundamentally reshaping the dental impression systems market. These technologies provide a level of precision and speed that is not possible with traditional methods. Advances in both software and hardware are enabling dental professionals to capture impressions faster and more accurately, leading to better treatment planning and patient outcomes by minimizing errors. This shift is reflected in rapid adoption rates, with recent data showing that over 60% of dental practices in developed regions have already integrated digital impression systems.

Innovations like the software for intraoral scanners from Straumann Group exemplify this progress, as they streamline workflows and enable seamless data integration, which eliminates time-consuming and error-prone manual data entry.

This technological evolution is also delivering significant operational and patient-experience benefits. According to the American Dental Association, the use of digital impression systems has reduced patient chair time by 30%, which improves both practice efficiency and patient satisfaction. This is particularly important given that patients increasingly seek more streamlined and comfortable dental visits. The market is also bolstered by an increase in preventive dental visits, which accounted for over half of all dental visits in the US in 2022, as reported by the Delta Dental Plans Association. This focus on proactive care creates a fertile environment for adopting advanced diagnostic and impression technologies.

The need for advanced dental care is further underscored by data from various organizations. The CDC reports that approximately 20.2% of US adults aged 65 and older had untreated dental caries as of 2022. A report from the American Dental Association’s Health Policy Institute found that in the same year, only 51.5% of seniors visited a dentist, highlighting a substantial underserved population.

The CareQuest Institute for Oral Health further notes that roughly 72 million adults in the US currently lack dental insurance, which can disproportionately affect older adults who often require more complex and expensive procedures. These statistics collectively emphasize a clear and growing demand for efficient, advanced, and cost-effective dental solutions to address persistent oral health challenges within the aging population.

Key Takeaways

- In 2024, the market for dental impression systems generated a revenue of US$ 1.9 billion, with a CAGR of 9.5%, and is expected to reach US$ 4.7 billion by the year 2034.

- The product type segment is divided into impression materials, impression trays, intraoral scanners, and others, with impression materials taking the lead in 2023 with a market share of 45.2%.

- Considering application, the market is divided into restorative & prosthodontics dentistry and orthodontics. Among these, restorative & prosthodontics dentistry held a significant share of 58.4%.

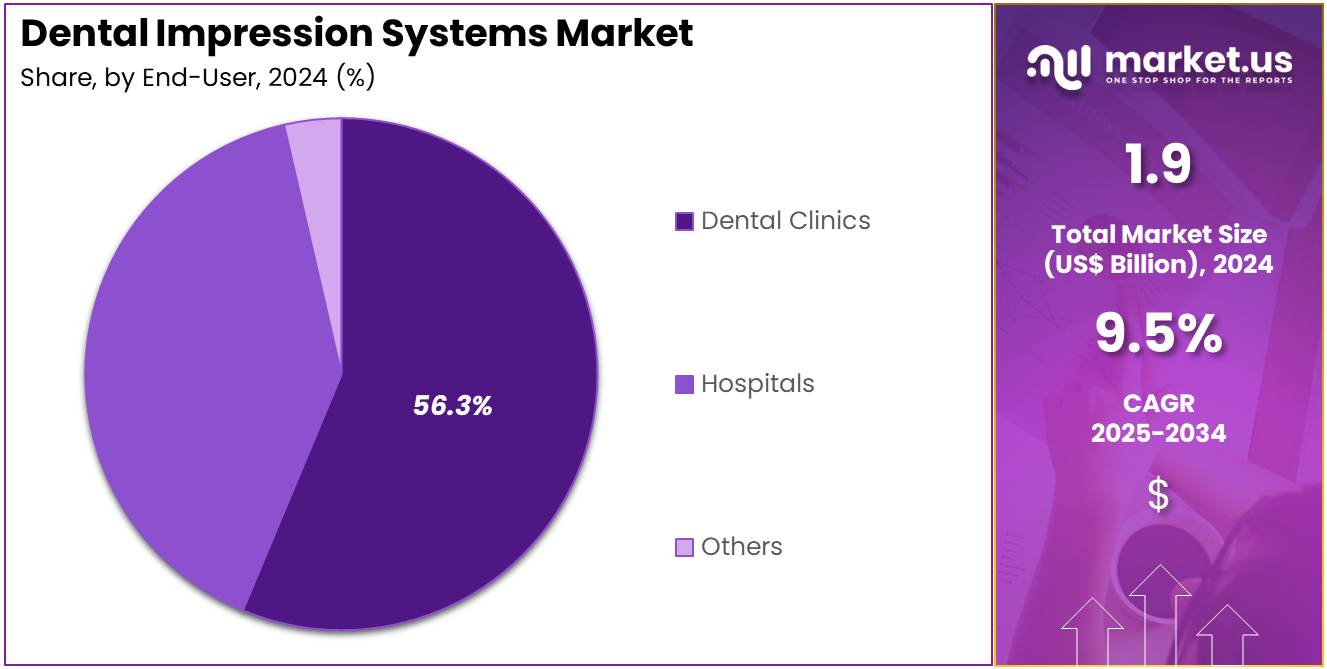

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, dental clinics, and others. The dental clinics sector stands out as the dominant player, holding the largest revenue share of 56.3% in the dental impression systems market.

- North America led the market by securing a market share of 39.7% in 2024.

Product Type Analysis

The impression materials segment holds the largest share of the dental impression systems market, capturing a significant 45.2%. This dominance is expected to continue, as these materials are the foundational components for creating precise dental impressions. The accuracy of these impressions is vital for the fabrication of high-quality dental restorations, including crowns, bridges, and dentures. This segment’s growth is directly tied to the increasing demand for both aesthetically pleasing and functionally superior dental work.

As dental procedures become more sophisticated and individualized, the need for advanced materials, such as vinyl polysiloxane (VPS) with its superior accuracy, will only grow. Innovations are also a key driver, with ongoing developments leading to materials with quicker setting times, better elasticity, and enhanced moisture resistance. The prevalence of these procedures is considerable; for example, the American College of Prosthodontists reports that approximately 2.3 million implant-supported crowns are produced in the US every year, showcasing the significant and sustained demand for these materials.

Application Analysis

The restorative and prosthodontics dentistry segment leads the application market with a commanding 58.4% share. This growth is a direct result of the increasing number of dental procedures aimed at restoring lost or damaged teeth. The global aging population and a heightened awareness of the importance of dental health are driving a surge in demand for treatments like crowns, bridges, implants, and dentures.

The prevalence of tooth loss, whether due to age, periodontal disease, or accidents, combined with rising disposable incomes and a growing focus on cosmetic dentistry, continues to propel this segment forward. The trend toward digital dentistry, particularly the use of CAD/CAM systems, further fuels this growth by requiring highly accurate impressions. A significant portion of this demand is from adults, with a CDC study noting that approximately 26% of adults aged 20-64 have untreated tooth decay, indicating a substantial need for restorative procedures across a wide demographic.

End-User Analysis

Dental clinics constitute the largest end-user segment in the dental impression systems market, holding a 56.3% share. This segment’s leading position is expected to strengthen, as hospitals are the primary venues for complex and advanced dental procedures, particularly those involving extensive restorative treatments. Hospitals are increasingly investing in cutting-edge dental technologies, including digital impression systems and intraoral scanners, to enhance patient outcomes, improve workflow efficiency, and reduce procedure times.

The demand for comprehensive dental work, such as implants and reconstructions, is rising, and hospitals are often the preferred choice for patients due to their ability to provide integrated and multidisciplinary care. The World Health Organization (WHO) has also highlighted the significant burden of oral diseases, noting that severe periodontal disease affects a large portion of the global population, which often necessitates complex surgical and restorative work best handled in a hospital setting. This integration of dental and medical services is expected to further drive growth within hospital-based dental practices and their reliance on sophisticated impression systems.

Key Market Segments

By Product Type

- Impression Materials

- Impression Trays

- Intraoral Scanners

- Others

By Application

- Restorative & Prosthodontics Dentistry

- Orthodontics

By End-user

- Hospitals

- Dental Clinics

- Others

Drivers

The increasing demand for aesthetic and cosmetic dentistry is driving the market

The escalating demand for aesthetic and cosmetic dental procedures is a significant driver for the dental impression systems market. Patients are increasingly seeking treatments such as veneers, crowns, bridges, and clear aligners to improve the appearance of their smiles. These procedures require highly accurate impressions to ensure a precise fit and aesthetically pleasing outcome.

The use of advanced systems, particularly digital impression scanners, caters directly to this demand by providing superior accuracy and detail compared to traditional methods. A 2024 report by the American Dental Association’s Health Policy Institute (ADA HPI) reported that national dental care expenditures amounted to $174 billion in 2023, up 2.5% from 2022. This overall increase in spending reflects a robust and growing demand for a wide range of dental services, including high-value cosmetic procedures that rely on precise impression technology.

The ADA HPI’s Q4 2024 economic outlook also noted that dental practices are seeing a sustained demand for cosmetic procedures, with patient volume remaining a top priority for dentists. This trend, driven by both functional needs and aesthetic desires, has created a robust and growing market for advanced impression systems that can deliver the precision and quality required for modern cosmetic dentistry.

Restraints

The high initial cost and a significant learning curve are restraining the market

A significant restraint on the market’s growth is the high initial investment required to acquire advanced systems, particularly intraoral scanners, and the steep learning curve associated with their implementation. While digital systems offer numerous advantages, their high price point can be a substantial barrier for many dental practices, especially smaller, independent clinics or those in developing regions. A 2024 report by the ADA HPI found that increasing expenses and overhead costs were a key concern for 45.7% of dentists, with the cost of new equipment being a major contributing factor.

Beyond the financial cost, integrating these new technologies into existing workflows requires extensive training for dentists and staff. A study published in a 2025 academic journal noted that while students’ knowledge and attitudes toward digital systems improved with experience, less than half of the students reported using intraoral scanners in clinical settings, indicating that the educational and practical integration of these technologies still faces significant hurdles. This combination of financial and educational barriers slows the overall adoption rate and limits market penetration.

Opportunities

The growing adoption of digital dentistry and CAD/CAM technology is creating growth opportunities

The accelerating adoption of digital dentistry and computer-aided design/computer-aided manufacturing (CAD/CAM) technology presents a major opportunity for the dental impression systems market. Digital impression systems are the foundational component of a fully digital workflow, enabling seamless integration with CAD/CAM software and in-house milling machines or 3D printers. This integration streamlines the entire restorative process, from scanning to fabrication, leading to improved efficiency and faster turnaround times.

A 2024 report from a key industry source noted that the digital dentistry market was valued at approximately $6 billion, with a significant portion of this growth attributed to the increasing adoption of intraoral scanners and other digital tools. Furthermore, a 2024 study in Nature Medicine highlighted the increasing use of AI-powered diagnostic tools in dentistry, which rely on the highly detailed digital models created by these systems. This synergy between digital impression systems and other advanced technologies creates a compelling value proposition for dental practices, driving the transition away from traditional methods and generating substantial growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the operational landscape for manufacturers and suppliers in the dental impression systems market. Global inflationary pressures have increased the cost of raw materials, energy, and skilled labor, placing upward pressure on the price of both traditional and digital impression materials and hardware components.

A 2025 report on global medical trends found that the global average medical trend rate, which includes price inflation and technology advances, is projected to be 10.0%, marking a second consecutive year of double-digit increases. This can compress profit margins for companies and lead to higher costs for dental practices, potentially impacting the budget for new equipment purchases. Concurrently, geopolitical tensions can disrupt intricate global supply chains. A company’s reliance on specific regions for critical materials can be jeopardized by trade disputes or logistical challenges, forcing a strategic shift toward more diversified sourcing and localized production.

The industry is successfully navigating this complex environment by prioritizing operational efficiency and strategic procurement. Companies with resilient supply chains and the ability to absorb or mitigate these cost pressures are better positioned to maintain stability and profitability, demonstrating that an agile and proactive approach can ensure a positive trajectory.

The current United States tariffs are creating a challenging dynamic for the supply chain. The imposition of new duties on various imported components and finished goods from key trading partners has increased the landed cost of these products. These tariffs, which in 2025 included a 10% baseline tariff on many imported goods and a 25% tariff on specific medical devices, are passed down the supply chain, affecting distributors’ margins and ultimately leading to higher prices for dental practices.

This can reduce the profitability of implementing new digital solutions and increase the cost to the end consumer, negatively impacting access to care and slowing the adoption of innovative technologies. For instance, the medical technology trade association AdvaMed has made public appeals to the White House to exempt devices from these tariffs due to their potential to disrupt the healthcare supply chain.

However, these tariffs are also providing a competitive advantage to US-based manufacturers who are not subject to these import duties. As a result, some dental clinics are beginning to shift their purchasing toward domestically produced goods to ensure a more stable supply and predictable pricing. This dynamic is fostering domestic manufacturing and encouraging companies to invest in local production capabilities to bypass the tariff burden and strengthen their market position. The industry is responding with adaptive measures, seeking out new suppliers and optimizing logistics, which demonstrates a resilient path forward.

Latest Trends

The emphasis on enhanced patient comfort and experience is a recent trend

A notable trend observed in 2024 and 2025 is the growing emphasis on enhancing patient comfort and overall experience through the use of advanced impression systems. Traditional impression methods using trays and gooey materials are often messy, uncomfortable, and can trigger a gag reflex in many patients. Digital intraoral scanners, by contrast, offer a non-invasive, quick, and highly comfortable alternative. This patient-centric approach is becoming a key differentiator for dental practices.

A 2024 survey by a dental health publication found that patient satisfaction with the impression process significantly increased when a digital scanner was used, with many patients expressing a preference for the technology. Another 2024 study in the Journal of Clinical and Diagnostic Research showed that digital impressions were perceived as more comfortable than conventional impressions, leading to a more positive patient experience. This focus on comfort is influencing purchasing decisions for dental practices, as they seek to attract and retain patients by offering a superior and more pleasant treatment journey.

Regional Analysis

North America is leading the Dental Impression Systems Market

The dental impression systems market in North America held a significant revenue share of 39.7% in 2023, largely due to the region’s advanced dental infrastructure and a high degree of technological adoption. The United States, in particular, leads the market, leveraging its extensive network of dental clinics and hospitals equipped with modern impression systems. This is supported by a strong emphasis on preventive and restorative dentistry, driven by the prevalence of oral health issues.

For example, the CDC’s 2024 Oral Health Surveillance Report indicates that nearly 26% of adults aged 20-64 have untreated dental caries, a condition that frequently necessitates the use of dental impression systems for effective treatment planning. The region’s market expansion is further fueled by a growing demand for cosmetic dentistry and digital solutions that promise enhanced accuracy and efficiency.

The market’s dominance is also reinforced by the sheer size of the dental professional workforce. According to the American Dental Association, there were 202,304 professionally active dentists in the US as of 2023, with a ratio of over 60 dentists per 100,000 people. This high density of practitioners supports a greater volume of dental procedures, which in turn drives the demand for both traditional and digital impression systems. The adoption of digital dentistry is also on the rise, with a 2021 ADA survey revealing that 55.5% of US dental practices use intraoral scanners, highlighting a clear shift toward more advanced and patient-friendly solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dental impression systems market in Asia Pacific is anticipated to exhibit the fastest growth over the forecast period. This is primarily due to a rising demand for cosmetic dentistry and an increasing prevalence of dental diseases. For instance, the World Health Organization estimates that untreated dental caries in permanent teeth is one of the most common ailments globally, with a significant burden in the Western Pacific Region, which includes many Asian nations. The region’s expanding middle class and a growing acceptance of dental care as a vital component of overall health also contribute to market expansion. Key players are making strategic investments, including new product launches and R&D activities, to capitalize on this burgeoning market.

Significant growth is expected in key countries within Asia Pacific, driven by unique demographic and technological trends. In Japan, the market benefits from a proactive adoption of Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) technology, which emphasizes precision and efficiency in dental prosthetics.

Furthermore, the aging population is a major driver, with nearly 30% of Japan’s population being aged 65 or older in 2022, according to the Statistics Bureau of Japan, creating a vast need for dental restorations. Meanwhile, in India, a growing demand for cosmetic dentistry and the rise of dental tourism, where patients seek high-quality, affordable care, are expected to fuel market growth. The increasing number of dental laboratories and a shift toward innovative technologies are also providing significant growth opportunities across the entire region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the dental impression systems market are implementing multifaceted growth strategies centered on innovation, partnerships, and market expansion. They are heavily investing in digital solutions like advanced intraoral scanners and CAD/CAM systems, which are increasingly favored for their precision and efficiency. A key trend in the industry is the integration of AI for more precise diagnostics and the use of cloud-based storage for digital impressions.

To increase their market footprint, these companies are also pursuing strategic mergers and acquisitions to quickly expand their product portfolios and geographical reach, particularly in high-growth regions like Asia-Pacific. Furthermore, they are focused on building brand loyalty and ensuring widespread adoption through targeted educational programs and collaborations with dental professionals.

3M Oral Care is a major participant in the dental impression systems market. The company offers a broad portfolio of dental solutions, with a strong focus on advanced materials science and digital dentistry. 3M has a global presence and is known for its long-standing history of leadership and a scientific approach to product development, creating solutions that simplify dental procedures and lead to predictable clinical outcomes. Their product catalog includes not only impression materials but also a wide range of other dental products, such as restoratives and orthodontics, which enables them to serve a diverse customer base and maintain a competitive edge.

Top Key Players in the Dental Impression Systems Market

- Ultradent Products Inc

- Septodont Holding

- Mitsui Chemicals

- Ivoclar Vivadent

- Henry Schein Inc.

- Envista (Kerr Corporation)

- Dentsply Sirona

- Coltene Group

- 3Shape

- 3M

Recent Developments

- In April 2024: Medit introduced its innovative i900 Intraoral Scanning System, designed to provide faster, more precise scans with superior quality. The device boasts a sleek aesthetic and features an intuitive Touch Band and Touch Pad, streamlining the scanning experience by enhancing speed, accuracy, and patient comfort. Integrated with Medit Link, the system seamlessly connects with other platforms, offering improved operational efficiency and optimized patient care.

- In September 2022: 3Shape launched the TRIOS 5 Wireless, an advanced intraoral scanner incorporating ScanAssist technology for enhanced scanning precision and improved infection control. The TRIOS 5 is the smallest and lightest model in the TRIOS series, featuring a hygienic, compact design and over fifty usability improvements. It integrates effortlessly with the 3Shape Unite platform, providing access to a wide range of dental solutions and applications, and includes TRIOS Share, enabling wireless scanning across multiple PCs in the practice.

- In October 2022: DEXIS unveiled its DEXIS IS Intraoral Scanning portfolio, marking a major milestone in dental technology. The portfolio blends cutting-edge software with award-winning scanning devices, aiming to optimize dental workflows by supporting practices through every stage of the scanning process.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 4.7 billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Impression Materials, Impression Trays, Intraoral Scanners, and Others), By Application (Restorative & Prosthodontics Dentistry and Orthodontics), By End-user (Hospitals, Dental Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ultradent Products Inc, Septodont Holding, Mitsui Chemicals, Ivoclar Vivadent, Henry Schein Inc., Envista (Kerr Corporation), Dentsply Sirona, Coltene Group, 3Shape, 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Impression Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Impression Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ultradent Products Inc

- Septodont Holding

- Mitsui Chemicals

- Ivoclar Vivadent

- Henry Schein Inc.

- Envista (Kerr Corporation)

- Dentsply Sirona

- Coltene Group

- 3Shape

- 3M