Global Date Powder Market Size, Share, And Enhanced Productivity By Product Type (Organic Date Powder, Conventional Date Powder, Instant Date Powder), By Application (Food and Beverage, Nutraceuticals, Cosmetics, Others), By End-User (Household, Food Service and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176004

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

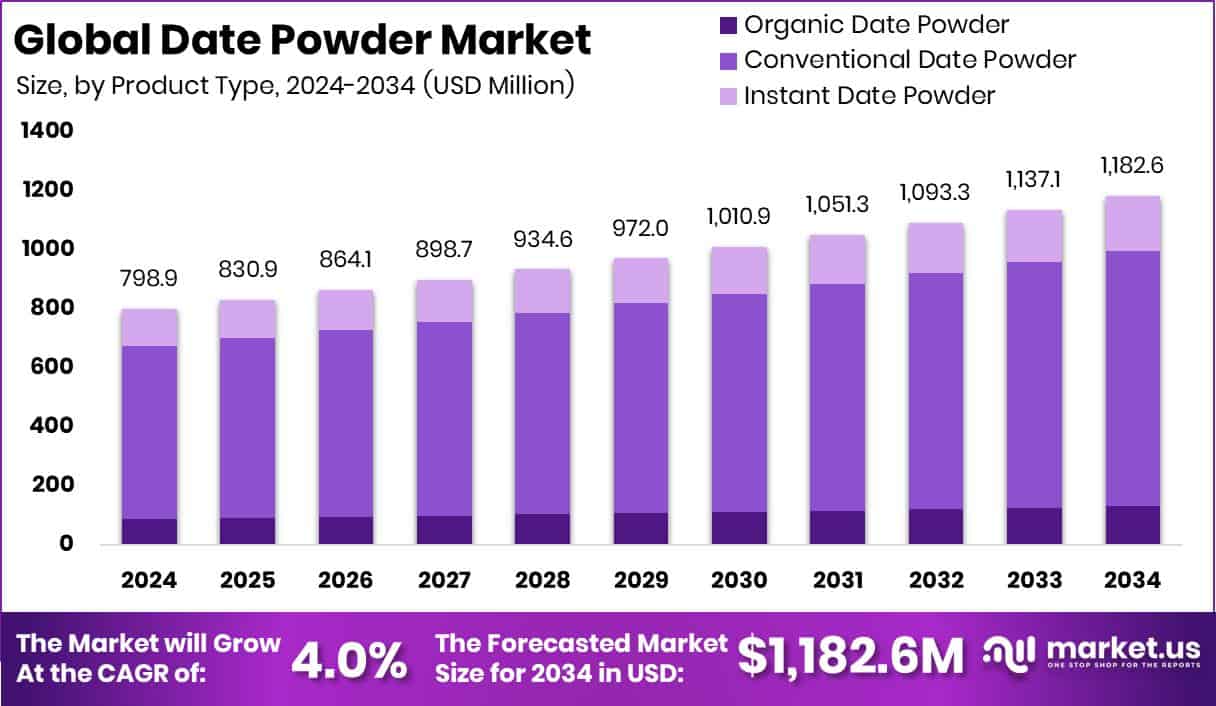

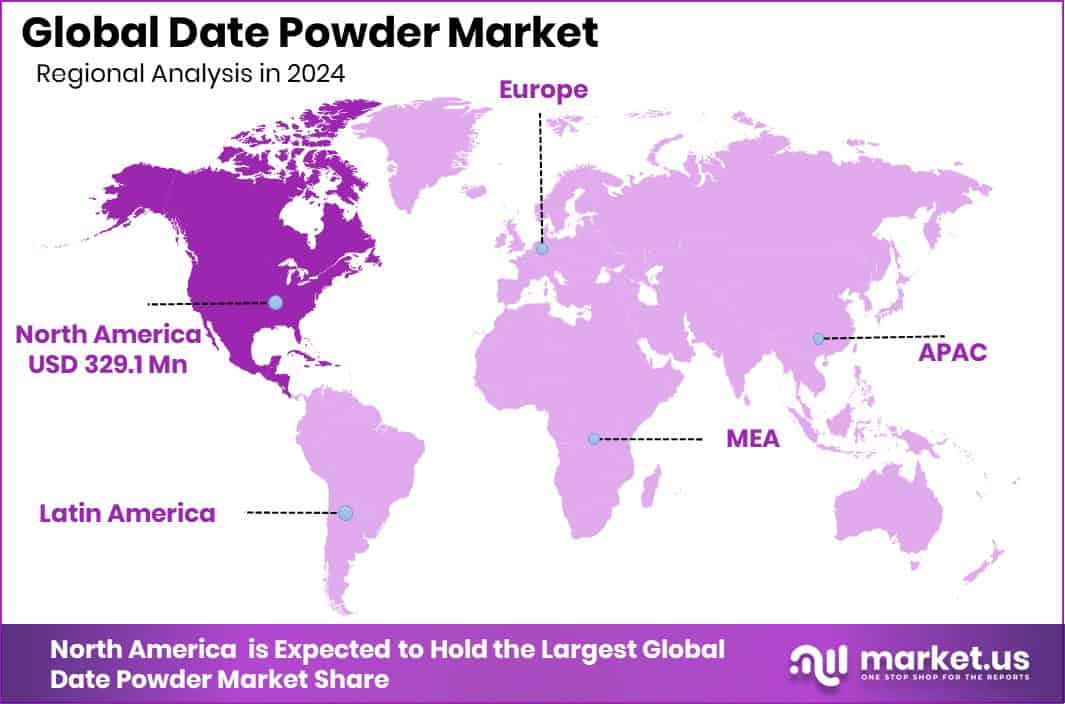

The Global Date Powder Market is expected to be worth around USD 1,182.6 million by 2034, up from USD 798.9 million in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. The Date Powder Market strengthened in North America at 41.2%, achieving USD 329.1 Mn revenue.

The Date Powder Market represents a growing segment within natural sweeteners, shaped around evolving food preferences and rising interest in clean-label ingredients. Date powder itself is a finely milled product made from dried dates, valued for its natural sweetness, mild caramel flavor, and nutrient content. It dissolves well, blends easily, and works as an alternative to refined sugar across food, beverage, nutraceutical, and cosmetic formulations. This versatility has helped establish a stable consumer base for both household and industrial use.

The broader Date Powder Market reflects the increasing shift toward plant-based ingredients, supported by expanding applications in packaged foods, nutritional blends, and beauty formulations. Growth is also encouraged by rising production of organic, conventional, and instant date powder varieties, which cater to different processing needs and product types. Interest in natural sweeteners continues to rise as consumers look for healthier sugar replacements that maintain flavor and functionality.

Demand gains strength due to the clean-label movement and the need for minimally processed ingredients. Industries prefer date powder because it offers sweetness without additives, making it suitable for modern product development. Household adoption has also grown through its use in baking, beverages, and everyday cooking.

Opportunities expand as global investments support ingredient innovation. Funding announcements such as $3 million for equipment expansion at Advanced Powder Products, climate-related reserves like $86 billion and $82 billion in dry powder allocations, and a $100 million donation reinforcing long-term initiatives demonstrate how capital availability encourages growth. These financial signals indirectly support sectors that depend on natural and sustainable ingredient sources, creating a favorable environment for markets like date powder.

Key Takeaways

- The Global Date Powder Market is expected to be worth around USD 1,182.6 million by 2034, up from USD 798.9 million in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- The Date Powder Market grows strongly as conventional date powder holds 73.3% market share.

- Rising use in beverages drives the Date Powder Market, with food and beverage dominating 69.5%.

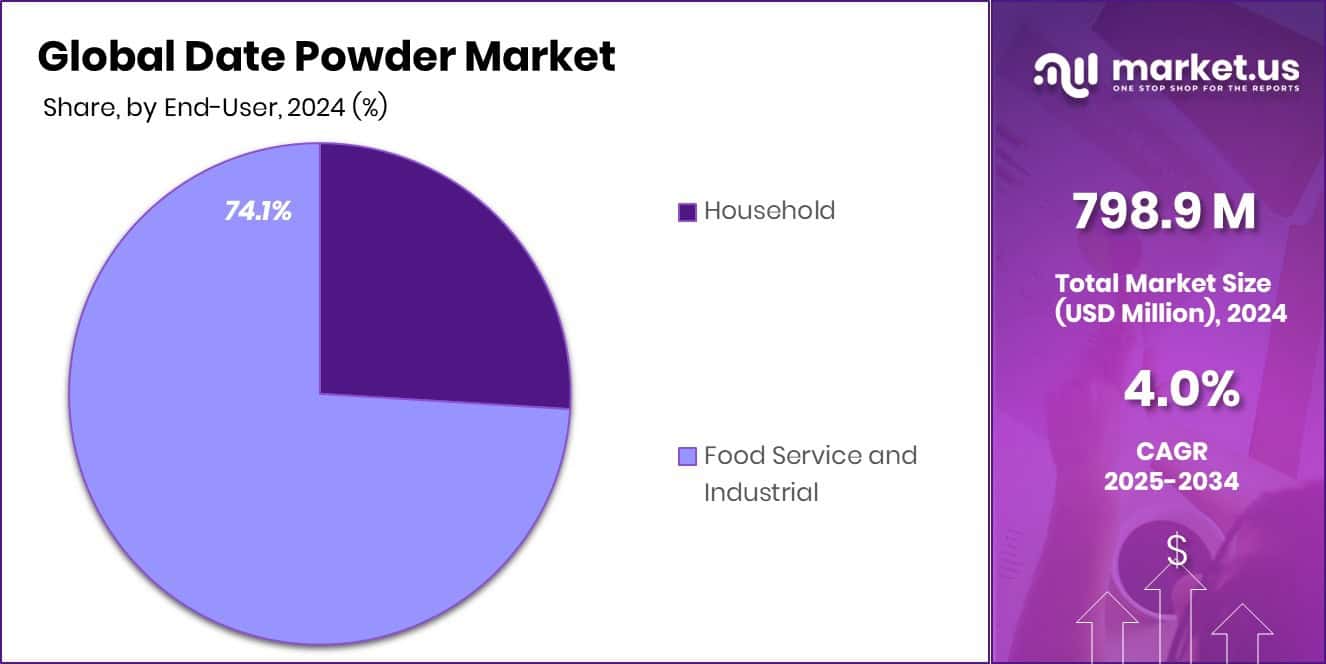

- Expanding bulk demand boosts the Date Powder Market as food service and industrial users reach 74.1%.

- In 2024, North America dominated with 41.2%, reaching USD 329.1 Mn value overall.

By Product Type Analysis

Conventional date powder leads the Date Powder Market with a strong 73.3% share.

In 2024, the Date Powder Market saw Conventional Date Powder hold a dominant 73.3% share, driven by its affordability and wide adoption across mainstream food production. Manufacturers prefer conventional variants because they offer reliable sweetness, longer shelf life, and stable supply volumes compared to organic alternatives.

Food processors, especially in bakery, confectionery, and cereal manufacturing, continue using date powder as a clean-label sweetener that aligns with global sugar-reduction trends. The cost efficiency of conventional date powder makes it more suitable for large-scale industrial applications, where consistent flavor and bulk purchasing are essential. As consumers seek natural replacements for refined sugar, conventional varieties remain the first choice for companies aiming to balance nutrition, taste, and production costs.

By Application Analysis

Food and beverage applications dominate the Date Powder Market, capturing a notable 69.5% share.

In 2024, the Food and Beverage segment commanded 69.5% of the Date Powder Market, reflecting its widespread integration into packaged foods and beverage formulations. Date powder is increasingly used as a natural sweetener in smoothies, dairy alternatives, flavored drinks, bakery items, snack bars, and ready-to-eat meals. Food brands appreciate that it enhances sweetness without adding artificial ingredients, supporting the clean-label movement and regulatory pressure to limit added sugars.

Beverage manufacturers have also adopted date powder to enrich flavor profiles while offering a low-glycemic alternative. Its ease of blending, long shelf life, and stable texture make it a preferred ingredient. As consumer demand for healthier, plant-based, and minimally processed products grows, the food and beverage industry continues driving major uptake.

By End-User Analysis

Food service and industrial users significantly drive the Date Powder Market with 74.1% share.

In 2024, the Food Service and Industrial sector dominated the Date Powder Market with 74.1%, reflecting strong usage in large-scale kitchens, bakeries, confectionery plants, and processed food factories. Industrial buyers value date powder for its ability to replace sugar syrups while reducing storage and handling challenges. Restaurants and café chains increasingly incorporate date powder into desserts, beverages, and bakery preparations to offer healthier menu options without compromising taste.

Its versatility across sauces, marinades, smoothies, and bakery mixes supports consistent output in high-volume operations. Additionally, manufacturers appreciate its cost-effectiveness and ability to maintain product quality during mass production. This broad functionality firmly positions the food service and industrial segment as the leading demand generator in 2024.

Key Market Segments

By Product Type

- Organic Date Powder

- Conventional Date Powder

- Instant Date Powder

By Application

- Food and Beverage

- Nutraceuticals

- Cosmetics

- Others

By End-User

- Household

- Food Service and Industrial

Driving Factors

Rising demand for natural sweeteners globally

The Date Powder Market continues to grow as consumers shift toward natural sweeteners, and this rising demand shapes the overall momentum of the industry. People prefer ingredients that offer sweetness without artificial additives, making date powder a reliable option across foods, beverages, and household use. This change in consumer preference aligns with the broader clean-label movement seen worldwide.

The sector also benefits indirectly from supportive investment patterns, such as Protein Brand David closing a $75 million Series A funding round, which reflects the flow of capital into nutrition-focused and ingredient-driven industries. Such financial activity strengthens the environment for natural sweetener adoption, contributing to the long-term expansion of date-based ingredients.

Restraining Factors

Limited sourcing of premium date varieties

The market still faces challenges, especially due to limited availability of premium date varieties required for high-quality powder production. Variations in climate, seasonal yield, and sourcing constraints often restrict access to consistent raw materials, slowing the pace of industrial-scale manufacturing.

Producers must balance quality with affordability, which becomes more difficult when supply inconsistencies occur. These limitations indirectly mirror funding activity seen in the broader nutrition sector, such as Zingavita securing Rs 10 crore from Anicut Capital, demonstrating that while nutritional demand grows, companies still require financial support to overcome resource and operational constraints. Similar pressures affect date powder suppliers as they navigate sourcing issues.

Growth Opportunity

Expanding use in functional food formulations

Date powder is finding strong opportunities in functional foods, where manufacturers look for natural ingredients that offer both flavor and nutrition. Its ability to blend well into bars, powdered mixes, dairy alternatives, and meal supplements makes it a valuable component in modern product development.

As consumers seek healthier formulations, the potential for date powder grows across multiple industries. This aligns with broader funding interest in health-focused innovation, such as Other Half Pet raising $3 million in a seed round led by Willow Growth, showing how investment continues to support science-backed and clean-ingredient categories. Such capital flows indirectly encourage innovation across sectors that value natural, nutrient-rich ingredients like date powder.

Latest Trends

Increasing shift toward instant date powder

One of the most visible trends in the Date Powder Market is the shift toward instant date powder, which dissolves faster and meets the needs of modern formulations. Manufacturers and households appreciate its convenience, making it suitable for beverages, bakery mixes, and ready-to-cook products. This trend aligns with growing demand for quick-integrating natural sweeteners that maintain authenticity without chemical enhancers.

Innovation around instant formats mirrors advancements seen in related industries, such as ExoLab Italia securing €5 million to scale plant exosome innovation, highlighting how investment is pushing food and ingredient technology forward. As processing methods improve, instant date powder continues gaining attention as a preferred choice in evolving food trends.

Regional Analysis

North America held 41.2% share, generating USD 329.1 Mn in the Date Powder Market.

North America led the global Date Powder Market with a strong 41.2% share, valued at USD 329.1 Mn, reflecting the region’s mature food processing ecosystem and high adoption of natural sweeteners across packaged foods, beverages, and industrial formulations. The market benefits from strong demand for clean-label ingredients and sugar alternatives within the U.S. and Canada.

Europe followed with steady usage of date powder in bakery, cereals, and plant-based beverages, supported by consumer interest in healthier carbohydrate sources. Asia Pacific continued to expand due to rising incorporation of date-based ingredients in snacks and ready-to-drink products across developing markets.

Meanwhile, the Middle East & Africa region maintained consistent consumption, driven by traditional use of dates in various food preparations. Latin America showed moderate growth as food manufacturers gradually increased adoption of fruit-derived sweeteners for mainstream applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Al Barakah Dates Factory L.L.C. remained one of the most influential suppliers, leveraging its large-scale date processing infrastructure and wide product portfolio. The company’s ability to maintain consistent quality and supply reliability helped it stay a preferred partner for food and beverage producers. Its advanced drying and milling capabilities supported the stable growth of date powder applications across bakery, beverage mixes, and industrial formulations.

Sharmeen Foods strengthened its position through deep regional sourcing networks and a focus on premium-grade date products. Its capability to supply bulk quantities while maintaining natural nutritional properties helped the company serve both domestic and export markets. Sharmeen Foods continued receiving demand from buyers seeking clean and unrefined sweetening ingredients.

GNS Pakistan contributed significantly by offering cost-effective and versatile date powder suitable for large food manufacturers. Its strong operational base and emphasis on maintaining purity and natural sweetness allowed it to cater to rising global interest in fruit-derived sweeteners.

Top Key Players in the Market

- Al Barakah Dates Factory L.L.C.

- Sharmeen Foods.

- GNS Pakistan

- Mevive International.

- NVR Nutrition Pvt. Ltd.

- Sarika Ventures Pvt Ltd.

- Arat Company Pjs.

- VHAfoods

- Miresi

Recent Developments

- In June 2025, GNS Pakistan highlighted availability of premium date products including Date Powder alongside pitted dates and diced formats on its official product listings. This update emphasized the company’s continued focus on broadening its Aseel Date Powder offerings for food manufacturers and exporters.

- In March 2025, Sarika Ventures Pvt Ltd showcased its Dates Powder, Date Syrup, and Date Paste at AAHAR 2025 in New Delhi. This participation highlighted the company’s plant-based sweetener products—including Date Powder—aimed at food manufacturers and retail buyers.

Report Scope

Report Features Description Market Value (2024) USD 798.9 Million Forecast Revenue (2034) USD 1,182.6 Million CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Date Powder, Conventional Date Powder, Instant Date Powder), By Application (Food and Beverage, Nutraceuticals, Cosmetics, Others), By End-User (Household, Food Service and Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Al Barakah Dates Factory L.L.C., Sharmeen Foods., GNS Pakistan, Mevive International., NVR Nutrition Pvt. Ltd., Sarika Ventures Pvt Ltd., Arat Company Pjs., VHAfoods, Miresi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Al Barakah Dates Factory L.L.C.

- Sharmeen Foods.

- GNS Pakistan

- Mevive International.

- NVR Nutrition Pvt. Ltd.

- Sarika Ventures Pvt Ltd.

- Arat Company Pjs.

- VHAfoods

- Miresi