Global Corn Gluten Meal Market Size, Share, And Business Benefits By Process (Wet Milling Process, Dry Milling Process), By Form (Unprocessed, Granulated, Pelletized), By Livestock (Poultry, Ruminants, Swine, Aquaculture, Others), By End Use (Livestock, Pet Food, Food and Beverage, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152171

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

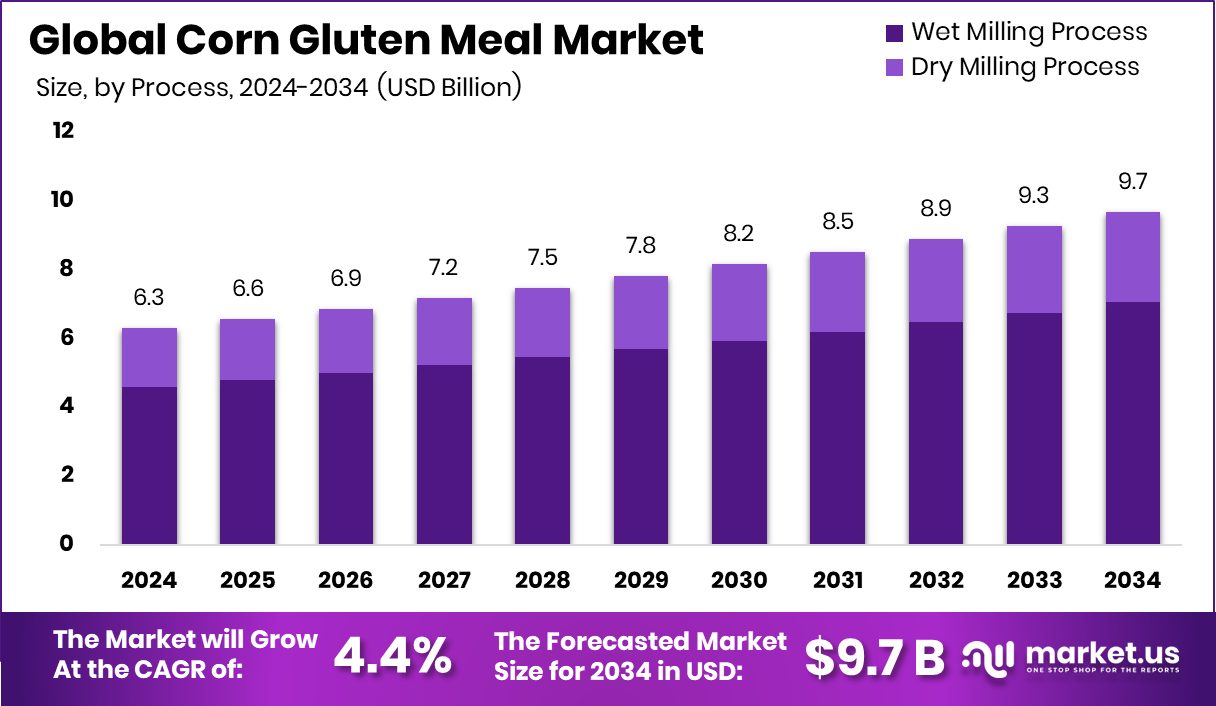

Global Corn Gluten Meal Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.3 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034. Strong livestock production and feed demand continue to drive growth across North America, 42.9% significantly.

Corn gluten meal is a byproduct derived during the wet milling process of corn, primarily after starch extraction. It is rich in protein—usually around 60%—and is widely used in animal and aquaculture feed due to its high digestibility and nutritional value. This yellow, powdery substance is also employed in horticulture as a natural pre-emergent herbicide, particularly in organic farming. It does not contain actual gluten, despite its name, and is not suitable for human consumption.

The corn gluten meal market represents the global trade and consumption of this protein-rich byproduct, primarily within the animal feed and agriculture sectors. Its demand is directly tied to livestock production, pet nutrition trends, and organic farming practices. With the rise in global meat consumption, especially in developing economies, the market has witnessed steady growth. According to an industry report, Partake Foods secured $11.5 million through its Series B funding round.

The market is growing due to increasing livestock farming and aquaculture activities across Asia Pacific, Latin America, and parts of Africa. Rising protein requirements in animal feed are driving preference for corn gluten meal over lower-protein alternatives. Moreover, as feed costs rise, producers seek high-efficiency, protein-rich feed inputs that improve weight gain and animal health. According to an industry report, Meal delivery company Thistle successfully raised $10.3 million in fresh funding.

Growing meat and dairy consumption is propelling demand for protein-rich feed ingredients. Corn gluten meal fits this need by offering a concentrated protein source that enhances growth and feed conversion rates. Additionally, the rising demand for pet food products that contain digestible plant proteins has also contributed to its rising consumption. According to an industry report, Ready, Set, Food received a $3 million investment, with Danone’s venture capital arm leading the round.

Key Takeaways

- Global Corn Gluten Meal Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.3 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, the wet milling process dominated the Corn Gluten Meal Market with a 72.8% share.

- Granulated form led the market in 2024, capturing 52.7% due to ease of mixing in feed.

- The poultry segment held the largest livestock share at 48.2%, driven by rising demand for poultry meat.

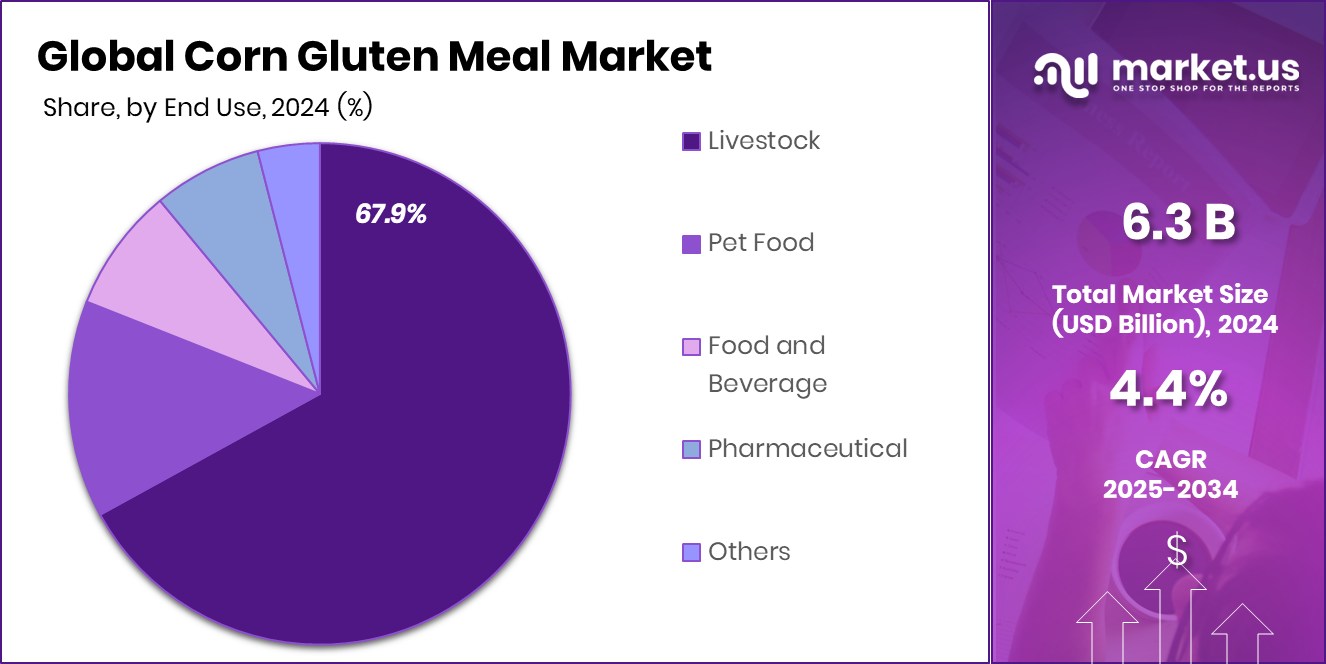

- Livestock feed remained the dominant end-use sector in 2024, accounting for 67.9% of total market consumption.

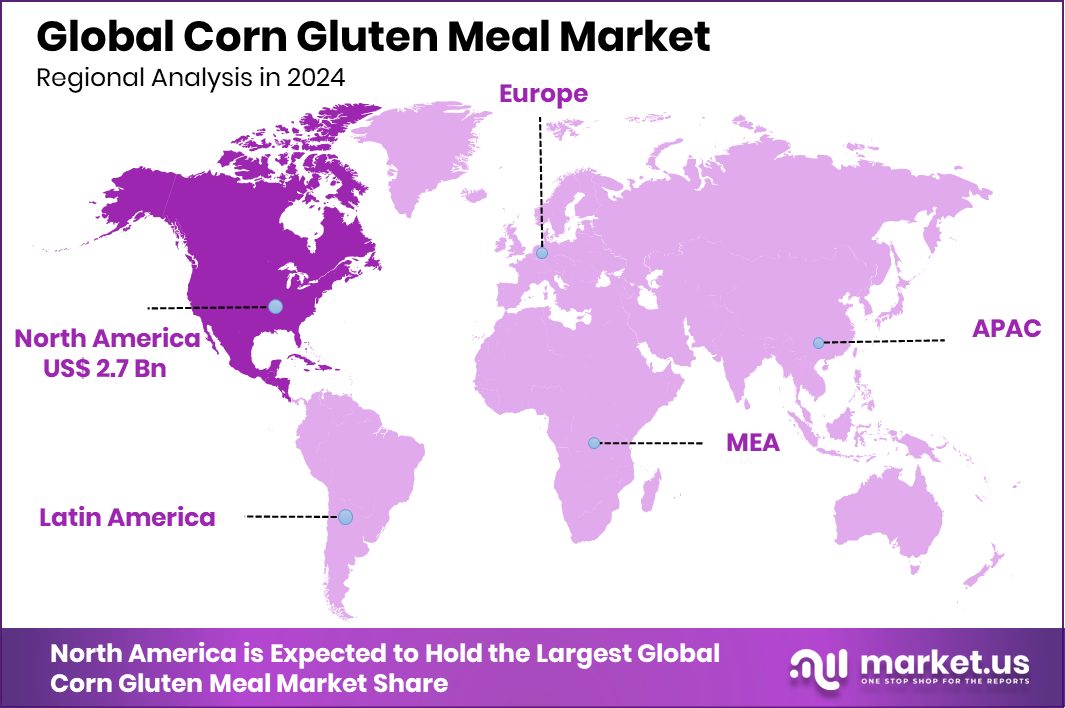

- The North American market was valued at approximately USD 2.7 billion during the year.

By Process Analysis

Wet milling process dominates the Corn Gluten Meal Market with 72.8%.

In 2024, Wet Milling Process held a dominant market position in the By Process segment of the Corn Gluten Meal Market, with a 72.8% share. This substantial dominance is attributed to the efficiency and scalability of the wet milling method, which allows for the comprehensive extraction of valuable components from corn, including starch, fiber, germ, and gluten meal.

The wet milling process enables the production of high-protein corn gluten meal, making it highly suitable for use in animal feed, aquaculture, and pet food industries. Its ability to produce a consistent and high-quality protein concentrate has reinforced its preference among feed manufacturers globally.

Moreover, the wet milling process supports large-scale industrial output, aligning well with the needs of commercial feed operations and agro-industrial applications. This process is particularly advantageous in regions with abundant corn production and advanced grain processing infrastructure, where it ensures cost-effectiveness and product uniformity.

The 72.8% market share held by wet milling in 2024 underscores its central role in meeting the global demand for protein-rich feed ingredients. As feed industries continue to prioritize quality and nutritional efficiency, the reliance on wet milling is expected to remain significant, maintaining its leadership in the process segment of the corn gluten meal market.

By Form Analysis

Granulated form leads Corn Gluten Meal Market with 52.7% share.

In 2024, Granulated held a dominant market position in the By Form segment of the Corn Gluten Meal Market, with a 52.7% share. This leading position is primarily due to the ease of handling, storage stability, and application efficiency that granulated corn gluten meal offers, especially in large-scale feed manufacturing and agricultural settings.

The granulated form ensures minimal dust formation during processing and transportation, which is a significant advantage for feed producers and distributors aiming to maintain operational cleanliness and reduce material loss.

Its uniform particle size contributes to better mixing with other feed components, enhancing overall feed quality and consistency. This characteristic is especially valued in poultry and livestock feed, where balanced nutrition and digestibility are critical. Moreover, granulated corn gluten meal is easier to store over long periods without degradation in quality, which adds to its logistical and economic appeal for bulk buyers and large-scale operations.

The 52.7% market share held by the granulated form in 2024 reflects its strong adoption in both domestic and export markets, particularly in regions emphasizing feed efficiency and production scalability. Its steady demand affirms granulated corn gluten meal as a preferred choice across key stakeholders in the feed and agricultural industries.

By Livestock Analysis

The poultry sector holds 48.2% of the Corn Gluten Meal Market usage.

In 2024, Poultry held a dominant market position in the By Livestock segment of the Corn Gluten Meal Market, with a 48.2% share. This dominance is largely driven by the widespread use of corn gluten meal as a high-protein, digestible ingredient in poultry diets, particularly for broilers and layers.

Its high energy content and amino acid profile make it an efficient feed additive, supporting rapid growth, egg production, and overall health in poultry. Feed manufacturers favor corn gluten meal for its consistency and nutritional value, which aligns well with the dietary needs of modern poultry farming systems.

The 48.2% share highlights poultry’s central role in global meat and egg production, where demand for protein-rich, cost-effective feed solutions remains strong. As the poultry industry continues to expand in both developed and emerging markets, the reliance on nutrient-dense feed components such as corn gluten meal becomes even more critical.

Additionally, the adaptability of corn gluten meal in various feed formulations contributes to its preference within poultry operations of different scales. The dominant position of the poultry segment in 2024 underscores the essential role of corn gluten meal in meeting the sector’s production efficiency and nutritional performance targets.

By End Use Analysis

Livestock end use captures 67.9% of Corn Gluten Meal Market.

In 2024, Livestock held a dominant market position in the By End Use segment of the Corn Gluten Meal Market, with a 67.9% share. This significant share is a reflection of the high demand for protein-rich feed ingredients in the livestock industry, especially in cattle, swine, and poultry farming.

Corn gluten meal, with its high protein content and digestibility, has become a preferred choice among livestock feed producers aiming to enhance growth rates, improve feed conversion efficiency, and support overall animal health. Its ability to provide a consistent source of energy and essential nutrients plays a crucial role in large-scale livestock operations where feed cost and productivity are closely monitored.

The 67.9% market share underlines the widespread adoption of corn gluten meal across diverse livestock farming systems, particularly in regions where meat and dairy production is expanding rapidly. As livestock farming remains central to global food supply chains, the demand for efficient feed inputs continues to grow.

Corn gluten meal’s compatibility with various livestock diets, coupled with its availability in large volumes, reinforces its strong position in the end-use category. The dominant share in 2024 confirms livestock as the leading application area, sustaining its critical role in the overall corn gluten meal demand landscape.

Key Market Segments

By Process

- Wet Milling Process

- Dry Milling Process

By Form

- Unprocessed

- Granulated

- Pelletized

By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

By End Use

- Livestock

- Pet Food

- Food and Beverage

- Pharmaceutical

- Others

Driving Factors

Rising Demand for High-Protein Animal Feed Globally

One of the main driving factors for the corn gluten meal market is the rising demand for high-protein animal feed across the world. As livestock and poultry farming continue to grow, especially in developing countries, farmers are increasingly looking for affordable and nutritious feed ingredients. Corn gluten meal, which contains about 60% protein, is widely used to improve animal growth and feed efficiency.

It supports better weight gain, enhances milk production in dairy cattle, and improves the overall health of poultry and livestock. With increasing global meat and dairy consumption, the need for protein-rich feed is rising. This growing demand directly boosts the use of corn gluten meal in feed formulations, making it a key growth driver.

Restraining Factors

Fluctuating Corn Prices Affecting Production Stability

One major restraining factor for the corn gluten meal market is the fluctuating prices of corn, which directly impact production costs and market stability. Since corn is the primary raw material used to produce corn gluten meal, any change in its price—due to weather conditions, export policies, or supply chain disruptions—can affect the overall cost and availability of corn gluten meal.

For feed manufacturers and livestock farmers, inconsistent pricing leads to budgeting challenges and lowers the attractiveness of corn gluten meal as a steady feed ingredient. These uncertainties often force producers to explore alternative protein sources. As a result, the unpredictability of corn prices remains a limiting factor for the consistent growth of the corn gluten meal market.

Growth Opportunity

Expansion into Organic and Sustainable Farming Markets

Corn gluten meal presents a strong growth opportunity through its use in organic and sustainable farming systems. As more farmers and gardeners seek natural methods to manage weeds, corn gluten meal offers an effective pre-emergent herbicide option free from synthetic chemicals. This aligns with the global trend toward sustainable agriculture and organic certification standards.

Its dual role as both a plant-based protein feed ingredient and a soil-friendly weed control agent enhances its appeal across farming sectors. Demand for eco-friendly farm products is rising in regions like North America and Europe, where environmental regulations favor natural alternatives. By expanding its presence in this niche, corn gluten meal can achieve new market growth and diversify its application beyond conventional animal feed.

Latest Trends

Increased Use in Natural Pet Food Ingredients

Corn gluten meal is being increasingly used in pet food as a natural, plant-based protein source, reflecting growing demand from pet owners for cleaner, healthier pet diets. Pet food makers have begun to replace artificial additives and lower-quality proteins with corn gluten meal, which is rich in essential amino acids and easy to digest.

This makes it ideal for both dry kibble and wet food formulations, especially in products marketed as natural or grain-inclusive alternatives. The trend is driven by pet owners’ concern over ingredient transparency and the health benefits of whole‑plant proteins. As pet humanization continues, this clean-label movement supports growth in the corn gluten meal market and encourages producers to develop pet‑focused feed options.

Regional Analysis

In 2024, North America led the corn gluten meal market with a 42.9% share.

In 2024, North America held a dominant position in the global corn gluten meal market, accounting for 42.9% of the total market share and reaching a value of approximately USD 2.7 billion. The region’s leadership is driven by its well-established livestock and poultry industries, which consistently demand high-protein feed ingredients. The presence of advanced feed processing infrastructure and widespread corn cultivation further supports the extensive production and consumption of corn gluten meal across the United States and Canada.

In Europe, demand is shaped by growing interest in sustainable and plant-based feed solutions, while regulatory frameworks encourage the use of naturally derived protein additives. The Asia Pacific region continues to be an important growth area, supported by expanding animal husbandry sectors and increasing feed production in countries such as China and India. Meanwhile, the Middle East & Africa region shows steady growth, underpinned by rising investments in livestock production to meet regional food security goals.

Latin America also contributes to the market through corn processing and agricultural export activities, particularly in Brazil and Argentina. Despite regional differences in growth pace, North America remains the dominant region in 2024, reflecting its strong production base and consistent consumption of corn gluten meal for animal nutrition.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company focused on leveraging its advanced corn wet milling facilities to ensure a consistent supply of high-protein gluten meal, aligning outputs with the growing demand from large-scale feed manufacturers. Meanwhile, Bunge Ltd. prioritized integrated logistics, enhancing regional distribution capabilities to serve domestic livestock producers efficiently and reduce supply chain delays.

Cargill, Inc. strengthened its market position by focusing on quality standards and feed safety protocols. Its emphasis on protein content uniformity and digestibility helped satisfy increasingly stringent feed requirements in poultry, swine, and cattle sectors. The organization also pursued partnerships with regional feed mills to optimize product availability in key markets.

Fox Forest Agriculture Limited, a more regionally focused participant, capitalized on niche market demands by supplying granulated corn gluten meal to medium-sized feed producers. Its agility in adjusting output volumes provided flexibility during periods of raw material price fluctuations. The company further distinguished itself by offering tailored batch sizes, appealing to small- and mid-scale livestock operations that prioritize cost-effective feed solutions.

Top Key Players in the Market

- Ag Processing Inc

- Archer Daniels Midland Company

- Bunge Ltd.

- Cargill, Inc.

- Fox Forest Agriculture Limited

- Gavdeo International Limited

- Grain Processing Corporation

- Gulshan Polyols Ltd.

- Ingredion

- JILIN COFCO BIO-CHEM AND BIO-ENERGY MARKETING CO., LTD

- Jungbunzlauer Suisse AG

- MGP Ingredients

- Tate Lyle

- The Andersons

Recent Developments

- In April 2025, Jungbunzlauer Suisse AG produces GMP+‑certified Corn Gluten Meal—a high‑protein, energy‑rich co‑product of corn wet‑milling that enhances egg‑yolk pigmentation (via xanthophyll), supports organic and aqua feed, and improves pet food digestibility, all while ensuring strict residue monitoring.

- In January 2024, Jungbunzlauer initiated a new Biogums facility in Port Colborne (Canada), leveraging corn wet milling by‑products, which include corn gluten meal, to support fermentation-based ingredient production.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 9.7 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Wet Milling Process, Dry Milling Process), By Form (Unprocessed, Granulated, Pelletized), By Livestock (Poultry, Ruminants, Swine, Aquaculture, Others), By End Use (Livestock, Pet Food, Food and Beverage, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ag Processing Inc, Archer Daniels Midland Company, Bunge Ltd., Cargill, Inc., Fox Forest Agriculture Limited, Gavdeo International Limited, Grain Processing Corporation, Gulshan Polyols Ltd., Ingredion, JILIN COFCO BIO-CHEM AND BIO-ENERGY MARKETING CO., LTD, Jungbunzlauer Suisse AG, MGP Ingredients, Tate Lyle, The Andersons Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ag Processing Inc

- Archer Daniels Midland Company

- Bunge Ltd.

- Cargill, Inc.

- Fox Forest Agriculture Limited

- Gavdeo International Limited

- Grain Processing Corporation

- Gulshan Polyols Ltd.

- Ingredion

- JILIN COFCO BIO-CHEM AND BIO-ENERGY MARKETING CO., LTD

- Jungbunzlauer Suisse AG

- MGP Ingredients

- Tate Lyle

- The Andersons