Global Coal Mining Market Size, Share, And Business Benefits By Type (Thermal Coal, Metallurgical Coal), By Grade (Bituminous Coal, Sub-Bituminous Coal, Lignite, Anthracite), By Mining Method (Surface Mining (Strip mining, Dredging, Open-pit Mining, Mountain Removal Mining, Highwall Mining), Underground Mining (Room and Pillar, Longwall Mining)), By End-Use (Thermal Power Generation, Cement Manufacturing, Steel Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144110

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

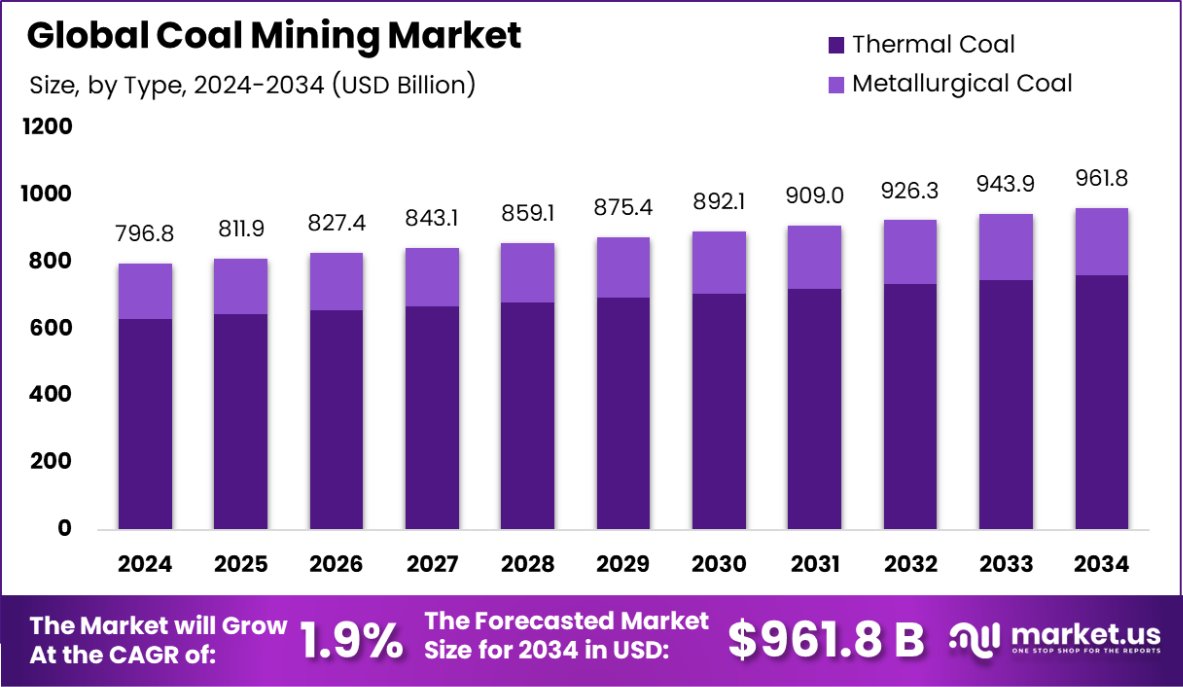

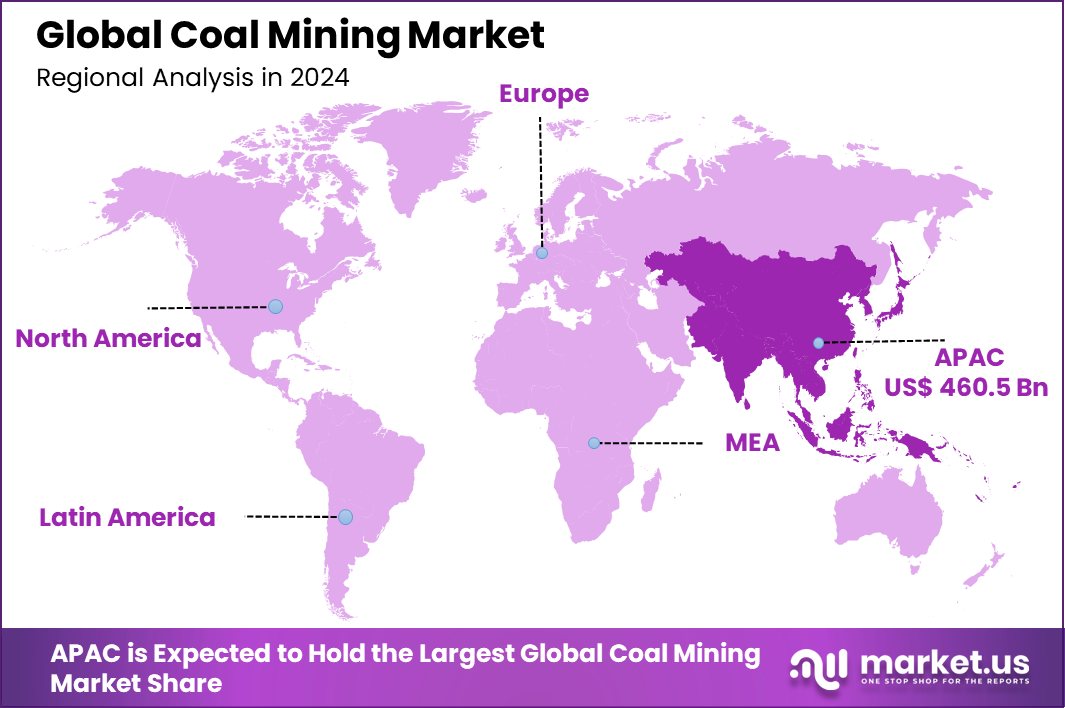

Global Coal Mining Market is expected to be worth around USD 961.8 billion by 2034, up from USD 796.8 billion in 2024, and grow at a CAGR of 1.9% from 2025 to 2034. Rapid industrial growth and power demand in Asia-Pacific continue to drive its USD 460.5 Bn market share.

Coal mining is the process of extracting coal from the earth, either through underground mining or surface mining methods like open-pit or strip mining. Coal is a combustible sedimentary rock used primarily for electricity generation and industrial energy needs. Depending on the depth and location of the coal deposit, mining techniques are selected to optimize extraction efficiency while minimizing environmental and safety risks.

The coal mining market refers to the broader industry involved in the exploration, extraction, processing, and distribution of coal. It includes activities such as mine development, transportation infrastructure, and coalwashing. This market plays a critical role in supporting energy systems in many countries, especially those that rely heavily on coal-fired power plants.

The growth of the coal mining market is influenced by consistent energy demand from emerging economies. Countries undergoing rapid industrialization often depend on coal as a cheap and reliable energy source. Despite the global shift towards renewables, coal remains essential in maintaining energy security and affordability in developing regions.

Demand continues to rise for metallurgical coal, which is vital in steel production. Infrastructure development and urbanization projects, especially in Asia and Africa, drive this demand forward. Additionally, certain industries still rely on thermal coal for cost-effective operations, supporting steady consumption patterns.

The Cabinet approved a scheme for Coal/Lignite Gasification Projects with ₹8,500 crore funding. In FY 2023-24, state governments earned ₹31,281.7 crore from coal revenues, including royalty, District Mineral Foundation (DMF) contributions, and State GST collections.

Key Takeaways

- Global Coal Mining Market is expected to be worth around USD 961.8 billion by 2034, up from USD 796.8 billion in 2024, and grow at a CAGR of 1.9% from 2025 to 2034.

- Thermal coal holds a dominant 79.30% share in the global coal mining market.

- Bituminous coal accounts for 47.40% due to its high heat content and wide availability.

- Surface mining leads with 58.50% due to lower operational costs and higher extraction efficiency.

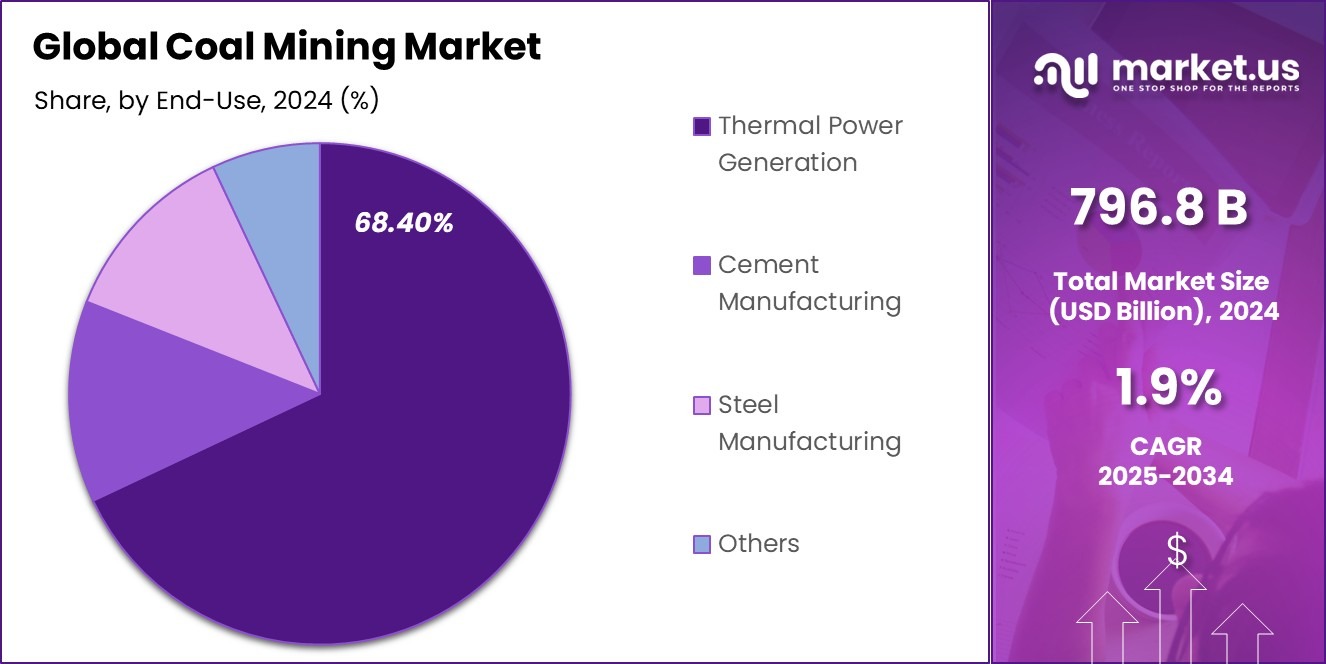

- Thermal power generation dominates with 68.40%, highlighting coal’s primary role in electricity supply.

- The regional coal mining market in Asia-Pacific was valued at approximately USD 460.5 billion in 2024.

By Type Analysis

Thermal coal accounts for 79.30% of the total coal mining market share.

In 2024, Thermal Coal held a dominant market position in the by-type segment of the Coal Mining Market, with a 79.30% share. This significant share was primarily driven by its extensive usage in power generation, especially across developing economies relying on coal-fired power plants.

Thermal coal remained the backbone of electricity production due to its cost-effectiveness and widespread availability, particularly in countries such as China, India, and Indonesia. Despite growing pressure from environmental regulations, demand continued in industrial sectors where alternatives remain costlier or less efficient.

Coking Coal followed as the second major segment, driven by its critical role in steel production. However, its market share was considerably smaller than thermal coal, owing to its limited end-use applications and higher production costs. The steel industry’s reliance on metallurgical coal preserved demand stability, especially in countries with strong infrastructure development.

The dominance of thermal coal in 2024 also reflects the slow transition pace toward renewable energy in many regions. While global sustainability efforts aim to reduce coal dependency, short-term energy security concerns have sustained thermal coal consumption. As governments balance economic growth and climate goals, the coal mining market—particularly the thermal coal segment—continues to play a strategic, albeit transitional, role in global energy supply.

By Grade Analysis

Bituminous coal represents 47.40% of the coal mining market by grade.

In 2024, Bituminous Coal held a dominant market position in the By Grade segment of the Coal Mining Market, with a 47.40% share. This leading position was primarily due to its high carbon content, relatively low moisture, and excellent combustion characteristics, making it highly suitable for both power generation and industrial fuel applications. Its abundant availability and balanced energy output further supported widespread utilization across energy-intensive sectors such as steel, cement, and chemicals.

Bituminous coal’s dominance was reinforced by its role in electricity generation in coal-dependent economies, especially in Asia-Pacific, where power demand continues to rise. Additionally, it remains a preferred grade for metallurgical processes requiring higher energy density, contributing to sustained demand from the steel manufacturing sector.

Other grades such as Sub-bituminous and Anthracite accounted for smaller market shares, with Sub-bituminous coal being used primarily in regions focused on lower-emission combustion, while Anthracite, known for its high energy density, was limited by its scarce availability and higher cost.

Bituminous coal’s versatility, economic viability, and broad industrial acceptance ensured its continued dominance in 2024. While environmental concerns persist, the grade’s critical role in traditional energy systems helped maintain its stronghold within the global coal mining landscape.

By Mining Method Analysis

Surface mining dominates the coal mining market, accounting for 58.50% of operations.

In 2024, Surface Mining held a dominant market position in the Mining Method segment of the Coal Mining Market, with a 58.50% share. This dominance was largely driven by its cost-efficiency, operational simplicity, and ability to extract large quantities of coal in a shorter time frame. Surface mining techniques such as strip mining, open-pit mining, and mountaintop removal were widely adopted due to their suitability in extracting coal from shallow seams.

Regions with vast coal reserves near the surface, particularly in the United States, China, and Australia, favored surface mining for its lower labor requirements and higher safety levels compared to underground mining. The method also allowed for the use of larger and more advanced machinery, enhancing productivity and reducing per-ton costs.

Underground mining, while essential for accessing deeper coal reserves, accounted for a smaller market share due to higher operational risks, increased costs, and complex safety regulations. However, it remained relevant in regions where surface deposits were depleted or inaccessible.

By End-Use Analysis

Thermal power generation is the leading end-use, comprising 68.40% of coal consumption.

In 2024, Thermal Power Generation held a dominant market position in the By End-Use segment of the Coal Mining Market, with a 68.40% share. This commanding share was primarily attributed to the large-scale dependence on coal-fired power plants across several major economies. Countries such as China, India, and Indonesia continued to rely heavily on coal to meet growing electricity demands due to its cost-effectiveness, stable supply, and established infrastructure.

Thermal coal, the primary fuel for these power stations, remained the most consumed type of coal in 2024, aligning with the segment’s strong market performance. The demand was particularly strong in regions with limited access to cleaner energy sources or where renewable energy infrastructure is still developing.

Industrial and other end-uses such as cement, iron, and steel production made up the remaining market share. While these sectors remained steady in their coal consumption, their scale was relatively smaller compared to the thermal power segment.

Key Market Segments

By Type

- Thermal Coal

- Metallurgical Coal

By Grade

- Bituminous Coal

- Sub-Bituminous Coal

- Lignite

- Anthracite

By Mining Method

- Surface Mining

- Strip mining

- Dredging

- Open-pit Mining

- Mountain Removal Mining

- Highwall Mining

- Underground Mining

- Room and Pillar

- Longwall Mining

By End-Use

- Thermal Power Generation

- Cement Manufacturing

- Steel Manufacturing

- Others

Driving Factors

Growing Energy Demand in Developing Economies

One of the biggest driving factors for the coal mining market in 2024 is the rising energy demand from developing countries. Nations like India, China, Indonesia, and Vietnam are still building new infrastructure, and industries, and expanding urban areas.

These growing regions need a steady and affordable energy source to power homes, factories, and transport systems. Coal remains a reliable option because it is widely available and cheaper than many alternatives.

While renewable energy is growing, many of these countries still rely on coal to meet short-term electricity needs. As a result, coal mining activity continues to rise in these regions, supporting jobs, boosting local economies, and keeping energy prices stable during times of rapid economic growth.

Restraining Factors

Rising Environmental Concerns and Emission Regulations

One of the main factors slowing down the coal mining market is the growing environmental concern around carbon emissions. Coal is known as one of the dirtiest fossil fuels, releasing large amounts of CO₂ and other harmful pollutants. Governments across the world are now setting stricter rules to reduce emissions and fight climate change.

Many countries are placing heavy taxes on coal usage or limiting new coal-based projects. International pressure and public demand for cleaner energy sources are also pushing industries to shift toward renewables like solar and wind. These actions make coal less attractive and increase the costs for mining companies, which affects profits and long-term growth of the coal mining market globally.

Growth Opportunity

Advanced Clean Coal Technologies Gaining Traction

A key growth opportunity in the coal mining market lies in the development of advanced clean coal technologies. These technologies help reduce harmful emissions while still allowing coal to be used as an energy source. Examples include carbon capture and storage (CCS), coal gasification, and supercritical boilers.

Many countries and companies are investing in these solutions to balance energy needs with environmental responsibilities. By making coal cleaner to burn, these innovations can extend the life of coal in the global energy mix. For coal mining companies, this opens new markets and partnerships, especially in regions working to upgrade their power infrastructure without fully giving up on coal. Clean coal tech could reshape the future of this industry.

Latest Trends

Automation and Smart Mining Technologies Reshaping Operations

One of the latest trends in the coal mining market is the use of automation and smart mining technologies. Companies are now using advanced tools like AI-powered monitoring systems, autonomous drilling machines, drones for site inspections, and real-time data analytics.

These technologies help improve safety, reduce labor costs, and increase productivity by allowing better decision-making and fewer human errors. Many large mining firms are investing in digital transformation to make operations more efficient and environmentally friendly. This shift also helps companies stay competitive in a tough market where cost control and sustainability are more important than ever.

Regional Analysis

In 2024, Asia-Pacific dominated the coal mining market with a strong 57.80% share overall.

In 2024, Asia-Pacific held the dominant position in the global coal mining market, accounting for a substantial 57.80% share, valued at USD 460.5 billion. The region’s dominance was supported by high coal demand from key economies such as China, India, and Indonesia, where coal continues to play a vital role in power generation and industrial activities. The availability of large coal reserves and cost-effective labor further strengthened the region’s leadership.

North America maintained a moderate share, supported by continued coal consumption in the power and steel sectors, particularly in the United States. Europe, on the other hand, experienced a declining trend in coal mining due to strict environmental regulations and a strong push toward renewable energy. Despite this, some Eastern European nations continued limited coal operations to ensure energy security.

Middle East & Africa registered steady demand, driven by coal-based projects in South Africa and developing energy infrastructure in parts of the Middle East. Latin America showed limited growth due to smaller coal reserves and a growing shift toward cleaner energy alternatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, major players such as Anglo American, BHP, and China Shenhua Energy Company Limited significantly influenced the dynamics of the global coal mining market through their scale, technological advancement, and strategic positioning.

Anglo American maintained a resilient market presence with diversified coal assets and strong operational efficiency. The company focused on metallurgical coal production, aligning with global steel industry demands. Its strategic divestment from thermal coal assets in recent years reflects a long-term sustainability transition, allowing it to strengthen its ESG profile while maintaining profitability in core segments.

BHP, one of the world’s largest resource companies, demonstrated a balanced approach by operating both metallurgical and thermal coal mines. In 2024, BHP continued to prioritize high-quality coking coal from its Australian mines, which remained in demand across Asia-Pacific markets. The company’s investment in autonomous mining equipment and digital operations further enhanced cost efficiency and safety.

China Shenhua Energy Company Limited, the largest coal mining company in China, dominated the market in both production and consumption. Backed by government support and vertically integrated operations, the company capitalized on strong domestic demand, particularly for thermal power generation. In 2024, Shenhua’s large-scale operations and logistics infrastructure allowed it to maintain competitive pricing and secure long-term contracts, especially within Asia.

Top Key Players in the Market

- Anglo American

- BHP

- China Shenhua Energy Company Limited

- ChinaCoal Energy

- Coal India

- Fortescue Metals Group

- Glencore

- JX Nippon Mining Metals

- Mitsubishi Corporation

- Mitsui Mining

- Peabody Energy

- Rio Tinto

- Shenhua Energy

- Whitehaven Coal

Recent Developments

- In May 2024, Mitsui completed the sale of its 45.515% stake in Indonesia’s 2,045MW Paiton coal-fired power plant, reducing its coal-fired power capacity and increasing its renewable energy ratio to 32%.

- In May 2022, Fortescue’s subsidiary, Fortescue Future Industries, announced plans to transform a former coal mine in Washington, USA, into a green hydrogen production facility, aiming to repurpose existing fossil fuel infrastructure for sustainable energy production.

Report Scope

Report Features Description Market Value (2024) USD 796.8 Billion Forecast Revenue (2034) USD 961.8 Billion CAGR (2025-2034) 1.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thermal Coal, Metallurgical Coal), By Grade (Bituminous Coal, Sub-Bituminous Coal, Lignite, Anthracite), By Mining Method (Surface Mining (Strip mining, Dredging, Open-pit Mining, Mountain Removal Mining, Highwall Mining), Underground Mining (Room and Pillar, Longwall Mining)), By End-Use (Thermal Power Generation, Cement Manufacturing, Steel Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anglo American, BHP, China Shenhua Energy Company Limited, ChinaCoal Energy, Coal India, Fortescue Metals Group, Glencore, JX Nippon Mining Metals, Mitsubishi Corporation, Mitsui Mining, Peabody Energy, Rio Tinto, Shenhua Energy, Whitehaven Coal Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Coal Mining MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Coal Mining MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Anglo American

- BHP

- China Shenhua Energy Company Limited

- ChinaCoal Energy

- Coal India

- Fortescue Metals Group

- Glencore

- JX Nippon Mining Metals

- Mitsubishi Corporation

- Mitsui Mining

- Peabody Energy

- Rio Tinto

- Shenhua Energy

- Whitehaven Coal