Global Chocolate Spread Market By Product Type (Hazelnut Chocolate Spread, Milk Chocolate Spread, Dark Chocolate Spread, White Chocolate Spread, Flavored Chocolate Spread), By End-Use (Residential, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Convenience Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150910

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

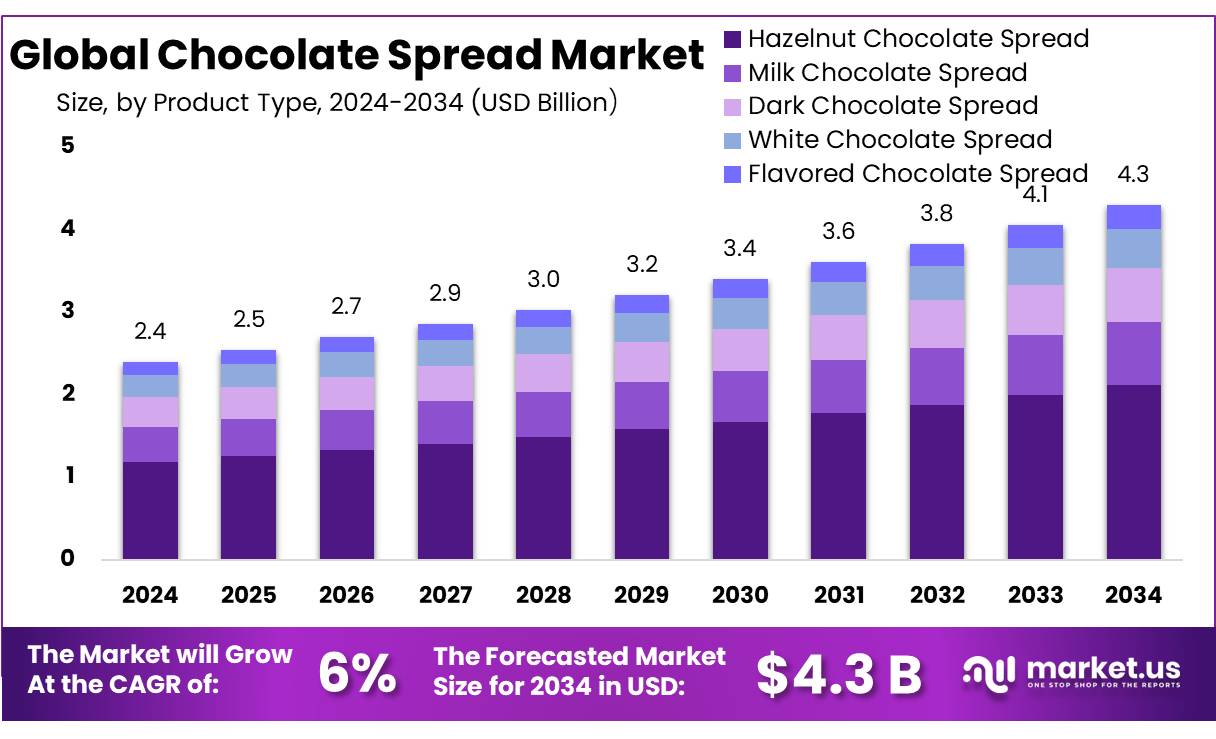

The Global Chocolate Spread Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Chocolate spread concentrates are sweet, cocoa-based products designed for versatile culinary applications, including as toppings for bread, pancakes, and pastries. These spreads, often enriched with ingredients like hazelnuts, almonds, or milk, offer a rich and smooth texture that appeals to a broad consumer base. The market for chocolate spread concentrates has witnessed significant growth, driven by evolving consumer preferences and lifestyle changes.

Several driving factors contribute to the market’s growth. First, the rising disposable incomes and changing lifestyles in emerging markets such as Asia-Pacific are pushing up the demand for ready-to-eat and indulgent food items, including chocolate spreads. According to the World Bank, emerging economies are expected to contribute to more than 60% of global consumption growth between 2020 and 2030.

Second, the increased availability of chocolate spread concentrates in various retail channels, including e-commerce platforms, has expanded the product’s reach. E-commerce sales of packaged foods, including chocolate spreads, are projected to increase by 11% annually over the next five years, reflecting the growing consumer preference for online shopping.

The Ministry of Food Processing Industries (MOFPI) plays a pivotal role in supporting the sector through policy formulation, infrastructure development, and technological advancements. Programs such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) aim to reduce wastage and enhance value addition in the food processing sector. These efforts are aligned with the government’s focus on achieving the target of a USD 5 trillion economy by 2025, with the food processing sector being a key contributor.

Key Takeaways

- Chocolate Spread Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 6.0%.

- Hazelnut Chocolate Spread held a dominant market position, capturing more than a 49.2% share of the global chocolate spread market.

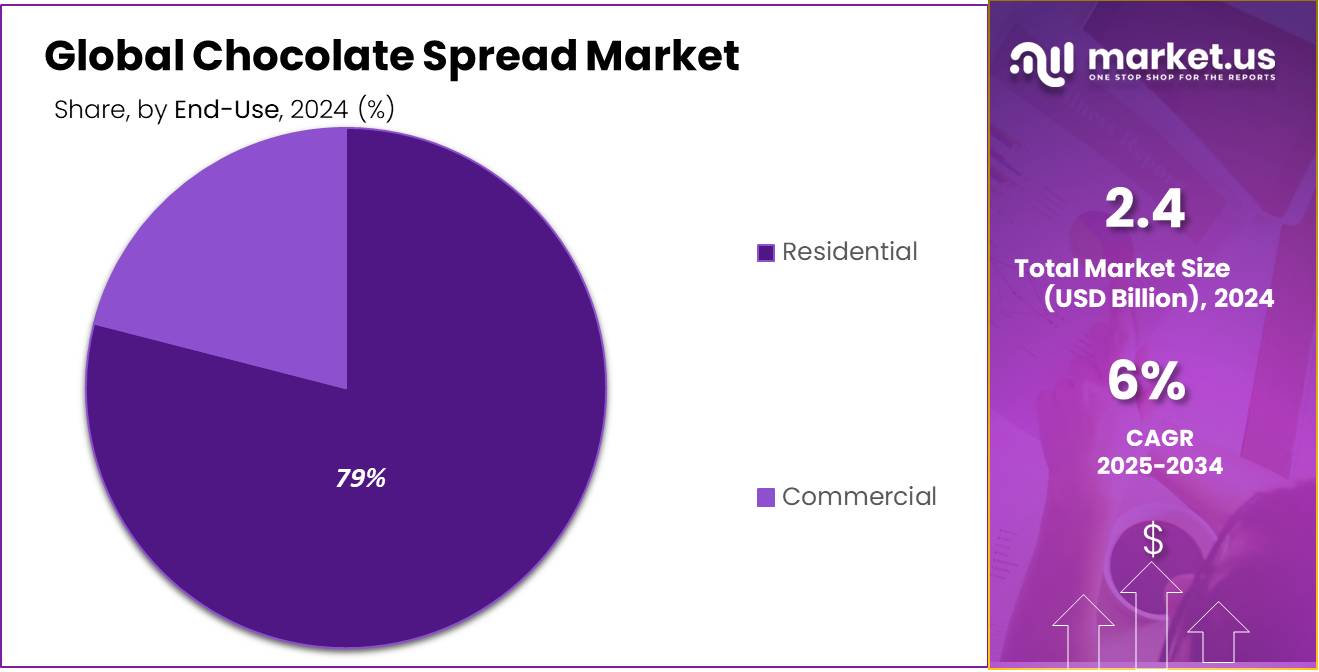

- Residential held a dominant market position, capturing more than a 79.3% share of the global chocolate spread market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.8% share of the global chocolate spread market.

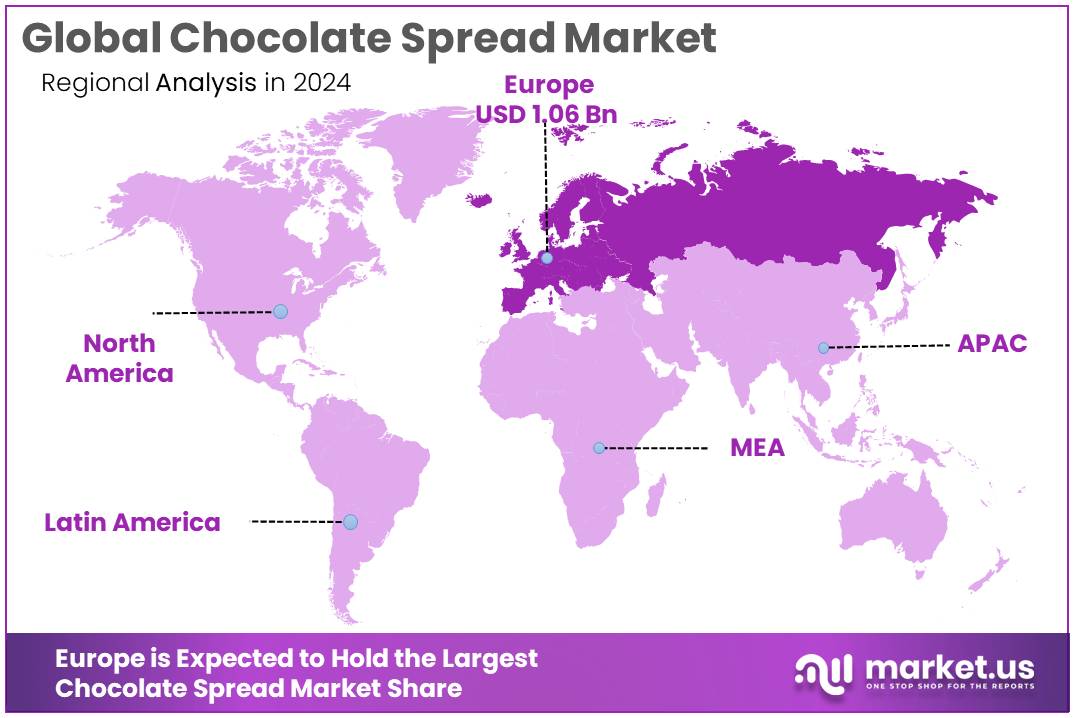

- Europe is a significant player in the global chocolate spread market, accounting for 44.5% of the total market share, with a valuation of approximately USD 1.06 billion.

By Product Type

Hazelnut Chocolate Spread dominates with 49.2% due to its widespread popularity and premium appeal

In 2024, Hazelnut Chocolate Spread held a dominant market position, capturing more than a 49.2% share of the global chocolate spread market. The growing preference for hazelnut-based spreads can be attributed to their rich flavor, versatility, and premium positioning. Hazelnut chocolate spreads are often considered a luxurious option, which has contributed to their widespread appeal among consumers seeking indulgent and high-quality alternatives.

As consumer interest in healthier yet indulgent snack options rises, hazelnut chocolate spreads continue to experience steady growth. In 2024, the segment saw consistent expansion driven by the increasing popularity of breakfast spreads, especially in Western markets. Retail sales of hazelnut chocolate spreads in regions like North America and Europe have been robust, with a year-over-year increase, particularly as hazelnut spreads align with the demand for organic and premium food products.

By End-Use

Residential dominates with 79.3% due to its widespread consumer preference and convenience

In 2024, Residential held a dominant market position, capturing more than a 79.3% share of the global chocolate spread market. This segment’s leading position can be attributed to the widespread use of chocolate spreads in households for daily consumption, particularly as a topping for bread, pancakes, and other breakfast items. The convenience of ready-to-eat chocolate spreads has made them a staple in many households, especially among families with children who enjoy the product for both its taste and ease of use.

The steady demand from residential end-users is expected to continue in 2025, as consumer habits favor indulgent yet quick snack options that cater to busy lifestyles. In particular, the increasing availability of chocolate spreads in convenient packaging, such as single-serve packs and large family-sized jars, continues to drive growth in the residential segment. Furthermore, as consumers become more health-conscious, the rise in demand for organic and lower-sugar chocolate spreads is expected to further bolster residential sales.

By Distribution Channel

Supermarkets/Hypermarkets dominate with 46.8% due to their extensive reach and convenience

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.8% share of the global chocolate spread market. This dominance can be attributed to the wide reach and convenience offered by these retail channels, making them a go-to destination for consumers seeking a variety of chocolate spread options. Supermarkets and hypermarkets provide consumers with easy access to both local and international brands, often at competitive prices, which significantly influences purchasing decisions.

The segment is expected to continue to grow in 2025 as supermarkets and hypermarkets expand their product offerings and increase their focus on health-conscious alternatives like organic and low-sugar chocolate spreads. The convenience of in-store shopping, combined with frequent promotions and large-scale availability, remains a key factor contributing to the popularity of chocolate spreads in this distribution channel. Additionally, supermarkets and hypermarkets are increasingly incorporating digital technologies, such as self-checkout and online ordering, further enhancing the shopping experience for consumers.

Key Market Segments

By Product Type

- Hazelnut Chocolate Spread

- Milk Chocolate Spread

- Dark Chocolate Spread

- White Chocolate Spread

- Flavored Chocolate Spread

By End-Use

- Residential

- Commercial

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retailers

- Convenience Stores

- Others

Drivers

Growing Consumer Demand for Convenient and Indulgent Breakfast Options

One of the major driving factors for the growth of the chocolate spread market is the increasing consumer demand for convenient, indulgent, and easy-to-consume breakfast options. With busy lifestyles becoming the norm, many consumers are opting for quick and tasty alternatives to traditional, time-consuming breakfast meals. Chocolate spreads, which offer a sweet, ready-to-use solution, have become an essential item for many households.

According to the U.S. Department of Agriculture (USDA), chocolate and nut spreads have become a significant part of the breakfast segment, with retail sales of chocolate spreads reaching approximately USD 2 billion annually in the United States. The USDA also reports that there has been a steady growth in consumer expenditure on ready-to-eat foods, especially among younger demographics, such as millennials, who favor convenience without compromising on taste.

Government initiatives promoting healthy eating habits, along with innovations in chocolate spread formulations, have contributed to the market’s growth. The Food and Drug Administration (FDA) has provided clear guidelines on product labeling, ensuring transparency, which has helped in building consumer trust.

Many chocolate spread brands now focus on offering products with added nutritional benefits, such as low-sugar options and fortified spreads, which align with health-conscious consumer trends. For example, in the U.S., Nutella, one of the leading brands, has introduced a reduced-sugar variant in response to consumer demand for healthier breakfast spreads.

Restraints

Health Concerns and Sugar Content

One of the significant restraining factors for the growth of the chocolate spread market is the growing health concerns related to high sugar content and its potential negative impact on health. As consumers become more health-conscious, there is increasing awareness of the adverse effects of consuming excessive sugar, including obesity, diabetes, and cardiovascular diseases. This shift in consumer preference towards healthier food options is causing many to reconsider their choices when it comes to indulgent spreads like chocolate.

According to the U.S. Food and Drug Administration (FDA), the average American consumes far more sugar than the recommended daily intake, which has led to increased government scrutiny on sugary foods. The FDA has implemented new food labeling regulations, requiring products like chocolate spreads to clearly indicate added sugar content.

In 2023, the FDA reported that more than 60% of food products in the U.S. contained added sugars, leading to significant concerns regarding public health. This has prompted many chocolate spread brands to rethink their formulations and consider reducing sugar content, but the challenge remains in retaining taste while meeting these health-conscious demands.

For instance, Nutella, one of the leading chocolate spread brands, has faced criticism for its sugar content, which led them to introduce a lower-sugar version in the market. Nevertheless, the broader challenge is convincing health-conscious consumers to continue purchasing indulgent products, especially as government initiatives to combat obesity and promote healthier diets gain traction.

Opportunity

Expansion of Organic and Health-Conscious Product Lines

A significant growth opportunity for the chocolate spread market lies in the rising demand for organic, sugar-free, and health-conscious alternatives. With growing concerns about health and nutrition, consumers are increasingly turning to products that offer better nutritional profiles without sacrificing taste. This shift in consumer preference has paved the way for chocolate spread brands to introduce organic, plant-based, and reduced-sugar versions, addressing the needs of health-conscious individuals who still crave indulgent flavors.

The U.S. Department of Agriculture (USDA) highlights that the organic food sector in the United States continues to expand, with sales of organic food reaching USD 62 billion in 2022, representing a 12% growth from the previous year. This growth is reflective of the broader trend towards organic and healthier food products. Chocolate spread brands are capitalizing on this shift by launching organic and non-GMO (genetically modified organisms) variants to meet consumer demand. Brands like Nutella have already started introducing more transparent and healthier versions of their products by reducing added sugars and using more sustainable ingredients.

Moreover, government initiatives and regulations aimed at improving public health have also played a role in pushing the chocolate spread market towards healthier alternatives. For instance, the FDA’s guidelines on added sugars and the push for transparency in food labeling have encouraged brands to develop better options. In addition, the popularity of plant-based diets, which is growing in many countries, has led to an increased demand for chocolate spreads made from plant-based ingredients such as coconut, almond, and hazelnut.

Trends

Rise of Health-Conscious Chocolate Spread Options

A notable trend in the chocolate spread market is the increasing consumer demand for healthier alternatives. As awareness about the health risks associated with high sugar intake grows, many consumers are seeking spreads that offer indulgence without compromising their well-being. This shift is prompting manufacturers to innovate and introduce products with reduced sugar content, organic ingredients, and added nutritional benefits.

According to the U.S. Food and Drug Administration (FDA), the average American consumes more added sugars than the recommended daily intake, leading to health concerns such as obesity and diabetes. In response, the FDA has updated food labeling requirements to include “added sugars” in grams and as a percentage of the daily value, aiming to provide consumers with clearer information to make healthier choices.

To cater to this health-conscious trend, chocolate spread brands are reformulating their products. For instance, some are reducing sugar levels, while others are incorporating organic and non-GMO ingredients. This aligns with the broader consumer shift towards organic foods, with the U.S. Department of Agriculture (USDA) reporting that organic food sales reached $62 billion in 2022, reflecting a 12% growth from the previous year.

Regional Analysis

Europe is a significant player in the global chocolate spread market, accounting for 44.5% of the total market share, with a valuation of approximately USD 1.06 billion. The region’s stronghold in the market is primarily driven by the high demand for chocolate spreads in countries like Italy, Germany, and France, where they have become staple ingredients in daily diets. In particular, Italy, home to Nutella, one of the leading brands, has a deep-rooted tradition of consuming chocolate spreads, and the country continues to be a major contributor to Europe’s market dominance.

The increasing trend towards indulgence and convenience, combined with a growing preference for premium, organic, and healthier variants, has significantly boosted the chocolate spread market in Europe. The European Union’s strict food safety regulations and consumer protection policies have also enhanced product quality and transparency, making it easier for consumers to trust the products they buy.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ferrero SpA, the creator of Nutella, is one of the leading players in the chocolate spread market. Known for its iconic hazelnut chocolate spread, the company holds a significant market share globally. Ferrero’s success lies in its premium product offerings, effective branding, and continuous innovation, introducing healthier, organic, and reduced-sugar versions. The company’s global presence, with strong distribution networks, makes it a dominant force in both retail and online markets.

The Hershey Company, an American chocolate and confectionery giant, has expanded its product range to include chocolate spreads. With its strong brand recognition and widespread distribution, Hershey offers consumers a rich and creamy chocolate spread. The company’s innovations include variations with reduced sugar and organic options, catering to the growing health-conscious consumer base. Hershey’s expertise in marketing and product development continues to solidify its position in the competitive chocolate spread market.

Nestlé, one of the largest food and beverage companies globally, has been a strong player in the chocolate spread market with its Nescafé and Nestlé-branded spreads. The company emphasizes using high-quality cocoa and sustainable sourcing practices. Nestlé’s chocolate spreads are known for their smooth texture and rich taste, appealing to both children and adults. As part of its commitment to sustainability, Nestlé also focuses on offering products with fewer artificial ingredients and healthier options in response to consumer demand.

Top Key Players in the Market

- Ferrero SpA Company

- The Hershey Company

- Nestle Food Company

- Dr. Oetker

- The J.M. Smucker Company

- Nutkao

- Mondelz International

- Nutiva Inc.

- ADM

- Andros

- Barry Callebaut

- Cargill

Recent Developments

In 2024, Ferrero reported a consolidated revenue of €18.4 billion, marking an 8.9% increase from the previous year. The company also invested €958 million in capital expenditures, an 18% rise, to enhance manufacturing capabilities and expand product offerings, including the launch of Nutella Ice Cream.

In 2024, Hershey’s North America Confectionery segment achieved net sales of USD 2.35 billion, reflecting a 6.0% year-over-year growth.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 4.3 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hazelnut Chocolate Spread, Milk Chocolate Spread, Dark Chocolate Spread, White Chocolate Spread, Flavored Chocolate Spread), By End-Use (Residential, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ferrero SpA Company, The Hershey Company, Nestle Food Company, Dr. Oetker, The J.M. Smucker Company, Nutkao, Mondelz International, Nutiva Inc., ADM, Andros, Barry Callebaut, Cargill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ferrero SpA Company

- The Hershey Company

- Nestle Food Company

- Dr. Oetker

- The J.M. Smucker Company

- Nutkao

- Mondelz International

- Nutiva Inc.

- ADM

- Andros

- Barry Callebaut

- Cargill