Global Cassia Gum Market Size, Share, And Business Benefits By Grade (Food Grade, Pharmaceutical Grade), By Application (Food and Beverages (Bakery and Confectionery, Dairy, Meat industry, Others), Personal Care and Cosmetics, Pharmaceutical, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148449

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

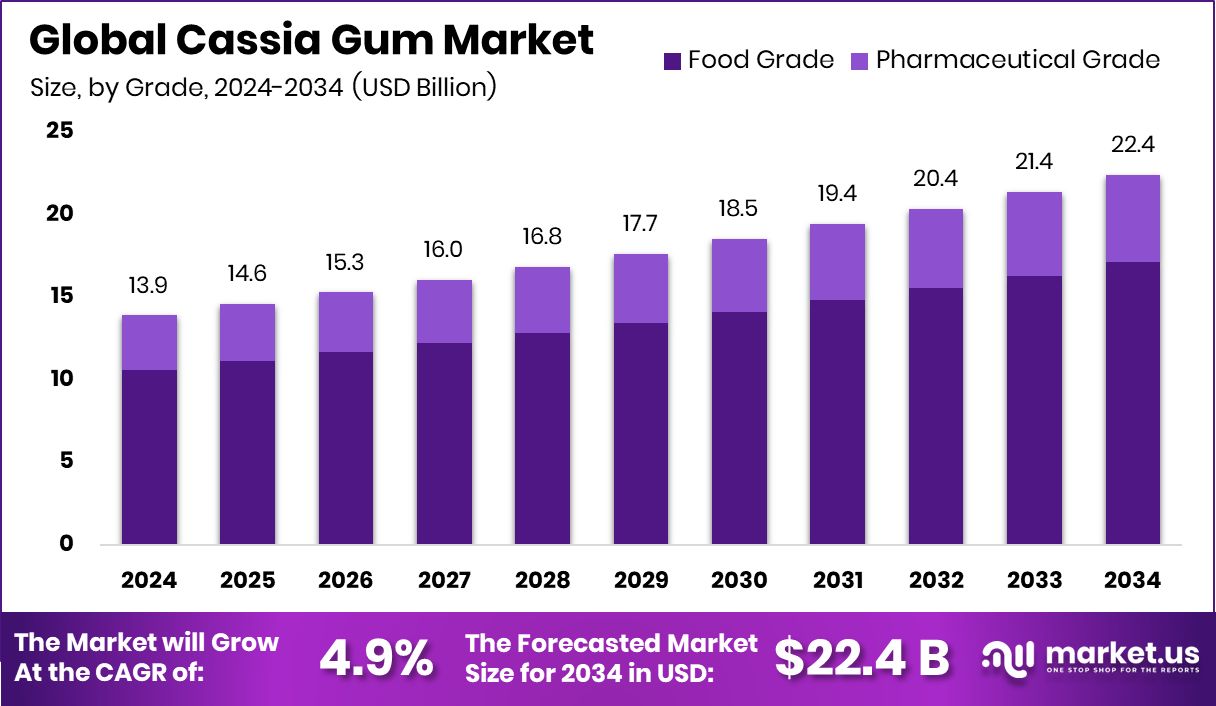

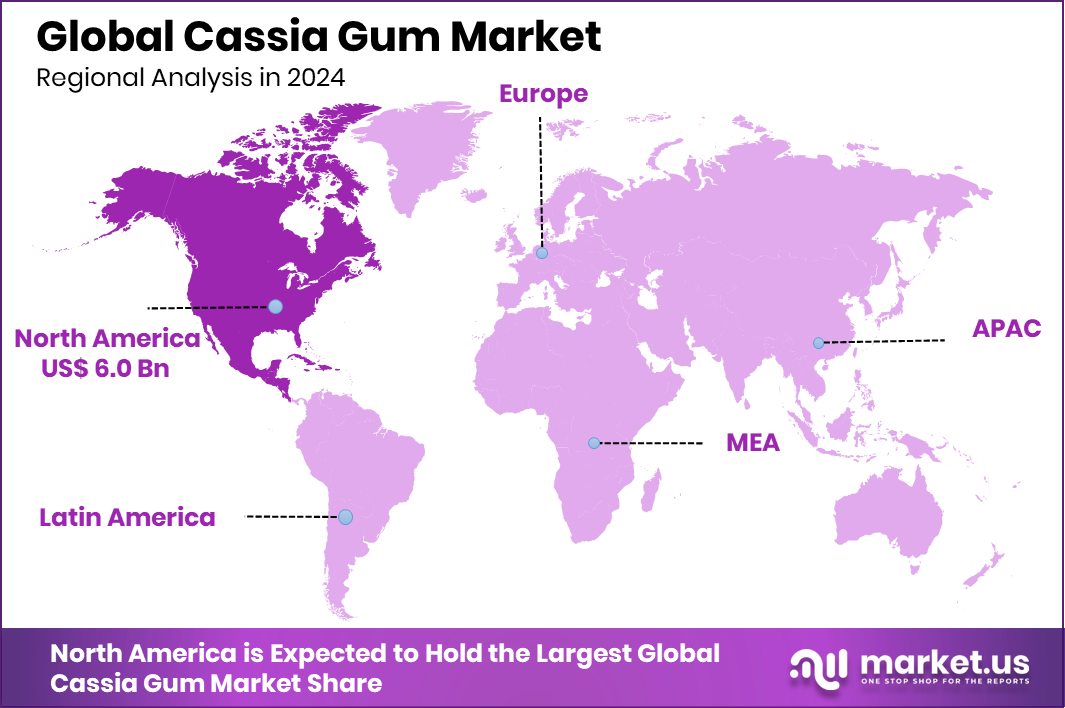

Global Cassia Gum Market is expected to be worth around USD 22.4 billion by 2034, up from USD 13.9 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. With a 43.7% share, North America’s Cassia Gum market reaches USD 6.0 billion.

Cassia gum is a natural gelling agent extracted from the seeds of the Cassia tora plant. It is widely used as a thickening, emulsifying, and stabilizing agent in various applications, including food, pharmaceuticals, cosmetics, and pet care products. The gum is rich in galactomannan, a polysaccharide that provides excellent water-binding properties.

The increasing demand for natural and plant-based ingredients in food products is a significant driver for the cassia gum market. Its widespread use as a stabilizer and thickening agent in processed foods, dairy products, and pet foods is fueling market growth. Furthermore, the rising awareness regarding the health benefits of plant-derived ingredients has further boosted their adoption in the food industry.

The demand for cassia gum is primarily driven by its applications in pet food manufacturing, where it is used as a binding agent for meat and fish-based products. The growing pet adoption rates and increasing expenditure on premium pet foods have led to a surge in cassia gum consumption. Additionally, the rising trend of vegan and gluten-free products has bolstered its demand in the food and beverage sector.

The expanding food processing industry and the increasing awareness of natural additives in these regions provide a favorable landscape for market penetration. According to industry reports, Cassia tora comprises approximately 1-2% volatile cassia oil, known for its intense, spicy, and aromatic flavor.

Key Takeaways

- Global Cassia Gum Market is expected to be worth around USD 22.4 billion by 2034, up from USD 13.9 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- Food-grade cassia gum accounted for 76.3% of the market, driven by widespread applications.

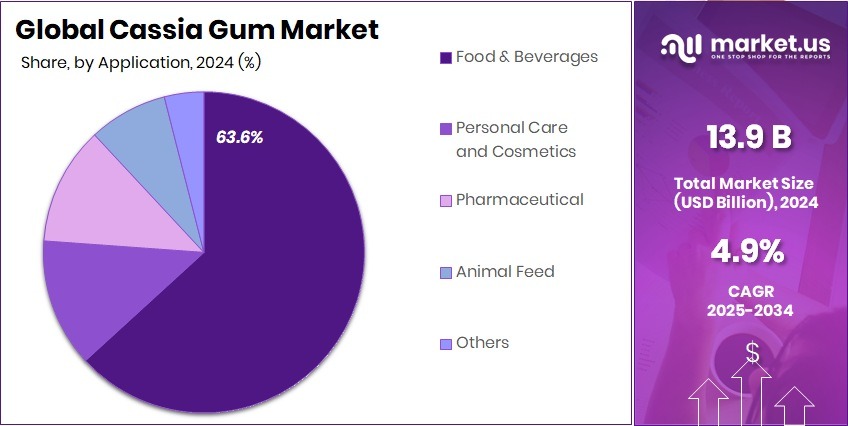

- Food and beverages sector captured 63.6% of the cassia gum market, driven by demand.

- Cassia Gum sales in North America hit USD 6.0 Bn, capturing 43.7%.

By Grade Analysis

The dominance of food-grade cassia gum highlights its extensive use in processed food products.

In 2024, Food Grade held a dominant market position in the By Grade segment of the Cassia Gum Market, with a 76.3% share. This substantial share can be attributed to the rising demand for natural food additives and stabilizers, driven by the expanding food and beverage industry globally. Cassia gum, known for its thickening and gelling properties, has gained widespread acceptance in processed foods, pet foods, and confectioneries.

The food industry is increasingly leveraging cassia gum for its cost-effectiveness and natural origin, enhancing product texture and shelf life. Additionally, regulatory approvals from major food safety authorities have further propelled its adoption, particularly in regions like North America and Europe. The extensive use of cassia gum in dairy products, meat processing, and bakery items has solidified its market position, aligning with the growing consumer preference for natural and clean-label products.

The rising inclination towards plant-based and vegan-friendly ingredients has also bolstered demand, further cementing Food Grade cassia gum as the dominant segment in 2024. With increasing investments in food processing and ingredient innovation, the Food Grade segment is anticipated to maintain its strong market position in the forthcoming years.

By Application Analysis

The expanding food and beverage industry propels cassia gum usage, capturing a 63.6% share.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Cassia Gum Market, with a 63.6% share. The widespread use of cassia gum as a stabilizer, thickener, and emulsifier in processed foods, dairy products, and bakery items significantly contributed to this dominance. Its ability to improve texture, maintain viscosity, and enhance shelf life has driven its adoption in a variety of food applications.

Furthermore, the growing consumer inclination towards natural and plant-based additives has propelled the demand for cassia gum in meat processing, frozen desserts, and pet food formulations. The increasing consumption of ready-to-eat meals and packaged food products has also amplified the application of cassia gum, particularly in emerging markets across Asia Pacific and Latin America.

The rising awareness about clean-label products has further driven cassia gum utilization, as manufacturers seek to replace synthetic additives with natural alternatives. With the food and beverage industry experiencing steady growth and expanding product portfolios, the application of cassia gum in this segment is projected to remain substantial, sustaining its dominant market position in the foreseeable future.

Key Market Segments

By Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Food and Beverages

- Bakery and Confectionery

- Dairy

- Meat industry

- Others

- Personal Care and Cosmetics

- Pharmaceutical

- Animal Feed

- Others

Driving Factors

Rising Demand for Natural Food Additives Drives Growth

The increasing consumer preference for natural and plant-based food additives is propelling the Cassia Gum market forward. Cassia gum, derived from the seeds of the Cassia tora plant, is widely used as a stabilizer, thickener, and emulsifier in food products. As consumers seek clean-label products free from synthetic additives, the demand for cassia gum continues to surge.

The food and beverage industry, particularly in sectors like dairy, bakery, and confectionery, is integrating cassia gum to enhance product texture and shelf life. Additionally, regulatory approvals for cassia gum in food applications further reinforce its market penetration, making it a key ingredient for natural food formulations globally.

Restraining Factors

Supply Chain Disruptions Limit Cassia Gum Availability

The Cassia Gum market faces challenges due to disruptions in the supply chain, impacting product availability and pricing. Fluctuations in raw material supply, primarily cassia seeds, affect the consistent production of cassia gum, leading to supply constraints. Seasonal variations, unpredictable weather patterns, and limited cultivation areas further exacerbate supply instability.

Additionally, transportation delays and logistical bottlenecks contribute to increased costs, affecting market dynamics. The dependency on specific regions for cassia seed sourcing also exposes the market to regional risks, impacting manufacturers and end-users alike.

Growth Opportunity

Expanding Applications in Pet Food Drive Demand

The growing pet food industry presents a significant growth opportunity for the Cassia Gum market. Cassia gum, known for its gelling and thickening properties, is increasingly used in wet and canned pet food formulations. It helps in maintaining texture, improving consistency, and preventing ingredient separation, making it an ideal stabilizer for pet food products.

With pet owners seeking premium, natural, and plant-based ingredients for their pets, the demand for cassia gum continues to rise. Additionally, regulatory approvals for its use in pet food further boost its market potential.

Latest Trends

Cassia Gum Gains Traction in Plant-Based Foods

The increasing demand for plant-based and vegan food products is significantly influencing the cassia gum market. Cassia gum, a natural thickener and stabilizer derived from the seeds of the Cassia tora plant, is being utilized to enhance the texture and consistency of meat substitutes and dairy alternatives.

Its ability to improve the mouthfeel and stability of plant-based products makes it a valuable ingredient in formulations aiming to replicate the sensory attributes of animal-based foods.

Regional Analysis

North America’s Cassia Gum market leads with 43.7% share, generating USD 6.0 Bn.

In 2024, North America emerged as the dominant region in the Cassia Gum Market, accounting for 43.7% of the market share and generating USD 6.0 Bn. The extensive use of cassia gum as a thickening and stabilizing agent in the region’s robust food and beverage sector has propelled its market dominance. The region’s strong presence in pet food manufacturing further amplifies cassia gum demand, driven by increasing consumer preference for natural ingredients.

Meanwhile, Europe follows as a significant market, driven by stringent food safety regulations and growing demand for clean-label products. In Asia Pacific, rapid industrialization and the expanding processed food sector have created lucrative opportunities for cassia gum manufacturers.

Latin America and the Middle East & Africa also witness steady demand, primarily due to the rising adoption of plant-based additives in food processing. As the market continues to expand, North America’s dominance is expected to persist, fueled by heightened awareness of cassia gum’s functional properties and increasing adoption across multiple industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Altrafine Gums, The Lubrizol Corporation, and Avlast Hydrocolloids held notable positions in the global Cassia Gum Market.

Altrafine Gums has leveraged its extensive expertise in natural hydrocolloids to strengthen its presence in the cassia gum segment, focusing on high-quality, food-grade products for the expanding processed food and pet food industries. The company’s strategic investments in advanced processing technologies have enabled it to maintain consistency in product quality, driving demand across North America and Asia Pacific.

The Lubrizol Corporation, known for its robust product portfolio, has capitalized on the growing demand for plant-based additives, integrating cassia gum into formulations targeted at personal care and industrial applications. The company’s emphasis on sustainable sourcing and innovative product development has further positioned it as a key player in the market.

Meanwhile, Avlast Hydrocolloids has focused on expanding its product range to include customized cassia gum solutions tailored for specific food applications. By catering to the increasing demand for natural stabilizers in dairy, bakery, and confectionery products, Avlast Hydrocolloids has successfully broadened its consumer base across Europe and Latin America.

Top Key Players in the Market

- Altrafine Gums

- The Lubrizol Corporation

- Avlast Hydrocolloids

- Agro Gums

- Premcem Gums Pvt. Ltd

- JD Gums And Chemicals

- Dwarkesh Industries

- Amba Gums & Feeds Products

Recent Developments

- In July 2024, JD Gums and Chemicals is a manufacturer and exporter specializing in natural and derivative products of Guar, Cassia, and Tamarind gums.

- In June 2024, Lubrizol Advanced Materials filed a petition with the U.S. Food and Drug Administration (FDA) to amend food additive regulations, seeking approval for the safe use of cassia gum as a stabilizer in frozen dairy desserts. The petition also proposes its use to improve texture and water retention in cheeses, meat products, and poultry products.

Report Scope

Report Features Description Market Value (2024) USD 13.9 Billion Forecast Revenue (2034) USD 22.4 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Pharmaceutical Grade), By Application (Food and Beverages (Bakery and Confectionery, Dairy, Meat industry, Others), Personal Care and Cosmetics, Pharmaceutical, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Altrafine Gums, The Lubrizol Corporation, Avlast Hydrocolloids, Agro Gums, Premcem Gums Pvt. Ltd, JD Gums And Chemicals, Dwarkesh Industries, Amba Gums & Feeds Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Altrafine Gums

- The Lubrizol Corporation

- Avlast Hydrocolloids

- Agro Gums

- Premcem Gums Pvt. Ltd

- JD Gums And Chemicals

- Dwarkesh Industries

- Amba Gums & Feeds Products