Global Bio Vanillin Market Size, Share, And Business Benefits By Source (Rice Bran, Wood, Others), By Form (Powder, Liquid, Crystal), By End-use (Food and Beverages, Cosmetics and Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155920

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

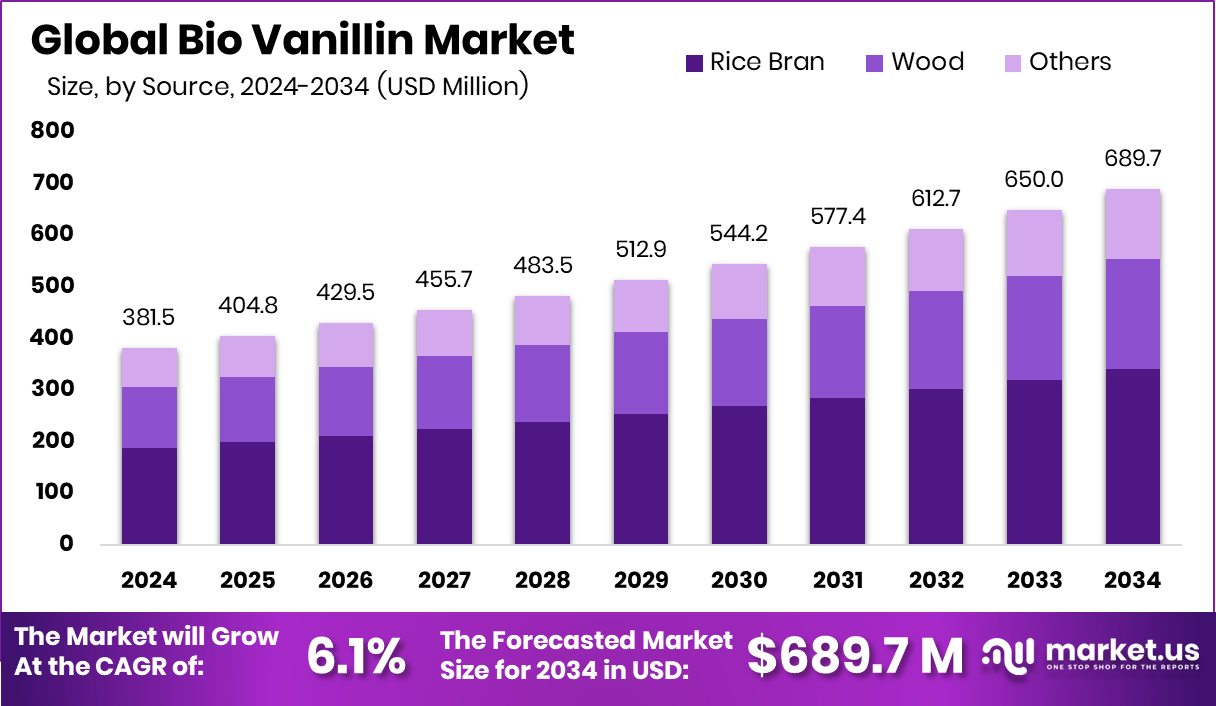

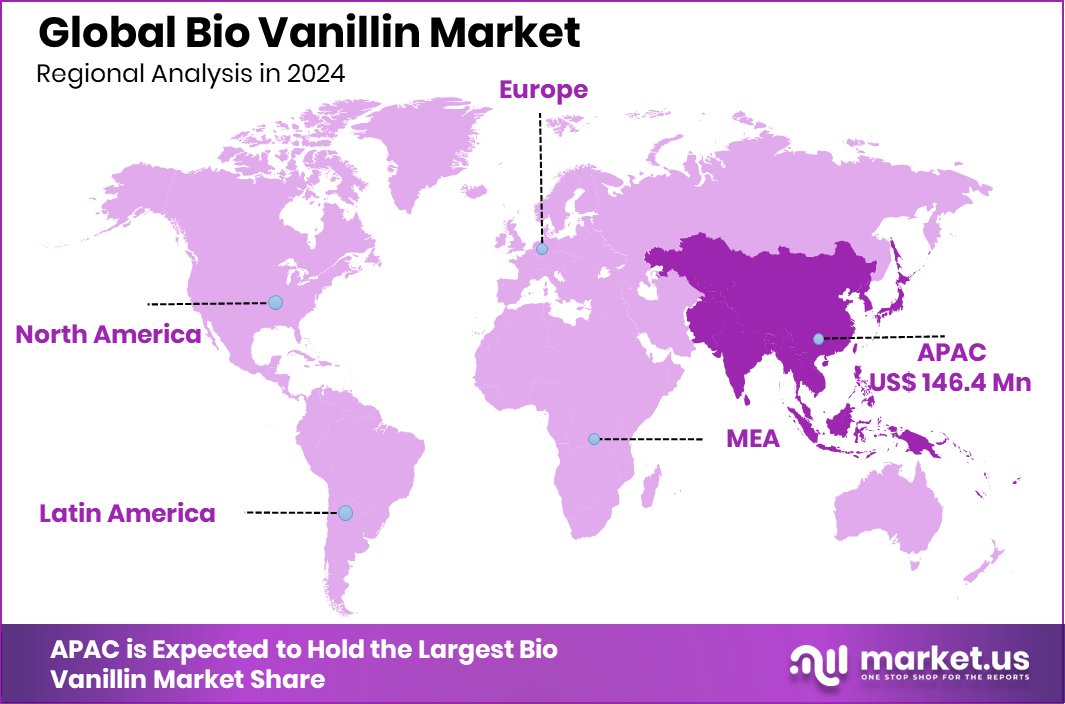

The Global Bio Vanillin Market is expected to be worth around USD 689.7 million by 2034, up from USD 381.5 million in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Growing clean-label trends supported Asia Pacific dominance at 38.4%, totaling USD 146.4 Mn.

Bio vanillin is a naturally derived form of vanillin, the primary flavor compound found in vanilla beans. Unlike synthetic vanillin made from petrochemicals or wood pulp, bio vanillin is produced through fermentation or bioconversion of natural raw materials like rice bran, ferulic acid, or other plant-based feedstocks. It offers a sustainable and eco-friendly alternative while maintaining the same aroma and taste profile that makes vanilla one of the most widely used flavors in food, beverages, and fragrances.

The bio vanillin market refers to the global trade and demand for this natural flavoring ingredient across industries such as food and beverages, cosmetics, and pharmaceuticals. As consumers increasingly seek clean-label and plant-based products, companies are shifting from synthetic vanillin to bio-based options to meet sustainability goals and appeal to health-conscious buyers. According to an industry report, Cambium has secured $18.5 million to support its mass timber initiatives.

One of the main growth factors driving the bio vanillin market is the rising consumer demand for natural and sustainable ingredients. Growing awareness about food safety, clean labeling, and eco-friendly sourcing has made bio vanillin a preferred choice in processed foods, premium confectionery, and dairy products. According to an industry report, an AI-powered startup focused on wood waste diversion has raised $3.75 million in seed funding.

The demand is further supported by regulatory policies favoring natural additives over synthetic chemicals. With many regions tightening restrictions on artificial flavoring, food manufacturers are adopting bio vanillin to align with labeling standards and consumer expectations. This compliance factor is adding momentum to its widespread adoption. According to an industry report, Ecohelix has obtained $2.5 million in EU funding to advance its wood-based biopolymer technology.

Key Takeaways

- The Global Bio Vanillin Market is expected to be worth around USD 689.7 million by 2034, up from USD 381.5 million in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Rice bran leads the bio vanillin market with 49.3%, highlighting sustainable natural sourcing.

- Powder dominates the bio vanillin market with 56.9%, preferred for easy blending in applications.

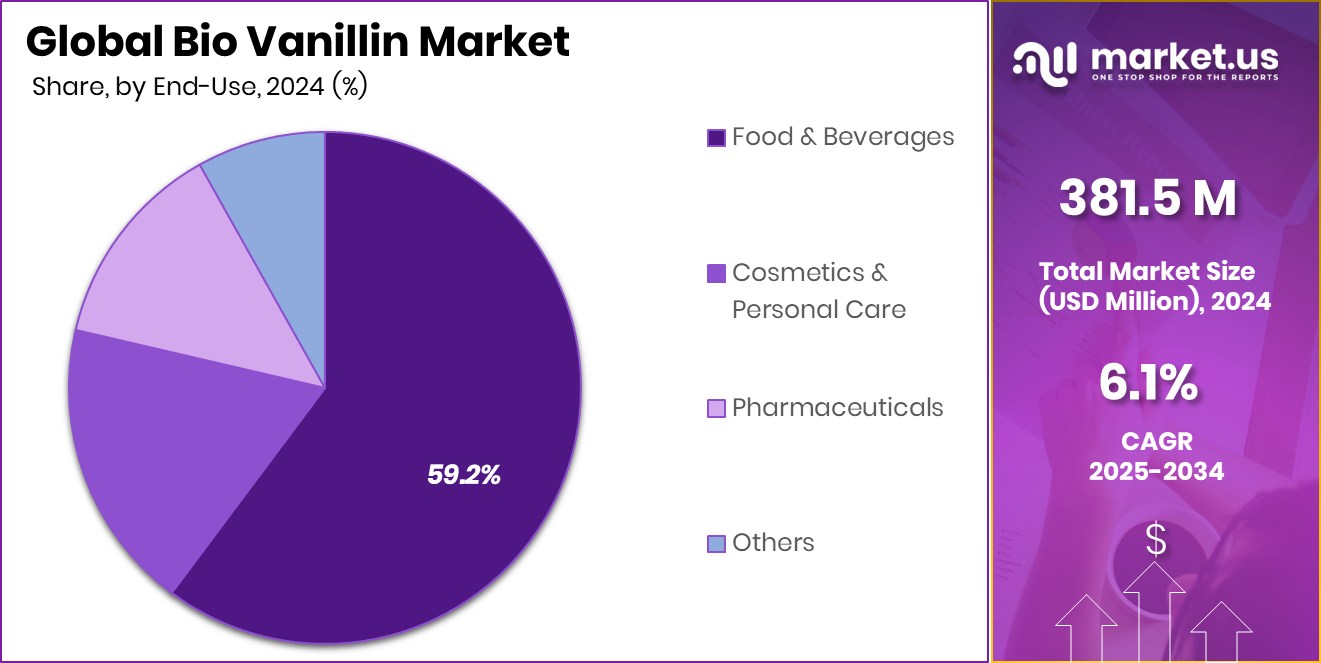

- Food and beverages capture 59.2% of the bio vanillin market, driven by natural flavor demand.

- Strong food and beverage demand helped the Asia Pacific secure 38.4%, worth USD 146.4 Mn.

By Source Analysis

Rice Bran accounted for 49.3%, driving the sustainable bio vanillin market.

In 2024, rice bran held a dominant market position in the By Source segment of the Bio Vanillin Market, with a 49.3% share. This strong position is driven by the abundant availability of rice bran as an agricultural byproduct and its cost-effectiveness as a sustainable raw material for producing biovanillin.

Rice bran is rich in ferulic acid, a key precursor in biovanillin production, making it one of the most efficient and eco-friendly feedstocks for large-scale use. The widespread cultivation of rice across Asia and other regions ensures a steady supply of rice bran, which has positioned it as the preferred choice for manufacturers focusing on natural flavoring solutions.

The dominance of rice bran is also linked to its alignment with the growing demand for plant-based and clean-label products. As consumers become more conscious about the ingredients in food, beverages, and personal care items, rice bran-based bio vanillin offers both sustainability and natural authenticity.

In 2025, this segment is expected to maintain its lead as industries expand the use of natural flavorings to replace synthetic alternatives. The combination of affordability, scalability, and environmental benefits will continue to strengthen rice bran’s share in the biovanillin market.

By Form Analysis

Powder held 56.9%, dominating the bio vanillin market globally.

In 2024, Powder held a dominant market position in the By Form segment of the Bio Vanillin Market, with a 56.9% share. The preference for powder form stems from its superior stability, longer shelf life, and ease of incorporation into a wide range of applications.

Food and beverage manufacturers particularly favor powdered bio vanillin because it blends seamlessly into dry formulations such as bakery mixes, confectionery items, dairy powders, and instant beverages. Its consistent quality and ability to retain aroma even after high-temperature processing further enhance its suitability for large-scale production.

Another factor behind the strong share of powder bio vanillin is its efficient storage and transport characteristics. Compared to liquid alternatives, powder requires less specialized packaging, is lighter to handle, and offers extended usability without losing potency. This makes it attractive not only for manufacturers but also for distribution channels seeking cost-efficient solutions.

In 2025, the powdered form is expected to retain its lead as the demand for ready-to-use ingredients in processed foods, premium desserts, and nutraceuticals continues to grow. The combination of functional advantages, wide application scope, and rising preference for natural powdered additives reinforces its position as the most reliable form of bio vanillin in the market.

By End-use Analysis

Food and beverages captured 59.2%, leading the bio vanillin market demand.

In 2024, Food and Beverages held a dominant market position in the by-end-use segment of the Bio Vanillin Market, with a 59.2% share. This leadership is largely driven by the growing shift of consumers toward natural flavors and clean-label ingredients in everyday food products.

Bio vanillin derived from sustainable sources has become a preferred choice for manufacturers of bakery goods, chocolates, dairy products, and beverages, as it not only enhances flavor but also meets rising consumer expectations for healthier and more authentic formulations. The wide use of vanilla as a core flavor across multiple categories has ensured that food and beverages remain the strongest demand center for bio vanillin.

The segment’s dominance is further supported by global regulatory encouragement for natural ingredients over synthetic alternatives. With food safety standards becoming stricter, producers are increasingly opting for bio vanillin to comply with natural labeling claims while catering to premium product lines.

In 2025, this trend is expected to strengthen further, as rising disposable incomes, particularly in emerging economies, fuel demand for processed and premium foods. The ability of bio vanillin to combine sustainability with a desirable taste profile positions the food and beverages sector as the backbone of growth within this market.

Key Market Segments

By Source

- Rice Bran

- Wood

- Others

By Form

- Powder

- Liquid

- Crystal

By End-use

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Driving Factors

Rising Consumer Preference for Natural Flavor Ingredients

One of the biggest driving factors for the Bio Vanillin Market is the strong global shift toward natural and clean-label ingredients. Consumers today are becoming more careful about what they eat and are increasingly avoiding synthetic or chemical-based additives. Bio vanillin, produced from natural sources like rice bran and ferulic acid, fits perfectly into this trend because it offers the same rich vanilla taste while being sustainable and safe.

Food and beverage companies are reformulating products to highlight natural flavors, which is pushing demand for bio vanillin higher. This preference is not only limited to premium foods but is also spreading across everyday items such as bakery products, chocolates, and dairy, strengthening long-term market growth.

Restraining Factors

Higher Production Costs Compared to Synthetic Alternatives

A key restraining factor for the Bio Vanillin Market is the relatively high cost of production when compared to synthetic vanillin. While synthetic vanillin is derived from petrochemical or wood-based processes that are cheaper and more established, biovanillin requires advanced fermentation or bioconversion methods. These processes involve higher investment in technology, infrastructure, and raw material handling, which increases overall costs.

For many price-sensitive industries, especially in developing regions, the higher cost makes it difficult to adopt bio vanillin at scale. Although demand for natural and sustainable flavors is rising, the cost gap between bio-based and synthetic options continues to act as a barrier, slowing down broader market penetration in cost-competitive sectors.

Growth Opportunity

Expanding Applications Beyond Food into Personal Care

A major growth opportunity for the Bio Vanillin Market lies in its expanding applications beyond food and beverages, particularly in personal care, cosmetics, and pharmaceuticals. Bio vanillin’s natural origin and pleasant aroma make it highly suitable for perfumes, skincare, and haircare products, where consumers are increasingly demanding safe and plant-based ingredients.

The cosmetic industry is shifting away from synthetic fragrances and adopting natural alternatives to align with clean beauty trends. Similarly, in pharmaceuticals, bio vanillin is being explored not only as a flavoring agent but also for its antioxidant and antimicrobial properties. As companies diversify their product portfolios, this cross-industry adoption of bio vanillin presents significant room for growth and long-term market expansion.

Latest Trends

Increasing Use of Fermentation for Sustainable Production

One of the latest trends shaping the Bio Vanillin Market is the growing use of fermentation technology for sustainable and efficient production. Instead of relying only on plant-based extraction, manufacturers are adopting advanced fermentation methods using natural feedstocks like rice bran or ferulic acid. This approach allows for consistent quality, scalability, and reduced dependency on limited raw materials, while also lowering the environmental footprint compared to traditional processes.

Fermentation-based bio vanillin not only meets rising consumer demand for natural ingredients but also aligns with global sustainability goals. As technology improves and costs gradually decrease, fermentation is expected to become the mainstream production method, making biovanillin more accessible across different industries in the coming years.

Regional Analysis

In 2024, the Asia Pacific accounted for a 38.4% share, reaching USD 146.4 Mn.

The Bio Vanillin Market shows strong regional variations, with Asia Pacific emerging as the dominant region in 2024, capturing 38.4% of the global share, valued at USD 146.4 million. The leadership of Asia Pacific is driven by its vast food and beverage industry, growing middle-class population, and rising consumer demand for natural and clean-label products. Countries like China, India, and Japan are witnessing rapid adoption of bio-based flavoring solutions due to their large-scale processed food and confectionery markets.

Europe follows closely, supported by stringent regulatory frameworks favoring natural ingredients and high consumer awareness of sustainable alternatives. North America also contributes significantly, with its advanced food processing industry and increasing inclination toward plant-based formulations. Meanwhile, the Middle East & Africa and Latin America are gradually expanding, mainly led by urbanization, changing dietary habits, and rising imports of natural flavors.

However, Asia Pacific’s dominance highlights its strong manufacturing capabilities, abundant raw material availability such as rice bran, and a fast-growing consumer base that actively prefers natural flavors over synthetic ones. With increasing investments in biotechnology and expanding applications across personal care and pharmaceuticals, the Asia Pacific is expected to retain its leading position and continue driving the overall market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Solvay continues to play a central role with its early investments in natural vanillin production and sustainable solutions. Its ability to scale production efficiently while maintaining product quality has positioned it as a benchmark in this space.

Ennolys, specializing in fermentation-based processes, has strengthened its standing by offering bio vanillin derived from natural fermentation, catering to the growing clean-label trend across food and beverage markets.

Advanced Biotech contributes through its extensive flavor ingredients portfolio, where bio vanillin is gaining prominence due to the rising preference for natural over synthetic alternatives. Its focus on consistent supply and tailored applications has enhanced its relevance among global food processors.

Givaudan, as a leader in flavors and fragrances, has integrated bio vanillin into its sustainable ingredient strategy, ensuring strong adoption across both food and personal care segments.

Top Key Players in the Market

- Solvay

- Ennolys

- Advanced Biotech

- Givaudan

- Borregaard

- Symrise

- Other Key Players

Recent Developments

- In June 2024, Solvay USA LLC filed new U.S. antidumping and countervailing duty petitions targeting imports of vanillin from China. While this action doesn’t involve product launches, it demonstrates Solvay’s active role in protecting its vanillin interests in the global market.

- In January 2024, Givaudan introduced Scentaurus™ Vanilla, a new non‑coloring, long‑lasting vanilla fragrance precursor crafted using green chemistry principles. Activated naturally by oxygen, this ingredient delivers a fresh, creamy powdery vanilla effect—ideal for applications like liquid detergents. It reflects Givaudan’s sustainability focus and extends creative possibilities for perfumers.

Report Scope

Report Features Description Market Value (2024) USD 381.5 Billion Forecast Revenue (2034) USD 689.7 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Rice Bran, Wood, Others), By Form (Powder, Liquid, Crystal), By End-use (Food and Beverages, Cosmetics and Personal Care, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Solvay, Ennolys, Advanced Biotech, Givaudan, Borregaard, Symrise, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Solvay

- Ennolys

- Advanced Biotech

- Givaudan

- Borregaard

- Symrise

- Other Key Players