Global Ball Valve Market Size, Share, And Industry Analysis Report By Material (Steel, Cast Iron, Cryogenic, Alloy Based), By Type (Trunnion-mounted Ball Valves, Floating Ball Valve, Rising Stem Ball Valve, Full-Port Ball Valve), By Size (Less than 1 inch, 1 to 5 inches, 6 to 24 inches, 25 to 50 inches, Greater than 50 inches), By End-Use (Oil and Gas, Energy and Power, Water and Wastewater Treatment, Pharmaceuticals, Pulp and Paper), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167548

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

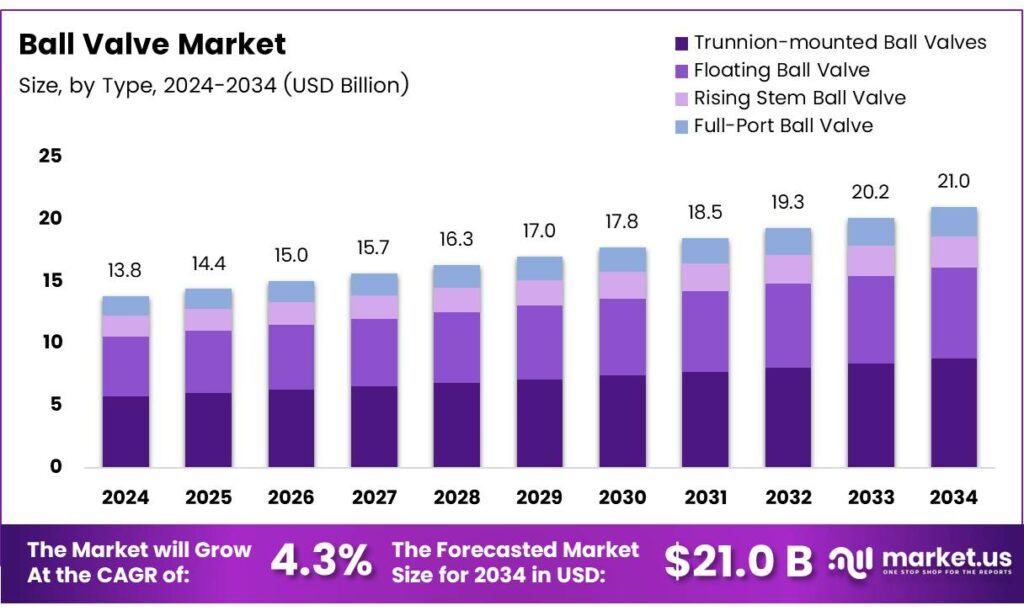

The Global Ball Valve Market size is expected to be worth around USD 21.0 billion by 2034, from USD 13.8 billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The Ball Valve Market represents a critical segment of industrial flow control systems used in oil and gas, water treatment, power generation, chemical processing, and manufacturing. A ball valve uses a rotating spherical ball to regulate flow with a simple quarter-turn motion. Because of its durability, quick shutoff capability, and low maintenance, adoption continues rising across industries implementing automation and safety upgrades.

As industries move toward digital and automated systems, smart and corrosion-resistant valve solutions gain importance. Furthermore, increasing investments in LNG terminals, hydrogen infrastructure, and cryogenic process lines strengthen demand for advanced ball valves capable of extreme conditions. The rising focus on leakage prevention and zero-emission operation also pushes the adoption of high-performance sealing and longer service-life materials.

In cryogenic applications, ball valve technology plays a vital role. Cryogenic ball valves are engineered to perform at temperatures as low as –196 °C, ensuring safety in applications involving liquefied gases. Each cryogenic valve includes an extended bonnet that keeps seals above the frost line to prevent freezing and enable reliable operations in LNG, hydrogen, and aerospace environments.

Mechanical structure and geometry also influence performance. The optimal valve channel size is 30°, improving pump and flow efficiency. Functionally, a ball valve regulates flow when a sphere with a central bore rotates 90°, shifting from full flow alignment to complete shutoff. This mechanism offers simplicity, robustness, and low manufacturing cost, making ball valves preferred in cost-sensitive industrial use cases.

Key Takeaways

- The Global Ball Valve Market is expected to reach USD 21.0 billion by 2034, growing at a 4.3% CAGR from USD 13.8 billion in 2024.

- Steel leads the material segment with a dominant share of 46.9% due to its high strength and industrial suitability.

- Trunnion-mounted Ball Valves dominate the type segment with a strong 38.6% share driven by demand in high-pressure systems.

- The 6 to 24 inches size category holds the largest share of 38.2% due to extensive use in oil, gas, and industrial plants.

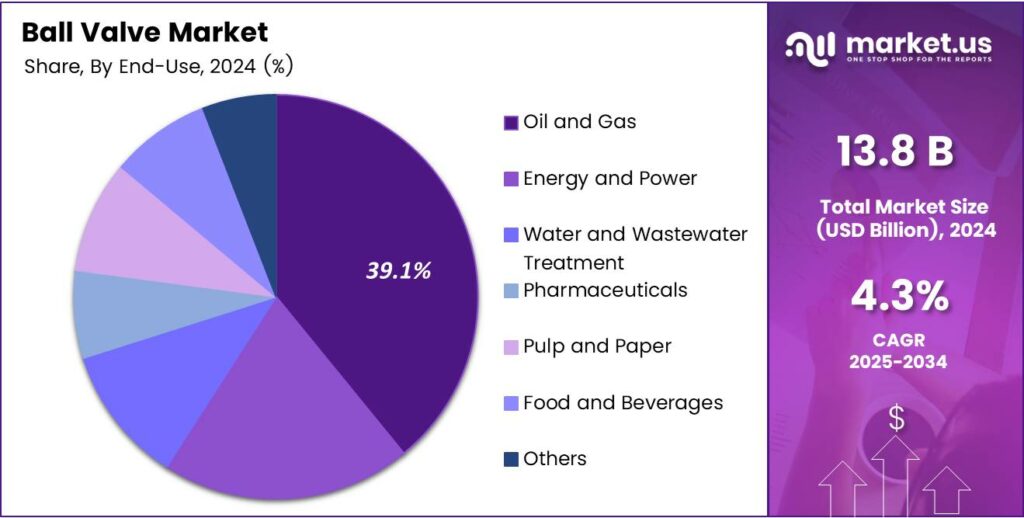

- The Oil and Gas sector leads end-use applications with a share of 39.1% supported by global pipeline expansion.

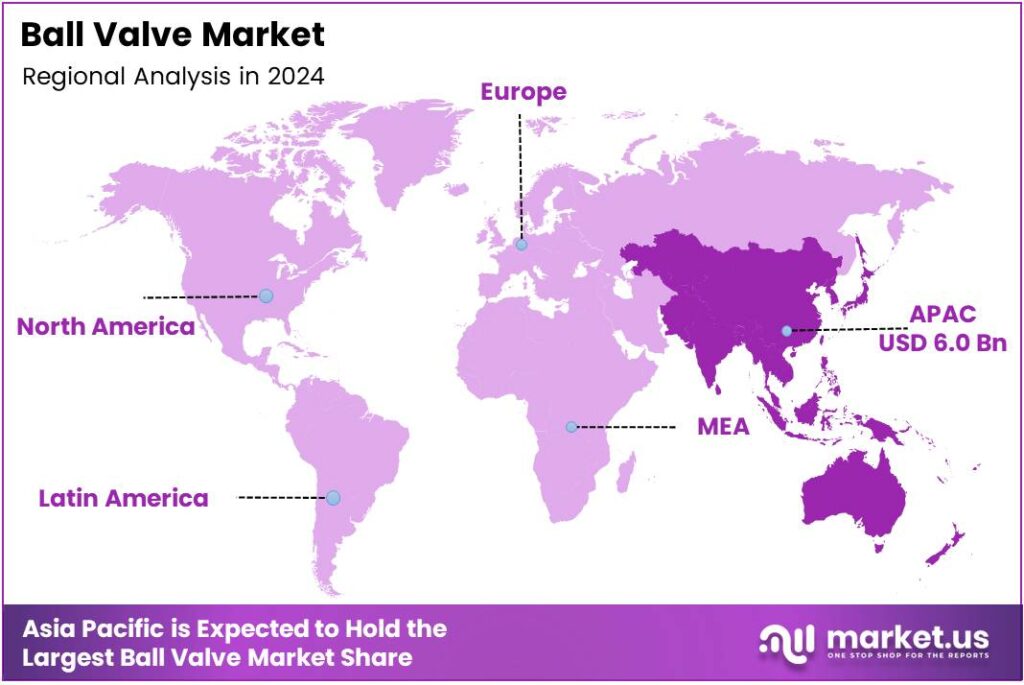

- Asia Pacific dominates the regional landscape with a market share of 43.9%, valued at nearly USD 6.0 billion in 2024.

Material Analysis

Steel dominates with 46.9% due to its durability and suitability for high-pressure industrial systems.

In 2024, Steel held a dominant market position in the By Material Analysis segment of the Ball Valve Market, with a 46.9% share. Steel ball valves are widely preferred in oil, gas, chemical, and refining systems because they deliver resistance to corrosion, extreme temperatures, and mechanical stress. Their long operational lifespan further strengthens demand.

Cast Iron ball valves are commonly found in low to medium-pressure water systems and commercial pipelines. These valves are cost-effective and easy to machine, making them suitable for large-scale municipal systems. The segment steadily grows due to rising urban water distribution infrastructure spending and replacement demand.

Cryogenic ball valves serve LNG, aerospace, and industrial gas storage, where temperatures reach extremely low ranges. They are engineered with extended bonnets and tight sealing properties. Growth continues as LNG trading expands globally, requiring safe flow control for liquid nitrogen, oxygen, hydrogen, and renewable-based fuels.

Type Analysis

Trunnion-mounted Ball Valve dominates with 38.6% due to its suitability for high-pressure operations.

In 2024, Trunnion-mounted Ball Valves held a dominant market position in the By Type Analysis segment of the Ball Valve Market, with a 38.6% share. Their fixed-ball design ensures low torque requirements and leak-free operation in large-diameter or high-pressure systems, making them essential in midstream oil and gas.

Floating Ball Valves continue to gain traction in small- to mid-size industrial and commercial pipelines. These valves rely on line pressure to create a seal, making them efficient for moderate pressure control. Adoption rises in water management, factory equipment, utilities, and general fluid transport environments.

Rising Stem Ball Valves provide zero-friction rotation and advanced sealing performance, making them ideal for critical process handling in chemical and refining systems. They also support fire-safe compliance. Their design reduces wear and delivers high reliability where frequent cycling and precision matter.

Full-Port Ball Valves allow unrestricted flow, minimising pressure drop. These valves are essential in pumping systems, slurry movement, and bulk material fluids. Industries requiring high throughput or pipeline pigging continue increasing their usage due to enhanced efficiency and low maintenance demand.

Size Analysis

6 to 24 inches dominate with 38.2% due to use in midstream oil, gas, and large industrial plants.

In 2024, 6 to 24 inches held a dominant market position in the By Size Analysis segment of the Ball Valve Market, with a 38.2% share. This size category is widely adopted in petrochemical plants, pipelines, LNG terminals, and high-volume industrial distribution systems requiring strong sealing and durability.

Valves less than 1 inch are frequently used in compact systems, including laboratory equipment, residential plumbing, medical devices, and small industrial assemblies. The segment benefits from rising demand in automation and compact mechanical devices where precise flow control matters.

Valves greater than 50 inches are rare and engineered for mega-pipeline systems, hydropower dams, and water authorities. They require customised designs, precision production, and advanced sealing technology, making them a premium category with limited but critical demand.

End-Use Analysis

Oil and Gas dominate with 39.1% due to heavy reliance on pressure-regulated flow systems.

In 2024, Oil and Gas held a dominant market position in the By End-Use Analysis segment of the Ball Valve Market, with a 39.1% share. Midstream and downstream activities rely heavily on ball valves for isolation, safety, and regulating high-pressure production, refining, and storage systems worldwide.

Energy and Power industries adopt ball valves within power plant feedwater, turbine control, and district heat networks. As renewable projects grow, valves support geothermal, hydrogen, and carbon-capture infrastructure, enhancing operational resilience and safety compliance standards.

Water and Wastewater Treatment systems rely on corrosion-resistant ball valves for filtration, desalination, sewage lines, and potable water handling. Rising investments in smart water infrastructure and city modernisation stimulate steady deployment across both public and private utility operators.

Pharmaceuticals require sterile, precision-machined ball valves for cleanroom processing and batch production. Their easy-clean design and compliance with hygienic standards make them essential in sterile drug manufacturing and biotech fermentation systems.

Key Market Segments

By Material

- Steel

- Cast Iron

- Cryogenic

- Alloy Based

- Others

By Type

- Trunnion-mounted Ball Valves

- Floating Ball Valve

- Rising Stem Ball Valve

- Full-Port Ball Valve

By Size

- Less than 1 inch

- 1 to 5 inches

- 6 to 24 inches

- 25 to 50 inches

- Greater than 50 inches

By End-Use

- Oil and Gas

- Energy and Power

- Water and Wastewater Treatment

- Pharmaceuticals

- Pulp and Paper

- Food and Beverages

- Others

Emerging Trends

Increasing Shift Toward Automation and Smart Systems Drives Market Trends

A key trend shaping the ball valve market is the shift toward smart and automated valve solutions. Industries are prioritising improved efficiency, reduced downtime, and remote operation, which boosts demand for electrically and pneumatically actuated ball valves. Material innovation is also becoming a major trend.

- Sectors such as chemicals, pharmaceuticals, marine, and cryogenic applications require specialised materials like high-alloy steel, ceramic coatings, and corrosion-resistant metals. This trend encourages product development and technical upgrades. The International Energy Agency (IEA) reports that global electricity consumption jumped by 4.3% in 2024, driven by rising cooling loads, electrified transport.

Sustainability and regulatory compliance are influencing buyer decisions. Industries now prefer valves that minimise leakage and energy loss. As environmental rules tighten, manufacturers offering durable and energy-efficient designs gain a competitive edge. This shift pushes manufacturers to improve engineering flexibility and digital configuration capabilities, shaping the future of the market.

Drivers

Growing Investment in Oil, Gas, and Power Infrastructure Drives Market Growth

Growing investment in oil and gas pipelines is a key driver for the ball valve market. As governments and companies expand pipeline networks to improve fuel transport, demand for reliable flow-control components increases. Ball valves are preferred because they offer tight sealing, low maintenance, and simple operation. With rising global energy demand, industries are strengthening their distribution networks, which directly supports market growth.

- In the power sector, new thermal, renewable, and nuclear facilities require effective control systems for steam, water, and fuel. Ball valves play a crucial role in these systems due to their high durability under high temperature and pressure. The IEA’s World Energy Investment 2024 report indicates that clean-energy investment in the U.S. exceeded USD 300 billion in 2024, about 1.6 times.

Water and wastewater treatment infrastructure is another fast-growing application. Rapid urbanisation has increased the need for municipal water networks and industrial treatment facilities. Ball valves are widely used because they prevent leakage and support automated control systems. As water scarcity becomes a global concern, governments are spending more on treatment and recycling systems, expanding the market further.

Restraints

High Installation and Maintenance Costs Limit Market Expansion

One major restraint for the ball valve market is the high cost linked with installation, especially in large-scale projects such as oil and gas, chemicals, and power plants. These industries often require valves made from advanced materials like stainless steel, alloy steel, or cryogenic-rated metals, which increases overall cost. For small industries or municipal systems working with limited budgets, these expenses can slow down adoption.

- Maintenance cost is another concern. Ball valves installed in corrosive, high-pressure, or high-temperature environments need frequent inspection and servicing to avoid leakage or failure. According to the IEA, while energy demand grew by 2.2% in 2024 (above the decade average of 1.3%), many advanced economies saw only 1% growth.

Operational downtime also affects market growth. When a valve fails, shutting down a pipeline or industrial process can result in productivity loss. For industries like petrochemicals or refineries, even a short disruption may lead to significant financial impact, making companies cautious about selecting ball valves without proven durability.

Growth Factors

Expansion of Energy and Water Infrastructure Creates New Market Opportunities

The ball valve market is experiencing strong growth opportunities due to increasing investments in water and wastewater treatment facilities. Many developing economies are upgrading outdated pipelines and distribution systems, which increases the demand for durable and corrosion-resistant valves. This shift supports long-term revenue growth for manufacturers.

Growth in the energy sector also contributes to new opportunities. LNG terminals, hydrogen production projects, and oil and gas pipeline expansions require high-performance ball valves that can operate under extreme pressure and temperature. Companies offering advanced sealing materials and automated technologies are well-positioned to benefit.

Another opportunity comes from the rising use of industrial automation. Industries are moving toward remote operation systems that require valves with smart sensors, actuators, and digital control features. Manufacturers able to integrate IoT-based monitoring and predictive maintenance capabilities can expand their customer base.

Regional Analysis

Asia Pacific Leads the Ball Valve Market with a Market Share of 43.9%, Valued at USD 6.0 Billion

In 2024, Asia Pacific remained the dominant regional hub for the Ball Valve Market due to strong investments in oil & gas, chemical processing, and industrial automation. The region’s share of 43.9%, worth nearly USD 6.0 billion, reflects rapid infrastructure expansion across China, India, South Korea, and Southeast Asia. Rising adoption of district heating systems, LNG terminals, and wastewater treatment facilities continues to boost demand.

North America shows steady demand, driven by pipeline modernisation, shale gas expansion, and increasing use of automation in the energy and process industries. Regulatory upgrades in water and wastewater systems also support market adoption. The region continues benefiting from industrial refurbishment cycles and rising digital control integration across critical infrastructure systems.

Europe’s market is influenced by stringent environmental standards, growing hydrogen infrastructure projects, and the modernisation of ageing pipeline networks. Countries like Germany, the UK, and Italy are focusing on carbon-neutral energy systems and municipal water treatment upgrades. The region is also experiencing rising demand for cryogenic and high-performance valves for advanced fluid control applications.

The U.S. market benefits from strong technological adoption, refinery upgrades, and rapid LNG export infrastructure growth. Modernisation of municipal water networks and increased focus on energy resiliency are key drivers. Moreover, the shift toward smart industrial control systems and predictive maintenance continues to reinforce demand across key industrial sectors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bray International holds a solid position in the ball valve market with a broad line of resilient-seated and high-performance designs serving water, HVAC, chemical, and power customers. Its strength lies in competitive pricing, fast delivery, and strong project support, making it a preferred partner for mid-size industrial and infrastructure projects worldwide. The company is also steadily adding automation-ready designs to stay relevant in smart plant upgrades.

Crane Co. is positioned as a technology-driven valve manufacturer with deep engineering expertise and strong OEM relationships. The company focuses on reliability in severe service, targeting oil and gas, petrochemicals, and power applications. By emphasising quality, standards compliance, and lifecycle support, it competes more on performance and total cost of ownership than on price. This approach helps Crane retain share in highly specified projects and brownfield retrofits.

Emerson Electric Co. leverages its wider industrial automation portfolio to differentiate in the ball valve landscape. Integrated digital control, diagnostics, and asset-management platforms allow customers to monitor valve health and optimise plant uptime. This systems-based approach, combined with global service centres, positions Emerson strongly in complex process industries and large capital projects. Its ability to bundle valves with controls and software remains a key commercial advantage.

Flowserve Corporation benefits from a large installed base across refineries, pipelines, and power plants, supporting recurring aftermarket revenue for ball valves and related services. Its focus on engineered solutions and lifecycle partnerships strengthens customer stickiness and margins. Flowserve’s global manufacturing footprint also helps it meet local content and delivery expectations in energy and industrial markets.

Top Key Players in the Market

- Bray International

- Crane Co.

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- KITZ Corporation

- Schlumberger

- Spirax Sarco Limited

- Trillium Flow Technologies

- Valmet

- Velan, Inc

Recent Developments

- In 2024, Bray International announced a strategic sales and distribution partnership with Aquestia Products, marking a significant step in its commitment to providing advanced flow control solutions, including ball valves and actuators, through exclusive channels.

- In 2024, Emerson outlined a four-pillar innovation strategy for valves, emphasising connectivity, sustainability, and performance enhancements for ball valves like the Fisher Vee-Ball series, which now integrate Whisper NXV trim to reduce noise and vibration in high-pressure gas services.

Report Scope

Report Features Description Market Value (2024) USD 13.8 billion Forecast Revenue (2034) USD 21.0 billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Cast Iron, Cryogenic, Alloy Based, Others), By Type (Trunnion-mounted Ball Valves, Floating Ball Valve, Rising Stem Ball Valve, Full-Port Ball Valve), By Size (Less than 1 inch, 1 to 5 inches, 6 to 24 inches, 25 to 50 inches, Greater than 50 inches), By End-Use (Oil and Gas, Energy and Power, Water and Wastewater Treatment, Pharmaceuticals, Pulp and Paper, Food and Beverages, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bray International, Crane Co., Emerson Electric Co., Flowserve Corporation, IMI plc, KITZ Corporation, Schlumberger, Spirax Sarco Limited, Trillium Flow Technologies, Valmet, Velan, Inc Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Bray International

- Crane Co.

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- KITZ Corporation

- Schlumberger

- Spirax Sarco Limited

- Trillium Flow Technologies

- Valmet

- Velan, Inc