Global Asphalt Additives Market Size, Share and Report Analysis By Product Type (Polymeric Modifiers, Emulsifiers, Anti-strip And Adhesion Promoters, Chemical Modifiers, and Others), By Form (Powder and Liquid), By Application (Road Paving, Roofing, and Others), By End Use (Industrial, Public infrastructure, Commercial, and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175373

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

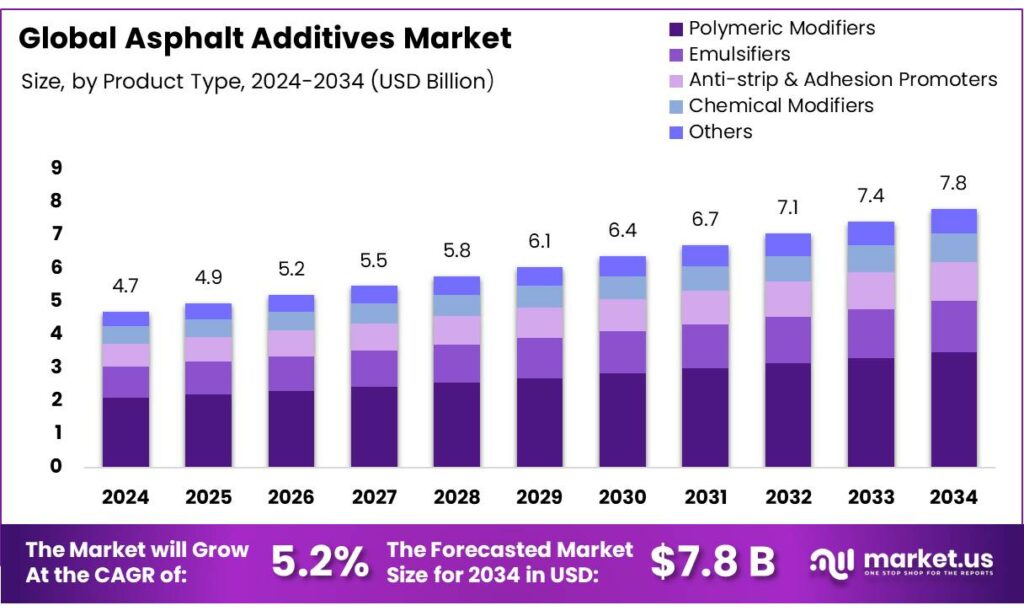

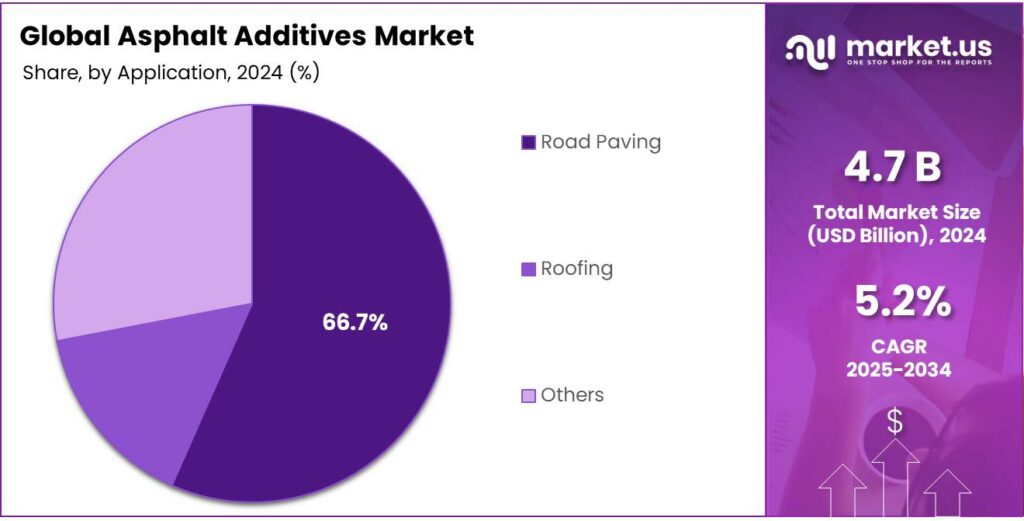

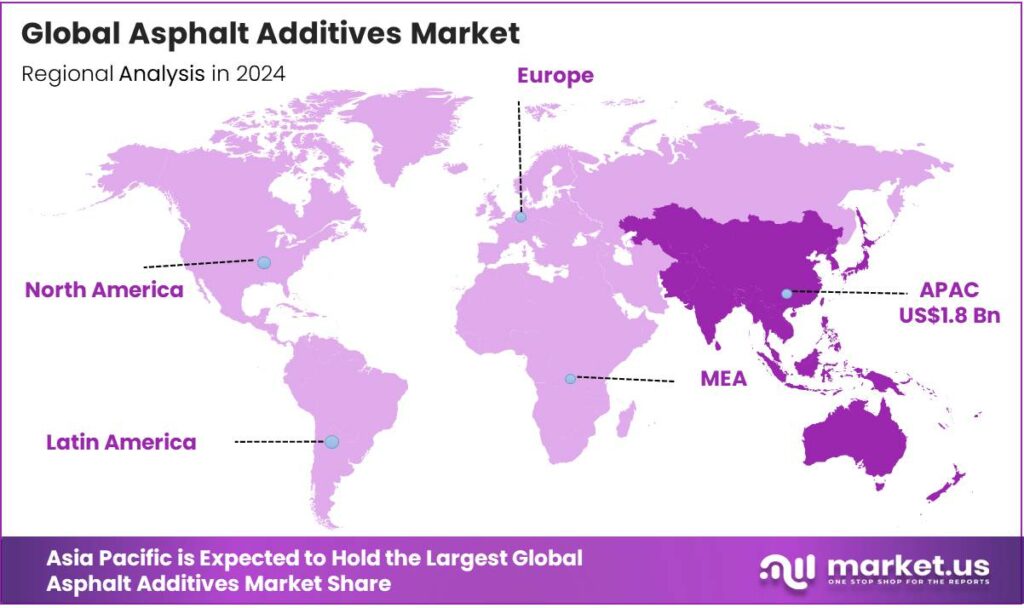

Global Asphalt Additives Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.7% share, holding USD 1.6 Billion in revenue.

Asphalt additives are specialized materials blended into asphalt binders to enhance the durability, workability, and sustainability of road surfaces. They are primarily used to address performance issues like rutting, cracking, and moisture damage. Modified asphalt can last 4-6 years longer on average than untreated asphalt. The market is primarily shaped by the expansion of infrastructure, government-led projects, and a shift toward sustainable construction practices.

- According to the United Nations, approximately 68% of the world’s population is projected to reside in urban areas by 2050, necessitating significant investment in new roads, highways, bridges, and transport systems.

Additives such as polymers, liquid modifiers, and chemical enhancers are widely used in road paving to improve durability, resistance to rutting, cracking, and moisture damage, with polymeric and liquid additives being the most prevalent due to their broad performance benefits and ease of integration into asphalt production.

- According to the European Asphalt Pavement Association (EAPA), in 2023, an average of 76% of asphalt was reused, 20% was recycled, and only 4% ended up in unknown applications or put to landfill, which marks a notable shift towards sustainable practices in the construction industry.

Additionally, public infrastructure dominates consumption as highways, bridges, and urban roads face high traffic loads and stringent durability standards, unlike residential or commercial applications. Furthermore, regional dynamics favor Asia Pacific, where large-scale initiatives such as China’s Belt and Road and India’s National Infrastructure Pipeline drive extensive use of advanced asphalt materials.

- In the US alone, through August 2024, about US$480 billion in federal funding was announced for more than 60,000 infrastructure projects. As investments in infrastructure development rise, there will be consistent demand for asphalt additives for the projects.

Moreover, trends such as warm mix asphalt (WMA) and environmentally friendly modifiers reflect a growing emphasis on sustainability, while challenges such as inconsistent awareness, lack of standardization, and geopolitical supply chain disruptions continue to affect adoption and material availability globally.

- Production of WMA at reduced temperatures saved 2.1 trillion Btu of energy and cut 0.14 million metric tons (MMT) of carbon dioxide emissions in 2024, which is equal to the emissions of 31,000 cars.

- According to the US National Asphalt Pavement Association (NAPA), the WMA represented approximately 39.1% of the total estimated asphalt mixture market in the 2023 construction season, totaling 172 million tons.

Key Takeaways

- The global asphalt additives market was valued at USD 4.7 billion in 2024.

- The global asphalt additives market is projected to grow at a CAGR of 5.2% and is estimated to reach USD 7.8 billion by 2034.

- On the basis of types of asphalt additives, polymeric modifiers dominated the market, constituting 44.5% of the total market share.

- Based on the form, liquid asphalt additives dominated the market, with a substantial market share of around 65.7%.

- Based on the applications of asphalt additives, road paving led the market, comprising 66.7% of the total market.

- Among the end uses of asphalt additives, public infrastructure held a major share in the market, 55.4% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the asphalt additives market, accounting for 38.7% of the total global consumption.

Product Type Analysis

Polymeric Modifiers Are a Prominent Segment in the Asphalt Additives Market.

The market is segmented based on types of asphalt additives into polymeric modifiers, emulsifiers, anti-strip & adhesion promoters, chemical modifiers, and others. The polymeric modifiers led the asphalt additives market, comprising 44.5% of the market share, as they deliver broad, measurable performance improvements across multiple pavement distress mechanisms.

- The polymer-modified asphalt can reduce rutting by over 50% under specific conditions compared to unmodified binders.

The polymer-modified asphalt significantly improves resistance to rutting at high temperatures, cracking at low temperatures, and fatigue under repeated traffic loads, which address the primary causes of premature pavement failure on heavily trafficked roads.

In contrast, emulsifiers and anti-strip or adhesion promoters are functional additives, designed to solve specific issues such as moisture damage or workability, rather than to enhance overall mechanical performance. Similarly, chemical modifiers often target niche performance requirements or processing efficiency. Additionally, the polymeric modifiers alter the viscoelastic behavior of the binder itself, enabling longer service life and reduced maintenance intervals. Consequently, polymers are more frequently recommended in national and state pavement guidelines, driving their wider adoption compared with other additive categories.

Form Analysis

Liquid Asphalt Additives Dominated the Market.

On the basis of the form, the asphalt additives market is segmented into powder and liquid. The liquid asphalt additives dominated the market, comprising 65.7% of the market share, primarily due to their ease of handling, dosing accuracy, and compatibility with existing asphalt production processes.

The liquid additives can be metered directly into asphalt binders or mixing drums, enabling precise and consistent dispersion without additional processing steps, which reduces operational complexity at asphalt plants and minimizes the risk of segregation or incomplete blending. Contrarily, the powder additives often require specialized feeding systems and stricter moisture control to avoid agglomeration or uneven distribution, which can affect pavement performance.

Application Analysis

Asphalt Additives Products Are Mostly Utilized for Road Paving Applications.

Based on the applications of asphalt additives, the market is divided into road paving, roofing, and others. The road paving dominated the asphalt additives market, with a notable market share of 66.7%, as road pavements are exposed to more severe and variable mechanical and environmental stresses. The traffic loading, rutting, fatigue cracking, thermal cracking, and moisture damage are the dominant causes of pavement failure.

Asphalt additives are specified to modify binder rheology, improve elasticity, and enhance durability under repeated axle loads and wide temperature ranges. In contrast, roofing asphalt is typically static and designed primarily for waterproofing and weather resistance, with limited exposure to mechanical stress. Consequently, fewer performance-enhancing additives are required. Road construction standards issued by transport ministries frequently mandate or recommend additives to extend pavement service life, driving their predominant use in paving applications.

End Use Analysis

Public Infrastructure Held a Major Share of the Asphalt Additives Market.

Among the end uses, 55.4% of the total global consumption of asphalt additives products is for public infrastructure, as roadways, highways, and bridges experience high traffic volumes and are subject to rigorous performance and durability standards. Public projects are often larger in scale and follow standardized specifications, requiring consistent quantities of high-performance asphalt.

In addition, the government agencies, such as the U.S. Federal Highway Administration and the European Commission, mandate the use of additives, particularly polymers, anti-stripping agents, and warm mix technologies, to ensure pavements withstand heavy loads, extreme temperatures, and environmental degradation over long service lives.

In contrast, industrial, commercial, or residential infrastructure involves smaller, lower-traffic pavements or roofing applications where mechanical stresses are limited, and performance standards are less stringent. Consequently, the bulk consumption and standardized use of additives in public road projects drive a disproportionately higher share of total revenue.

Key Market Segments

By Product Type

- Polymeric Modifiers

- Emulsifiers

- Anti-strip & Adhesion Promoters

- Chemical Modifiers

- Others

By Form

- Powder

- Liquid

By Application

- Road Paving

- Roofing

- Others

By End Use

- Industrial

- Public infrastructure

- Commercial

- Residential

Drivers

Expansion of Infrastructure Drives the Asphalt Additives Market.

The expansion of infrastructure driven by increasing industrialization and urbanization has significantly impacted the asphalt additives market, which is essential for enhancing the performance and durability of asphalt in road construction, pavements, and other infrastructure projects. As industrialization increases, there is a growing interest in infrastructure development for the transportation of goods, which propels the demand for asphalt additives. Additionally, as the population in urban areas increases, there is demand for new roads, highways, bridges, and transport systems.

- According to the TRIP, a national non-profit transportation research organization in the US, in 2022, the U.S. freight system moved 19.7 billion tons of freight, valued at US$18.8 trillion, with trucks carrying 72% of freight by value and 64% by weight.

As countries prioritize infrastructure development, particularly in emerging economies, the demand for high-performance materials, including modified asphalts, has surged. As there is a heightened demand for developed infrastructure, the total asphalt production is increasing across the globe, driving the demand for asphalt additives.

- According to the EAPA, in 2023, total asphalt production was 202.7 million tons in the EU-27 and 269.0 million tons including additional European countries.

Restraints

Lack of Awareness and Standardization Might Restrain the Demand for Asphalt Additives.

The lack of awareness and standardization of asphalt additives presents a significant challenge to the market, hindering their widespread adoption and effective use in infrastructure projects. The state highway agencies have had varying specifications for additives, making it difficult to mandate or encourage consistent use. According to a report by the U.S. Federal Highway Administration, many state-level transportation agencies still face challenges in adopting advanced asphalt technologies due to insufficient training and a lack of technical support for asphalt additives.

Furthermore, the absence of standardized specifications for asphalt additives across different regions exacerbates this issue. In India, the Bureau of Indian Standards (BIS) has made strides in creating guidelines for modified bituminous mixes, but variability in local standards persists, which can lead to inconsistencies in the quality and performance of asphalt used in road construction projects.

Similarly, the European Union’s efforts to harmonize asphalt standards through the European Asphalt Pavement Association have encountered slow progress, which has created challenges for manufacturers and contractors seeking uniform product specifications. This lack of standardization and awareness undermines the potential for consistent product performance, complicating the integration of high-quality asphalt additives into infrastructure projects globally.

Opportunity

Government Investments in Infrastructure Create Opportunities in the Asphalt Additives Market.

Government investments in infrastructure have created significant opportunities for the asphalt additives market, particularly as nations prioritize road construction, repair, and urban development. For instance, in the United States, the Infrastructure Investment and Jobs Act (IIJA) allocates substantial funding for highway and road maintenance projects. The U.S. Department of Transportation has specifically emphasized sustainable infrastructure, which includes the use of durable materials such as modified asphalts enhanced by additives for longer-lasting pavements.

In India, the National Infrastructure Pipeline (NIP) program, which envisioned a US$1.4 trillion investment between 2019 and 2025, spanning over 9,000 projects across sectors such as energy, transport, and urban development, has placed significant emphasis on road development. As part of this initiative, the Ministry of Road Transport and Highways (MoRTH) has promoted the use of high-performance asphalt mixes, including those containing additives, to meet the rising demands of urbanization and expressway construction.

Similarly, in the European Union, the European Investment Bank (EIB) has provided funding for the Trans-European Transport Network (TEN-T), focusing on improving road quality through the adoption of advanced materials such as modified asphalts. Similarly, the US Bipartisan Infrastructure Investment and Jobs Act allocated US$110 billion for roads, bridges, and major projects. These investments create an enabling environment for the increased use of asphalt additives to ensure roads meet safety, durability, and environmental standards.

Trends

Shift Towards Sustainable Construction Practices.

The shift toward sustainable construction practices, particularly the adoption of warm mix asphalt (WMA), is a notable trend in the asphalt additives market. WMA technologies allow asphalt to be produced and applied at lower temperatures compared to traditional hot mix asphalt (HMA), resulting in reduced energy consumption and lower greenhouse gas emissions.

- According to the U.S. Federal Highway Administration (FHWA), WMA technologies have gained traction due to their environmental benefits and improved workability, with approximately 50% of all new asphalt pavements in the U.S. incorporating WMA techniques in recent years.

In Europe, the European Commission has supported sustainable road construction through initiatives, such as the Horizon program, which encourages the use of WMA and other environmentally friendly asphalt solutions. The use of WMA reduces the release of harmful fumes during asphalt production, aligning with the EU’s strict environmental standards on air quality and carbon emissions. These trends indicate that WMA, facilitated by specific asphalt additives, is increasingly seen as a key solution in the construction industry’s move toward greener, more sustainable practices.

Geopolitical Impact Analysis

Severely Affected Supply Chains of Asphalt Additives Amid Geopolitical Tensions.

The geopolitical tensions, particularly those arising from conflicts and trade disruptions, have had a notable impact on the asphalt additives market, primarily through supply chain disruptions and fluctuating raw material prices. For instance, the war in Ukraine has led to instability in global supply chains, affecting the availability of key raw materials used in asphalt production, such as bitumen and certain polymers. The European Union’s reliance on imported bitumen from Russia, prior to sanctions, has intensified the challenge of securing a consistent supply, as reported by the EAPA.

Similarly, sanctions imposed on Russia and ongoing trade tensions between the U.S. and China have disrupted the availability of certain chemicals and additives used in modified asphalt formulations. The U.S. Department of Transportation has acknowledged challenges in securing consistent material supplies, noting that some domestic projects have faced delays due to these global supply chain disturbances. Furthermore, geopolitical tensions in the Middle East have influenced oil prices, indirectly affecting asphalt production costs.

According to the International Energy Agency (IEA), fluctuations in oil prices have impacted the cost of bitumen, a critical component in asphalt manufacturing. These geopolitical factors have contributed to cost volatility and supply uncertainties in the asphalt additives market, complicating procurement and project timelines for infrastructure projects globally.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Asphalt Additives Market.

In 2024, the Asia Pacific dominated the global asphalt additives market, holding about 38.7% of the total global consumption, driven by rapid industrialization, urbanization, and extensive infrastructure development. The region has invested heavily in road construction and expansion, with China and India leading major infrastructure initiatives such as the Belt and Road Initiative and the National Infrastructure Pipeline, respectively.

In India, the Ministry of Road Transport & Highways accelerated construction rates, with the national highway network length expanding substantially year over year to accommodate increasing commercial and passenger traffic. For instance, the Bharatmala Pariyojana program involves the development of approximately 83,677 km of roads. These projects necessitate the use of high-performance materials, including modified asphalts enhanced by additives.

In China, the Ministry of Transport has promoted the use of advanced asphalt technologies to improve the durability and sustainability of roads, particularly in high-traffic urban areas. Similarly, the Indian Ministry of Road Transport and Highways has increasingly advocated for the use of superior asphalt mixes containing additives to ensure road longevity and resistance to extreme weather conditions. The region’s growing demand for durable and sustainable infrastructure has driven a consistent demand for asphalt additives, positioning Asia Pacific as the dominant market globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of asphalt additives focus on innovation in product development, with emphasis on improving the performance and environmental sustainability of additives, including developing additives that enhance the durability, weather resistance, and load-bearing capacity of asphalt while reducing environmental impact, such as through the promotion of warm mix asphalt (WMA) technologies.

In addition, these companies focus on collaboration with government and regulatory bodies to ensure that products comply with evolving standards and sustainability guidelines, particularly in regions with stringent environmental regulations. Similarly, manufacturers emphasize strategic geographic expansion. Furthermore, they invest in strengthening supply chains to ensure the timely availability of key raw materials, safeguarding against market volatility, and ensuring the consistent quality of their products.

The Major Players in The Industry

- Ingevity

- Dow Inc.

- BASF SE

- Kraton Corporation

- Sasol Limited

- Nouryon Holding B.V.

- Evonik Industries AG

- Arkema S.A.

- Kao Corporation

- Huntsman Corporation

- Honeywell International Inc.

- DuPont de Nemours, Inc.

- TotalEnergies SE

- Shell Chemicals

- Shrieve Group

- Other Key Players

Key Development

- In February 2024, Shrieve announced the official launch of its PROGILINE ECO-T range, three innovative organic asphalt additives, into the European market.

- In October 2025, Honeywell announced the successful completion of the previously announced spin-off of its Advanced Materials business, which now operates as Solstice Advanced Materials.

Report Scope

Report Features Description Market Value (2024) US$4.7 Bn Forecast Revenue (2034) US$7.8 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Polymeric Modifiers, Emulsifiers, Anti-strip & Adhesion Promoters, Chemical Modifiers, and Others), By Form (Powder and Liquid), By Application (Road Paving, Roofing, and Others), By End Use (Industrial, Public infrastructure, Commercial, and Residential) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Ingevity, Dow Inc., BASF SE, Kraton Corporation, Sasol Limited, Nouryon Holding B.V., Evonik Industries AG, Arkema S.A., Kao Corporation, Huntsman Corporation, Honeywell International Inc., DuPont de Nemours, Inc., TotalEnergies SE, Shell Chemicals, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Ingevity

- Dow Inc.

- BASF SE

- Kraton Corporation

- Sasol Limited

- Nouryon Holding B.V.

- Evonik Industries AG

- Arkema S.A.

- Kao Corporation

- Huntsman Corporation

- Honeywell International Inc.

- DuPont de Nemours, Inc.

- TotalEnergies SE

- Shell Chemicals

- Shrieve Group

- Other Key Players