Global Amino Acids Market Size, Share, Growth Analysis By Product (Essential, Non-essential), By Source (Plant-based, Animal-based, Chemical Synthesis, Fermentation), By Grade (Food Grade, Feed Grade, Pharma Grade, Other), By End Use (Food and Beverage, Animal Feed, Pet Food, Pharmaceuticals, Vaccine Formulation, Personal Care and Cosmetics, Dietary Supplements, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158481

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

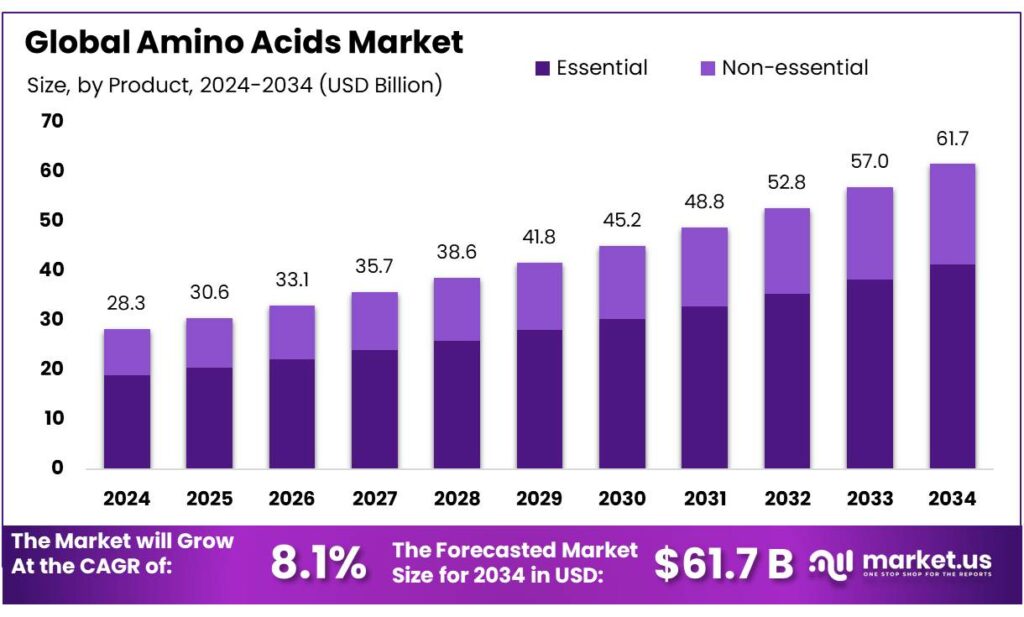

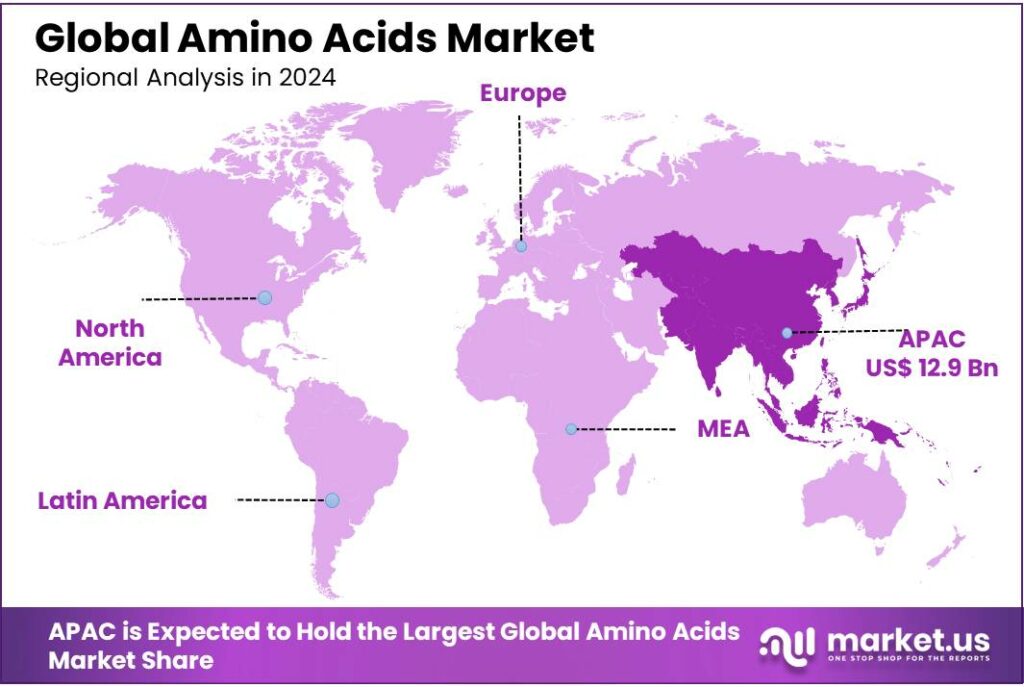

The Global Amino Acids Market size is expected to be worth around USD 61.7 Billion by 2034, from USD 28.3 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.9% share, holding USD 8.6 Billion in revenue.

The amino acids industry in India plays a pivotal role in sectors such as animal nutrition, pharmaceuticals, food processing, and agriculture. Amino acids are organic compounds essential for various physiological functions, including protein synthesis, enzyme activity, and metabolic regulation. In India, the demand for amino acids has been steadily increasing due to the expanding livestock industry, rising consumer awareness about health and nutrition, and advancements in production technologies.

The government’s initiatives have further bolstered the amino acids industry. The Department of Animal Husbandry and Dairying has launched programs such as the National Livestock Mission and the Rashtriya Gokul Mission to enhance livestock development and improve feed quality. Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of ₹15,000 crore, aims to increase private sector investment in developing animal husbandry infrastructure, including animal feed plants.

The pharmaceutical sector is a major contributor to this growth, with India being the world’s third-largest producer of pharmaceuticals by volume. The country produces over 60,000 generic drugs in different therapeutic categories and supplies more than 40% of the U.S. demand for generic drugs. Amino acids play a crucial role in drug formulations, particularly in parenteral nutrition and biopharmaceuticals.

Key Takeaways

- Amino Acids Market size is expected to be worth around USD 61.7 Billion by 2034, from USD 28.3 Billion in 2024, growing at a CAGR of 8.1%.

- Essential amino acids are projected to account for approximately 58.5% of the global amino acids market share.

- Plant-based amino acids held a dominant position in the global market, capturing more than a 44.2% share.

- Food-grade amino acids held a dominant market position, capturing more than a 39.5% share.

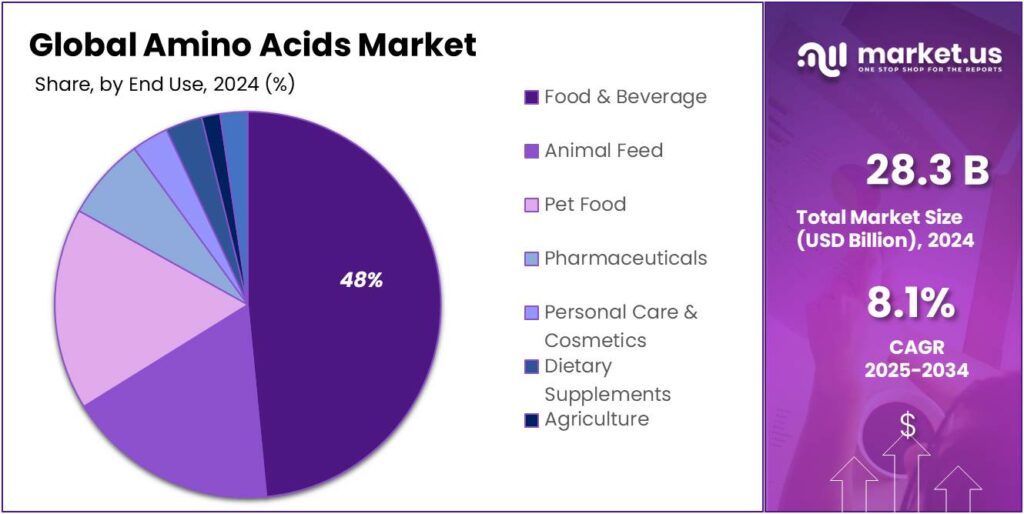

- Food & Beverage industry held a dominant position in the global amino acids market, capturing more than a 32.1% share.

- Asia Pacific region held a commanding 45.90% share of the global amino acids market, valued at approximately USD 12.9 billion.

By Product Analysis

Essential Amino Acids Lead Market Growth with 58.5% Share in 2025

In 2025, essential amino acids are projected to account for approximately 58.5% of the global amino acids market share, reflecting their critical role in human nutrition and animal health. These amino acids, which the human body cannot synthesize and must obtain through diet, are integral to various applications, including dietary supplements, pharmaceuticals, and animal feed. The increasing consumer awareness regarding health and wellness, coupled with the rising demand for protein-rich diets, has significantly contributed to the growth of this segment. Moreover, advancements in biotechnology and fermentation processes have enhanced the production efficiency and sustainability of essential amino acids, further driving their market share.

By Source Analysis

Plant-Based Amino Acids Dominate with 44.2% Market Share in 2024

In 2024, plant-based amino acids held a dominant position in the global market, capturing more than a 44.2% share. This dominance is attributed to several factors, including the increasing consumer preference for plant-based diets, advancements in fermentation technology, and the growing demand for sustainable and clean-label products. Plant-based sources such as soy, peas, and other legumes provide efficient and natural supplies of amino acids, aligning with the global trends of veganism and plant-based nutrition. Consumers are increasingly expecting their protein products to be natural and clean-label, further driving the demand for plant-based amino acids.

By Grade Analysis

Food Grade Amino Acids Capture 39.5% Market Share in 2024

In 2024, food-grade amino acids held a dominant market position, capturing more than a 39.5% share. This segment’s prominence is attributed to the increasing consumer demand for fortified and functional foods, driven by rising health consciousness and nutritional awareness. Food-grade amino acids are integral to enhancing the nutritional profile of various food products, including dietary supplements, beverages, and processed foods.

The demand for food-grade amino acids is further bolstered by the growing popularity of plant-based diets and the increasing incorporation of amino acids into vegan and vegetarian food products. Advancements in fermentation technology have also contributed to the efficient production of food-grade amino acids, ensuring a steady supply to meet the rising market demand.

By End Use Analysis

Food & Beverage Sector Leads Amino Acids Market with 32.1% Share in 2024

In 2024, the Food & Beverage industry held a dominant position in the global amino acids market, capturing more than a 32.1% share. This significant market presence underscores the critical role amino acids play in enhancing the nutritional profile and functional properties of food products.

Key drivers of this growth include the rising popularity of health-conscious diets, the demand for functional foods that offer additional health benefits, and the incorporation of amino acids into various food products to improve taste, texture, and nutritional value. As consumers become more aware of the health benefits associated with amino acids, their inclusion in food and beverage products is expected to become more prevalent, thereby sustaining the segment’s leading market position.

Key Market Segments

By Product

- Essential

-

- Histidine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenylalanine

- Threonine

- Tryptophan

- Valine

- Non-essential

- Alanine

- Arginine

- Asparagine

- Aspartic Acid

- Cysteine

- Glutamic Acid

- Glutamine

- Glycine

- Proline

- Serine

- Tyrosine

- Ornithine

- Citrulline

- Creatine

- Selenocysteine

- Taurine

- Others

By Source

- Plant-based

- Animal-based

- Chemical Synthesis

- Fermentation

By Grade

- Food Grade

- Feed Grade

- Pharma Grade

- Others

By End Use

- Food & Beverage

- Bakery

- Dairy

- Confectionery

- Convenience Foods

- Functional Beverages

- Meat Processing

- Infant Formulation

- Others

- Animal Feed

- Pet Food

- Pharmaceuticals

- Personal Care & Cosmetics

- Dietary Supplements

- Agriculture

- Others

Emerging Trends

Surge in Plant-Based Amino Acids

The global demand for plant-based amino acids is experiencing significant growth, driven by increasing consumer interest in health, sustainability, and ethical considerations. As more individuals adopt vegetarian and vegan diets, the need for high-quality, plant-derived amino acids has surged. This shift is not only influenced by personal health choices but also by heightened awareness of environmental issues and animal welfare.

Plant-based proteins, including amino acids from sources like soy, pea, and rice, are gaining popularity due to their lower environmental impact compared to animal-based proteins. Additionally, advancements in food technology have improved the taste, texture, and nutritional profiles of plant-based products, making them more appealing to a broader audience.

Governments worldwide are recognizing the importance of sustainable food systems and are implementing policies to support the development and adoption of plant-based proteins. These initiatives include funding research into alternative protein sources, providing incentives for sustainable farming practices, and establishing regulatory frameworks to ensure the safety and efficacy of fortified food products.

The food industry is responding to this trend by incorporating plant-based amino acids into a variety of products, including dietary supplements, functional foods, and meat alternatives. This growing market aligns with the global shift towards sustainable and plant-centric lifestyles, positioning plant-based amino acids as a key component in the evolving landscape of modern dietary preferences.

Drivers

Government Initiatives Driving the Growth of Food Amino Acids

The increasing global demand for food amino acids is significantly influenced by various government initiatives aimed at enhancing food security, promoting sustainable agriculture, and improving public health. These initiatives are particularly evident in countries like China and India, where governments are actively supporting the integration of amino acids into food systems.

- For instance, China plans to lower the soymeal content in animal feed from 13% in 2023 to 10% by 2030, aiming to decrease annual soybean imports by about 10 million metric tons. This strategy encourages the use of alternative protein sources, including synthetic amino acids, to maintain livestock productivity while reducing import dependence.

Similarly, in India, the government has been promoting the cultivation and utilization of Quality Protein Maize (QPM), a maize variety enriched with essential amino acids like lysine and tryptophan. The Rashtriya Krishi Vikas Yojna has established centers to facilitate the processing and value addition of QPM, integrating it into various food products such as biscuits, cakes, and pasta. This initiative aims to combat malnutrition and enhance the nutritional quality of staple foods.

These government-led efforts not only support the growth of the food amino acids market but also contribute to broader objectives of nutritional improvement and agricultural sustainability. By fostering an environment conducive to the production and incorporation of amino acids into food systems, these initiatives play a pivotal role in shaping the future of global food security.

Restraints

Regulatory Hurdles in Amino Acid Additives for Food Products

The integration of amino acids into food products has been met with increasing scrutiny from regulatory bodies worldwide, posing significant challenges for manufacturers. While amino acids are essential for human health, their use as food additives is tightly regulated to ensure safety and efficacy.

In the United States, the Food and Drug Administration (FDA) oversees the safety of food additives, including amino acids. Under the Food Additives Amendment of 1958, any substance added to food must be proven safe through rigorous testing before approval. However, the FDA’s Generally Recognized As Safe (GRAS) designation allows companies to self-affirm the safety of certain substances without prior FDA approval, leading to concerns about the thoroughness of safety evaluations.

Similarly, in the European Union, the use of amino acids as food additives is governed by strict regulations. The European Food Safety Authority (EFSA) evaluates the safety of food additives, including amino acids, before they can be authorized for use in food products. This process involves comprehensive assessments to ensure that the additives do not pose health risks to consumers.

These regulatory frameworks, while essential for consumer safety, can create barriers for manufacturers seeking to introduce new amino acid-based products. The lengthy approval processes and stringent safety requirements can delay product development and increase costs, potentially hindering innovation in the food industry.

Opportunity

Amino Acids in Functional Foods and Dietary Supplements

The global food industry is undergoing a transformation, with consumers increasingly seeking products that offer more than just basic nutrition. Amino acids, the building blocks of proteins, are gaining prominence in this shift, especially within functional foods and dietary supplements. These products are designed not only to nourish but also to support specific health benefits, catering to a more health-conscious and informed consumer base.

Functional foods are those that provide health benefits beyond basic nutrition. Amino acids play a crucial role in this category due to their essential functions in the body. For instance, they are vital for muscle repair, immune function, and overall metabolic processes. As consumers become more aware of the importance of these nutrients, there’s a growing demand for foods enriched with amino acids.

Dietary supplements have become a significant part of daily health routines for many individuals. Amino acids are among the most sought-after supplements, particularly branched-chain amino acids (BCAAs) like leucine, isoleucine, and valine, which are popular among athletes and fitness enthusiasts for their role in muscle recovery and performance enhancement.

For example, the Food Safety and Standards Authority of India (FSSAI) has been actively working on updating food fortification standards, which includes the incorporation of amino acids into staple foods to address nutritional deficiencies. Such regulatory support is facilitating the inclusion of amino acids in a wide range of food products, making them more accessible to the general population.

Regional Insights

Asia Pacific Dominates Global Amino Acids Market with 45.90% Share in 2024

In 2024, the Asia Pacific region held a commanding 45.90% share of the global amino acids market, valued at approximately USD 12.9 billion. This dominance is driven by several key factors, including the region’s large population base, increasing health consciousness, and robust industrial activities across various sectors.

In the food and beverage sector, the demand for amino acids is escalating due to the increasing popularity of functional foods and dietary supplements. Consumers are becoming more health-conscious, seeking products that offer enhanced nutritional benefits. This trend is particularly evident in countries like China and India, where rising disposable incomes and urbanization are driving the consumption of protein-enriched foods.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is a global leader in food ingredients and agricultural products. In the amino acids market, ADM focuses on producing essential amino acids like lysine and methionine, which are primarily used in animal nutrition and human health applications. The company leverages its advanced fermentation technology to produce high-quality amino acids and supports sustainable practices. With a strong global presence, ADM is well-positioned to cater to the growing demand for amino acids across various industries.

Ajinomoto Co., Inc. is a prominent player in the amino acids market, specializing in both food and pharmaceutical-grade amino acids. The company produces a wide range of amino acids, including glutamic acid, aspartic acid, and leucine. Known for its innovation in fermentation technology, Ajinomoto supplies amino acids for food, beverage, and animal feed industries. With a significant global footprint, the company continues to lead in research and development, focusing on health-enhancing products and sustainable production processes.

MartinBauer Group is a leading player in the amino acids market, particularly known for its natural and plant-based amino acid solutions. The company supplies amino acids for various applications, including food, beverages, and nutraceuticals. MartinBauer emphasizes the use of high-quality raw materials and environmentally friendly production methods. With extensive research and development capabilities, MartinBauer focuses on providing innovative, natural solutions that meet the growing consumer demand for plant-based and functional foods.

Top Key Players Outlook

- ADM

- Ajinomoto Co., Inc.

- AMINO GmbH

- MartinBauer

- CJ CheilJedang Corp.

- DAESANG

- dsm-firmenich.

- Evonik

- Fermentis Life Sciences

- IRIS BIOTECH GmbH

Recent Industry Developments

In 2024, Ajinomoto Co., Inc. reported consolidated revenues of ¥1.53 trillion , marking a 6.3% increase year-over-year. The company achieved a business profit of ¥159.3 billion, reflecting a 7.9% growth, primarily driven by its Seasonings and Foods segment, which saw a 5.8% rise in sales to ¥896.0 billion and a 2.2% increase in business profit to ¥113.9 billion.

In 2024, ADM’s Nutrition segment reported an operating profit of $88 million in Q4, a notable recovery from a $10 million loss in the same quarter of the previous year.

Report Scope

Report Features Description Market Value (2024) USD 28.3 Bn Forecast Revenue (2034) USD 61.7 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Essential, Non-essential), By Source (Plant-based, Animal-based, Chemical Synthesis, Fermentation), By Grade (Food Grade, Feed Grade, Pharma Grade, Other), By End Use (Food and Beverage, Animal Feed, Pet Food, Pharmaceuticals, Vaccine Formulation, Personal Care and Cosmetics, Dietary Supplements, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Ajinomoto Co., Inc., AMINO GmbH, MartinBauer, CJ CheilJedang Corp., DAESANG, dsm-firmenich., Evonik, Fermentis Life Sciences, IRIS BIOTECH GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Ajinomoto Co., Inc.

- AMINO GmbH

- MartinBauer

- CJ CheilJedang Corp.

- DAESANG

- dsm-firmenich.

- Evonik

- Fermentis Life Sciences

- IRIS BIOTECH GmbH