Global Advanced Packaging Market Size, Share, Growth Analysis By Type (Flip-Chip, Fan-Out WLP, Embedded-Die, Fan-In WLP, 2.5D/3D, Others), By Application (Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace & Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147680

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

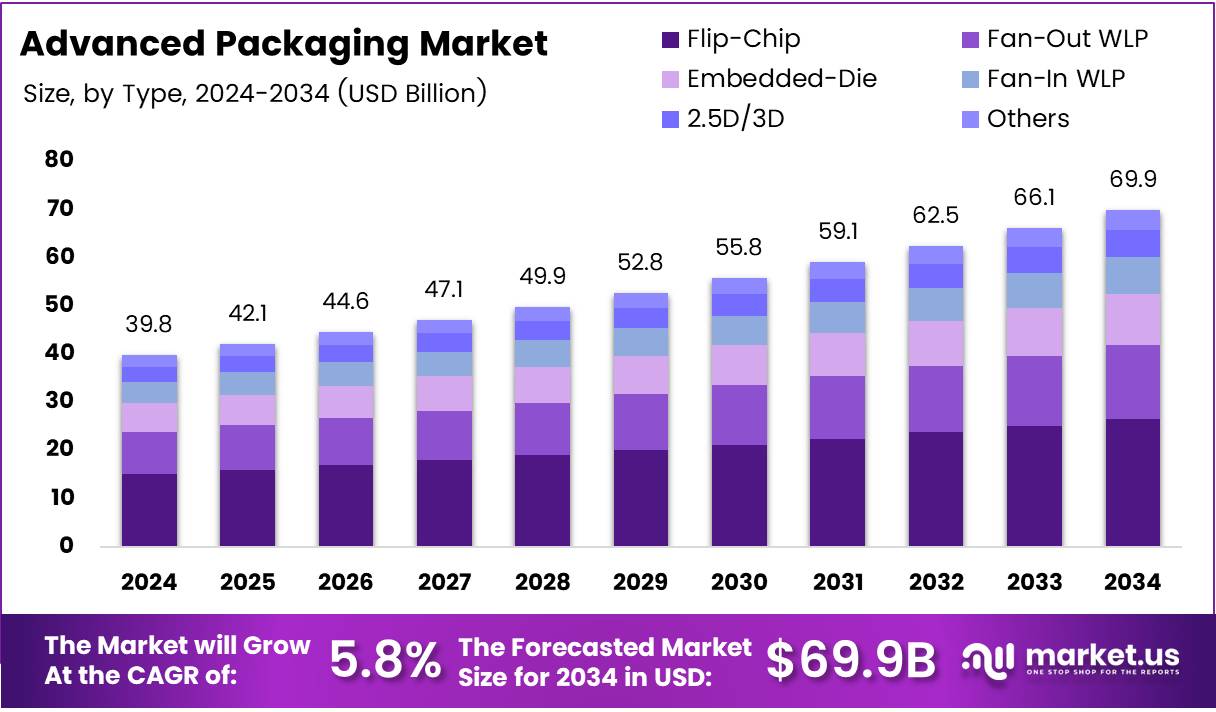

The Global Advanced Packaging Market size is expected to be worth around USD 69.9 Billion by 2034, from USD 39.8 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The advanced packaging market refers to the integration of packaging technologies into various consumer and industrial sectors, including electronics, pharmaceuticals, and food & beverages. Advanced packaging enhances product protection, facilitates functionality, and supports sustainability efforts. The sector is driven by the growing demand for miniaturization in electronics, consumer preferences for premium packaging, and advancements in materials and technologies.

According to Yole Group, advanced packaging revenue accounted for 44% of the total integrated circuit (IC) packaging market in 2023. This highlights the significant role of advanced packaging in the broader IC industry, with companies focusing on improving packaging efficiency, performance, and cost-effectiveness. The shift towards smaller, more powerful electronics, such as smartphones, wearables, and other consumer electronics, is expected to drive further growth in the coming years.

The food and beverage sector is another key driver for advanced packaging, as consumers increasingly seek products with premium packaging. Research by Brprinters indicates that 61% of consumers are more likely to repurchase luxury products with premium packaging. This trend underscores the rising importance of packaging aesthetics and functionality in influencing consumer purchase decisions, creating a growing market for high-quality, innovative packaging solutions.

Government investment in packaging innovation is playing a vital role in market expansion. Many countries are introducing regulations to improve sustainability in packaging. Governments are promoting the development of eco-friendly and recyclable materials to reduce plastic waste.

For instance, the European Union’s regulations on packaging and packaging waste are pushing companies to adopt sustainable packaging technologies. These regulations are expected to lead to increased investments in environmentally responsible advanced packaging solutions, creating both challenges and opportunities for companies.

As demand for advanced packaging continues to rise, companies are capitalizing on opportunities to innovate and diversify their product offerings. Businesses focusing on incorporating smart packaging technologies, such as RFID and QR codes, can enhance product traceability and consumer engagement.

Additionally, companies that invest in eco-friendly packaging solutions are likely to benefit from increasing consumer demand for sustainable products. The advanced packaging market, therefore, presents significant opportunities for both growth and innovation.

Key Takeaways

- Global Advanced Packaging Market is projected to reach USD 69.9 Billion by 2034, growing from USD 39.8 Billion in 2024 at a CAGR of 5.8%.

- Flip-Chip technology led the market in 2024 with a 38.6% share in the By Type Analysis segment due to its high-density and cost-efficient packaging advantages.

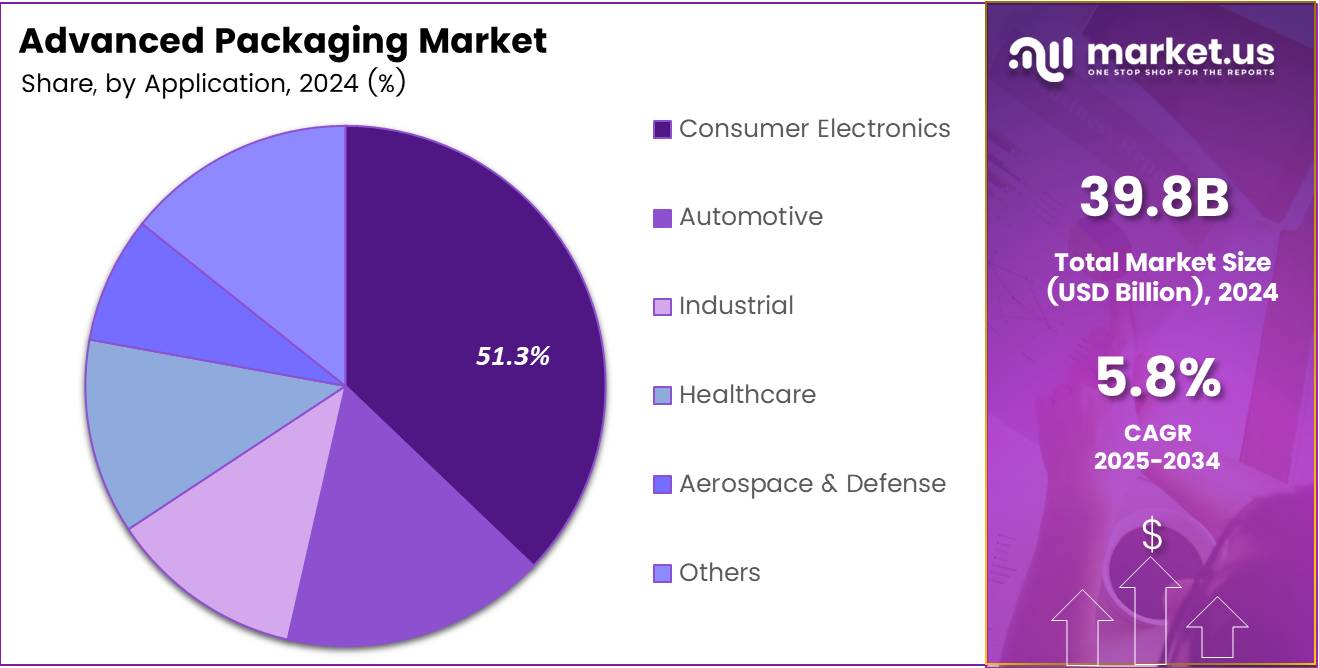

- Consumer Electronics dominated the By Application Analysis in 2024, holding a 51.3% market share, driven by demand in smartphones, laptops, and wearables.

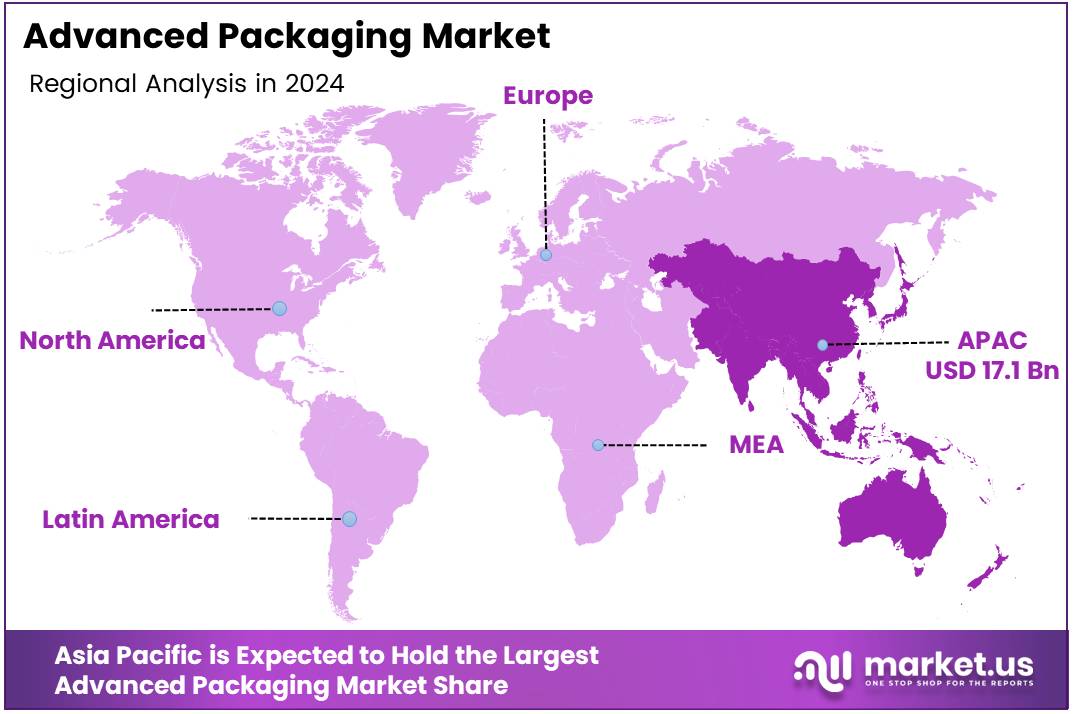

- Asia Pacific was the leading region with a 43.2% market share, valued at USD 17.1 Billion in 2024, thanks to strong semiconductor manufacturing in China, Taiwan, and South Korea.

Type Analysis

In 2024, Flip-Chip leads the Advanced Packaging Market with a 38.6% share.

In 2024, Flip-Chip held a dominant market position in the By Type Analysis segment of the Advanced Packaging Market, with a 38.6% share. Flip-Chip technology is increasingly favored for its ability to provide high-density, reliable, and cost-efficient packaging, especially in applications where space optimization and thermal management are critical. This packaging type is widely used in semiconductors, memory devices, and integrated circuits, contributing to its significant market share.

The widespread adoption of Flip-Chip packaging is driven by its ability to support miniaturization trends across several industries, such as consumer electronics, automotive, and industrial applications. Additionally, Flip-Chip technology supports high-speed data transmission and enhanced performance, making it particularly suitable for the growing demand in high-performance computing and telecommunications sectors.

With continuous advancements in Flip-Chip technology, including improvements in materials and manufacturing processes, this type of packaging remains a central component in meeting the market’s evolving demands. Therefore, Flip-Chip’s dominant market position reflects its strategic importance in ensuring efficient, scalable, and high-performance packaging solutions across multiple sectors.

Application Analysis

In 2024, Consumer Electronics dominates the Advanced Packaging Market with a 51.3% share.

In 2024, Consumer Electronics held a dominant market position in the By Application Analysis segment of the Advanced Packaging Market, with a 51.3% share. This segment benefits from the rapid technological advancements in consumer electronics, such as smartphones, laptops, and wearables, where packaging plays a critical role in ensuring product reliability, performance, and miniaturization. The increasing demand for compact, high-performance devices with advanced features propels the growth of packaging solutions designed to meet these requirements.

Consumer Electronics packaging requires a mix of lightweight, efficient, and cost-effective solutions, driving the demand for innovative advanced packaging techniques. This is evident in the growing need for Fan-In WLP and 2.5D/3D packaging solutions, which support improved thermal management and enhanced connectivity.

Moreover, the surge in electronic device adoption, coupled with increasing consumer demand for high-quality, multi-functional devices, continues to solidify the market position of Consumer Electronics in this segment.

As electronic devices evolve, their packaging requirements become more complex, contributing to the sustained demand for specialized packaging solutions. These developments make the Consumer Electronics sector the leading driver in the global Advanced Packaging Market.

Key Market Segments

By Type

- Flip-Chip

- Fan-Out WLP

- Embedded-Die

- Fan-In WLP

- 2.5D/3D

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Aerospace & Defense

- Others

Drivers

Increasing Consumer Demand for Electronics Drives Market Growth

The rising use of smartphones, tablets, and wearable devices is pushing the need for advanced packaging solutions. Consumers want sleek, high-performing gadgets, and advanced packaging helps manufacturers build smaller, faster, and more powerful electronics. As people continue to adopt smartwatches, wireless earbuds, and compact devices, packaging must evolve to support tiny, high-functioning components without overheating or breaking down.

Semiconductor technology is also improving rapidly. Chips are becoming smaller, yet more powerful, and this requires packaging that can handle high-speed processing while fitting into tighter spaces. Advanced packaging techniques like 2.5D and 3D stacking allow manufacturers to meet performance goals without making devices bulkier. This demand keeps growing as industries focus on miniaturization.

At the same time, there’s increasing awareness about sustainability. Companies are now trying to use eco-friendly materials and processes to reduce waste. Advanced packaging that is recyclable, uses fewer raw materials, or requires less energy to produce is gaining attention. These innovations not only help the planet but also appeal to environmentally conscious consumers, creating further demand.

Restraints

High Manufacturing Costs Pose a Major Challenge

One of the biggest challenges in the advanced packaging market is the high cost of manufacturing. These packaging methods involve complex technologies and precision tools, which make the production process expensive. This cost can be a major barrier, especially for smaller companies or new players in the industry. As a result, some businesses may delay adopting these solutions, slowing down market growth.

Another problem is the lack of standardization in packaging formats. Different manufacturers use different techniques and materials, which can lead to compatibility issues. For example, chips from one company might not fit into another company’s device packaging without modifications. This lack of uniform standards makes integration more difficult and can prevent mass adoption across various industries.

Growth Factors

Expansion in Emerging Markets Unlocks New Opportunities

Emerging markets like India, Southeast Asia, and parts of Latin America are experiencing rapid growth in electronics and industrialization. With more factories and tech startups in these regions, the demand for advanced packaging is set to rise. Companies entering these markets can offer modern solutions that support efficient, small-scale, and cost-effective electronics production.

The rise of the Internet of Things (IoT) is another big opportunity. As more smart devices connect to the internet—from home assistants to industrial sensors—packaging must support wireless communication, power efficiency, and durability. Advanced packaging plays a crucial role in enabling these features by providing compact, protective, and high-performance housing for chips and sensors.

Additionally, smart packaging that includes features like embedded sensors, temperature control, and tamper detection is gaining popularity. This is especially useful in consumer goods, pharmaceuticals, and food products. These smart solutions offer added value and improve user experience, opening up new applications and boosting demand.

Emerging Trends

Miniaturization of Electronics Influences Market Trends

The push to make electronics smaller and more powerful is shaping trends in the advanced packaging market. Consumers and businesses alike want devices that take up less space but deliver more performance. Advanced packaging supports this by allowing chip components to be stacked or placed closely together, which is essential for compact designs like wearables and ultra-thin laptops.

Another trend is the shift toward flexible and lightweight packaging. These solutions are being adopted in industries like healthcare and consumer electronics, where devices need to be portable and easy to use. Flexible packaging also supports the production of bendable or rollable screens, which are becoming more popular in modern gadgets.

A key technological advancement is the adoption of 3D packaging. This technique stacks chips vertically instead of spreading them out flat, allowing for faster data processing and better heat management. It’s especially useful in high-performance applications like AI and 5G, where space and speed are critical.

These trends—smaller electronics, flexible materials, and 3D technology—are reshaping how packaging is designed and used. Companies that keep up with these innovations are likely to stay competitive in this fast-changing market.

Regional Analysis

Asia Pacific Dominates the Advanced Packaging Market with a Market Share of 43.2%, Valued at USD 17.1 Billion

Asia Pacific leads the global advanced packaging market with Share of 43.2%, Valued at USD 17.1 Billion, driven by robust semiconductor manufacturing capabilities, particularly in countries such as China, Taiwan, and South Korea. The region benefits from strong governmental support for electronics and growing investments in next-generation packaging technologies. The rising demand for consumer electronics and mobile devices further fuels the market growth in this region.

Regional Mentions:

North America holds a significant position in the advanced packaging market, supported by technological innovation and a strong focus on R&D. The region is witnessing increased adoption of advanced packaging in applications like automotive electronics, AI, and IoT. The presence of major semiconductor fabs and growing chip design activities also contribute to regional market expansion.

Europe follows closely with rising investments in semiconductor infrastructure and a strong emphasis on sustainability and energy-efficient packaging solutions. Countries like Germany and the Netherlands are fostering advancements through public-private partnerships and strategic industry collaborations. The push for electric vehicles and digitalization also supports growth in the advanced packaging space.

The Middle East & Africa region is emerging gradually, backed by increasing initiatives to diversify economies beyond oil and invest in technology infrastructure. While the market is still in a nascent stage, government-led innovation hubs and smart city projects are beginning to create demand for advanced semiconductor technologies.

Latin America represents a developing market for advanced packaging, with growth primarily concentrated in Brazil and Mexico. The expansion of electronics manufacturing and gradual adoption of modern semiconductor technologies are creating opportunities, although infrastructural challenges and limited local production capacity remain key constraints.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Advanced Packaging Market continues to evolve rapidly, with key players driving innovation, efficiency, and market competitiveness. SEMICON plays a pivotal role by fostering collaboration across the semiconductor supply chain, supporting advancements in packaging technologies through global events and initiatives that connect industry stakeholders.

Taiwan Semiconductor Manufacturing Company (TSMC) remains a dominant force, leveraging its cutting-edge 3D packaging and chiplet integration capabilities to meet the growing demands of high-performance computing and AI applications. TSMC’s focus on advanced nodes continues to reinforce its leadership.

Yole Group contributes valuable insights into market trends and technology evolution through its analytical expertise. Its role as a market intelligence firm helps guide strategic decisions within the industry, making it a critical player in shaping the direction of advanced packaging.

Prodrive Technologies B.V. is gaining traction with its emphasis on high-reliability electronics and vertically integrated production, offering tailored solutions for semiconductor packaging that align with industrial and automotive market needs.

Together, these players represent a cross-section of technological leadership, manufacturing prowess, and strategic intelligence, all of which are crucial in advancing the capabilities of semiconductor packaging in 2024.

Top Key Players in the Market

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Yole Group

- Prodrive Technologies B.V.

- JCET Group

- Intel

- ASMPT SMT Solutions

- Amkor Technology Inc.

- Advanced Semiconductor Engineering (ASE)

- IPC International, Inc.

- Samsung Electronics

Recent Developments

- In Jan 2025, Micron broke ground on a new advanced packaging facility in Singapore focused on High Bandwidth Memory (HBM) technologies. This move strengthens Micron’s role in next-gen memory solutions and expands its global manufacturing footprint.

- In Dec 2024, the European Union approved €1.3 billion in funding to support the development of an advanced semiconductor packaging facility. The initiative aims to boost Europe’s self-sufficiency and competitiveness in the global semiconductor supply chain.

- In Nov 2024, CHIPS for America announced up to $300 million in funding to enhance U.S. capabilities in semiconductor packaging. The investment is intended to accelerate innovation and reduce reliance on overseas packaging services.

- In Jul 2024, a $1.6 billion CHIPS Act subsidy was allocated to bolster advanced packaging infrastructure in the United States. This funding supports domestic manufacturing expansion and ensures secure supply chains for critical technologies.

Report Scope

Report Features Description Market Value (2024) USD 39.8 Billion Forecast Revenue (2034) USD 69.9 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flip-Chip, Fan-Out WLP, Embedded-Die, Fan-In WLP, 2.5D/3D, Others), By Application (Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Taiwan Semiconductor Manufacturing Company (TSMC), Yole Group, Prodrive Technologies B.V., JCET Group, Intel, ASMPT SMT Solutions, Amkor Technology Inc., Advanced Semiconductor Engineering (ASE), IPC International, Inc., Samsung Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Advanced Packaging MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Advanced Packaging MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Yole Group

- Prodrive Technologies B.V.

- JCET Group

- Intel

- ASMPT SMT Solutions

- Amkor Technology Inc.

- Advanced Semiconductor Engineering (ASE)

- IPC International, Inc.

- Samsung Electronics