Global Packaging Wax Market Size, Share, Growth Analysis By Product (Mineral Wax, Synthetic Wax, Natural Wax), By Packaging (Rigid, Flexible), By Application (Pharmaceutical, Food & Beverage, Furniture, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146459

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Packaging Wax Market size is expected to be worth around USD Packaging Wax by 2034, from USD Packaging Wax in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The packaging wax market refers to the use of waxes, including paraffin, microcrystalline, and synthetic waxes, in the packaging industry. These waxes are applied to packaging materials to improve properties such as water resistance, gloss, and barrier performance, which are crucial in preserving the integrity of products during transit and storage.

Packaging wax is commonly used for food packaging, cosmetics, pharmaceuticals, and other consumer goods, providing durability, aesthetics, and functionality to the packaging. These waxes help to enhance the performance of materials like paper, cardboard, and film, offering added protection to the products inside.

The demand for packaging wax has been growing due to its multifunctionality and the increasing need for better packaging solutions. Additionally, the shift towards more sustainable and eco-friendly packaging options is further driving innovation and adoption in the market. Packaging wax offers an efficient solution for enhancing product presentation while maintaining sustainability objectives, making it a key material in the packaging industry.

The packaging wax market is experiencing steady growth, driven by evolving consumer preferences for sustainable packaging solutions. According to research by Shorr, over half (54%) of respondents intentionally choose products with sustainable packaging in the last six months. This shift in consumer behavior is creating new opportunities for manufacturers to innovate and adopt environmentally friendly packaging materials, including wax-coated options that provide superior product protection and biodegradability.

Moreover, government investments in sustainability and green initiatives are accelerating the adoption of eco-friendly packaging materials. As regulations surrounding packaging waste become stricter, there is increased pressure on manufacturers to use renewable and recyclable materials. According to Greenmatch, 76% of consumers in the UK, Europe, and the United States prefer paper-based packaging, which is often enhanced with waxes to improve functionality.

Furthermore, consumer willingness to pay a premium for sustainable packaging is evident. Research by APAengineering shows that 60-70% of consumers are willing to spend more on products with sustainable packaging, and over 50% would purchase more products if sustainable packaging options were available. This trend opens up substantial market opportunities for packaging wax companies to position their products as part of a greener and more sustainable packaging solution.

As governments around the world introduce stricter regulations regarding packaging waste and sustainability, the market for packaging wax is likely to witness further growth. The increasing demand for environmentally friendly and cost-effective packaging solutions aligns with the industry’s focus on innovation, creating both challenges and opportunities for companies to stay ahead in this dynamic market.

Key Takeaways

- Global Packaging Wax Market is expected to reach USD Packaging Wax by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

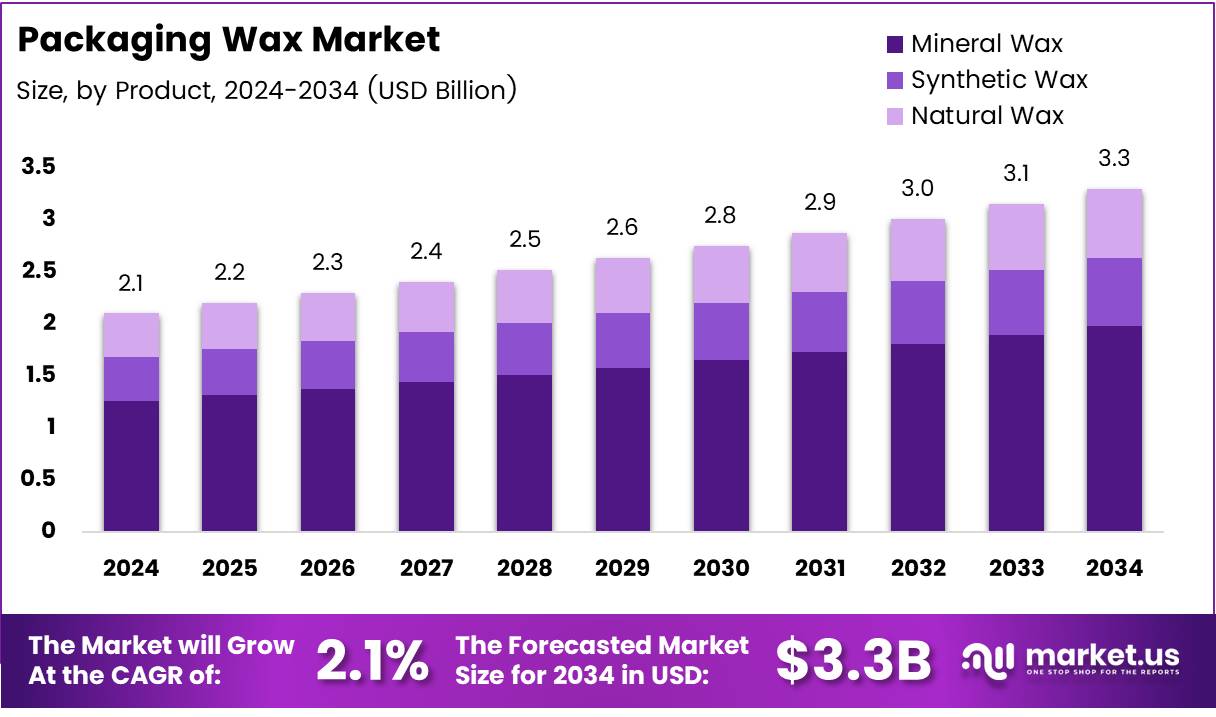

- In 2024, mineral wax led the By Product Analysis segment with a 70.5% market share due to its cost-effectiveness and excellent barrier properties.

- Rigid packaging dominated the By Packaging Analysis segment in 2024, holding a 57.1% share, driven by demand in pharmaceuticals and food & beverage sectors.

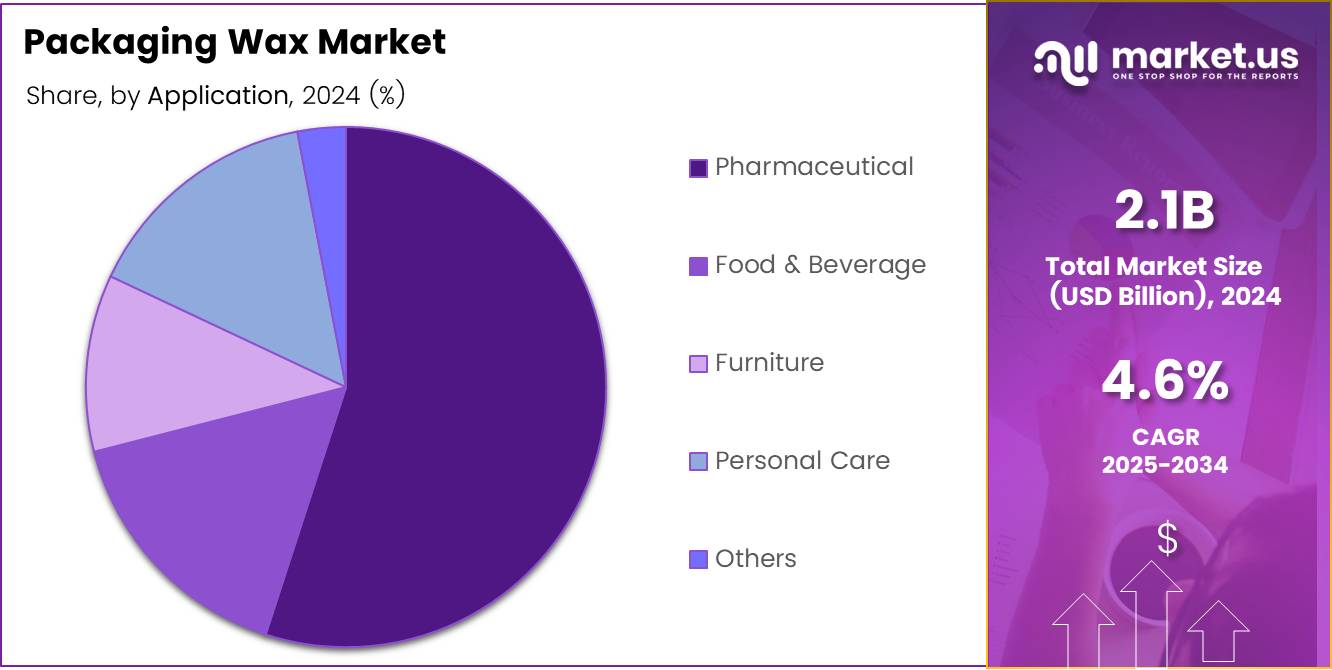

- The pharmaceutical sector led the By Application Analysis segment in 2024, driven by the need for secure and tamper-evident packaging solutions.

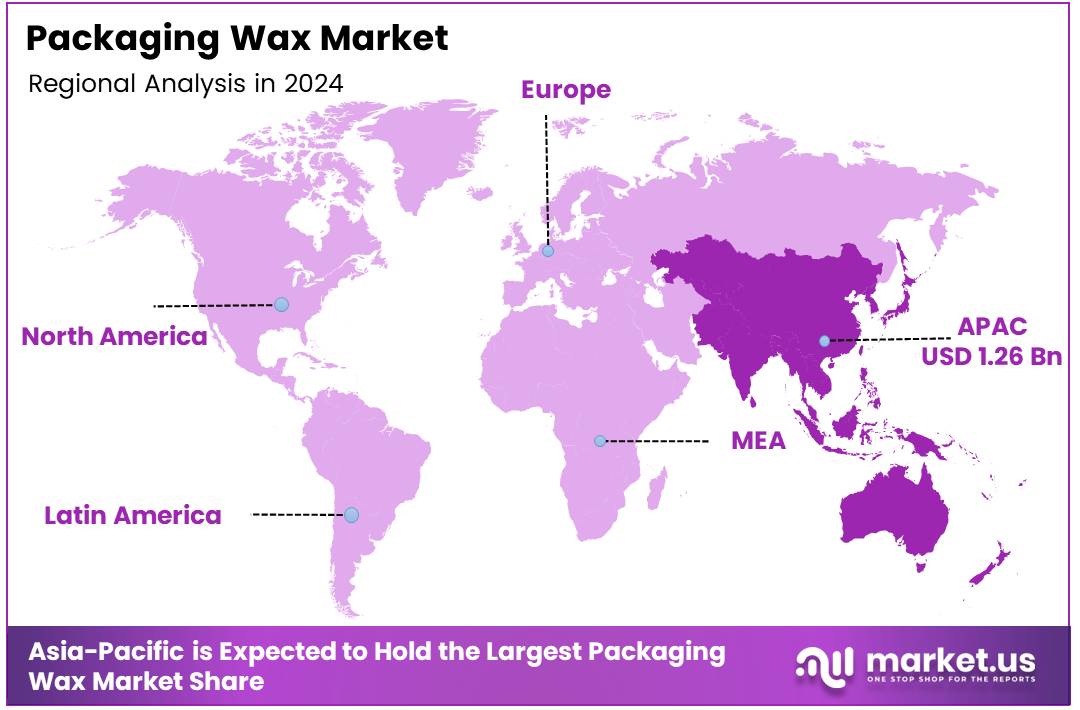

- The Asia Pacific region holds a dominant share of 60.1% in the global packaging wax market, valued at USD 1.26 billion in 2024, fueled by industrialization and urbanization in China, India, and Japan.

Product Analysis

In 2024, Mineral Wax held a dominant market position in By Product Analysis segment of Packaging Wax Market, with a 70.5% share

In 2024, mineral wax led the By Product Analysis segment of the packaging wax market, commanding a significant 70.5% share. The widespread use of mineral wax in various applications, including its superior barrier properties and cost-effectiveness, continues to drive its dominance. Its ability to provide excellent protection for packaged goods has made it the preferred choice across numerous industries.

Synthetic wax also plays a vital role in the market but holds a much smaller share compared to mineral wax. Its use is primarily driven by demand in high-performance packaging solutions, where specific properties like resistance to heat and moisture are needed. However, it still only contributes to a smaller portion of the market, indicating the strength of mineral wax.

Natural wax, while growing, represents a niche segment. Its appeal lies in its eco-friendly and biodegradable properties, which are increasingly valued in environmentally conscious packaging solutions. However, it has not yet reached the widespread adoption seen by mineral wax, limiting its overall market share.

Packaging Analysis

In 2024, Rigid held a dominant market position in By Packaging Analysis segment of Packaging Wax Market, with a 57.1% share

In 2024, rigid packaging led the By Packaging Analysis segment of the packaging wax market with a substantial 57.1% share. The demand for rigid packaging in sectors such as pharmaceuticals and food & beverage, where product integrity and safety are paramount, continues to drive its market dominance. Rigid packaging is preferred for its strength and ability to preserve the product throughout the supply chain.

Flexible packaging, while growing steadily, holds a smaller portion of the market compared to rigid packaging. Flexible packaging’s adaptability and lower production costs make it attractive in certain product categories. However, it is still less preferred in sectors where durability and protection are more critical.

As the packaging landscape continues to evolve, the preference for rigid packaging is likely to remain strong, driven by its versatility and protective qualities across a wide array of industries.

Application Analysis

In 2024, Pharmaceutical held a dominant market position in By Application Analysis segment of Packaging Wax Market, with a significant share

In 2024, the pharmaceutical sector led the By Application Analysis segment of the packaging wax market. This dominance is largely attributed to the high demand for secure and tamper-evident packaging solutions in the pharmaceutical industry. Packaging waxes, especially mineral-based varieties, are essential for preserving the integrity and safety of medicinal products, making this sector the largest contributor to the market.

The food and beverage sector also plays a significant role, benefiting from packaging waxes’ ability to extend shelf life and provide product protection. While the share of food and beverage applications is growing, it remains secondary to pharmaceutical use in terms of market value.

Furniture applications, though smaller, are steadily contributing to the market. Wax coatings in furniture packaging provide an additional layer of protection, especially for high-end wooden furniture. The personal care industry follows suit, with packaging waxes being utilized for various cosmetic products that require durable and aesthetic packaging.

Other industries, including electronics and automotive, contribute a smaller share to the overall market. These sectors utilize packaging wax primarily for its protective and moisture-resistant properties.

Key Market Segments

By Product

- Mineral Wax

- Synthetic Wax

- Natural Wax

By Packaging

- Rigid

- Flexible

By Application

- Pharmaceutical

- Food & Beverage

- Furniture

- Personal Care

- Others

Drivers

Increased Demand for Sustainable Packaging Boosts Packaging Wax Market Growth

The increasing global emphasis on sustainability is a major driver for the growth of the packaging wax market. As consumers and businesses shift toward eco-friendly practices, the demand for sustainable packaging solutions is rising, and natural waxes are becoming a key part of this trend. Packaging wax, derived from renewable and biodegradable sources, offers a natural alternative to conventional plastic and synthetic materials, which are major contributors to environmental pollution.

With the growing concerns about plastic waste and its long-term impact on the planet, industries are turning to more sustainable options like wax-based packaging. This demand is particularly high in sectors such as food and beverages, where protective coatings and seals are essential. Additionally, as consumer preferences lean toward products that align with environmental responsibility, companies are opting for packaging solutions that reflect these values.

Wax packaging not only helps reduce environmental impact but also appeals to eco-conscious consumers, enhancing brand image and loyalty. The rise of legislation banning or restricting single-use plastics in many regions also acts as a catalyst, pushing companies to adopt more sustainable packaging solutions. As sustainability continues to drive purchasing decisions, the packaging wax market is likely to see continued growth and adoption in various industries.

Restraints

High Cost of Natural Wax Sources Limits Packaging Wax Market Growth

Despite the growing interest in packaging wax, its widespread adoption faces significant challenges, primarily due to the high cost of natural waxes. Natural waxes, such as beeswax, soy wax, and palm wax, are more expensive to produce than synthetic alternatives like plastic or polyethylene. This price difference can be a significant barrier for companies, especially those in cost-sensitive industries, from fully embracing wax-based packaging solutions.

While natural waxes provide environmental benefits, such as being biodegradable and non-toxic, their higher production costs can make them less attractive compared to cheaper, non-biodegradable options. As a result, many businesses continue to rely on synthetic materials, which, although less sustainable, are more affordable and widely available. Additionally, the process of harvesting and refining natural waxes involves complex steps that contribute to the higher cost.

Although the price of natural waxes may decrease with advancements in production efficiency, it remains a key restraint in the packaging wax market’s growth. Until these cost challenges are addressed, the adoption of packaging wax may remain limited, particularly for large-scale commercial use, where cost-effectiveness is a major concern.

Growth Factors

Expanding Use of Packaging Wax in Cosmetics and Pharmaceuticals Presents Growth Opportunities

The packaging wax market is witnessing new growth opportunities due to its expanding applications in industries like cosmetics, personal care, and pharmaceuticals. In the cosmetics industry, packaging wax plays a crucial role in creating moisture-resistant packaging, which is essential for products such as lip balms, lotions, and deodorants. Wax packaging helps preserve the integrity of cosmetic products by protecting them from external contaminants, maintaining their quality, and prolonging shelf life.

Moreover, as the demand for organic and natural beauty products increases, waxes derived from renewable sources like soy and beeswax are becoming increasingly popular in cosmetic packaging. In the pharmaceutical sector, packaging wax offers significant potential due to its antimicrobial properties, which help in maintaining the safety and hygiene of medicines and supplements. The rise of health-conscious consumers and the growing demand for hygienic, safe, and sustainable packaging solutions in these industries present substantial growth prospects for packaging wax.

Furthermore, the increasing focus on eco-friendly packaging across the pharmaceutical and cosmetics sectors aligns well with the demand for biodegradable and natural packaging materials, including wax. As more brands prioritize sustainability and consumer safety, the use of packaging wax is likely to expand, offering manufacturers an opportunity to diversify their product portfolios and meet changing market needs.

Emerging Trends

Biodegradable and Smart Packaging Solutions Drive Trends in the Packaging Wax Market

Several key trends are currently shaping the packaging wax market, with the shift toward biodegradable and smart packaging solutions at the forefront. The demand for biodegradable packaging is rising as consumers and businesses become more environmentally conscious. Natural waxes are favored in this trend due to their compostable nature, which provides an eco-friendly alternative to plastic and other synthetic materials that contribute to environmental pollution.

Wax-based packaging, which can break down naturally, helps reduce waste and supports the circular economy, where materials are reused or biodegraded. This trend is especially prominent in industries like food and beverages, where packaging waste is a growing concern.

Another emerging trend in the packaging wax market is the integration of smart packaging technologies. Packaging wax is increasingly being used alongside technologies like RFID tags, temperature sensors, and QR codes, which offer added functionality for tracking and monitoring product freshness, temperature, or authenticity. This trend is gaining traction in industries such as pharmaceuticals and food, where product integrity is crucial.

Additionally, the growing preference for vegan and cruelty-free packaging is influencing the market, with consumers seeking wax alternatives that do not use animal-derived materials like beeswax. Plant-based waxes, such as those made from soy or palm, are gaining popularity as a cruelty-free option, further driving the demand for sustainable and ethical packaging solutions.

Regional Analysis

Asia Pacific Leads Global Packaging Wax Market with 60.1% Share, Valued at USD 1.26 Billion

The Asia Pacific region dominates the global packaging wax market, holding a significant share of 60.1%, valued at USD 1.26 billion in 2024. This dominance can be attributed to rapid industrialization, urbanization, and the growing middle class, especially in countries like China, India, and Japan.

The demand for packaging wax is particularly strong in the food packaging, cosmetics, and pharmaceutical sectors. Furthermore, the shift toward sustainable and eco-friendly packaging solutions has driven the increasing use of natural waxes like beeswax and carnauba, which are biodegradable and meet the growing consumer preference for green products.

Regional Mentions:

North America follows as the second-largest market, with a significant share in the global packaging wax industry. The United States, in particular, leads the demand for packaging wax, primarily in the candle and packaging sectors. Paraffin wax, known for its cost-effectiveness and versatile functional properties, remains the most popular choice. Additionally, consumer awareness about sustainability and stricter regulations are prompting a gradual shift towards natural and synthetic wax alternatives.

Europe’s packaging wax market, while smaller than that of North America, has shown steady growth. The demand is largely driven by the cosmetics and personal care industries, where waxes are used for their aesthetic and protective qualities. Germany, in particular, is expected to register significant growth due to its strong industrial base and ongoing innovations in packaging technologies.

The Middle East and Africa (MEA) market is also showing promising growth, with a steady rise in packaging demand across sectors such as food and pharmaceuticals. This growth is bolstered by expanding infrastructure and increasing industrial activities in the region. Similarly, Latin America’s packaging wax market, though smaller in size, is expected to grow at a steady pace, driven by industrial expansion and the increasing adoption of sustainable packaging solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Packaging Wax Market in 2024 is set to be shaped by the dominance and strategic innovations of key players, including Honeywell International Inc., Dow, and Exxon Mobil Corporation. Honeywell stands out with its advanced materials technology and sustainable wax products, driving innovation in eco-friendly packaging solutions.

Dow, on the other hand, continues to lead in product diversification, offering high-quality waxes for various packaging applications, leveraging its strong global presence. Exxon Mobil, with its significant focus on petrochemical products, remains a critical player, ensuring a steady supply of paraffin-based waxes for the market.

Sasol Limited and The International Group, Inc. are expected to capitalize on their respective expertise in refining processes and additive technology. Sasol’s robust manufacturing capabilities ensure consistent quality, while The International Group’s specialization in industrial waxes positions it as a reliable supplier for diverse packaging needs.

Royal Dutch Shell P.L.C. and BP p.l.c. are further influencing market dynamics through their extensive oil and gas operations, securing a stable supply chain for wax derivatives. Shell’s investments in sustainability initiatives also make it a key contributor to the development of renewable wax alternatives.

Companies like Baker Hughes, CNPC, and NIPPON SEIRO CO., LTD. are enhancing the sector’s competitiveness by improving extraction technologies and refining capabilities, catering to the evolving demand for specialty packaging materials. BASF and Evonik Industries AG offer advanced chemical solutions, enabling better performance and environmental compliance for packaging wax products.

HF Sinclair Corporation and China Petrochemical Corporation’s involvement in the market reinforces their commitment to sustainable and scalable wax production, essential for meeting global market needs. Together, these companies are poised to drive the evolution of the packaging wax market in 2024 and beyond.

Top Key Players in the Market

- Honeywell International Inc.

- Dow

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Royal Dutch Shell P.L.C

- BP p.l.c.

- Baker Hughes Company

- CNPC

- NIPPON SEIRO CO., LTD

- BASF

- HF Sinclair Corporation

- China Petrochemical Corporation

- Evonik Industries AG

Recent Developments

- In May 2024, KCC Corporation completed the acquisition of Momentive Performance Materials Group, enhancing its capabilities in the high-performance materials sector and broadening its product portfolio. The move strengthens KCC’s presence in key industries, including automotive and electronics.

- In April 2024, Novolex announced a strategic investment in OZZI, a leader in reusable packaging innovation, aiming to expand its sustainable packaging solutions and reduce environmental impact. This partnership aligns with Novolex’s commitment to advancing eco-friendly practices in the packaging industry.

- In October 2024, Green packaging startup Earthodic secured a $6 million investment to accelerate the development and expansion of its water-resistant packaging technology. The funding will enable Earthodic to scale production and meet the growing demand for sustainable packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD Packaging Wax Forecast Revenue (2034) USD Packaging Wax CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Mineral Wax, Synthetic Wax, Natural Wax), By Packaging (Rigid, Flexible), By Application (Pharmaceutical, Food & Beverage, Furniture, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., Dow, Exxon Mobil Corporation, Sasol Limited, The International Group, Inc., Royal Dutch Shell P.L.C, BP p.l.c., Baker Hughes Company, CNPC, NIPPON SEIRO CO., LTD, BASF, HF Sinclair Corporation, China Petrochemical Corporation, Evonik Industries AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honeywell International Inc.

- Dow

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Royal Dutch Shell P.L.C

- BP p.l.c.

- Baker Hughes Company

- CNPC

- NIPPON SEIRO CO., LTD

- BASF

- HF Sinclair Corporation

- China Petrochemical Corporation

- Evonik Industries AG