Global Flip Chip Market Size, Share, Statistics Analysis Report By Packaging Technology (3D IC Packaging, 2.5D IC Packaging, 2D IC Packaging), By Bumping Technology (Copper Pillar, Gold Bumping, Solder Bumping, Other Bumping Technologies), By End-Use Industry (Consumer Electronics, Aerospace & Defense, Automotive, IT and Telecommunications, Healthcare, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134119

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Packaging Technology Analysis

- Bumping Technology Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

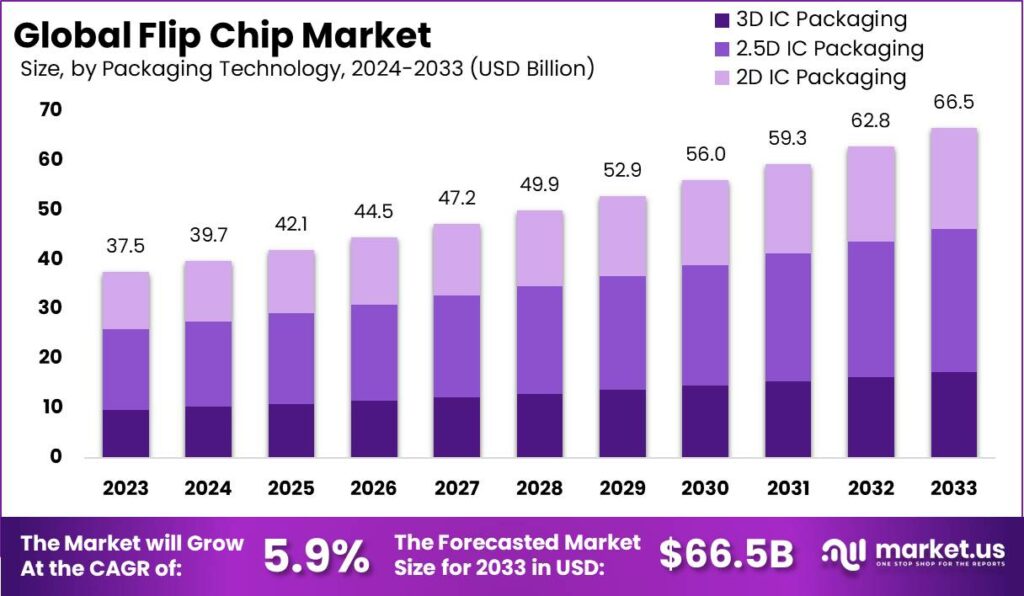

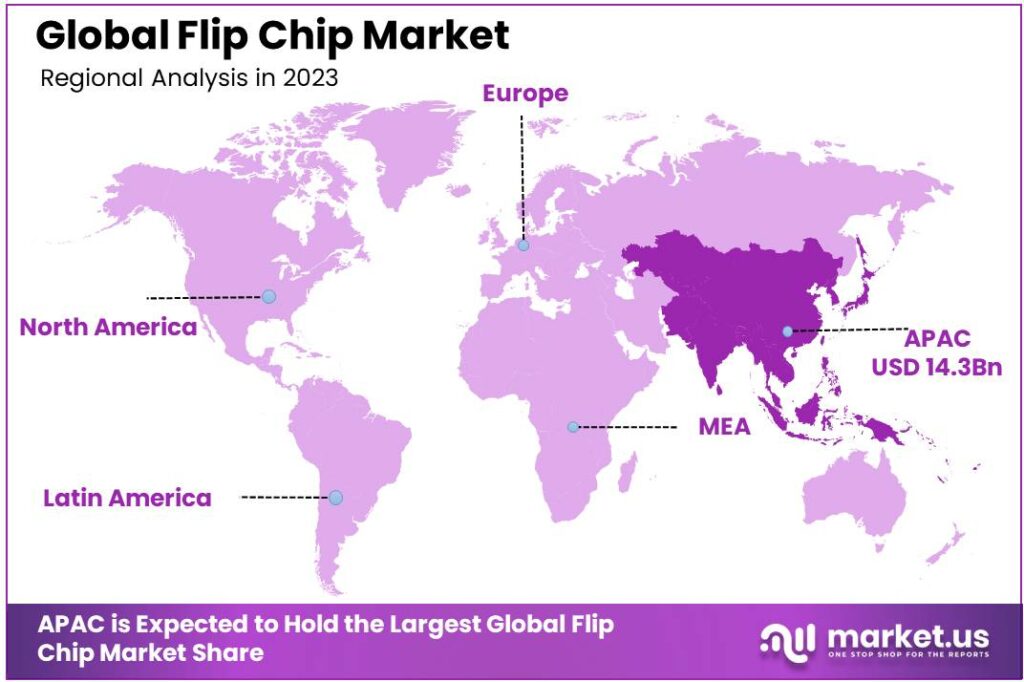

The Global Flip Chip Market size is expected to be worth around USD 66.5 Billion By 2033, from USD 37.5 Billion in 2023, growing at a CAGR of 5.90% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region dominated the Flip Chip market, accounting for over 38.1% of the share, with revenues reaching USD 14.3 billion.

Flip chip technology is a sophisticated method used in semiconductor packaging where an integrated circuit (IC) chip is mounted directly onto a substrate or circuit board with its active area facing down. This arrangement eliminates the need for wire bonds, instead using conductive bumps placed directly on the chip pads. The direct connection allows for shorter paths between the chip and the board, which enhances performance by reducing inductance and improving heat dissipation.

The flip chip market is experiencing substantial growth driven by the demand for more compact and efficient electronic devices. As industries continue to advance in digitalization, the need for sophisticated electronics that incorporate flip chip technology escalates. This market encompasses various sectors including telecommunications, automotive, healthcare, and consumer electronics, each contributing to the expansion and diversification of flip chip applications.

The flip chip market is propelled by several key factors. Technological advancements have led to more sophisticated packaging solutions that offer superior thermal and electrical performance. There’s also a rising demand for small electronic devices and high-performance computing applications, which require the efficient, high-density interconnects that flip chips provide. Additionally, the growth of data-intensive applications such as 5G networks continues to drive demand for more advanced semiconductor packaging solutions.

The demand for flip chip technology is primarily driven by its use in high-performance applications, including smartphones, servers, and automotive electronics. Market opportunities are expanding, particularly in the automotive sector, where advanced driver-assistance systems (ADAS) and autonomous vehicles heavily rely on high-performance computing capabilities.

Flip chip technology is also increasingly being adopted in medical devices and military and aerospace applications, where reliability and performance are critical. Innovations in flip chip technology include developments in materials used for the bumps, such as copper pillars and lead-free solders, which offer improved conductivity and reliability. Advances in packaging technologies like 2.5D and 3D IC integration also play a crucial role, enabling greater performance and integration levels.

For instance, In January 2024, India’s cabinet approved an important step toward strengthening its semiconductor industry through a partnership with the European Union. This move builds on a MoU signed in November 2023 under the EU-India Trade and Technology Council (TTC). The agreement focuses on fostering collaboration in semiconductor ecosystems, enhancing supply chain resilience, and driving innovation.

The market is set to expand as manufacturers explore new applications and improvements in flip chip technology. This includes developments in materials used for bumping processes and enhancements in underfill materials that could lead to more robust and reliable products. As electronic devices continue to evolve with increased functionality packed into smaller sizes, the flip chip technology is expected to play a crucial role in enabling this progression.

Key Takeaways

- The Global Flip Chip Market is projected to reach USD 66.5 billion by 2033, growing from USD 37.5 billion in 2023, at a CAGR of 5.90% during the forecast period from 2024 to 2033.

- In 2023, the 2.5D IC Packaging segment dominated the Flip Chip market, holding over 43.5% of the market share.

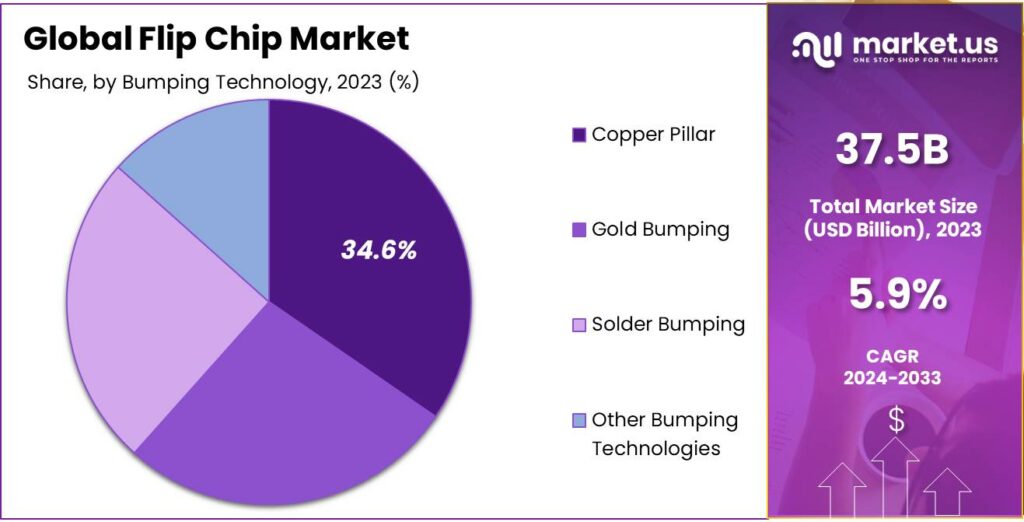

- The Copper Pillar segment also had a strong market presence in 2023, capturing more than 34.6% of the market share.

- Consumer Electronics led the Flip Chip market in 2023, accounting for 32.1% of the market share. This dominance is driven by the widespread adoption of advanced electronics requiring sophisticated packaging solutions.

- The Asia-Pacific region was the largest market for Flip Chip technology in 2023, holding 38.1% of the market share, with revenues amounting to USD 14.3 billion.

Packaging Technology Analysis

Bumping Technology Analysis

In 2023, the Copper Pillar segment held a dominant market position, capturing more than a 34.6% share in the flip chip market. This segment leads primarily due to its superior electrical and thermal performance compared to other bumping technologies.

Copper pillar bumping’s dominance is further bolstered by its compatibility with advanced packaging technologies like 3D ICs, where chips are stacked vertically. This method reduces the interconnect length between stacked dies, significantly improving performance while reducing power consumption.

Additionally, the ongoing miniaturization of electronic components drives the need for more efficient and smaller-scale connections, where copper pillar bumping excels. Its robustness in creating strong mechanical bonds and its ability to integrate with various underfill materials also add to its suitability for smaller yet powerful devices.

The environmental aspect also plays a role in the popularity of copper pillar bumping. Unlike traditional lead-based solder techniques, copper is a less toxic alternative that offers enhanced performance benefits. This aligns with the growing regulatory and consumer pressure for more environmentally friendly manufacturing processes.

End-Use Industry Analysis

In 2023, the Consumer Electronics segment held a dominant position in the Flip Chip market, capturing more than a 32.1% share. This leadership stems primarily from the widespread adoption of advanced electronics that require sophisticated packaging solutions.

As consumer electronics devices such as smartphones, tablets, and laptops continue to evolve with higher functionality packed into smaller sizes, flip chip technology has become indispensable. This technology offers superior connectivity solutions with enhanced performance capabilities, which are essential for meeting the increasing demands for faster, more efficient devices.

Moreover, the consumer electronics industry benefits from robust consumer demand and rapid technological advancements. The integration of flip chips in various devices supports high-speed data transmission and efficient heat dissipation, which are critical for the functionality of modern consumer electronics.

Additionally, the economic scaling of these devices makes flip chip technology a cost-effective option for manufacturers seeking to optimize their assembly processes and improve overall performance. This economic advantage further cements the leading position of the Consumer Electronics segment in the Flip Chip market.

Key Market Segments

By Packaging Technology

- 3D IC Packaging

- 2.5D IC Packaging

- 2D IC Packaging

By Bumping Technology

- Copper Pillar

- Gold Bumping

- Solder Bumping

- Other Bumping Technologies

By End-Use Industry

- Consumer Electronics

- Aerospace & Defense

- Automotive

- IT and Telecommunications

- Healthcare

- Other End-Use Industries

Driver

Demand for Miniaturization in Electronics

The relentless pursuit of smaller, more powerful electronic devices has significantly propelled the adoption of flip chip technology. Traditional wire bonding methods often fall short in meeting the compactness and performance requirements of contemporary gadgets.

Flip chip technology addresses these demands by enabling higher interconnect densities and reducing signal path lengths, which enhances both speed and reliability. This capability is crucial for applications ranging from smartphones to medical devices, where space is at a premium and performance cannot be compromised.

Restraint

Thermal Management

One of the key challenges in flip-chip technology is thermal management. Flip-chip packaging involves attaching a semiconductor chip directly to a substrate or circuit board, with solder bumps connecting the chip to the board.

When a semiconductor chip is running, it generates heat. As the chip works harder, especially in high-performance applications like gaming, data centers, or processors, the amount of heat increases. If this heat isn’t properly managed, it can lead to overheating. Overheating can cause the chip to perform poorly, become less reliable, or even break down over time.

The compact structure of flip-chip technology makes heat dissipation more difficult. Unlike older packaging methods, which left some space between the chip and the board for heat to escape, flip chips are densely packed. The solder bumps that connect the chip to the board are small, and there isn’t a lot of room for heat to spread out easily.

Opportunity

Expansion into Emerging Markets

The rise of emerging markets presents a significant opportunity for flip chip technology. Regions experiencing rapid industrialization and technological adoption are seeking advanced electronic solutions, creating a demand for efficient and compact components.

By tailoring flip chip technology to meet the specific needs and economic conditions of these markets, companies can tap into new customer bases and drive growth. Collaborations with local firms and investments in region-specific research and development can facilitate the integration of flip chip solutions, fostering innovation and expanding market reach.

Challenge

Thermal Management Issues

Effective thermal management remains a critical challenge in flip chip technology. The high density of interconnects and the proximity of active components can lead to significant heat generation. If not properly managed, this heat can affect device performance and longevity.

Developing materials and designs that enhance heat dissipation without compromising the compactness and efficiency of the package is essential. Innovations such as advanced underfill materials and heat spreaders are being explored to address these issues, but achieving an optimal balance between thermal management and miniaturization continues to be a complex engineering challenge.

Emerging Trends

One significant trend is the integration of flip chip with three-dimensional (3D) packaging techniques. By stacking multiple dies vertically, manufacturers can achieve greater functionality within a smaller footprint, which is crucial for modern electronics like smartphones and IoT devices.

Another development is the use of advanced materials and bumping technologies, such as copper pillars and lead-free solder. These materials enhance the reliability and thermal performance of flip chip assemblies, making them suitable for high-frequency and high-power applications.

The rise of heterogeneous integration is also noteworthy. This approach combines different types of components such as processors, memory, and sensors into a single package, optimizing each for its specific function. Flip chip technology facilitates this integration, leading to more versatile and powerful electronic systems.

Business Benefits

Adopting flip chip technology offers several advantages for businesses in the electronics sector. It enables the production of smaller and lighter devices without compromising performance, meeting consumer demand for portable and compact products.

Flip chip assemblies provide superior electrical and thermal performance compared to traditional packaging methods. This results in faster data transfer rates and better heat dissipation, which are essential for high-performance applications like data centers and advanced computing.

Moreover, flip chip technology supports higher input/output (I/O) densities, allowing for more complex and capable devices. This is particularly beneficial in sectors such as telecommunications and automotive, where advanced functionalities are increasingly required.

From a manufacturing perspective, flip chip can lead to cost savings. By enabling the use of smaller dies and reducing the need for extensive wiring, it can lower material costs and improve production efficiency. Additionally, the technology’s compatibility with existing manufacturing processes means that companies can integrate it without significant overhauls to their production lines.

Regional Analysis

In 2023, the Asia-Pacific region held a dominant position in the Flip Chip market, capturing more than a 38.1% share with revenues amounting to USD 14.3 billion. This substantial market share can largely be attributed to the dense concentration of semiconductor manufacturing and electronics assembly industries, particularly in countries such as South Korea, Taiwan, and China.

Asia-Pacific’s leadership in the market is further supported by robust government initiatives aimed at enhancing the semiconductor industry’s growth. Significant investments in research and development, subsidies for semiconductor production, and favorable trade policies help sustain the region’s competitive edge in the global market. These initiatives have led to technological advancements and capacity expansions, thus fueling the markets growth.

Additionally, the rising demand for consumer electronics such as smartphones, tablets, and wearable devices in the Asia-Pacific region plays a crucial role in driving the Flip Chip market. The region’s expanding middle-class population and increasing disposable income levels contribute to higher consumption rates of advanced electronics, thereby boosting the demand for efficient and compact packaging solutions offered by Flip Chip technology.

The strategic presence of supply chain entities, from raw material suppliers to end product manufacturers, also enhances the region’s ability to efficiently produce and integrate Flip Chips at a reduced cost and with shorter lead times. This integration across the supply chain is pivotal in meeting the quick turnaround demands of the electronics market and positions Asia-Pacific as a continuing leader in the Flip Chip market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the competitive landscape of the Flip Chip market, three key players stand out due to their market influence, technological prowess, and strategic initiatives.

Intel Corporation a key player in the Flip Chip market, known for its strong research and development and leadership in semiconductor innovation. Its advanced manufacturing processes help maintain a leading position, especially in high-performance computing and data centers, where Flip Chip technology is essential for high-speed and high-density chip connections.

Amkor Technology, Inc. specializes in semiconductor product packaging and test services, holding a vital position in the Flip Chip market. The company’s commitment to technological innovation and customer service has enabled it to adapt swiftly to the changing demands of the semiconductor packaging industry, thus securing its role as a leader in Flip Chip solutions.

Samsung Electronics Co., Ltd. leverages its dual role as a major consumer electronics manufacturer and a semiconductor powerhouse to excel in the Flip Chip market. Samsung’s integration across both the fabrication of chips and their application in end-user devices provides a significant competitive edge.

Top Opportunities Awaiting for Players

The flip chip market is poised for significant growth, presenting several lucrative opportunities for market players which stem from various technological and industry trends.

- Miniaturization in Consumer Electronics: As devices such as smartphones and wearables continue to decrease in size while increasing in functionality, there’s a growing demand for advanced packaging solutions like flip chips. This demand is driving the need for smaller, more efficient integrated circuits, which flip chip technology is well-suited to provide due to its high performance in a compact form factor.

- Advancements in Materials and Technology: Continuous research and development in materials science are enhancing the performance of flip chip technologies. Innovations in substrate materials are improving thermal conductivity and electrical performance, which are critical for high-power and frequency applications. This opens new opportunities for flip chip adoption across various sectors.

- Increased Application in High-Performance Areas: Flip chips are essential for new complex system architectures and high-density packaging, especially in applications such as sensors, pixel devices, and microelectronics packaging. The market is expanding as the technology becomes integral to developing low-cost, high-yield, and high-quality bumped wafers or dice.

- Growing Markets in Developing Regions: Regions like Asia-Pacific, driven by major semiconductor manufacturing hubs, are seeing a substantial increase in the demand for advanced packaging solutions. This regional demand contributes to the global dominance and expansion of the flip chip market, with significant contributions from countries like Taiwan, South Korea, China, and Japan.

Top Key Players in the Market

- Intel Corporation

- Amkor Technology, Inc.

- Samsung Electronics Co., Ltd.

- Advanced Micro Devices, Inc.

- ASE Technology Holding Co., Ltd.

- ChipMOS Technologies Inc.

- Powertech Technology Inc.

- JCET Group

- Other Key Players

Recent Developments

- In October 2024, Microchip Technology’s RTG4 FPGA has made history as the first to feature lead-free bumps and achieve QML Class V status. This prestigious certification qualifies it for the most demanding space missions, including human-rated, deep space exploration, and national security programs.

- In November 2024, Tata’s new semiconductor facility in Assam is set to produce up to 48 million chips daily. The plant will leverage cutting-edge packaging technologies, including flip chip and integrated system in package (ISIP), to enhance chip performance and efficiency.

Report Scope

Report Features Description Market Value (2023) USD 37.5 Bn Forecast Revenue (2033) USD 66.5 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Packaging Technology (3D IC Packaging, 2.5D IC Packaging, 2D IC Packaging), By Bumping Technology (Copper Pillar, Gold Bumping, Solder Bumping, Other Bumping Technologies), By End-Use Industry (Consumer Electronics, Aerospace & Defense, Automotive, IT and Telecommunications, Healthcare, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Amkor Technology, Inc., Samsung Electronics Co., Ltd., Advanced Micro Devices, Inc., ASE Technology Holding Co., Ltd., ChipMOS Technologies Inc., Powertech Technology Inc., JCET Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intel Corporation

- Amkor Technology, Inc.

- Samsung Electronics Co., Ltd.

- Advanced Micro Devices, Inc.

- ASE Technology Holding Co., Ltd.

- ChipMOS Technologies Inc.

- Powertech Technology Inc.

- JCET Group

- Other Key Players