Global FMCG Packaging Market Size, Share, Growth Analysis By Packaging Type (Rigid Packaging, Flexible Packaging, Others), By Material (Plastic, Paper, Metal, Glass, Others), By End Use (Food and Beverages, Cosmetic and Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147561

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

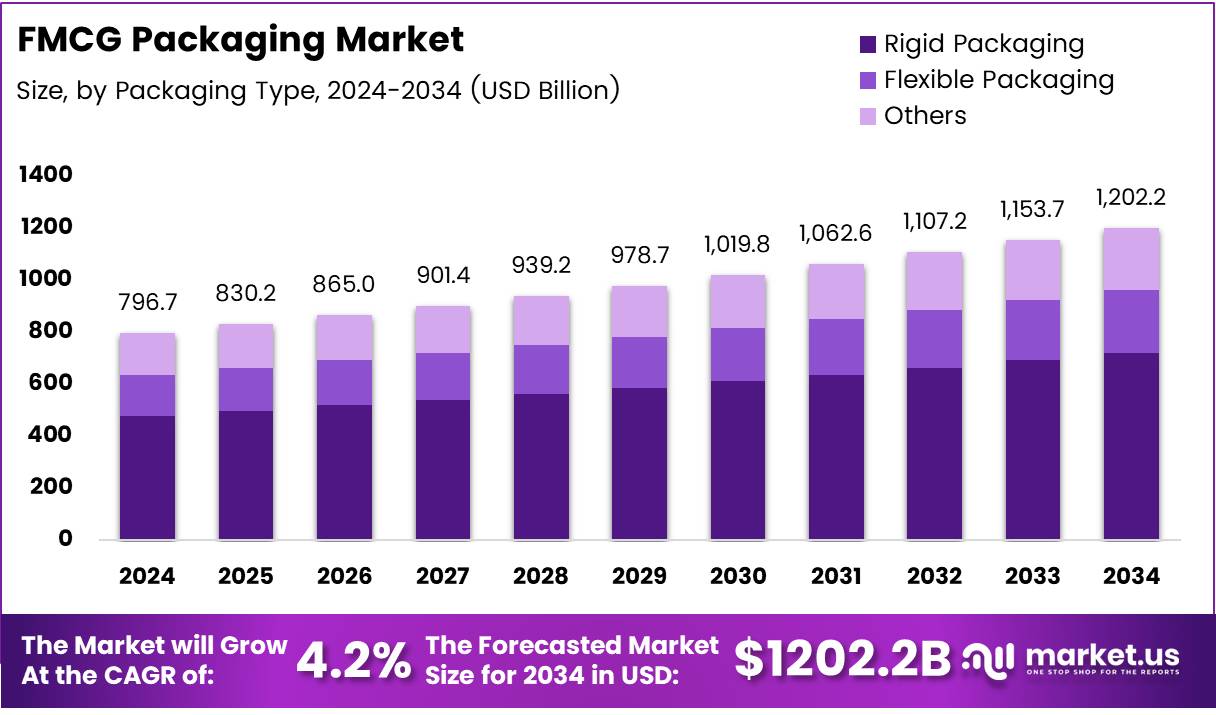

The Global FMCG Packaging Market size is expected to be worth around USD 1202.2 Billion by 2034, from USD 796.7 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

The fast-moving consumer goods (FMCG) packaging sector plays a vital role in product safety, brand visibility, and consumer convenience. As consumer preferences shift toward sustainability and personalization, packaging has become more than just a protective layer—it’s a strategic tool influencing market share, brand loyalty, and supply chain agility.

Companies are increasingly focusing on environmentally friendly packaging to match evolving expectations. According to Rocket Industrial, 82% of consumers across age groups are willing to pay more for sustainable packaging, underlining a growing business case for eco-friendly innovation. Similarly, according to MeteorSpace, 74% of U.S. consumers believe packaging design influences purchasing behavior, reinforcing the value of aesthetic appeal and functionality in packaging strategies.

Asia-Pacific is witnessing dynamic shifts in this space. As per regional consumer studies, 90% of APAC consumers are ready to spend more on sustainable products, particularly due to packaging considerations. This strong regional sentiment is prompting manufacturers to revamp packaging materials and technologies in line with local sustainability goals.

The FMCG packaging market is experiencing steady expansion driven by urbanization, e-commerce, and lifestyle changes. Sustainable packaging materials like bioplastics, paper, and compostables are gaining traction. Players are adopting circular economy models, emphasizing recyclability and reuse to align with evolving regulatory frameworks and public expectations.

Governments are also stepping in to accelerate this transition. Regulatory support such as India’s Plastic Waste Management Rules and the EU’s Green Deal targets are pushing FMCG brands to rethink their packaging choices. These regulations are setting benchmarks for recyclability, carbon footprint reduction, and compliance labeling, thereby fostering innovation in the sector.

Growth opportunities abound in smart packaging solutions that integrate QR codes, sensors, and tracking systems. These innovations not only enhance customer engagement but also streamline logistics and combat counterfeiting. Markets are opening up for digital printing technologies and anti-microbial packaging, particularly post-pandemic.

Investments are pouring into automation and digital transformation of packaging lines. FMCG giants are collaborating with material science firms to create lightweight, durable, and biodegradable solutions. Furthermore, private and public investments in R&D are strengthening the industry’s capacity to scale new technologies while complying with sustainability norms.

Key Takeaways

- The Global FMCG Packaging Market is projected to reach USD 1202.2 Billion by 2034, up from USD 796.7 Billion in 2024, growing at a CAGR of 4.2% from 2025 to 2034.

- Rigid Packaging dominated in 2024 with a 62.9% market share, driven by its strength and protective properties for food, beverages, and personal care items.

- Plastic emerged as the leading material in 2024, capturing a 43.6% share due to its lightweight, durable, and cost-effective attributes for mass FMCG production.

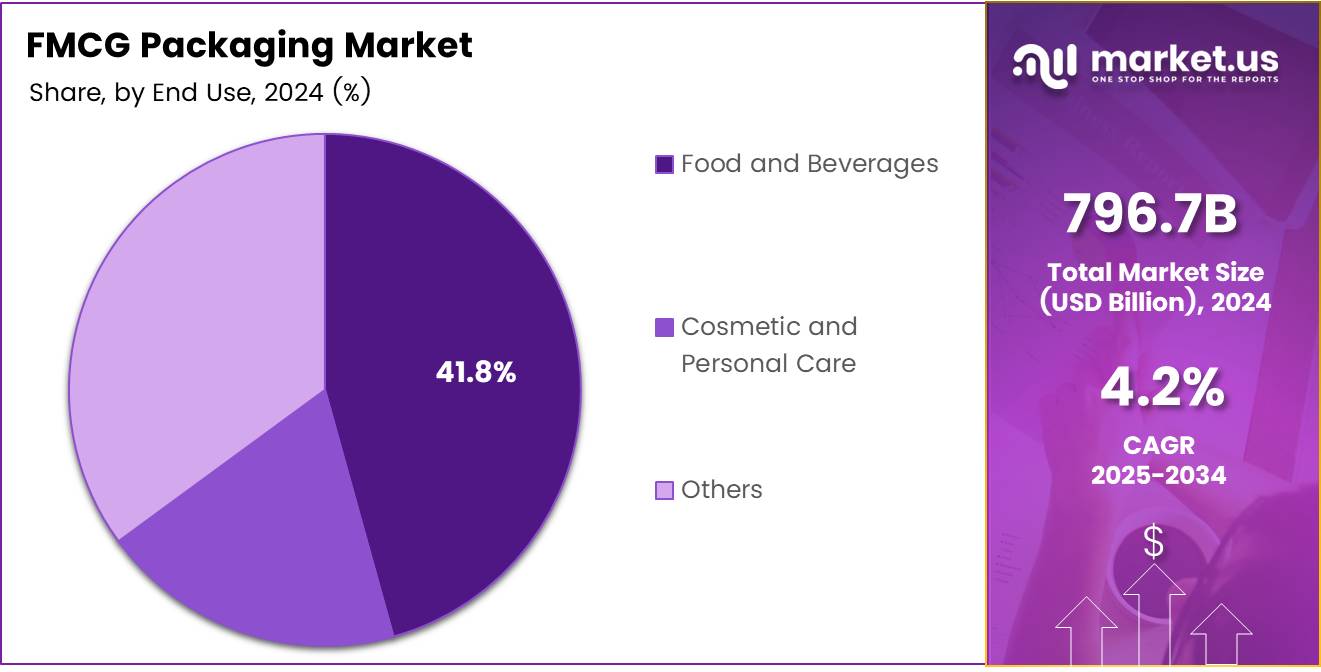

- Food and Beverages led the end-use segment in 2024 with a 41.8% share, supported by increasing demand for packaged and shelf-stable consumables.

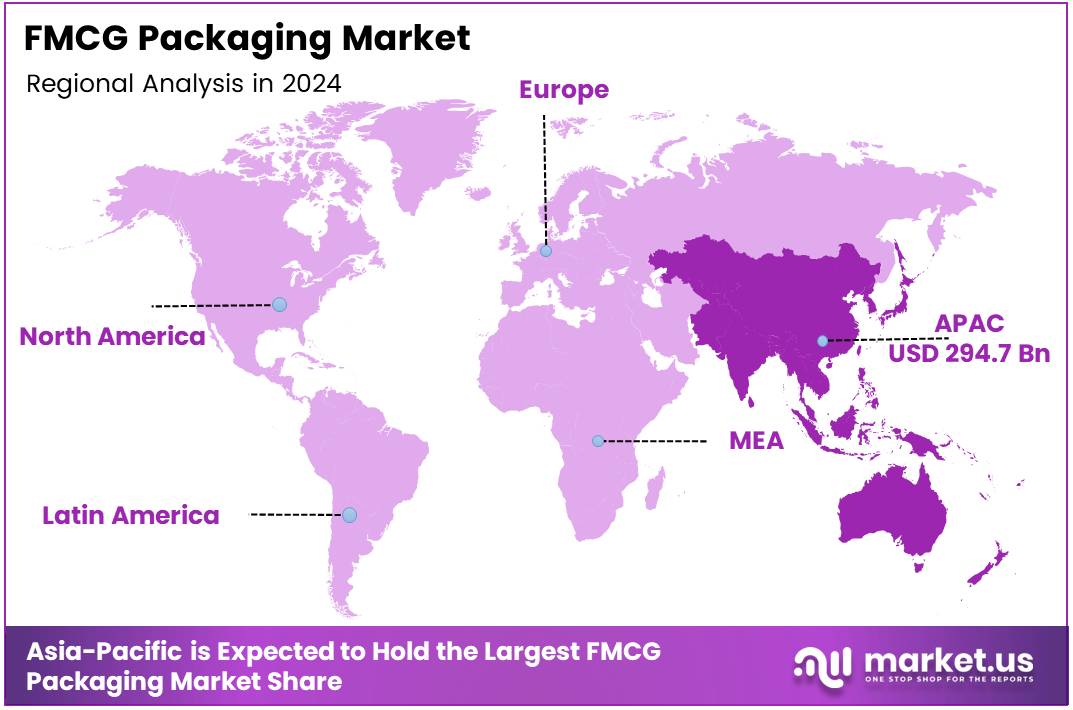

- Asia Pacific led the regional market in 2024, commanding a 36.8% share valued at USD 294.7 Billion, fueled by urban growth, middle-class expansion, and rising e-commerce in China and India.

Packaging Type Analysis

Rigid Packaging leads FMCG packaging with 62.9% due to strength and shelf appeal.

In 2024, Rigid Packaging held a dominant market position in the By Packaging Type Analysis segment of the FMCG Packaging Market, accounting for a 62.9% share. Its strength, barrier properties, and ability to protect contents from physical damage make it ideal for high-volume FMCG products, especially in food, beverages, and personal care segments.

Flexible Packaging is growing rapidly due to its lightweight nature and adaptability to modern consumer lifestyles. It offers benefits such as space-saving, extended shelf life, and reduced transportation costs, making it a preferred option for snacks, ready-to-eat meals, and single-use applications.

The Others category, which includes hybrid and eco-innovative formats, is gaining momentum, particularly in niche and premium product lines. These solutions are being adopted for their visual appeal and sustainability advantages in response to rising environmental consciousness among consumers.

Material Analysis

Plastic dominates material usage in FMCG packaging with 43.6% due to cost and versatility.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of the FMCG Packaging Market, capturing a 43.6% share. Its lightweight nature, durability, and compatibility with mass production make it highly suitable for high-speed FMCG production lines.

Paper is increasingly being adopted as a sustainable alternative, especially in secondary and tertiary packaging. It is gaining preference in regulatory-sensitive regions aiming to curb plastic usage.

Metal packaging, mainly used in canned foods and beverages, offers excellent barrier properties and long shelf life, but higher cost and weight limit broader usage.

Glass, though eco-friendly and reusable, remains niche due to its fragility and higher logistical costs. However, it continues to thrive in premium product packaging.

The Others category includes bioplastics and composite materials, which are slowly entering mainstream packaging as sustainability goals tighten globally.

End Use Analysis

Food and Beverages lead FMCG packaging demand with 41.8% due to mass consumption.

In 2024, Food and Beverages held a dominant market position in the By End Use Analysis segment of the FMCG Packaging Market, accounting for a 41.8% share. The segment benefits from the continuous global demand for packaged food, ready meals, bottled drinks, and shelf-stable goods.

Cosmetic and Personal Care follows closely, with increasing product launches and growing awareness of personal hygiene driving packaging innovations. Aesthetic appeal, brand differentiation, and product protection are critical to this segment’s growth.

The Others segment includes household goods and over-the-counter healthcare products. Growth in this segment is moderate, yet steady, driven by increasing consumer spending on home essentials and minor health solutions.

Key Market Segments

By Packaging Type

- Rigid Packaging

- Flexible Packaging

- Others

By Material

- Plastic

- Paper

- Metal

- Glass

- Others

By End Use

- Food and Beverages

- Cosmetic and Personal Care

- Others

Drivers

Rising Demand for Convenience and Portability Boosts FMCG Packaging Innovation

The shift toward fast-paced lifestyles has led to higher demand for packaging that supports convenience and portability. Consumers now look for packaging that’s resealable, lightweight, and easy to open or carry. This is especially important for food, beverages, and personal care products, where on-the-go consumption is rising. As a result, manufacturers are focusing on user-friendly designs and compact formats that suit mobile lifestyles.

The rise of e-commerce has further intensified the need for durable and secure packaging. Online orders require packaging that can withstand rough handling during transit while keeping the product intact. This demand has led to the adoption of shock-absorbent materials, leak-proof seals, and tamper-evident features. E-retailers are pushing for designs that ensure product safety while also enhancing unboxing experiences, contributing to brand perception and customer retention.

Urbanization and expanding middle-class populations, especially in Asia-Pacific and Africa, are accelerating the consumption of packaged goods. As more people move into urban areas and gain access to higher incomes, demand for packaged foods, beverages, and personal care items has surged. Packaging is not just a protective layer; it has become a tool for branding and convenience in busy, modern households. This demographic trend is encouraging companies to invest in tailored packaging solutions that meet diverse consumer needs.

Restraints

Fluctuating Raw Material Prices Challenge FMCG Packaging Stability

Volatile prices of raw materials like plastic, aluminum, and paperboard continue to strain the FMCG packaging industry. These fluctuations are often driven by global oil prices, geopolitical tensions, or supply chain disruptions. For manufacturers, such unpredictability makes it harder to maintain stable production costs, directly affecting profit margins and forcing adjustments in packaging strategies or product pricing.

Environmental regulations are becoming stricter across regions, particularly concerning single-use plastics and waste management. Governments are introducing bans, taxes, or compliance obligations aimed at reducing plastic waste and promoting sustainability.

While these initiatives benefit the environment, they place additional pressure on packaging companies to redesign products, switch to alternative materials, and invest in new technologies. Smaller firms, in particular, may struggle with the financial burden of meeting these regulatory standards, slowing innovation and limiting product options.

Growth Factors

Sustainable and Eco-friendly Packaging Unlocks New Growth Pathways

Sustainability is now a central concern for both consumers and brands. The demand for recyclable, compostable, and biodegradable packaging has created significant opportunities in the FMCG sector. Companies that invest in plant-based materials, reduced plastic usage, or closed-loop recycling systems are seeing stronger brand loyalty and consumer preference. This shift aligns with broader global sustainability goals and green marketing trends.

Smart packaging is another growing frontier. Features like freshness indicators, QR codes, and track-and-trace functions are being integrated into packages to improve transparency and user engagement. These technologies not only boost customer trust but also enhance supply chain efficiency by providing real-time data on product status and location.

Customization and personalization are emerging as strategic tools in brand differentiation. With advancements in digital printing and design flexibility, FMCG brands can now offer limited-edition or targeted packaging for specific customer segments. Personalized packaging not only boosts brand recognition but also deepens emotional connections with consumers, particularly in competitive categories like cosmetics, snacks, and beverages.

Emerging Trends

Minimalist and Clean Design Aesthetics Reshape FMCG Packaging Trends

Minimalist design is gaining popularity as consumers gravitate toward brands that reflect clarity, authenticity, and transparency. Clean labels, soft color palettes, and clutter-free layouts help communicate brand values and product simplicity. This trend resonates strongly with health-conscious and sustainability-driven buyers who prefer straightforward, no-frills packaging that aligns with their values.

On the other end of the spectrum, chaos packaging is emerging as a bold design strategy. Bright colors, unconventional typography, and abstract visuals are used to create visual disruption on shelves, grabbing attention in saturated retail environments. This approach is particularly effective for new brands trying to carve out niche recognition or stand out among legacy players.

Digital elements are also playing a vital role in transforming packaging into an interactive medium. Features like QR codes, NFC tags, and augmented reality offer added value to consumers by delivering information, gamified experiences, or traceability features. These innovations are reshaping how brands engage with tech-savvy and mobile-first customers, especially in markets with high digital penetration.”

Regional Analysis

Asia Pacific Leads the FMCG Packaging Market with a 36.8% Share, Valued at USD 294.7 Billion

Asia Pacific dominates the global FMCG packaging market with a 36.8% Share, Valued at USD 294.7 Billion, supported by strong demand from densely populated countries like China and India. Rapid urbanization, rising middle-class income, and expanding retail and e-commerce sectors are key growth drivers in this region. Governments’ increasing push for sustainable packaging also plays a crucial role in driving innovation and adoption.

Regional Mentions:

North America follows with substantial growth fueled by high consumer awareness, a mature retail infrastructure, and increased adoption of sustainable and smart packaging. The presence of automated logistics and an advanced supply chain further supports packaging innovation and efficiency across FMCG segments.

Europe is witnessing stable growth driven by stringent environmental regulations and a strong push for recyclable and biodegradable materials. Consumer preference for premium, eco-conscious packaging has led to significant innovation in materials and formats, especially in Western Europe.

The Middle East & Africa region is experiencing gradual growth, primarily propelled by rising urbanization, a growing young population, and expanding FMCG sectors in Gulf countries. However, economic disparities and infrastructural limitations may pose short-term challenges.

Latin America shows emerging potential, driven by increasing demand for packaged goods and rising investments in manufacturing sectors. Countries like Brazil and Mexico are focusing on improving distribution networks, which is expected to positively impact the demand for efficient and durable FMCG packaging solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global FMCG packaging market has seen consistent momentum led by strategic innovations and sustainability initiatives among top-tier companies.

Graham Packaging Company continued to focus on lightweight and recyclable plastic solutions, enhancing its appeal among environmentally conscious brands. Its emphasis on customization also supported client-specific packaging solutions across food and beverage categories.

Berry Global Inc. demonstrated strength through investments in circular economy practices, expanding its portfolio of post-consumer recycled (PCR) content packaging. Its global scale and technical capabilities helped meet growing demand for durable and sustainable packaging formats.

DS Smith PLC maintained its leadership in fiber-based packaging by aligning closely with retailers and e-commerce players. The firm’s focus on design innovation and supply chain optimization positioned it well to serve rapidly evolving retail needs.

Tetra Pak International S.A. continued to lead in aseptic and carton-based packaging, with increased investments in renewable material sourcing. The company’s integration of smart packaging technologies also added value in terms of traceability and brand protection for FMCG manufacturers.

Collectively, these players represent a diverse cross-section of material innovation, regional expertise, and sustainable packaging strategies. Their performance in 2024 reflects the broader industry transition toward eco-efficiency, digital integration, and adaptability to shifting consumer behavior.

Top Key Players in the Market

- Graham Packaging Company

- Berry Global Inc.

- DS Smith PLC

- Tetra Pak International S.A.

- AptarGroup Inc.

- Crown Holdings Inc.

- Albéa Group

- Toyo Seikan Group Holdings Ltd.

- Amcor plc

- Sonoco Products Company

- Consol Glass (Pty) Ltd

- Ball Corporation

- Sealed Air Corporation

Recent Developments

- In March 2024, Bambrew raised ₹60 crore in Series-A funding to boost its production capacity and strengthen its portfolio of sustainable packaging alternatives to plastic. The funds will also be used to scale its operations and deepen its market reach across India.

- In February 2025, Wingspire Equipment Finance committed US$20 million in financing to support a global plastics manufacturer in upgrading its machinery and expanding eco-efficient production capabilities. The move reflects growing institutional backing for greener manufacturing investments.

- In December 2024, Movopack secured US$2.5 million in funding to accelerate its development of sustainable, reusable packaging tailored for the e-commerce sector. The capital will aid in technology upgrades and market expansion efforts.

Report Scope

Report Features Description Market Value (2024) USD 796.7 Billion Forecast Revenue (2034) USD 1202.2 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Rigid Packaging, Flexible Packaging, Others), By Material (Plastic, Paper, Metal, Glass, Others), By End Use (Food and Beverages, Cosmetic and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Graham Packaging Company, Berry Global Inc., DS Smith PLC, Tetra Pak International S.A., AptarGroup Inc., Crown Holdings Inc., Albéa Group, Toyo Seikan Group Holdings Ltd., Amcor plc, Sonoco Products Company, Consol Glass (Pty) Ltd, Ball Corporation, Sealed Air Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Graham Packaging Company

- Berry Global Inc.

- DS Smith PLC

- Tetra Pak International S.A.

- AptarGroup Inc.

- Crown Holdings Inc.

- Albéa Group

- Toyo Seikan Group Holdings Ltd.

- Amcor plc

- Sonoco Products Company

- Consol Glass (Pty) Ltd

- Ball Corporation

- Sealed Air Corporation