Global Foliar Fertilizer Market By Type (Nutrient-Type Foliar Fertilizer, Bio-Type Foliar Fertilizer, Compound Foliar Fertilizer), By Physical Form (Solid, Liquid), By Composition (Nitrogen, Phosphorus, Potassium, Others), By Nutrient Type (Macro Nutrients, Micro Nutrients, Specialty Nutrients), By Crop Types (Grains and Cereals, Oilseeds and Pulses, Flowers, Fruits and Vegetables, Others), By Distribution Channel (Direct Sales, Retail Sales, E-commerce), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133720

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Physical Form Analysis

- By Composition Analysis

- By Nutrient Type Analysis

- By Crop Types Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Trending Factors

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

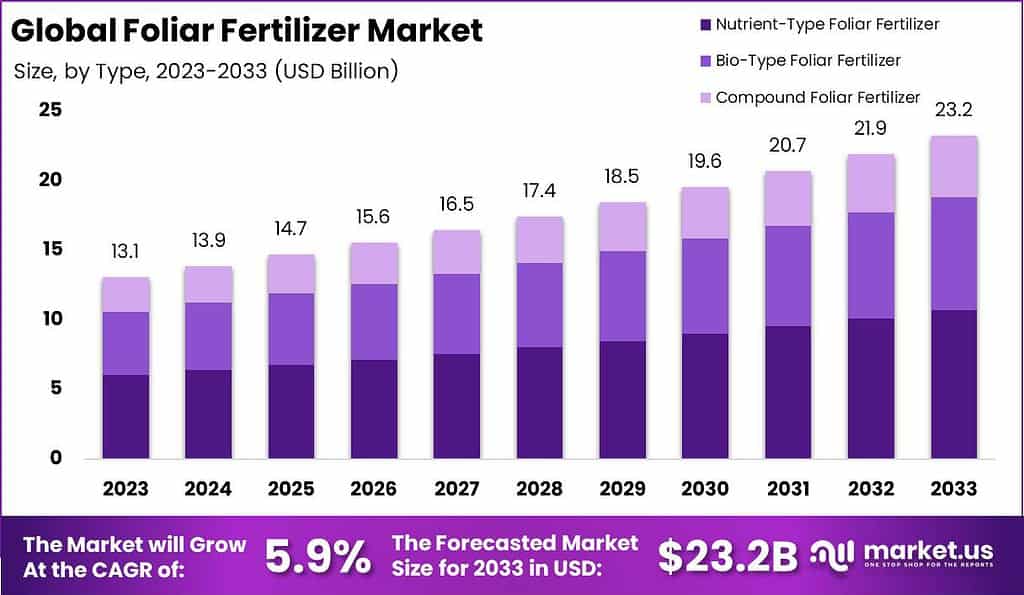

The Global Foliar Fertilizer Market size is expected to be worth around USD 23.2 Billion by 2033, from USD 13.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The foliar fertilizer market involves the production and application of liquid fertilizers directly to plant leaves to provide essential nutrients that enhance plant growth, health, and yield. This method is particularly effective in addressing nutrient deficiencies that soil application may not resolve efficiently.

The market is primarily driven by the increasing demand for higher agricultural productivity, sustainable farming practices, and technological advancements in agriculture.

The demand for foliar fertilizers has been steadily increasing. This growth is largely due to farmers seeking more efficient ways to ensure that their crops receive the right nutrients at the right time, especially in cases where soil application alone is insufficient.

As global agricultural practices evolve, the need for foliar fertilizers, which offer quicker and more targeted nutrient delivery, is growing. Moreover, the global push toward sustainability and the adoption of precision farming are contributing to this rise.

Regulatory environments surrounding foliar fertilizers are becoming stricter, as governments seek to minimize the environmental impact of fertilizers. In the European Union, for instance, the REACH Regulation ensures that all fertilizers, including foliar types, meet safety standards. The EU also introduced the Farm to Fork Strategy in 2022, aiming to reduce synthetic fertilizer use by 20% by 2030.

On the global trade front, the import-export dynamics of foliar fertilizers are influenced by the supply chains of key agricultural regions. In 2022, global exports of foliar fertilizers were valued at approximately USD 1.9 billion, with China, India, and the United States as major exporters.

China was the largest exporter, accounting for nearly 30% of global foliar fertilizer exports, valued at USD 570 million. On the other hand, Brazil and Canada are significant importers, with Brazil alone importing around USD 450 million annually, driven by its large-scale agricultural sector.

Governments in emerging markets, particularly in Asia-Pacific and Latin America, are actively promoting foliar fertilizers through subsidies and incentives. In India, for example, the government has allocated over USD 500 million in subsidies for precision agriculture technologies, including foliar fertilizers.

Similarly, Brazil has launched initiatives to improve fertilizer use efficiency, contributing to a 7% annual growth rate in foliar fertilizer adoption between 2021 and 2023.

Private investment in the foliar fertilizer market has also seen a significant rise. In 2023, global investments in agricultural innovations, including foliar fertilizers, exceeded USD 1.8 billion. Major companies such as Nutrien Ag Solutions and Yara International are investing heavily in research and development for more efficient and sustainable foliar fertilizers. Strategic mergers and acquisitions are also shaping the market. For instance, ICL Group’s acquisition of Haifa Group in 2022 for USD 2.3 billion expanded its footprint in the global foliar fertilizer market.

Innovation is a key trend in this market, with a strong focus on increasing nutrient efficiency and reducing environmental impact. The development of nano-fertilizers, which enhance nutrient absorption through foliar application, is gaining momentum.

The Nano Fertilizer market was valued at USD 250 million in 2023 and is expected to grow at a CAGR of 9.4% through 2030. Leading companies such as BASF and Syngenta are investing in these advanced technologies to improve plant nutrition and sustainability.

Key Takeaways

- The Global Foliar Fertilizer Market size is expected to be worth around USD 23.2 Billion by 2033, from USD 13.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

- Nutrient-Type Foliar Fertilizer led with 46.1% market share, driving growth.

- Liquid foliar fertilizers led with 68.1% market share, favored for efficiency.

- Nitrogen foliar fertilizers led with 44.1% market share, driving crop productivity.

- Macro Nutrients led with 54.1% share, driving foliar fertilizer market growth.

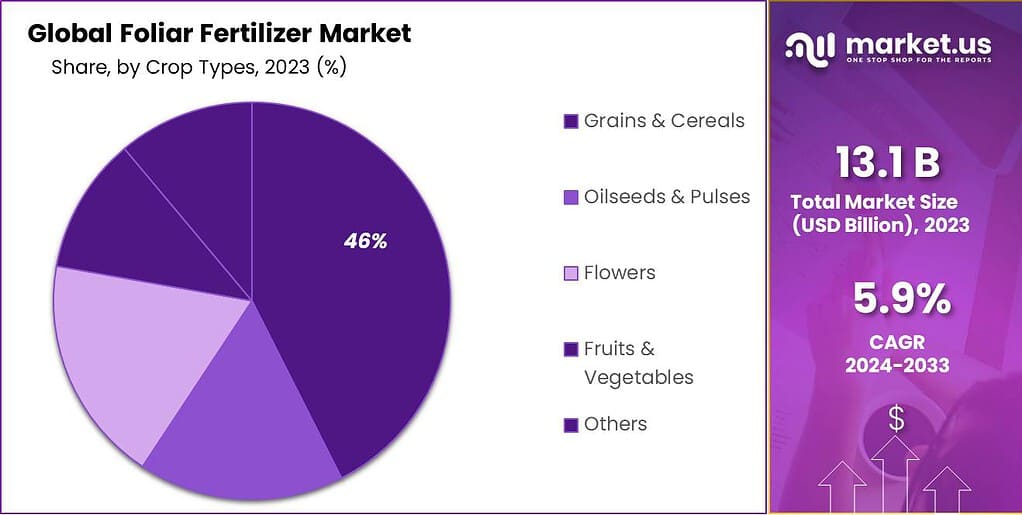

- Grains & Cereals led with a 46.1% share, driving foliar fertilizer demand.

- Direct Sales led with a 55.1% share, driving foliar fertilizer distribution growth.

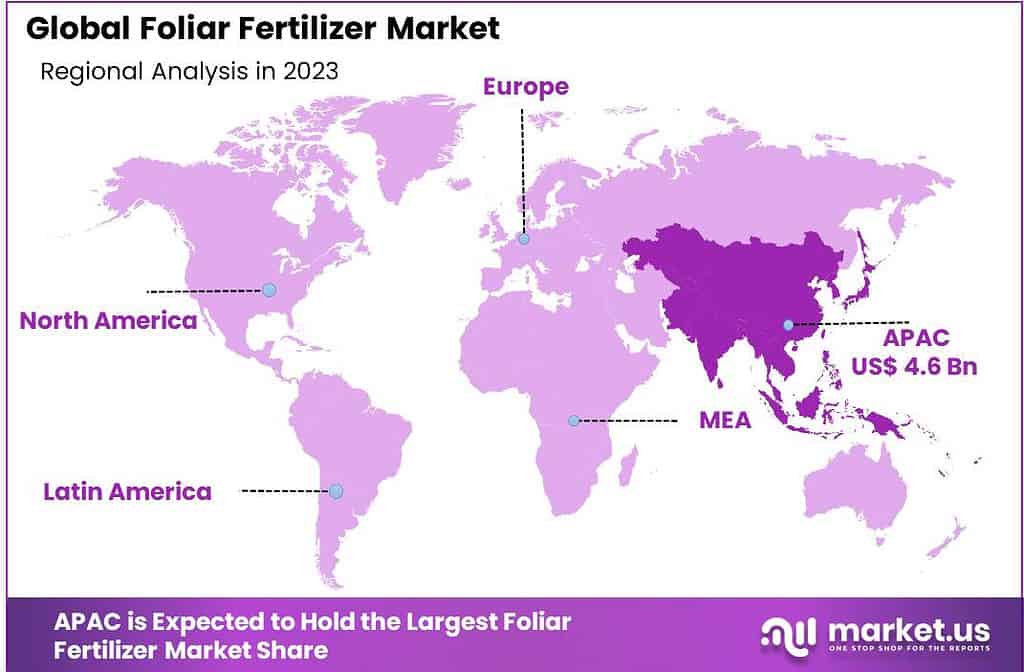

- Asia Pacific dominates the foliar fertilizer market with a 35.5% share, valued at USD 4.6 Bn.

By Type Analysis

Nutrient-Type Foliar Fertilizer led with 46.1% market share, driving growth.

In 2023, Nutrient-Type Foliar Fertilizer held a dominant market position in the By Type segment of the foliar fertilizer market, capturing more than 46.1% share. This growth is driven by the widespread adoption of nutrient-specific fertilizers that directly address common deficiencies in crops, such as nitrogen, phosphorus, and potassium. Nutrient-type foliar fertilizers are favored for their quick absorption and targeted application, allowing farmers to rapidly correct nutrient imbalances, thereby improving crop yields and quality.

Bio-Type Foliar Fertilizer followed as a significant segment, gaining traction due to increasing demand for sustainable and organic farming solutions. These fertilizers, derived from natural sources like seaweed, plant extracts, and amino acids, are growing in popularity for their eco-friendly characteristics and ability to improve plant resistance to pests and diseases. With the global shift towards organic farming, bio-type foliar fertilizers are expected to witness robust growth in the coming years.

Compound Foliar Fertilizer, which combines multiple nutrients in a single formulation, also captured a notable share of the market. These fertilizers are highly efficient for large-scale operations, offering convenience by providing a balanced mix of essential nutrients in one application. The segment is particularly prominent in regions with intensive agricultural practices.

By Physical Form Analysis

Liquid foliar fertilizers led with 68.1% market share, favored for efficiency.

In 2023, Liquid foliar fertilizers held a dominant market position in the By Physical Form segment of the foliar fertilizer market, capturing more than 68.1% share. This dominance is driven by the ease of application and faster absorption rates offered by liquid formulations. Liquid fertilizers are highly preferred for their efficiency in delivering nutrients directly to plant leaves, ensuring rapid uptake and immediate benefits. They also provide better distribution and coverage on plant surfaces, which is particularly beneficial for large-scale farming operations.

Solid foliar fertilizers, while capturing a smaller share of the market, still remain relevant, particularly for specific agricultural practices. Solid fertilizers are often used in dry, arid climates where liquid application can be less effective due to evaporation or environmental conditions. They offer convenience in handling and storage and are frequently used in combination with irrigation systems. Additionally, solid foliar fertilizers are gaining traction in organic farming due to their slow-release properties, which provide a steady supply of nutrients to crops over an extended period.

By Composition Analysis

Nitrogen foliar fertilizers led with 44.1% market share, driving crop productivity.

In 2023, Nitrogen foliar fertilizers held a dominant market position in the By Composition segment of the foliar fertilizer market, capturing more than 44.1% share. This dominance is largely attributed to nitrogen’s crucial role in promoting vigorous plant growth, enhancing photosynthesis, and improving overall crop productivity. Nitrogen fertilizers are particularly favored in regions where crops face nitrogen deficiencies, which can significantly impact yield. The versatility of nitrogen-based foliar fertilizers in various crops, such as cereals, fruits and vegetables further supports their leading position in the market.

Phosphorus foliar fertilizers, while capturing a smaller share of the market, are still an essential component in optimizing root development, flower formation, and overall plant energy transfer. Phosphorus is particularly beneficial in the early stages of crop growth, and its role in promoting flowering and fruiting stages makes it vital for high-yield crops. The demand for phosphorus-based fertilizers is growing, particularly in regions with phosphorus-deficient soils.

Potassium foliar fertilizers, although representing a smaller portion of the market, are critical for enhancing plant health, water regulation, and disease resistance. Potassium is essential for improving stress tolerance and overall plant vitality, making it particularly valuable in regions affected by drought or extreme weather conditions.

By Nutrient Type Analysis

Macro Nutrients led with 54.1% share, driving foliar fertilizer market growth.

In 2023, Macro Nutrients held a dominant market position in the By Nutrient Type segment of the foliar fertilizer market, capturing more than 54.1% share. This dominance is driven by the essential role that macronutrients namely nitrogen, phosphorus, and potassium play in plant growth. These nutrients are required in large quantities and are crucial for key processes such as photosynthesis, root development, and overall plant health. The high demand for macro nutrient-based foliar fertilizers reflects their fundamental importance in optimizing crop yields, particularly in large-scale agricultural operations.

Micro Nutrients, while representing a smaller portion of the market, are still vital for plant health and growth, especially for correcting specific nutrient deficiencies. Elements such as zinc, iron, and copper are essential for enzyme activity, chlorophyll production, and disease resistance. The increasing awareness of soil depletion and nutrient imbalances has driven the demand for micronutrient foliar fertilizers, especially in regions with nutrient-poor soils.

Specialty Nutrients, including secondary nutrients like calcium, magnesium, and sulfur, as well as trace elements, are growing in importance for specific crop needs. These nutrients help in improving plant vigor, enhancing disease resistance, and supporting overall crop quality. Together, these segments address a broad range of agricultural challenges, with macronutrients remaining the dominant contributor to market growth.

By Crop Types Analysis

Grains & Cereals led with a 46.1% share, driving foliar fertilizer demand.

In 2023, Grains & Cereals held a dominant market position in the By Crop Types segment of the foliar fertilizer market, capturing more than 46.1% share. This dominance is driven by the widespread cultivation of grains and cereals, such as wheat, rice, and corn, which are staple crops globally. Foliar fertilizers play a critical role in maximizing yields by addressing nutrient deficiencies that can affect grain development, especially in nutrient-depleted soils. The high demand for grains and cereals in both developed and emerging markets further boosts the demand for foliar fertilization to ensure optimal crop performance.

Oilseeds & Pulses represent the second-largest segment, with crops like soybeans, canola, and lentils benefiting from foliar fertilization. These crops are highly sensitive to nutrient imbalances, and foliar fertilizers are increasingly used to enhance growth and improve overall yield quality. The rising global consumption of plant-based proteins is driving this segment’s growth.

Flowers Fruits & Vegetables also contribute significantly to the foliar fertilizer market. Flowers benefit from improved nutrient uptake, which enhances color and bloom quality. Similarly, fruits and vegetables require precise nutrient management to ensure high-quality and marketable produce, making foliar fertilizers crucial for farmers aiming to meet consumer demand for fresh, nutrient-dense produce.

By Distribution Channel Analysis

Direct Sales led with a 55.1% share, driving foliar fertilizer distribution growth.

In 2023, Direct Sales held a dominant market position in the By Distribution Channel segment of the foliar fertilizer market, capturing more than 55.1% share. This dominance is primarily attributed to the close relationships that manufacturers have with large-scale agricultural producers. Direct sales allow fertilizer companies to provide tailored solutions, offer technical support, and establish long-term partnerships with customers, ensuring a steady stream of demand. Furthermore, direct sales channels help manufacturers offer competitive pricing by cutting out intermediaries, which is particularly beneficial for large commercial farms and agribusinesses.

Retail Sales also play a significant role in the distribution of foliar fertilizers, particularly for smaller-scale farmers and those involved in home gardening or local agriculture. Retail sales, through agrochemical stores or farm supply outlets, are accessible and convenient for a broad range of consumers. This segment continues to grow as smallholder farmers seek high-quality, easy-to-use products for improving their crop yields.

E-commerce is an emerging channel, gaining traction due to its convenience and the increasing shift toward online shopping in the agriculture sector. E-commerce platforms enable farmers to access a wide variety of foliar fertilizers and related products, offering easy price comparisons and home delivery, which is especially appealing to those in remote or underserved areas.

Key Market Segments

By Type

- Nutrient-Type Foliar Fertilizer

- Bio-Type Foliar Fertilizer

- Compound Foliar Fertilizer

By Physical Form

- Solid

- Liquid

By Composition

- Nitrogen

- Phosphorus

- Potassium

- Others

By Nutrient Type

- Macro Nutrients

- Micro Nutrients

- Specialty Nutrients

By Crop Types

- Grains & Cereals

- Oilseeds & Pulses

- Flowers

- Fruits & Vegetables

- Others

By Distribution Channel

- Direct Sales

- Retail Sales

- E-commerce

Driving factors

Advancements in Agricultural Practices: Paving the Way for Foliar Fertilizer Adoption

The evolution of agricultural practices has been a major driver of the growth of the foliar fertilizer market. As farming techniques continue to advance with greater precision, efficiency, and sustainability, the adoption of foliar fertilizers has become more widespread. Modern agricultural methods emphasize high yields, soil health, and resource optimization, which aligns perfectly with the benefits that foliar fertilizers offer.

Foliar fertilizers provide an efficient way to correct nutrient deficiencies directly through plant leaves, ensuring quicker absorption compared to soil-based fertilizers. This rapid uptake minimizes nutrient loss, reduces runoff, and promotes optimal growth in a variety of crops. The increasing use of precision agriculture, including tools like drones, sensors, and satellite technology, allows farmers to apply these fertilizers in a more targeted and effective manner, further enhancing their role in modern farming systems.

Additionally, the shift toward more sustainable agricultural practices is contributing to the growth of foliar fertilizers. These fertilizers often require less water, reduce the need for excessive soil fertilization, and can be part of integrated nutrient management strategies that are crucial for long-term soil fertility.

Rising Global Food Demand: A Catalyst for Fertilizer Innovation

The growing global population and increasing urbanization have led to a surge in global food demand, which directly impacts the agricultural sector’s need for efficient and high-yielding farming methods. As farmers face the dual challenge of producing more food while conserving resources and maintaining soil health, the demand for high-performance agricultural inputs like foliar fertilizers has intensified.

This rising demand for food is pushing the need for innovative solutions to boost crop productivity. Foliar fertilizers are becoming essential in achieving these higher yields due to their ability to rapidly address nutrient deficiencies in crops, particularly in areas with poor or degraded soils.

The increasing emphasis on food security, along with government and industry incentives to adopt sustainable farming practices, is further fueling the adoption of foliar fertilizers. Farmers are looking for ways to maximize crop output while minimizing environmental impact, and foliar fertilizers offer a convenient and environmentally friendlier alternative to traditional soil fertilizers.

Compatibility with Integrated Pest Management (IPM): Enhancing Crop Health and Sustainability

The compatibility of foliar fertilizers with Integrated Pest Management (IPM) practices has emerged as a key factor in their growing market presence. IPM is a holistic approach that combines biological, cultural, mechanical, and chemical practices to control pest populations while minimizing the use of harmful pesticides. The use of foliar fertilizers aligns well with IPM because they not only provide essential nutrients directly to plants but can also help plants strengthen their natural defenses against pests and diseases.

For example, certain foliar fertilizers, particularly those rich in micronutrients like zinc, manganese, and copper, have been shown to improve plant resistance to pests and pathogens. These nutrients play a vital role in enhancing plant immunity, which can reduce the need for chemical pest control and help farmers adopt a more sustainable, eco-friendly approach to farming.

Moreover, by using foliar fertilizers in conjunction with IPM practices, farmers can reduce their reliance on synthetic pesticides, lowering their environmental footprint and contributing to healthier ecosystems. This synergy between foliar fertilizers and IPM not only supports crop health but also aligns with global trends toward sustainable agriculture, further driving the demand for foliar fertilizer solutions.

Restraining Factors

Application Challenges in Adverse Weather: A Barrier to Consistent Fertilizer Use

One of the key restraining factors affecting the growth of the foliar fertilizer market is the challenge posed by adverse weather conditions, which can significantly impact the effectiveness of these fertilizers. The timing and method of foliar fertilizer application are critical to their success. Extreme weather conditions, such as heavy rainfall, high winds, or excessive heat, can hinder or delay the application process and reduce the absorption of nutrients by plants.

For instance, heavy rainfall shortly after application can cause foliar fertilizers to wash off, leading to nutrient loss and the need for reapplication. Similarly, high temperatures can lead to plant stress, reducing the efficacy of foliar fertilizers, especially if they are applied during the hottest parts of the day. Additionally, high humidity and misty conditions can cause uneven distribution of the fertilizer on plant surfaces, affecting its absorption and overall effectiveness.

These challenges are particularly pronounced in regions with highly variable climates or unpredictable weather patterns, making farmers hesitant to invest in foliar fertilizers due to concerns about the uncertainty of application success. While there are technologies available to help mitigate some of these issues (such as controlled-environment farming or advanced spray equipment), the impact of weather on foliar fertilizer efficiency continues to be a major concern that limits market growth in certain areas.

Market Penetration of Alternative Technologies: Increasing Competition

The foliar fertilizer market faces significant competition from alternative agricultural technologies that offer similar benefits with different application methods. Among these alternatives, soil fertilizers, micro-irrigation systems, and slow-release fertilizers have garnered considerable attention due to their established presence in the market and perceived ease of use.

Soil fertilizers, for example, are still the most common method of nutrient delivery, especially in traditional farming practices. While foliar fertilizers offer advantages in terms of faster nutrient uptake, many farmers prefer soil-based fertilization methods because they are often seen as simpler to implement and more cost-effective for large-scale operations.

Micro-irrigation systems, such as drip irrigation, also provide an alternative route for delivering nutrients directly to plant roots. These systems are often seen as more efficient than traditional irrigation, offering water and nutrient delivery with minimal waste.

Fluctuating Raw Material Prices: Economic Uncertainty in Fertilizer Production

Fluctuating raw material prices, particularly for key ingredients in foliar fertilizers like nitrogen, potassium, and phosphorus, have a direct impact on the cost and affordability of these products. These price variations are often influenced by factors such as geopolitical tensions, supply chain disruptions, and changes in demand from other industries. For example, the global supply chain disruptions caused by the COVID-19 pandemic and subsequent geopolitical conflicts, such as the war in Ukraine, have caused significant volatility in the prices of raw materials used in fertilizer production.

When raw material prices increase, manufacturers of foliar fertilizers are faced with higher production costs, which can lead to price hikes for end-users. This makes foliar fertilizers less attractive, especially to small-scale or price-sensitive farmers who may already be struggling with rising input costs. In turn, the higher costs may limit the overall demand for foliar fertilizers, particularly in developing markets where price sensitivity is more pronounced.

Additionally, raw material price fluctuations can lead to supply shortages or production delays, creating an unpredictable market environment. This uncertainty can discourage investment in foliar fertilizer production and research, as companies may be hesitant to commit to large-scale production or product innovations when the cost of key ingredients remains volatile.

Growth Opportunity

Organic Agriculture: A Growing Sector for Fertilizer Demand

The global shift toward organic agriculture continues to gain momentum. In 2022, the area of organic agricultural land worldwide reached over 75 million hectares, and this trend is expected to expand further as consumers demand healthier and more environmentally friendly food options. Organic farming relies heavily on efficient nutrient management since synthetic fertilizers are not permitted.

Foliar fertilizers, particularly those made from organic ingredients, offer a viable solution for supplying nutrients quickly and effectively to crops. This growing demand for organic produce presents a significant opportunity for foliar fertilizer companies to innovate and offer tailored solutions for the organic farming sector.

Sustainable Product Innovations: Meeting Eco-Friendly Demands

As sustainability becomes a core focus of agricultural practices, there is a rising demand for eco-friendly, low-impact fertilization options. Foliar fertilizers, especially those derived from natural sources or those that reduce nutrient runoff, align with this movement. Companies that invest in research and development to create environmentally sustainable foliar fertilizers such as bio-based and slow-release formulations are likely to see increased market share.

The growing preference for sustainable agricultural inputs is driving investment in such innovations, which will support the long-term growth of the foliar fertilizer market.

Vertical Farming: Capitalizing on Urban Agriculture

The rise of vertical farming, particularly in urban areas, presents another growth opportunity for foliar fertilizers. Vertical farming systems are highly controlled environments, where precise nutrient delivery is critical for maximizing crop yields. Foliar fertilizers, due to their ability to be applied directly to plant leaves for rapid absorption, are ideal for vertical farming operations. As urban farming continues to grow globally, particularly in cities with limited arable land, the demand for foliar fertilizers that can optimize growth in such settings is expected to rise.

Trending Factors

Bio-based Foliar Fertilizers: The Shift Toward Sustainability

One of the most significant trends in the foliar fertilizer market is the growing demand for bio-based, organic, and natural fertilizers. As consumers and farmers alike become more environmentally conscious, the shift toward sustainable agricultural practices accelerates. Bio-based foliar fertilizers, derived from plant extracts, seaweed, or animal by-products, are gaining popularity due to their eco-friendly nature.

These fertilizers are seen as safer for the environment and human health, offering an attractive alternative to chemical-based fertilizers. As regulatory pressures and consumer preferences move toward sustainability, bio-based foliar fertilizers are expected to see strong growth.

Climate Change Adaptation: A Necessity for Resilient Agriculture

With climate change leading to unpredictable weather patterns, extreme temperatures, and more frequent droughts, farmers are increasingly turning to foliar fertilizers as part of their adaptation strategies. Foliar fertilizers enable crops to absorb nutrients more efficiently, particularly in areas where soil conditions are compromised due to changing weather patterns.

Fertilizers that help plants withstand heat stress, water scarcity, or nutrient deficiencies will be in high demand as part of climate-resilient agricultural practices. This trend aligns with the broader focus on climate-smart agriculture, making foliar fertilizers an essential tool for boosting crop productivity in challenging environments.

Consumer Demand for Quality Produce: Raising the Bar for Agriculture

As global consumers become more health-conscious, the demand for high-quality, nutrient-rich produce is driving changes in agricultural practices. Foliar fertilizers play a crucial role in enhancing the nutritional content and appearance of crops. By ensuring optimal nutrient delivery directly to plant leaves, foliar fertilizers can improve both the yield and the quality of fruits, vegetables, and grains.

This is particularly important in markets where premium produce such as organic or high-quality fresh produce is in high demand. In 2024, we can expect to see foliar fertilizers increasingly marketed as solutions that meet consumer demand for food that is not only plentiful but also of superior nutritional quality.

Regional Analysis

Asia Pacific dominates the foliar fertilizer market with a 35.5% share, valued at USD 4.6 Bn.

Asia Pacific is the dominant region in the global foliar fertilizer market, accounting for 35.5% of the market share, valued at approximately USD 4.6 billion in 2024. This growth is driven by the region’s large agricultural base, increasing adoption of advanced farming techniques, and the rising demand for high-yield crops. Countries like China, India, and Japan are key players, with China being the largest producer and consumer of foliar fertilizers in the region. The increasing need for sustainable farming solutions and climate-resilient agriculture further boosts the adoption of foliar fertilizers in APAC.

North America, particularly the United States, is a significant market for foliar fertilizers, driven by a strong focus on precision agriculture and sustainability. The market is expanding as farmers adopt more targeted, efficient fertilization techniques to improve crop productivity. The U.S. has seen increasing demand for bio-based foliar fertilizers, aligning with broader trends toward organic and sustainable farming practices. The market in North America is expected to grow steadily, supported by high technological adoption and regulatory incentives for eco-friendly products.

Europe is another key market, where the adoption of foliar fertilizers is bolstered by stringent environmental regulations and the growing preference for organic farming. Countries like Germany, France, and Italy are prominent in the use of advanced foliar fertilization technologies. The European market is also influenced by strong consumer demand for organic produce, with bio-based fertilizers gaining traction.

The Middle East & Africa region is witnessing steady growth due to increased agricultural investments in countries like Saudi Arabia and Egypt, which are focused on improving crop yields through efficient fertilization practices. Water scarcity issues in the region also drive the demand for efficient, water-conserving products like foliar fertilizers.

Latin America is emerging as a growth region, particularly in Brazil and Argentina, where agriculture is a significant part of the economy. Foliar fertilizers are gaining popularity due to their effectiveness in maximizing crop yields, especially in nutrient-deficient soils.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global foliar fertilizer market in 2024 is highly competitive, with key players spanning multinational corporations to regional innovators. Among these, ADAMA Agricultural Solutions, BASF, and Syngenta stand out as leaders, leveraging their robust research and development capabilities, extensive distribution networks, and broad product portfolios.

ADAMA Agricultural Solutions, known for its wide range of crop protection and nutritional products, is investing heavily in foliar fertilizers to meet the growing demand for sustainable agriculture. Their global presence and strong market penetration allow them to cater to diverse agricultural needs, particularly in emerging markets in Asia and Latin America.

BASF, a global giant in agricultural chemicals, is focusing on developing eco-friendly, bio-based foliar fertilizers as part of its strategy to support sustainable farming. With significant R&D investments, BASF is well-positioned to benefit from the increasing demand for organic and eco-conscious farming inputs.

Syngenta, also a major player, offers a comprehensive portfolio of foliar fertilizers and crop protection products. The company’s emphasis on precision farming and technological innovations such as fertigation and drone-assisted applications—positions it at the forefront of the market, particularly in North America and Europe.

Other prominent companies like Yara International ASA, ICL Group, and Nutrien are also making significant strides in the foliar fertilizer sector. Yara, for example, is focusing on digital farming technologies to deliver precision nutrient solutions, while ICL is strengthening its position in sustainable fertilizer solutions. Nutrien is tapping into the growing demand for bio-based fertilizers, supported by its large-scale production capabilities.

With increasing investment in sustainable product development, strategic partnerships, and technological advancements, these key players are shaping the future of the foliar fertilizer market, positioning themselves to capitalize on the growing global demand for efficient and eco-friendly agricultural solutions.

Market Key Players

- ADAMA Agricultural Solutions

- Artal Smart Agriculture

- BASF

- Coromandel International Ltd.

- FMC Corporation

- Grupa Azoty S.A. (Compo Expert)

- Haifa Group

- Humintech

- Hydrite Chemical

- ICL Group

- Igea

- Indian Farmers Fertiliser Cooperative Limited

- Israel Chemicals Ltd.

- K+S AG

- Nutrien

- OMEX Agriculture Ltd

- Oro Agri

- Sociedad Quimica y Minera de Chile SA

- Spraygro Liquid Fertilizers

- Syngenta

- Tessenderlo Group

- The Mosaic Company

- UPL Limited

- Verdesian Life Sciences

- Yara International ASA

Recent Development

- In April 2024, BASF announced the expansion of its portfolio of sustainable foliar fertilizers aimed at improving crop efficiency while reducing environmental impact. The new products are designed to help farmers improve yields with less resource use, reflecting BASF’s commitment to meeting global sustainability goals.

- In March 2024, ADAMA launched a new line of bio-based foliar fertilizers designed to enhance nutrient uptake and promote sustainable farming practices. This launch aligns with the growing demand for eco-friendly agricultural inputs and is expected to increase ADAMA’s market share in the organic farming sector.

- In February 2024, Nutrien entered into a strategic partnership with a leading precision agriculture technology firm to develop advanced foliar fertilizer solutions that utilize data-driven insights. The collaboration focuses on optimizing nutrient delivery through smart farming practices, allowing farmers to maximize their crop productivity efficiently.

Report Scope

Report Features Description Market Value (2023) USD 13.1 Billion Forecast Revenue (2033) USD 23.2 Billion CAGR (2024-2032) 5.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Nutrient-Type Foliar Fertilizer, Bio-Type Foliar Fertilizer, Compound Foliar Fertilizer), By Physical Form (Solid, Liquid), By Composition (Nitrogen, Phosphorus, Potassium, Others), By Nutrient Type (Macro Nutrients, Micro Nutrients, Specialty Nutrients), By Crop Types (Grains and Cereals, Oilseeds and Pulses, Flowers, Fruits and Vegetables, Others), By Distribution Channel (Direct Sales, Retail Sales, E-commerce) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ADAMA Agricultural Solutions, Artal Smart Agriculture, BASF, Coromandel International Ltd., FMC Corporation, Grupa Azoty S.A. (Compo Expert), Haifa Group, Humintech, Hydrite Chemical, ICL Group, Igea, Indian Farmers Fertiliser Cooperative Limited, Israel Chemicals Ltd., K+S AG, Nutrien, OMEX Agriculture Ltd, Oro Agri, Sociedad Quimica y Minera de Chile SA, Spraygro Liquid Fertilizers, Syngenta, Tessenderlo Group, The Mosaic Company, UPL Limited, Verdesian Life Sciences, Yara International ASA Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Foliar Fertilizer MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Foliar Fertilizer MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADAMA Agricultural Solutions

- Artal Smart Agriculture

- BASF

- Coromandel International Ltd.

- FMC Corporation

- Grupa Azoty S.A. (Compo Expert)

- Haifa Group

- Humintech

- Hydrite Chemical

- ICL Group

- Igea

- Indian Farmers Fertiliser Cooperative Limited

- Israel Chemicals Ltd.

- K+S AG

- Nutrien

- OMEX Agriculture Ltd

- Oro Agri

- Sociedad Quimica y Minera de Chile SA

- Spraygro Liquid Fertilizers

- Syngenta

- Tessenderlo Group

- The Mosaic Company

- UPL Limited

- Verdesian Life Sciences

- Yara International ASA