Global Fish-Oil Based Drugs Market By Source (Salmon, Mackerel, Herring, Tuna and Others), By Form (Docosahexaenoic Acid (DHA) and Eicosapentaenoic Acid (EPA)), By Application (Coronary Heart Disease (CHD), Stroke, Rheumatoid Arthritis, Raynaud’s Syndrome, Dysmenorrhea and Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, Drug Stores & Pharmacies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173685

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

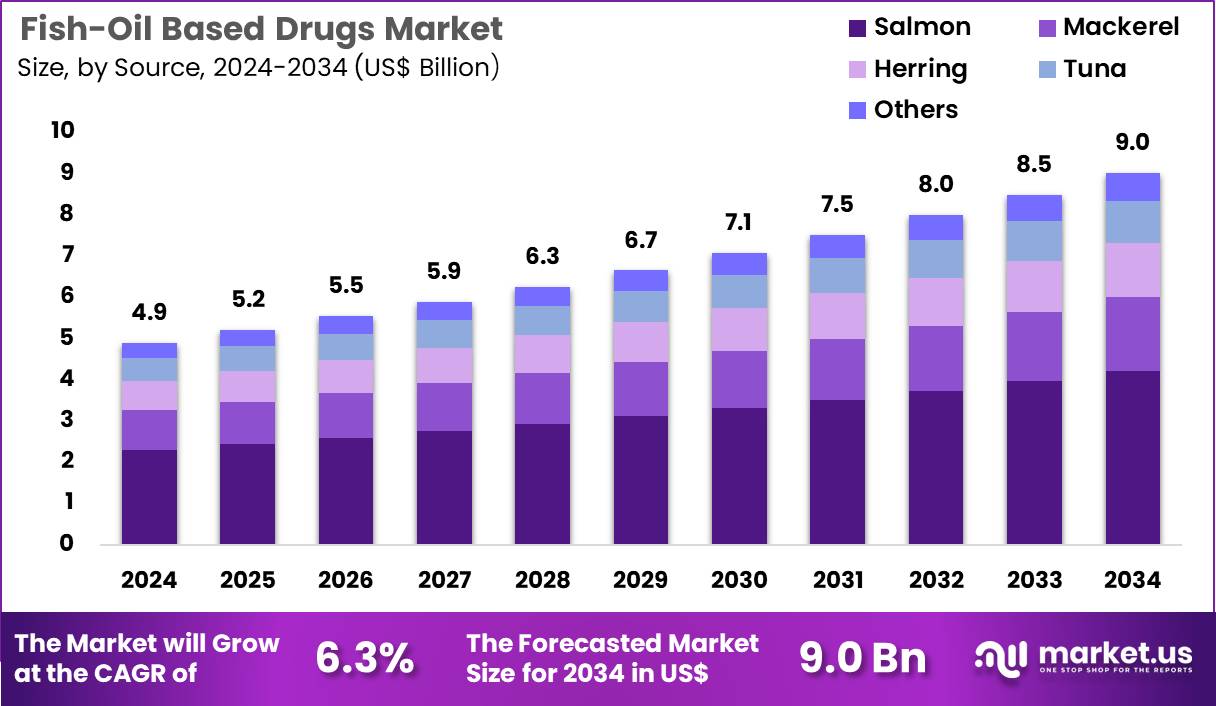

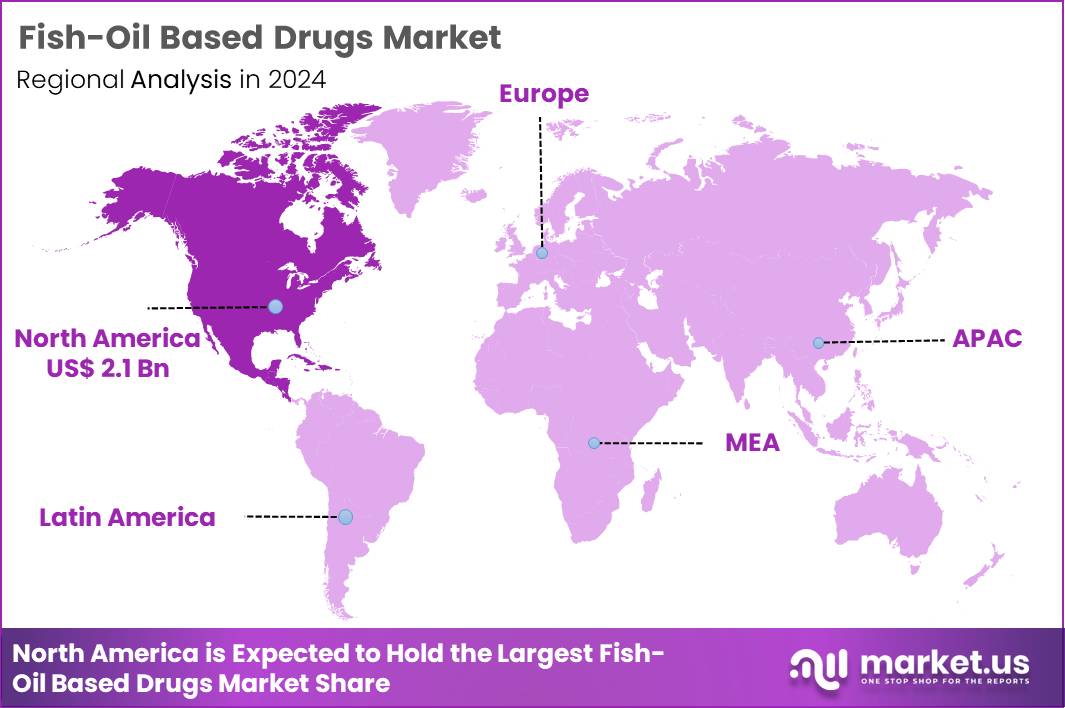

The Global Fish-Oil Based Drugs Market size is expected to be worth around US$ 9.0 Billion by 2034 from US$ 4.9 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.5% share with a revenue of US$ 2.1 Billion.

Growing emphasis on cardiovascular risk reduction propels pharmaceutical companies to advance fish-oil-based drugs that deliver highly purified omega-3 fatty acids for targeted triglyceride management in patients with severe hypertriglyceridemia. Cardiologists prescribe these formulations as adjuncts to statin therapy, significantly lowering triglyceride levels in adults with concentrations exceeding 500 mg/dL to mitigate pancreatitis risk. These medications support secondary prevention strategies by reducing major adverse cardiovascular events in high-risk individuals with established heart disease and persistent hypertriglyceridemia.

Clinicians utilize purified eicosapentaenoic acid derivatives to address residual cardiovascular risk beyond LDL cholesterol control, improving overall lipid profiles. These therapies also facilitate management of mixed dyslipidemia, providing consistent plasma exposure that enhances patient outcomes in long-term treatment regimens.

In 2024, Croda International PLC completed the acquisition of Solutex GC, adding advanced supercritical CO2 extraction expertise to its portfolio. The transaction strengthens Croda’s ability to manufacture highly concentrated omega-3 ingredients, enabling expansion into high-potency formulations for both pharmaceutical and nutraceutical customers seeking differentiated lipid technologies.

Manufacturers pursue opportunities to develop next-generation ethyl ester and carboxylic acid formulations that achieve superior bioavailability, broadening applications in patients intolerant to conventional lipid-lowering agents. Companies engineer combination regimens that pair fish-oil-based drugs with emerging anti-inflammatory agents, enhancing efficacy in complex atherothrombotic conditions. These innovations facilitate earlier initiation in prediabetic populations with elevated triglycerides, supporting preventive cardiovascular strategies.

Opportunities expand in exploring adjunctive roles for these medications in metabolic syndrome management, where triglyceride reduction complements weight control and glycemic interventions. Developers advance high-purity concentrates that minimize gastrointestinal side effects, improving tolerability during prolonged therapy for chronic hyperlipidemia. Firms invest in patient-specific dosing protocols that optimize response rates in individuals with genetic lipid disorders.

Industry specialists refine purification processes using supercritical fluid extraction to eliminate contaminants and achieve pharmaceutical-grade consistency, elevating safety profiles for extended cardiovascular protection. Developers prioritize evidence-based expansion of indications beyond severe hypertriglyceridemia, incorporating cardiovascular outcome data to strengthen clinical guidelines. Market participants emphasize real-world evidence collection that validates sustained triglyceride control and event reduction in diverse patient cohorts.

Innovators introduce improved capsule technologies that reduce burping and reflux, enhancing adherence in outpatient settings. Companies advance integrated monitoring tools to track lipid responses, facilitating timely adjustments in high-risk populations. Ongoing efforts focus on mechanistic studies that elucidate pleiotropic benefits, reinforcing the position of fish-oil-based drugs in comprehensive lipid management strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.9 Billion, with a CAGR of 6.3%, and is expected to reach US$ 9.0 Billion by the year 2034.

- The source segment is divided into salmon, mackerel, herring, tuna and others, with salmon taking the lead in 2024 with a market share of 46.8%.

- Considering form, the market is divided into docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA). Among these, docosahexaenoic acid (DHA) held a significant share of 57.4%.

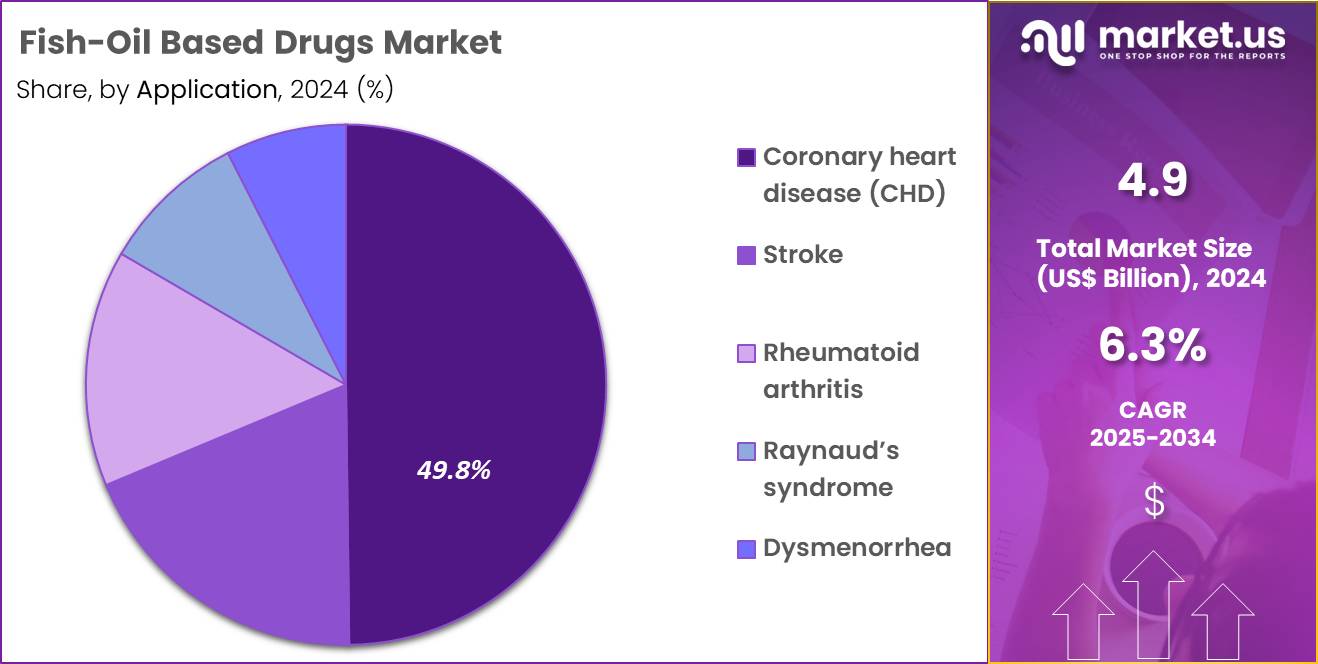

- Furthermore, concerning the application segment, the market is segregated into coronary heart disease (CHD), stroke, rheumatoid arthritis, raynaud’s syndrome, dysmenorrhea and others. The coronary heart disease (CHD) sector stands out as the dominant player, holding the largest revenue share of 49.8% in the market.

- The distribution channel segment is segregated into supermarkets/hypermarkets, online retailers, drug stores & pharmacies and others, with the supermarkets/hypermarkets segment leading the market, holding a revenue share of 44.2%.

- North America led the market by securing a market share of 43.5% in 2024.

Source Analysis

Salmon accounted for 46.8% of growth within the source category and represents the leading raw material base in the Fish Oil Based Drugs market. Salmon offers high and consistent omega-3 content, supporting pharmaceutical-grade extraction. Manufacturers prefer salmon due to stable DHA and EPA profiles. Farmed salmon ensures reliable year-round supply chains. Traceability standards remain stronger for salmon sourcing. Regulatory compliance improves with controlled aquaculture practices.

Lower contamination risk strengthens pharmaceutical acceptance. Processing efficiencies reduce production variability. Global salmon farming expansion supports volume scalability. Quality perception among consumers favors salmon-derived products. Sustainability certifications increase brand credibility. Advanced purification techniques align well with salmon oil composition. Higher yield per unit supports cost efficiency. Clinical studies frequently reference salmon-based omega-3s.

Healthcare professionals recognize salmon oil as a trusted source. Cold-water origin enhances fatty acid stability. Manufacturers invest in salmon-focused supply partnerships. Product labeling emphasizes salmon origin to drive demand. Market confidence reinforces repeat procurement. The segment is projected to maintain dominance due to supply reliability and quality consistency.

Form Analysis

Docosahexaenoic acid represented 57.4% of growth within the form category and leads the Fish Oil Based Drugs market. DHA supports cardiovascular, neurological, and cellular health outcomes. Pharmaceutical formulations increasingly emphasize DHA-rich compositions. Strong clinical evidence reinforces DHA relevance in chronic disease management. DHA improves membrane fluidity and anti-inflammatory pathways. Cardiologists frequently recommend DHA-focused omega-3 therapies.

Higher bioavailability strengthens therapeutic performance. DHA demand rises with aging populations. Cognitive health awareness indirectly supports DHA adoption. Manufacturers develop DHA-dominant formulations for differentiation. Regulatory approvals increasingly reference DHA efficacy data. DHA integrates well into prescription and OTC drug formats. Long-term supplementation aligns with preventive healthcare trends. DHA stability supports extended shelf life.

Hospital prescribing practices favor DHA-inclusive therapies. Consumer awareness campaigns emphasize DHA benefits. Clinical dosing guidelines highlight DHA contribution. Pharmaceutical branding centers on DHA potency. Research pipelines continue to explore DHA applications. The segment is anticipated to retain leadership due to broad clinical relevance.

Application Analysis

Coronary heart disease captured 49.8% of growth within the application category and remains the primary driver of Fish Oil Based Drugs demand. CHD prevalence continues rising across global populations. Omega-3 therapies support lipid profile management. DHA and EPA reduce triglyceride levels effectively. Cardiovascular risk reduction strategies prioritize omega-3 supplementation. Physicians increasingly integrate fish-oil drugs into preventive regimens.

Post-myocardial infarction care supports continued usage. Aging demographics expand the CHD patient base. Lifestyle-related risk factors accelerate demand. Long-term therapy requirements sustain volume growth. Clinical guidelines reinforce omega-3 inclusion in CHD management. Improved patient compliance supports outcomes. Combination therapies incorporate fish-oil drugs effectively.

Healthcare systems emphasize non-invasive cardiovascular prevention. Reduced hospitalization risk strengthens adoption. Awareness campaigns highlight heart-health benefits. Prescription trends favor chronic cardiovascular applications. Insurance coverage supports cardiovascular therapies. Clinical outcome data improves physician confidence. The segment is projected to dominate due to sustained disease burden.

Distribution Channel Analysis

Supermarkets and hypermarkets accounted for 44.2% of growth within the distribution channel category and lead the Fish Oil Based Drugs market. High consumer footfall supports large sales volumes. Easy accessibility improves purchase frequency. Retail chains expand health and wellness product sections. Consumers prefer one-stop shopping for supplements and drugs. Shelf visibility enhances brand recognition. Bulk purchasing options improve affordability.

Private-label offerings increase category penetration. In-store promotions stimulate impulse purchases. Pharmacist-assisted counters strengthen consumer trust. Supermarkets support wide SKU availability. Urbanization increases dependence on organized retail. Point-of-sale education influences buyer decisions. Supply chain efficiency ensures product freshness.

Retail compliance supports regulated drug sales. Brand loyalty grows through consistent availability. Seasonal promotions boost sales cycles. Supermarkets reach diverse demographic groups. Offline retail reassures quality-conscious consumers. Distribution scale supports national penetration. The segment is expected to remain dominant due to accessibility and retail reach.

Key Market Segments

By Source

- Salmon

- Mackerel

- Herring

- Tuna

- Others

By Form

- Docosahexaenoic acid (DHA)

- Eicosapentaenoic acid (EPA)

By Application

- Coronary heart disease (CHD)

- Stroke

- Rheumatoid arthritis

- Raynaud’s syndrome

- Dysmenorrhea

- Others

By Distribution Channel

- Supermarkets/hypermarkets

- Online retailers

- Drug stores & pharmacies

- Others

Drivers

Rising prevalence of high triglycerides is driving the market

The fish-oil based drugs market is propelled by the rising prevalence of high triglycerides, which increases the demand for treatments like icosapent ethyl to manage hypertriglyceridemia and associated cardiovascular risks. Healthcare providers prescribe these drugs to patients with elevated levels to reduce the likelihood of heart events, supporting market growth. Regulatory agencies highlight the role of fish-oil based therapies in lipid management guidelines for high-risk individuals.

Pharmaceutical companies invest in production to meet the needs of a growing patient population with metabolic disorders. Clinical protocols integrate these drugs into comprehensive care for conditions like diabetes, where high triglycerides are common. Global health organizations track lipid disorder trends to inform policy on drug accessibility. Academic research validates the efficacy of fish-oil derivatives in lowering triglycerides without raising LDL cholesterol.

Patient education on heart health promotes earlier intervention with prescription fish-oil products. Economic burdens from untreated hypertriglyceridemia further justify market expansion. Adjusted average marginal effects per decade younger birth cohort for triglyceride levels are negative, indicating lower levels in younger groups, but overall high levels persist in older populations driving drug demand.

Restraints

Generic competition impacting branded product revenues is restraining the market

The fish-oil based drugs market is restrained by generic competition, which erodes revenues for branded products like Vascepa through lower-priced alternatives entering the market. Manufacturers face decreased sales as generics capture share, leading to reduced investment in marketing and R&D. Regulatory approvals for generics accelerate market entry, intensifying price pressures on originators.

Healthcare payers favor generics to control costs, limiting reimbursement for branded versions. Clinical practices shift toward generics for cost-effective lipid management, affecting branded market penetration. Global supply chains facilitate generic availability, exacerbating competition in key regions. Academic analyses of market dynamics highlight the impact on innovator profitability.

Patient access to affordable options increases, but innovation slows due to diminished returns. Economic models project continued revenue declines for branded drugs as generics dominate. Amarin’s total revenue declined by 26% in 2024 compared to 2023, driven by a 28% drop in U.S. product revenue for VASCEPA.

Opportunities

Growth in clinical trials for fish oil supplements is creating growth opportunities

The fish-oil based drugs market offers growth opportunities through the growth in clinical trials exploring their effects on gene expression and serum protein markers in healthy volunteers. Developers can expand indications based on trial data, targeting new therapeutic areas beyond lipid lowering. Regulatory pathways for supplements as drugs facilitate approvals for evidence-based claims from these studies.

Healthcare research focuses on fish oil’s potential in preventive medicine, opening avenues for product diversification. Pharmaceutical firms partner with institutions to conduct trials, accelerating data generation for market applications. Clinical findings from these studies provide insights into mechanisms like anti-inflammation, supporting broader use. Global collaborations refine trial designs to include diverse populations for inclusive results.

Academic institutions contribute to the evidence base, fostering innovation in fish-oil formulations. Patient populations benefit from trials validating safe, effective doses for health maintenance. The goal of this clinical trial is to learn whether fish-oil based supplements can affect gene expression and serum protein markers in healthy volunteers, as registered in 2024.

Impact of Macroeconomic / Geopolitical Factors

Sustained global economic momentum directs enhanced funding toward cardiovascular health programs, invigorating the fish-oil based drugs market with greater prescriptions for omega-3 therapies. Companies pursue market share in affluent societies, where lifestyle diseases prompt wider acceptance of purified ethyl ester formulations. Conversely, unchecked international inflation inflates sourcing fees for marine lipids, limiting profit potentials for producers in inflationary hotspots.

Intensified superpower competitions in oceanic territories jeopardize sustainable fishing quotas, impeding raw oil extractions from pivotal suppliers. Executives neutralize these threats via sustainable aquaculture investments, which stabilizes yields and promotes environmental stewardship alliances. Prevailing US tariffs, exacting 100% surcharges on foreign patented medications post-October 2025, overburden importers with escalated duties on specialty fish-oil derivatives.

Indigenous developers respond by channeling capital into biotech enhancements, which accelerates homegrown innovations and safeguards supply continuity. Groundbreaking clinical validations of anti-inflammatory benefits reliably steer the industry toward thriving horizons and inclusive health advancements.

Latest Trends

Focus on high-concentration and purified formulations is a recent trend

In 2024, the fish-oil based drugs market has exhibited a prominent trend toward the focus on high-concentration and purified formulations to enhance efficacy and reduce side effects in cardiovascular applications. Manufacturers are prioritizing specialized products like EPA-only formulations to target specific lipid profiles. Healthcare professionals are adopting these for patients with high triglycerides, improving treatment precision.

Regulatory evaluations are accommodating data on purified omega-3 for label claims in heart health. Clinical studies are evaluating high-concentration fish oil in combination with statins for synergistic effects. Academic research is exploring purification techniques to minimize contaminants in drug-grade oil. Global supply chains are adapting to source sustainable fish for high-purity production.

Patient therapies gain from formulations that minimize fishy aftertaste and gastrointestinal issues. Ethical protocols are ensuring sustainable sourcing in formulation development. Emerging trends are shaping the future of the Fish-Oil Based Drugs market: Development of specialized formulations: Focus on highly concentrated and purified products.

Regional Analysis

North America is leading the Fish-Oil Based Drugs Market

In 2024, North America captured a 43.5% share of the global fish-oil based drugs market, driven by heightened prescriptions for omega-3 formulations targeting hypertriglyceridemia and cardiovascular risk reduction, as healthcare providers sought alternatives to statins amid concerns over side effects and drug interactions.

Rheumatologists and cardiologists expanded use of purified eicosapentaenoic acid products for adjunctive therapy in patients with persistent high triglycerides, supported by updated clinical guidelines that emphasized their role in preventing atherosclerotic events. Innovations in high-purity extraction methods improved tolerability and compliance, aligning with patient preferences for marine-derived options in managing inflammatory conditions like rheumatoid arthritis.

Demographic factors, including obesity epidemics, amplified demand for these agents in integrated care models focusing on metabolic health. Pharmaceutical firms refined dosage forms with enhanced bioavailability, facilitating broader integration into telemedicine-driven follow-ups. Collaborative studies validated long-term cardiovascular benefits, bridging gaps in underserved ethnic groups.

Supply networks optimized cold-chain logistics for biologic stability, ensuring availability in specialty pharmacies. ClinCalc’s DrugStats Database estimates 244,271 prescriptions for fish oil in the United States during 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate robust proliferation of fish-oil based drugs in Asia Pacific throughout the forecast period, propelled by intensifying metabolic disorder burdens and governmental pushes for affordable cardioprotective therapies. Clinicians prescribe omega-3 concentrates to manage elevated triglycerides in diabetic cohorts, optimizing regimens for urban lifestyles prone to dietary excesses.

National health bodies subsidize marine-sourced formulations through public insurance, equipping community clinics to address inflammatory joint issues amid humid climates. Biotech developers customize purified extracts with improved stability, tailoring them to regional genetic variations in lipid metabolism. Cross-national research alliances conduct efficacy trials on adjunctive uses, fostering adoption for secondary prevention of strokes in aging populations.

Pharmaceutical manufacturers localize production of high-concentration variants, complying with harmonized safety standards to sustain export growth. Community outreach programs educate on dietary integrations, extending reach to rural areas facing nutritional imbalances. A 2023 study in the Journal of Lipid and Atherosclerosis documents hypertriglyceridemia prevalence at 29.6% among Korean adults based on KNHANES data through 2020.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Fish-Oil Based Drugs market drive growth by prioritizing pharmaceutical-grade purification, high EPA or DHA concentrations, and consistent bioavailability that clearly differentiate prescription therapies from dietary supplements. Companies expand adoption by investing in cardiovascular and metabolic outcome studies that strengthen clinician confidence and support inclusion in treatment guidelines.

Commercial strategies emphasize payer engagement, formulary access, and specialist-focused education to position these therapies within long-term chronic disease management. Innovation efforts focus on reducing gastrointestinal side effects, improving stability, and refining dosing profiles to enhance patient adherence.

Market expansion targets regions with rising dyslipidemia prevalence and stronger acceptance of omega-based prescription interventions. Amarin operates as a leading participant through its focused cardiovascular portfolio, deep clinical evidence base, and disciplined commercialization strategy that supports sustained uptake of purified omega-derived prescription therapies.

Top Key Players

- Stepan Company

- Solutex GC

- Pharma Marine

- Omega Protein Corporation

- GC Rieber Oil

- Croda International PLC

- Clover Corporation

- Cellana

- BASF SE

- Aker Biomarine

Recent Developments

- In June 2024, BASF SE entered into a collaborative arrangement with DSM to jointly develop refined omega-3 fatty acid formulations for the nutraceutical segment. The initiative combines BASF’s large-scale purification and formulation capabilities with DSM’s established commercial channels, strengthening market penetration across North America and Europe and supporting the shift toward pharmaceutical-grade omega-3 products.

- In April 2024, Aker BioMarine introduced a krill-derived omega-3 ingredient tailored for pharmaceutical use, emphasizing traceability and environmentally responsible sourcing. This launch reflects rising demand for sustainably harvested marine lipids and supports broader adoption of omega-3 actives in regulated drug and therapeutic applications where supply transparency and consistency are critical.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 Billion Forecast Revenue (2034) US$ 9.0 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Salmon, Mackerel, Herring, Tuna and Others), By Form (Docosahexaenoic Acid (DHA) and Eicosapentaenoic Acid (EPA)), By Application (Coronary Heart Disease (CHD), Stroke, Rheumatoid Arthritis, Raynaud’s Syndrome, Dysmenorrhea and Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, Drug Stores & Pharmacies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stepan Company, Solutex GC, Pharma Marine, Omega Protein Corporation, GC Rieber Oil, Croda International PLC, Clover Corporation, Cellana, BASF SE, Aker Biomarine Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fish-Oil Based Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Fish-Oil Based Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Stepan Company

- Solutex GC

- Pharma Marine

- Omega Protein Corporation

- GC Rieber Oil

- Croda International PLC

- Clover Corporation

- Cellana

- BASF SE

- Aker Biomarine