Guaifenesin Market By Drug Composition (Single-agent Formulations, Combination Formulations), By Purity Level (>99%, 98%-99%), By Formulation (Tablets and capsules, Syrups, Granules/Extended-Release, Others), By Application (Cough Suppressant, Mucolytic Agent, Veterinary Use, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 133056

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drug Composition Analysis

- Purity Level Analysis

- Formulation Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

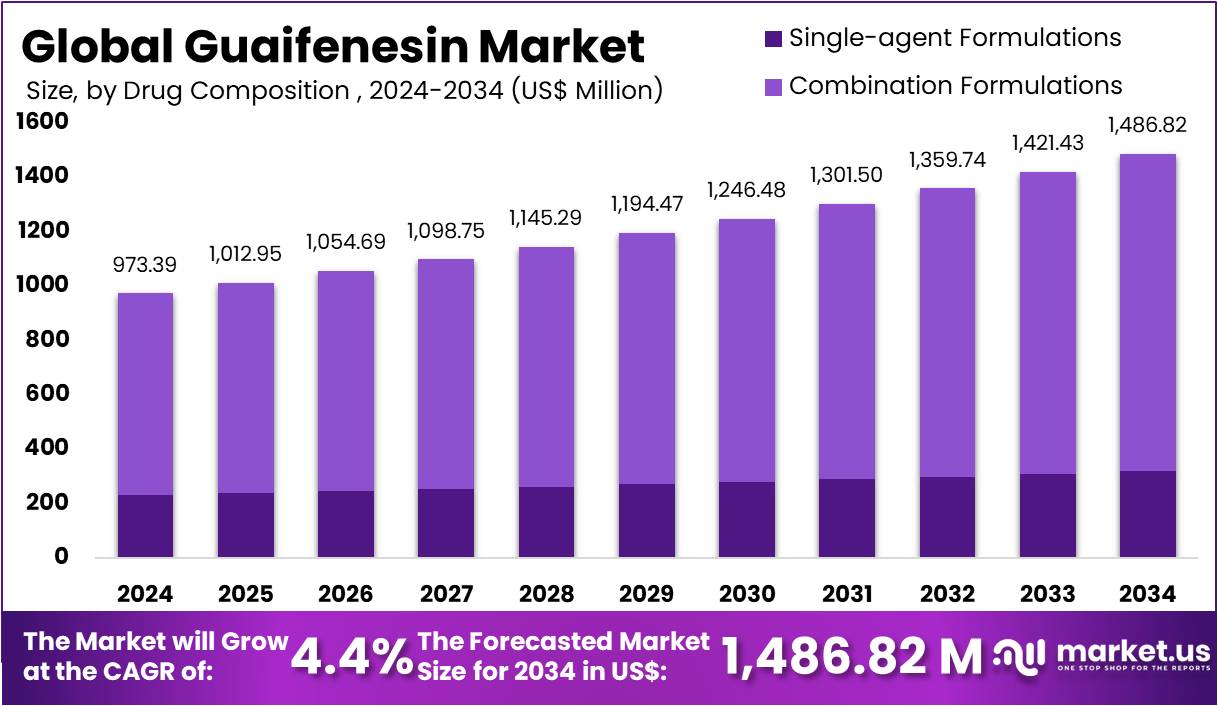

The Guaifenesin Market size is expected to be worth around US$ 1,486.82 million by 2034 from US$ 973.39 million in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034.

Guaifenesin Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 1,005.44 984.73 900.27 935.87 973.39 4.4% Guaifenesin, an expectorant, is primarily used to alleviate symptoms associated with respiratory conditions such as cough, bronchitis, and sinusitis. It works by thinning mucus in the airways, making it easier to expel. The market is characterized by a diverse range of formulations, including tablets, syrups, and granules, with tablets leading in market share. Its relevance has grown in tandem with the rising global incidence of respiratory diseases driven by factors such as pollution, seasonal infections, and increasing awareness of respiratory health.

The pharmaceutical industry’s push towards accessible over-the-counter (OTC) medications has significantly expanded the guaifenesin market. Consumers increasingly prefer self-medication for mild to moderate respiratory symptoms, boosting demand for effective, easy-to-use treatments. According to Journal of Postgraduate, In the United States, more than 80 classes of medications have transitioned from prescription to OTC status, with notable examples including triamcinolone acetonide, fluticasone (spray), loratadine, and fexofenadine.

The U.S. FDA has established clear criteria for such switches, emphasizing safety, efficacy, and appropriate labeling. This shift has encouraged pharmaceutical companies to innovate with various guaifenesin formulations, including tablets, syrups, granules, extended-release options, and combination therapies that address multiple symptoms simultaneously.

Technological advancements in drug formulation and delivery systems have enhanced product efficacy and patient compliance. Extended-release tablets, for example, provide sustained symptom relief, reducing dosing frequency and improving user convenience. Additionally, manufacturers are responding to consumer preferences by developing natural and clean-label products, integrating guaifenesin with herbal extracts or avoiding artificial additives.

Regulatory frameworks governing pharmaceutical products play a critical role in shaping the industry landscape. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce stringent quality, safety, and efficacy standards, ensuring that guaifenesin products meet rigorous benchmarks before market approval. These regulations foster consumer trust but also require significant investment in clinical testing and compliance. Moreover, the guaifenesin market is influenced by broader healthcare trends such as aging populations, which increase susceptibility to respiratory illnesses, and rising healthcare expenditure worldwide. Public health initiatives targeting respiratory disease management and seasonal flu outbreaks also contribute to sustained product demand.

Key Takeaways

- In 2024, the market for Guaifenesin generated a revenue of US$ 39 million, with a CAGR of 4.4%, and is expected to reach US$ 1,486.82 million by the year 2034.

- In the guaifenesin market, combination formulations represent the dominant segment by drug composition with 76.1% share in 2024.

- By Purity Level, >99% led accounting for US$ 612.99 Mn, in 2024.

- By Formulation, the market is segregated into Tablets and capsules, Syrups/Solution, Granules/Extended-Release and Others. Tablets and capsules accounted for the highest share of 35% in 2024.

- In terms of Application, Cough Suppressant dominated the market accounting for 45.2% in 2024.

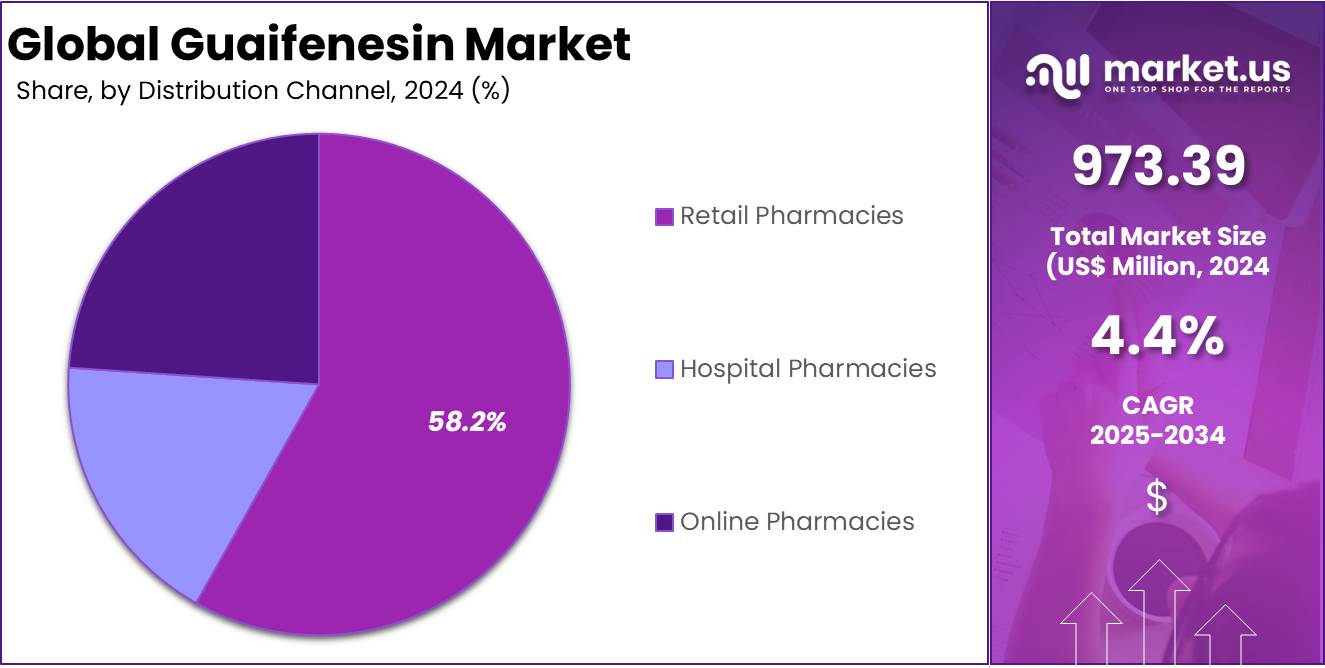

- Based on distribution channel, the retail pharmacies segment held the maximum share of 58.2% in 2024.

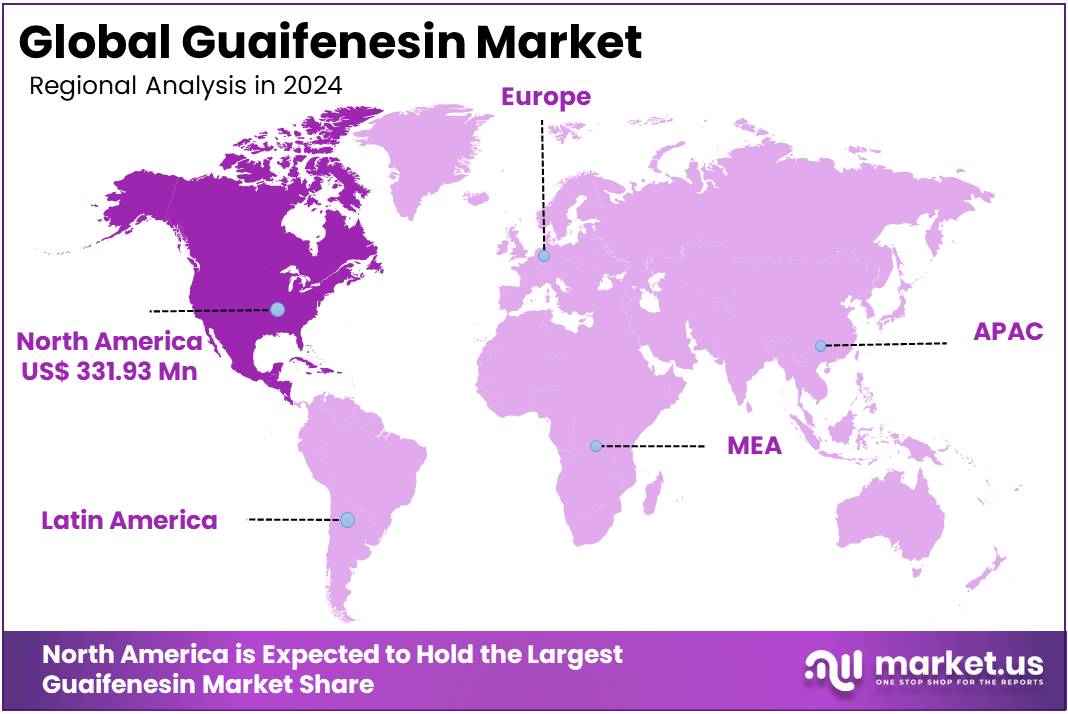

- North America led the market by securing a market share of 34.1% in 2024.

Drug Composition Analysis

The combination formulations segment held the maximum share in the guaifenesin market of 76.1% in 2024 due to its ability to provide comprehensive relief by addressing multiple symptoms associated with respiratory illnesses. These formulations typically combine guaifenesin, an expectorant that helps thin and loosen mucus, with other active ingredients such as cough suppressants, decongestants, or antihistamines. This multi-action approach appeals to consumers looking for convenient, all-in-one medications to alleviate symptoms such as chest congestion, persistent cough, nasal congestion, and allergy-related discomfort.

The availability of these products over-the-counter enhances accessibility, encouraging widespread use. The combination drugs offer several advantages over single-drug therapies by enhancing clinical efficacy through improved patient adherence and streamlined treatment regimens. By combining multiple active ingredients into a single pill, fixed-dose combinations (FDCs) significantly reduce the total number of pills a patient needs to take, which simplifies medication schedules and decreases the risk of missed doses. This reduction in pill burden often leads to fewer prescriptions, minimizing complexity for both patients and healthcare providers.

Simplified packaging associated with FDCs further supports ease of use, making it more convenient for patients to manage their medications. In the veterinary field, guaifenesin is more frequently administered in combination product formulations. Guaifenesin serves as a centrally acting muscle relaxant, facilitating muscle relaxation during surgical procedures. For example, Creative Science cough tablets combine an expectorant and antitussive to provide temporary relief of coughing symptoms in dogs.

Guaifenesin Market, Drug Composition Analysis, 2020-2024 (US$ Million)

Drug Composition 2020 2021 2022 2023 2024 Single-agent Formulations 249.08 241.73 218.97 225.52 232.54 Combination Formulations 756.37 743.00 681.30 710.35 740.85 Purity Level Analysis

The >99% segment dominated the Guaifenesin market with a share of 63.0% in 2024. Guaifenesin with purity above 99% represents the pharmaceutical-grade standard crucial for ensuring the safety, efficacy, and consistency of respiratory medications. High-purity guaifenesin is typically produced under stringent Good Manufacturing Practices (GMP), adhering to regulatory requirements such as those set by the United States Pharmacopeia (USP) and other pharmacopeial standards worldwide.

Achieving purity levels above 99% minimizes the presence of impurities and contaminants that could compromise product quality or cause adverse effects. Demand for guaifenesin with purity above 99% is robust and growing, primarily driven by the pharmaceutical sector’s stringent quality requirements and the need for enhanced safety and efficacy in expectorant medications.

The “above 99%” purity segment commands a significant share of the global guaifenesin market, as regulatory authorities and pharmaceutical manufacturers increasingly require high-purity active pharmaceutical ingredients (APIs) to meet compliance and ensure product quality. Companies like Granules and Synthokem Labs are investing in capacity expansion and innovation specifically to supply high-purity (>99%) guaifenesin to global pharmaceutical companies.

Guaifenesin Market, Purity Level Analysis, 2020-2024 (US$ Million)

Purity Level 2020 2021 2022 2023 2024 >99% 624.64 613.87 563.12 587.37 612.99 98%-99% 380.80 370.87 337.15 348.50 360.40 Formulation Analysis

The Tablets and capsules segment held a revenue share of US$ 340.99 Mn in 2024. Guaifenesin is widely formulated into tablets and capsules to provide effective relief from chest congestion by loosening and thinning mucus in the respiratory tract. These solid oral dosage forms offer several advantages, including precise dosing, convenience, portability, and improved patient compliance.

Tablets and capsules are popular choices for both over-the-counter (OTC) and prescription cough and cold medications containing guaifenesin. Tablet formulations often include immediate-release or extended-release options. Immediate-release tablets deliver guaifenesin rapidly to provide quick symptom relief, while extended-release tablets ensure a sustained therapeutic effect over several hours, reducing the frequency of dosing.

Capsules, which may contain powder or liquid-filled formulations, also facilitate controlled release and ease of swallowing. These solid oral dosage forms offer advantages such as precise dosing, extended shelf life, and ease of administration, which enhance patient compliance. Extended-release formulations, in particular, provide prolonged therapeutic effects, reducing the frequency of dosing and improving patient adherence to treatment regimens.

Guaifenesin Market, Formulation Analysis, 2020-2024 (US$ Million)

Formulation 2020 2021 2022 2023 2024 Tablets and capsules 366.98 355.80 321.95 331.22 340.99 Syrups/Solution 323.55 315.68 287.50 297.72 308.48 Granules/Extended-Release 212.02 211.34 196.53 207.77 219.83 Others 102.89 101.91 94.29 99.17 104.09 Application Analysis

The Cough Suppressant segment held the largest share of 45.2% in 2024. Guaifenesin is frequently included in combination cough suppressant formulations to provide comprehensive relief from cough and chest congestion. By thinning and loosening mucus in the airways, guaifenesin helps clear respiratory passages, which can indirectly reduce the frequency and intensity of coughing caused by mucus buildup.

In many over-the-counter (OTC) cough remedies, guaifenesin is combined with active cough suppressants such as dextromethorphan. While guaifenesin facilitates mucus clearance, dextromethorphan acts centrally on the brain to reduce the cough reflex. This dual-action approach addresses both the cause of the cough and the symptom itself, offering enhanced therapeutic benefits.

Market demand for guaifenesin-containing cough suppressants remains strong due to increasing respiratory illness prevalence and consumer preference for multi-symptom relief products. Pharmaceutical companies continue to innovate by developing formulations with balanced doses of guaifenesin and cough suppressants, often adding flavors and excipients to enhance palatability and compliance.

Guaifenesin Market, Application Analysis, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 Cough Suppressant 462.23 450.72 410.24 424.56 439.64 Mucolytic Agent 357.77 350.11 319.81 332.18 345.21 Veterinary Use 80.03 79.67 74.02 78.18 82.63 Others 105.41 104.24 96.20 100.95 105.91 Distribution Channel Analysis

Retail pharmacies serve as the main distribution channel for guaifenesin due to their wide accessibility and convenience. This segment held 58.2% share in 2024. Consumers often buy guaifenesin over the counter at these locations to relieve cold and cough symptoms without needing a prescription. This easy access and quick availability drive strong growth in guaifenesin sales through retail pharmacies.

The large network of retail pharmacies includes both national chains and many local independent stores, ensuring guaifenesin is available across urban and rural areas. Pharmacists play an important role by offering advice and recommendations, which builds consumer trust and encourages purchases of OTC medicines like guaifenesin.

Seasonal outbreaks of respiratory illnesses, such as influenza and colds, influence buying patterns at retail pharmacies. During these peak times, demand for expectorants like guaifenesin rises sharply. This regular seasonal demand supports continuous growth in this segment. Consumers rely on local pharmacies for immediate relief, maintaining the channel’s leading role in guaifenesin distribution.

Guaifenesin Market, Distribution Channel Analysis, 2020-2024 (US$ Million)

Distribution Channel 2020 2021 2022 2023 2024 Retail Pharmacies 593.80 579.34 527.62 546.37 566.10 Hospital Pharmacies 178.90 175.51 160.73 167.37 174.37 Online Pharmacies 232.75 229.88 211.93 222.14 232.92 Key Market Segments

By Drug Composition

- Single-agent Formulations

- Combination Formulations

By Purity Level

- >99%

- 98%-99%

By Formulation

- Tablets and capsules

- Syrups

- Granules/Extended-Release

- Others

By Application

- Cough Suppressant

- Mucolytic Agent

- Veterinary Use

- Others

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Drivers

Increasing Prevalence of Respiratory Disorders

Increasing prevalence of respiratory disorders serves as a significant driver in the guaifenesin market, fueling demand for effective expectorant therapies worldwide. Respiratory conditions such as chronic bronchitis, asthma, chronic obstructive pulmonary disease (COPD), and acute respiratory infections are on the rise globally due to factors like air pollution, smoking, aging populations, and increasing exposure to allergens and infectious agents.

As per the data by WHO, in 2021, chronic obstructive pulmonary disease (COPD) ranked as the fourth leading cause of death globally, responsible for 3.5 million fatalities, accounting for about 5% of all deaths worldwide. Approximately 90% of COPD-related deaths among individuals younger than 70 years took place in low- and middle-income countries (LMICs).

The modeling risk factor data from the Global Burden of Disease database estimates that the global number of COPD cases among individuals aged 25 years and older will rise by 23% from 2020 to 2050, nearing 600 million patients by 2050. These disorders often manifest with symptoms such as excessive mucus production, chest congestion, and persistent cough, creating a strong need for medications that can relieve these symptoms and improve patient comfort.

Guaifenesin, a widely used expectorant, functions by loosening and thinning mucus in the respiratory tract, making it easier for patients to clear airway secretions. As respiratory illnesses become more prevalent, both in developed and developing regions, healthcare providers increasingly recommend guaifenesin-containing products to manage symptomatic relief, driving market growth. For instance, urbanization and industrialization contribute to elevated air pollutant levels, which aggravate respiratory conditions, especially among vulnerable groups like children and the elderly, thereby expanding the patient base relying on guaifenesin.

Restraints

Availability of Substitute Medications

The availability of substitute medications poses a notable restraint to growth in the guaifenesin market. Guaifenesin primarily functions as an expectorant, helping to loosen and thin mucus in the respiratory tract. However, the market is crowded with a variety of alternative treatments that target similar symptoms, including other expectorants, mucolytics, cough suppressants, and combination drugs. This extensive array of substitutes limits guaifenesin’s market share and challenges its pricing power.

Many consumers and healthcare providers often prefer alternative medications such as bromhexine, acetylcysteine, or ambroxol, which also act as mucolytics but may offer different mechanisms of action, faster relief, or additional therapeutic benefits. Additionally, some prefer cough suppressants like dextromethorphan when the symptom of cough predominates without thick mucus production. The choice of substitutes is further broadened by traditional and herbal remedies, which have a growing acceptance, particularly in regions with strong preferences for natural or holistic treatments.

Combination therapies, where guaifenesin is paired with other active ingredients such as decongestants, antihistamines, or analgesics, compete directly with single-ingredient expectorants by offering multi-symptom relief, making standalone guaifenesin products less attractive. For example, Dextromethorphan (DM) is cough suppressant that reduces the urge to cough which is an alternative to Guaifenesin. In September 2024, ANI Pharmaceuticals, Inc. announced the launch of Promethazine Hydrochloride and Dextromethorphan Hydrobromide Oral Solution, available in a concentration of 6.25 mg/15 mg per 5 ml.

Opportunities

Product Innovation and Combination Therapies

Product innovation and combination therapies represent a key opportunity in the guaifenesin market, enabling companies to differentiate their offerings and address evolving consumer needs. Guaifenesin, primarily used as an expectorant, is often combined with other active pharmaceutical ingredients (APIs) to provide multi-symptom relief in respiratory conditions such as colds, bronchitis, and flu. This trend toward combination products enhances therapeutic efficacy and convenience, making these formulations increasingly attractive to consumers.

Manufacturers are innovating by developing novel dosage forms such as extended-release tablets, liquid gels, flavored syrups, and pediatric-friendly formulations to improve patient compliance and experience. These innovations also target specific demographics, including children, elderly patients, and individuals with chronic respiratory conditions, thus broadening the market base. The growing consumer preference for over-the-counter (OTC) products that address multiple cold and flu symptoms is fueling demand for combination formulations.

These drugs, which include guaifenesin alongside ingredients like dextromethorphan (for cough suppression) and pseudoephedrine (for nasal decongestion), offer convenience and faster relief, making them a top choice in both pharmacy and retail channels. This consolidated approach simplifies treatment regimens, enhancing patient adherence and satisfaction. For example, Guaifenesin + Dextromethorphan, which is found in products, like Mucinex DM and Robitussin DM, this combination addresses both chest congestion (guaifenesin) and suppresses cough (dextromethorphan).

Impact of Macroeconomic / Geopolitical Factors

In developed regions, strong economic growth boosts consumer spending on healthcare products, including over-the-counter (OTC) medications like guaifenesin. Conversely, economic downturns and inflationary pressures in emerging markets can limit consumer purchasing power, reducing sales of non-essential pharmaceuticals such as guaifenesin.

Export restrictions or changes in trade agreements can influence where pharmaceutical companies locate their manufacturing plants and how efficiently they can distribute products worldwide. For example, export restrictions during global crises have affected the timely supply of guaifenesin to certain markets, leading to regional shortages and price fluctuations.

The reliance of the U.S. on foreign sources for essential medications has raised concerns about supply chain stability amid escalating trade tensions. According to Apollo’s chief economist on April 30, 2025, the U.S. obtains nearly all of its common over-the-counter pain medications from China, meaning that President Donald Trump’s hefty 145% tariffs on Chinese goods could significantly disrupt the country’s supply of these vital drugs.

Generic medications remain affordable primarily due to manufacturers operating on extremely narrow profit margins. However, the increased costs caused by these tariffs may deter producers from manufacturing certain pain-relief medications, threatening their availability in the U.S. market.

Latest Trends

Preference for Natural and Plant-Based Remedies

The guaifenesin market is experiencing a significant shift towards natural and plant-based remedies, reflecting broader consumer preferences for holistic and sustainable healthcare options. This trend is driven by increasing awareness of the potential side effects associated with synthetic medications and a growing demand for products perceived as safer and more aligned with natural healing processes.

Herbal expectorants, such as those containing thyme, eucalyptus, and licorice root, are gaining popularity as alternatives to traditional guaifenesin-based products. These plant-based ingredients are known for their ability to clear mucus and support respiratory health, offering a more natural approach to managing cough and congestion.

Consumers are increasingly seeking products that combine the efficacy of guaifenesin with the perceived benefits of herbal components, leading to the development of innovative formulations that cater to this demand. An example of a product that combines guaifenesin with natural ingredients is Zarbee’s Naturals Cough Syrup + Mucus.

This formulation blends guaifenesin, a well-known expectorant, with natural components like honey and herbal extracts (such as ivy leaf and marshmallow root) to soothe the throat and help loosen mucus. The combination appeals to consumers seeking effective cough relief with the added benefits of natural, gentle ingredients.

Regional Analysis

North America is leading the Guaifenesin Market

North America dominated the market with the highest revenue share of 34.1% in 2024. This trend is projected to continue in the coming years due to an increase in respiratory cases across the US and Canada. In one study measuring respiratory syncytial virus (RSV) in four US states from October 2022 to April 2024, RSV-associated acute respiratory illness (ARI) rates remained consistent, with 5.5-5.8% of those tested returning positive each season.

This ongoing prevalence of respiratory conditions, such as the common cold and flu is estimated to significantly boost the market. Guaifenesin is readily available as an OTC medication. This allows consumers easy access off the shelf for treating cough or chest congestion, making it an attractive option. According to data from 2022, guaifenesin was a frequently prescribed medication in the US, with over 400,000 prescriptions, demonstrating its widespread use.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for guaifenesin medications grew in 2024 and is rising at a faster rate. Rising cases of respiratory illnesses in the region drive this growth. The World Health Organization reported an increase in acute respiratory infections in early 2025, particularly during the winter season. This ongoing prevalence of influenza and other respiratory viruses is projected to increase demand for expectorants like guaifenesin.

The increased use of guaifenesin in the Asia Pacific is a result of rising levels of air pollution across the region, which is linked to a higher incidence of respiratory issues and a greater need for expectorants to manage symptoms. The WHO’s updated 2025 Air Quality Standards database indicates that only seven countries, including Australia and New Zealand, met the WHO’s air quality guidelines in 2024. Countries like Chad, Bangladesh, and Pakistan had PM2.5 levels up to 18 times higher than recommended.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The guaifenesin market features a competitive landscape shaped by a blend of multinational pharmaceutical giants and specialized regional players, each striving to expand their market share through innovation, product diversification, and strategic partnerships. Perrigo Company is recognized for its strong presence in the over-the-counter (OTC) segment, leveraging a broad portfolio of respiratory care products that include guaifenesin formulations.

Reckitt Benckiser, known for its flagship Mucinex brand, remains a dominant player through aggressive marketing and continuous product innovation aimed at improving consumer convenience and efficacy. Granules India Limited is notable for its integrated manufacturing capabilities, offering both APIs and finished dosage forms, thus playing a crucial role in cost-effective production and supply chain efficiency.

Haleon’s Respiratory Health segment shows consistent growth, with emerging markets becoming a bigger contributor. Johnson & Johnson is a multinational corporation with a strong presence in the global pharmaceutical, medical devices, and consumer health markets. The company’s products are sold in over 175 countries. While not exclusively a Guaifenesin-focused brand, J&J incorporates the ingredient in combination products.

Top Key Players in the Guaifenesin Market

- Perrigo Company

- Reckitt Benckiser

- Pharmaceutical Associates, Inc. (PAI Pharma)

- Granules India Limited

- Genexa

- Haleon

- Bayer AG

- Lupin Pharmaceuticals

- Johnson & Johnson

- AstraZeneca plc

- Marksans Pharma Ltd.

Recent Developments

- In May 2025: Haleon collaborated with Brightseed, a trailblazer in AI-driven bioactive compound discovery, to accelerate the identification of plant-based small molecules that may enhance human health. This collaboration will utilize Brightseed’s proprietary AI platform, Forager®, to fast-track scientific understanding of natural compounds and support Haleon’s goal of providing innovative, science-driven health solutions.

- In December 2024: Reckitt Benckiser Group Plc announced the acquisition of a pharmaceutical facility in Wilson, North Carolina, to enhance its U.S. manufacturing capabilities. This initiative involves an investment of approximately $145.59 million. This strategic move aims to bolster the production of Mucinex tablets and liquids, addressing the growing consumer demand for cold and flu symptom relief in the United States.

- In September 2023: Genexa launched new clean OTC kids’ medicines, strengthening its role as a pioneer in safe, effective treatments. The Kids’ Multi-Symptom Cold & Flu and Kids’ Daytime + Nighttime Cough Relief Value Pack offer parents clean alternatives with proven active ingredients—free from dyes, artificial sweeteners, parabens, and common allergens—using organic agave syrup instead of artificial fillers.

- In August 2023: Marksans Pharma Ltd., announced that it has obtained final approval from the US Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for Guaifenesin Extended-Release Tablets in 600 mg and 1200 mg (OTC) strengths. These tablets are bioequivalent to the reference listed drug (RLD), Mucinex Extended-Release Tablets, 600 mg and 1200 mg, marketed by RB Health (US) LLC. Guaifenesin extended-release tablets function by loosening phlegm and thinning bronchial secretions, aiding in clearing mucus from the bronchial passages to make coughs more effective. The company plans to launch the product promptly.

Report Scope

Report Features Description Market Value (2024) US$ 973.39 million Forecast Revenue (2034) US$ 1,486.82 million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Composition (Single-agent Formulations, Combination Formulations), By Purity Level (>99%, 98%-99%), By Formulation (Tablets and capsules, Syrups, Granules/Extended-Release, Others), By Application (Cough Suppressant, Mucolytic Agent, Veterinary Use, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Perrigo Company, Reckitt Benckiser, Pharmaceutical Associates, Inc. (PAI Pharma), Granules India Limited, Genexa, Haleon, Bayer AG, Lupin Pharmaceuticals, Johnson & Johnson, AstraZeneca plc, Marksans Pharma Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Perrigo Company

- Reckitt Benckiser

- Pharmaceutical Associates, Inc. (PAI Pharma)

- Granules India Limited

- Genexa

- Haleon

- Bayer AG

- Lupin Pharmaceuticals

- Johnson & Johnson

- AstraZeneca plc

- Marksans Pharma Ltd.