Global Pediatric Telehealth Market By Product Type (Hardware, Software, Services), By Delivery Mode Type (On-premises, Web-based, and Cloud-based), By End-User (Payers, Providers, and Patients), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135838

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

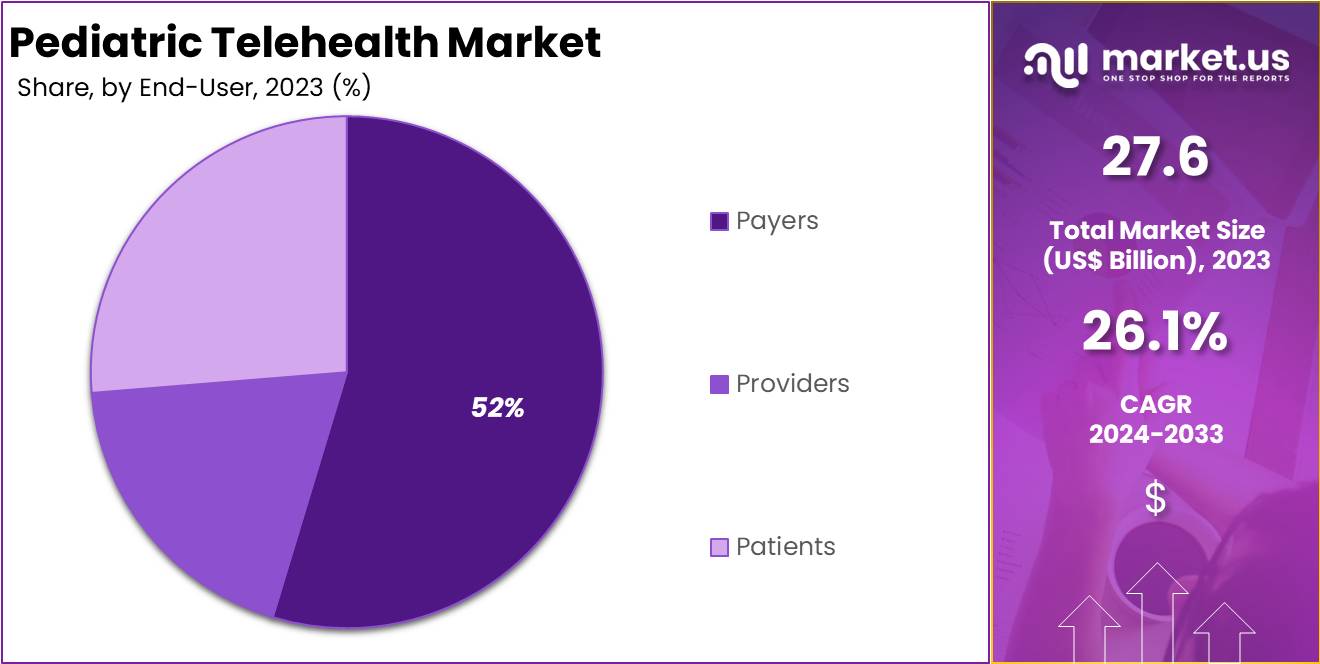

The Global Pediatric Telehealth Market size is expected to be worth around US$ 280.6 Billion by 2033, from US$ 27.6 Billion in 2023, growing at a CAGR of 26.1% during the forecast period from 2024 to 2033.

The global pediatric telehealth market is influenced by several dynamic factors driving its growth. Increasing demand for remote healthcare services is one of the key drivers, fueled by the convenience and accessibility telehealth offers, particularly for rural or underserved regions. Advancements in telecommunication technology and the widespread use of smartphones have made telehealth more feasible, enabling virtual consultations, remote monitoring, and management of pediatric health conditions.

The increasing prevalence of cardiovascular diseases in the pediatric population is a key driver of growth in the pediatric telehealth market. As the incidence of pediatric cardiovascular conditions rises, the demand for continuous monitoring and remote care has surged, making telehealth an essential tool in managing these complex health issues.

Telehealth platforms allow healthcare providers to remotely monitor pediatric patients with cardiovascular conditions, enabling timely interventions and reducing the need for frequent in-person visits. This is particularly beneficial for managing CHDs, as children with these conditions require ongoing care and monitoring.

- According to The Children’s Heart Foundation, Congenital Heart Defects (CHDs) impact roughly 1 in every 100 newborns annually in the United States.

Key Takeaways

- The global pediatric telehealth market was valued at US$ 27.6 billion in 2023 and is anticipated to register substantial growth of USD 280.6 billion by 2033, with a 26.1% CAGR.

- In 2023, the services segment took the lead in the global market, securing 46% of the total revenue share.

- Among delivery mode type segments, web-based emerged as the dominant segment, capturing 40% of the total revenue.

- The payers segment took the lead in the global market, securing 52% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 40% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into hardware, software, and services. Amongst these, services dominated the global pediatric telehealth market capturing a significant market share of 46% in 2023. The services segment has dominated the global pediatric telehealth market due to the increasing demand for remote healthcare solutions that offer convenience, accessibility, and affordability.

This segment includes virtual consultations, remote monitoring, and specialized telehealth services such as mental health counseling, chronic disease management, and developmental assessments for children. Virtual consultations, in particular, are increasingly preferred by families, especially in rural or underserved areas, as they eliminate the need for travel and reduce waiting times. Additionally, companies are ramping up investments in the development, launch, and enhancement of telehealth services aimed at the pediatric population.

- For example, in December 2022, OSF Healthcare introduced a Real Patient Monitoring (RPM) program for toddlers and infants affected by Respiratory Syncytial Virus (RSV). This initiative helped reduce the number of occupied hospital beds for RSV cases while providing remote care for young patients, including toddlers and infants, in the comfort of their homes.

Delivery Mode Type Analysis

The market is fragmented by delivery mode type into on-premises, web-based, and cloud-based. Web-based dominated the global pediatric telehealth market capturing a significant market share of 40% in 2023 due to its widespread accessibility, ease of use, and cost-effectiveness. Web-based platforms allow healthcare providers to conduct virtual consultations, manage patient records, and offer remote monitoring services directly through internet-enabled devices like laptops, tablets, or smartphones.

These platforms are particularly popular because they do not require specialized hardware or software, making them easier for both providers and patients to access. Additionally, they can be used across various devices, increasing flexibility for both families and healthcare providers. Web-based solutions also enable real-time communication and efficient data sharing, crucial for managing pediatric conditions that require continuous monitoring.

End-User Analysis

The market is fragmented by end-users into payers, providers, and patients. Hospital pharmacies dominated the global pediatric telehealth market capturing a significant market share of 47% in 2023. Hospital pharmacies have emerged as a dominant force in the global pediatric telehealth market, primarily due to their pivotal role in managing pediatric medications and providing essential pharmaceutical services remotely.

By integrating telehealth solutions, hospital pharmacies enable seamless consultation and medication management for pediatric patients, particularly those with chronic conditions or requiring specialized therapies. Telehealth platforms allow pharmacists to monitor prescriptions, provide counseling on medication use, and ensure proper drug administration without the need for in-person visits, improving both access and convenience for families.

Furthermore, the increasing number of collaborations and partnerships between public and private healthcare institutions is anticipated to boost the accessibility and adoption of telehealth services, driving growth in the segment.

- For example, in August 2022, Louisiana Hospital partnered with Cleveland Clinic to gain improved access to pediatric radiology specialists via telehealth. This partnership enables better utilization of expertise and enhances the delivery of remote pediatric care.

Key Segments Analysis

By Product Type

- Hardware

- Monitors

- Medical Peripheral Devices

- Blood Pressure Meters

- Blood Glucose Meters

- Weighing Scales

- Pulse Oximeters

- Peak Flow Meters

- ECG Monitors

- Others

- Software

- Standalone Software

- Integrated Software

- Services

- Remote Patient Monitoring

- Real-Time Interactions

- Store and Forward

- Other Services

By Delivery Mode Type

- On-premises

- Web-based

- Cloud-based

By End-User

- Payers

- Providers

- Patients

Drivers

The Growing Demand for Real-Time Patient Monitoring

The growing demand for real-time patient monitoring is a key factor driving the expansion of the pediatric telehealth market. With an increasing number of children diagnosed with chronic conditions such as diabetes, asthma, and congenital heart defects, the need for continuous health monitoring has surged.

Real-time monitoring allows healthcare providers to track vital health data such as blood sugar levels, heart rates, and oxygen saturation remotely, offering timely interventions without the need for frequent in-person visits. This is particularly beneficial for pediatric patients, as it enables caregivers and healthcare providers to detect changes in condition early and prevent complications. As a result, companies are actively introducing and adopting telehealth solutions tailored to pediatrics.

- For example, in September 2023, Kismet Health launched a pediatric telehealth platform designed specifically for healthcare providers. The platform offers high-quality, accessible care for children and their families while also delivering clinical support to providers.

Restraints

Data Privacy and Security Concerns

As telehealth services rely heavily on digital platforms to transmit sensitive health information, the risk of data breaches and unauthorized access to patient records is a significant concern for both healthcare providers and families. Pediatric patients, being minors, require additional protections under data privacy laws, making compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe more complex.

Many families may feel hesitant to share their children’s health data online due to fears about potential cyberattacks or misuse of personal information. These concerns can slow the adoption of telehealth services in pediatric care, especially in regions where data protection frameworks are still developing or enforcement is weak. To overcome this barrier, telehealth providers must invest heavily in robust cybersecurity measures and ensure full regulatory compliance to gain trust and drive growth.

Opportunities

Growing Demand for Mental Health Services

The rising awareness of mental health issues among young people, including anxiety, depression, and behavioral disorders, has created a pressing need for accessible, affordable mental health care. Telehealth platforms can bridge this gap by offering confidential, remote counseling sessions, reducing stigma, and making it easier for children and their families to access care, especially in underserved or rural areas.

Pediatric telehealth can provide a wide range of mental health services, from therapy and counseling to early intervention programs, all from the comfort of home. This opportunity is further supported by the increasing acceptance of telemedicine for mental health care, coupled with the expansion of insurance coverage for telehealth services. As the demand for pediatric mental health services continues to grow, telehealth solutions can play a vital role in improving access, convenience, and quality of care for young patients.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the pediatric telehealth market. Economically, factors like inflation, healthcare spending, and economic growth determine the affordability and accessibility of telehealth services. In regions with economic uncertainty, governments may cut healthcare budgets, affecting telehealth investments, while in growing economies, increased disposable income and a focus on digital healthcare boost telehealth adoption.

Geopolitically, international relations and regulatory policies also play a critical role. Tensions or trade restrictions can affect the availability of telehealth technologies or disrupt supply chains for software and hardware. Additionally, varying healthcare regulations across countries impact market expansion while some countries have favorable policies for telemedicine, others impose strict licensing or reimbursement rules.

Trends

The pediatric telehealth market is seeing significant growth driven by several trends. The increased adoption of virtual consultations remains a central shift, with parents and healthcare providers embracing remote visits for routine check-ups, chronic condition management, and mental health support. The integration of AI and machine learning is enhancing diagnostic accuracy and care personalization, while also streamlining triage and follow-up processes.

As mental health concerns rise among children, telehealth platforms are expanding to include mental health services, such as counselling and therapy, to address this growing need. Another key trend is the expansion of insurance coverage and reimbursement for telehealth services, which is improving access and affordability for pediatric care.

Additionally, improved telehealth technologies, such as mobile apps and wearable devices, are making remote care more effective, increasing market demand. These trends are collectively contributing to the broadening scope and adoption of pediatric telehealth services.

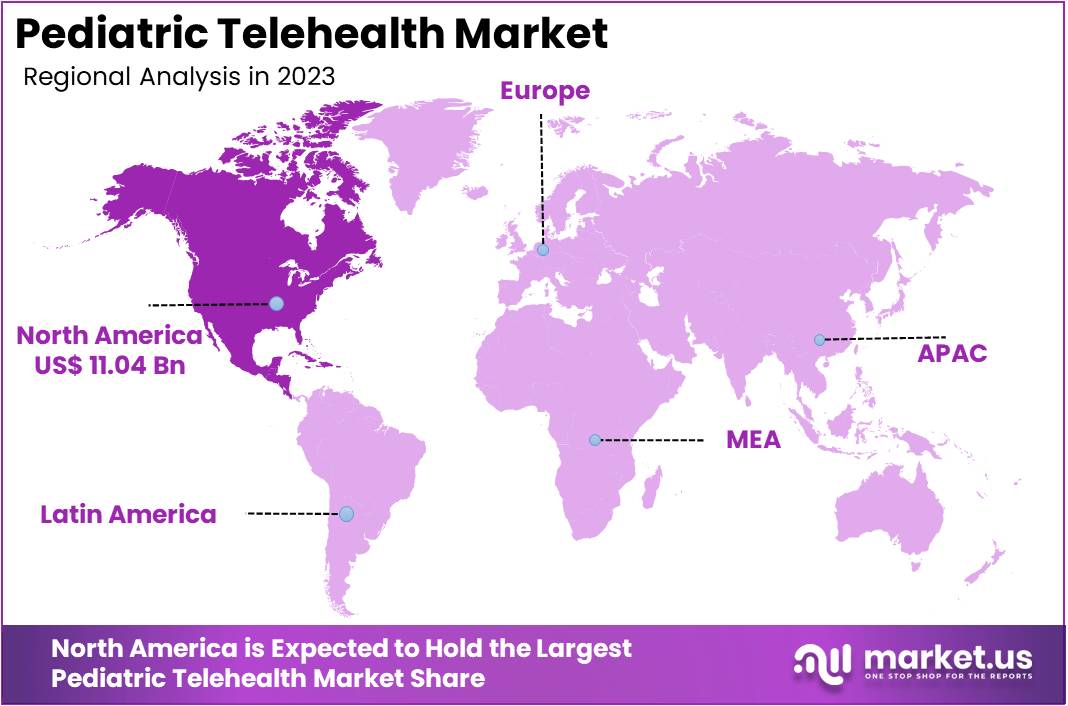

Regional Analysis

North America accounted for a significant 40% share of the global pediatric telehealth market, driven by high disease prevalence, the presence of leading pharmaceutical companies, and supportive government initiatives. North America’s well-established healthcare systems also integrate telehealth solutions into pediatric care, particularly for non-urgent consultations, mental health services, and chronic condition management.

Additionally, high digital penetration and the widespread use of smartphones and telemedicine platforms have enabled greater access to pediatric telehealth services. These factors, coupled with a growing focus on improving pediatric healthcare delivery, position North America as a dominant player in the global market.

- For example, in January 2022, Good Parents Inc., the innovator behind the Kiddo Remote Patient Monitoring (RPM) platform, secured a Series A investment of approximately USD 16.0 million. This funding, along with strategic partnerships, will enable Kiddo to significantly expand its workforce across the U.S. and Asia.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The pediatric telehealth market is witnessing significant competition, with several key players dominating the landscape. These companies provide comprehensive telehealth solutions that include virtual consultations, chronic disease management, and mental health services tailored specifically for children.

The market share is largely concentrated among a few leading players who have established themselves by offering scalable platforms, integrating advanced technologies like AI and machine learning to enhance diagnostic capabilities and personalized care.

Additionally, partnerships with healthcare providers and insurance companies have boosted market penetration, making pediatric telehealth more accessible to a wider audience. The market is also growing due to increasing demand for mental health services, expanded reimbursement policies, and the need for remote care in rural or underserved areas.

As more healthcare providers integrate telehealth into their services, the market is becoming more fragmented, with both established companies and new entrants vying for market share in this rapidly growing sector.

Top Key Players in the Pediatric Telehealth Market

- Teladoc Health, Inc.

- American Well

- MDLive

- Oracle

- GlobalMedia Group, LLC

- Siemens Healthineers AG

- Medtronic

- Pediatric Partners

- Anytime Pediatrics

- Kiddo Health Inc.

- PediaMetrix

- Brave Care, Inc.

Recent Developments

- In April 2023: Oracle and Zoom collaborated to streamline telehealth services, integrating telemedicine features with Oracle Cerner Millennium. This integration allows healthcare providers to seamlessly access patient electronic health records during virtual consultations, enhancing the efficiency and quality of care for pediatric patients, regardless of location.

- In September 2020: Medtronic’s MiniMed 770G Insulin Pump received FDA approval, featuring smartphone connectivity that enhances the management of type 1 diabetes. Furthermore, Medtronic extended the advantages of hybrid closed-loop therapy to younger children with type 1 diabetes. This update has simplified the process of acquiring and sharing real-time data from Continuous Glucose Monitoring (CGM) systems and insulin pumps.

- In April 2023: a team of expert pediatricians launched Vamio Health, a telehealth platform designed to assist children affected by nocturnal enuresis, or bedwetting. With over 5 million children in the U.S. impacted by this condition, the platform aims to streamline the consultation process for families.

Report Scope

Report Features Description Market Value (2023) US$ 27.6 billion Forecast Revenue (2033) US$ 280.6 billion CAGR (2024-2033) 26.1% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware, Software, Services), By Delivery Mode Type (On-premises, Web-based, and Cloud-based), By End-User (Payers, Providers, and Patients) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teladoc Health, Inc., American Well, MDLive, Oracle, GlobalMedia Group, LLC, Siemens Healthineers AG, Medtronic, Pediatric Partners, Anytime Pediatrics, Kiddo Health Inc., PediaMetrix, Brave Care, Inc. and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pediatric Telehealth MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Pediatric Telehealth MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Teladoc Health, Inc.

- American Well

- MDLive

- Oracle

- GlobalMedia Group, LLC

- Siemens Healthineers AG

- Medtronic

- Pediatric Partners

- Anytime Pediatrics

- Kiddo Health Inc.

- PediaMetrix

- Brave Care, Inc.