Global Weight Management Supplements Market By Product Type (Vitamins & Minerals, Amino Acids, Natural Extracts/Botanicals, Protein, Fiber, Green Tea Extract, Conjugate Linoleic Acid, Green Coffee, L-Carnitine, and Others), By Formulation (Liquid, Powder, Softgels, Tablets, and Others), By Distribution Channel (Brick & Mortar and E-commerce), By End-User (18 years & Below, 19-40 years, 41-50 years, and 51 years & Above), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2024

- Report ID: 140812

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Weight Management Supplements Market Size is expected to be worth around US$ 127.9 Billion by 2034, from US$ 35.8 Billion in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034.

The Global Weight Management Supplements Market is experiencing robust growth, driven by increasing obesity rates, rising health and wellness consciousness, and advancements in supplement formulation and marketing techniques. Consumers are seeking effective, natural, and convenient solutions to support their weight loss and overall health goals.

The market is highly competitive, with key players such as Herbalife Nutrition Ltd., Glanbia PLC, Abbott Laboratories, Amway, GNC Holdings, and Nestlé Health Science continuously innovating to meet evolving consumer demands.

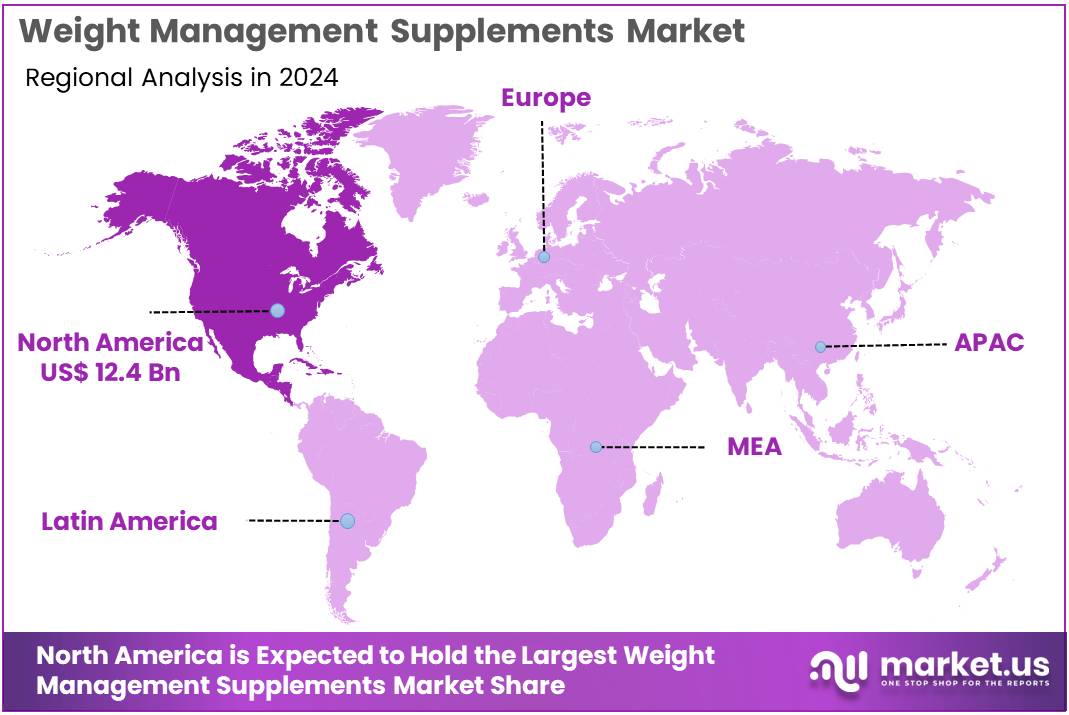

Regional dynamics vary, with North America and Europe leading the market, while the Asia Pacific region is poised for significant growth due to increasing disposable incomes and health awareness. Despite regulatory challenges, the market presents ample opportunities for growth, particularly in plant-based and personalized nutrition products.

Weight Management Supplements Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 19.7 26.9 29.2 32.2 35.8 13.6% Key Takeaways

- The global weight management supplements market was valued at USD 35.8 billion in 2024 and is anticipated to register substantial growth of USD 127.9 billion by 2034, with 13.6% CAGR.

- In 2024, the vitamins & minerals segment took the lead in the global market, securing 14.7% of the total revenue share.

- The powder segment took the lead in the global market, securing 32.2% of the total revenue share.

- The brick & mortar segment took the lead in the global market, securing 58.3% of the total revenue share.

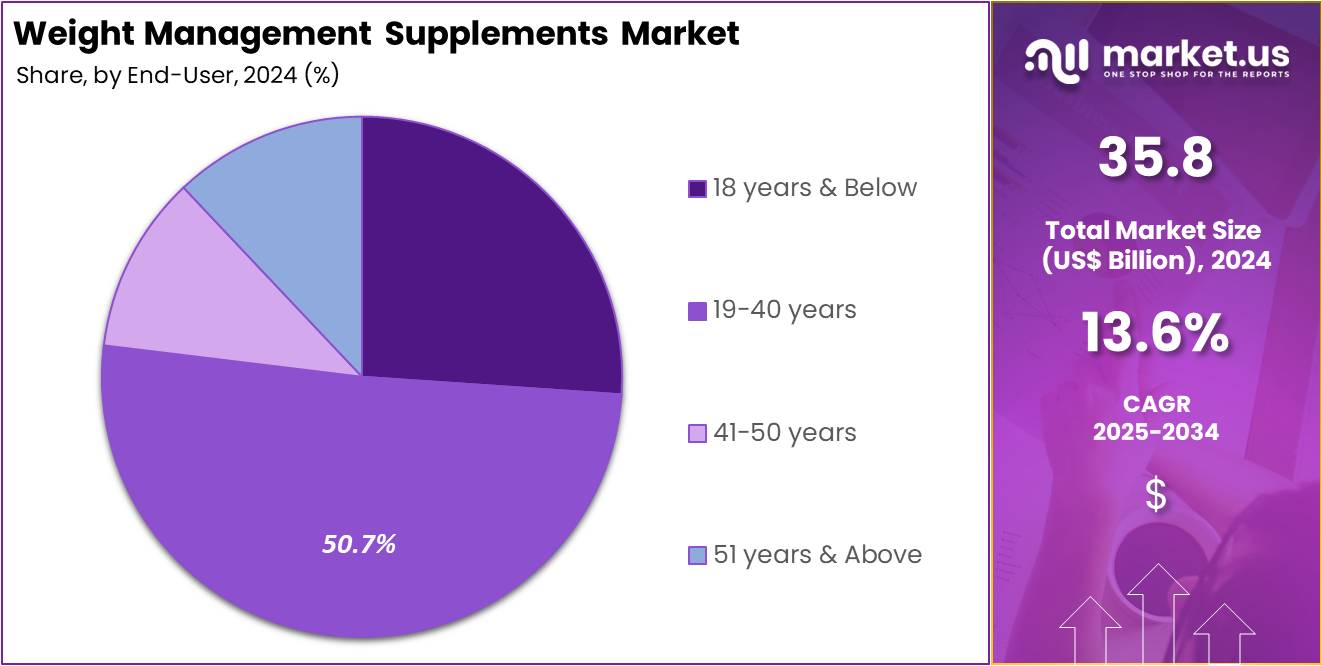

- The 19-40 years segment took the lead in the global market, securing 50.7% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 34.7% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into vitamins & minerals, amino acids, natural extracts/botanicals, protein, fiber, green tea extract, conjugate linoleic acid, green coffee, l-carnitine, and others. Amongst these, vitamins & minerals segment dominated the global Weight Management Supplements market capturing a significant market share of 14.7% in 2024.

Vitamins and minerals are fundamental components of weight management supplements, essential for supporting metabolic processes, energy production, and overall health. These micronutrients facilitate various biochemical reactions in the body, including those involved in converting food into energy, maintaining immune function, and repairing cellular damage. A balanced intake of vitamins and minerals ensures optimal metabolic function, which is crucial for effective weight management.

B vitamins, particularly B6 and B12, are vital for energy metabolism. Calcium, another essential mineral, not only supports bone health but also plays a role in regulating body weight. Research has suggested that calcium can bind to small amounts of dietary fat and prevent its absorption, which can aid in weight management. Iron is important for the formation of hemoglobin, thus ensuring that muscles get adequate oxygen to burn fat efficiently.

- GNC Total Lean® Lean Shake™ 25 is a meal replacement shake designed to support weight management. It provides a balanced mix of vitamins and minerals, including high levels of vitamin B6, B12, calcium, and magnesium, which are crucial for energy metabolism and muscle function. This shake also includes 25 grams of protein per serving, helping to promote satiety and muscle maintenance, essential for effective weight management.

Weight Management Supplements Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Vitamins & Minerals 3.0 4.1 4.4 4.8 5.3 Amino Acids 1.3 1.7 1.8 2.0 2.1 Natural Extracts/ Botanicals 2.5 3.5 3.9 4.4 5.1 Protein 3.0 4.1 4.5 4.9 5.4 Fiber 1.1 1.5 1.5 1.7 1.8 Green Tea Extract 1.1 1.5 1.6 1.7 1.9 Conjugate linoleic acid 2.4 3.4 3.7 4.2 4.7 Green coffee 1.2 1.6 1.7 1.8 2.0 L-Carnitine 2.4 3.3 3.5 3.8 4.2 Others 1.7 2.3 2.6 2.9 3.3 Formulation Analysis

The market is fragmented by formulation into liquid, powder, softgels, tablets, and others. Powder dominated the global weight management supplements market capturing a significant market share of 32.2% in 2024. Liquid supplements often contain a blend of vitamins, minerals, amino acids, and herbal extracts that support weight management by enhancing metabolism, promoting fat burning, and suppressing appetite.

The liquid form allows for faster absorption of these nutrients, leading to quicker onset of effects compared to other formulations. Additionally, liquids can be flavored to enhance palatability, making them more appealing to consumers.

- Herbalife Nutrition Formula 1 Shake is a popular meal replacement liquid supplement that provides a balanced mix of protein, fiber, and essential nutrients. It supports weight management by promoting satiety and reducing overall calorie intake.

Weight Management Supplements Market, Formulation Analysis, 2020-2024 (US$ Billion)

Formulation 2020 2021 2022 2023 2024 Liquid 3.1 4.2 4.5 4.9 5.3 Powder 6.6 8.9 9.6 10.5 11.5 Soft gels 2.7 3.8 4.2 4.8 5.4 Tablets 4.6 6.3 6.8 7.5 8.3 Others 2.7 3.8 4.1 4.6 5.2 Distribution Channel Analysis

The market is fragmented by distribution channel into brick & mortar and e-commerce. Brick & mortar dominated the global weight management supplements market capturing a significant market share of 58.3% in 2024. The prevalence of brick & mortar stores can be attributed to several factors.

Firstly, these physical stores provide a tangible shopping experience where consumers can physically examine products, consult with store staff, and receive personalized recommendations. This face-to-face interaction is especially valuable in the supplements market, where consumers often seek advice on product efficacy and suitability for their health needs.

Chemists and pharmacies play a critical role within this channel, holding a substantial share of the market. These outlets are trusted sources of health-related products, and their staff often includes pharmacists who can provide expert advice. Consumers feel confident purchasing supplements from these venues, knowing that they are receiving products that meet regulatory standards and are safe for consumption.

Weight Management Supplements Market, Distribution Channel Analysis, 2020-2024 (US$ Billion)

Distribution Channel 2020 2021 2022 2023 2024 Brick & Mortar 11.6 15.8 17.1 18.8 20.9 E-commerce 8.0 11.0 12.1 13.4 14.9 End-User Analysis

The market is fragmented by end-user into 18 years & below, 19-40 years, 41-50 years, and 51 years & above. 19-40 years dominated the global Weight Management Supplements market capturing a significant market share of 50.7% in 2024. This age group, primarily consisting of children and adolescents, is becoming increasingly significant due to the rising prevalence of childhood obesity.

- According to the World Health Organization (WHO), childhood obesity is a serious public health challenge. Global rates of overweight or obese children have increased dramatically. In 1975, 4% of children aged 5-19 were affected. By 2016, the rate had risen to over 18%. This trend has significant implications for healthcare costs and economic productivity. Preventive measures and policy interventions are essential. Stakeholders must invest in education and nutrition programs. These steps can help curb the rising trend.

This alarming trend is driving demand for weight management supplements designed specifically for younger populations. Parents and guardians are increasingly seeking safe and effective products to help manage their children’s weight. Supplements for this age group often include vitamins, minerals, and herbal extracts that support healthy metabolism and growth without adverse side effects. Products are carefully formulated to ensure safety and effectiveness for growing bodies.

Weight Management Supplements Market, End-User Analysis, 2020-2024 (US$ Billion)

End-User 2020 2021 2022 2023 2024 18 years & Below 2.6 3.4 3.6 3.9 4.2 19-40 years 9.7 13.3 14.6 16.2 18.2 41-50 years 4.8 6.6 7.2 8.0 9.0 51 years & Above 2.6 3.5 3.8 4.1 4.5 Key Segments Analysis

By Product Type

- Vitamins & Minerals

- Amino Acids

- Natural Extracts/Botanicals

- Protein

- Fiber

- Green Tea Extract

- Conjugate Linoleic Acid

- Green Coffee

- L-Carnitine

- Others

By Formulation

- Liquid

- Powder

- Softgels

- Tablets

- Others

By Distribution Channel

- Brick & Mortar

- Direct Selling

- Chemist/Pharmacies

- Health Food Shops

- Hypermarkets

- Supermarkets

- E-commerce

By End-User

- 18 years & Below

- 19-40 years

- 41-50 years

- 51 years & Above

Drivers

Increasing Prevalence of Obesity

The rising prevalence of obesity is a significant driver of the global weight management supplements market. The alarming increase in obesity rates is primarily due to sedentary lifestyles, unhealthy eating habits, and genetic factors, prompting individuals to seek effective weight management solutions, including dietary supplements.

- According to the World Health Organization (WHO), in 2022, 1 in 8 people globally lived with obesity. Since 1990, adult obesity rates have more than doubled. Adolescent obesity has quadrupled. In 2022, 2.5 billion overweight adults aged 18 years and older were recorded. Out of these, 890 million lived with obesity. Additionally, 43% of adults were overweight and 16% had obesity.

Restraints

Negative Perception of Synthetic Ingredients

One significant restraint in the weight management supplements market is the growing negative perception of synthetic ingredients. Consumers are increasingly aware and concerned about the potential health risks and side effects associated with synthetic additives and preservatives.

This trend is driven by a broader movement towards natural and organic products, fueled by the belief that natural ingredients are safer, more effective, and healthier. The skepticism towards synthetic ingredients stems from various studies and media reports highlighting the potential adverse effects of certain artificial substances used in dietary supplements.

- For example, synthetic chemicals such as artificial sweeteners, colors, and preservatives have been linked to a range of health issues, from allergic reactions to more serious conditions like metabolic disorders and cancer.

Market data reflects this growing concern. The shift in consumer preference is impacting the sales of products containing synthetic ingredients, as more people opt for supplements that are labeled as natural, organic, or free from artificial additives.

- According to a survey conducted by the Organic Trade Association in 2016, 82% of American households reported buying organic products, with a significant portion of these consumers indicating a preference for natural and organic supplements.

Opportunities

Growing Demand for Plant-Based and Organic Supplements

The increasing consumer preference for plant-based and organic supplements offers a substantial opportunity for growth in the weight management supplements market. As awareness of health and environmental issues rises, more consumers are turning towards natural, clean-label products. This trend is driven by the perception that plant-based and organic ingredients are healthier, safer, and more sustainable than synthetic alternatives. The overall growth of the plant-based sector is evident globally.

- India, a major player in the global plant-based sector, exemplifies this growth potential. As a top producer of protein-rich crops, India is well-positioned to supply both domestic and global plant-based food industries. The country is home to 45,000 plant species and ranks among the top five producers globally for essential plant proteins such as chickpeas, lentils, millet, peas, rice, soybeans, and wheat. India accounts for 24% of worldwide pulse production, making it the largest producer by a significant margin. This abundant resource base supports the growth of the plant-based sector, contributing to the increased availability and variety of plant-based supplements.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the weight management supplements market. Economic downturns or recessions often lead to reduced consumer spending, which can decrease demand for non-essential products like dietary supplements. Conversely, during periods of economic growth, rising disposable incomes may increase demand for health-related products, including weight management supplements.

Geopolitical factors, such as trade restrictions or supply chain disruptions, can impact the availability and cost of raw materials for these supplements, affecting production and pricing. Additionally, shifting global health trends, influenced by economic policies or public health initiatives, can drive consumer interest in weight management products.

Trends

The weight management supplements market is currently experiencing several key trends driven by consumer demand for more personalized and sustainable health solutions. There is a growing preference for natural, plant-based ingredients, such as Garcinia Cambogia, green tea extract, and CLA (Conjugated Linoleic Acid), as consumers seek safer alternatives to synthetic compounds.

Additionally, the rise of fitness-focused lifestyles and increasing awareness about obesity are fueling demand for fat-burning, appetite-suppressing, and metabolism-boosting products. Technology-driven innovations, such as personalized supplement formulations based on genetic or microbiome data, are also gaining traction.

Moreover, consumers are prioritizing transparency and clean-label products, prompting brands to offer clear information about ingredient sourcing and manufacturing practices. The shift toward e-commerce has accelerated, with online platforms becoming primary channels for supplement sales. Lastly, there is a growing trend towards combination supplements, which offer multiple benefits like weight loss, energy enhancement, and improved overall wellness in one product.

Regional Analysis

North America holds a commanding lead in the global weight management supplements market, securing a 34.7% share. The market was valued at an impressive US$ 12.4 billion in 2024. This dominance is fueled by a combination of factors, including the widespread prevalence of obesity and a well-informed consumer base that is keenly aware of health and wellness issues. The region’s robust dietary supplements industry further supports this leading position, catering to a significant demand for weight management solutions.

The obesity epidemic in North America is a major driver for the weight management supplements market. According to the Centers for Disease Control and Prevention (CDC), 41.9% of adults aged 20 and older were classified as obese from 2017 to March 2020. This alarming rate highlights the critical need for effective weight management strategies among the adult population.

The high prevalence of obesity has led to increased consumer demand for weight management products. Individuals are actively seeking effective solutions to combat obesity and enhance their overall health. This trend is reflected in the growing popularity of dietary supplements designed to aid in weight management.

The market’s growth is supported by strong consumer awareness regarding the benefits of maintaining a healthy weight. This awareness drives the demand for dietary supplements as part of a holistic approach to weight management. As consumers continue to prioritize health and wellness, the demand for these products is expected to remain robust, further reinforcing the market’s growth trajectory in North America.

Weight Management Supplements Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 7.0 9.5 10.2 11.2 12.4 Europe 5.6 7.7 8.3 9.1 10.1 Asia Pacific 3.8 5.3 5.9 6.7 7.6 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global weight management supplements market is highly competitive, characterized by the presence of numerous international and regional players. The market’s growth is propelled by rising consumer awareness regarding health and wellness, an increase in obesity rates, and a growing preference for natural and organic products.

Key players in the industry are continuously striving to gain a competitive edge through various strategic initiatives such as mergers and acquisitions, product launches, partnerships, and expansions. Major companies dominating the market include Herbalife Nutrition Ltd., Glanbia PLC, Abbott Laboratories, Amway, GNC Holdings, and Nestlé Health Science.

These companies leverage extensive research and development activities to innovate and introduce new products to meet evolving consumer demands. The market also witnesses significant contributions from smaller players and start-ups that focus on niche segments and offer unique, high-quality products.

Glanbia Plc is a global performance nutrition and ingredients company headquartered in Ireland, specializing in the development, manufacturing, and distribution of nutritional supplements, dairy-based products, and functional ingredients.

In addition, Herbalife Nutrition Ltd., global leader in weight management, nutritional supplements, and personal care products. Headquartered in Los Angeles, the company sells its products through a vast network of independent distributors. Herbalife’s product range includes protein shakes, supplements, and energy drinks designed to support weight management, fitness, and overall well-being.

Top Key Players in the Weight Management Supplements Market

- Glanbia Plc

- Herbalife Nutrition Ltd

- Abbott

- GSK plc.

- NESTLÉ

- Amway Corp.

- NOW Foods

- NutriSports Pharmaceuticals

- BioThrive Sciences

- SMPNutra

Recent Developments

- In April 2024: Glanbia plc, announced that it has entered into an agreement with the shareholders of Aroma Holding Company, LLC and related entities to acquire Flavor Producers LLC. The initial consideration for this acquisition is $300 billion, with additional deferred consideration to be paid as part of the transaction.

- In April 2022: Supernus Pharmaceuticals, Inc. received FDA approval for Qelbree, developed by Supernus Pharmaceuticals, Inc., for treating ADHD patients aged 18 years and above. This approval was anticipated to increase the consumer base for the product.

Report Scope

Report Features Description Market Value (2024) US$ 35.8 billion Forecast Revenue (2034) US$ 127.9 billion CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamins & Minerals, Amino Acids, Natural Extracts/Botanicals, Protein, Fiber, Green Tea Extract, Conjugate Linoleic Acid, Green Coffee, L-Carnitine, and Others), By Formulation (Liquid, Powder, Softgels, Tablets, and Others), By Distribution Channel (Brick & Mortar and E-commerce), By End-User (18 years & Below, 19-40 years, 41-50 years, and 51 years & Above Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Glanbia Plc, Herbalife Nutrition Ltd, Abbott, GSK plc., NESTLÉ, Amway Corp., NOW Foods, NutriSports Pharmaceuticals , BioThrive Sciences SMPNutra Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Weight Management Supplements MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Weight Management Supplements MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Glanbia Plc

- Herbalife Nutrition Ltd

- Abbott

- GSK plc.

- NESTLÉ

- Amway Corp.

- NOW Foods

- NutriSports Pharmaceuticals

- BioThrive Sciences

- SMPNutra