Europe Electroplating for Fashion And Accessories Market By Base Material (Brass, Copper, Zinc, Nickel, Aluminum, Stainless Steel, and Others), By Plating Material (Gold, Silver, Platinum, Rhodium, and Others), By Chemistry (Cyanide Solutions, and Non-cyanide Solutions) By Process Type (Barrel Plating, Rack Plating, Continuous Plating, and Others) By Application (Jewelry, Handbags, Footwear, Apparel, Watches, Belts and Wallets, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153236

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Base Material Analysis

- Plating Material Analysis

- Chemistry Analysis

- Process Type Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Trends

- Geopolitical Impact Analysis

- Key Countries Covered in this Report

- Key Players Analysis

- Recent Development

- Market Key Players

- Report Scope

Report Overview

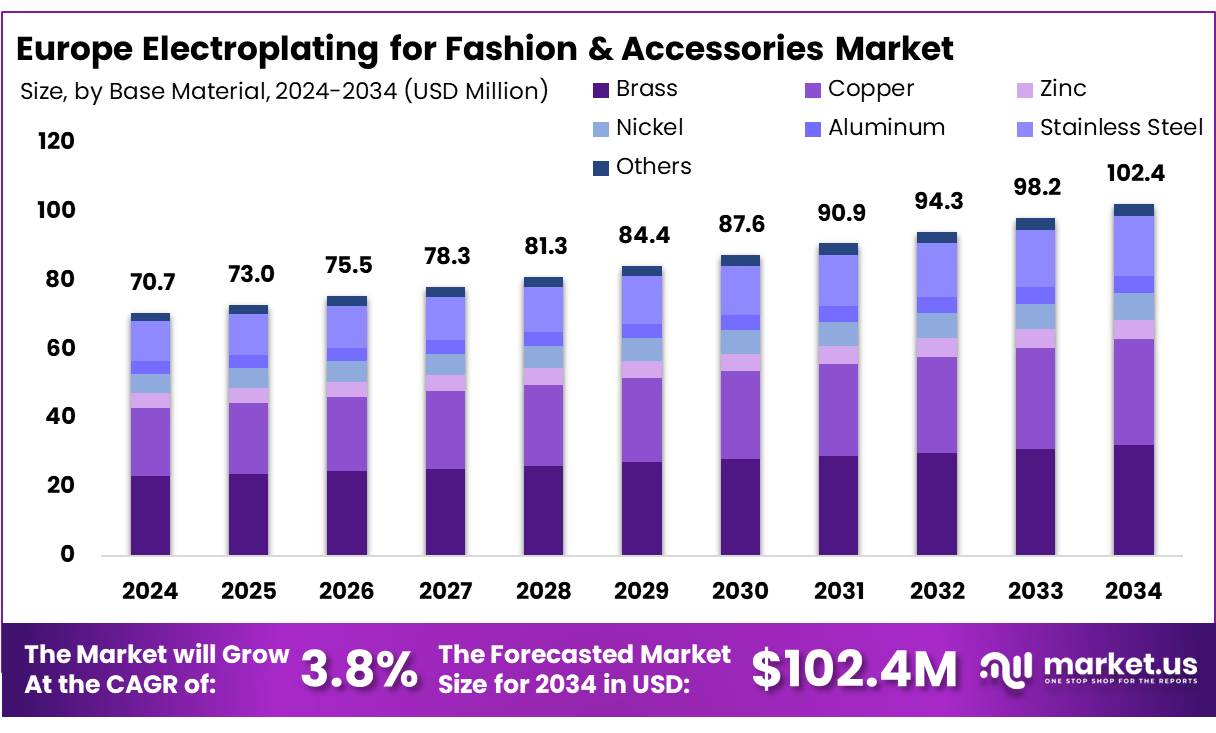

The Europe Electroplating for Fashion And Accessories Market size is expected to be worth around USD 102,437.9 Thousands by 2034, from USD 70,679.3 Thousands in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The European electroplating market for fashion and accessories is poised for robust growth, primarily fueled by the region’s fast-paced fashion cycles, demand for affordable luxury, and rising investments in sustainable and customizable manufacturing. Jewelry electroplating continues to be the backbone of the market, as fashion brands increasingly rely on high-quality plating finishes to mimic precious metals at lower costs. While gold and brass dominate the material landscape, innovations in process automation and non-cyanide chemistries are expected to gain traction due to mounting environmental regulations under REACH.

From an operational standpoint, the market is shifting toward localized plating workshops and agile production models to meet on-demand and short-run customization, supported by 3D printing and digital design trends. Furthermore, luxury refurbishment services and resale trends are opening up new revenue streams, particularly for players offering re-plating and restoration solutions. However, regulatory compliance costs and raw material sourcing volatility, driven in part by geopolitical tensions and supply chain disruptions, remain key challenges.

Key Takeaways

- The Europe Electroplating for Fashion And Accessories Market was valued at USD 70,679.3 thousands in 2024.

- The Europe Electroplating for Fashion And Accessories Market is projected to reach USD 102,437.9 thousands by 2034.

- Among base material of Europe Electroplating Market for Fashion & Accessoriess, the brass held the majority of the revenue share at 32.6%.

- Based on plating material, gold accounted for the largest market share with 64.6%.

- Among chemistry, cyanide solutions accounted for the majority of the electroplating market for fashion and accessories share with 62.0%.

- Based on process type, barrel plating accounted for the largest market share with 52.2%.

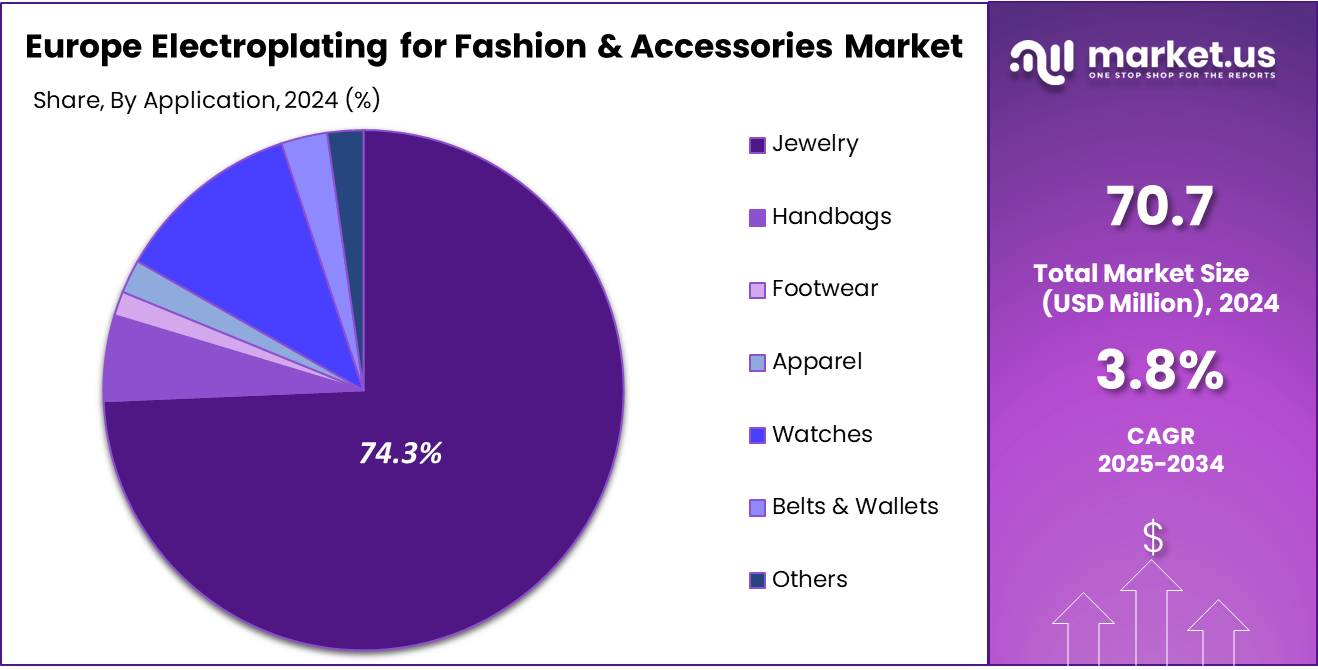

- Based on application, Jewelry accounted for the largest market share with 74.3%.

- Among countries, Italy held the major market share of 30.5% as of 2024.

Base Material Analysis

Brass Material Held The Major Share Owing To Its Excellent Corrosion Resistance

The Europe electroplating market for fashion and accessories is segmented by base material into brass, copper, zinc, nickel, aluminum, stainless steel, and others. Among these, brass emerged as the leading segment in 2024, accounting for approximately 32.6% of the total market revenue. Brass is widely favored in the fashion industry due to its excellent corrosion resistance, aesthetic appeal, and compatibility with various electroplating finishes such as gold, silver, and chrome.

Its malleability and durability make it ideal for crafting intricate jewelry, buckles, buttons, and decorative accessories. In 2024, the rising consumer demand for affordable luxury items and designer fashion supported the growth of brass-based electroplated products. Moreover, manufacturers increasingly prefer brass due to its cost-efficiency compared to precious metals, while still delivering a premium appearance.

Europe Electroplating Market for Fashion & Accessories, By Base Material, 2020-2024 (USD Thousands)

Base Material 2020 2021 2022 2023 2024 Brass 20,742.9 21,379.4 21,694.0 22,345.4 23,065.7 Copper 17,980.9 18,440.3 18,679.9 19,253.9 19,929.4 Zinc 3,893.4 3,997.8 4,050.0 4,171.6 4,285.8 Nickel 5,165.3 5,300.0 5,350.7 5,485.8 5,642.8 Aluminum 3,343.0 3,438.0 3,492.4 3,608.7 3,724.2 Stainless Steel 10,595.7 10,808.5 10,900.7 11,188.7 11,531.9 Others 2,331.1 2,362.5 2,369.5 2,426.3 2,499.6 Plating Material Analysis

Gold Plating Material Dominated the Europe Electroplating Market for Fashion & Accessories

Based on plating material, the Europe electroplating market for fashion and accessories is segmented into gold, silver, platinum, rhodium, and others. Among these, gold plating dominated the market in 2024, accounting for a substantial 64.6% of the total market share. Gold is highly valued in the fashion and accessories sector due to its luxurious appearance, excellent corrosion resistance, and strong consumer appeal. It is widely used in electroplating fashion jewelry, watches, handbag hardware, and decorative trims, providing a premium finish that enhances the perceived value of products.

The demand for gold-plated accessories continues to rise across Europe, driven by evolving fashion trends and increasing preference for affordable luxury. Additionally, advancements in gold-plating technologies have enabled manufacturers to achieve high-quality finishes using minimal gold content, making it more economically viable. As a result, gold remains the most preferred plating material in the European fashion accessory segment, contributing significantly to overall market revenues.

Europe Electroplating Market for Fashion & Accessories, By Plating Material, 2020-2024 (USD Thousands)

Plating Material 2020 2021 2022 2023 2024 Gold 41,074.2 42,256.3 42,866.8 44,185.4 45,643.6 Yellow Gold 22,379.2 23,067.9 23,419.0 24,144.4 24,918.4 Rose Gold 10,607.2 10,840.6 10,952.1 11,262.6 11,629.7 White Gold 5,649.2 5,852.0 5,973.7 6,184.1 6,415.6 Black Gold 2,438.6 2,495.8 2,522.1 2,594.3 2,679.9 Silver 13,803.6 14,109.1 14,238.0 14,626.9 15,090.2 Platinum 5,256.3 5,373.8 5,430.3 5,586.0 5,769.9 Rhodium 2,195.2 2,230.3 2,237.3 2,283.9 2,339.1 Others 1,722.9 1,756.8 1,764.7 1,798.3 1,836.4 Chemistry Analysis

Cyanide Solutions Has Dominated The Europe Electroplating Market for Fashion & Accessories

The electroplating market for fashion and accessories in Europe was further categorized based on chemistry such cyanide solutions and non-cyanide solutions. Among these, cyanide solutions accounted for the largest market share of 62.0% as of 2024. Cyanide solutions are widely used in the electroplating process, especially for metals like gold and silver, due to their superior conductivity, uniform metal deposition, and strong adhesion properties. Despite environmental and health concerns, cyanide-based plating remains dominant in the fashion industry because of its cost-effectiveness and established efficiency in achieving high-quality finishes.

Several manufacturers continue to rely on these solutions for producing visually appealing and durable accessories such as jewelry, belts, buttons, and zippers. However, growing regulatory pressures and increasing awareness around sustainable manufacturing are encouraging a gradual shift toward non-cyanide alternatives, which are expected to gain momentum in the coming years as safer and more environmentally friendly technologies evolve.

Europe Electroplating Market for Fashion & Accessories, By Chemistry, 2020-2024 (USD Mn)

Product Type 2020 2021 2022 2023 2024 Cyanide Solutions 41,377.8 42,091.0 42,184.0 42,940.9 43,787.2 Gold 25,090.5 25,791.4 26,066.6 26,710.8 27,375.9 Yellow Gold 13,975.2 14,764.7 15,257.8 15,919.5 16,556.2 Rose Gold 6,123.9 6,067.6 5,940.5 5,923.6 5,931.8 White Gold 3,324.9 3,300.5 3,237.2 3,234.1 3,244.7 Black Gold 1,666.5 1,658.5 1,631.0 1,633.6 1,643.1 Silver 10,568.5 10,591.0 10,487.8 10,576.8 10,711.3 Platinum 3,230.0 3,224.6 3,181.1 3,196.0 3,224.6 Rhodium 1,334.7 1,336.0 1,320.2 1,327.9 1,340.0 Others 1,154.2 1,148.1 1,128.3 1,129.4 1,135.4 Non-cyanide Solutions 22,674.5 23,635.3 24,353.2 25,539.6 26,892.1 Gold 15,983.8 16,465.0 16,800.2 17,474.6 18,267.7 Yellow Gold 8,404.0 8,303.2 8,161.2 8,224.9 8,362.2 Rose Gold 4,483.3 4,773.1 5,011.5 5,339.0 5,697.8 White Gold 2,324.3 2,551.4 2,736.4 2,950.0 3,170.9 Black Gold 772.2 837.3 891.0 960.7 1,036.7 Silver 3,235.2 3,518.1 3,750.2 4,050.2 4,378.9 Platinum 2,026.4 2,149.2 2,249.1 2,390.0 2,545.4 Rhodium 860.5 894.3 917.1 956.0 999.1 Others 568.7 608.7 636.5 668.9 701.1 Process Type Analysis

Meat & Poultry Has Dominated The Europe Electroplating Market for Fashion & Accessories

The electroplating market for fashion and accessories in Europe is further segmented based on process type into barrel plating, rack plating, continuous plating, and others. Among these, barrel plating held the largest market share in 2024, accounting for approximately 52.2% of the total market. Barrel plating is a widely adopted technique, particularly suitable for electroplating large volumes of small, durable items such as buttons, beads, snaps, and fasteners commonly used in fashion accessories.

The method is highly efficient, cost-effective, and capable of uniformly plating multiple components simultaneously, making it ideal for mass production. Its versatility and ability to handle a range of metals and chemistries further contribute to its widespread use across the European fashion manufacturing landscape. While other methods such as rack plating are preferred for delicate or intricately shaped items, the dominance of barrel plating reflects the high demand for functional and decorative components in fashion that require high throughput and consistent quality.

Europe Electroplating Market for Fashion & Accessories, By Process Type, 2020-2024 (USD Thousands)

Process Type 2020 2021 2022 2023 2024 Barrel Plating 33,053.8 34,070.1 34,616.8 35,721.5 36,922.0 Rack Plating 22,475.8 22,984.8 23,207.3 23,853.1 24,620.9 Continuous Plating 6,491.9 6,595.9 6,622.8 6,770.9 6,951.0 Others 2,030.8 2,075.5 2,090.3 2,135.0 2,185.3 Application Analysis

The electroplating market for fashion and accessories in Europe is further segmented by application into jewelry, handbags, footwear, apparel, watches, belts & wallets, and others. Among these segments, jewelry emerged as the dominant application in 2024, accounting for a significant 74.3% of the total market share. Electroplating plays a crucial role in enhancing the visual appeal, durability, and corrosion resistance of fashion jewelry.

It allows manufacturers to achieve high-end finishes such as gold, silver, or rhodium at a fraction of the cost of solid precious metals, making luxury aesthetics more accessible to a broader consumer base. The popularity of fashion jewelry in Europe, driven by fast-changing style trends, increasing affordability, and consumer demand for premium-looking accessories, has significantly contributed to the growth of this segment. Additionally, electroplated jewelry offers a variety of design possibilities and surface finishes, making it a preferred choice among designers and manufacturers throughout the region.

Europe Electroplating Market for Fashion & Accessories, By Application, 2020-2024 (USD Thousands)

Application 2020 2021 2022 2023 2024 Jewelry 47,685.2 48,943.4 49,543.1 50,957.4 52,535.2 Handbags 3,438.0 3,513.9 3,548.3 3,649.1 3,768.3 Footwear 979.1 996.9 1,004.1 1,033.8 1,070.9 Apparel 1,361.9 1,382.4 1,387.3 1,422.8 1,468.0 Watches 7,358.3 7,564.0 7,674.7 7,929.1 8,226.4 Belts & Wallets 1,805.6 1,858.8 1,890.1 1,954.9 2,028.5 Others 1,424.2 1,467.1 1,489.6 1,533.4 1,582.0 Jewelry 47,685.2 48,943.4 49,543.1 50,957.4 52,535.2 Key Market Segments

By Base Material

- Brass

- Copper

- Zinc

- Nickel

- Aluminum

- Stainless Steel

- Others

By Plating Material

- Gold

- Yellow Gold

- Rose Gold

- White Gold

- Black Gold

- Silver

- Platinum

- Rhodium

- Others

By Chemistry

- Cyanide Solutions

- Gold

- Yellow Gold

- Rose Gold

- White Gold

- Black Gold

- Silver

- Platinum

- Rhodium

- Others

- Gold

- Non-cyanide Solutions

- Gold

- Yellow Gold

- Rose Gold

- White Gold

- Black Gold

- Silver

- Platinum

- Rhodium

- Others

- Gold

By Process Type

- Barrel Plating

- Rack Plating

- Continuous Plating

- Others

By Application

- Jewelry

- Handbags

- Footwear

- Apparel

- Watches

- Belts & Wallets

- Others

Drivers

Booming Fast Fashion Industry in Europe Anticipated to Boost Market’s Growth

The booming fashion industry in Europe is significantly driving the demand for electroplating in the fashion and accessories market. As one of the world’s leading fashion hubs, Europe is home to iconic luxury houses, emerging sustainable designers, and fast-fashion retailers—each of which relies on electroplated components to enhance the visual appeal, durability, and perceived value of their products. Electroplating is widely used in creating finishes for accessories such as jewelry, handbags, belts, watches, footwear trims, and apparel embellishments.

With fashion cycles becoming shorter and seasonal trends changing rapidly, brands are under pressure to deliver high-quality, trend-responsive products in greater volumes and at competitive prices. Electroplating allows manufacturers to replicate the luxurious appearance of precious metals such as gold, silver, and platinum without incurring the high material costs, making it an ideal solution for both premium and affordable segments. Moreover, the European fashion market’s increasing focus on product differentiation and customization has led to the growth of innovative finishes such as matte gold, rose tones, antique textures, and two-tone patterns—which are made possible through advanced electroplating techniques.

- The EU is a major exporter and re-exporter of apparel, ranking as the second largest apparel exporter globally in 2022, with a 23.8% share of world exports, second only to China. According to Eurostat, EU apparel exports reached €140.3 billion in 2023 (up from €107.3 billion in 2018), with 73.3% of these exports going to other EU countries and 26.7% destined for markets outside the EU.

Restraints

Environmental Impacts Of Electroplating May Hamper the Market Growth

Environmental impacts associated with electroplating processes are a significant concern and could hinder the growth of the Europe electroplating market for fashion and accessories over the coming years. Electroplating involves the use of several hazardous chemicals such as cyanide, hexavalent chromium, and nickel salts, which pose serious risks to both human health and the environment if not properly managed. In Europe—where environmental sustainability is a core legislative and consumer concern—these issues are becoming increasingly restrictive for electroplating businesses.

The European Union’s REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation already places strict limits on substances deemed toxic or hazardous. For instance, hexavalent chromium, a known carcinogen, is subject to authorization under REACH, pushing many companies toward costly substitution or reformulation. According to the European Chemicals Agency (ECHA), nearly 70% of plating companies using restricted substances are now facing higher compliance costs or technical challenges due to chemical phase-outs. Electroplating also generates heavy metal-laden wastewater, sludge, and airborne particulates, requiring treatment systems that significantly raise operational expenses.

Opportunity

Luxury Resale and Refurbishment Trends Create Significant Opportunities For Manufacturers

As pre-owned fashion gains traction, there’s demand for re-plating worn items. Services like jewelry and watch refurbishment are creating niche markets for electroplating within the luxury secondhand economy. As sustainability becomes a central pillar of consumer behavior, luxury resale is thriving. These platforms depend on high-quality restoration to maintain the appearance and value of secondhand luxury items.

Electroplating plays a critical role in refurbishing and enhancing accessories such as watches, bracelets, rings, belt buckles, eyewear frames, and hardware on handbags. By reapplying precious metal finishes (e.g., gold, rhodium, or silver) and correcting worn or oxidized surfaces, electroplating enables aging pieces to regain their original luster, extending product lifecycles and supporting circular fashion.

Manufacturers and plating workshops now find rising demand from both consumers and luxury brands that offer in-house refurbishment services or partner with authorized refinishers. Brands are actively encouraging customers to refurbish rather than replace, aligning with ESG commitments and tapping into Gen Z and Millennial consumer values around conscious consumption. Electroplating also supports value retention in refurbished goods. For instance, a lightly scratched gold-plated watch can see up to 30% higher resale value after professional replating.

Trends

3D Printing and Customized Manufacturing Influencing the Market

The integration of 3D printing and customized manufacturing is rapidly emerging as a transformative trend in the European electroplating market for fashion and accessories. As fashion brands and independent designers increasingly seek personalization and rapid product development, 3D printing technologies—especially metal and resin-based additive manufacturing—are being used to create highly detailed, unique components for jewelry, footwear embellishments, belt buckles, eyewear frames, and handbag hardware.

These 3D-printed parts often require electroplating to enhance surface finish, provide metallic luster, improve durability, and deliver the luxury aesthetic expected by European consumers. Electroplating complements 3D printing by converting basic prints into premium-looking accessories through coatings of gold, silver, nickel, and rhodium, among others. The trend toward mass customization is accelerating.

- A 2023 report by the European Institute of Innovation & Technology (EIT) noted that over 48% of fashion SMEs in Europe have either adopted or are testing 3D printing for prototype and small-batch production. These prototypes and limited-edition pieces are often coated using electroplating to elevate their appeal.

Geopolitical Impact Analysis

Geopolitical tensions have significantly impacted the growth of the electroplating market for fashion and accessories in Europe, primarily by disrupting supply chains, changing trade policies, and causing price volatility.

The Russia-Ukraine war has significantly impacted the European electroplating, jewelry, and fashion accessory industries, particularly in terms of raw material availability, ethical sourcing concerns, and global supply chain disruptions. As the conflict escalated in early 2022, numerous countries and companies imposed sanctions and trade restrictions on Russia, affecting critical commodities exported by the nation, including diamonds, gold, and palladium, which are central to the jewelry and fashion accessory industries in Europe.

Russia is the world’s largest producer of natural diamonds and ranks second globally in gold production. These materials are vital inputs in luxury goods and accessories, not only for crafting jewelry and watches but also for high-end decorative electroplating processes that give fashion pieces a premium aesthetic.

European luxury conglomerates such as LVMH, Kering, and Hermès suspended operations and commercial ties with Russia, signaling both an ethical stance and a disruption in market access. This decision extended into raw material sourcing: for example, Kering publicly refused to procure diamonds mined in Russia after the conflict began. Similarly, Richemont and Pandora exited the Responsible Jewellery Council (RJC) due to the organization’s continued links with Alrosa, a Russian state-owned entity responsible for nearly 90% of Russia’s diamond mining and around 28% of the global supply. This loss of Russian diamonds and gold from the European sourcing pipeline has created gaps in raw material availability.

Key Countries Covered in this Report

- Europe

- Germany

- K.

- France

- Spain

- Italy

- Russia & CIS

- Rest of Europe

Key Players Analysis

Market Players In Europe Electroplating Market for Fashion & Accessories Industry Are Adopting Several Key Strategies To Stay Competitive

Market players in the European food safety testing industry are adopting several key strategies to maintain competitiveness and address evolving regulatory and consumer demands. One of the primary approaches includes investing in advanced testing technologies such as PCR-based methods, next-generation sequencing (NGS), and biosensors to enhance the speed, sensitivity, and accuracy of contaminant detection. Companies are also focusing on expanding their service portfolios to cover a broader range of pathogens, allergens, GMOs, and chemical residues. Strategic collaborations and partnerships with food manufacturers, regulatory bodies, and research institutions are being formed to strengthen market presence and foster innovation.

Recent Development

In March, 2022, LEGOR GROUP S.p.A has announced the acquisition of HSO Herbert Schmidt GmbH & Co. KG, a privately-owned international company that specializes in developing surface finishing technologies and chemicals.

Market Key Players

- Umicore N.V

- Element Solutions Inc

- Spa Plating

- Bluclad S.p.A

- Technic Inc

- Metakem

- LEGOR GROUP S.p.A

- Valmet Plating srl

- MARAWE GmbH & Co. KG

- Italfimet REA

- Heimerle + Meule

- IWG Ing. W. Garhöfer Ges.m.b.H.

- GERWECK GMBH Surface Technology

- Schlötter GmbH

- Other Key Players

Report Scope

Report Features Description Market Volume (2024) US$ 70,679.3 Thousands Forecast Revenue (2034) US$ 102,437.9 Thousands CAGR (2024-2033) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Material (Brass, Copper, Zinc, Nickel, Aluminum, Stainless Steel, and Others), By Plating Material (Gold, Silver, Platinum, Rhodium, and Others), By Chemistry (Cyanide Solutions, and Non-cyanide Solutions) By Process Type (Barrel Plating, Rack Plating, Continuous Plating, and Others) By Application (Jewelry, Handbags, Footwear, Apparel, Watches, Belts & Wallets, and Others) Country Analysis Europe – Germany, France, U.K., Italy, Spain, Russia & CIS, and Rest of Europe Competitive Landscape Umicore N.V, Element Solutions Inc., Spa Plating, Bluclad S.p., Technic Inc., Metakem, LEGOR GROUP S.p.A, Valmet Plating srl, MARAWE GmbH & Co. KG, Italfimet REA, Heimerle + Meule, IWG Ing. W. Garhöfer Ges.m.b.H, GERWECK GMBH Surface Technology, Schlötter GmbH, & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Europe Electroplating for Fashion And Accessories MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Electroplating for Fashion And Accessories MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Umicore N.V

- Element Solutions Inc

- Spa Plating

- Bluclad S.p.A

- Technic Inc

- Metakem

- LEGOR GROUP S.p.A

- Valmet Plating srl

- MARAWE GmbH & Co. KG

- Italfimet REA

- Heimerle + Meule

- IWG Ing. W. Garhöfer Ges.m.b.H.

- GERWECK GMBH Surface Technology

- Schlötter GmbH

- Other Key Players