Global Embedded Die Packaging Market By Product Type (Embedded Die in Flexible Board, Embedded Die in Rigid Board, Embedded Die in IC Package Substrate), By End-Use (Consumer Electronics, IT & Telecommunications, Automotive, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 49324

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

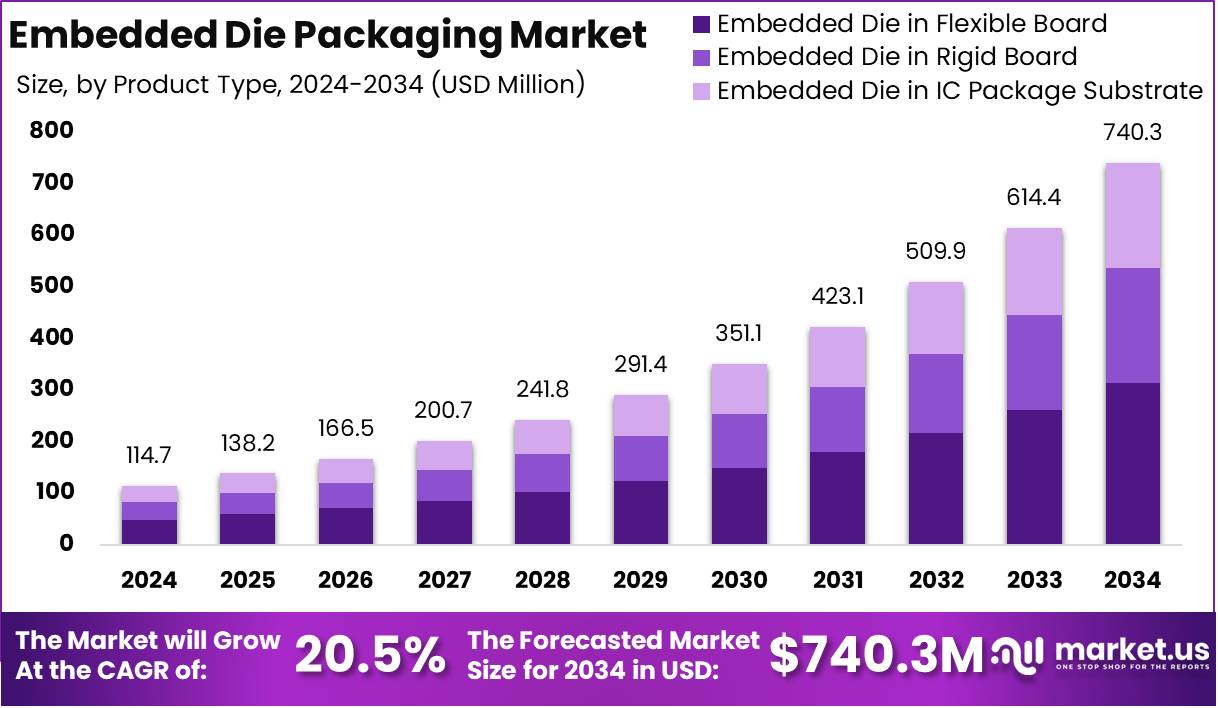

The Global Embedded Die Packaging Market size is expected to be worth around USD 740.3 Million by 2034 from USD 114.7 Million in 2024, growing at a CAGR of 20.5% during the forecast period from 2025 to 2034.

Embedded die packaging is an advanced semiconductor packaging technology that involves integrating a semiconductor die directly within a substrate or printed circuit board (PCB) instead of mounting it on the surface. This innovative approach eliminates the need for traditional wire bonding and provides a more compact, reliable, and thermally efficient packaging solution.

The process typically includes embedding the die into a multilayer laminate using redistribution layers (RDL), enabling shorter electrical paths, enhanced signal integrity, and improved overall device performance. By minimizing form factor while boosting functionality, embedded die packaging has emerged as a critical enabler for next-generation electronic devices.

The embedded die packaging market refers to the global industry landscape focused on the development, production, and commercialization of semiconductor packages using embedded die technology. This market spans a wide range of applications including smartphones, wearable electronics, automotive electronics, industrial sensors, medical devices, and high-performance computing systems.

It comprises various stakeholders such as substrate manufacturers, semiconductor foundries, OSATs (outsourced semiconductor assembly and test providers), and original equipment manufacturers (OEMs). As the demand for miniaturized, high-performance, and energy-efficient electronic components intensifies, the market for embedded die packaging is gaining traction across multiple high-growth verticals.

The growth of the embedded die packaging market can be attributed to the increasing need for compact and lightweight electronic devices, coupled with rising functionality requirements. Technological advancements in automotive electronics, particularly in advanced driver-assistance systems (ADAS) and electric vehicles (EVs), are accelerating the adoption of embedded die solutions due to their ability to reduce size and enhance thermal performance.

A significant surge in demand is being observed from consumer electronics and automotive sectors, where embedded die packaging is addressing critical challenges related to space constraints and power efficiency. In mobile devices and wearables, where ultra-thin form factors are paramount, this packaging method enables manufacturers to integrate more functionality without compromising design or performance.

The embedded die packaging market presents substantial growth opportunities driven by the proliferation of Internet of Things (IoT) devices, smart medical wearables, and autonomous vehicle technologies. As industries move toward heterogeneous integration and system-in-package (SiP) architectures, embedded die packaging is well-positioned to meet future miniaturization and high-speed data transmission requirements.

According to Telecoms, approximately 70% of the global population around 6 billion people will be active mobile internet users by 2025, while GSMA projects that 40% of the world’s population will be covered by 5G networks in the same timeframe.

This accelerated connectivity surge is expected to significantly fuel demand in the Embedded Die Packaging Market, as device miniaturization, high-speed data transfer, and advanced semiconductor integration become critical enablers of next-generation mobile and edge computing technologies.

The Embedded Die Packaging Market is experiencing robust momentum, driven by advancements in next-generation wireless technologies. According to GSA, by the end of September 2023, 578 operators across 173 countries and territories were investing in 5G infrastructure, including trials, licensing, planning, and deployment.

Among these, 300 operators in 114 countries had launched 3GPP-compliant 5G services, while 290 in 113 countries had introduced or soft-launched 5G mobile offerings. Furthermore, 152 operators in 70 countries had launched 5G fixed wireless access services, representing over 52% of active 5G deployments.

Additionally, 13 operators had initiated soft launches, and 121 were investing in 5G standalone networks, with 43 having launched or deployed them in public settings. This widespread and rapid adoption of 5G technologies is expected to accelerate the demand for miniaturized, high-performance semiconductor packaging, thereby positioning Embedded Die Packaging as a critical enabler of integration, efficiency, and form factor reduction in compact 5G-enabled devices.

Key Takeaways

- The global embedded die packaging market is projected to reach approximately USD 740.3 Million by 2034, rising from USD 114.7 Million in 2024, at a robust CAGR of 20.5% during the forecast period from 2025 to 2034.

- In 2024, Embedded Die in Flexible Board emerged as the leading product type, accounting for over 42.4% of the global market share.

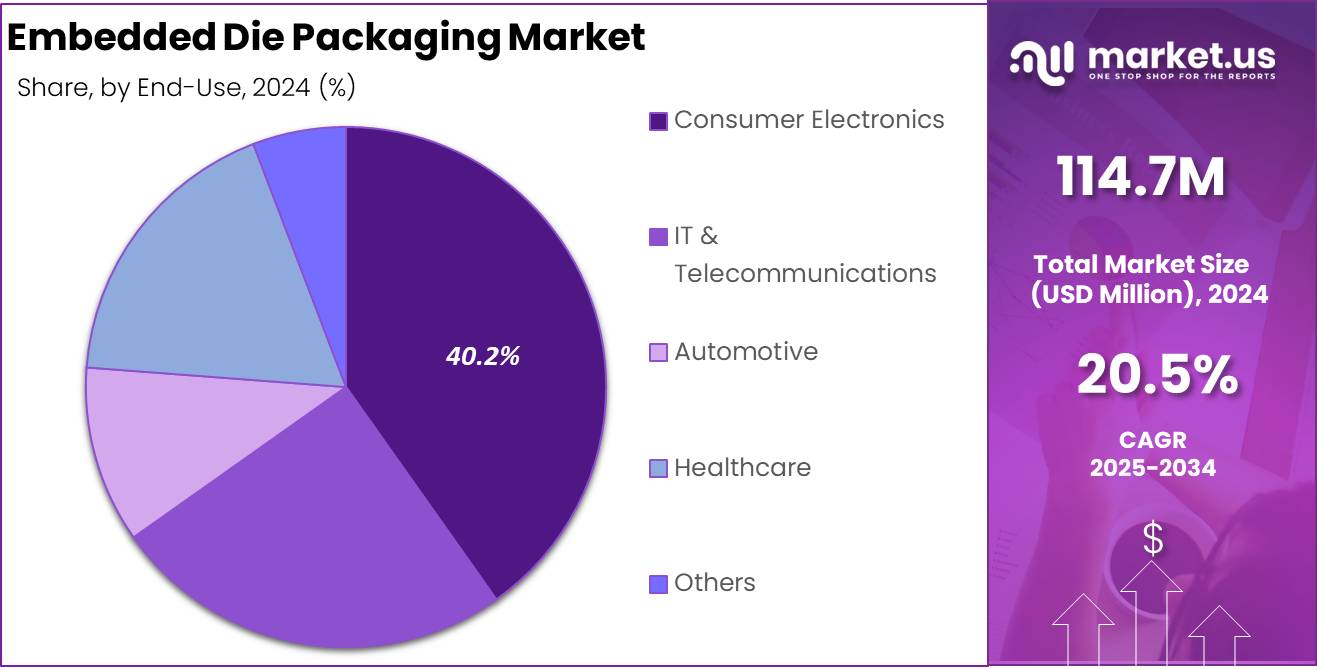

- The consumer electronics sector held the highest share among end-use segments in 2024, capturing more than 40.2% of the global embedded die packaging market.

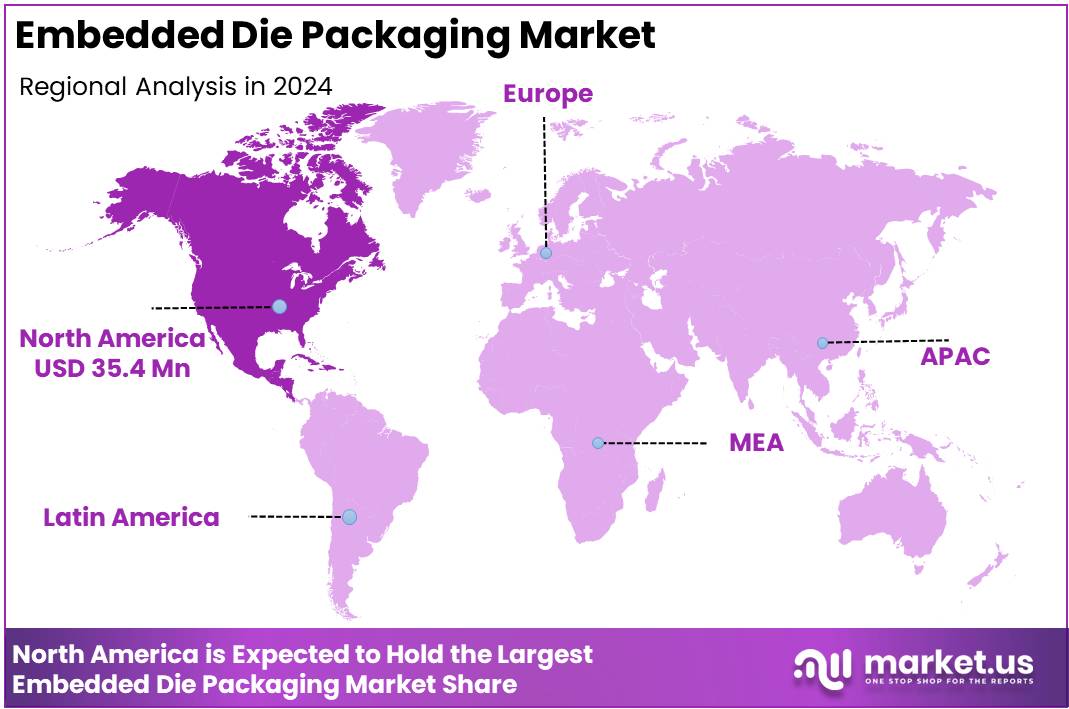

- North America led the global embedded die packaging market in 2024, representing approximately 30.9% of the total share. This equates to a regional market value of nearly USD 35.4 Million, supported by a strong semiconductor ecosystem and technological advancements.

By Product Analysis

Embedded Die in Flexible Board Dominated the Embedded Die Packaging Market with 42.4% Share

In 2024, Embedded Die in Flexible Board held a dominant market position in the By Product Type segment of the Embedded Die Packaging Market, capturing more than 42.4% of the global share. This strong performance can be attributed to the increasing adoption of compact and lightweight electronic devices across sectors such as consumer electronics, medical devices, and wearables.

The flexible nature of the substrate allows for greater design versatility, which is critical in miniaturized and bendable device configurations. Moreover, the segment has been driven by advancements in flexible printed circuit technologies, enabling better performance, high-density integration, and improved thermal management.

In addition, the growing demand for smart electronics and IoT-enabled devices has reinforced the preference for flexible board-based embedded die solutions. Manufacturers are prioritizing flexible substrates to meet the increasing need for energy-efficient, durable, and space-saving packaging formats.

In 2024, the Embedded Die in Rigid Board segment secured a notable share in the Embedded Die Packaging Market by product type. This segment continues to serve critical roles in applications demanding high mechanical strength, superior thermal conductivity, and dense interconnect structures. It is widely utilized in sectors such as industrial electronics, automotive electronic control units (ECUs), and advanced communication infrastructure. The rigid substrate format provides exceptional reliability, which is particularly vital in mission-critical systems where operational consistency and long-term durability are essential.

In 2024, the Embedded Die in IC Package Substrate segment held a moderate share within the Embedded Die Packaging Market, targeting specialized and performance-driven semiconductor applications. This product type is predominantly used in mobile devices, telecommunication systems, and high-frequency electronic components, where space efficiency, signal integrity, and electrical performance are paramount. The embedding of die within IC substrates facilitates the integration of multiple chips and passive components, enabling higher performance in compact form factors.

By End-Use Analysis

Consumer Electronics Dominated the Embedded Die Packaging Market with 40.2% Share

In 2024, Consumer Electronics held a dominant market position in the By End-Use segment of the Embedded Die Packaging Market, capturing more than 40.2% of the global share. This dominance can be attributed to the widespread adoption of compact, lightweight, and multifunctional consumer electronic devices such as smartphones, tablets, wearable gadgets, and AR/VR systems.

The demand for advanced packaging technologies that offer space efficiency, high electrical performance, and low power consumption is steadily increasing across consumer electronics manufacturers. Embedded die packaging is increasingly being integrated into mobile processors, RF modules, and power management units, where miniaturization is critical.

In 2024, the IT & Telecommunications segment emerged as a significant contributor to the Embedded Die Packaging Market by end use. This segment has gained considerable traction due to the rising demand for high-speed data processing and communication systems.

Embedded die packaging supports essential performance metrics such as enhanced signal integrity, reduced latency, and improved high-frequency response, which are vital in telecom infrastructure and cloud computing applications. Devices such as network switches, routers, and base stations benefit substantially from the compact and high-performance nature of this packaging technology.

In 2024, the Automotive segment demonstrated notable growth in the Embedded Die Packaging Market by end use. The transformation of the automotive industry driven by electric vehicle adoption, advanced driver-assistance systems (ADAS), and digital infotainment has significantly expanded the use of compact, high-reliability electronic modules.

Embedded die packaging addresses key requirements such as thermal resilience, mechanical stability, and space optimization, which are essential for electronic control units (ECUs), sensors, and communication modules within vehicles.

In 2024, the Healthcare segment maintained a steady presence in the Embedded Die Packaging Market by end use. The adoption of advanced electronic components across medical devices, diagnostic systems, and wearable health monitors is creating new opportunities for embedded die technologies. These applications require miniaturization, power efficiency, and reliable performance areas where embedded die packaging provides significant advantages.

In 2024, the Others segment which includes defense, aerospace, industrial automation, and energy systems represented an emerging area within the Embedded Die Packaging Market by end use. These industries demand robust, high-performance electronics capable of operating under extreme environmental conditions. Embedded die packaging supports such needs through enhanced thermal management, reduced footprint, and long-term reliability.

Key Market Segments

By Product Type

- Embedded Die in Flexible Board

- Embedded Die in Rigid Board

- Embedded Die in IC Package Substrate

By End-Use

- Consumer Electronics

- IT & Telecommunications

- Automotive

- Healthcare

- Others

Driver

Increasing Demand for Miniaturized and High-Performance Electronic Devices

The rising demand for compact and multifunctional electronic devices has significantly driven the adoption of embedded die packaging technology. As modern electronics continue to scale down in size while demanding higher computational performance, embedded die packaging offers a crucial advantage by enabling more compact designs, improved electrical performance, and enhanced thermal management.

The integration of the die within the substrate shortens interconnection lengths, resulting in lower power consumption, higher speed, and reduced signal loss—critical requirements in smartphones, wearable electronics, and high-performance computing devices. This technological evolution is further reinforced by the growing penetration of IoT-enabled devices, where space and power efficiency are key considerations.

Furthermore, the growing sophistication of consumer electronics and the evolution of 5G infrastructure have placed greater emphasis on advanced packaging solutions like embedded die. The ability of this packaging method to offer a smaller footprint with greater functional density has attracted manufacturers seeking to balance cost and performance.

In 2024, the embedded die packaging market is witnessing increased investment in R&D and production scalability to meet these evolving requirements. This shift is not only optimizing the design and integration of electronic systems but is also expanding the application base, reinforcing the market’s upward trajectory.

Restraint

High Production Cost and Complex Manufacturing Process

One of the primary restraints hindering the growth of the embedded die packaging market in 2024 is the high cost associated with manufacturing and integration. Embedded die packaging involves intricate processes such as die thinning, precise alignment, and advanced substrate integration, all of which require sophisticated equipment and highly controlled environments.

These capital-intensive requirements elevate the production costs significantly compared to traditional packaging techniques. As a result, many manufacturers particularly small and medium-sized enterprises face financial and technical barriers to adopting this technology on a large scale, thus limiting broader market penetration.

Additionally, the complexity of the production process poses considerable challenges in terms of yield optimization and quality control. Even minor defects in the embedded die or substrate can compromise the performance of the final device, leading to higher rates of wastage and rework. The need for specialized expertise and advanced process knowledge further increases the overall cost of ownership.

These factors contribute to a cautious adoption curve, especially in cost-sensitive sectors where price-to-performance ratios are critical. Unless advancements in standardization and automation lead to reductions in production complexity and cost, this restraint will continue to temper the market’s expansion pace despite the strong underlying demand.

Opportunity

Integration in Automotive Electronics and Electric Vehicles (EVs)

The increasing integration of embedded die packaging in the automotive sector especially within electric vehicles (EVs) presents a substantial growth opportunity for the global market in 2024. The automotive industry is undergoing a rapid technological transformation with a surge in electronic content per vehicle.

Embedded die packaging plays a critical role in supporting the miniaturization, durability, and high-temperature resilience required in automotive-grade electronic systems. This is particularly relevant for applications in advanced driver assistance systems (ADAS), battery management systems, inverters, and power modules, where compact, high-performance, and thermally efficient packaging is essential.

Moreover, the rapid proliferation of EVs globally is fueling demand for highly reliable, high-power electronic components that can withstand harsh environments while maintaining long-term operational efficiency. Embedded die packaging, by reducing parasitic inductance and improving electrical conductivity, is increasingly preferred in power electronics used within EV systems.

The shift towards electrification and autonomous driving has led to accelerated investments in next-generation semiconductor packaging tailored for automotive applications. This trend is anticipated to significantly expand the commercial scope of embedded die solutions, unlocking long-term revenue streams and reinforcing the market’s evolution into more diverse and high-growth verticals.

Trends

Rising Adoption of Heterogeneous Integration and System-in-Package (SiP) Technologies

A key trend shaping the embedded die packaging market in 2024 is the growing emphasis on heterogeneous integration and System-in-Package (SiP) solutions. These approaches involve the integration of diverse functional components such as logic, memory, RF, and analog within a single, compact package.

Embedded die packaging enables this convergence by allowing multiple dies to be integrated into the substrate itself, thereby reducing form factor, enhancing signal integrity, and improving overall performance. This trend is particularly prominent in advanced computing, edge AI devices, and mobile electronics, where high-density integration is essential.

As industries push toward greater functionality in smaller footprints, the embedded die packaging method is being increasingly leveraged to overcome limitations associated with traditional multi-chip modules. In addition to spatial efficiency, the embedded approach supports better thermal management and faster signal processing critical for next-generation semiconductor applications.

This shift toward SiP and heterogeneous integration is also aligned with the broader industry roadmap that favors high-bandwidth, low-latency architectures, and power efficiency. The embedded die packaging market is, therefore, benefitting from this ongoing packaging evolution, positioning itself as a strategic enabler of future-ready semiconductor ecosystems.

Regional Analysis

North America Leads the Embedded Die Packaging Market with Largest Market Share of 30.9% in 2024

In 2024, North America is projected to dominate the global embedded die packaging market, accounting for the largest share of 30.9%, which translates to a market value of approximately USD 35.4 million. The region’s strong position is supported by widespread adoption of advanced semiconductor technologies and the presence of robust electronics manufacturing infrastructure.

Increased demand for compact and high-performance electronic devices in industries such as automotive, telecommunications, and consumer electronics has accelerated the deployment of embedded die packaging solutions. Furthermore, continuous investment in R&D and innovations in packaging technologies are contributing to sustained regional growth.

Europe represents a significant portion of the embedded die packaging market, with increasing emphasis on advanced electronic applications in automotive and industrial automation. Countries such as Germany, France, and the Netherlands are witnessing a rising preference for high-density packaging solutions that enhance product performance and reduce form factor.

This trend is further reinforced by government support for the development of microelectronics and chip integration technologies, enhancing Europe’s share in the global market. The region is also focusing on strengthening its semiconductor supply chain to reduce dependency on imports, which indirectly supports the growth of embedded die packaging.

Asia Pacific is emerging as a rapidly growing region in the embedded die packaging market, driven by escalating electronics production and rising consumer demand. Key economies such as China, Japan, South Korea, and Taiwan are witnessing a surge in semiconductor manufacturing capacities, which is positively influencing the adoption of embedded die packaging. The region benefits from lower production costs, high-volume manufacturing capabilities, and expanding investment in miniaturized electronics, making it a strategically significant market for future growth.

The Middle East & Africa region is experiencing gradual adoption of embedded die packaging technology, primarily driven by increasing digital transformation initiatives and infrastructure development in countries such as the UAE and Saudi Arabia. Although the market size remains relatively modest, demand is expected to increase steadily due to the growing use of advanced electronics in telecommunications and industrial sectors.

Latin America also contributes a smaller share to the embedded die packaging market, with Brazil and Mexico leading regional advancements. Growth in the consumer electronics sector, supported by urbanization and increased connectivity, is gradually propelling demand for innovative packaging solutions. However, the market is still in its nascent stages compared to other regions and is expected to grow at a moderate pace over the forecast period.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global embedded die packaging market in 2024 is characterized by the strategic positioning and technological advancements of several key players, each contributing uniquely to the competitive dynamics of the industry. Microsemi Corporation, a subsidiary of Microchip Technology, continues to lead in military-grade and aerospace embedded die solutions, capitalizing on its strong portfolio of secure, high-reliability components.

Fujikura Ltd. strengthens its market position through advanced interconnect technologies and flexible printed circuits, aligning with the industry’s growing demand for miniaturized, high-performance devices. Meanwhile, Infineon Technologies AG leverages its expertise in power semiconductors and automotive electronics to offer integrated embedded packaging solutions tailored to EVs and industrial automation.

ASE Group, one of the largest OSAT providers, plays a pivotal role in scaling embedded die packaging through high-volume manufacturing capabilities and robust R&D infrastructure. AT&S Company and Schweizer Electronic AG contribute significantly through innovations in advanced substrate and printed circuit board (PCB) designs, supporting complex system-in-package (SiP) architectures.

Intel Corporation, a global semiconductor leader, remains at the forefront with its investment in heterogeneous integration and embedded multi-die interconnect bridge (EMIB) technology, accelerating adoption in AI and data center applications. Taiwan Semiconductor Manufacturing Company (TSMC) continues to drive innovation by offering advanced wafer-level packaging solutions that integrate embedded dies with exceptional power and space efficiency.

Additionally, TDK Corporation and General Electric focus on the industrial and energy sectors by deploying embedded components in power electronics and harsh environments. Shinko Electric Industries Co. Ltd. and Amkor Technology maintain strong positions through expanded production capacities and partnerships, reinforcing their roles as critical enablers of embedded die packaging across consumer electronics, automotive, and communication sectors.

Collectively, these players are fostering technological convergence, enhancing performance, and reducing form factors, thereby propelling the market’s expansion.

Top Key Players in the Market

- Microsemi Corporation

- Fujikura Ltd.

- Infineon Technologies AG

- ASE Group

- AT&S Company

- Schweizer Electronic AG

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company

- TDK Corporation

- General Electric

- Shinko Electric Industries Co. Ltd

- Amkor Technology

Recent Developments

- In 2025, Retym raised over $180 million to support its growth in AI infrastructure. In its Series D funding round, the company secured $75 million, led by Spark Capital. Retym works on digital signal processing technology that boosts data transfer in AI and cloud systems. The funds will help the company expand its product roadmap and address the rising demand in AI data centers. James Kuklinski from Spark Capital also joined Retym’s board as part of the investment.

- In 2025, Baya Systems received more than $36 million in Series B funding to grow its intelligent compute IP solutions. The round was led by Maverick Silicon with strategic support from Synopsys and repeat investors like Intel Capital and Matrix Partners. The funding will be used to speed up product development and support chiplet-based system-on-chip designs. Baya Systems aims to strengthen its position in the advanced semiconductor space.

- In 2023, Infineon Technologies and Schweizer Electronic started working together to improve the efficiency of silicon carbide chips. The partnership focuses on embedding Infineon’s 1200V CoolSiC chips directly onto circuit boards. This new approach will help electric vehicles travel longer distances and cut down system costs.

- In 2024 – Silicon Box announced a $3.6 billion investment plan with the Italian government to build a semiconductor facility in Northern Italy. The site will focus on advanced chip assembly and testing to support future tech needs by 2028. The new facility will mirror the company’s Singapore model and employ about 1,600 people. Thousands of additional jobs are expected through suppliers. Design begins immediately, with construction pending EU funding approval

- In 2025, UFP Technologies reported strong results for 2024, with net income rising to $59 million, up from $44.9 million in 2023. Sales reached $504.4 million, showing a 26% increase. In the fourth quarter alone, sales jumped to $144.1 million, a 42% rise year-over-year. Adjusted earnings per share also rose to $8.68 for the year. CEO Jeffrey Bailly expressed confidence in the company’s growth and ongoing performance.

Report Scope

Report Features Description Market Value (2024) USD 114.7 Million Forecast Revenue (2034) USD 740.3 Million CAGR (2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Embedded Die in Flexible Board, Embedded Die in Rigid Board, Embedded Die in IC Package Substrate), By End-Use (Consumer Electronics, IT & Telecommunications, Automotive, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsemi Corporation, Fujikura Ltd., Infineon Technologies AG, ASE Group, AT&S Company, Schweizer Electronic AG, Intel Corporation, Taiwan Semiconductor Manufacturing Company, TDK Corporation, General Electric, Shinko Electric Industries Co. Ltd, Amkor Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Embedded Die Packaging MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Embedded Die Packaging MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsemi Corporation

- Fujikura Ltd.

- Infineon Technologies AG

- ASE Group

- AT&S Company

- Schweizer Electronic AG

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company

- TDK Corporation

- General Electric

- Shinko Electric Industries Co. Ltd

- Amkor Technology