Global Electric Vehicle Power Inverter Market Size, Share, Growth Analysis By Hybrid Electric Vehicles (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Power Output (UP TO 100 KW, 101-300 kW, 301-600 kW, 601 kW & Above), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148091

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

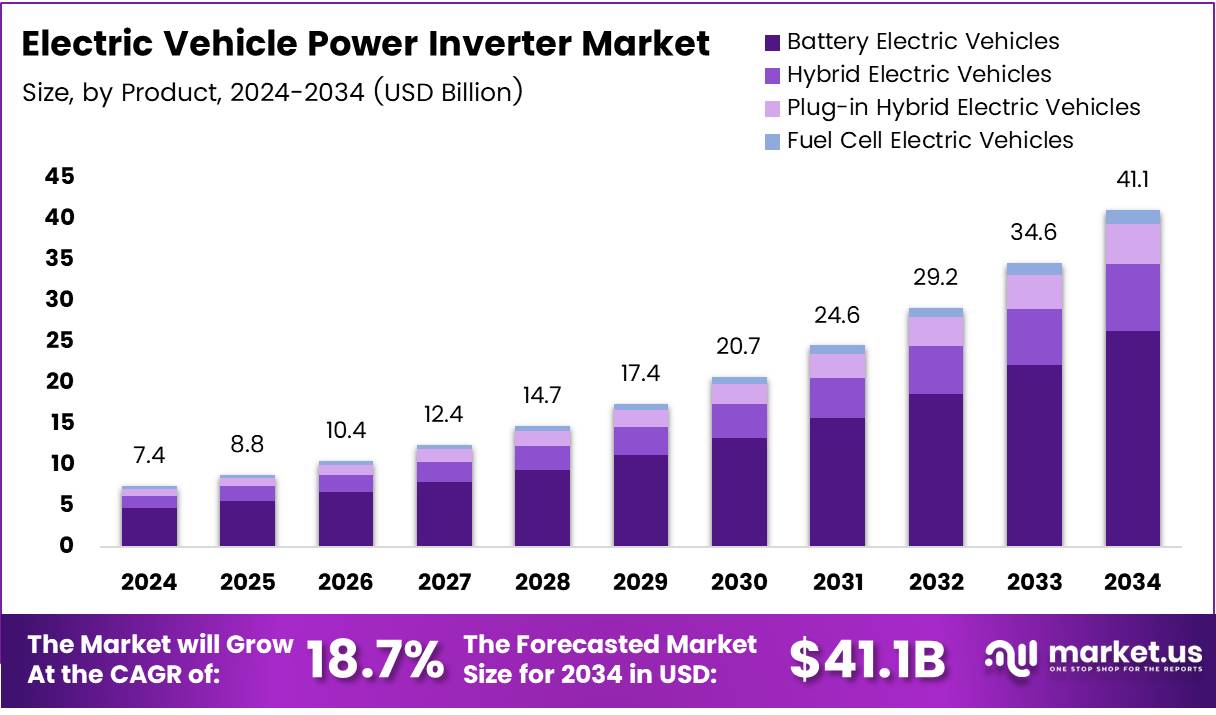

The Global Electric Vehicle Power Inverter Market size is expected to be worth around USD 41.1 Billion by 2034, from USD 7.4 Billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034.

The Electric Vehicle (EV) power inverter market plays a pivotal role in the efficient operation of electric vehicles by converting DC power from the battery into AC power to drive the electric motor. With the rise in EV adoption globally, this market has been growing significantly, driven by advancements in power electronics, increased consumer demand, and government incentives. According to ScienceDirect, 26 million EVs, including battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), were registered worldwide in 2022, indicating strong market momentum.

The EV power inverter market is witnessing robust growth due to the expanding EV fleet and the demand for improved driving efficiency. As countries push towards electrification, the demand for high-performance inverters to enhance vehicle performance and range is growing.

CNBC reported that in the U.S., approximately 3.2 million electrified vehicles were sold, with 1.3 million being all-electric models, signaling increasing consumer confidence in EV technology. This growth in sales is expected to drive the need for more sophisticated and efficient power inverters.

The market offers substantial opportunities for companies that focus on developing more efficient, compact, and cost-effective inverters. Technological advancements, such as the adoption of silicon carbide (SiC) in power inverters, provide a chance to enhance efficiency and reduce energy losses.

The growing demand for EVs in key markets like China, the U.S., and Europe presents new avenues for manufacturers. Additionally, according to Europa, the share of hybrid and electric vehicles in global car production increased from 21% in 2021 to 30% in 2023, indicating a rising market penetration and further opportunities for power inverter manufacturers.

Government investments and regulations are crucial drivers of the EV power inverter market. Several governments are introducing stringent emission standards, tax incentives, and subsidies to accelerate EV adoption. For instance, the U.S. has made significant investments in EV infrastructure, including incentives for consumers and manufacturers.

Regulatory frameworks in Europe and China also play an essential role in shaping the demand for EV power inverters, creating a favorable environment for market expansion. These government-driven initiatives ensure a growing demand for EV components, including power inverters.

Key Takeaways

- Global Electric Vehicle Power Inverter Market is expected to reach USD 41.1 Billion by 2034, growing at a CAGR of 18.7% from 2025 to 2034.

- Battery Electric Vehicles (BEVs) held a dominant market position in By Hybrid Electric Vehicles Analysis with 63.8% market share in 2024.

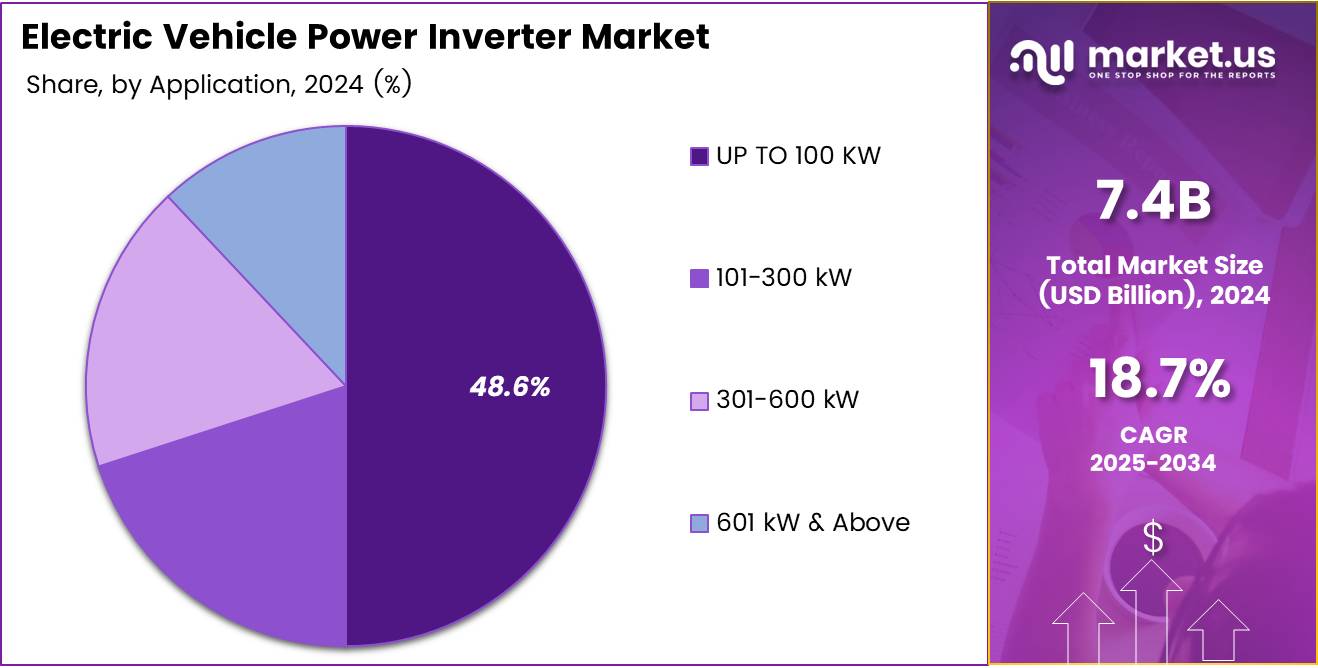

- UP TO 100 KW power output range led the market in By Power Output Analysis with 48.6% market share in 2024.

- Passenger Cars dominated the market in By Vehicle Type Analysis, capturing 72.6% market share in 2024.

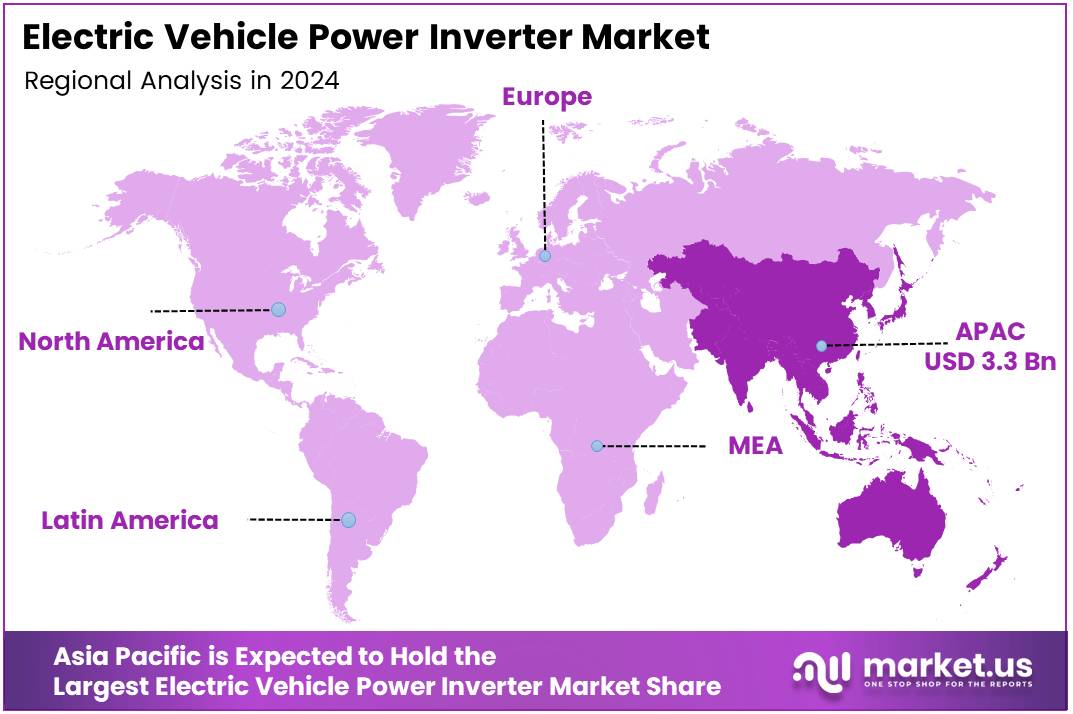

- Asia Pacific region held a dominant market share of 44.6%, valued at USD 3.3 billion in 2024.

Hybrid Electric Vehicles Analysis

Battery Electric Vehicles lead with 63.8% in Hybrid Electric Vehicles Analysis segment

In 2024, Battery Electric Vehicles (BEVs) held a dominant market position in the Electric Vehicle Power Inverter Market, capturing a remarkable 63.8% share in the By Hybrid Electric Vehicles Analysis segment. This growth can be attributed to the continued advancements in battery technology, coupled with a growing global emphasis on reducing carbon emissions. BEVs provide a fully electric alternative, making them a preferred choice among environmentally conscious consumers.

Hybrid Electric Vehicles (HEVs) follow closely behind, contributing significantly to the market. With both an electric motor and a traditional internal combustion engine, HEVs offer a practical solution for those seeking fuel efficiency without completely transitioning to electric-only vehicles. Their appeal lies in their ability to reduce fuel consumption while providing flexibility in long-range driving.

Plug-in Hybrid Electric Vehicles (PHEVs) also make a noteworthy impact. PHEVs combine the best of both worlds, allowing drivers to travel short distances on electricity alone, while still maintaining the option of using gasoline for longer trips. This versatility attracts a wide range of consumers.

Fuel Cell Electric Vehicles (FCEVs), though a smaller segment, are emerging as a clean alternative powered by hydrogen. With advancements in hydrogen production and refueling infrastructure, FCEVs have the potential to drive further growth in the market.

Power Output Analysis

UP TO 100 KW holds 48.6% in Power Output Analysis segment

In 2024, the UP TO 100 KW power output range led the Electric Vehicle Power Inverter Market in the By Power Output Analysis segment, with a commanding 48.6% market share. This range is primarily used in smaller to mid-sized electric vehicles that are ideal for urban commuting. The growing popularity of affordable, efficient EVs in city environments is a key factor driving this segment’s dominance.

The 101-300 kW range captures a significant portion of the market, with its increasing application in larger vehicles that require more power, such as SUVs and commercial vehicles. As the demand for higher-performance EVs grows, this range continues to show strong potential.

The 301-600 kW category is seeing growth due to its use in luxury and high-performance vehicles. EVs in this range offer superior acceleration and longer driving ranges, attracting consumers looking for premium options.

Lastly, the 601 kW & Above segment, though smaller in comparison, caters to ultra-performance vehicles and heavy-duty electric trucks. This segment is expected to expand as the market for specialized, high-powered electric vehicles increases.

Vehicle Type Analysis

Passenger Cars dominate with 72.6% in Vehicle Type Analysis segment

In 2024, Passenger Cars held a dominant position in the Electric Vehicle Power Inverter Market, with a market share of 72.6% in the By Vehicle Type Analysis segment. This dominance reflects the increasing consumer demand for affordable, efficient, and eco-friendly transportation options. As more automakers launch electric models, the popularity of passenger electric vehicles continues to grow.

While Passenger Cars lead, Commercial Vehicles also represent a rapidly growing segment. With businesses seeking cost savings, environmental benefits, and lower operating costs, electric commercial vehicles—such as delivery vans and trucks—are becoming an attractive option. This segment’s growth is further fueled by government incentives and regulations aimed at reducing emissions in the commercial transportation sector.

The electric vehicle market is poised for growth across both segments, with Passenger Cars remaining the primary driver of adoption while Commercial Vehicles show great promise for future expansion.

Key Market Segments

By Hybrid Electric Vehicles

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

By Power Output

- UP TO 100 KW

- 101-300 kW

- 301-600 kW

- 601 kW & Above

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Growing EV Adoption Fuels Demand for Electric Vehicle Power Inverters

The global rise in electric vehicle (EV) adoption is boosting demand for power inverters, which convert battery DC power into AC for motor use. As EVs become more popular due to fuel savings and lower emissions, the need for efficient inverters is growing. This trend is encouraging automakers to invest in advanced inverter technology that enhances EV performance and range.

Government support through subsidies and strict emissions laws is accelerating EV sales. These incentives are driving demand for inverters, as every electric vehicle relies on them for power conversion. As more countries push green mobility, inverter demand is set to rise.

Technology improvements are making EV power inverters more efficient and affordable. New designs offer better energy conversion, compact size, and improved cooling. These advancements not only boost EV performance but also attract buyers and manufacturers looking for reliable, cost-effective solutions.

Restraints

High Initial Cost Restrains Electric Vehicle Power Inverter Market Growth

Despite progress, the high cost of producing power inverters keeps EV prices high, which can deter potential buyers. This is especially true in cost-sensitive markets where affordability plays a major role in vehicle choice. Until costs drop, inverter adoption may remain limited.

Lack of widespread charging infrastructure also hinders EV and inverter market growth. Without convenient access to charging stations, consumers hesitate to switch to electric vehicles. This slows inverter demand, especially in rural and developing regions with limited EV support systems.

Growth Factors

Integration with Renewable Energy Sources Creates Growth Opportunities for Power Inverters

Linking power inverters with renewable energy sources like solar or wind enables clean, efficient EV charging. These systems help reduce reliance on the grid and support green energy goals. As demand for sustainable transport grows, this integration offers strong market potential.

Improving inverter efficiency is another growth area. High-performance inverters boost driving range and reduce energy waste. This makes EVs more practical for consumers, encouraging wider adoption and driving inverter sales.

Emerging markets such as India and Southeast Asia are seeing increased EV interest. As infrastructure develops, demand for affordable and efficient inverters will grow, creating opportunities for new players and localized solutions.

Emerging Trends

Solid-State Inverter Technology Emerges as a Key Trend in the EV Market

Solid-state inverters are becoming popular for being smaller, lighter, and more efficient than traditional ones. Using advanced materials, these inverters improve EV performance and battery life, making them a key trend in future vehicle designs.

Vehicle-to-Grid (V2G) technology, where EVs send power back to the grid, is gaining traction. This creates demand for bidirectional inverters, which enable two-way energy flow. As smart energy systems grow, so will interest in V2G-ready inverters.

Autonomous and connected EVs need advanced inverters to handle higher electrical loads. As these high-tech vehicles grow in number, demand for smarter, high-capacity inverters is expected to rise.

Regional Analysis

Asia Pacific Dominates the Electric Vehicle Power Inverter Market with a Market Share of 44.6%, Valued at USD 3.3 Billion

The Asia Pacific region leads the electric vehicle power inverter market with a dominant share of 44.6%, valued at USD 3.3 billion. This is driven by the rapid adoption of electric vehicles (EVs) in countries such as China, Japan, and South Korea, alongside strong government support for sustainable transportation solutions. The high concentration of EV manufacturing facilities and a large consumer base further fuel growth in the region.

Regional Mentions:

North America follows closely, driven by the increasing demand for EVs and the growing investment in infrastructure for electric mobility. The region’s market growth is bolstered by advancements in battery technology and the ongoing push for greener transportation options.

Europe, with a rising focus on reducing carbon emissions and advancing green technologies, has become a significant player in the electric vehicle market. Strong policies and incentives from the European Union are fostering innovation and increasing the adoption of electric vehicles and related technologies, including power inverters.

The Middle East & Africa is still in the early stages of electric vehicle adoption, with limited infrastructure and high dependency on fossil fuels. However, some countries in the region are beginning to invest in renewable energy and electric mobility, which could drive future growth in the power inverter market.

Latin America, while relatively small in comparison to other regions, is witnessing a gradual increase in electric vehicle sales, particularly in countries like Brazil and Mexico. The growing interest in clean energy and environmental sustainability is expected to contribute to the market’s expansion in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, Toyota Industries Corporation is anticipated to maintain a prominent position in the Electric Vehicle (EV) Power Inverter market, leveraging its vast expertise in automotive systems and power electronics. The company’s innovative solutions are key in optimizing the efficiency of EV powertrains, focusing on enhancing performance and reducing energy consumption in electric vehicles.

Robert Bosch GmbH is another major player, known for its leadership in automotive technology and its focus on the development of cutting-edge inverters that contribute to the optimization of EV powertrains. Bosch’s products are integral to improving the reliability and efficiency of electric vehicles, providing strong competition in the market.

Eaton Corporation continues to strengthen its footprint in the EV power inverter market with its diverse range of products, focusing on advanced electrical systems that enhance the energy efficiency of electric vehicles. Eaton’s strategic partnerships and deep technological capabilities are propelling its growth within the global EV market.

Valeo SA is highly active in the development of EV power electronics and inverters. With its focus on reducing vehicle emissions and improving performance, Valeo is playing a crucial role in advancing the adoption of electric mobility through high-performance, compact, and cost-effective inverters for electric vehicles. The company’s strong R&D efforts position it well for future market growth.

These companies are crucial drivers of innovation in the global EV power inverter market, continually shaping the industry with their technology and strategic investments.

Top Key Players in the Market

- Toyota Industries Corporation

- Robert Bosch GmbH

- Eaton Corporation

- Valeo SA

- Meidensha Corporation

- Tesla, Inc.

- BorgWarner Inc.

- Mitsubishi Electric Corporation

- Denso Corporation

- ZF Friedrichshafen AG

Recent Developments

- In February 2025, EV charging platform Presto raised $15 million in seed funding to accelerate the development of its next-generation EV charging solutions and expand its footprint in the global electric vehicle charging infrastructure market.

- In June 2025, EcoG partnered with Switch EV and acquired Josev EV charging OS to strengthen its position in the EV ecosystem, enhancing its platform’s capabilities with advanced software and charging management systems.

- In April 2025, a German startup launched a bidirectional charging kit for EVs, enabling vehicles to both charge and discharge electricity, thereby creating new possibilities for energy storage and grid management.

- In December 2024, ABB announced its decision to acquire Gamesa Electric’s business, including its Battery Energy Storage Systems (BESS) and utility inverters, expanding its portfolio in the renewable energy and energy storage sectors.

- In August 2024, Enteligent raised $6 million to scale the commercialization of its world’s first solar-powered DC-to-DC charger, offering a sustainable solution for electric vehicle charging that reduces dependency on traditional grid power.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 41.1 Billion CAGR (2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Hybrid Electric Vehicles (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Power Output (UP TO 100 KW, 101-300 kW, 301-600 kW, 601 kW & Above), By Vehicle Type (Passenger Cars, Commercial Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Toyota Industries Corporation, Robert Bosch GmbH, Eaton Corporation, Valeo SA, Meidensha Corporation, Tesla, Inc., BorgWarner Inc., Mitsubishi Electric Corporation, Denso Corporation, ZF Friedrichshafen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Vehicle Power Inverter MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Vehicle Power Inverter MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Toyota Industries Corporation

- Robert Bosch GmbH

- Eaton Corporation

- Valeo SA

- Meidensha Corporation

- Tesla, Inc.

- BorgWarner Inc.

- Mitsubishi Electric Corporation

- Denso Corporation

- ZF Friedrichshafen AG