Global WBG Power Devices Market By Type (GaN Power Devices, SiC Power Devices, Diamond Substrate Power Devices, Others), By Application (Automotive, Communication, Consumer Electronics, Aerospace, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143588

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

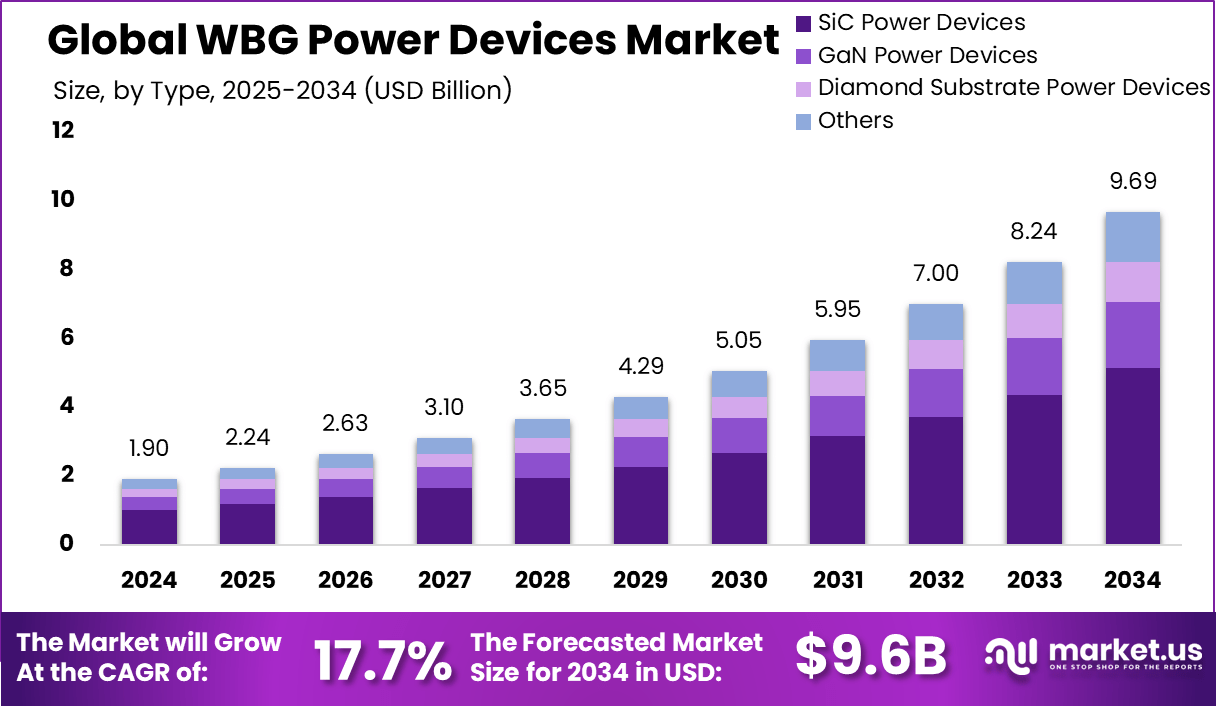

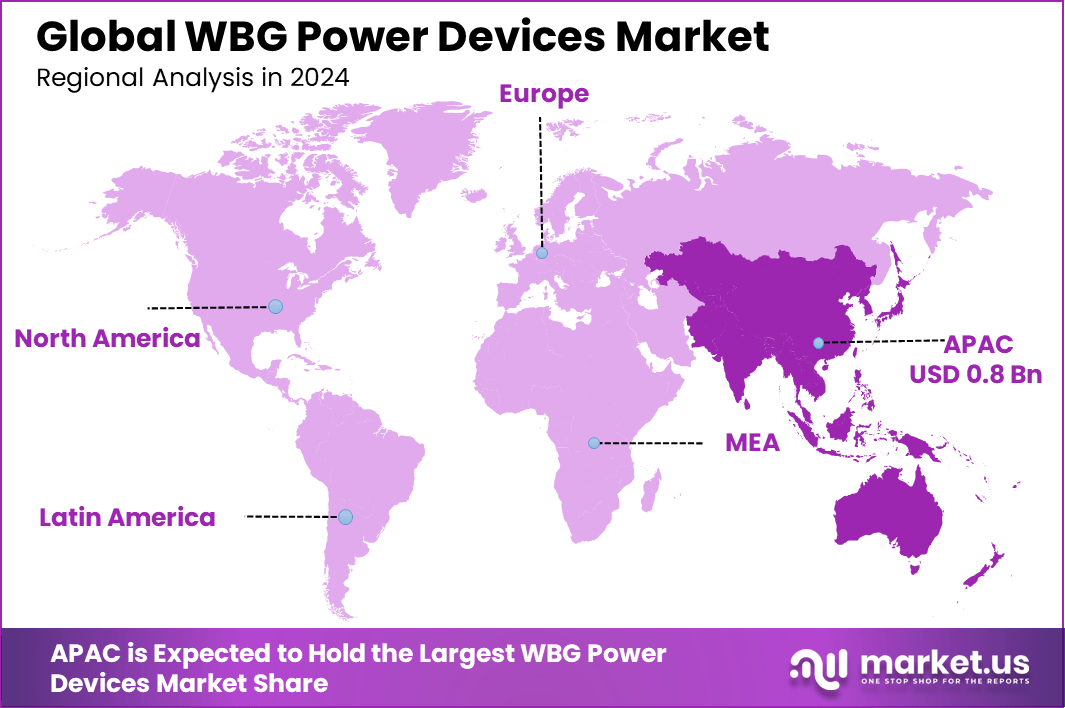

The Global WBG Power Devices Market size is expected to be worth around USD 9.7 Bn by 2034, from USD 1.9 Bn in 2024, growing at a CAGR of 17.7% during the forecast period from 2025 to 2034. Asia-Pacific (APAC) region is a dominating force in the Wide Band Gap (WBG) power devices market, holding a substantial share of 43.20%, which translates to approximately USD 0.8 billion.

Wide Bandgap (WBG) Power Devices refer to semiconductor devices made from materials such as silicon carbide (SiC) and gallium nitride (GaN). These materials allow the devices to operate at higher voltages, frequencies, and temperatures than traditional silicon-based devices, significantly enhancing their performance in power electronics.

WBG power devices are pivotal in applications that demand high efficiency and durability, such as in electric vehicles, renewable energy systems, and power supplies. The primary catalyst for the WBG power devices market is the escalating need for energy efficiency across multiple industries. These devices are essential in reducing energy losses and enhancing the performance of power systems, which is critical in the context of rising energy costs and growing environmental concerns.

There is a grow rapidly demand for WBG power devices driven by their superior performance attributes, such as lower energy losses and higher power density, compared to silicon devices. This demand spans various applications from industrial machinery and automotive to consumer electronics, all seeking to leverage the efficiency and longevity offered by WBG technologies

In December 2024, India introduced initiatives to support domestic industries, mandating that clean energy projects use locally produced solar photovoltaic modules starting June 2026. This move aims to decrease import dependence and bolster domestic manufacturing. Additionally, the government plans to offer up to $5 billion in incentives to companies that produce electronic components within the country, enhancing local value addition and strengthening supply chains.

The European Commission, under its Green Deal initiative, allocated approximately €1 billion specifically to foster innovation in high-performance power electronics based on wide bandgap semiconductors. Similarly, in the U.S., the Department of Energy (DOE) initiated a USD 100 million investment program aimed explicitly at advancing WBG technologies to promote energy conservation and renewable energy integration.

According to a Siemens AG report, incorporating SiC (Silicon Carbide) devices in power electronics can enhance efficiency by over 15%, substantially lowering manufacturing operational costs. Furthermore, the automotive sector is emerging as a key growth area, with major players like General Electric (GE) and Tesla increasingly using SiC and GaN-based components to improve electric vehicle (EV) performance and battery life.

The International Energy Agency (IEA) data indicates that the renewable energy sector, primarily wind and solar installations, is expected to see an annual growth rate of about 20% through 2030, driving significant demand. Additionally, advancements in GaN power devices are poised to transform power management solutions across telecommunications, data centers, and consumer electronics. These markets are collectively projected to exceed ~USD 15 billion by 2032.

Key Takeaways

- WBG Power Devices Market size is expected to be worth around USD 9.7 Bn by 2034, from USD 1.9 Bn in 2024, growing at a CAGR of 17.7%.

- SiC (Silicon Carbide) Power Devices held a commanding position in the WBG (Wide Bandgap) power devices market, securing over a 53.20% share.

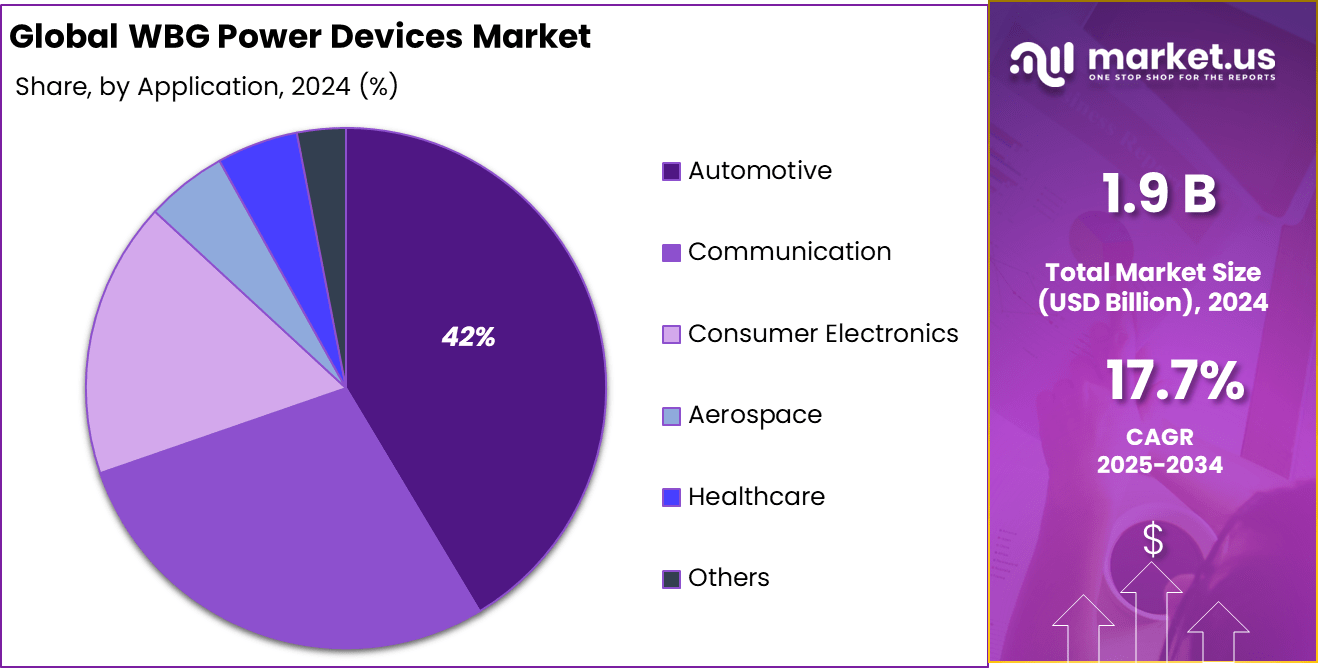

- Automotive sector significantly influenced the WBG power devices market by securing a dominant market position with a 41.20% share.

- Asia-Pacific (APAC) region is a dominating force in the Wide Band Gap (WBG) power devices market, holding a substantial share of 43.20%, which translates to approximately USD 0.8 billion.

Analysts’ Viewpoint

Adopting WBG power devices offers significant business benefits, including enhanced operational efficiency and reduced operational costs due to lower power consumption and decreased maintenance. These devices also enable companies to adhere to increasingly stringent energy regulations and sustainability goals, thereby not only improving their market competitiveness but also aligning with global environmental objectives.

The continuous expansion in applications of WBG power devices, especially in sectors like renewable energy and electric mobility, presents lucrative investment opportunities. Investors are particularly interested in companies innovating in SiC and GaN technologies, which are pivotal in driving forward the next generation of power electronics

Innovations such as the development of advanced packaging solutions that enhance the thermal and electrical performance of WBG devices are critical. For instance, new embedding techniques for PCBs are being utilized to improve device efficiency and reliability in high-power applications

The regulatory landscape is increasingly favoring technologies that can offer substantial energy savings and reduce carbon footprints. This regulatory push is accelerating the adoption of WBG power devices across various industries, further stimulating market growth

By Type Analysis

SiC Power Devices Lead with a 53.20% Market Share in 2024

SiC power devices hold a significant 53.20% market share due to their exceptional performance characteristics, which make them highly suitable for modern power applications demanding efficiency and durability.

The intrinsic properties of SiC, such as high thermal conductivity, high breakdown voltage, and the ability to operate at high temperatures, contribute to less power loss and higher efficiency in electronic devices. These features are particularly advantageous in sectors like renewable energy and automotive, where the need for reliable and efficient power management is critical.

Additionally, the ability of SiC devices to handle higher voltages and frequencies with better thermal properties than silicon makes them ideal for applications in high-power settings, driving their adoption across a range of industrial applications

By Application

Wide Bandgap (WBG) Power Devices Surge in the Automotive Sector with 41.20% Market Share in 2024

The substantial market share of 41.20% in the automotive sector is driven by the critical role SiC power devices play in electric and hybrid vehicles. As the automotive industry shifts towards more sustainable solutions, SiC power devices meet the demand for efficient power conversion systems essential for electric vehicles (EVs), including onboard chargers, inverters, and powertrain components.

These devices enhance the range and efficiency of EVs by reducing energy losses during power conversion processes. The ongoing innovation and improvements in SiC technology also help in downsizing power electronics components, making vehicles lighter and enhancing overall vehicle performance.

The continuous push for more environmentally friendly automotive solutions ensures that the demand for SiC power devices in this sector remains strong. The adoption of SiC power devices in automotive applications is not just a trend but a crucial component in the industry’s drive towards more energy-efficient and high-performance vehicle systems.

Key Market Segments

By Type

- GaN Power Devices

- SiC Power Devices

- Diamond Substrate Power Devices

- Others

By Application

- Automotive

- Communication

- Consumer Electronics

- Aerospace

- Healthcare

- Others

Driver

Increasing Demand for Energy Efficiency

The push for greater energy efficiency stands as a fundamental driver for the growth of the Wide Band Gap (WBG) Power Devices market. As global energy consumption rises, industries and governments are prioritizing technologies that can reduce energy waste.

WBG devices, including silicon carbide (SiC) and gallium nitride (GaN), play a critical role in this arena due to their ability to operate efficiently at higher voltages, frequencies, and temperatures compared to traditional silicon devices. Their superior performance is pivotal in applications ranging from renewable energy systems to electric vehicles, where efficiency improvements can lead to significant reductions in carbon emissions and operational costs.

Restraint

Complex Manufacturing Processes

One major restraint in the WBG power devices market is the complexity of their manufacturing processes. Producing WBG devices, particularly those made from materials like SiC and GaN, involves intricate fabrication techniques that are not only costly but also require high precision and quality control.

This complexity can lead to higher production costs, limiting their widespread adoption, especially in cost-sensitive markets. Despite ongoing advancements in manufacturing technologies, the initial setup and maintenance of production facilities for WBG devices pose significant challenges that can deter new entrants and slow down market growth.

Opportunity

Expansion in Electric Vehicle Markets

WBG power devices are increasingly crucial in the automotive sector, particularly for electric and hybrid electric vehicles (EVs/HEVs). As the automotive industry continues to evolve towards electrification, the demand for efficient, high-performance power electronics that can enhance the range and durability of EVs is growing.

WBG devices meet these needs by enabling more efficient power conversion systems, thereby reducing energy losses and improving vehicle performance. This trend is supported by government incentives and regulations aimed at increasing the adoption of EVs, representing a significant growth opportunity for the WBG power devices market.

Challenge

Thermal Management Issues

Despite their many advantages, WBG power devices face challenges related to thermal management. As these devices operate at higher voltages and power densities, they generate significant heat, which can affect performance and reliability. Effective thermal management solutions are necessary to maintain the integrity and efficiency of WBG devices.

Developing these solutions involves advanced materials and innovative cooling techniques that can add to the complexity and cost of WBG systems. Addressing these thermal issues is crucial for the wider adoption and long-term success of WBG technologies in various high-power applications.

Growth Factors

The Wide Band Gap (WBG) Power Devices market is seeing significant growth, primarily driven by the need for energy-efficient solutions across various industries. WBG devices like silicon carbide (SiC) and gallium nitride (GaN) are central to this trend, offering high efficiency and performance over traditional silicon devices.

These devices are essential in applications demanding high voltage and power handling capabilities, such as in electric vehicles, renewable energy systems, and industrial power supplies. The rising demand for energy-efficient power electronics, spurred by global pushes towards greener energy practices, underscores this growth

Emerging Trends

There are several emerging trends within the WBG power devices sector that are set to redefine market dynamics. Notably, the adoption of GaN and SiC in sectors like automotive, industrial, and renewable energy highlights the shift towards more robust and efficient power solutions.

Advances in material science and fabrication technologies are enabling these devices to handle higher power densities and efficiencies, making them increasingly attractive in high-performance sectors. Additionally, trends towards miniaturization and integration of power devices into more compact and efficient systems are evident, driven by advancements in semiconductor processing and design techniques.

Business Benefits

Integrating WBG power devices brings substantial business benefits, particularly in operational efficiencies and cost savings. These devices significantly reduce power losses, which in turn lowers energy costs and enhances system performance and reliability.

Industries that deploy these devices, such as automotive and industrial manufacturers, benefit from their enhanced power handling capabilities and improved thermal management, leading to longer system lifespans and reduced maintenance costs. Furthermore, companies leveraging WBG technology can achieve better compliance with stringent energy efficiency regulations, gaining a competitive edge in increasingly eco-conscious marketplaces

Regional Analysis

The Asia-Pacific (APAC) region is a dominating force in the Wide Band Gap (WBG) power devices market, holding a substantial share of 43.20%, which translates to approximately USD 0.8 billion in market value. This commanding presence is fueled by several key factors that make APAC a hotspot for WBG technologies.

Predominantly, the rapid industrialization across major economies such as China, Japan, and South Korea contributes significantly to the region’s market expansion. These countries are spearheading advancements in sectors that heavily utilize WBG power devices, including automotive, renewable energy, and consumer electronics.

China, in particular, is a major contributor to the region’s dominance, driven by its aggressive environmental policies and significant investments in electric vehicles (EVs) and renewable energy infrastructures, such as solar and wind power installations.

Furthermore, the region benefits from a well-established semiconductor manufacturing base, which provides a robust supply chain and R&D capabilities that are crucial for the development and commercialization of advanced WBG power devices.

Government support in the form of subsidies, incentives, and favorable policies also plays a critical role in fostering growth within this sector, making APAC an attractive market for both local and international investors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Efficient Power Conversion (EPC) is at the forefront of gallium nitride (GaN) technology, providing a range of GaN-based power devices that offer significant improvements in performance over traditional silicon solutions. EPC’s products are geared towards applications that demand high efficiency, including wireless power transfer and data center power supplies, positioning them as a leader in GaN power electronics innovation.

Fuji Electric is renowned for its robust portfolio of power semiconductor products, including WBG devices. The company leverages its expertise in energy and power electronics to develop SiC power modules that enhance performance in high-voltage industrial applications. Fuji Electric’s focus on durable and reliable products supports critical infrastructure and advanced industrial systems worldwide.

GaN Systems specializes in providing GaN-based power devices that are designed to replace traditional silicon technologies in various high-efficiency applications. Their products are used in consumer, industrial, and automotive sectors, delivering high performance with reduced size and weight, which is critical for modern energy solutions and electronic devices.

GeneSiC GeneSiC is a pioneer in silicon carbide (SiC) technology, developing high-quality SiC devices for high-temperature, high-voltage, and high-frequency conditions. Their products are crucial for applications in harsh environments, such as automotive drivetrains, renewable energy inverters, and power supplies, offering superior reliability and efficiency.

Top Key Players

- Efficient Power Conversion (EPC)

- Fuji Electric Co., Ltd.

- GaN Systems

- GeneSiC

- Infineon

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ROHM CO., LTD.

- STMicroelectronics

- TOSHIBA CORPORATION

- United Silicon Carbide Inc

- VisIC Technologies

Recent Developments

- In 2024, EPC continues to leverage its expertise in GaN to expand its market presence. This includes enhancing the performance of power systems in various applications such as data centers, automotive, and renewable energy systems.

- Fuji Electric is actively enhancing its semiconductor offerings for electrified vehicles, which is a major component of their business strategy moving forward.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 9.7 Bn CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (GaN Power Devices, SiC Power Devices, Diamond Substrate Power Devices, Others), By Application (Automotive, Communication, Consumer Electronics, Aerospace, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Efficient Power Conversion (EPC, Fuji Electric Co., Ltd., GaN Systems, GeneSiC, Infineon, Microchip Technology Inc., Mitsubishi Electric Corporation, ROHM CO., LTD., STMicroelectronics, TOSHIBA CORPORATION, United Silicon Carbide Inc, VisIC Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Efficient Power Conversion (EPC)

- Fuji Electric Co., Ltd.

- GaN Systems

- GeneSiC

- Infineon

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ROHM CO., LTD.

- STMicroelectronics

- TOSHIBA CORPORATION

- United Silicon Carbide Inc

- VisIC Technologies