Electric Scooter and Motorcycle Market Report By Type (Electric Scooters , Electric Motorcycles), By Battery Type (Lithium-ion Battery , Lead Acid Battery , Others), By Voltage Segment (24V , 36V , 48V , Above 48V), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 62156

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

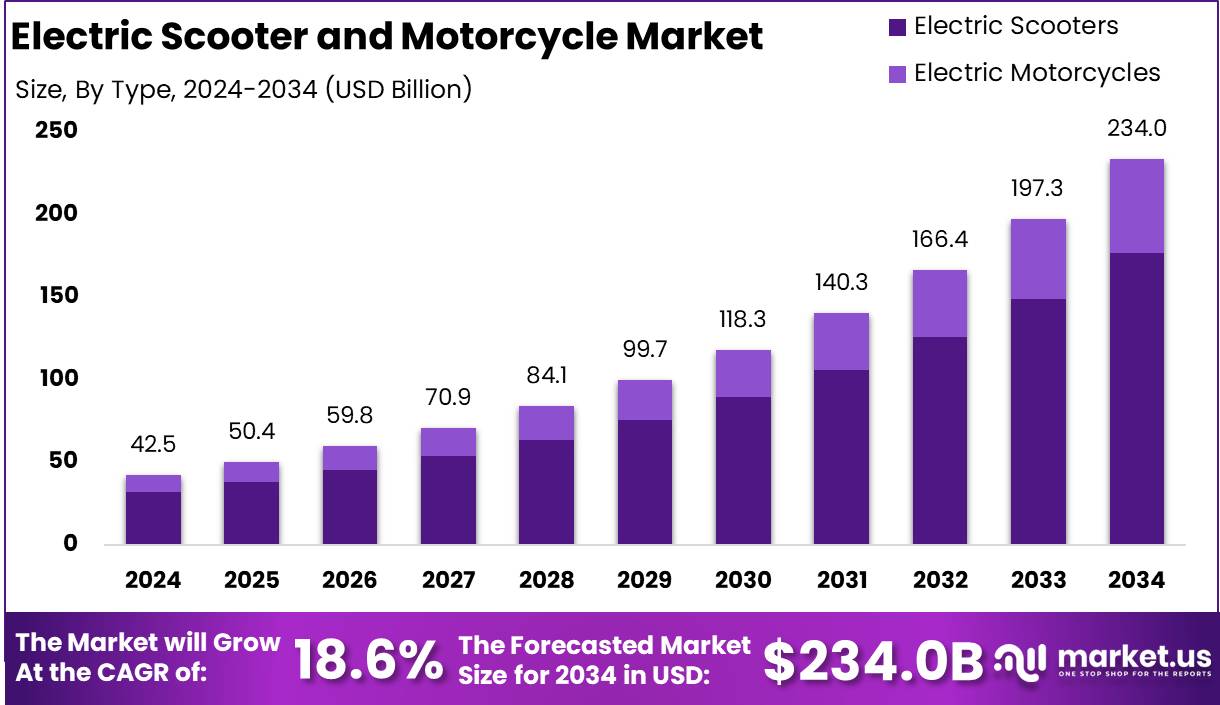

The Global Electric Scooter and Motorcycle Market size is expected to be worth around USD 234.0 Billion by 2034 from USD 42.5 Billion in 2024, growing at a CAGR of 18.6% during the forecast period from 2025 to 2034.

Electric scooters and motorcycles are two-wheeled electric-powered vehicles designed for personal and commercial transportation. Unlike conventional motorcycles and scooters that rely on internal combustion engines, these vehicles use electric motors powered by rechargeable batteries.

Electric scooters are typically smaller, lightweight, and suited for short-distance commuting, while electric motorcycles are designed for higher speeds and longer ranges, comparable to traditional motorcycles.

These vehicles are celebrated for their eco-friendly operation, reduced maintenance costs, and efficiency in urban and suburban mobility. Advancements in battery technology, lightweight materials, and electric drivetrain systems have significantly enhanced their performance, making them a viable alternative to fuel-powered vehicles.

The electric scooter and motorcycle market encompasses the global industry focused on the design, production, distribution, and sale of electric-powered two-wheelers. This market includes a diverse range of electric scooters and motorcycles, from compact urban scooters to high-performance electric motorcycles. Key stakeholders include manufacturers, component suppliers, technology developers, distributors, and end-users.

The market is driven by increasing environmental awareness, stringent emission regulations, government incentives for electric vehicles (EVs), and the growing trend of sustainable urban mobility. Rapid urbanization, rising fuel prices, and advancements in battery technology further propel market expansion. The industry also encompasses ancillary services such as battery swapping, charging infrastructure, and after-sales support.

The growth of the electric scooter and motorcycle market can be attributed to a combination of environmental, technological, and economic factors. The global shift towards sustainable transportation solutions has spurred demand for electric vehicles, with electric scooters and motorcycles emerging as practical, cost-efficient alternatives to traditional two-wheelers.

Government initiatives, including subsidies, tax benefits, and the establishment of EV-friendly infrastructure, have further accelerated market adoption. Additionally, ongoing advancements in lithium-ion batteries have enhanced vehicle performance, offering longer range, faster charging, and improved efficiency.

The demand for electric scooters and motorcycles is primarily driven by the rising need for efficient, low-emission urban transportation. With the increasing adoption of electric mobility, these vehicles are gaining traction as a sustainable and economical alternative to traditional fuel-powered two-wheelers. Growing environmental consciousness, coupled with government policies favoring electric mobility, has significantly boosted consumer interest.

The electric scooter and motorcycle market presents significant opportunities driven by evolving consumer preferences, regulatory support, and technological innovation. One of the most promising areas is the development of high-performance electric motorcycles designed for long-distance travel, which could appeal to traditional motorcycle enthusiasts seeking sustainable alternatives.

Strategic partnerships between automotive manufacturers and technology firms to develop advanced battery management systems and charging solutions also offer substantial growth potential.

According to Bikesure, the Electric Scooter and Motorcycle Market is witnessing a significant shift in consumer preferences, with 46.7% of riders expressing a desire to own an electric motorbike or scooter/moped, while 3.6% already possess one. The appeal of instant torque and power from electric models excites 57.8% of potential buyers. However, 65.1% of respondents cite limited travel distance before recharging as a deterrent.

Interestingly, 43.7% of consumers believe electric models are more economical compared to petrol counterparts, while 44% oppose banning petrol-powered bikes, despite 38.3% acknowledging the carbon reduction benefits.

Notably, this environmental consideration is less prioritized by older age groups, with only 25.3% of individuals over 65 and 33% aged 55-64 focusing on reducing their carbon footprint. Furthermore, opinions are divided on policy changes, as 44% of respondents feel that petrol engines should never be banned, contrasting with another 44% advocating for a ban by 2030 or later.

According to Electron, the Electric Scooter and Motorcycle Market is witnessing significant growth driven by increased adoption and investment. In the United States, men constitute 75% of electric scooter trips, while the e-scooter-sharing industry is projected to reach 133.80 million users by 2027. Bird, a leading investor, has invested $2 billion in electric scooters, contributing to the expansion of the 252 electric scooter systems currently available in the country as of 2024.

Furthermore, injuries linked to e-scooters, e-bikes, and hoverboards have surged by 70% over the last four years, raising safety concerns. Despite this, 72% of users with incomes below $25K express positive perceptions of electric scooters. Notably, in 2023, 8% of all two-wheelers on the road are expected to be electric, indicating a gradual shift towards sustainable mobility solutions.

Key Takeaways

- Global Electric Scooter and Motorcycle Market is expected to grow from USD 42.5 billion in 2024 to USD 234.0 billion by 2034, at a CAGR of 18.6%.

- Electric scooters held a dominant 75.6% share of the market in 2024.

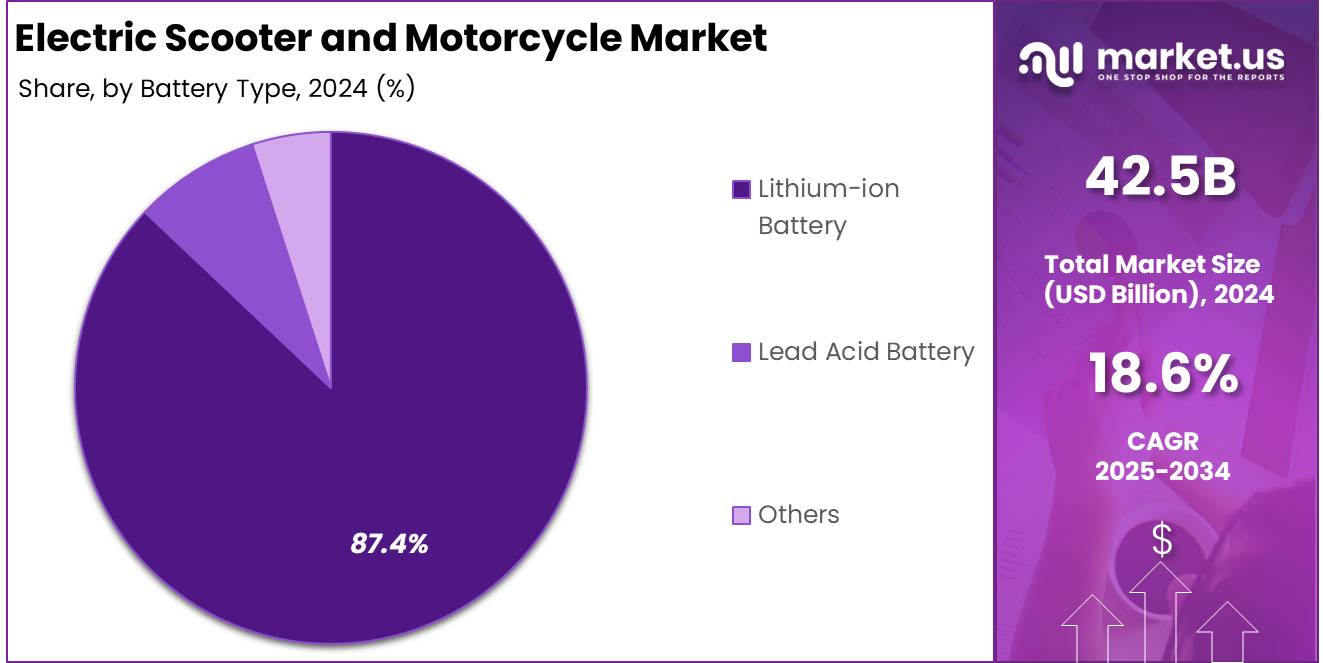

- Lithium-ion batteries accounted for more than 87.4% of the market share in 2024.

- Electric vehicles with above 48V systems captured over 80.6% of the market in 2024.

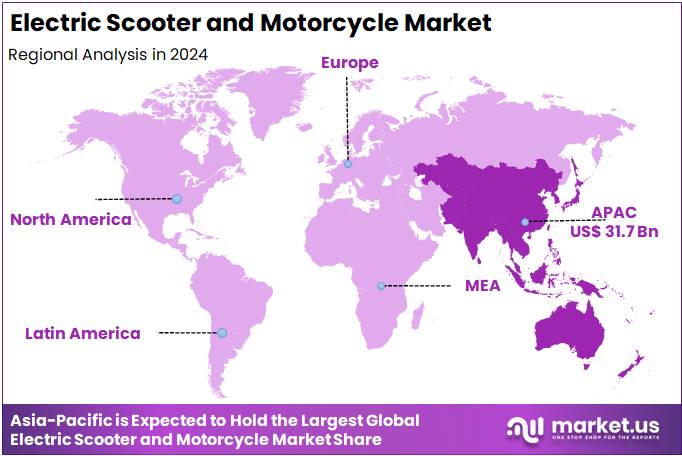

- Asia-Pacific led the market with a 74.6% share in 2024, valued at USD 31.7 billion.

By Type Analysis

Electric Scooters Dominated The Electric Scooter and Motorcycle Market 75.6% Share

In 2024, Electric Scooters held a dominant market position in the Electric Scooter and Motorcycle Market, capturing more than a 75.6% share. This substantial market presence is attributed to the growing consumer preference for electric scooters as a cost-effective and eco-friendly urban mobility solution.

The increasing adoption rate of electric scooters among commuters and the expansion of charging infrastructure in metropolitan areas have further driven their dominance in the market.

The market growth of electric scooters is also propelled by favorable government initiatives, including subsidies and incentives for electric two-wheelers, particularly in regions experiencing heightened air pollution levels.

Furthermore, the integration of advanced features such as smart connectivity, GPS tracking, and battery management systems has enhanced the appeal of electric scooters, making them a preferred choice among urban consumers.

the Electric Motorcycles segment holds a comparatively smaller share of the Electric Scooter and Motorcycle Market. Despite this, the segment is experiencing steady growth driven by the rising consumer preference for high-performance electric two-wheelers, especially among enthusiasts and long-distance commuters.

The increasing focus on sustainable mobility solutions, combined with the introduction of electric motorcycles that offer enhanced range and powerful torque, is positively influencing the segment’s growth. Furthermore, advancements in fast-charging technology and battery improvements are expected to accelerate the adoption of electric motorcycles, particularly in areas where charging infrastructure is well established.

By Battery Type Analysis

Lithium-ion Battery Dominated The Electric Scooter and Motorcycle Market 87.4% Share

In 2024, Lithium-ion Battery held a dominant market position in the Electric Scooter and Motorcycle Market, capturing more than an 87.4% share. The dominance of lithium-ion batteries is attributed to their superior energy density, longer lifespan, and faster charging capabilities compared to conventional battery types. These advantages make lithium-ion batteries the preferred choice for electric scooters and motorcycles, particularly in urban areas where quick charging and long-distance commuting are essential.

The growing focus on reducing carbon emissions and the increasing adoption of electric mobility solutions have significantly contributed to the market expansion of lithium-ion batteries. Additionally, ongoing advancements in battery technology, including improvements in energy storage capacity and safety features, are expected to further strengthen the market share of lithium-ion batteries in the electric two-wheeler segment.

Lead Acid Batteries hold a comparatively smaller share in the Electric Scooter and Motorcycle Market. Despite being a more economical option, the limited lifespan, lower energy density, and longer charging times associated with lead acid batteries make them less favorable for modern electric scooters and motorcycles. However, their continued use in low-cost electric vehicles and entry-level models helps maintain a stable demand.

The segment’s growth is further influenced by manufacturers focusing on cost-sensitive markets where affordability takes precedence over performance. Additionally, the availability of recycling infrastructure for lead acid batteries and their proven reliability in basic electric two-wheeler models contribute to sustaining their presence in the market.

The Others segment in the Electric Scooter and Motorcycle Market, which includes emerging battery technologies like nickel-metal hydride and solid-state batteries, holds a relatively minor share. This segment’s limited market presence is primarily attributed to the early-stage development of alternative battery technologies, which have yet to achieve widespread commercial adoption.

By Voltage Analysis

Above 48V Dominated The Electric Scooter and Motorcycle Market 80.6% Share

In 2024, Above 48V held a dominant market position in the Electric Scooter and Motorcycle Market, capturing more than an 80.6% share. This significant market dominance can be attributed to the growing demand for high-performance electric two-wheelers that require higher voltage systems to deliver increased power and extended range. These vehicles are particularly popular among consumers seeking enhanced speed and long-distance commuting capabilities.

The preference for above 48V electric scooters and motorcycles is also driven by the increasing number of models equipped with advanced battery management systems and efficient power output. Additionally, the rising adoption of electric motorcycles for both urban commuting and recreational purposes has further strengthened the market share of this segment, making it a critical component of the electric two-wheeler market.

The 48V segment accounts for a moderate share of the Electric Scooter and Motorcycle Market. It remains a popular choice for mid-range electric scooters due to its balanced power output and affordability. The compatibility of 48V systems with various electric scooter models, particularly those designed for urban commuting, contributes to its steady demand.

The continued use of 48V systems is primarily seen in commuter scooters that require sufficient power without significantly increasing the overall vehicle cost. Additionally, the availability of 48V battery packs with improved energy density and reduced weight has made these systems a practical option for both manufacturers and consumers.

The 36V segment holds a smaller share in the Electric Scooter and Motorcycle Market. These systems are generally found in entry-level electric scooters and light electric motorcycles. Their lower power output and limited range make them less suitable for high-performance applications but ideal for short-distance commuting.

Manufacturers targeting budget-conscious consumers often opt for 36V systems to keep production costs low while maintaining basic performance standards. Additionally, the compact design and relatively lower weight of 36V batteries make them suitable for lightweight electric two-wheelers.

The 24V segment accounts for a minor share of the Electric Scooter and Motorcycle Market. These low-voltage systems are primarily utilized in low-speed electric scooters designed for short-distance, low-power applications. Due to their limited power and range, they are mostly used in niche segments such as children’s electric scooters and lightweight urban mobility solutions.

The minimal adoption of 24V systems is mainly attributed to their inability to meet the performance requirements of modern electric two-wheelers. However, they remain relevant in specific applications where low cost and simplicity are prioritized over performance.

Key Market Segments

By Type

- Electric Scooters

- Electric Motorcycles

By Battery Type

- Lithium-ion Battery

- Lead Acid Battery

- Others

By Voltage

- 24V

- 36V

- 48V

- Above 48V

Driver

Increasing Urbanization and Traffic Congestion

The global electric scooter and motorcycle market is experiencing robust growth driven by rapid urbanization and the resulting increase in traffic congestion. As cities around the world continue to expand, the pressure on urban transportation networks intensifies. This has led to heightened demand for efficient, compact, and environmentally friendly commuting solutions. Electric scooters and motorcycles, known for their agility, compact design, and emission-free operation, are increasingly viewed as ideal solutions for urban mobility challenges.

The push for cleaner cities and sustainable transportation systems has prompted municipal governments to encourage the adoption of electric two-wheelers. Consequently, the market is witnessing significant growth, propelled by the alignment of electric scooters and motorcycles with urban planning strategies that prioritize reduced emissions and traffic efficiency.

Moreover, rising consumer awareness regarding environmental issues and the introduction of urban policies aimed at reducing carbon footprints further bolster the market’s expansion. Governments in various regions are incentivizing the adoption of electric two-wheelers by offering subsidies and tax exemptions, thereby making them more accessible to the general public.

The affordability factor, coupled with the rising cost of fossil fuels, has made electric scooters and motorcycles increasingly attractive to commuters, particularly in densely populated cities. As the preference for sustainable transportation solutions continues to grow, the electric scooter and motorcycle market is anticipated to maintain an upward trajectory, driven by urban-centric demand and governmental support.

Restraint

Limited Battery Capacity and Charging Infrastructure

Despite the growing demand for electric scooters and motorcycles, the market faces a significant restraint in the form of limited battery capacity and inadequate charging infrastructure. While advancements have been made in battery technology, electric two-wheelers still face challenges in terms of range and charging convenience compared to traditional gasoline-powered vehicles.

The limited mileage offered by current battery technology often restricts their utility for long-distance commuting, which can deter potential consumers, particularly in regions where charging stations are sparse. This challenge is exacerbated in rural or less-developed areas, where the absence of charging infrastructure significantly hinders the adoption of electric scooters and motorcycles.

Additionally, the time required to charge electric two-wheelers remains a critical issue. Unlike refueling a conventional motorcycle, which takes mere minutes, charging an electric scooter or motorcycle can take several hours. Fast-charging solutions are emerging, but they are often associated with higher costs and limited availability.

Consumers who rely on their vehicles for daily commutes may find this inconvenience a substantial drawback. As a result, the growth of the electric scooter and motorcycle market may be impeded unless substantial investments are made in expanding charging networks and enhancing battery efficiency. Overcoming these infrastructure challenges remains crucial for achieving widespread adoption and long-term market growth.

Opportunity

Technological Advancements Enhancing Performance and User Experience

The global electric scooter and motorcycle market is poised to capitalize on the rapid technological advancements in electric mobility. Innovations in battery technology, such as the development of lithium-ion and solid-state batteries, are significantly improving the range and performance of electric two-wheelers. These advancements not only enhance the efficiency of electric vehicles but also reduce charging times, making them more convenient for daily use.

As manufacturers continue to invest in research and development, electric scooters and motorcycles are becoming increasingly competitive with their gasoline counterparts, offering comparable speed, torque, and reliability. This technological progress is pivotal in attracting a broader consumer base and facilitating market growth.

Furthermore, the integration of smart features in electric scooters and motorcycles is elevating the user experience, making these vehicles more appealing to tech-savvy consumers. Features such as GPS tracking, smartphone connectivity, and remote diagnostics are becoming standard, offering convenience and added value. The ability to monitor battery health, optimize routes, and access ride data through mobile apps enhances consumer satisfaction and loyalty.

As electric two-wheelers become more technologically sophisticated, they are not only addressing performance concerns but also appealing to modern urban consumers looking for advanced mobility solutions. Consequently, technological innovation is expected to be a significant catalyst for market expansion in the coming years.

Trends

Rising Popularity of Subscription-Based and Sharing Models

The electric scooter and motorcycle market is increasingly witnessing the emergence of subscription-based and sharing models as a key trend. These innovative business models address the growing urban need for flexible and affordable transportation. Instead of purchasing electric two-wheelers outright, consumers are opting for subscription services that offer a range of vehicles at a fixed monthly cost.

This trend is particularly prominent in metropolitan areas where personal vehicle ownership can be cumbersome and costly. Subscription models typically include maintenance and insurance, making them a cost-effective and hassle-free option. As a result, the market is experiencing an influx of users who prefer the convenience of accessing electric scooters and motorcycles without the long-term financial commitment.

Moreover, shared mobility solutions, including electric scooter-sharing platforms, are gaining traction as an efficient way to navigate congested urban landscapes. Such models are increasingly favored by environmentally conscious consumers who prefer sustainable commuting options. Companies offering shared electric scooters often station them strategically around city centers, allowing users to pick up and drop off vehicles with ease.

This model not only reduces the environmental impact but also helps alleviate traffic congestion. As urban centers increasingly adopt shared mobility solutions, the electric scooter and motorcycle market is expected to benefit from the continued expansion of these subscription and sharing models, reinforcing their role in modern urban transportation ecosystems.

Regional Analysis

Asia-Pacific Electric Scooter and Motorcycle Market with Largest Market Share of 74.6%

The Asia-Pacific region dominates the global electric scooter and motorcycle market, accounting for a substantial market share of 74.6% in 2024. This dominance can be attributed to the extensive adoption of electric two-wheelers across major economies such as China, India, Japan, and Southeast Asian countries. The region’s market size reached USD 31.7 billion in 2024, driven primarily by government initiatives aimed at reducing carbon emissions, growing consumer awareness regarding sustainable mobility solutions, and increasing investments in electric vehicle (EV) infrastructure.

Countries like China and India lead in the production and sales of electric scooters and motorcycles, owing to the presence of well-established manufacturing hubs and favorable government policies promoting electric mobility. The high urban population density and the increasing demand for affordable, low-emission vehicles are further fueling market growth. The Asia-Pacific region’s significant market size is also supported by advancements in battery technology, leading to improved performance and cost efficiency of electric two-wheelers.

The electric scooter and motorcycle market in North America is exhibiting promising growth, supported by a rising consumer shift towards eco-friendly transportation alternatives. The market in this region is primarily driven by increasing environmental awareness and stringent emission regulations, which encourage the adoption of electric two-wheelers.

Additionally, the growing trend of electric mobility solutions among urban commuters is propelling market growth. The adoption rate is particularly high in the United States and Canada, where government incentives and tax rebates for electric vehicles are widely available. The expansion of EV charging infrastructure, along with advancements in battery technology, is anticipated to bolster market demand. However, the region’s market share remains significantly lower compared to Asia-Pacific, highlighting its potential as an emerging market rather than an established leader.

Europe represents a significant market for electric scooters and motorcycles, driven by the region’s robust environmental policies and increasing consumer inclination towards sustainable urban mobility. Countries like Germany, France, the Netherlands, and Italy are key contributors to the regional market, benefiting from government initiatives that promote electric mobility, such as subsidies and low-emission zone regulations.

The demand for electric two-wheelers is particularly high in urban areas where congestion and emission challenges persist. Europe’s commitment to achieving carbon neutrality by 2050 and the ongoing investment in electric mobility infrastructure are instrumental in sustaining market growth. Despite being a prominent region, Europe’s market share is comparatively lower than Asia-Pacific, yet it remains a focal point for innovation and sustainability in electric mobility.

The electric scooter and motorcycle market in the Middle East and Africa is at a nascent stage, characterized by limited adoption compared to other regions. The market growth in this region is primarily hindered by infrastructural challenges and a traditional preference for conventional fuel-based vehicles. However, countries like the UAE and South Africa are witnessing gradual acceptance, driven by increased awareness of sustainable mobility and government initiatives aimed at reducing urban pollution.

The rising trend of urbanization and the increasing availability of charging stations are likely to boost the adoption rate in the coming years. Nonetheless, the market remains underdeveloped compared to the leading regions, with growth opportunities largely dependent on policy support and infrastructural advancements.

Latin America is witnessing a gradual increase in the adoption of electric scooters and motorcycles, fueled by urban mobility challenges and the need for cost-effective transportation solutions. Countries like Brazil, Mexico, and Argentina are leading the regional market, supported by local government incentives aimed at promoting electric vehicle usage. The region’s urban centers are increasingly adopting electric two-wheelers as a viable alternative to conventional motorcycles, primarily driven by fuel cost savings and reduced environmental impact.

However, the lack of robust charging infrastructure and limited consumer awareness about electric mobility hinder more rapid adoption. As the market matures, enhanced government support and infrastructure development are expected to facilitate significant growth in the electric scooter and motorcycle market across Latin America.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global electric scooter and motorcycle market in 2024 is characterized by the presence of key players who are leading the transition toward sustainable urban mobility. Among the top companies, Xiaomi and Niu Technologies stand out due to their strong market presence in Asia, leveraging their advanced battery technology and cost-effective production to maintain competitive pricing. Segway Inc. and Gogoro Inc. are also notable for their innovative battery swapping networks and high-performance urban scooters, particularly influential in densely populated regions.

European brands like Vespa and BMW Motorrad are prominent for their stylish and premium electric scooter offerings, appealing to the urban commuter segment seeking luxury and performance. Meanwhile, iconic American brands such as Harley-Davidson and Zero Motorcycles have made strides in the electric motorcycle sector, focusing on robust performance and long-range capabilities. Similarly, Energica Motor Company caters to high-end markets with its powerful, sport-oriented electric motorcycles.

Asian manufacturers like Okinawa Autotech and Hero Electric dominate the budget segment, offering affordable and reliable electric two-wheelers to cater to the growing middle-class population. Indian manufacturer Mahindra GenZe and European player KTM are also pivotal in broadening market reach through diverse product portfolios.

Furthermore, Evoke Motorcycles focuses on advanced connectivity features, while Zero Motorcycles continues to innovate in the electric adventure bike segment. The dynamic strategies of these players underscore the competitive and evolving nature of the global electric scooter and motorcycle market.

Top Key Players in the Market

- Xiaomi

- Niu Technologies

- Segway Inc.

- Gogoro Inc.

- Vespa

- BMW Motorrad

- Harley-Davidson

- KTM

- Zero Motorcycles

- Evoke Motorcycles

- Energica Motor Company

- Mahindra GenZe

- Okinawa Autotech

- Hero Electric

Recent Developments

- In March 26, 2025, Rivian (NASDAQ: RIVN) announced the launch of a new independent company named Also, Inc. The spin-out of its micromobility business marks a strategic move to focus on small, lightweight vehicles. Also, Inc. aims to address contemporary mobility challenges by developing innovative transportation solutions designed for urban and global markets.

- In January 2024, TIER and Dott finalized their merger, combining resources to establish a leading entity in the European shared micro-mobility sector. The consolidated company, generating annual revenues of €250 million, supports over 125 million trips across more than 20 countries, positioning itself as a dominant player in the region’s mobility landscape.

- In 2023, Motovolt, an electric mobility company based in India, announced its acquisition of a stake in Germany-based eROCKIT. The investment, amounting to €1 million (~$1.07 million), is aimed at supporting the production and development of eROCKIT’s premium electric two-wheeler models at their Berlin facility. eROCKIT’s Human Hybrid technology integrates motorcycle performance with the ease of an e-bike, delivering a unique riding experience.

- In 2024, the Ministry of Heavy Industries, Government of India, introduced the Electric Mobility Promotion Scheme 2024 (EMPS 2024). Approved by the Department of Expenditure, Ministry of Finance, the scheme allocates Rs. 500 crore over four months, from April 1 to July 31, 2024. Its primary objective is to enhance the adoption of electric two-wheelers (e-2W) and three-wheelers (e-3W) while fostering the growth of the EV manufacturing ecosystem within the country.

- In October 26, 2023, Ola Electric, India’s leading EV manufacturer, secured funding of approximately INR 3,200 crores through a mix of equity and debt. The investment was led by marquee investors, including Temasek, with additional project debt sourced from the State Bank of India. The funds will support the expansion of Ola’s EV operations and the establishment of the country’s first lithium-ion cell manufacturing plant in Krishnagiri, Tamil Nadu.

Report Scope

Report Features Description Market Value (2024) USD 42.5 Billion Forecast Revenue (2034) USD 234.0 Billion CAGR (2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electric Scooters , Electric Motorcycles), By Battery Type (Lithium-ion Battery , Lead Acid Battery , Others), By Voltage Segment (24V , 36V , 48V , Above 48V) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xiaomi, Niu Technologies, Segway Inc. , Gogoro Inc., Vespa , BMW Motorrad, Harley-Davidson, KTM, Zero Motorcycles, Evoke Motorcycles, Energica Motor Company, Mahindra GenZe, Okinawa Autotech, Hero Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Scooter and Motorcycle MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Scooter and Motorcycle MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Xiaomi

- Niu Technologies

- Segway Inc.

- Gogoro Inc.

- Vespa

- BMW Motorrad

- Harley-Davidson

- KTM

- Zero Motorcycles

- Evoke Motorcycles

- Energica Motor Company

- Mahindra GenZe

- Okinawa Autotech

- Hero Electric