Global Dried Herbs Market Size, Share, And Business Benefits By Type (Basil, Oregano, Rosemary, Thyme, Parsley, Mint, Bay leaves, Chives, Coriander/cilantro, Dill, Others), By Product Form (Crushed, Cut, Powder, Whole Leaf), By Application (Aromatherapy, Cosmetic (Hair Care, Skin Care), Culinary, Medicinal, Home Remedies, Others), By Distribution Channel (Offline (Convenience Stores, Pharmacies, Specialty Stores, Supermarkets, Others), Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154105

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

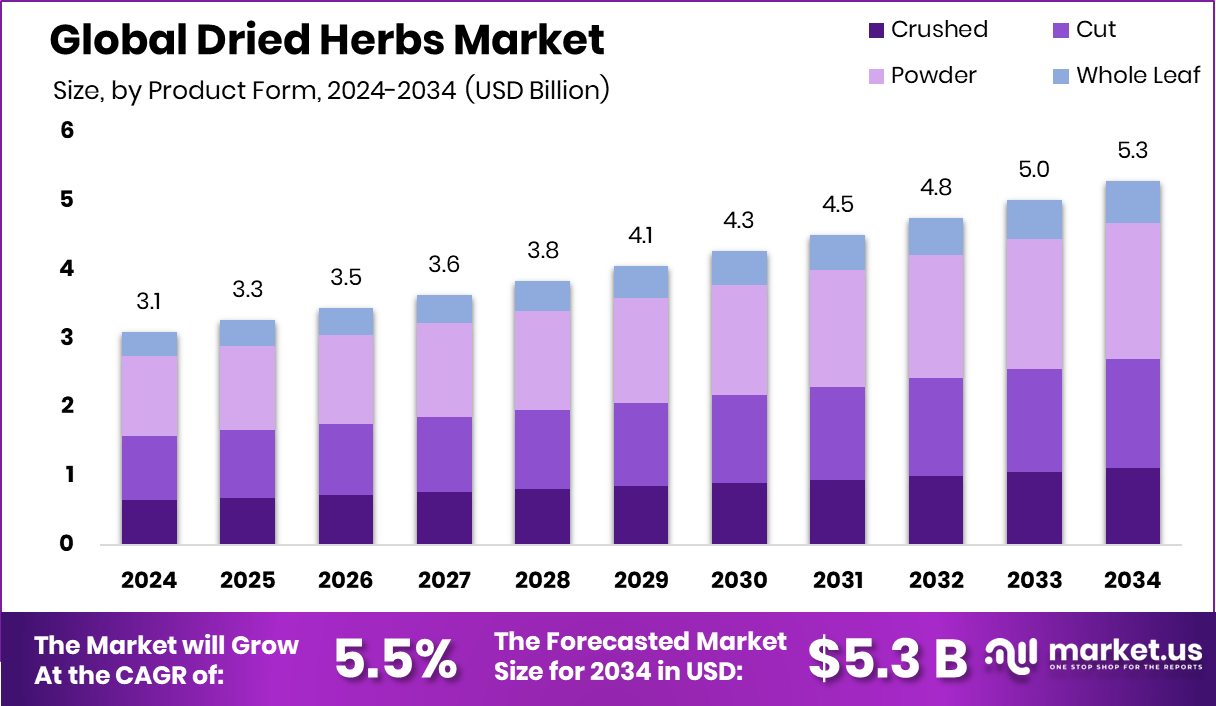

The Global Dried Herbs Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Europe leads globally in dried herbs consumption, accounting for 42.8% market share.

Dried herbs are plant leaves that have been harvested, cleaned, and dehydrated to preserve their flavor, aroma, and shelf life. Commonly used in cooking, teas, and traditional medicine, dried herbs offer a concentrated source of taste and nutrients. The drying process removes moisture while retaining the essential oils and volatile compounds that give herbs their characteristic flavor. They are available in whole, crushed, or powdered forms and include varieties such as basil, thyme, oregano, rosemary, and mint.

The dried herbs market refers to the global trade and consumption of dehydrated herb products across culinary, pharmaceutical, and cosmetic applications. This market encompasses the production, processing, packaging, and distribution of dried herbs to meet consumer and industrial demands. Growth in this sector is supported by rising awareness of healthy diets, increased interest in plant-based food, and demand for natural flavoring agents.

Supporting this trend, Ayurvedic luxury beauty label Just Herbs, operated by Chandigarh’s Apcos Naturals, has secured $1.5 million (approximately ₹11 crore) in a pre-Series A round led by Roots Ventures to help broaden its herbal product portfolio. Similarly, Gaia Herbs, a startup based in Brevard, raised close to $5 million in fresh funding to expand its botanical offerings in the natural wellness space.

Demand for dried herbs is steadily rising due to their wide culinary applications and growing interest in international cuisines. Consumers are incorporating herbs not just for taste but also for their perceived wellness properties. The increased popularity of home cooking, especially post-pandemic, has further amplified purchases of shelf-stable cooking ingredients like dried herbs.

In addition, ready-to-eat meals, sauces, and seasoning blends in the food industry rely heavily on these ingredients to maintain consistent flavor profiles. Companies like Meati, which secured $100 million in funding, and Origin in Bengaluru, with plans to raise $10 million, reflect the broader investment movement in the plant-based and botanical segments.

Key Takeaways

- The Global Dried Herbs Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the dried herbs market, basil leads by type, capturing a significant 15.2% of overall consumption.

- Powder form dominates the dried herbs market by product form, accounting for a notable 37.5% share globally.

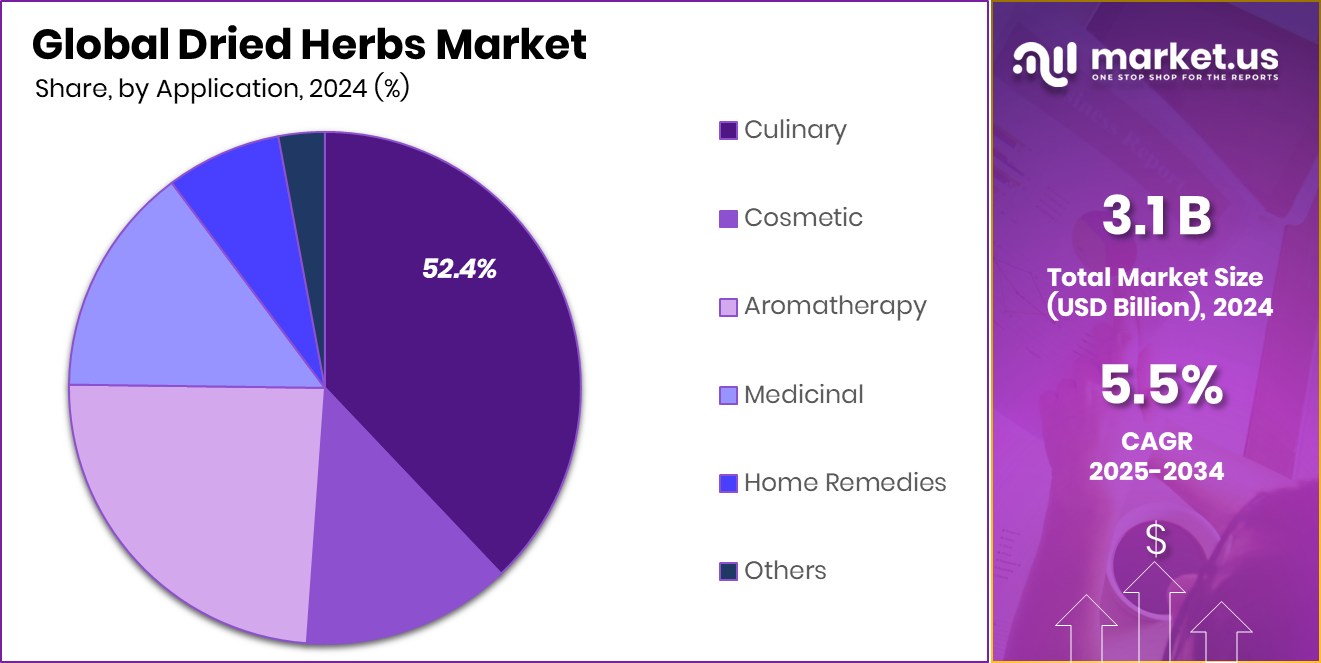

- Culinary applications drive the dried herbs market strongly, representing the largest segment with a 52.4% usage share.

- Offline distribution channels hold a dominant position in the dried herbs market, securing 81.8% of total sales.

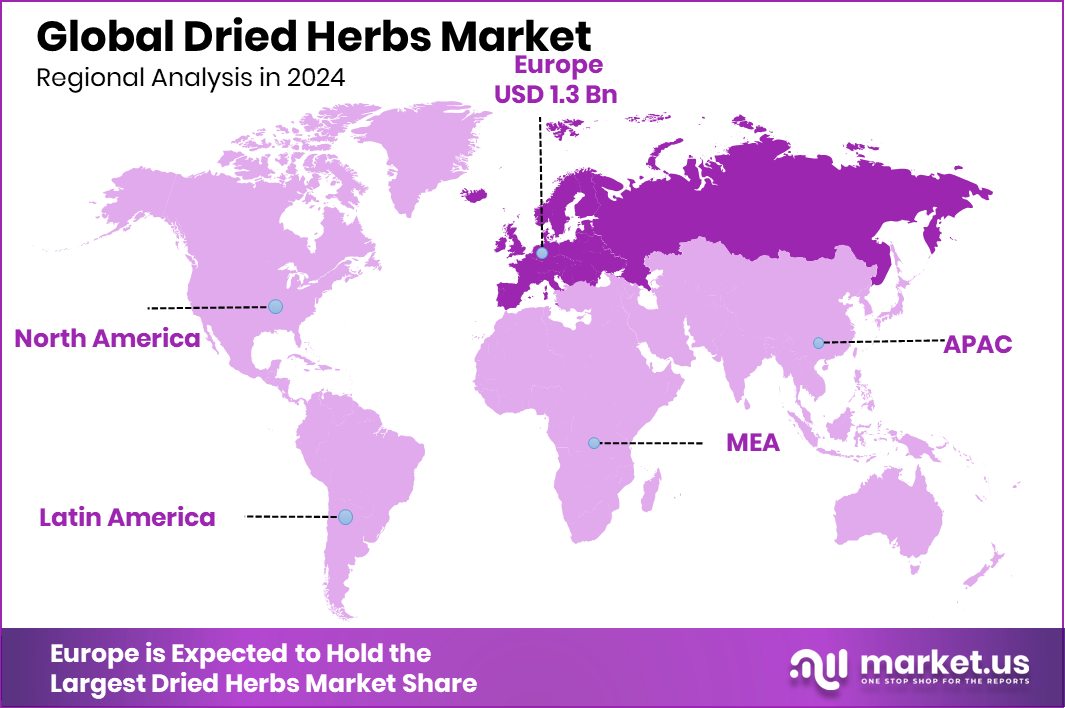

- Strong demand for natural seasonings boosts Europe’s dried herbs market to USD 1.3 billion.

By Type Analysis

Basil holds a 15.2% share in the Dried Herbs Market globally.

In 2024, Basil held a dominant market position in the By Type segment of the Dried Herbs Market, with a 15.2% share. This leading position can be attributed to basil’s widespread use across multiple cuisines, especially in Mediterranean and Asian dishes, where it is valued for its distinctive aroma and flavor. Its versatility in culinary applications—ranging from pasta sauces and soups to spice blends and ready-to-eat meals—has sustained consistent demand from both household consumers and the food processing industry.

The increasing trend toward natural and plant-based ingredients has further supported basil’s market share, as consumers seek healthier alternatives to synthetic flavoring agents. Dried basil offers a longer shelf life and easy storage, making it a preferred choice for packaged food manufacturers and home cooks alike.

Additionally, basil is often associated with digestive and anti-inflammatory benefits, reinforcing its popularity in health-conscious markets. With the rise in home cooking and the growing influence of global cuisines, especially in urban settings, dried basil continues to maintain a strong presence in retail shelves and food service menus.

By Product Form Analysis

Powder form dominates with 37.5% in the dried herbs market.

In 2024, Powder held a dominant market position in the By Product Form segment of the Dried Herbs Market, with a 37.5% share. This dominance is driven by its high usability, ease of blending, and suitability for both industrial and household applications.

Powdered dried herbs offer a uniform texture that mixes seamlessly into soups, sauces, spice blends, seasoning packets, and processed food items, ensuring consistent flavor distribution. Food manufacturers favor powdered herbs due to their precise dosing and compatibility with automated production lines, enhancing both efficiency and product standardization.

The shelf stability and compact packaging of herb powders also contribute to their popularity in retail formats, as they occupy less space and have lower transportation costs. From a consumer perspective, powdered herbs offer convenience, especially in busy kitchens where quick preparation and easy storage are essential.

The growing inclination toward ready-to-cook and pre-seasoned foods further supports the strong demand for powdered dried herbs in the global market. As clean-label trends continue to shape purchasing behavior, powdered herbs are increasingly appreciated not just for flavor but also for their natural, additive-free profile.

By Application Analysis

Culinary usage leads with 52.4% in the dried herbs market.

In 2024, Culinary held a dominant market position in the By Application segment of the Dried Herbs Market, with a 52.4% share. This leadership is primarily supported by the widespread use of dried herbs in daily cooking across households, restaurants, and food processing units.

Dried herbs such as basil, oregano, and thyme are integral to a wide variety of global cuisines, offering a convenient and long-lasting way to enhance the flavor of food. The culinary segment benefits from the increasing trend toward home cooking, especially in urban areas where consumers are experimenting with diverse recipes and international dishes.

The dominance of the culinary segment is also reinforced by the growth of packaged and ready-to-eat meals, where dried herbs are essential for flavor consistency and shelf stability. Consumers are increasingly inclined toward natural seasoning options, and dried herbs meet this demand without compromising taste or convenience.

Their extended shelf life, ease of use, and rich aroma make them a staple in both domestic and commercial kitchens. This consistent utility across food preparation platforms has helped the culinary application secure more than half of the market share in the dried herbs industry, maintaining its leading position within the application-based segmentation in 2024.

By Distribution Channel Analysis

Offline channels account for 81.8% of the dried herbs market.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Dried Herbs Market, with an 81.8% share. This significant lead is attributed to the widespread availability of dried herbs across traditional retail platforms such as supermarkets, grocery stores, and specialty food outlets.

Consumers continue to prefer offline channels due to the ability to physically examine product packaging, verify freshness, and choose from a diverse selection of herb varieties. Additionally, trusted retail environments enhance buyer confidence, especially when it comes to food-related purchases.

Offline distribution remains a preferred route for bulk buyers, including restaurants, catering services, and small food businesses, who often rely on consistent supply chains and local distributors. The accessibility of dried herbs in physical retail locations supports impulse purchases and encourages consumers to try new varieties.

Promotional activities and in-store product placements further support visibility and sales in this segment. Moreover, the offline presence provides an advantage in regions with limited digital infrastructure or low online shopping penetration. The dominance of offline channels reflects both consumer behavior and established retail networks, enabling this segment to command a substantial share of the dried herbs market in 2024.

Key Market Segments

By Type

- Basil

- Oregano

- Rosemary

- Thyme

- Parsley

- Mint

- Bay leaves

- Chives

- Coriander/cilantro

- Dill

- Others

By Product Form

- Crushed

- Cut

- Powder

- Whole Leaf

By Application

- Aromatherapy

- Cosmetic

- Hair Care

- Skin Care

- Culinary

- Medicinal

- Home Remedies

- Others

By Distribution Channel

- Offline

- Convenience Stores

- Pharmacies

- Specialty Stores

- Supermarkets

- Others

- Online

Driving Factors

Rising Demand for Natural Food Ingredients Globally

One of the main driving factors for the dried herbs market is the growing global demand for natural food ingredients. As more consumers shift toward clean-label products and plant-based diets, dried herbs have become a preferred choice for seasoning and flavor enhancement.

They are widely used in home kitchens, restaurants, and packaged food industries due to their rich flavor, long shelf life, and health benefits. Dried herbs contain no artificial additives or preservatives, which appeals to health-conscious buyers.

This trend is further supported by increasing awareness of the harmful effects of synthetic flavorings and additives. The demand is particularly high in urban areas, where convenience, nutrition, and natural ingredients are major factors influencing food purchases.

Restraining Factors

Quality Loss During Processing and Storage Stages

A key restraining factor in the dried herbs market is the loss of flavor, color, and nutritional value during processing and storage. The drying process, especially when done at high temperatures, can reduce the concentration of essential oils that give herbs their distinctive taste and aroma.

This affects overall product quality, leading to reduced consumer satisfaction. In addition, improper storage conditions—such as exposure to moisture, light, or air—can further degrade the quality of dried herbs over time. This creates challenges for producers and retailers in maintaining consistent standards.

As consumer expectations for freshness and potency rise, concerns over quality deterioration may limit repeat purchases and weaken trust in dried herb products if not managed properly.

Growth Opportunity

Expansion into Health and Wellness Product Applications

A key growth opportunity in the dried herbs market lies in expanding applications within health and wellness products. Dried herbs like basil, chamomile, peppermint, and others are increasingly being used in natural teas, herbal supplements, and wellness blends due to their perceived benefits, such as digestive support, stress relief, and antioxidant properties.

As more consumers prioritize holistic health and preventive care, these herbs offer a natural alternative to synthetic ingredients. This growing demand is opening new market avenues beyond the culinary segment.

Manufacturers can develop value-added offerings—such as herbal infusion kits or functional snack products—that appeal to health‑oriented consumers. The ability to position dried herbs as key ingredients in wellness-focused formulations presents a promising path for market expansion and higher value creation.

Latest Trends

Rising Demand for Organic and Clean Labels

One of the most noticeable trends in the dried herbs market is the growing preference for organic and clean-label products. Consumers are increasingly choosing food products made without artificial additives, pesticides, or genetically modified ingredients. Dried herbs, when labeled as organic and natural, are seen as healthier and safer for daily use in cooking and health remedies.

This trend is especially strong among health-conscious individuals and those following plant-based or vegan diets. As awareness about food safety and sustainability continues to grow, both small producers and large companies are shifting toward offering certified organic dried herbs.

Regional Analysis

Europe dominated the dried herbs market with a 42.8% share, worth USD 1.3 billion.

In 2024, Europe held a dominant position in the global dried herbs market, accounting for 42.8% of the total market share, valued at USD 1.3 billion. The region’s stronghold can be attributed to increasing consumer preference for natural food products and widespread use of herbs in traditional and modern European cuisines.

North America followed as a significant regional contributor, supported by rising demand for clean-label and organic seasonings in both home cooking and the foodservice sector. The Asia Pacific region also exhibited notable growth, driven by a growing inclination toward herbal ingredients in health-conscious diets and expanding culinary applications across countries such as India, China, and Japan.

The Middle East & Africa region showed steady development, influenced by the incorporation of herbs in traditional dishes and expanding retail distribution. Latin America, while a smaller market in comparison, demonstrated rising interest in locally sourced and dried herbal products, especially in countries with rich culinary traditions.

Among all regions, Europe emerged as the leading market in terms of value and share, reflecting the region’s mature food sector and consumer emphasis on flavor enhancement through natural ingredients. This regional performance highlights the importance of geographic preferences in shaping dried herb consumption trends globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Badia Spices maintained a strong market position through its broad portfolio of dried herbs, catering to both retail and foodservice sectors. The company’s wide product accessibility across grocery chains and its focus on ethnic seasoning blends have helped strengthen its brand recognition in North America. Badia’s commitment to quality and affordability has contributed to its continued relevance in a price-sensitive consumer base.

Bergin Fruit and Nut Company diversified its dried herb offerings alongside its core portfolio of health-oriented food products. Its emphasis on wholesale distribution and bulk packaging appeals particularly to foodservice providers and health food stores. The company’s positioning within the natural and organic food segment supports its performance among wellness-focused consumers.

Dried Fruits & Nuts, recognized for its clean-label and preservative-free offerings, has steadily gained ground in niche dried herb markets. Its strategic focus on quality sourcing and small-batch production has enabled the company to attract premium-segment customers. This positioning is particularly relevant in regions where demand for artisanal and minimally processed herbs is growing.

Euroma, based in Europe, plays a leading role in the dried herbs sector due to its deep integration with the regional food manufacturing industry. The company benefits from its expertise in herb processing and long-standing relationships with European food producers. Its emphasis on sustainability, flavor innovation, and culinary partnership has aligned well with evolving food trends, particularly in Europe, where it leverages its regional proximity and understanding of consumer taste preferences.

Top Key Players in the Market

- Badia Spices

- Bergin Fruit and Nut Company

- Dried Fruits & Nuts

- Euroma

- Frontier Coop

- Husarich

- Kraft Heinz

- Kräuter Mix

- McCormick & Company

- Olam International

- Paulig

- Pure Spice

- Rituals Cosmetics

- Savory Spice

- Starwest Botanicals

Recent Developments

- In June 2024, Badia Spices’ family owners reportedly explored strategic options, engaging investment bank Raymond James to solicit acquisition offers. The process indicated a valuation forecast of over USD 1.2 billion (including debt), based on approximately USD 100 million in EBITDA at the time. These discussions explicitly included the company’s dried herbs and seasoning portfolio.

- In December 2023, Marubeni Corporation completed the full acquisition of Euroma Holding B.V. on December 8, 2023. Euroma, recognized for its wide portfolio of dried herbs and spice blends, became a wholly owned subsidiary of Marubeni. The company continues to supply herb and spice ingredients to food manufacturers in over 60 countries, leveraging Marubeni’s network for future expansion, particularly across Europe.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Basil, Oregano, Rosemary, Thyme, Parsley, Mint, Bay leaves, Chives, Coriander/cilantro, Dill, Others), By Product Form (Crushed, Cut, Powder, Whole Leaf), By Application (Aromatherapy, Cosmetic (Hair Care, Skin Care), Culinary, Medicinal, Home Remedies, Others), By Distribution Channel (Offline (Convenience Stores, Pharmacies, Specialty Stores, Supermarkets, Others), Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Badia Spices, Bergin Fruit and Nut Company, Dried Fruits & Nuts, Euroma, Frontier Coop, Husarich, Kraft Heinz, Kräuter Mix, McCormick & Company, Olam International, Paulig, Pure Spice, Rituals Cosmetics, Savory Spice, Starwest Botanicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Badia Spices

- Bergin Fruit and Nut Company

- Dried Fruits & Nuts

- Euroma

- Frontier Coop

- Husarich

- Kraft Heinz

- Kräuter Mix

- McCormick & Company

- Olam International

- Paulig

- Pure Spice

- Rituals Cosmetics

- Savory Spice

- Starwest Botanicals