Global Cosmetic Dentistry Market By Product (Dental Systems & Equipment, Dental Implants, Dental Crowns & Bridges, Dental Veneer, Orthodontic Braces and Other Products) By End-User (Dental Hospitals and Clinics, Dental Laboratories and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 19316

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

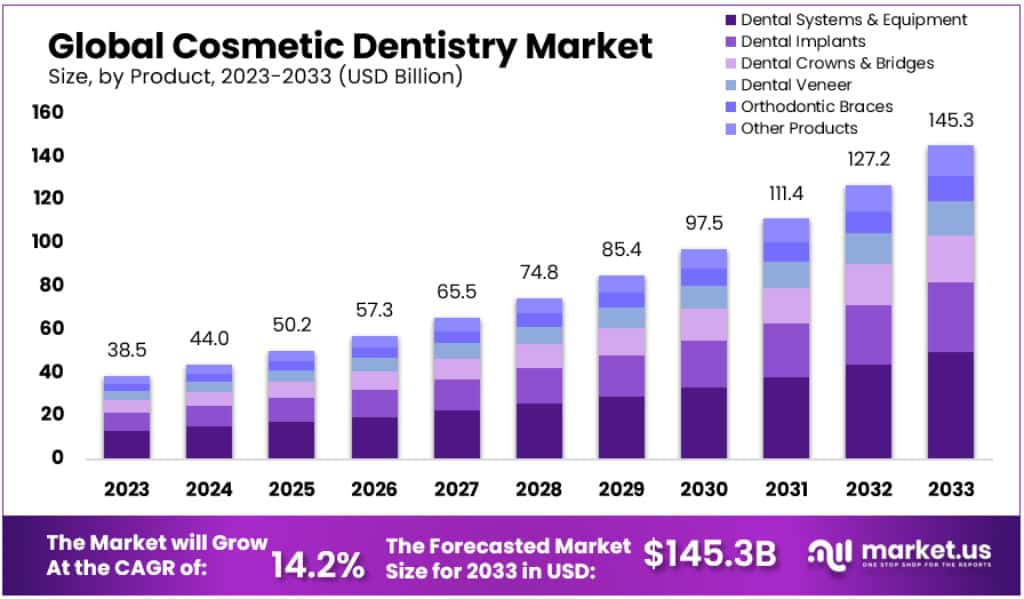

The Global Cosmetic Dentistry Market size is expected to be worth around USD 145.3 Billion by 2033, from USD 38.5 Billion in 2023, growing at a CAGR of 14.2% during the forecast period from 2024 to 2033.

Cosmetic dentistry is the practice of improving the appearance of your teeth, bite, or gums. Cosmetic dentistry is about improving the overall aesthetics of your smile, including color, shape, alignment, size, and position. Cosmetic dental procedures are more elective than necessary, but some treatments, such as crowns for dental implants, can also have restorative benefits.

There are several factors for the enhanced cosmetic dentistry market. Dental diseases in today’s society are common and may be classified into periodontal diseases, caries, gum diseases, dental cracks, and cavities, which make cosmetic dentistry vital as a way of improving physical looks. Moreso, increased prevalence of dental complications, growth in the geriatric population group who are more vulnerable to these conditions also foster forward the market growth. The availability of CAD/CAM systems that include 3-dimensional systems for both design and manufacturing of dental restorations with increased precision and speed also makes a positive contribution to the growth of this market.

In addition, high disposable income and consciousness about facial appearance also adds to the advantage, where cosmetic dental surgeries meet market demand. However, factors such as high costs of dental products with improved dental implants/prosthetics, unfavorable reimbursement policies and a weak pool of dental practitioners are major impediments to market growth. On the other hand, there is increasing trend towards dental tourism, especially in developing world, see a greater opportunity for the manufactures as the cost of dental procedures in developed world such as in the U. S remains high.

Key Takeaways

- Current Market Value The Cosmetic Dentistry Market is valued at USD 38.5 billion in 2023.

- Expected Market Value: It is projected to reach approximately USD 145.3 billion by 2033.

- Growth Rate: The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.2% from 2023 to 2033.

- Dominant Product Segment: Dental systems and equipment held over a 34.3% share of the market in 2023.

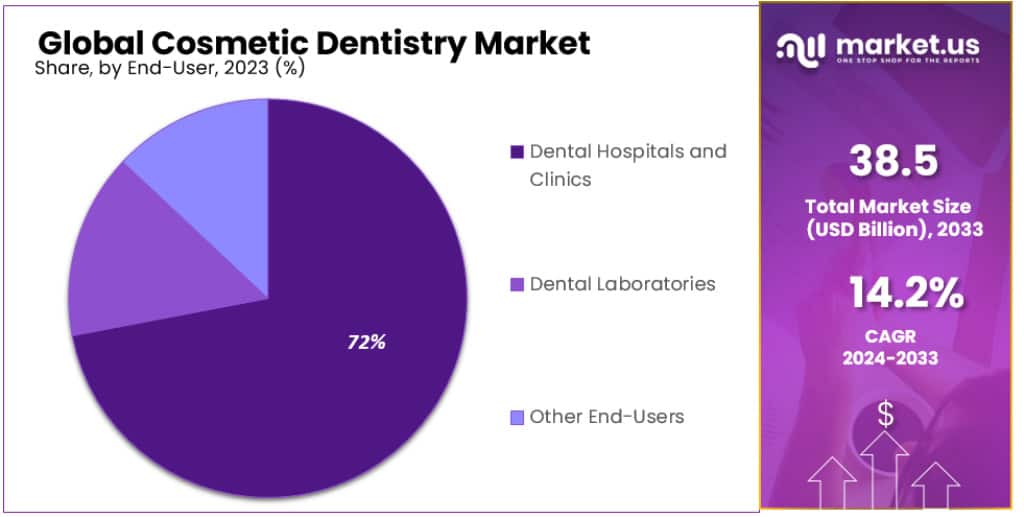

- Key End-User: Dental hospitals and clinics dominated the market with more than a 72% share in 2023.

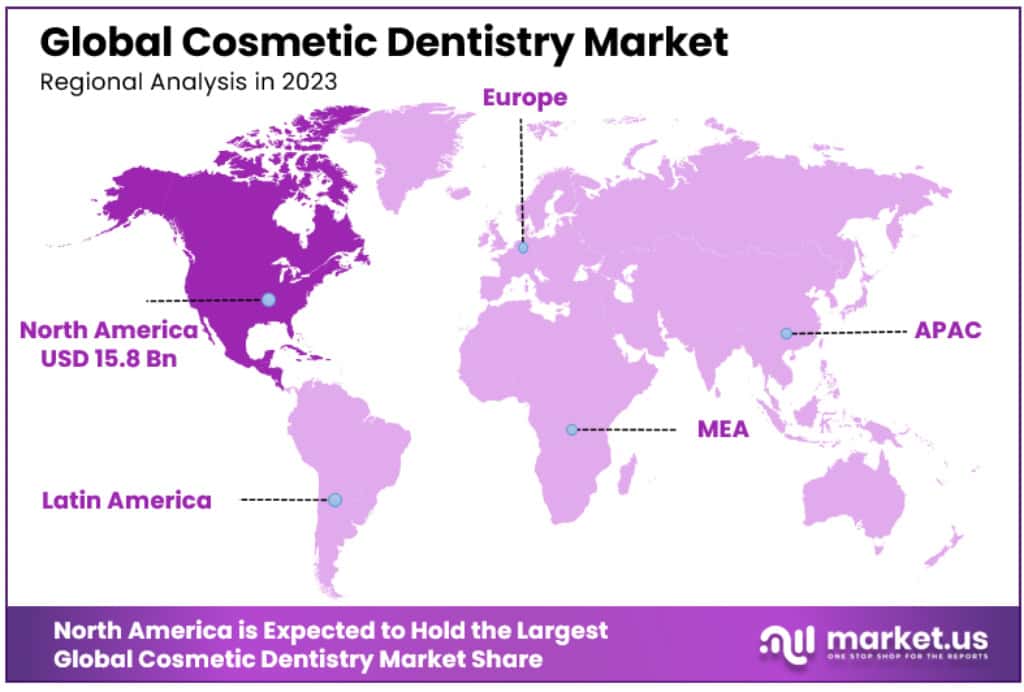

- North American Market Share: North America accounted for 41% of the market, valued at USD 15.8 billion.

- Asia Pacific Growth Rate: This region is projected to grow at a CAGR of 13.8% from 2023 to 2030.

- Dental Implant Segment: This segment is significant due to the rising popularity and advancements in implant materials and techniques.

- Dental Crowns & Bridges Segment: Driven by the increasing prevalence of dental caries and tooth loss.

- Dental Veneer Segment: Gains traction for its aesthetic appeal and advancements in materials and application techniques.

- Orthodontic Braces Segment: Witnessing growth due to the rising awareness of dental alignment and innovations like clear and removable braces.

- Dental Laboratories Segment: Plays a crucial role in fabricating dental prosthetics and benefits from digital dentistry advancements.

- Annual U.S. Expenditure: Approximately $2.75 billion is spent annually on cosmetic dental services in the U.S.

- Technological Investments: The market is experiencing increased investment in CAD/CAM technologies and other advancements.

Product Analysis

In 2023, the dental systems and equipment segment held a dominant position in the cosmetic dentistry market, capturing more than a 34.3% share. This segment’s prominence is driven by significant advancements in dental technology and an increasing number of dental clinics and practitioners adopting modern equipment. The availability of advanced imaging systems and laser dentistry tools has further propelled the growth of this segment. Dental equipment includes a wide range of dental systems and equipment such as instrument delivery systems, dental handpieces, light-curing devices, light-curing and scaling equipment, dental CAD/CAM system, lasers, and radiology equipment. As more people want to improve their dental aesthetics, orthodontic braces consisting of fixed and adjustable braces have seen a rapid increase.

Dental implants follow as a substantial segment, attributed to their rising popularity for tooth replacement. The durability and aesthetic appeal of implants have made them a preferred choice for patients seeking long-term solutions. Market expansion in this area is further bolstered by improvements in implant materials and techniques. Patients who have had disfigurations or injuries and need dental implants consisting of zirconium and titanium implants are often also using these implants.

Dental crowns and bridges also form a key segment in the cosmetic dentistry market. Their demand is primarily fueled by the increasing prevalence of dental caries and tooth loss among the global population. Technological advancements in crown and bridge materials, offering better color matching and longevity, have enhanced their acceptance among both dentists and patients.

Dental veneers represent another significant segment, gaining traction for their ability to transform the appearance of teeth. The rising emphasis on aesthetic appeal and the growing trend of smile makeovers contribute to the popularity of veneers. This segment benefits from innovations in veneer materials and minimally invasive application techniques.

Lastly, the orthodontic braces segment, while smaller in comparison, is witnessing growth due to increasing awareness of dental alignment and its impact on oral health and aesthetics. The advent of clear and removable braces has expanded the patient base, including adults who seek discreet orthodontic solutions.

End-User Analysis

Dental hospitals and clinics held a dominant market position in the cosmetic dentistry sector, capturing more than a 72% share in 2023. This dominance is attributed to the comprehensive range of dental services they offer, including advanced cosmetic procedures. The growth in this segment is driven by the increasing number of dental facilities globally, coupled with the rising demand for cosmetic dental treatments.

Dental laboratories represent another significant segment in this market. These specialized facilities play a crucial role in the fabrication of dental prosthetics like crowns, bridges, and veneers. The segment benefits from the collaboration with dental clinics and advancements in digital dentistry, which streamline the production process and improve the precision of dental products.

The ‘other end-users’ segment, while smaller, encompasses various facilities like research institutes and academic centers. This segment is growing due to its role in advancing cosmetic dentistry through research and development. Additionally, the increasing focus on training and education in cosmetic dental procedures contributes to the growth of this segment.

Each of these end-user segments contributes distinctly to the cosmetic dentistry market. Dental hospitals and clinics lead due to their direct patient interaction and wide range of services, while dental laboratories support the market with their technical expertise and product manufacturing capabilities. Other end-users, though a smaller segment, play a vital role in the continuous evolution and education within the field.

Key Market Segments

By Product

- Dental Implants

- Dental Systems & Equipment

- Orthodontic Braces

- Dental Crowns & Bridges

- Dental Veneer

- Other Products

By End-User

- Dental Laboratories

- Dental Hospitals & Clinics

- Other End-Users

Driver

Increasing Awareness and Aesthetic Focus

The cosmetic dentistry market is experiencing growth due to heightened awareness and a stronger focus on aesthetics. A significant increase in tooth-whitening procedures, along with the popularity of veneers, inlays, onlays, crowns, and bonding agents, is driving this trend. In the U.S. alone, approximately $2.75 billion is spent annually on these services. Both government and private sector initiatives are enhancing public awareness and accessibility to cosmetic dental services.

For example, the Indian Dental Association’s National Oral Health Program aims to distribute dental care more equitably. Additionally, the baby boomer generation and adults in the 31-40 age group are increasingly seeking cosmetic dental treatments.

Restraint

Complications with Certain Treatments

Despite the growing demand, there are concerns about the complications associated with dental bridge and orthodontic treatments. These include potential damage to surrounding bone structure and teeth, as well as risks like enamel damage, sensitivity, allergies, and tooth discoloration during orthodontic procedures. Such issues could hinder the adoption of these treatments.

Opportunity

Advanced Technological Developments

There’s a significant opportunity in the development and adoption of advanced dental technologies and materials. Innovations such as dental lasers and adhesive dentistry are leading to more minimally invasive procedures with better results. These advancements are increasing patient compliance and demand for such treatments.

Challenge

High Costs of Procedures

One major challenge in the market is the high cost of cosmetic dental procedures, which can be a barrier for many potential patients. While major market players are established globally, penetrating local markets with lower-priced alternatives remains difficult.

Trends

Increased Demand and Technological Investments

The market is witnessing a growing demand for procedures like veneers, teeth whitening, and complete mouth reconstructions. This is supported by technological advancements, increasing investments in CAD/CAM technologies in dental laboratories, and rising awareness of these procedures. Additionally, the growth in disposable income is making these procedures more accessible to a broader audience.

Regional Analysis

North America

Leading with Technological Innovation and High Demand

In 2023, North America held a commanding position in the aesthetic medicine market, accounting for a 41% share, valued at USD 15.8 billion. This dominance is largely due to significant technological advancements and a surge in individuals opting for cosmetic dentistry procedures. The region’s openness towards aesthetic treatments and heightened awareness of appearance have further fueled this growth.

A notable development is the introduction of W&H’s Assistina One, a rapid, efficient device for dental handpiece maintenance, which has set a new standard in the market for speed and effectiveness. Factors like high disposable income, substantial healthcare spending, and well-established healthcare infrastructure also contribute to North America’s market leadership.

Asia Pacific

Fastest Growing Market with Expanding Healthcare Infrastructure

Projected to grow at a CAGR of 13.8% from 2023 to 2030, Asia Pacific is rapidly emerging as a key player in the aesthetic medicine market. This growth is driven by an increase in dental clinics, a surge in dental tourism, and enhanced research and development in manufacturing. Enhanced awareness about oral care, coupled with expanding healthcare infrastructure equipped with advanced technology, is propelling the market in this region.

Initiatives by companies and governments, especially in China and India, are playing a crucial role in spreading dental care awareness. A notable development is My Dental Plan’s expansion, aiming to add 4,000 clinics across 250 cities by the end of 2021. Additionally, the launch of Harrisdale Dental Centre’s new website in July 2023, facilitating online appointment booking and providing comprehensive dental service information, exemplifies the region’s digital advancements in healthcare.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Companies in the dental industry frequently update and enhance their existing products, which not only broadens their product range but also strengthens their market position. Collaborations and partnerships are common strategies employed to maintain a competitive edge. For instance, Benco Dental’s iTero Element scanner is a testament to such innovation, enabling dentists to conduct a variety of procedures, including restorative and orthodontic treatments, with increased accuracy.

Significant acquisitions also mark the industry’s landscape. In 2020, Danaher Corporation acquired Nobel Biocare, a prominent dental products company, aiming to enlarge its product line and extend its market presence. Earlier, in 2017, Align Technology Inc. took over Osstell, a digital dentistry firm, enhancing its capabilities in 3D printing and broadening its range of products. Similarly, in 2019, 3M Company acquired Lava, another digital dentistry firm, to augment its digital solutions portfolio and strengthen its 3D printing technologies.

Маrkеt Кеу Рlауеrѕ

- Danaher Corporation

- Align Technology Inc.

- Dentsply International, Inc.

- 3M Company

- Zimmer Biomet Holding, Inc.

- Institut Straumann AG

- Sirona Dental Systems, Inc.

- Biolase, Inc.

- Planmeca Oy

Recent Developments

- Danaher Corporation: In May 2024, Danaher Corporation announced the acquisition of a leading dental software company, expanding its digital dentistry portfolio. This strategic move aims to enhance Danaher’s capabilities in providing advanced technological solutions to the cosmetic dentistry market.

- Align Technology Inc.: In April 2024, Align Technology Inc. launched a new clear aligner product, the Invisalign Lite, designed for mild to moderate teeth misalignment. This product aims to cater to a broader patient base seeking cosmetic dental improvements.

- Dentsply International, Inc.: In March 2024, Dentsply International, Inc. merged with a prominent dental equipment manufacturer to strengthen its product offerings and expand its market presence in the cosmetic dentistry sector. The merger is expected to streamline operations and enhance innovation.

- 3M Company: In June 2024, 3M Company introduced a new line of aesthetic dental composites, designed to provide superior esthetics and durability. This product launch aims to meet the growing demand for high-quality cosmetic dental materials.

- Zimmer Biomet Holding, Inc.: In May 2024, Zimmer Biomet Holding, Inc. acquired a dental implant company, broadening its portfolio of dental solutions. This acquisition is set to enhance Zimmer Biomet’s position in the cosmetic dentistry market by offering a comprehensive range of products.

- Institut Straumann AG: In April 2024, Institut Straumann AG announced a strategic partnership with a leading dental clinic chain to develop and distribute advanced cosmetic dental solutions. This collaboration aims to leverage both companies’ strengths to drive innovation and market growth.

Report Scope

Report Features Description Market Value (2023) USD 38.5 Billion Forecast Revenue (2033) USD 145.3 Billion CAGR (2023-2032) 14.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dental Systems & Equipment, Dental Implants, Dental Crowns & Bridges, Dental Veneer, Orthodontic Braces and Other Products) By End-User (Dental Hospitals and Clinics, Dental Laboratories and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Danaher Corporation, Align Technology Inc., Dentsply International, Inc., 3M Company, Zimmer Biomet Holding, Inc., Institut Straumann AG, Sirona Dental Systems, Inc., Biolase, Inc. and Planmeca Oy. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cosmetic dentistry?Cosmetic dentistry focuses on improving the appearance of teeth, gums, and overall smile. It includes procedures such as teeth whitening, veneers, crowns, bonding, and orthodontics.

How big is the Cosmetic Dentistry Market?The global Cosmetic Dentistry Market size was estimated at USD 38.5 Billion in 2023 and is expected to reach USD 145.3 Billion in 2033.

What is the Cosmetic Dentistry Market growth?The global Cosmetic Dentistry Market is expected to grow at a compound annual growth rate of 14.2%. From 2024 To 2033

Who are the key companies/players in the Cosmetic Dentistry Market?Some of the key players in the Cosmetic Dentistry Markets are Danaher Corporation, Align Technology Inc., Dentsply International, Inc., 3M Company, Zimmer Biomet Holding, Inc., Institut Straumann AG, Sirona Dental Systems, Inc., Biolase, Inc. and Planmeca Oy. and Other Key Players.

What factors are driving the growth of the cosmetic dentistry market?The growth is driven by an increase in dental disorders, a rise in the geriatric population, technological advancements like CAD/CAM systems, higher disposable incomes, and a growing focus on aesthetic appearance.

What recent trends are observed in the cosmetic dentistry market?Recent trends include increased mergers and acquisitions, product launches, and technological innovations such as 3D printing and digital dentistry solutions.

How do technological advancements impact the cosmetic dentistry market?Technological advancements, such as CAD/CAM systems, improve the design and creation of dental restorations, enhancing treatment outcomes and patient satisfaction.

What is the role of dental tourism in the cosmetic dentistry market?Dental tourism, particularly in emerging countries, offers cost-effective dental procedures, attracting patients from developed countries where treatment costs are higher. This trend creates growth opportunities for manufacturers and service providers.

-

-

- Danaher Corporation

- Align Technology Inc.

- Dentsply International, Inc.

- 3M Company

- Zimmer Biomet Holding, Inc.

- Institut Straumann AG

- Sirona Dental Systems, Inc.

- Biolase, Inc.

- Planmeca Oy