Global Commercial Blower Market Size, Share, And Industry Analysis Report By Product Type (Positive Displacement Blowers, Centrifugal Blowers, High-Speed Turbo Blowers, Regenerative Blowers), By Pressure (Up to 15 Psi, 15 to 20 Psi, Above 20 Psi), By End-Use (Cement, Steel, Power, Mining, Pulp and Paper, Food and Beverage, Water and Wastewater Treatment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175271

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

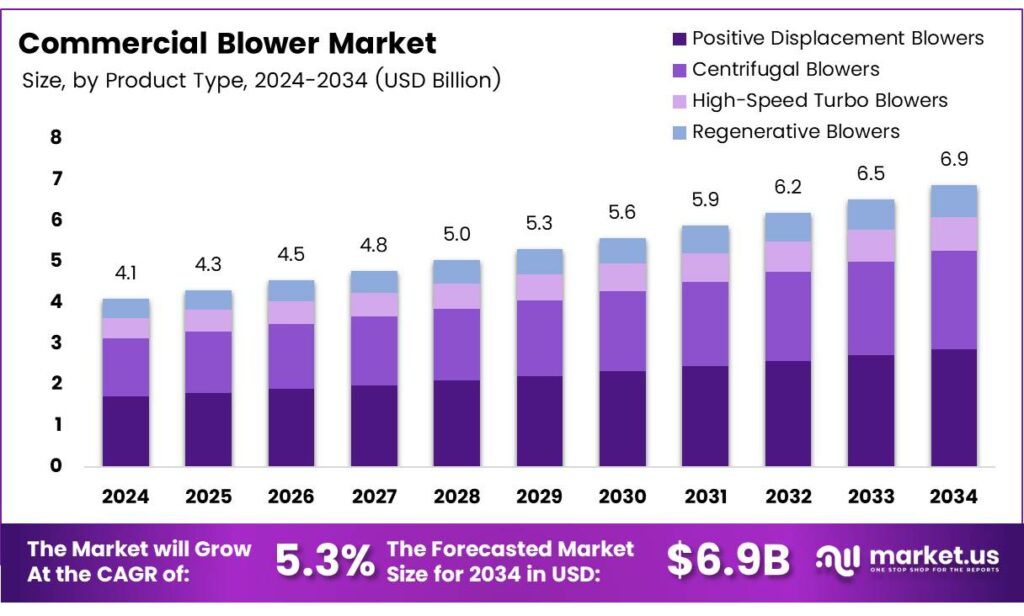

The Global Commercial Blower Market size is expected to be worth around USD 6.9 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Commercial Blower market continues to grow as industries prioritize energy-efficient ventilation systems to enhance workplace safety and productivity. Demand strengthens across manufacturing, construction, food processing, and commercial buildings due to rising compliance requirements and operational upgrades. Businesses increasingly view commercial blowers as essential infrastructure equipment supporting airflow, heat control, and facility hygiene.

Moreover, market expansion accelerates as companies shift toward automation and modern HVAC solutions. Commercial blowers enable stable airflow for drying, cooling, and fume extraction, supporting several industrial workflows. Their adaptability across harsh environments positions them as indispensable assets for process efficiency, creating consistent purchasing cycles for both new installations and replacement demand.

- Toward the technical landscape, the market benefits from versatile specifications widely accepted across industries. Commercial blowers support up to 1000 square feet of ventilation space and operate on 230–440 V power at 50–60 Hz. They deliver 2500–2800 RPM speeds with 0.5–10 HP input capacity, ensuring reliable performance across varied environments.

Finally, materials such as aluminium, plastic, MS, FRP, and cast iron enhance durability, while noise output remains low at 40–45 dBA, making the equipment suitable for noise-sensitive facilities. As per industrial equipment guidelines, turbo and centrifugal types collectively strengthen market versatility, allowing businesses to select models aligned with safety, energy, and productivity needs.

The Commercial Blower Market demonstrates solid momentum as organizations upgrade to durable ventilation technologies offering long-term performance. Buyers prefer systems offering stable airflow, robust construction, and low operational noise. As manufacturing clusters expand globally, procurement activity for commercial blowers rises, driven by capacity expansion and retrofitting of older ventilation setups.

Key Takeaways

- The Global Commercial Blower Market reached USD 4.1 billion in 2024 and is projected to hit USD 6.9 billion by 2034, at a CAGR of 5.3% between 2025 and 2034.

- Positive Displacement Blowers dominated the product segment with a 39.4% share in 2025.

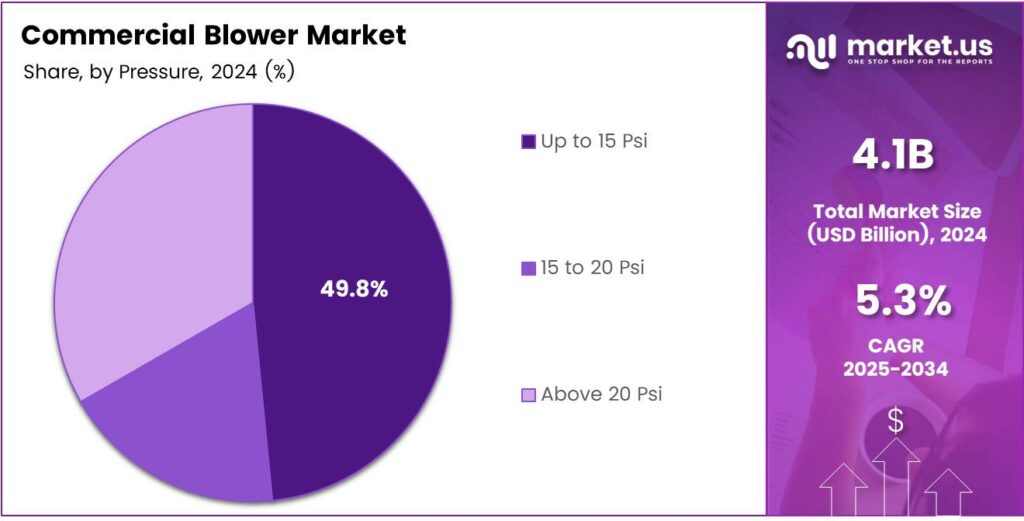

- The Up to 15 Psi pressure category led with 49.8% market share in 2025.

- The Cement end-use segment held the highest share at 19.2% in 2025.

- Asia Pacific led the global market with a 48.1% share valued at USD 1.9 billion in 2025.

By Product Type Analysis

Positive Displacement Blowers dominate the segment with 39.4% in 2025 due to their reliability and broad industrial adoption.

In 2025, Positive Displacement Blowers held a dominant market position in the By Product Type segment of the Commercial Blower Market, with a 39.4% share. These blowers gained prominence due to their consistent airflow delivery and suitability for heavy-duty applications. Industries increasingly preferred them for demanding operations, driving steady adoption.

Centrifugal Blowers continued to expand as industries transitioned toward energy-efficient solutions. Their ability to manage varied flow and pressure conditions strengthened demand, especially in HVAC and process industries. Users valued their low maintenance requirements, enabling wider use across commercial environments.

High-Speed Turbo Blowers advanced due to their high efficiency and compact design. Industries adopting modern automation systems are increasingly integrating these blowers to reduce operational energy costs. Their performance advantages, especially in wastewater treatment, accelerated market penetration and improved long-term productivity.

Regenerative Blowers maintained stable demand owing to their ability to deliver moderate pressure and clean airflow. These systems became ideal for lightweight industrial tasks, including aeration and pneumatic conveying. Their simple structure and quiet operation further strengthened adoption among small and mid-sized commercial facilities.

By Pressure Analysis

Up to 15 Psi dominates the pressure segment with 49.8% due to broad suitability across industries.

In 2025, Up to 15 Psi held a dominant market position in the By Pressure segment of the Commercial Blower Market, with a 49.8% share. This pressure range remained the industry’s preferred choice because it supports diverse commercial applications efficiently. Its low energy consumption encouraged companies to adopt cost-effective systems.

15 to 20 Psi blowers saw growing traction as industries required higher operational pressure. These systems performed well in material handling and industrial processing, where consistent medium-pressure airflow is essential. Their reliability strengthened their role in the industry’s expanding automation.

Above 20 Psi blowers continued to serve specialized applications requiring strong pressure performance. Industries such as mining and heavy manufacturing deployed them for demanding airflow operations. Their capability to handle intensified workloads ensured steady use despite higher operational requirements.

By End-Use Analysis

The cement industry leads with 19.2% share, driven by continuous production and airflow needs.

In 2025, Cement held a dominant market position in the By End-Use segment of the Commercial Blower Market, with a 19.2% share. The cement sector relied heavily on blowers for material movement, combustion air supply, and cooling operations, supporting consistent market leadership.

Steel applications expanded steadily as blowers supported critical processes like furnace combustion and exhaust handling. Their role in improving production efficiency drove continuous adoption across integrated and secondary steel plants. Power generation facilities used blowers for air handling, ash movement, and cooling.

Mining applications utilized blowers for ventilation, dust control, and conveying. Increased safety requirements encouraged widespread use, ensuring sustained market utilization in both surface and underground mining operations. Pulp and Paper industries continued using blowers for drying, aeration, and material handling.

Food and Beverage facilities integrated blowers for drying, cleaning, and air circulation. Their role in maintaining hygiene and quality standards enhanced their use throughout the processing stages. Water and Wastewater Treatment relied heavily on blowers for aeration and biological processing.

Key Market Segments

By Product Type

- Positive Displacement Blowers

- Centrifugal Blowers

- High-Speed Turbo Blowers

- Regenerative Blowers

By Pressure

- Up to 15 Psi

- 15 to 20 Psi

- Above 20 Psi

By End-Use

- Cement

- Steel

- Power

- Mining

- Pulp and Paper

- Food and Beverage

- Water and Wastewater Treatment

- Others

Emerging Trends

Growing Adoption of Smart and Automated Blower Technologies

A key trend shaping the commercial blower market is the rapid adoption of smart technologies. Modern blowers increasingly feature digital controls, variable frequency drives (VFDs), and monitoring sensors that enhance performance and energy savings.

- Industries prefer automated ventilation systems that adjust airflow based on temperature, pressure, or occupancy, offering greater efficiency and reliability. In the European Union, fan/blower efficiency rules have covered equipment from 125 W up to 500 kW input power, which is essentially the whole commercial/industrial range from small packaged units to heavy-duty plant equipment.

The rising preference for low-noise and compact blower models, especially in food processing, pharmaceuticals, and commercial facilities. Manufacturers are designing quieter systems to meet evolving workspace standards. Sustainability trends are also influencing material innovation, including lightweight, corrosion-resistant designs that extend product life in heavy-duty applications.

Drivers

Rising Industrial Ventilation Needs Drive Market Expansion

Growing industrial activity is increasing the need for effective ventilation systems, which directly boosts demand for commercial blowers. Industries such as manufacturing, food processing, mining, and power generation rely on blowers to manage dust, heat, fumes, and air circulation.

Additionally, stricter workplace safety guidelines encourage industries to adopt high-performance blowers that maintain clean and controlled environments. This shift is further supported by ongoing automation in factories, where machines require constant temperature regulation to avoid overheating.

Energy-efficient blower models are also gaining rapid traction as businesses aim to reduce operational costs and comply with sustainability goals. With many companies upgrading outdated ventilation systems, the replacement cycle continues to drive steady market growth.

Restraints

High Operational and Maintenance Costs Restrict Market Adoption

One of the major restraints for the commercial blower market is the high cost associated with installation, operation, and long-term maintenance. Many industries require heavy-duty blowers that consume significant power, making energy expenses a major concern for small and medium-sized facilities.

- The International Energy Agency (IEA) estimates that data centres consumed around 415 TWh of electricity in 2024, equal to roughly 1.5% of global electricity consumption. The same IEA analysis notes that data centre electricity use has grown at about 12% per year over the last five years.

The need for regular servicing, lubrication, filter replacement, and mechanical repairs adds to operational burdens. This can discourage budget-sensitive industries from upgrading to advanced blower systems. Some sectors also face challenges related to noise levels and vibration, especially in older industrial environments where acoustic insulation is limited.

Growth Factors

Growing Shift Toward Energy-Efficient Systems Creates New Market Potential

There is a significant opportunity for commercial blower manufacturers to develop energy-efficient technologies that enable customers to reduce their electricity costs. As industries strive for sustainability, demand is increasing for blowers that consume less power yet deliver higher output.

Digital monitoring, smart control systems, and IoT-enabled blowers also open new prospects. These technologies help businesses track performance, detect faults early, and optimise airflow based on real-time needs. Expanding industrialisation in emerging economies presents another growth window.

Urbanisation and infrastructure development contribute further demand, especially from commercial buildings, warehouses, and wastewater treatment facilities. These sectors focus on improving indoor air quality, making blowers an essential part of long-term operational planning.

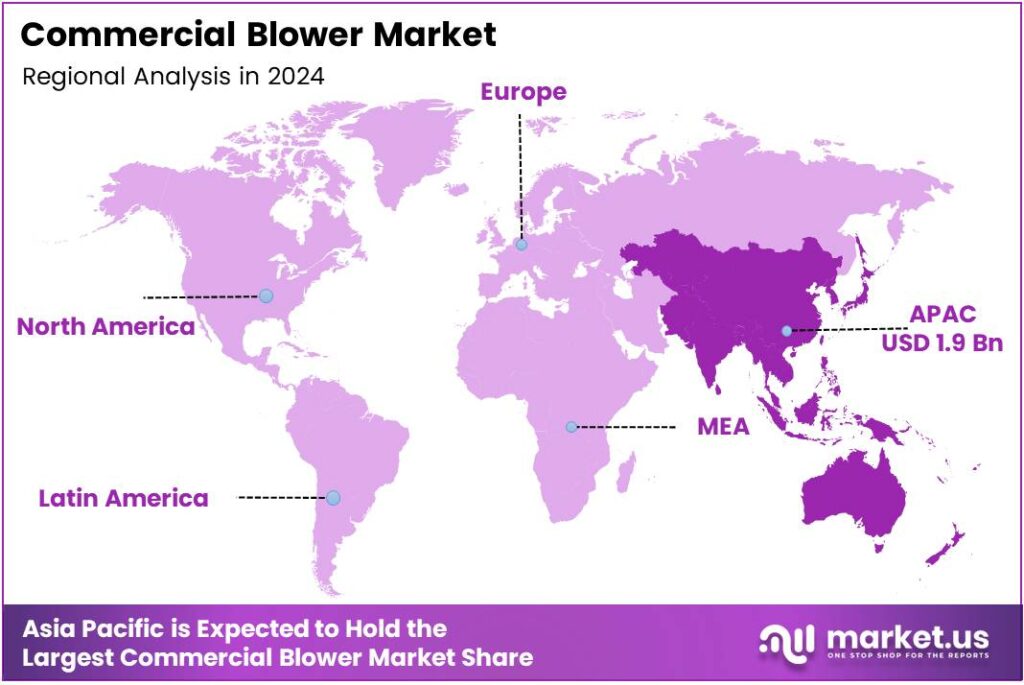

Regional Analysis

Asia Pacific Dominates the Commercial Blower Market with a Market Share of 48.1%, Valued at USD 1.9 Billion

Asia Pacific held the leading position in the Commercial Blower Market, driven by rapid industrialization, expansion of manufacturing hubs, and rising infrastructure development. The region’s strong dominance of 48.1% and valuation of USD 1.9 billion reflect its growing focus on efficient air-handling and industrial ventilation technologies. Increasing adoption of energy-efficient machinery further enhances market penetration across diverse applications.

North America demonstrates steady growth due to advancements in industrial automation, strict environmental norms, and rising investment in upgrading aging infrastructure. The U.S. remains a significant contributor, supported by expansions in food processing, pharmaceuticals, and power generation.

Europe’s market expansion is supported by strong environmental regulations, widespread adoption of energy-efficient industrial systems, and modernization of wastewater treatment facilities. The region benefits from technological innovation and sustainability-focused industrial policies that encourage the replacement of aging blower systems.

The Middle East & Africa region is experiencing gradual growth driven by developments in oil & gas, chemical processing, and large-scale infrastructure projects. Increased investment in desalination plants, power utilities, and industrial ventilation systems fuels demand for advanced blowers. Growing urbanization and government-backed diversification initiatives further enhance market prospects across major economies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Commercial Blower Market reflects steady modernization as industries prioritize energy-efficient ventilation, regulated airflow, and automation-driven maintenance. Major manufacturers continue shifting toward high-performance blowers that reduce operational downtime and align with tightening environmental standards across wastewater treatment, power generation, chemicals, and heavy manufacturing.

Atlas Copco Ab maintains a strong competitive stance with its focus on low-noise, oil-free blowers engineered for industrial sustainability. The company’s digital monitoring platforms and ISO-certified energy-efficient product lines reinforce its relevance across compressor-integrated blower systems in large facilities.

Kaeser Kompressoren strengthens market performance with its advanced rotary blowers and SIGMA-profile airends optimized for lower power consumption. Its integrated control systems and strong global servicing network continue to make it a preferred choice for high-duty-cycle industries.

Aerzen remains a dominant engineering innovator offering tri-lobe and turbo blowers tailored for wastewater, chemical, and process manufacturing. Its emphasis on oil-free compression, durability, and Industry 4.0-ready diagnostics supports growing adoption in automation-driven facilities.

Xylem plays an influential role in the blower landscape due to its strong presence in water and wastewater management solutions. With a portfolio oriented toward aeration efficiency and reduced treatment-plant energy use, the company benefits from rising global investments in municipal and industrial water infrastructure.

Top Key Players in the Market

- Atlas Copco Ab

- Kaeser Kompressoren

- Aerzen

- Xylem

- Mittal Blowers India Pvt. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Sofasco Fans

- Kay International Pvt. Ltd.

- Airpro Fan and Blower Company

Recent Developments

- In 2025, Atlas Copco continues to emphasize its range of oil-free air blowers for low-pressure compressed air applications, as highlighted in its product offerings. The company’s sustainability initiatives include promoting oil-free air blowers as part of greener production processes.

- In 2025, Kaeser will provide industrial blowers for applications like wastewater treatment, pneumatic conveying, and fermentation. Kaeser rotary screw blowers were recommended in a package for the Beacon, NY, Wastewater Treatment Facility aeration blower replacement project, as detailed in a city addendum.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 6.9 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Positive Displacement Blowers, Centrifugal Blowers, High-Speed Turbo Blowers, Regenerative Blowers), By Pressure (Up to 15 Psi, 15 to 20 Psi, Above 20 Psi), By End-Use (Cement, Steel, Power, Mining, Pulp and Paper, Food and Beverage, Water and Wastewater Treatment, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Atlas Copco Ab, Kaeser Kompressoren, Aerzen, Xylem, Mittal Blowers India Pvt. Ltd., Mitsubishi Heavy Industries, Ltd., Sofasco Fans, Kay International Pvt. Ltd., Airpro Fan and Blower Company Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Commercial Blower MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Commercial Blower MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Atlas Copco Ab

- Kaeser Kompressoren

- Aerzen

- Xylem

- Mittal Blowers India Pvt. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Sofasco Fans

- Kay International Pvt. Ltd.

- Airpro Fan and Blower Company