Global HVAC Services Market Size, Share, Growth Analysis By Type (Heating, Ventilation, Cooling), By Service (Consulting, Installation, Maintenance & Repair, Upgrade/Replacement), By End Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141728

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

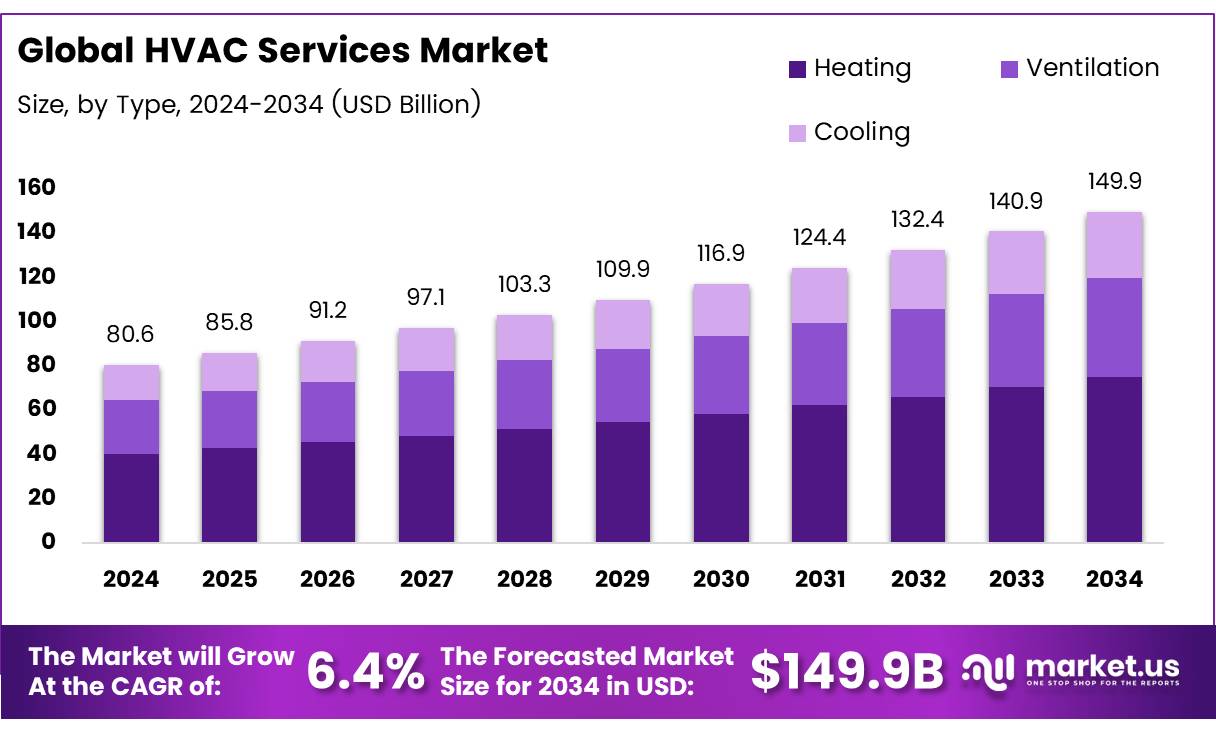

The Global HVAC Services Market size is expected to be worth around USD 80.6 Billion by 2034, from USD 149.9 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The HVAC (Heating, Ventilation, and Air Conditioning) Services Market encompasses the installation, maintenance, and repair of HVAC systems across residential, commercial, and industrial sectors. These services ensure optimal climate control, energy efficiency, and compliance with environmental regulations.

As businesses and households increasingly prioritize indoor air quality and sustainability, demand for HVAC services continues to grow. Additionally, rapid urbanization and rising construction activities drive market expansion, particularly in North America, Europe, and Asia-Pacific. With advancing technology, service providers are integrating smart HVAC solutions, enhancing operational efficiency and customer satisfaction.

The HVAC services sector is undergoing a transformation, driven by labor shortages, technological advancements, and heightened regulatory scrutiny. With approximately 80% of U.S. construction companies struggling to find skilled professionals (NTINow), the demand for certified HVAC technicians is intensifying. This talent gap presents a challenge but also creates opportunities for automation and training programs.

Furthermore, the annual spending on HVAC repair and maintenance services is projected to surpass USD 10 billion in 2025 as GetJobber, indicating strong aftermarket service growth. Companies that invest in workforce development and predictive maintenance solutions will gain a competitive edge in the evolving landscape.

The broader HVAC services market is a vital component of the global economy, with companies generating $150 billion in annual revenue and employing over 1.5 million people in the U.S. alone (SBE Odyssey). Increasing regulatory mandates around energy efficiency and sustainability are reshaping service demand.

Governments worldwide are implementing policies to encourage green HVAC solutions, further propelling the market. Additionally, the rising adoption of IoT-enabled HVAC systems is revolutionizing maintenance strategies, reducing operational costs, and improving energy efficiency. Industry leaders must prioritize innovation and digital transformation to stay competitive in this expanding market.

The HVAC services market is positioned for robust growth due to increasing urbanization, infrastructure development, and climate change concerns. Government incentives for energy-efficient HVAC systems are driving higher adoption rates.

Regulations like the U.S. Energy Policy Act and EU directives on carbon neutrality are prompting businesses to invest in modern HVAC solutions. Additionally, advancements in AI-driven predictive maintenance are creating new revenue streams for service providers. Despite labor shortages, companies that focus on automation, technician training, and smart HVAC solutions will capitalize on emerging opportunities.

Key Takeaways

- Global HVAC Services Market projected to grow from USD 149.9 billion in 2024 to USD 80.6 billion by 2034 at a CAGR of 6.4%.

- Heating segment dominated the market in 2024 with 39.3% share, driven by demand in colder regions and energy-efficient technologies.

- Consulting services led in 2024, holding 34.1% of the market, due to demand for energy-efficient designs and regulatory compliance.

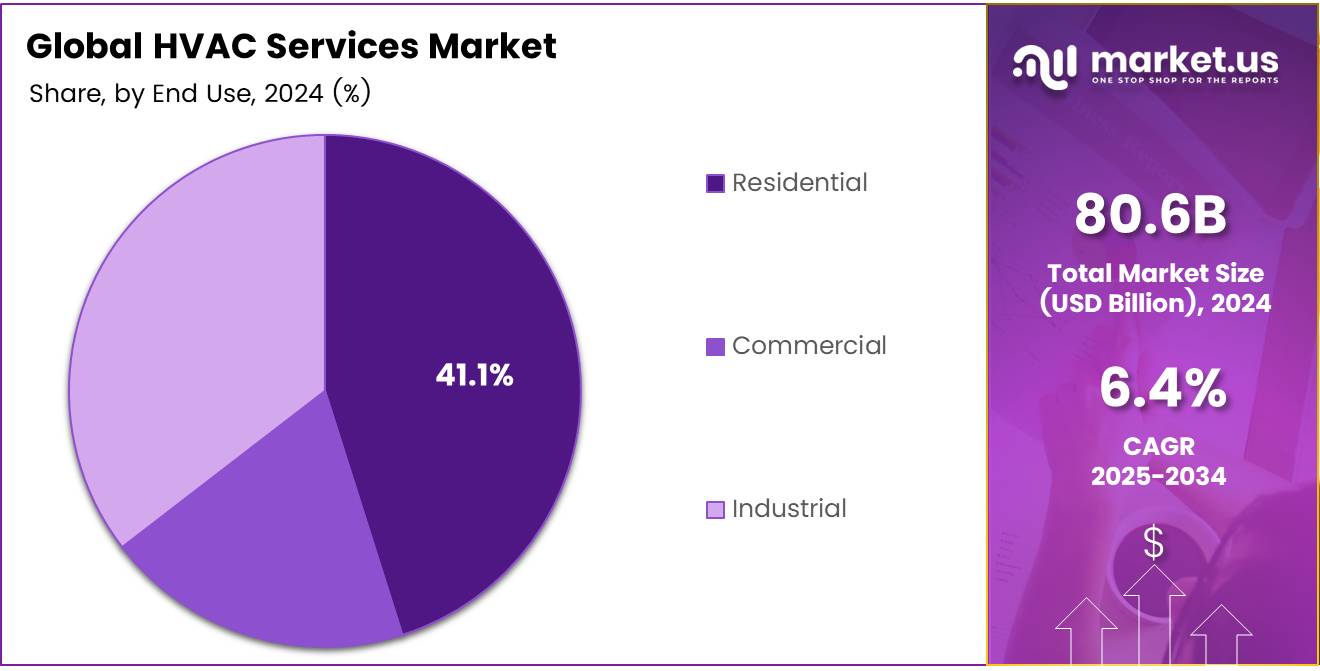

- Residential segment held a major share of 41.1% in 2024, propelled by urbanization, climate change, and higher living standards.

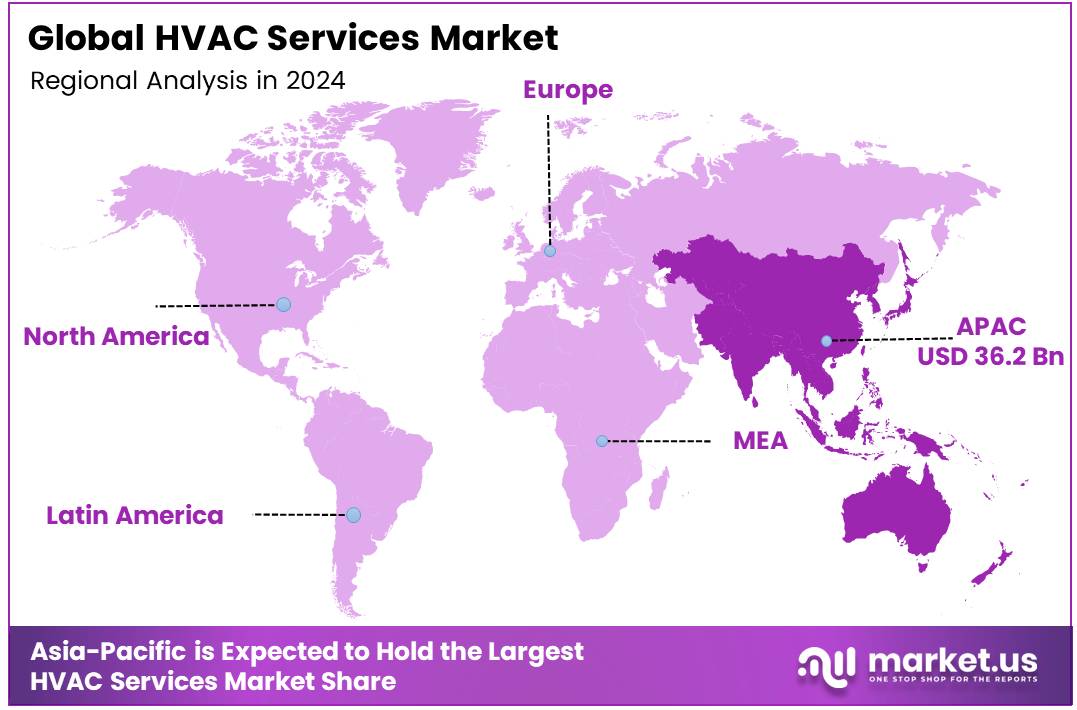

- Asia Pacific led the global market with a 45.6% share, fueled by rapid urbanization, climatic changes, and construction booms in China and India.

Type Analysis

Heating Maintains Leading Position with 39.3% Market Share in HVAC Services Type Analysis

In 2024, the Heating segment of the HVAC Services Market secured a prominent position, capturing 39.3% of the market share in the By Type Analysis category. This substantial share underscores the segment’s pivotal role in temperature regulation across residential, commercial, and industrial applications, primarily driven by growing demand in colder regions and advances in energy-efficient technologies.

Turning to the Ventilation segment, its significance in ensuring optimal indoor air quality and energy efficiency continues to rise. This segment benefits from heightened awareness about health and environmental quality, leading to innovations in filtration and air-purifying technologies, which are increasingly integrated into modern architectural designs.

Lastly, the Cooling segment, essential for comfort and process control in warmer climates and specific industrial settings, is witnessing advancements in refrigeration technologies and sustainable practices. The push towards eco-friendly refrigerants and energy-saving systems is reshaping market dynamics, aligning with global sustainability goals and regulatory mandates.

Together, these segments reflect a robust and evolving landscape within the HVAC services market, driven by technological innovations, regulatory frameworks, and shifting consumer preferences towards energy efficiency and environmental sustainability.

Service Analysis

Consulting Leads HVAC Services Market with a 34.1% Share in Service Analysis

In 2024, Consulting emerged as the leading service in the HVAC Services Market, capturing a dominant 34.1% market share within the By Service Analysis segment. This prominent position is largely attributed to the increasing demand for expert guidance in energy-efficient system designs and compliance with evolving building codes and regulations.

The consulting segment benefits significantly from the heightened emphasis on sustainability and energy savings, which compels building owners and operators to seek specialized advice on optimizing their HVAC systems.

Following Consulting, the Installation segment also plays a critical role, driven by the continuous construction of residential and commercial buildings and the consequent need for new HVAC systems. Maintenance & Repair services are essential to ensure the longevity and efficiency of HVAC systems, addressing regular wear and tear, and preventing costly breakdowns.

The Upgrade/Replacement segment has seen growth as older systems are being replaced with more energy-efficient models in response to regulatory pressures and technological advancements. Each of these segments complements the consulting services, together facilitating a holistic approach to managing HVAC needs in various environments

End Use Analysis

Residential Sector Leads HVAC Services Market with a 41.1% Share Due to Increasing Urbanization and Consumer Demand

In 2024, the HVAC services market witnessed a significant dominance of the Residential segment, holding a substantial 41.1% market share in the By End Use Analysis category.

This commanding position can be attributed primarily to the accelerated pace of urbanization and the heightened demand for residential comfort, driven by climatic changes and improved living standards. The growing inclination towards energy-efficient and technologically advanced HVAC systems in private households further bolsters this segment’s expansion.

The Commercial sector also portrayed robust growth within the HVAC services market, facilitated by the rising construction activities in office spaces, retail units, and hospitality establishments. The need for enhanced air quality and energy management in these facilities continues to drive the adoption of sophisticated HVAC solutions, aiming to optimize operational efficiency and comfort.

Meanwhile, the Industrial segment showed a steady uptake of HVAC services, particularly in manufacturing facilities and warehouses. The primary focus in this sector remains on maintaining product integrity and ensuring a safe working environment, which significantly influences the deployment of comprehensive HVAC systems tailored to industrial needs.

Together, these segments underscore a diverse and dynamic HVAC services market, where each sector’s unique requirements propel the demand for innovative and efficient climate control solutions.

Key Market Segments

By Type

- Heating

- Ventilation

- Cooling

By Service

- Consulting

- Installation

- Maintenance & Repair

- Upgrade/Replacement

By End Use

- Residential

- Commercial

- Industrial

Drivers

Urbanization Boosts HVAC Services Demand

The demand for HVAC services is significantly driven by escalating urbanization and construction activities. As cities expand and the number of residential and commercial buildings rises globally, the need for advanced heating, ventilation, and air conditioning systems escalates.

Additionally, governments are implementing stricter energy efficiency regulations for buildings, which compels property owners to install modern HVAC systems that comply with these new standards. Technological advancements further stimulate this market; innovations like smart thermostats and systems that maximize energy efficiency not only cater to regulatory compliance but also offer cost-effective, efficient solutions.

Furthermore, changes in climate patterns, marked by rising temperatures and extreme weather conditions, are increasing the reliance on HVAC systems to maintain comfort and safety in buildings. These factors collectively propel the HVAC services market forward, reflecting a robust trajectory driven by necessity and regulatory frameworks.

Restraints

High Installation Costs Challenge HVAC Services Market Expansion

The HVAC services market is constrained by several significant factors that can influence market growth and customer decisions. Foremost among these is the high initial cost associated with the installation of new HVAC systems. This financial barrier is particularly impactful for both residential and commercial clients, who may hesitate to invest in new systems due to the substantial upfront expenditures required.

Additionally, the market faces challenges from broader economic conditions. During periods of economic downturn, both individuals and businesses typically curtail their spending, which can lead to a decrease in new installations and upgrades of HVAC systems.

These economic fluctuations directly affect the HVAC services market, as reduced spending power leads to fewer sales and installations. This restraint is critical for stakeholders to consider, as it can significantly shape market dynamics and influence strategic planning within the industry.

Growth Factors

Smart Integration Enhances HVAC Services Market

The HVAC services market is poised for significant expansion, driven primarily by the integration of Internet of Things (IoT) technologies. These advancements foster smarter, connected HVAC systems that not only improve energy efficiency but also enhance user convenience and system reliability.

Additionally, the market sees promising growth opportunities in the adoption of geothermal heating and cooling systems, recognized for their environmental benefits and long-term cost savings. Service providers are increasingly offering customizable and flexible solutions, tailored to diverse climatic conditions and customer preferences, further boosting market appeal.

Moreover, expansion into new geographical areas, particularly underserved or emerging markets, presents a lucrative avenue for growth. These strategic initiatives collectively contribute to a robust growth trajectory for the HVAC services market, reflecting a blend of technological innovation and market expansion strategies.

Emerging Trends

Smart Controls Revolutionize the HVAC Services Market

In the HVAC services market, several trending factors are currently shaping the industry landscape. Foremost among these is the escalating adoption of smart controls and automated systems, which are revolutionizing user convenience and energy efficiency. These advanced technologies enable precise control and automated adjustments based on real-time data, leading to significant energy savings and optimal performance.

Additionally, the integration of mobile technology allows for remote monitoring and management, empowering users with the ability to control their systems from anywhere, enhancing flexibility and responsiveness. Artificial intelligence and machine learning are also playing pivotal roles, with their capabilities to predict maintenance needs and fine-tune operations for peak efficiency.

Moreover, there is a growing consumer focus on indoor air quality, driven by increased awareness of its impact on health. This has spurred demand for HVAC systems that can deliver cleaner air, highlighting a shift towards health-centric features in HVAC design and services.

Regional Analysis

Asia Pacific Dominates HVAC Services Market with a 45.6% Share Due to Rapid Urbanization and Construction Growth

The Asia Pacific region, holding a dominant share of 45.6% and valued at USD 36.2 billion, leads the global HVAC services market. Rapid urbanization, climatic variations, and booming construction activities, particularly in China and India, drive the demand for HVAC services. This region’s growth is bolstered by increasing disposable incomes and the growing emphasis on optimal indoor air quality.

Regional Mentions:

North America, the market is characterized by high adoption rates of energy-efficient systems, driven by stringent government regulations and high energy costs. This region’s focus on sustainable practices is propelling the retrofitting and upgrading of old HVAC systems, making North America a significant contributor to the market’s revenue.

Europe’s HVAC services market is advancing due to the increasing installation of HVAC systems in new residential and commercial buildings coupled with the rising demand for retrofitting and renovation of existing buildings. The market in Europe is also benefiting from the strict implementation of EU directives aimed at enhancing energy efficiency.

In the Middle East & Africa, the market is expanding steadily. Factors such as extreme weather conditions and increasing infrastructure development projects, especially in the Gulf Cooperation Council (GCC) countries, are significant drivers. The focus on diversifying economies and reducing dependency on oil revenues is fostering the growth of commercial and residential sectors, subsequently boosting HVAC service demands.

Latin America’s HVAC services market is evolving with the recovery of economic stability. Increased construction activities, particularly in countries like Brazil and Mexico, along with rising awareness about energy-efficient HVAC systems, are key factors contributing to the growth in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of the global HVAC services market, Siemens AG emerges as a pivotal player. The company’s strategic initiatives, centered around digitalization and sustainability, position it advantageously for growth in 2024. Siemens AG’s integration of IoT technologies into its HVAC solutions enhances system efficiency and predictive maintenance capabilities, catering to the increasing demand for energy-efficient and intelligent building solutions.

Ingersoll-Rand PLC, with its robust portfolio of heating, ventilation, and air conditioning products, continues to expand its footprint by focusing on energy-efficient solutions and services. This approach not only aligns with global sustainability trends but also meets the regulatory demands across various regions, enhancing its market competitiveness.

Honeywell International Inc. remains a key influencer in the market, driven by its innovative technologies and smart building solutions. The company’s commitment to developing eco-friendly products that reduce carbon footprints and improve energy efficiency resonates well with the current market dynamics.

Carrier Corporation’s focus on R&D investments to innovate and expand its HVAC product lines ensures its strong presence in the market. The company’s dedication to environmental stewardship and energy efficiency continues to attract customers seeking sustainable solutions.

Daikin Industries Ltd, renowned for its technological advancements in air conditioning solutions, leverages its global R&D capabilities to drive product innovation and maintain its leadership in the HVAC market. Its strategic emphasis on eco-friendly refrigerants and high-efficiency systems aligns with global efforts to combat climate change.

Overall, these key players, with their focus on innovation, sustainability, and technology integration, are set to drive the global HVAC services market forward in 2024. Each company’s unique strategic direction not only strengthens their market position but also contributes significantly to the industry’s growth and evolution.

Top Key Players in the Market

- Siemens AG

- Ingersoll-Rand PLC

- Honeywell International Inc.

- Carrier Corporation

- Daikin Industries Ltd

- LG Electronics Inc.

- Electrolux AB

- Johnson Controls International PLC

- Lennox International Inc.

- Fujitsu General Ltd

- Robert Bosch GmbH

- Nortek Global HVAC

Recent Developments

- In February 2025, AdvisorShares introduced the HVAC and Industrials ETF (Ticker: HVAC), offering a novel investment opportunity in thematic investing, focusing on the HVAC and industrial sectors.

- In March 2025, AE Industrial announced the launch of a new commercial HVAC services platform, facilitated through the investment in United Building Solutions, aiming to enhance service delivery and market reach.

- In July 2024, Bosch expanded its operations by acquiring the residential and light commercial HVAC business from Johnson Controls and Hitachi, a strategic move to broaden its portfolio in the HVAC market.

- In November 2024, Sila Services secured an equity investment from Goldman Sachs Alternatives’ Private Equity Business, signaling confidence and providing capital to fuel its growth strategy in the HVAC services sector.

Report Scope

Report Features Description Market Value (2024) USD 80.6 Billion Forecast Revenue (2034) USD 149.9 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Heating, Ventilation, Cooling), By Service (Consulting, Installation, Maintenance & Repair, Upgrade/Replacement), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Ingersoll-Rand PLC, Honeywell International Inc., Carrier Corporation, Daikin Industries Ltd, LG Electronics Inc., Electrolux AB, Johnson Controls International PLC, Lennox International Inc., Fujitsu General Ltd, Robert Bosch GmbH, Nortek Global HVAC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- Ingersoll-Rand PLC

- Honeywell International Inc.

- Carrier Corporation

- Daikin Industries Ltd

- LG Electronics Inc.

- Electrolux AB

- Johnson Controls International PLC

- Lennox International Inc.

- Fujitsu General Ltd

- Robert Bosch GmbH

- Nortek Global HVAC