Global Chocolate Biscuit Market Size, Share, And Business Benefits By Product Type (Chocolate Coated, Cream Filled (Chocolate Cream, Strawberry Cream, Vanilla Cream), Sandwich, Wafer), By Flavor (Milk, Dark, White, Mixed), By Distribution Channel (Supermarket Hypermarket, Online, Specialty Store, Convenience Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153693

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

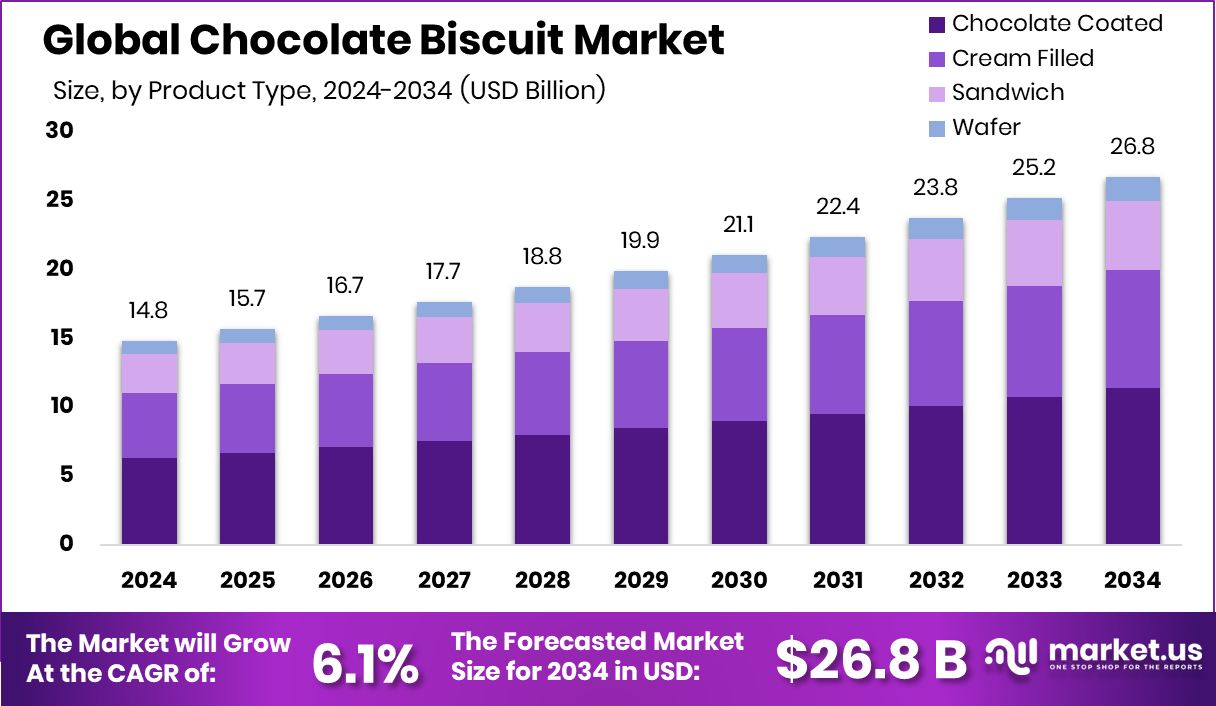

The Global Chocolate Biscuit Market is expected to be worth around USD 26.8 billion by 2034, up from USD 14.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Strong consumer demand in Europe, 47.8% continues to support chocolate biscuit sales and expansion.

A chocolate biscuit is a baked snack made by combining biscuit dough with chocolate in various forms—such as chocolate chips, chocolate coating, or chocolate filling. These biscuits are known for their sweet taste, crisp texture, and wide appeal across age groups. They are commonly enjoyed as a quick snack, dessert, or with beverages like tea and coffee. Available in various shapes, sizes, and flavors, chocolate biscuits are a staple in households, convenience stores, and supermarkets around the world.

The chocolate biscuit market refers to the global industry involved in the production, distribution, and consumption of biscuits that contain chocolate as a key ingredient. This market includes a broad range of products such as chocolate-coated biscuits, chocolate cream-filled biscuits, and chocolate-flavored cookies. It spans across various distribution channels, including retail stores, online platforms, and foodservice outlets.

The market is growing steadily due to the rising consumption of on-the-go snacks and increasing urbanization. Busy lifestyles are encouraging consumers to opt for ready-to-eat snack options, and chocolate biscuits fit well into this trend. Growth is also supported by product innovation and attractive packaging aimed at younger demographics. In line with this, MOSH secured $3 million in a Series A funding round to strengthen its position in the healthier snack segment.

Demand is fueled by growing consumer preference for sweet snacks, especially among children and millennials. The availability of diverse flavors, health-conscious variants, and seasonal launches adds to the appeal. Jnck Bakery exceeded its £200k funding goal to expand its healthy cookie line, indicating strong market interest in better-for-you options. Additionally, Nestlé has committed R$2.7 billion in investment toward its chocolate and biscuit segment by 2026, which is expected to enhance its product portfolio and manufacturing capabilities.

Key Takeaways

- The Global Chocolate Biscuit Market is expected to be worth around USD 26.8 billion by 2034, up from USD 14.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Chocolate-coated biscuits lead the Chocolate Biscuit Market with 42.6% share due to their indulgent appeal.

- Milk flavor dominates the Chocolate Biscuit Market at 48.5%, driven by widespread consumer preference and taste.

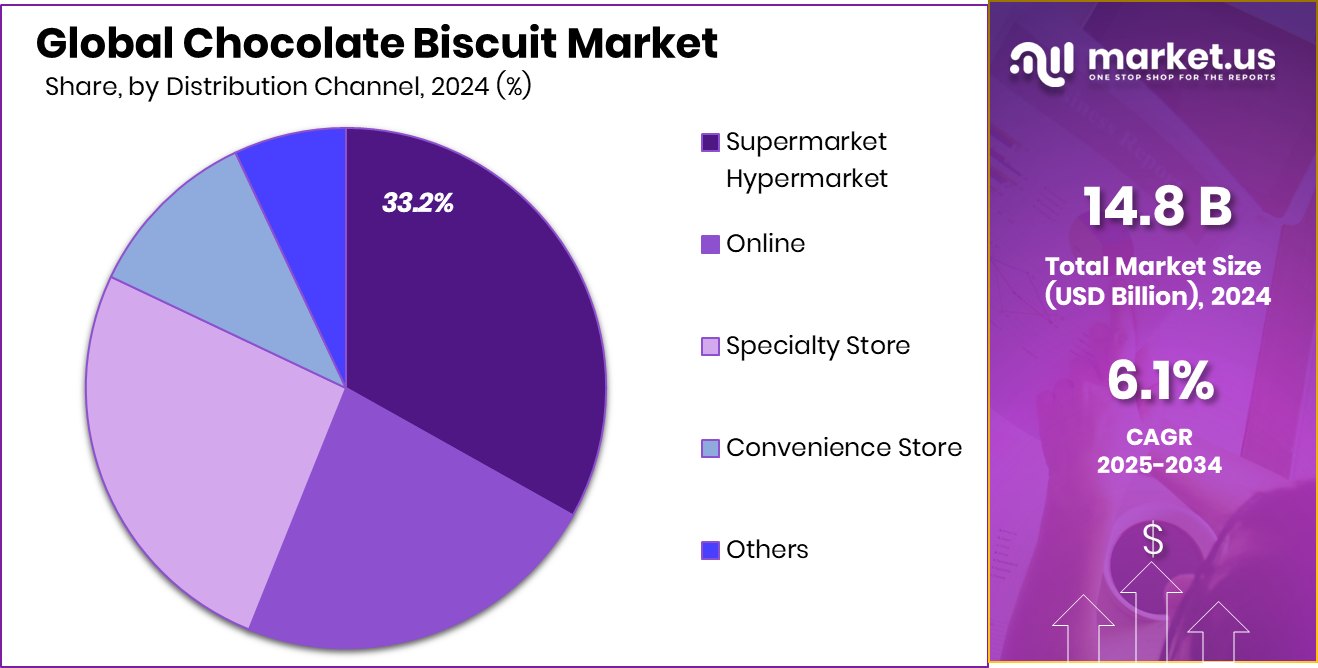

- Supermarket hypermarket segment holds a 33.2% share, making it the key retail channel in this market.

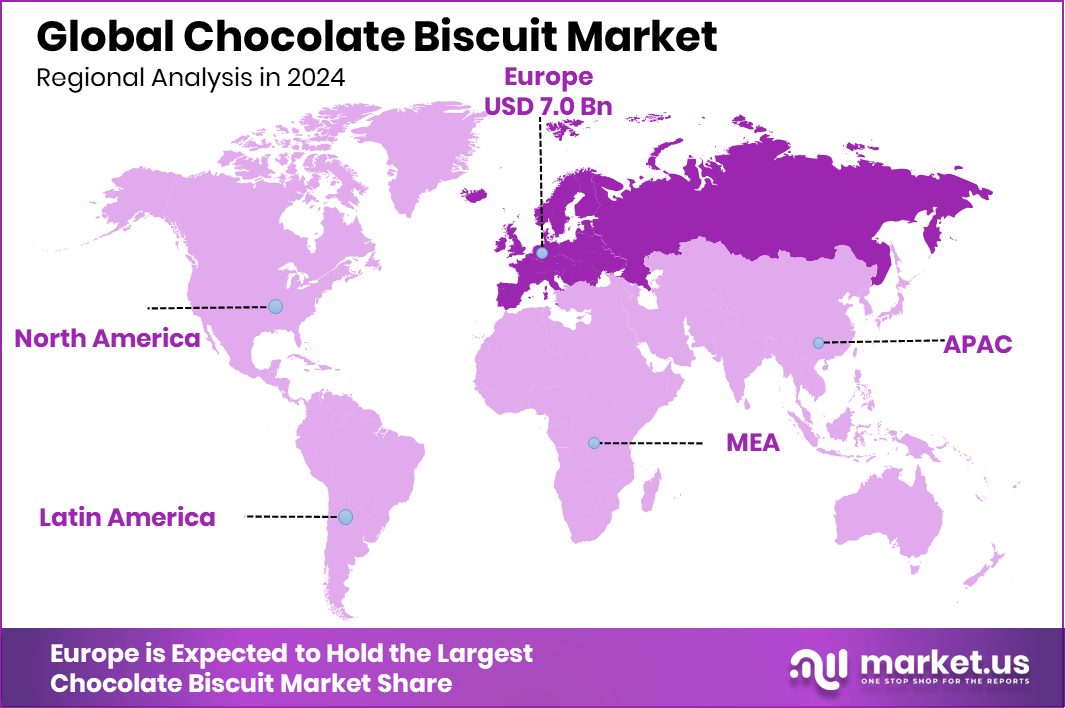

- The European chocolate biscuit market was valued at approximately USD 7.0 billion overall.

By Product Type Analysis

Chocolate coated biscuits lead the market with 42.6% share.

In 2024, Chocolate Coated held a dominant market position in the By Product Type segment of the Chocolate Biscuit Market, with a 42.6% share. This leadership can be attributed to strong consumer preference for rich, indulgent snacks that combine the crispness of biscuits with the smoothness of chocolate. The popularity of chocolate-coated biscuits has remained consistent due to their wide appeal among both children and adults, as well as their versatility in consumption—served as standalone snacks or alongside beverages like tea and coffee.

The dominance of this segment is further supported by the growing demand for premium snacking options, particularly in urban markets where convenience and taste drive purchase decisions. Shelf-ready packaging, attractive visuals, and long shelf life also contribute to their strong presence across retail and e-commerce platforms. Additionally, festive consumption patterns and gifting traditions have bolstered seasonal demand, particularly in regions with high chocolate consumption.

As lifestyles continue to evolve with a focus on indulgence and convenience, chocolate-coated biscuits are expected to maintain their strong position within the product mix. Manufacturers are also likely to leverage this demand by focusing on product innovations and limited-edition launches that appeal to changing consumer tastes while reinforcing the segment’s growth trajectory.

By Flavor Analysis

Milk flavor dominates consumer preference with 48.5% market share.

In 2024, Milk held a dominant market position in the By Flavor segment of the Chocolate Biscuit Market, with a 48.5% share. This significant share reflects strong consumer affinity toward the smooth, creamy taste profile that milk chocolate offers. The familiarity and universal appeal of milk chocolate have made it a preferred choice for both children and adults, positioning it as a staple in the flavored biscuit category.

The segment’s dominance is also driven by the comfort and indulgence associated with milk chocolate, which resonates well across different demographics and geographies. Easy availability, attractive packaging, and affordability have further helped strengthen the presence of milk-flavored chocolate biscuits in organized retail and convenience stores. Moreover, the flavor is often seen as a safe and classic option, making it a frequent choice for households, gifting, and everyday snacking.

The high share of the milk flavor segment is also a result of consistent demand across all seasons, unlike some niche or seasonal variants. Its popularity has encouraged producers to launch new variations while retaining the base milk chocolate taste, reinforcing consumer loyalty. As taste preferences continue to favor classic chocolate profiles, the milk flavor segment is expected to maintain its leading position in the coming years.

By Distribution Channel Analysis

Supermarkets and hypermarkets account for 33.2% of sales distribution.

In 2024, Supermarket Hypermarket held a dominant market position in the By Distribution Channel segment of the Chocolate Biscuit Market, with a 33.2% share. This leading position can be attributed to the wide availability of product choices, attractive shelf displays, and the ability to offer both premium and value-for-money options under one roof.

The segment has also benefited from the regular promotional offers and discounts typically available in supermarkets and hypermarkets, which influence bulk buying behavior, especially for household consumption. In-store branding and visibility also play a key role in enhancing customer recall and encouraging impulse purchases. Additionally, the strategic placement of chocolate biscuits in snack aisles and checkout counters has contributed to strong footfall-driven sales.

Urbanization and the expansion of modern retail infrastructure have further supported this channel’s growth. As consumers increasingly seek convenience and variety in their shopping experiences, supermarkets and hypermarkets remain the preferred choice for purchasing everyday snack items like chocolate biscuits. With continued investment in retail networks and improved product accessibility, this distribution channel is expected to maintain its leadership position in the near term.

Key Market Segments

By Product Type

- Chocolate Coated

- Cream Filled

- Chocolate Cream

- Strawberry Cream

- Vanilla Cream

- Sandwich

- Wafer

By Flavor

- Milk

- Dark

- White

- Mixed

By Distribution Channel

- Supermarket Hypermarket

- Online

- Specialty Store

- Convenience Store

- Others

Driving Factors

Rising Demand for Convenient and Tasty Snacks

One of the key driving factors for the chocolate biscuit market is the growing consumer preference for convenient and tasty snack options. Busy lifestyles, especially in urban areas, are pushing people to choose ready-to-eat food products that require no preparation. Chocolate biscuits fit well into this need as they are easy to carry, quick to eat, and satisfy sweet cravings instantly.

Their long shelf life and attractive packaging make them suitable for lunchboxes, travel snacks, and casual consumption. Additionally, their appeal across age groups—particularly among children and young adults—further supports consistent demand. As consumers continue to look for enjoyable yet practical food items, chocolate biscuits remain a popular and accessible choice in both developed and emerging markets.

Restraining Factors

Health Concerns Over Sugar and Calorie Intake

One of the major restraining factors in the chocolate biscuit market is the growing awareness of health and nutrition among consumers. Many chocolate biscuits are high in sugar, saturated fats, and calories, which can contribute to obesity, diabetes, and other lifestyle-related health issues. As a result, health-conscious individuals are reducing their intake of such products or switching to healthier alternatives like low-sugar or whole-grain snacks.

This shift in eating habits, especially in developed countries, is affecting the overall consumption of traditional chocolate biscuits. Moreover, increasing government regulations on sugar content, food labeling, and advertising to children are further limiting the growth of this category. These health-related concerns are expected to challenge market expansion in the long term.

Growth Opportunity

Launching Healthier Low‑Sugar Chocolate Biscuits

The chocolate biscuit market presents a significant growth opportunity in the development and promotion of healthier, low‑sugar options. Many consumers are now seeking snacks with reduced sugar content, natural sweeteners, and improved nutritional profiles. By offering chocolate biscuits made with whole grains, less sugar, and added fiber, manufacturers can tap into the growing health-conscious segment, which includes families, working adults, and fitness-oriented individuals.

Such healthier products can be positioned as guilt‑free indulgences, aligning taste with better nutritional value. Additionally, clear labeling and transparent ingredient sourcing can further build consumer trust. As more people gravitate toward snacks that balance flavor with health benefits, the introduction of nutritious chocolate biscuits can unlock new customer segments and boost sales across both traditional and modern retail channels.

Latest Trends

Innovations in Premium Flavored Chocolate Biscuits

Consumers are increasingly drawn to premium chocolate biscuits featuring unique and bold flavors. Brands are introducing options such as dark chocolate with sea salt, caramel swirl, mint-infused varieties, and even fruit‑chocolate combinations like raspberry or orange. These innovative flavor profiles cater to adventurous taste seekers and those who prefer a more gourmet snacking experience.

Limited‑edition releases tied to seasons or festivals enhance appeal and drive repeat purchases. Attractive packaging with elegant designs further reinforces the perception of premium quality. As consumers seek elevated and differentiated indulgences over standard offerings, the introduction of innovative, upscale flavors provides a way to attract new buyers and support higher price points.

Regional Analysis

In 2024, Europe led the chocolate biscuit market with 47.8% share dominance.

In 2024, Europe held the dominant position in the global chocolate biscuit market, capturing a significant 47.8% share, equivalent to a market value of USD 7.0 billion. The region’s leadership is driven by high per capita consumption of chocolate-based snacks, strong retail networks, and a long-standing tradition of biscuit production and consumption. European consumers show consistent demand for premium and indulgent products, contributing to sustained sales across supermarket, hypermarket, and specialty retail formats.

North America also represents a key market, supported by a developed food industry and widespread consumer preference for convenient snack options. Asia Pacific is witnessing rising consumption due to urbanization and growing middle-class income, particularly in emerging economies. The Middle East & Africa and Latin America show steady progress, with increasing product availability and changing dietary habits.

However, these regions currently hold smaller shares in comparison to Europe and North America. While all regions present growth potential, Europe clearly dominates the global landscape in terms of both value and volume, setting the benchmark for product innovation and consumer engagement. The regional performance underscores the importance of aligning product offerings with cultural preferences and retail dynamics to capture market share in competitive and evolving environments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Balocco S.p.A., an Italian bakery brand, maintained its stronghold in Europe by offering premium chocolate biscuit assortments. The company focused on family-sized packaging and festive product lines, enhancing its market presence in seasonal sales. Its commitment to traditional Italian recipes paired with modern production capabilities has allowed consistent performance in Western European markets.

Britannia Industries Limited, a major Indian food company, continued leveraging its extensive distribution network across India and emerging markets. The brand expanded its premium biscuit range with chocolate variants under categories like “Treat” and “Good Day.” With India’s biscuit exports rising in 2024, Britannia capitalized on global demand by entering select African and Middle Eastern regions.

Ferrero SpA, known globally for Ferrero Rocher and Kinder brands, strengthened its chocolate biscuit segment through cross-branding strategies. Its biscuit products under the Kinder brand, such as “Kinder Cards” and “Kinder Bueno Biscuits,” gained popularity in European and North American markets. Ferrero’s emphasis on quality ingredients and indulgent textures remained a key differentiator.

Grupo Bimbo, S.A.B. de C.V., the world’s largest bakery company, expanded its chocolate biscuit offerings under brands like Marinela and Gamesa. In 2024, the company focused on Latin America and the U.S. markets, integrating sustainability goals with product innovation and widening its portfolio of indulgent snacks.

Top Key Players in the Market

- Balocco S.p.A

- Britannia Industries Limited

- Ferrero SpA

- Grupo Bimbo, S.A.B. de C.V.

- ITC Limited

- Kellogg Company

- Lotus Bakeries NV

- Mondelēz International, Inc.

- Nestlé S.A.

- Parle Products Private Limited

- Pladis Global Limited

- Tatawa Industries(M) Sdn. Bhd.

Recent Developments

- In May 2025, During TuttoFood 2025 in Milan, Balocco unveiled a new wafer line featuring a lemon‑flavored variant, aimed at international expansion. Although not purely chocolate, it complements the wafer portfolio (which includes cocoa‑filled wafers), and reflects innovation framing chocolate biscuit segments under new offerings.

- In May 2025, During the Sweets & Snacks Expo May 2025, Ferrero introduced Kinderini Cookies, a new crunchy shortbread cookie available in buttery and cocoa varieties. These cookies are chocolate‑related products under the global Kinder brand, aimed at North American consumers.

Report Scope

Report Features Description Market Value (2024) USD 14.8 Billion Forecast Revenue (2034) USD 26.8 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Chocolate Coated, Cream Filled (Chocolate Cream, Strawberry Cream, Vanilla Cream), Sandwich, Wafer), By Flavor (Milk, Dark, White, Mixed), By Distribution Channel (Supermarket Hypermarket, Online, Specialty Store, Convenience Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Balocco S.p.A, Britannia Industries Limited, Ferrero SpA, Grupo Bimbo, S.A.B. de C.V., ITC Limited, Kellogg Company, Lotus Bakeries NV, Mondelēz International, Inc., Nestlé S.A., Parle Products Private Limited, Pladis Global Limited, Tatawa Industries(M) Sdn. Bhd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Balocco S.p.A

- Britannia Industries Limited

- Ferrero SpA

- Grupo Bimbo, S.A.B. de C.V.

- ITC Limited

- Kellogg Company

- Lotus Bakeries NV

- Mondelēz International, Inc.

- Nestlé S.A.

- Parle Products Private Limited

- Pladis Global Limited

- Tatawa Industries(M) Sdn. Bhd.