Global Cardiac Arrhythmia Monitoring Devices Market By Product Type (Holter Monitors, ECG Monitors, Implantable Monitors, and Mobile Cardiac Telemetry), By Application (Atrial Fibrillation, Bradycardia, Tachycardia, Ventricular Fibrillation, Premature Contraction, and Others), By End-user (Hospitals and Clinics, Ambulatory Centers, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148803

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

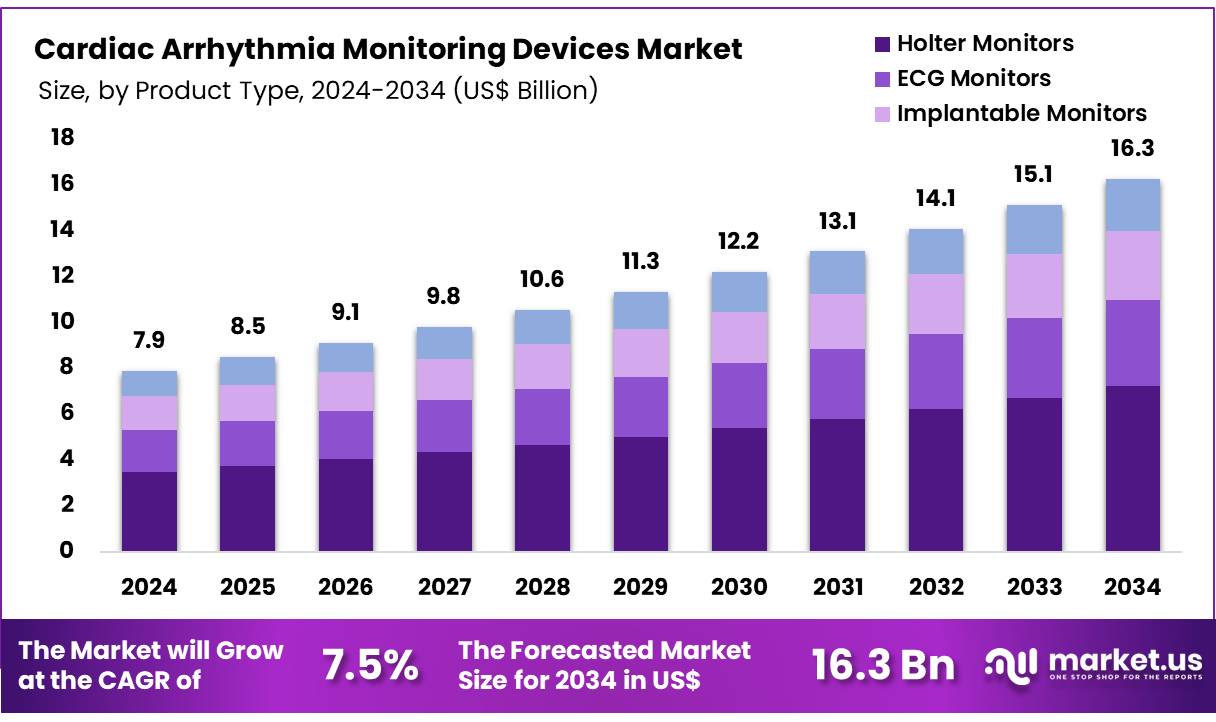

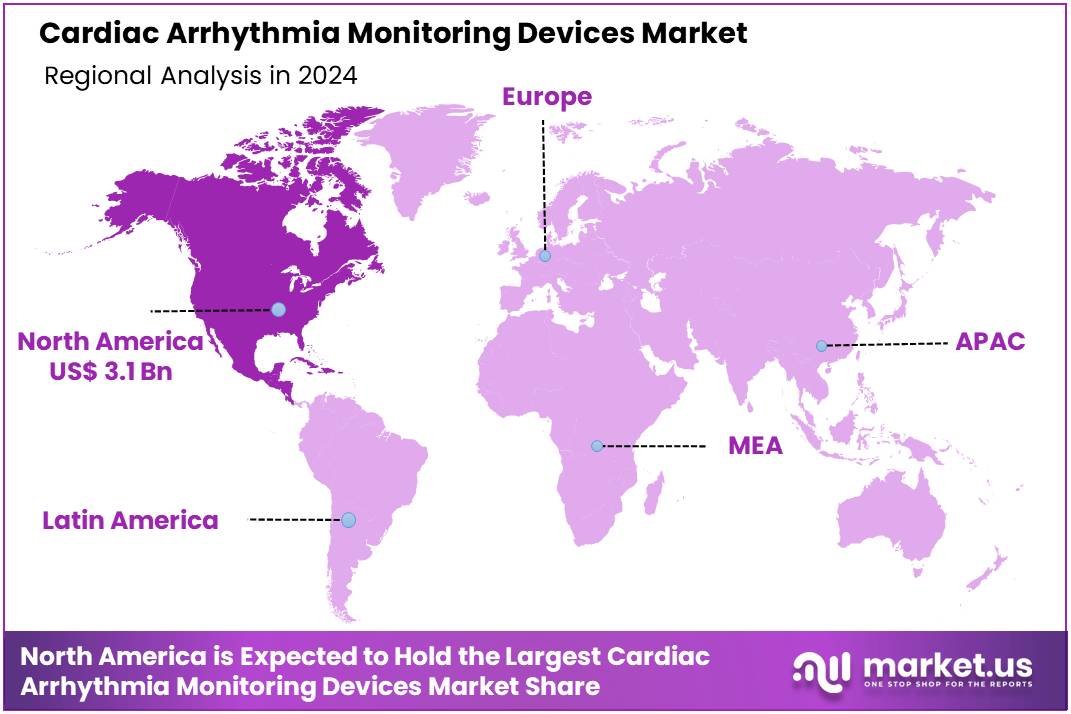

The Global Cardiac Arrhythmia Monitoring Devices Market size is expected to be worth around US$ 16.3 billion by 2034 from US$ 7.9 billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.4% share with a revenue of US$ 3.1 Million.

Rising prevalence of cardiovascular disorders and increasing awareness about early detection drive the expansion of the cardiac arrhythmia monitoring devices market. These devices play a critical role in diagnosing, managing, and monitoring irregular heart rhythms, helping clinicians tailor personalized treatment strategies. Applications range from continuous heart rate monitoring and detecting atrial fibrillation to managing sudden cardiac events and assessing therapy effectiveness.

In July 2021, Medtronic announced FDA clearance for two AccuRhythm AI algorithms designed to work with its LINQ II insertable cardiac monitor. These AI-powered algorithms enhance the precision of data analysis, enabling physicians to detect arrhythmias more accurately and respond swiftly. The integration of artificial intelligence and machine learning boosts diagnostic confidence and reduces false positives, improving patient outcomes.

Additionally, wearable and implantable devices have gained traction, offering real-time, long-term monitoring with minimal patient discomfort. Innovations focus on improving device miniaturization, battery life, and wireless connectivity to facilitate seamless data transmission to healthcare providers. Growing adoption in outpatient and remote care settings creates new growth opportunities, as healthcare providers seek cost-effective, patient-friendly solutions.

Increasing partnerships between technology developers and healthcare institutions accelerate advancements in monitoring capabilities. These trends, combined with rising investment in cardiac care, position the market for sustained growth while addressing unmet clinical needs in arrhythmia management.

Key Takeaways

- In 2023, the market for cardiac arrhythmia monitoring devices generated a revenue of US$ 7.9 billion, with a CAGR of 7.5%, and is expected to reach US$ 16.3 billion by the year 2033.

- The product type segment is divided into holter monitors, ECG monitors, implantable monitors, and mobile cardiac telemetry, with holter monitors taking the lead in 2023 with a market share of 44.3%.

- Considering application, the market is divided into atrial fibrillation, bradycardia, tachycardia, ventricular fibrillation, premature contraction, and others. Among these, atrial fibrillation held a significant share of 36.4%.

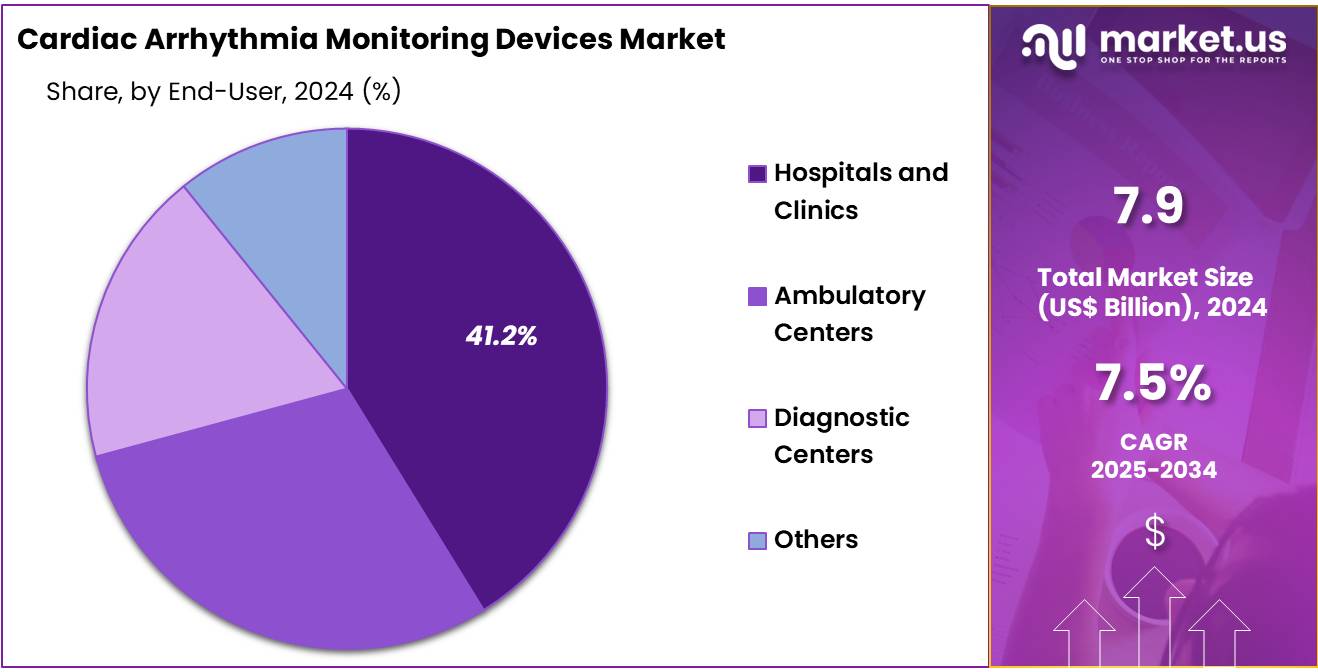

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and clinics, ambulatory centers, diagnostic centers, and others. The hospitals and clinics sector stands out as the dominant player, holding the largest revenue share of 41.2% in the cardiac arrhythmia monitoring devices market.

- North America led the market by securing a market share of 39.4% in 2023.

Product Type Analysis

The holter monitors segment claimed a market share of 44.3% owing to its established reliability and ease of use. Increasing prevalence of cardiovascular diseases, especially arrhythmias, is expected to drive demand for continuous ambulatory monitoring, which Holter monitors effectively provide. Healthcare providers likely favor these devices for their ability to record heart activity over 24 to 48 hours, offering detailed insights for diagnosis and treatment planning.

Technological improvements enhancing data accuracy and patient comfort are anticipated to further boost adoption rates. The segment’s cost-effectiveness compared to implantable monitors or mobile telemetry is projected to attract both hospitals and outpatient clinics. Growing awareness among patients about early arrhythmia detection is expected to increase the utilization of Holter monitors.

Moreover, rising geriatric populations with higher cardiac risk will likely expand this market segment. Integration with digital platforms for remote monitoring is also anticipated to encourage broader use. These factors collectively position Holter monitors for robust market growth in the coming years.

Application Analysis

The atrial fibrillation held a significant share of 36.4% due to the increasing global incidence of this condition. Rising prevalence of lifestyle-related risk factors such as hypertension, obesity, and diabetes is expected to drive the demand for effective atrial fibrillation detection and management tools. Early and accurate diagnosis of atrial fibrillation is crucial to preventing severe complications like stroke, which underscores the need for advanced monitoring solutions.

Healthcare providers are likely to adopt specialized devices that provide continuous, real-time heart rhythm analysis to monitor this irregular heartbeat disorder. Ongoing technological advancements, including wearable and implantable monitors tailored for atrial fibrillation, are projected to fuel segment growth.

Additionally, growing patient awareness and proactive screening initiatives will contribute to rising device utilization. The segment’s importance in personalized treatment planning and improved patient outcomes further supports its expansion. Increasing geriatric populations at higher risk also amplify demand for atrial fibrillation monitoring technologies. Collectively, these factors suggest significant market growth driven by the atrial fibrillation segment.

End-User Analysis

The hospitals and clinics segment had a tremendous growth rate, with a revenue share of 41.2% owing to the increasing focus on comprehensive cardiac care in these settings. Hospitals are likely to invest heavily in advanced diagnostic tools to enhance arrhythmia detection and management, benefiting from integrated healthcare infrastructures and skilled medical professionals.

Clinics offering outpatient cardiac services are anticipated to expand their use of portable and easy-to-use monitoring devices to cater to a growing patient base. Rising cardiovascular disease prevalence prompts frequent cardiac evaluations, making hospitals and clinics primary purchasers of such technologies. Favorable reimbursement policies and government initiatives supporting cardiovascular health are projected to stimulate procurement in these healthcare facilities.

Furthermore, advancements in remote monitoring and telehealth integration encourage hospitals and clinics to adopt more sophisticated devices for continuous patient observation. The segment benefits from a large patient inflow requiring timely diagnosis and follow-up, reinforcing demand. Collaborations between hospitals and cardiac device manufacturers also accelerate access to innovative solutions. These dynamics collectively propel the hospitals and clinics segment toward notable expansion.

Key Market Segments

Product Type

- Holter Monitors

- ECG Monitors

- Implantable Monitors

- Mobile Cardiac Telemetry

Application

- Atrial Fibrillation

- Bradycardia

- Tachycardia

- Ventricular Fibrillation

- Premature Contraction

- Others

End-user

- Hospitals and Clinics

- Ambulatory Centers

- Diagnostic Centers

- Others

Drivers

The increasing prevalence of cardiac arrhythmias is driving the market

The increasing prevalence of cardiac arrhythmias, particularly atrial fibrillation (AFib), is a significant driver for the cardiac arrhythmia monitoring devices market. As populations age and the incidence of cardiovascular risk factors rises, more individuals develop abnormal heart rhythms requiring diagnosis and management. Effective monitoring is crucial for detecting arrhythmias, assessing their frequency and severity, and guiding treatment decisions to prevent serious complications like stroke.

The growing number of people affected by these conditions fuels the demand for a range of monitoring technologies, from wearable patches to implantable devices, capable of continuous or intermittent heart rhythm assessment. The sheer scale of the affected population underscores the critical need for these diagnostic tools; the CDC estimates that in the US, 12.1 million people will have AFib in 2030.

Restraints

Reimbursement challenges and varying coverage policies are restraining the market

Reimbursement challenges and varying coverage policies pose a significant restraint on the cardiac arrhythmia monitoring devices market. Securing adequate and consistent reimbursement from both government and private payors for different types of monitoring devices and the associated interpretation services remains a complex issue.

Policies regarding the duration of monitoring, the specific clinical indications for device use, and the acceptable methodologies for data analysis vary, creating uncertainty for healthcare providers and manufacturers.

These inconsistencies and limitations in coverage can restrict patient access to optimal monitoring solutions and impact the adoption of newer, potentially more expensive, technologies. Navigating this fragmented reimbursement landscape presents an ongoing challenge for companies operating within the market.

Opportunities

Advancements in remote monitoring and connectivity are creating growth opportunities

Advancements in remote monitoring and connectivity are creating significant growth opportunities in the market. Newer generations of cardiac arrhythmia monitoring devices, such as long-term wearable sensors and insertable cardiac monitors, feature enhanced capabilities for wirelessly transmitting patient data to healthcare providers.

This enables continuous or near-real-time monitoring outside of traditional clinical settings, allowing for earlier detection of arrhythmias and more timely intervention. The integration of these devices with mobile applications and cloud-based platforms facilitates seamless data flow and remote patient management, improving convenience for both patients and clinicians.

Companies focused on these innovative remote monitoring solutions are experiencing growth; iRhythm Technologies, a key player in ambulatory cardiac monitoring, reported total revenue of US$591.8 million in fiscal year 2024, a 20.1% increase compared to US$492.7 million in fiscal year 2023, reflecting the growing adoption of connected monitoring technologies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the cardiac arrhythmia monitoring devices market. Economic conditions impact healthcare expenditures by individuals, hospitals, and health systems, affecting the affordability of monitoring devices and the investment capacity of healthcare facilities for purchasing new equipment; during economic downturns, patients might delay or forgo recommended monitoring procedures, and hospitals may reduce capital spending, while periods of economic stability generally support increased adoption of advanced medical technologies.

Geopolitical events and trade policies can disrupt the global supply chains for electronic components, sensors, and manufacturing materials needed to produce monitoring devices, potentially leading to increased production costs or delays in product availability. Reports in early 2025 indicated that geopolitical risks were contributing to volatility across various global supply chains, impacting sectors including medical technology.

Despite potential negative impacts from economic fluctuations and supply chain disruptions, the critical need for accurate and timely detection of cardiac arrhythmias to prevent serious health events maintains a fundamental demand, driving manufacturers and healthcare providers to build resilience and ensure continued access to these essential diagnostic tools.

Current US tariff policies can indirectly impact the market by affecting the cost of imported components and finished medical devices used for monitoring heart rhythms. The manufacturing of sophisticated monitoring devices often involves complex global supply chains for specialized electronic parts, batteries, and other materials sourced internationally, and tariffs imposed on these imported goods can increase the production costs for companies operating in or importing into the US.

For example, according to the US International Trade Commission DataWeb, US imports for consumption of electro-diagnostic apparatus (under HTS 9018.19), a category that includes some types of cardiac monitoring equipment, had a Customs Value of approximately US$1.56 billion in 2023. These increased input costs present a financial challenge for technology providers and could potentially lead to higher prices for cardiac monitoring devices and services, influencing procurement decisions by healthcare facilities and potentially impacting the cost of monitoring for patients.

Nevertheless, the vital role of these devices in diagnosing potentially life-threatening arrhythmias and guiding interventions to improve patient outcomes provides a strong incentive for their continued use, encouraging stakeholders to manage cost pressures and ensure access to essential cardiac monitoring technology.

Latest Trends

Integration of artificial intelligence and advanced algorithms is a recent trend

The integration of artificial intelligence (AI) and advanced algorithms is a recent trend in the market. Device manufacturers are increasingly incorporating AI and machine learning into their monitoring systems to improve the accuracy and efficiency of arrhythmia detection and analysis.

These intelligent algorithms can process vast amounts of ECG data to identify complex arrhythmia patterns, differentiate between clinically significant and benign events, and potentially predict future arrhythmic episodes. AI-powered analysis tools aim to reduce the burden on clinicians by automating initial data review and highlighting critical findings, leading to faster diagnoses and improved workflow. This trend reflects a broader movement towards leveraging AI in healthcare to enhance diagnostic capabilities and personalize patient care.

Regional Analysis

North America is leading the Cardiac Arrhythmia Monitoring Devices Market

North America dominated the market with the highest revenue share of 39.4% owing to the increasing prevalence of cardiac arrhythmias, such as atrial fibrillation. The Centers for Disease Control and Prevention (CDC) estimated that 12.1 million people in the US would have atrial fibrillation in 2030, indicating a substantial existing and growing patient pool requiring monitoring.

Furthermore, technological advancements in monitoring devices, including the development of more user-friendly wearable technologies and longer-lasting implantable monitors, have enhanced adoption. The American Heart Association highlights the importance of continuous monitoring for effective management of these conditions. Additionally, the established healthcare infrastructure in North America facilitates quicker adoption of advanced medical devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising awareness of cardiovascular diseases and the increasing geriatric population, which is more susceptible to cardiac rhythm disorders. In 2022, Asia accounted for a significant portion of new cardiovascular disease cases globally.

Furthermore, increasing investments in healthcare infrastructure across the Asia Pacific region are improving access to advanced medical technologies. Government initiatives aimed at enhancing cardiac care and the growing adoption of telehealth solutions for remote monitoring are also expected to fuel market expansion. The Asia Pacific Heart Rhythm Society (APHRS) supports opportunistic screening for atrial fibrillation, which is likely to increase the demand for monitoring devices.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cardiac arrhythmia monitoring devices market drive growth by developing advanced wearable and implantable solutions that support real-time and long-term heart rhythm tracking. They integrate AI-driven analytics to improve diagnostic precision and enable timely interventions. Strategic collaborations with hospitals, clinics, and digital health firms allow companies to broaden their reach and enhance patient care services.

Many also focus on regulatory approvals and enter underserved regions to tap into growing demand driven by rising cardiovascular cases. Continuous R&D investment ensures the launch of more accurate, compact, and connected devices.

Medtronic plc stands out as a leading company in this market, offering a wide range of cardiac monitoring technologies, including insertable cardiac monitors and remote telemetry systems. The company emphasizes innovation and clinical reliability, providing tools that help physicians detect and manage arrhythmias more efficiently. With a strong global footprint, Medtronic collaborates closely with healthcare systems to improve cardiac care outcomes. Its solutions aim to reduce hospital readmissions and support personalized treatment plans through consistent and accurate monitoring.

Top Key Players

- Octagos Health

- Medtronic

- iRhythm Technologies, Inc

- GE HeathCare

- FUKUDA DENSHI

- Biotronik

- ACS Diagnostics

- Abbott

Recent Developments

- In July 2024, Octagos Health, an innovative company specializing in AI-powered cardiac monitoring solutions, raised US$ 43 million in funding, led by Morgan Stanley. This capital infusion is expected to accelerate their efforts to advance cardiac care by developing state-of-the-art patient monitoring systems driven by artificial intelligence.

- In January 2024, iRhythm Technologies, Inc. received approval from the BSI Group for its Zio ECG monitoring system, marking its successful certification under the EU MDR. This CE mark indicates that the device meets stringent European standards for safety, quality, and efficacy in identifying heart arrhythmias.

Report Scope

Report Features Description Market Value (2024) US$ 7.9 billion Forecast Revenue (2034) US$ 16.3 billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Holter Monitors, ECG Monitors, Implantable Monitors, and Mobile Cardiac Telemetry), By Application (Atrial Fibrillation, Bradycardia, Tachycardia, Ventricular Fibrillation, Premature Contraction, and Others), By End-user (Hospitals and Clinics, Ambulatory Centers, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Octagos Health, Medtronic, iRhythm Technologies, Inc, GE HeathCare, FUKUDA DENSHI, Biotronik, ACS Diagnostics, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiac Arrhythmia Monitoring Devices MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Cardiac Arrhythmia Monitoring Devices MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Octagos Health

- Medtronic

- iRhythm Technologies, Inc

- GE HeathCare

- FUKUDA DENSHI

- Biotronik

- ACS Diagnostics

- Abbott