Global Brewers Yeast Powder Market Size, Share, And Industry Analysis Report By Flavor (Unflavored, Flavored), By Type (Beer Dry Yeast, Alcohol Dry Yeast, Liquor Dry Yeast, Wine Dry Yeast, Rice Wine Dry Yeast), By Application (Brewing and Baking, Feed, Biological Research, Medicine), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177436

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

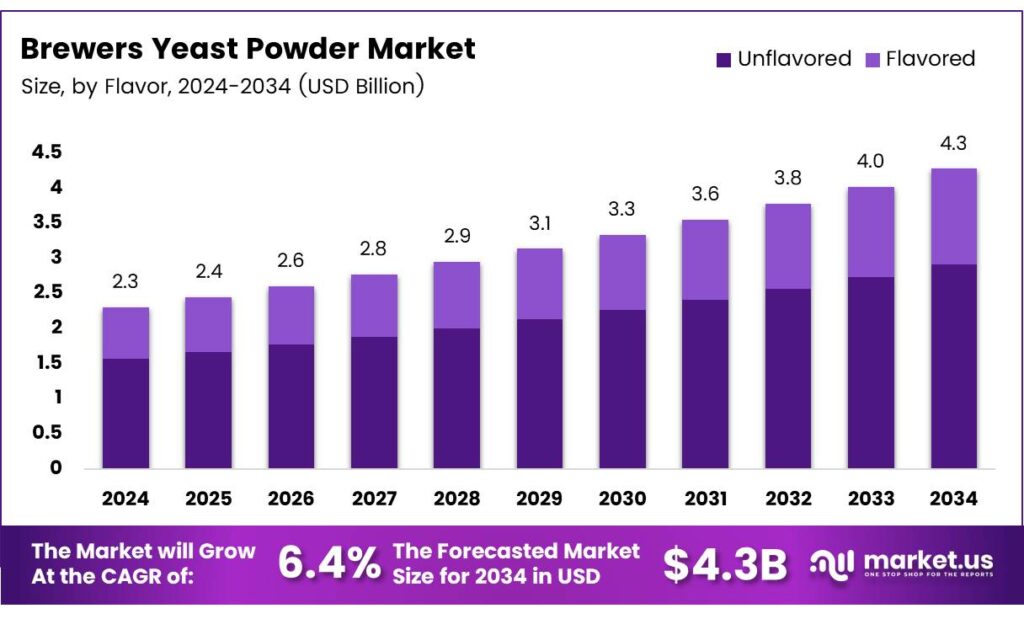

The Global Brewers Yeast Powder Market size is expected to be worth around USD 4.3 Billion by 2034 from USD 2.3 Billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034.

Brewer’s yeast powder is a nutrient-rich functional ingredient made from Saccharomyces cerevisiae used in brewing, offering B-vitamins, proteins, minerals, and beta-glucans that support health. As consumers seek natural nutrition sources, manufacturers are adding them to protein supplements, fortified foods, and wellness drinks, while the animal feed industry increasingly uses yeast derivatives to improve livestock digestion and performance.

Health-conscious consumers drive demand for clean-label probiotic alternatives. Brewer’s yeast powder serves multiple applications across brewing, baking, nutraceuticals, and biological research. Moreover, the ingredient supports sustainable food systems through waste valorization from brewing operations.

- Taking 500–1000 mg of brewer’s yeast daily for 8–12 weeks has been shown to ease stomach pain and improve stools in people with IBS, giving the ingredient stronger clinical credibility among healthcare professionals and supplement developers.

- Products with live yeast have also been safely used at 4–8 billion CFU for up to 12 weeks, a safety record that motivates brands to create higher-value functional beverages and sports-nutrition formulas enhanced with yeast for digestive support and recovery.

Industrial stakeholders expand production capacity to meet rising functional food requirements. Companies develop specialized yeast strains with enhanced nutritional profiles for targeted consumer segments. Consequently, product innovation accelerates across sports nutrition, digestive wellness, and immunity support categories.

Key Takeaways

- The Global Brewers Yeast Powder Market is valued at USD 2.3 billion in 2024, projected to reach USD 4.3 billion by 2034, at a CAGR of 6.4% during the forecast period 2025-2034.

- Unflavored segment leads By Flavor category with 76.2% market share.

- Beer Dry Yeast dominates the By Type segment, holding 42.7% share.

- The Brewing and Baking application accounts for 48.6% of the market demand.

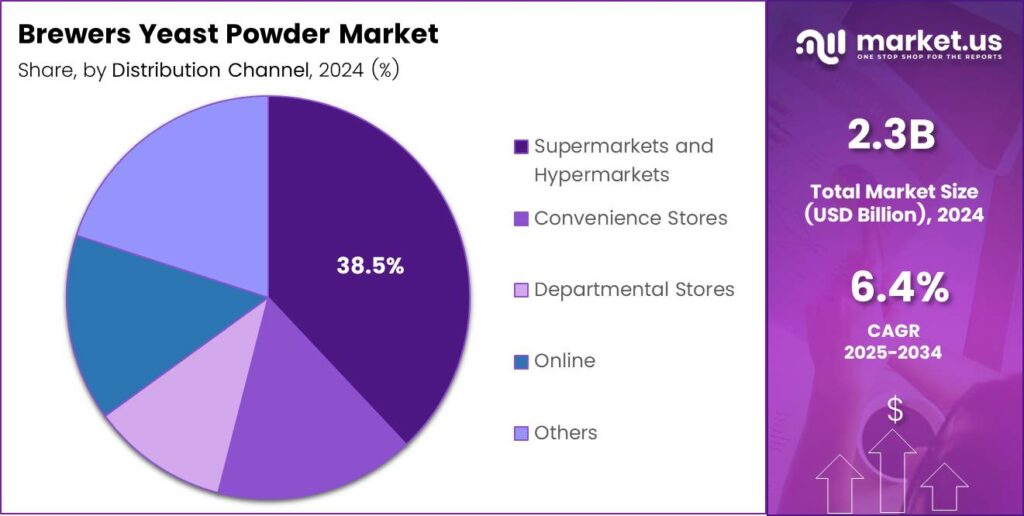

- Supermarkets and Hypermarkets lead distribution with 38.5% market share.

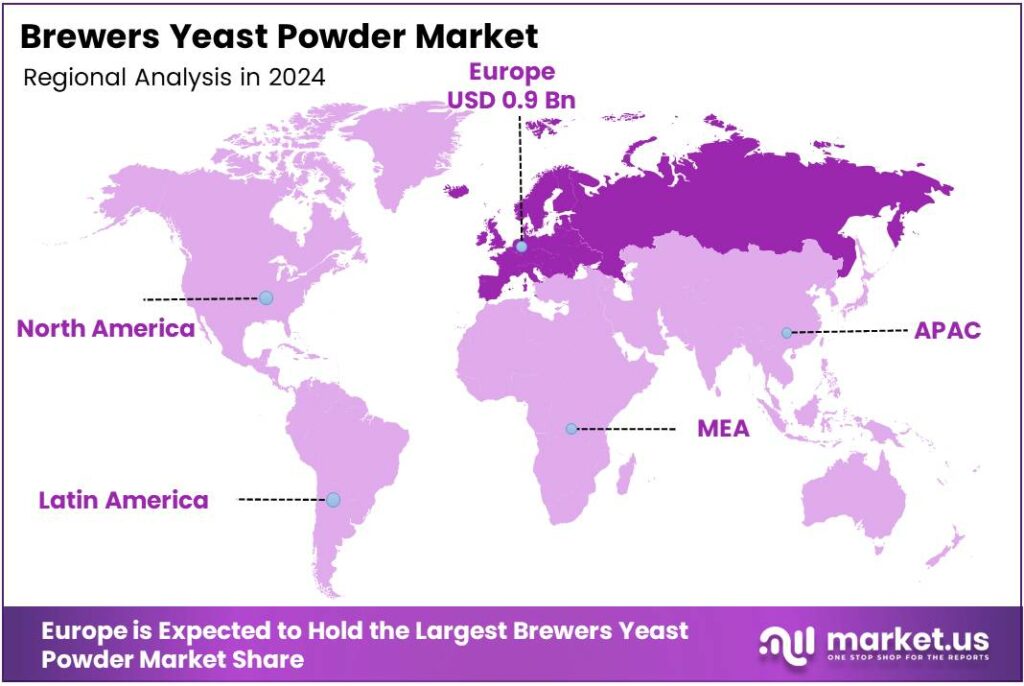

- Europe dominates with 37.1% market share, valued at USD 0.9 billion.

Flavor Analysis

Unflavored dominates with 76.2% due to versatile application compatibility and clean-label positioning.

In 2025, Unflavored held a dominant market position in the By Flavor segment of the Brewers Yeast Powder Market, with a 76.2% share. Food manufacturers prefer unflavored variants for seamless integration into diverse product formulations without altering taste profiles. This segment serves pharmaceutical applications requiring neutral organoleptic properties for encapsulation and tableting processes.

Flavored brewers’ yeast powder addresses consumer palatability concerns in direct-consumption applications. Manufacturers develop chocolate, vanilla, and fruit-based flavor profiles to mask the natural yeast taste. However, flavored variants face formulation complexity and higher production costs, limiting mainstream adoption across industrial applications.

Type Analysis

Beer Dry Yeast dominates with 42.7% due to established brewing infrastructure and standardized production protocols.

In 2025, Beer Dry Yeast held a dominant market position in the By Type segment of Brewers Yeast Powder Market, with a 42.7% share. Brewing operations generate consistent yeast biomass volumes suitable for commercial powder extraction. This segment benefits from proven fermentation parameters and quality control systems developed across global beer manufacturing facilities.

Alcohol Dry Yeast serves the distillation industries requiring specialized strain characteristics for spirit production. Manufacturers utilize these variants in whiskey, vodka, and rum fermentation processes. Additionally, alcohol yeast derivatives find applications in flavor enhancement and aroma development formulations.

Liquor Dry Yeast supports premium beverage manufacturing with unique metabolic profiles. Producers select specific strains to achieve desired alcohol content and flavor complexity. Moreover, this segment caters to craft distillery operations, emphasizing artisanal production methods.

Wine Dry Yeast enables controlled fermentation in viticulture applications across diverse grape varieties. Winemakers deploy specialized strains to optimize sugar conversion and preserve varietal characteristics. Furthermore, wine yeast powders support consistent quality in commercial wine production facilities.

Rice Wine Dry Yeast addresses traditional Asian beverage markets requiring amylase-active strains. Manufacturers develop yeast variants capable of fermenting rice starch into alcohol efficiently. Consequently, this segment serves sake, huangjiu, and other rice-based alcoholic beverage producers.

Application Analysis

Brewing and Baking dominate with 48.6% due to core industrial demand and established supply chains.

In 2025, Brewing and Baking held a dominant market position in the By Application segment of Brewers Yeast Powder Market, with a 48.6% share. Bakeries utilize yeast powder for dough leavening and flavor development in bread production. Brewing operations consume substantial yeast volumes for fermentation control and beer quality standardization across production batches.

Feed applications leverage brewers’ yeast as protein-rich animal nutrition supplements. Livestock producers incorporate yeast powder into poultry, swine, and aquaculture diets to enhance growth performance. Additionally, yeast derivatives improve feed digestibility and gut health in commercial farming operations.

Biological Research institutions employ brewer’s yeast for laboratory studies and experimental protocols. Scientists utilize yeast cultures in genetic research, fermentation studies, and biotechnology development. Moreover, academic institutions rely on standardized yeast powders for reproducible research outcomes.

Medicine applications encompass dietary supplements and therapeutic formulations for digestive health. Pharmaceutical companies develop yeast-based probiotics addressing immune support and nutrient deficiency conditions. Furthermore, medical nutrition products incorporate brewers’ yeast for patient recovery and wellness programs.

Others category includes cosmetic applications, industrial fermentation, and specialty chemical production. Manufacturers explore yeast extracts for skincare formulations and biotechnology processes. Therefore, emerging applications expand market opportunities beyond traditional food sectors.

Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 38.5% due to extensive retail networks and consumer accessibility.

In 2025, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of Brewers Yeast Powder Market, with a 38.5% share. Large retail chains provide shelf space for diverse yeast powder brands across health supplement sections. Consumers prefer these channels for product comparison, competitive pricing, and immediate purchase availability.

Convenience Stores serve urban consumers seeking quick access to nutritional supplements and wellness products. These outlets stock popular yeast powder brands in single-serve packaging formats. However, limited shelf space restricts product variety compared to larger retail formats.

Departmental Stores position brewers’ yeast powder within premium health and wellness categories. Retailers offer personalized consultation services and curated product selections for discerning consumers. Additionally, departmental stores provide gift packaging options for health-conscious shoppers.

Online platforms accelerate market growth through subscription services and direct-to-consumer models. E-commerce channels enable manufacturers to reach global audiences without physical retail infrastructure. Moreover, digital platforms facilitate consumer education through detailed product information and usage guidelines.

Other distribution channels include specialty health stores, pharmacies, and direct sales networks. Health food retailers provide expert guidance and niche product selections for targeted consumer segments. Furthermore, pharmacy channels serve medical nutrition requirements with professional recommendations.

Key Market Segments

By Flavor

- Unflavored

- Flavored

By Type

- Beer Dry Yeast

- Alcohol Dry Yeast

- Liquor Dry Yeast

- Wine Dry Yeast

- Rice Wine Dry Yeast

By Application

- Brewing and Baking

- Feed

- Biological Research

- Medicine

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online

- Others

Drivers

Growing Preference for High-Protein Functional Food Ingredients Drives Market Growth

Consumers increasingly seek natural protein sources to supplement dietary requirements across fitness and wellness applications. Brewer’s yeast powder delivers complete amino acid profiles alongside essential vitamins and minerals. Moreover, plant-based diet followers adopt yeast derivatives as sustainable protein alternatives to animal-sourced ingredients.

- Brewers yeast serves as a multifunctional ingredient providing protein fortification, flavor development, and texture improvement. In 2024, EU countries produced 34.7 billion litres of beer in total, a volume that naturally creates large yeast streams that can be captured, dried, and repurposed into powders for food and nutrition applications.

Rising health consciousness drives demand for nutrient-dense ingredients supporting metabolic function and energy production. Brewer’s yeast contains B-complex vitamins essential for cellular processes and nervous system health. Consequently, supplement manufacturers develop specialized yeast formulations targeting specific wellness categories and consumer demographics.

Restraints

Limited Consumer Awareness in Emerging Nutraceutical Markets Limits Market Adoption

Developing regions demonstrate insufficient knowledge regarding brewers’ yeast nutritional benefits and application versatility. Consumers lack familiarity with yeast-based supplements compared to established vitamin and mineral products. Additionally, traditional dietary preferences and cultural perceptions hinder acceptance of fermentation-derived ingredients.

- Educational initiatives require substantial investment to communicate product value and usage recommendations effectively. The EU brewed 2 billion litres of low/no-alcohol beer, up 11.1%, which signals real momentum and more experimentation with yeast behavior, aroma, and nutrient profiles. Manufacturers face challenges establishing brand credibility without extensive marketing campaigns and clinical validation.

High production sensitivity to raw material quality and fermentation parameters creates supply chain vulnerabilities. Manufacturers experience batch-to-batch variations affecting powder consistency, potency, and organoleptic properties. Furthermore, contamination risks during fermentation and drying processes necessitate stringent quality control protocols.

Growth Factors

Technological Advancements Accelerate Market Expansion

Manufacturers develop vegan protein alternatives incorporating brewers’ yeast as the primary ingredient source. Plant-based nutrition companies formulate meat substitutes, dairy alternatives, and protein shakes with yeast derivatives. Additionally, food technology innovations enable flavor masking and texture optimization in yeast-fortified products.

Animal nutrition sectors adopt yeast-based feed additives to improve livestock performance and health outcomes. Farmers utilize brewers’ yeast powder for enhanced digestibility, immunity support, and growth promotion in poultry and aquaculture. Moreover, pet food manufacturers integrate yeast ingredients addressing digestive wellness and coat health.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Food processors prioritize clean-label yeast ingredients meeting consumer transparency expectations and regulatory requirements. Manufacturers eliminate synthetic additives by replacing them with natural yeast-derived alternatives. Therefore, ingredient suppliers invest in traceability systems documenting fermentation processes and quality certifications.

- Sports nutrition brands incorporate fermented yeast blends providing sustained energy release and muscle recovery support. Athletes adopt yeast supplements for endurance enhancement and post-workout nutrition optimization. In the U.S., craft brewers produced 23.1 million barrels of beer in 2024, and craft still held 13.3% share by volume.

Producers transition toward organic certification and non-GMO yeast powder manufacturing to capture premium market segments. Consumers demonstrate willingness to pay premium prices for certified sustainable and environmentally responsible products. Moreover, organic yeast production aligns with regenerative agriculture principles and circular economy models.

Regional Analysis

Europe Dominates the Brewers Yeast Powder Market with a Market Share of 37.1%, Valued at USD 0.9 Billion

Europe leads global brewers’ yeast powder consumption, accounting for 37.1% of the global market, valued at USD 0.9 billion. The region demonstrates strong consumer acceptance of fermentation-based ingredients across nutraceutical applications. European manufacturers maintain advanced production facilities with stringent quality standards. Regulatory frameworks support yeast ingredient commercialization through clear safety guidelines and health claim approvals.

North America experiences robust growth fueled by health-conscious consumers and expanding supplement markets. Manufacturers develop innovative yeast formulations targeting digestive wellness and immune support categories. Additionally, craft brewing operations generate substantial yeast biomass suitable for commercial powder extraction.

Asia Pacific demonstrates rapid market expansion supported by traditional fermentation practices and rising nutrition awareness. Countries like China and Japan leverage indigenous brewing expertise to develop specialized yeast products. Furthermore, growing middle-class populations increase demand for premium functional food ingredients.

Latin America shows emerging potential with increasing health supplement adoption and expanding food processing industries. Brewer’s yeast powder gains traction in animal feed applications, supporting regional livestock production. Moreover, urbanization drives convenience-focused nutrition product consumption across major metropolitan areas.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lesaffre maintains global leadership through extensive fermentation expertise and diversified yeast product portfolios. The company operates production facilities across multiple continents, serving bakery, brewing, and nutrition markets. Moreover, Lesaffre invests in biotechnology research, developing specialized yeast strains for emerging applications. Their commitment to sustainability and quality certifications strengthens their market position among ingredient buyers.

Associated British Foods plc leverages integrated supply chains connecting agricultural operations with downstream yeast production. The company supplies brewers’ yeast powder to food manufacturers, animal nutrition producers, and pharmaceutical companies. Additionally, AB Foods emphasizes innovation in yeast extraction technologies, improving powder functionality and bioavailability. Their global distribution networks enable consistent product availability across diverse markets.

Lallemand Inc. specializes in probiotic yeast development and functional ingredient solutions for human and animal nutrition. The company maintains research facilities dedicated to strain selection and fermentation optimization. Furthermore, Lallemand collaborates with academic institutions advancing yeast science and application development. Their technical support services assist customers in product formulation and quality optimization.

Angel Yeast Co. Ltd dominates Asian markets through cost-competitive production and regional distribution capabilities. The company supplies brewers’ yeast powder to domestic food processors and export markets globally. Additionally, Angel Yeast expands capacity, addressingthe the growing demand for yeast-based nutritional ingredients. Their vertical integration strategy ensures raw material security and production efficiency.

Top Key Players in the Market

- Inland Island Yeast Laboratories

- Lesaffre

- Associated British Foods plc

- Lallemand Inc.

- Angel Yeast Co. Ltd

- AB Mauri Ltd

- Laffort SA

- Alltech Inc.

- Oriental Yeast Co. Ltd

- Omega Yeast Labs

Recent Developments

- In 2025, Lesaffre completed the acquisition of DSM-Firmenich’s yeast extract business. The deal includes production assets and a long-term supply agreement back to DSM-Firmenich for its savory business, plus a technology partnership for future yeast-extract development. Yeast extracts are directly related to the brewer’s yeast powder sector (processed, deactivated yeast used in food, flavor, and nutrition).

- In 2025, AB Mauri North America acquired Omega Yeast Labs LLC. Omega is a leading U.S. producer of liquid yeast for craft brewing. The move strengthens AB Mauri’s specialty-yeast position in North America, expands AB Biotek’s portfolio (Pinnacle brand), and adds cutting-edge strains for lagers, IPAs, seltzers, etc.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.3 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Unflavored, Flavored), By Type (Beer Dry Yeast, Alcohol Dry Yeast, Liquor Dry Yeast, Wine Dry Yeast, Rice Wine Dry Yeast), By Application (Brewing and Baking, Feed, Biological Research, Medicine, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Inland Island Yeast Laboratories, Lesaffre, Associated British Foods plc, Lallemand Inc., Angel Yeast Co. Ltd, AB Mauri Ltd, Laffort SA, Alltech Inc., Oriental Yeast Co. Ltd, Omega Yeast Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brewers Yeast Powder MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Brewers Yeast Powder MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Inland Island Yeast Laboratories

- Lesaffre

- Associated British Foods plc

- Lallemand Inc.

- Angel Yeast Co. Ltd

- AB Mauri Ltd

- Laffort SA

- Alltech Inc.

- Oriental Yeast Co. Ltd

- Omega Yeast Labs