Global Biopellet Energy Market Size, Share, And Industry Analysis Report By Feedstock (Forestry Residues, Agricultural Residues, Energy Crops, Animal Manure, Municipal Solid Waste), By Pellet Size (6 mm, 8 mm, 10 mm, 12 mm, Other Sizes), By Pellet Quality (Industrial Grade, Premium Grade, Ultra-Premium Grade), By Application (Heat Generation, Power Generation, Biogas Production, Fuel Pellets Production), By End-Use (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170987

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

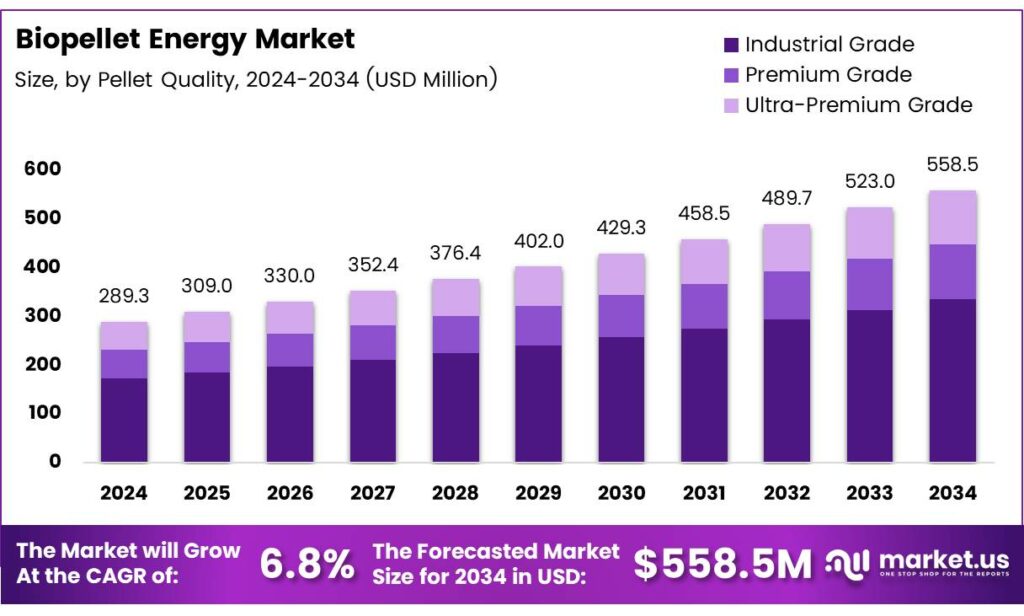

The Global Biopellet Energy Market size is expected to be worth around USD 558.5 million by 2034, from USD 289.3 million in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The biopellet energy market refers to the production, trade, and use of compressed biomass pellets as a renewable fuel alternative. These pellets are made from agricultural residues, forestry waste, and organic by-products. Biopellet energy supports clean heating, power generation, and industrial decarbonization across residential, commercial, and utility users.

Biopellet energy is gaining relevance as energy buyers seek stable, low-carbon fuel options. Rising fossil fuel volatility is pushing industries toward biomass pellets for predictable operating costs. Moreover, improved pellet durability, higher calorific values, and standardised sizes are strengthening confidence among boiler operators and energy planners.

- Pellet size plays a key role in biopellet performance and end-use efficiency. 6 mm pellets are widely used in homes and small systems because they ignite easily and feed smoothly, delivering 3,800–4,500 kcal/kg. In contrast, 8 mm pellets support medium heating systems and industrial boilers, offering balanced energy output of 4,000–4,700 kcal/kg for stable and consistent operation.

Larger pellets meet industrial energy needs effectively. 10 mm pellets are used in large boilers and coal co-firing, delivering 4,200–5,000 kcal/kg, while 12 mm pellets support heavy-duty industrial and CHP systems with slow combustion and 4,500–5,200 kcal/kg output. Produced using about 15% adhesive for added strength, biopellets remain a practical transition fuel as fossil sources still supply nearly 84% of global energy demand.

The biopellet energy market aligns closely with climate and waste-management policies, as governments promote biomass use to cut landfill waste and rural burning. Regulatory support, including renewable heat incentives and emission mandates, drives adoption, while sustainably sourced biopellets are often classified as carbon-neutral. Industries use pellet-based fuels to meet emission limits while ensuring a reliable energy supply.

Key Takeaways

- The Global Biopellet Energy Market is projected to grow from USD 289.3 million in 2024 to USD 558.5 million by 2034, registering a 6.8% CAGR during 2025–2034.

- Forestry Residues dominate the feedstock segment with a market share of 38.4%, supported by stable availability and established biomass supply chains.

- The 8 mm pellets lead the market with a share of 38.6% due to balanced energy output and wide boiler compatibility.

- Industrial-Grade pellets account for the largest pellet quality share at 48.2%, driven by large-scale industrial and power generation demand.

- Heat Generation holds a dominant share of 41.5%, reflecting widespread use in residential and industrial heating systems.

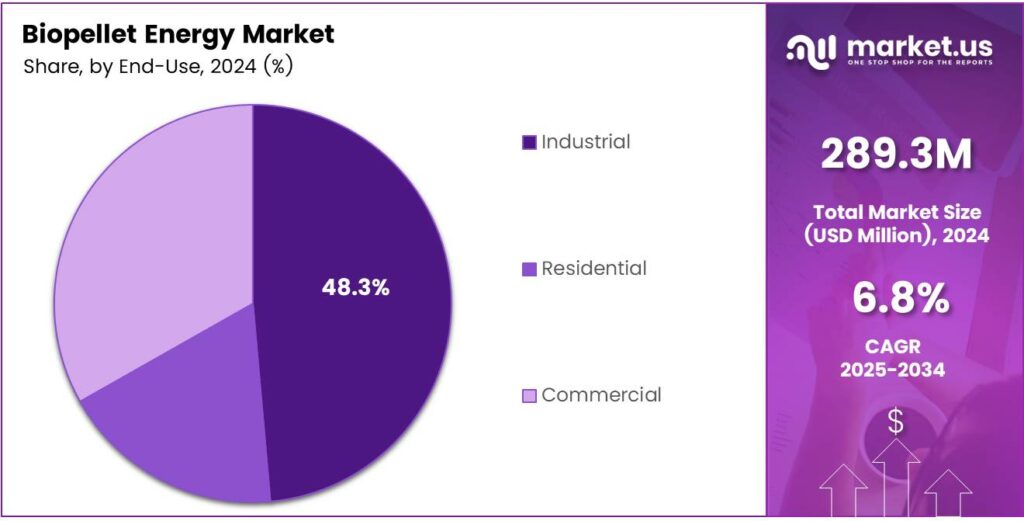

- The Industrial end-use segment leads the market with a share of 48.3%, supported by continuous energy demand and emission compliance needs.

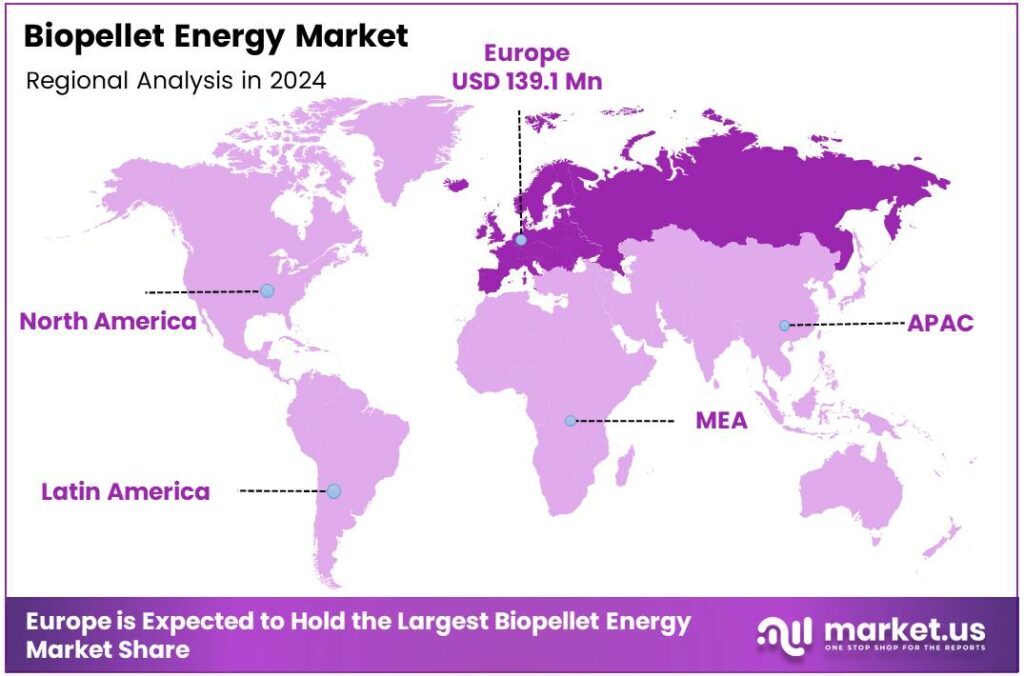

- Europe is the leading regional market, holding a share of 48.1% and valued at USD 139.1 million in 2024.

By Feedstock Analysis

Forestry Residues dominate with 38.4% due to stable availability and established biomass collection systems.

In 2024, Forestry Residues held a dominant market position in the By Feedstock Analysis segment of the Biopellet Energy Market, with a 38.4% share. These residues benefit from consistent supply chains linked to sawmills and forest operations. Moreover, they provide uniform calorific value, supporting reliable pellet quality and steady industrial demand.

Agricultural Residues are gaining attention as pellet producers increasingly utilize crop waste such as straw and husks. Consequently, this segment supports waste reduction while improving farmer income. Although seasonal, better storage and preprocessing technologies are improving feedstock reliability and commercial adoption across rural regions.

Energy Crops serve as a dedicated biomass source grown specifically for pellet production. Therefore, they offer predictable yields and controlled quality. However, land-use concerns and cultivation costs limit rapid expansion, positioning this segment as a supplementary rather than dominant feedstock option.

Animal Manure and Municipal Solid Waste represent emerging feedstock routes. While they support circular economy goals, complex processing and odor control challenges slow adoption. Still, technological improvements continue to enhance pelletization efficiency and regulatory acceptance.

By Pellet Size Analysis

8 mm pellets dominate with 38.6% due to balanced energy output and wide boiler compatibility.

In 2024, 8 mm held a dominant market position in the By Pellet Size Analysis segment of the Biopellet Energy Market, with a 38.6% share. This size offers efficient combustion and smooth feeding, making it suitable for both residential and mid-scale industrial heating systems.

6 mm pellets are commonly used in residential heating due to easy ignition and consistent burn behavior. As a result, they remain popular in small boilers and stoves where precise fuel flow and quick startup are essential. 10 mm pellets are increasingly adopted in large industrial boilers and coal co-firing systems.

Consequently, they support higher energy output and longer burn cycles, making them suitable for continuous industrial operations. 12 mm and Other Sizes cater to heavy-duty industrial and CHP systems. While niche, these pellets offer slow combustion and sustained heat. Therefore, they are preferred where operational stability outweighs flexibility.

By Pellet Quality Analysis

Industrial Grade dominates with 48.2% due to cost efficiency and large-scale energy demand.

In 2024, Industrial Grade held a dominant market position in the By Pellet Quality Analysis segment of the Biopellet Energy Market, with a 48.2% share. These pellets meet bulk energy requirements while maintaining acceptable performance standards for industrial boilers and power plants. Premium-grade pellets are favored in residential and commercial heating applications.

They emphasize lower ash content and better combustion efficiency, supporting cleaner operations and reduced maintenance needs. Ultra-Premium Grade pellets address high-end applications requiring strict emission control and consistent quality. Although limited in volume, this segment continues to grow as sustainability standards and consumer expectations rise.

By Application Analysis

Heat Generation dominates with 41.5% due to widespread use in residential and industrial heating.

In 2024, Heat Generation held a dominant market position in the By Application Analysis segment of the Biopellet Energy Market, with a 41.5% share. Biopellets provide reliable thermal energy, supporting space heating, process heat, and district heating systems.

Power Generation applications use biopellets in dedicated biomass plants and co-firing facilities. Consequently, they help utilities reduce fossil fuel dependence while maintaining grid stability. Biogas Production increasingly integrates pellets as a supplemental feedstock.

Therefore, pellets enhance digestion consistency and energy yield in anaerobic systems. Fuel Pellets Production and Others represent supporting applications. These segments focus on downstream processing and niche energy uses, gradually expanding as biomass technologies mature.

By End-Use Analysis

Industrial end-use dominates with 48.3% due to continuous energy demand and large-scale consumption.

In 2024, Industrial held a dominant market position in the By End-Use Analysis segment of the Biopellet Energy Market, with a 48.3% share. Industries rely on biopellets for process heat and power, supporting cost control and emission compliance. Residential end-use continues to expand as households adopt pellet stoves and boilers.

This segment benefits from rising energy costs and growing awareness of renewable heating options. Commercial end-use includes offices, institutions, and hospitality facilities. Although smaller in volume, this segment values stable heating performance and sustainability credentials, supporting steady long-term adoption.

Key Market Segments

By Feedstock

- Forestry Residues

- Agricultural Residues

- Energy Crops

- Animal Manure

- Municipal Solid Waste

By Pellet Size

- 6 mm

- 8 mm

- 10 mm

- 12 mm

- Other Sizes

By Pellet Quality

- Industrial Grade

- Premium Grade

- Ultra-Premium Grade

By Application

- Heat Generation

- Power Generation

- Biogas Production

- Fuel Pellets Production

- Others

By End-Use

- Industrial

- Residential

- Commercial

Emerging Trends

Advancements in Biomass Utilization Shape Market Trends

One of the key trends in the biopellet energy market is the use of diverse and non-traditional biomass feedstocks. Producers are increasingly converting agricultural waste, municipal organic waste, and energy crops into high-quality pellets. This reduces raw material dependency and improves long-term feedstock security.

- The International Energy Agency (IEA), global modern bioenergy use supplied nearly 55 EJ of energy, and solid biomass pellets are one of the fastest-improving fuel formats within this mix. Utilities are choosing higher-quality pellets because they reduce handling losses and improve combustion efficiency.

The rising adoption of biopellets in combined heat and power systems. These systems improve overall energy efficiency by producing both electricity and heat from a single fuel source. Biopellets support stable and continuous operation, making them suitable for such applications.

Drivers

Rising Focus on Clean and Renewable Energy Drives Market Growth

The biopellet energy market is mainly driven by the global shift toward cleaner and renewable energy sources. Governments, industries, and households are actively reducing dependence on fossil fuels due to rising environmental concerns. Biopellets offer a low-carbon alternative, helping users cut emissions while maintaining reliable energy output. This makes them suitable for heating, power generation, and co-firing applications.

- The growing availability of biomass feedstock, such as agricultural residues, forestry waste, and organic by-products. These materials are often low-cost and locally available, improving supply security and lowering fuel expenses. Eurostat reports that wood pellet production in the EU exceeded 20 million tonnes, with a rising share classified as industrial-grade pellets suitable for large power stations.

Supportive government policies and renewable energy targets also play a strong role. Incentives for biomass heating systems, renewable fuel standards, and carbon reduction mandates encourage industries and utilities to adopt biopellet-based energy solutions. As a result, biopellets are increasingly seen as a practical transition fuel supporting energy security and sustainability goals.

Restraints

Supply Chain and Cost Challenges Restrain Market Expansion

Despite strong growth potential, the biopellet energy market faces several restraints. One major challenge is the high initial cost of pellet production equipment and biomass processing facilities. Small producers often struggle with financing, which limits production capacity and slows market penetration in developing regions.

- Transporting bulky biomass materials over long distances also increases logistics costs, reducing the cost advantage of biopellets in some markets. The government originally set a target for all coal-based thermal power plants to use at least 5% biomass pellets in their fuel mix. The trend is moving toward even higher thresholds, with some regions aiming for 7% to 10%.

Competition from other renewable energy sources such as solar, wind, and biogas further restrains growth. These alternatives often receive higher policy attention and funding support. Additionally, limited awareness about biopellet benefits in residential and small commercial sectors restricts wider adoption, especially in regions with established fossil fuel infrastructure.

Growth Factors

Industrial Decarbonization Creates Strong Growth Opportunities

The biopellet energy market holds strong growth opportunities through industrial decarbonization efforts. Many manufacturing units and power plants are actively seeking cleaner fuels to meet emission norms without major equipment changes. Biopellets can be easily integrated into existing boilers and co-firing systems, making them an attractive solution.

- Biopellet production facilities can be set up close to biomass sources, creating local employment and improving rural income streams. The U.S. Energy Information Administration (EIA) reports that biomass power generation reached about 58 TWh, with pellets forming an increasing share of fuel inputs.

Technological improvements in pellet quality, durability, and combustion efficiency also open new growth avenues. Advanced pelletizing techniques improve energy output and handling, making biopellets suitable for larger industrial and utility-scale applications. These factors together position biopellets as a scalable and flexible renewable energy option.

Regional Analysis

Europe Dominates the Biopellet Energy Market with a Market Share of 48.1%, Valued at USD 139.1 Million

Europe leads the biopellet energy market due to strong renewable energy policies and strict carbon reduction targets. In the region, biopellets are widely used for district heating, residential boilers, and industrial heat generation. With a dominant share of 48.1% and a market value of USD 139.1 million, Europe benefits from advanced biomass supply chains and consistent government incentives.

North America shows stable growth supported by the rising adoption of biomass heating and co-firing in power plants. The region benefits from abundant forestry residues and agricultural waste, which ensure reliable feedstock availability. Industrial users increasingly adopt biopellets to meet emission compliance while maintaining energy efficiency. Policy-driven renewable targets further encourage market expansion.

Asia Pacific is emerging as a high-growth region due to increasing energy demand and waste-to-energy initiatives. Rapid industrialization and urban heating need support for the use of biopellets as an alternative to coal. Governments in the region promote biomass utilization to reduce open-field residue burning. Cost-effective feedstock availability strengthens regional production capacity.

The U.S. market is driven by the rising use of biopellets in industrial boilers and power generation applications. Strong forestry resources and established pellet manufacturing support a consistent supply. Policy focus on emission reduction encourages the substitution of fossil fuels with biomass-based energy. Export demand also supports production scale-up.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Enviva Corporation remained one of the most visible pure-play industrial wood pellet suppliers in 2024, closely tied to utility and industrial decarbonization needs. From an analyst lens, its performance is best read through contract stability, feedstock security, and the ability to keep plants running reliably while meeting tightening sustainability and traceability expectations.

Mitsubishi Corporation stands out as a trading-and-investment platform rather than a single-asset pellet producer, which matters in a volatile biomass market. In 2024, its advantage came from linking pellet procurement, shipping, and end-user demand across regions, helping buyers manage supply risk, currency swings, and logistics constraints more smoothly.

Weyerhaeuser Company brings upstream strength to the biopellet value chain through its scale in timberlands and wood products, which can support feedstock flexibility and cost discipline. In 2024, the strategic angle is that pellet markets increasingly reward suppliers who can prove responsible sourcing and keep fiber costs predictable during competing demand from construction and panel markets.

BioPower typically competes by staying close to project-level economics—serving specific heat and power users where pellets reduce fuel handling complexity versus loose biomass. In 2024, the key analyst takeaway is that smaller or mid-sized players win by specializing: tailored pellet specs, dependable local delivery, and partnerships that convert policy incentives into bankable offtake and steady cash flow.

Top Key Players in the Market

- Enviva Corporate

- Mitsubishi Corporation

- Weyerhaeuser Company

- BioPower

- Abellon Clean Energy Limited

- Biomass Secure Power Inc

- Curran Renewable

- Orsted A/S

- GREEN FRIENDLY PELLETS, LLC

- VT Wood Pellet Co LLC

Recent Developments

- In 2025, Enviva, the world’s largest producer of industrial wood pellets for bioenergy, has undergone significant restructuring and operational changes recently. Enviva joined the Roundtable on Sustainable Biomaterials (RSB) and is piloting RSB’s new Forestry Residue Guidance in the southeastern U.S. to ensure the responsible sourcing of forestry residues for biomass.

- In 2025, Mitsubishi Corporation has limited direct recent developments in wood pellet production, focusing instead on biomass utilization in power generation and related supply chains in Japan, where imported wood pellets are a key fuel. Mitsubishi has been involved in converting or developing biomass-fired power plants.

Report Scope

Report Features Description Market Value (2024) USD 289.3 Million Forecast Revenue (2034) USD 558.5 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Feedstock (Forestry Residues, Agricultural Residues, Energy Crops, Animal Manure, Municipal Solid Waste), By Pellet Size (6 mm, 8 mm, 10 mm, 12 mm, Other Sizes), By Pellet Quality (Industrial Grade, Premium Grade, Ultra-Premium Grade), By Application (Heat Generation, Power Generation, Biogas Production, Fuel Pellets Production, Others), By End-Use (Industrial, Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Enviva Corporate, Mitsubishi Corporation, Weyerhaeuser Company, BioPower, Abellon Clean Energy Limited, Biomass Secure Power Inc, Curran Renewable, Orsted A/S, GREEN FRIENDLY PELLETS, LLC, VT Wood Pellet Co LLC Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Biopellet Energy MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Biopellet Energy MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Enviva Corporate

- Mitsubishi Corporation

- Weyerhaeuser Company

- BioPower

- Abellon Clean Energy Limited

- Biomass Secure Power Inc

- Curran Renewable

- Orsted A/S

- GREEN FRIENDLY PELLETS, LLC

- VT Wood Pellet Co LLC