Global Big Data Consulting Market Size, Share, Statistics Analysis Report By Service Type (Consulting Services, Integration Services, Managed Services), By Deployment (On-premises, Cloud-Based), By End-User Industry (BFSI, Retail & E-commerce, Healthcare, Manufacturing, Government, Telecom & IT, Energy & Utilities), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140933

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst’s Review

- Key Statistics

- Regional Analysis

- By Service Type

- By Deployment

- By End-User Industry

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

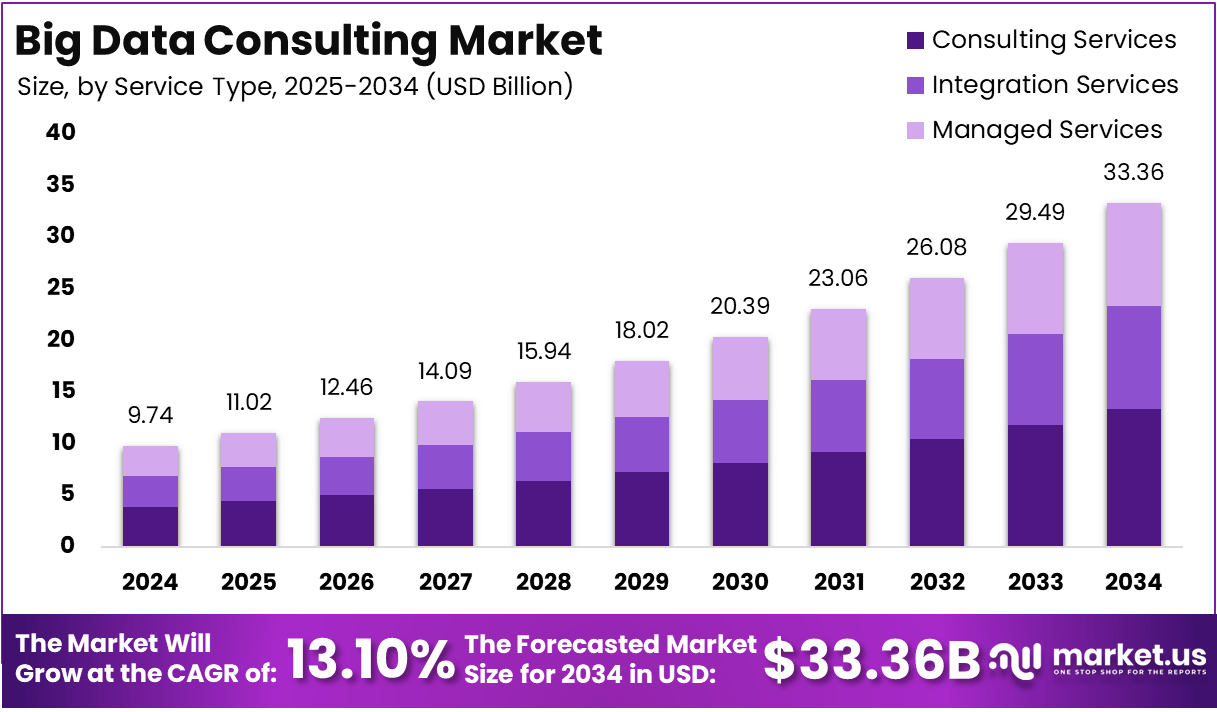

The Global Big Data Consulting Market is expected to be worth around USD 33.36 Billion By 2034, up from USD 9.74 Billion in 2024. It is expected to grow at a CAGR of 13.10% from 2025 to 2034.

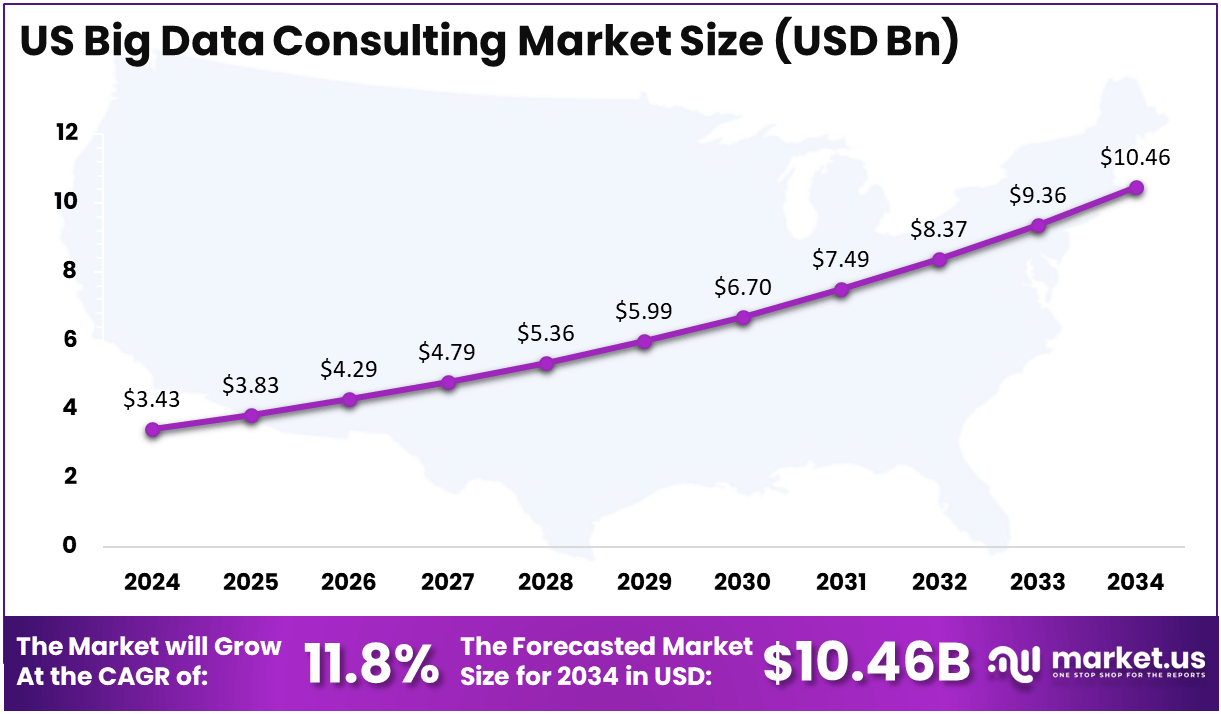

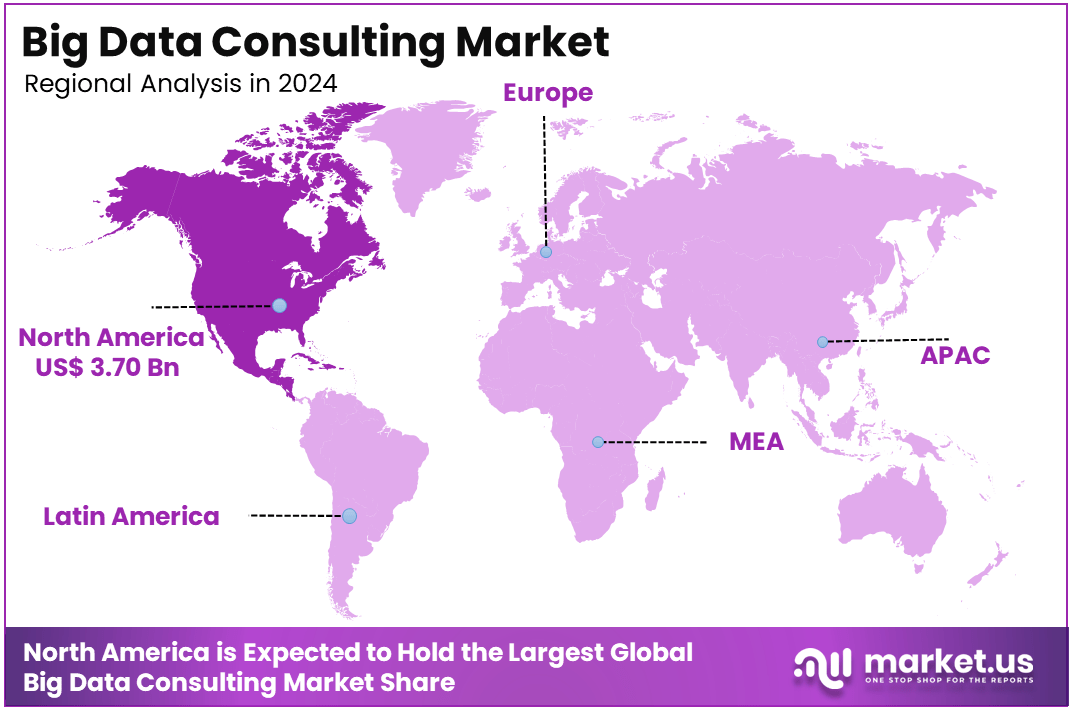

In 2024, North America held a dominant market position, capturing over a 38% share and earning USD 3.70 Billion in revenue. Further, the United States dominates the market by USD 3.43 Billion, steadily holding a strong position with a CAGR of 11.8%.

The Big Data Consulting Market refers to the growing demand for professional services aimed at helping businesses leverage large volumes of data to drive decision-making, optimize operations, and gain a competitive edge. As organizations increasingly realize the potential of big data, they turn to consulting firms to guide them through the complexities of data management, analytics, and strategy implementation.

This market includes a wide range of services such as data analytics, cloud solutions, business intelligence, and data governance, all of which play a critical role in transforming raw data into actionable insights. With data volumes rapidly expanding across industries, the market for big data consulting services is expected to see substantial growth in the coming years.

One of the key driving factors for the Big Data Consulting Market is the growing emphasis on data-driven decision-making. In today’s digital age, businesses are seeking ways to make faster, more informed decisions by tapping into vast datasets. Big data consulting firms enable businesses to harness technologies such as artificial intelligence (AI), machine learning (ML), and predictive analytics to uncover trends, forecast future outcomes, and optimize operations.

Additionally, the rise of the Internet of Things (IoT) and cloud computing has significantly increased the volume of data being generated, fueling the need for specialized consulting services. With industries such as healthcare, retail, and finance increasingly relying on data, the demand for expert guidance in managing and utilizing big data has never been higher.

Key Takeaways

- Market Value: The Big Data Consulting Market is expected to be valued at USD 9.74 billion in 2024.

- Projected Market Value: The market is projected to grow to USD 33.36 billion by 2034, with a CAGR of 13.10%.

- Market Share by Service Type: Consulting Services account for 40% of the market share.

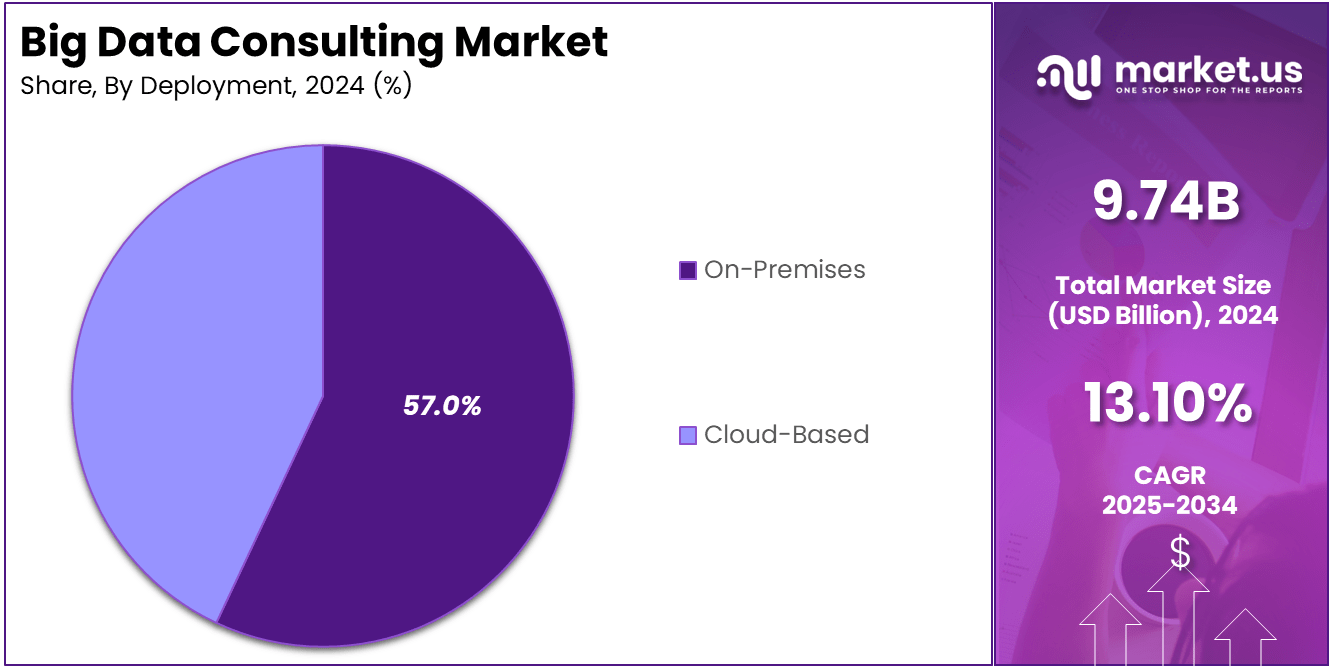

- Market Share by Deployment: On-premises solutions lead with 57% of the market share.

- Market Share by End-User Industry: The BFSI (Banking, Financial Services, and Insurance) sector holds 21% of the market share.

- Regional Insights: North America holds a dominant share of 38% of the global market.

- US Market: The US contributes USD 3.43 billion to the overall market value.

- US Growth Rate: The US Big Data Consulting Market is expected to grow at a CAGR of 11.8%.

Analyst’s Review

The demand for big data consulting services is surging, driven by digital transformation initiatives across sectors. Companies are recognizing that data is one of their most valuable assets, and they need professional help to unlock its full potential. Industries like healthcare, banking, finance, and retail are particularly notable for adopting big data solutions to improve operational efficiency, enhance customer experiences, and drive revenue growth.

For instance, in healthcare, big data analytics is being used to predict patient outcomes, optimize resource allocation, and improve diagnostic accuracy. In retail, companies are utilizing data to personalize customer experiences and streamline supply chains. As a result, big data consulting firms are experiencing increasing demand for their services as more organizations adopt data-centric strategies to stay competitive.

Technological advancements play a crucial role in the Big Data Consulting Market. The rise of artificial intelligence (AI), machine learning (ML), and advanced analytics is transforming how big data is processed and utilized. AI and ML algorithms can sift through enormous datasets, identify patterns, and provide insights much faster than traditional methods.

Moreover, advancements in data visualization tools allow businesses to present complex data in easily understandable formats, enhancing decision-making. The increasing availability of cloud platforms such as AWS, Google Cloud, and Microsoft Azure has made big data analytics more accessible and scalable for businesses of all sizes. As these technologies continue to evolve, consulting firms that stay ahead of the curve in adopting and implementing cutting-edge tools will be in high demand, further driving the growth of the big data consulting market.

Key Statistics

Big Data Adoption

- Adoption Rate: By 2017, 53% of companies were using big data, up from 17% in 2015.

- User Segments: Very large organizations (5,000+ employees) are the main adopters, with 70% using big data.

Data Generation and Storage

- Daily Data Generation: Approximately 2.5 quintillion bytes of data are generated each day.

- Total Data Volume: Over 44 zettabytes of data exist in the digital universe, with 70% being user-generated.

Big Data Usage

- Use Cases: Common use cases include data warehouse optimization, predictive maintenance, and customer analytics.

- Industry Application: Big data analytics is highly favored across industries like healthcare, retail, and supply chain.

Organizational Size and Big Data Adoption

- Small Organizations: Interested in using big data for customer analytics.

- Mid-Sized and Large Organizations: Focus on data warehouse optimization and predictive maintenance.

Regional Analysis

US Region Market Size

In North America, the United States dominates the market size, contributing USD 3.43 billion in revenue. The US holds a strong position in the market, steadily leading with a solid CAGR of 11.8%. This growth is fueled by the increasing reliance on big data solutions in industries such as Banking, Financial Services, and Insurance (BFSI), healthcare, and manufacturing. The widespread adoption of cloud-based big data solutions, coupled with a growing emphasis on data-driven decision-making, ensures the US continues to lead and expand its footprint in the global big data consulting market.

In 2024, North America holds a dominant position in the Big Data Consulting Market, accounting for a substantial portion of the market share. The region’s growth is largely driven by high adoption rates of data-driven technologies across various industries, such as banking, healthcare, and retail. With the rise of digital transformation, businesses in North America are increasingly turning to big data consulting services to gain a competitive edge, optimize operations, and enhance customer experiences.

The market in this region benefits from a well-developed IT infrastructure, a strong demand for data analytics, and the widespread use of advanced technologies like AI and machine learning. Additionally, the presence of major consulting firms and technology providers in North America further solidifies its leadership in the global market.

In 2024, North America held a dominant market position in the Big Data Consulting Market, capturing more than 38% of the global market share, generating approximately USD 3.70 billion in revenue. This strong market position is driven by the region’s advanced technological infrastructure, high adoption of digital transformation strategies, and a growing demand for data-driven insights across multiple industries.

The United States, in particular, plays a pivotal role in this dominance, thanks to its robust technology ecosystem, the presence of leading consulting firms, and the widespread use of big data analytics across industries such as BFSI (Banking, Financial Services, and Insurance), healthcare, and retail. Companies in North America are increasingly leveraging big data solutions to enhance decision-making, optimize operations, and improve customer experiences, contributing to the region’s market leadership.

One of the key factors behind North America’s leadership is its well-developed IT infrastructure and the high level of investment in emerging technologies, such as artificial intelligence (AI) and machine learning (ML), which are essential for big data analytics.

Additionally, the region has a large number of cloud service providers offering scalable and cost-effective big data solutions, enabling businesses of all sizes to harness the power of data. The increasing emphasis on cybersecurity and data governance also drives demand for big data consulting services, further boosting the region’s growth.

In Europe, the market for big data consulting is expanding but at a slower pace compared to North America. European businesses are increasingly adopting data analytics solutions, particularly in sectors like manufacturing, automotive, and retail. In the Asia-Pacific (APAC) region, demand for big data consulting is rapidly increasing, particularly in China, India, and Japan. The growing digitalization of industries in these countries, coupled with the rise of IoT devices and mobile technology, has contributed to a surge in data generation.

In Latin America, the big data consulting market is in its early stages of development but shows strong growth potential, especially in countries like Brazil and Mexico. As businesses in these regions begin to embrace digital transformation, they are increasingly looking to big data to improve their operational efficiencies and customer engagement.

In the Middle East and Africa (MEA), the market for big data consulting is still emerging, with significant growth opportunities in countries such as the UAE, Saudi Arabia, and South Africa. Rapid urbanization, the expansion of smart cities, and increased investment in infrastructure are fueling demand for big data solutions.

By Service Type

In 2024, the Consulting Services segment held a dominant market position in the Big Data Consulting Market, capturing more than 40% of the market share. This segment’s leadership can be attributed to the increasing need for businesses to develop customized strategies for leveraging big data.

As companies across various industries—such as BFSI (Banking, Financial Services, and Insurance), healthcare, and retail—adopt data-driven decision-making, they turn to consulting services for expert guidance in navigating the complexities of big data analytics. Consulting firms help businesses design and implement tailored data strategies, from data collection to advanced analytics and reporting, ensuring they can make informed decisions and stay competitive.

The high demand for Consulting Services is also driven by the need for expertise in emerging technologies such as AI and machine learning, which require specialized knowledge. As organizations face challenges like data governance, integration with legacy systems, and real-time analytics, they increasingly rely on consultants to streamline their big data initiatives. This shift towards specialized consulting services is expected to continue driving growth in the segment, as businesses increasingly view data as a strategic asset.

By Deployment

In 2024, the On-Premises segment held a dominant market position in the Big Data Consulting Market, capturing more than 57% of the market share. This dominance is primarily driven by the preference of large enterprises, particularly in industries such as banking, finance, and healthcare, for maintaining full control over their data infrastructure.

On-premises solutions allow businesses to keep sensitive data within their facilities, providing enhanced security and data privacy, which is critical for compliance with strict regulations like GDPR. For sectors handling sensitive customer data or proprietary business information, the control offered by on-premises deployments outweighs the potential benefits of cloud-based alternatives.

Moreover, the on-premises model is often preferred by organizations that have significant legacy systems or specialized hardware requirements, where the integration of cloud solutions may be challenging or less cost-effective. Although the cloud-based segment is growing rapidly due to its scalability and cost-efficiency, the preference for on-premises deployment remains strong, especially among industries where data security, governance, and compliance are top priorities. This trend is expected to persist as organizations continue to prioritize security alongside innovation.

By End-User Industry

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Big Data Consulting Market, capturing more than 21% of the market share. This leadership is driven by the growing reliance on data analytics for improving decision-making, risk management, and customer experience in the BFSI sector.

Financial institutions are increasingly leveraging big data to identify emerging market trends, predict customer behavior, and detect fraudulent activities in real-time. With the vast amounts of transactional data generated daily, big data consulting helps organizations in this sector implement advanced analytics, machine learning models, and AI algorithms to streamline operations and enhance service offerings.

The BFSI sector also faces significant regulatory pressure, necessitating robust data management and compliance solutions, making the need for expert consulting even more critical. Big data consulting services provide the expertise required to navigate complex data governance and reporting requirements, ensuring compliance while optimizing business performance. Given the substantial investments in digital transformation by banks, insurance companies, and other financial service providers, the BFSI segment is expected to maintain its leading position in the big data consulting market.

Key Market Segments

By Service Type

- Consulting Services

- Integration Services

- Managed Services

By Deployment

- On-premises

- Cloud-Based

By End-User Industry

- BFSI

- Retail & E-commerce

- Healthcare

- Manufacturing

- Government

- Telecom & IT

- Energy & Utilities

Driving Factors

Increasing Demand for Data-Driven Decision-Making

One of the primary driving factors for the Big Data Consulting Market is the increasing demand for data-driven decision-making across industries. As organizations recognize the vast potential of big data in providing actionable insights, they are increasingly relying on consulting firms to help them harness the power of their data. With the growing complexity and volume of data generated by businesses, having the right tools and strategies in place is crucial to making informed decisions quickly and accurately.

In sectors like finance, healthcare, and retail, big data consulting services are enabling companies to analyze customer behaviors, optimize supply chains, improve operational efficiency, and enhance the customer experience. For instance, banks are using data analytics to detect fraud, predict market trends, and tailor financial products to specific customer segments.

Similarly, healthcare providers are leveraging big data to personalize treatments and predict patient outcomes. This push towards becoming more data-centric is fueling the demand for consulting services that help organizations navigate and capitalize on these opportunities, making data an integral part of their strategic operations.

Restraining Factors

High Implementation and Maintenance Costs

Despite the significant advantages of big data solutions, one major restraining factor in the Big Data Consulting Market is the high implementation and maintenance costs associated with big data technologies. Building the necessary infrastructure for handling large volumes of data, especially for smaller businesses, can be prohibitively expensive.

For companies looking to implement on-premises big data solutions, the costs can include not only hardware and software but also the hiring of skilled data scientists and IT personnel. Additionally, the integration of big data systems with existing legacy systems can be a complex and resource-intensive process, further increasing costs. Even with cloud-based solutions, while the initial costs may be lower, ongoing subscription and usage fees can add up over time, especially for organizations dealing with massive amounts of data.

Growth Opportunities

Expansion in Emerging Markets

One of the most promising growth opportunities for the Big Data Consulting Market lies in the expansion into emerging markets, particularly in regions such as Asia-Pacific, Latin America, and the Middle East. These regions are undergoing rapid digital transformation, and businesses are increasingly recognizing the importance of data-driven strategies to remain competitive.

In emerging markets, industries like retail, banking, manufacturing, and telecom are witnessing an explosion of data, and many are now seeking the expertise of big data consultants to unlock their value. For example, countries like India and Brazil have seen a surge in the adoption of digital banking, creating vast amounts of customer and transaction data that need to be analyzed and utilized effectively. Similarly, China and Southeast Asia are seeing exponential growth in e-commerce and smart manufacturing, both of which rely heavily on data analytics.

Challenging Factors

Data Privacy and Security Concerns

A significant challenging factor for the Big Data Consulting Market is the growing concerns surrounding data privacy and security. As the volume of data being collected continues to expand, so too do the risks associated with potential breaches, data misuse, and non-compliance with global regulations such as the General Data Protection Regulation (GDPR) in Europe and CCPA in California.

Organizations that adopt big data solutions must ensure they are complying with data protection laws and are prepared to implement robust security measures to protect sensitive information. For example, data breaches in industries like healthcare or finance can result in significant financial losses, legal penalties, and irreparable damage to a company’s reputation. Many organizations are therefore hesitant to fully embrace big data technologies unless they are confident that their data will be secure.

Growth Factors

Increasing Demand for Data-Driven Insights

The Big Data Consulting Market is experiencing significant growth driven by the increasing demand for data-driven insights across a wide range of industries. In 2024, the market is expected to be valued at USD 9.74 billion, reflecting the shift towards leveraging data for smarter decision-making. As organizations realize the potential of big data, they are increasingly relying on consulting services to help them tap into this valuable resource.

For example, the BFSI (Banking, Financial Services, and Insurance) sector, which accounts for more than 21% of the market, is investing heavily in data analytics to enhance customer experience, improve risk management, and prevent fraud. Similarly, healthcare providers are utilizing big data to personalize patient care and optimize operational efficiency.

The growing emphasis on real-time data and AI-driven analytics in industries such as retail, telecommunications, and energy further fuels demand. As companies adopt digital transformation strategies, big data consulting services are helping them integrate advanced technologies and optimize their data infrastructure, making data an integral part of their business strategies.

Emerging Trends

AI and Machine Learning Integration

A key emerging trend in the Big Data Consulting Market is the integration of artificial intelligence (AI) and machine learning (ML) with big data solutions. These technologies allow businesses to analyze large datasets more efficiently and generate actionable insights that were previously difficult to uncover. In 2024, AI and ML are expected to significantly influence market growth, as businesses look to automate decision-making processes and improve operational efficiencies.

AI-powered analytics enable organizations to predict market trends, customer behavior, and even potential risks with greater accuracy. For example, companies in sectors like e-commerce and telecom are leveraging AI to personalize recommendations, optimize supply chains, and enhance customer engagement. Machine learning algorithms also help businesses refine their data models over time, enabling continuous improvement.

According to industry estimates, by 2034, the Big Data Consulting Market is expected to grow to USD 33.36 billion, with AI and ML playing a pivotal role in this growth. As these technologies evolve, their integration into big data consulting services will continue to drive innovation and create new opportunities for businesses to stay competitive.

Business Benefits

Enhanced Operational Efficiency and Cost Reduction

One of the primary business benefits of adopting big data consulting services is the enhanced operational efficiency and cost reduction it offers. By leveraging big data analytics, organizations can streamline their processes, identify inefficiencies, and improve resource allocation. For example, in the manufacturing sector, companies are using big data to monitor production lines in real time, identify bottlenecks, and optimize supply chain management.

As a result, these businesses can reduce downtime, lower operational costs, and increase overall productivity. Similarly, in the energy sector, big data solutions are helping companies optimize energy consumption and improve grid management, which leads to cost savings and more sustainable operations.

According to industry research, the implementation of big data strategies has led to a 30-40% improvement in decision-making speed for many organizations. Furthermore, by reducing waste and improving forecasting accuracy, big data consulting services allow businesses to save both time and money, driving long-term profitability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Accenture continues to be a dominant player in the Big Data Consulting Market, largely due to its strong global presence and extensive portfolio of services. The company’s focus on innovation and technology-driven solutions has played a pivotal role in its growth. Accenture has made several key acquisitions to bolster its data analytics capabilities.

McKinsey & Company, known for its high-level consulting services, has also strengthened its position in the Big Data Consulting Market through strategic acquisitions and investments in advanced technologies. In recent years, McKinsey has made several moves to enhance its data and analytics capabilities, such as acquiring LUNAR, a design and innovation firm, and Orpheus, a digital analytics company.

Deloitte Touche Tohmatsu Limited, a key player in the Big Data Consulting Market, has firmly positioned itself as a leader by leveraging its global network and consulting expertise. The company has expanded its big data offerings through various acquisitions, such as the acquisition of Analytics, a firm specializing in data analytics and business intelligence solutions.

Top Key Players in the Market

- Accenture plc

- McKinsey & Company

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers International Limited (PwC)

- IBM Corporation

- Capgemini SE

- Ernst & Young Global Limited (EY)

- Tata Consultancy Services Limited (TCS)

- Hewlett Packard Enterprise Company (HPE)

- Cognizant Technology Solutions Corporation

- Other Key Players

Recent Developments

- In 2024, Accenture expanded its big data capabilities by acquiring Cognizant’s analytics division, enhancing its ability to deliver advanced data-driven solutions across industries.

- In 2024, Deloitte launched a new AI-powered analytics platform, aimed at helping businesses automate data insights and improve decision-making across key sectors like finance and healthcare.

Report Scope

Report Features Description Market Value (2024) USD 9.74 Billion Forecast Revenue (2034) USD 33.36 Billion CAGR (2025-2034) 13.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Consulting Services, Integration Services, Managed Services), By Deployment (On-premises, Cloud-Based), By End-User Industry (BFSI, Retail & E-commerce, Healthcare, Manufacturing, Government, Telecom & IT, Energy & Utilities) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Accenture plc, McKinsey & Company, Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers International Limited (PwC), IBM Corporation, Capgemini SE, Ernst & Young Global Limited (EY), Tata Consultancy Services Limited (TCS), Hewlett Packard Enterprise Company (HPE), Cognizant Technology Solutions Corporation, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Accenture plc

- McKinsey & Company

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers International Limited (PwC)

- IBM Corporation

- Capgemini SE

- Ernst & Young Global Limited (EY)

- Tata Consultancy Services Limited (TCS)

- Hewlett Packard Enterprise Company (HPE)

- Cognizant Technology Solutions Corporation

- Other Key Players