Global AI in Data Quality Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Healthcare, Retail and E-commerce, Manufacturing, Government and Public Sector, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 136488

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By Industry Vertical

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

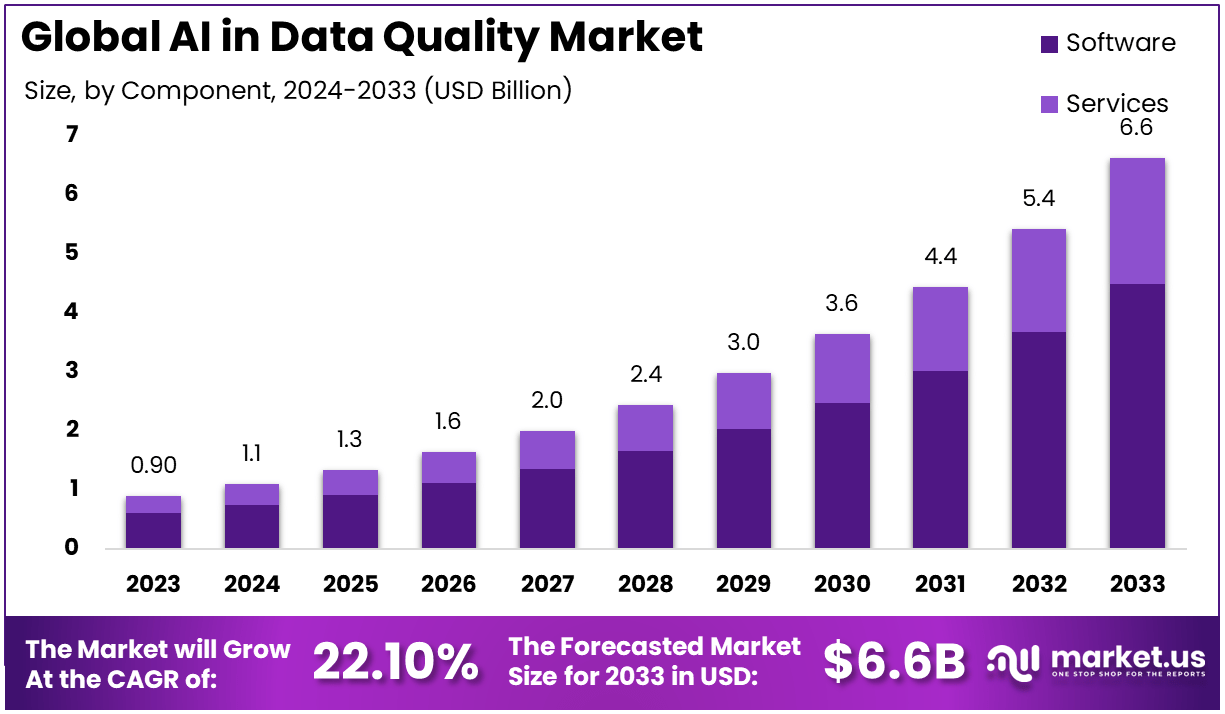

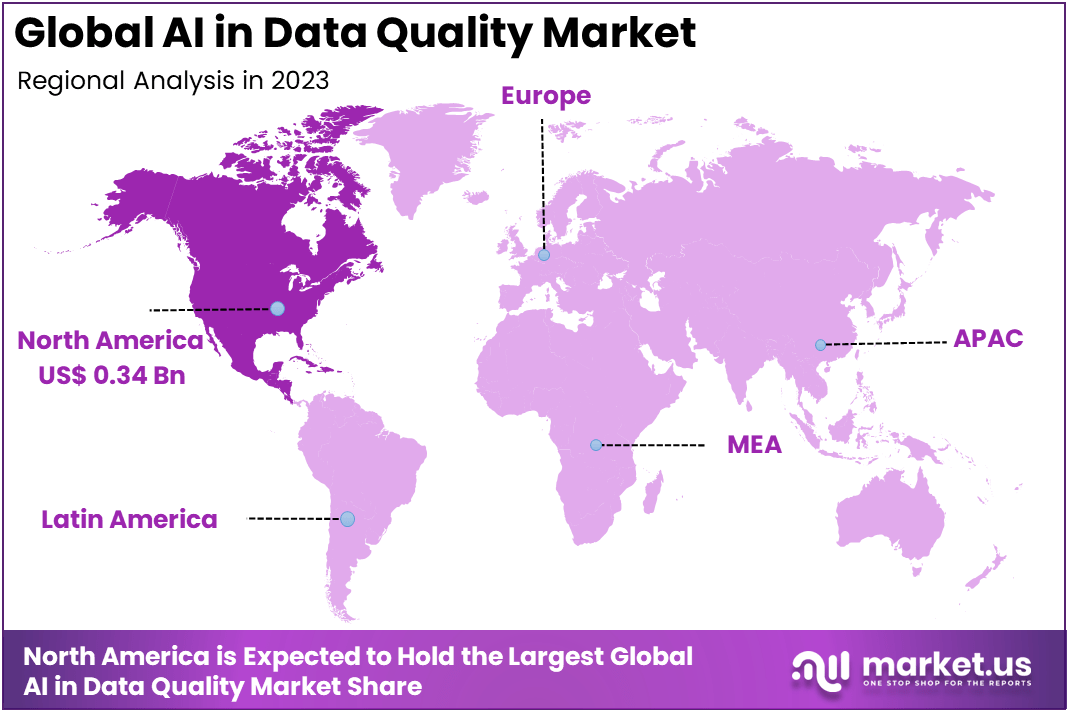

The Global AI in Data Quality Market size is expected to be worth around USD 6.6 Billion By 2033, from USD 0.9 Billion in 2023, growing at a CAGR of 22.10% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.2% share, holding USD 0.34 Billion in revenue.

AI in Data Quality refers to the use of Artificial Intelligence (AI) to enhance the accuracy, consistency, and reliability of data. These tools employ machine learning algorithms, natural language processing, and pattern recognition to detect, correct, and prevent data errors. AI-driven solutions help in identifying duplicates, filling missing values, and ensuring adherence to data standards. This technology not only reduces manual efforts but also ensures high-quality data for critical business processes like analytics, reporting, and decision-making.

The AI in Data Quality Market encompasses software and solutions designed to use AI technologies to improve data quality across industries. The market has been growing rapidly due to the increasing demand for real-time data integrity and accuracy in sectors like finance, healthcare, retail, and IT. Key drivers include the rise in big data adoption, advancements in AI algorithms, and the increasing need for regulatory compliance in data management.

The market is primarily driven by the exponential growth of big data and the need for accurate and reliable information. Organizations are leveraging AI to handle data complexity and reduce inaccuracies, particularly in real-time analytics and automated workflows. Regulatory requirements like GDPR and HIPAA are also pushing companies to adopt AI-driven data quality solutions to meet compliance standards. A study in 2023 reported that 70% of companies identified data quality improvement as a top priority for achieving digital transformation.

The demand for AI in Data Quality solutions is rising as companies recognize the value of high-quality data in decision-making. Industries like finance and healthcare are leading adopters, seeking to eliminate errors in transactional data and patient records. The growing reliance on cloud platforms and data-driven marketing strategies is further boosting demand. In 2023, the finance sector accounted for 28% of the market share due to the necessity of precise data in risk management and reporting.

The integration of AI in emerging areas like predictive analytics and business intelligence presents significant growth opportunities. Companies are exploring solutions that can integrate seamlessly with existing data management platforms. Another opportunity lies in small and medium businesses (SMBs), which are increasingly adopting AI tools to manage limited data resources effectively. By 2025, 40% of SMBs are expected to invest in AI-powered data quality solutions.

Advancements in AI technologies such as deep learning, generative AI, and reinforcement learning are revolutionizing data quality management. These technologies enable better anomaly detection, faster data cleansing, and more effective data matching. The rise of explainable AI (XAI) is also helping organizations understand AI decision-making processes, fostering trust and adoption. Cloud-based solutions are further enhancing accessibility and scalability, with cloud deployments expected to dominate the market by 2030.

Artificial Intelligence (AI) plays a significant role in enhancing data quality across various sectors, with several key statistics highlighting its impact. Poor data quality costs organizations an average of $12.9 million annually, emphasizing the need for effective data management solutions.

AI-driven tools can automate data cleansing processes, significantly reducing the time required to clean thousands of records from hours to mere seconds. Approximately 77% of IT decision-makers express a lack of trust in their organization’s data quality, underscoring the importance of implementing AI solutions to improve accuracy and reliability.

AI systems excel at real-time anomaly detection, identifying issues such as duplicates or missing values instantly, which helps prevent larger problems from developing. Continuous monitoring facilitated by AI can lead to a 30% reduction in fraudulent activities by analyzing transaction data for unusual patterns.

Furthermore, organizations utilizing AI for data quality management have reported improvements in operational efficiency, with some experiencing up to a 10% increase in production efficiency due to better data governance practices. In terms of data preparation, it is estimated that 80% of the effort in machine learning projects is spent on ensuring data quality, highlighting the critical role that AI plays in streamlining these processes and enhancing overall data integrity.

Key Takeaways

- Market Growth: The global AI in Data Quality Market is valued at USD 0.9 billion in 2023 and is projected to reach USD 6.6 billion by 2033, registering a robust CAGR of 22.10%.

- Dominant Component: The Software segment holds a dominant position, accounting for 67.9% of the market share in 2023, driven by increased demand for automated data management solutions.

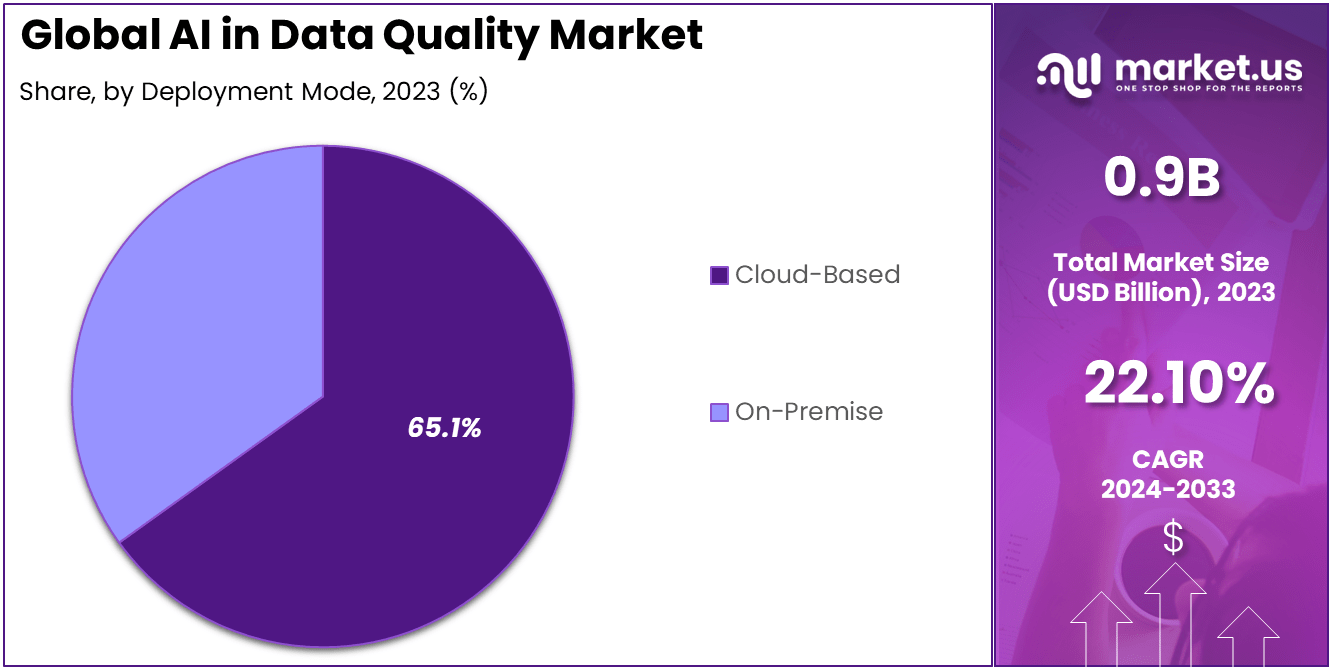

- Deployment Mode: Cloud-based solutions are leading the market, representing 65.1% of the share in 2023, as businesses prioritize scalability and accessibility.

- Organization Size: Large Enterprises dominate the market with a 68.0% share in 2023, leveraging AI to manage complex data landscapes and ensure regulatory compliance.

- Leading Industry Vertical: The BFSI sector holds a significant share of 21.5% in 2023, owing to the critical need for accurate and reliable data in risk management and compliance reporting.

- Regional Leadership: North America leads the global market with a 38.2% share in 2023, driven by the early adoption of AI technologies and a strong presence of key players in the region.

By Component

In 2023, the Software segment held a dominant market position, capturing over 67.9% of the total market share. This leadership can be attributed to the growing adoption of AI-driven tools that automate and optimize data quality processes, such as data cleansing, validation, and enrichment. As organizations increasingly rely on large volumes of data for decision-making, software solutions equipped with advanced AI capabilities provide an efficient way to maintain data accuracy and integrity.

The dominance of the Software segment is fueled by its ability to integrate seamlessly with existing IT systems and its adaptability across various industry verticals. For instance, industries such as BFSI and healthcare demand real-time data accuracy to comply with regulatory requirements and improve operational efficiency. AI-powered software ensures high-quality data by identifying patterns, detecting anomalies, and reducing human intervention, making it a preferred choice for enterprises.

Another key factor driving the preference for software solutions is their scalability and customization. Cloud-based software, a major subset of this segment, has gained significant traction due to its cost-effectiveness and ease of deployment. Businesses can scale their data quality initiatives without heavy upfront investments, which is particularly advantageous for organizations with fluctuating data needs.

By Deployment Mode

In 2023, the Cloud-Based segment held a dominant market position, capturing over 65.1% of the total market share. The widespread preference for cloud-based deployment is primarily driven by its scalability, cost-efficiency, and ease of access. Organizations across industries are leveraging cloud solutions to streamline data quality processes, enabling seamless integration with existing systems while reducing the need for extensive infrastructure investments.

The Cloud-Based segment’s dominance is also fueled by its flexibility in handling large volumes of data. As data generation continues to grow exponentially, businesses require agile solutions that can adapt to increasing workloads. Cloud-based AI in data quality tools allows organizations to scale operations up or down based on their needs without incurring additional costs for hardware or maintenance. This scalability makes it especially appealing for industries like BFSI and retail, where data volumes fluctuate significantly.

Additionally, cloud-based solutions provide enhanced accessibility and collaboration. Teams can access data quality tools from any location, ensuring real-time updates and streamlined decision-making. This capability has become particularly important in the wake of remote work trends, where geographically dispersed teams rely on centralized data quality platforms to maintain consistency and accuracy in their datasets.

By Organization Size

In 2023, the Large Enterprises segment held a dominant market position, capturing more than a 68.0% share of the AI in the Data Quality Market. The significant adoption of AI-driven data quality solutions by large enterprises is primarily driven by their need to manage vast volumes of complex and diverse datasets across multiple business functions and geographies. These enterprises often deal with big data ecosystems, requiring sophisticated tools to ensure accuracy, reliability, and compliance.

Large enterprises heavily invest in AI-powered data quality solutions because of their ability to automate tedious data validation, cleansing, and enrichment processes. These organizations have diverse datasets originating from various sources, such as customer databases, supply chain systems, and operational records. AI-driven tools enable these enterprises to streamline these datasets, uncover actionable insights, and make data-driven decisions faster and more effectively, ensuring a competitive edge in their respective industries.

Additionally, large enterprises typically operate in highly regulated industries, such as BFSI, healthcare, and telecommunications, where compliance with stringent data protection regulations is critical. AI-powered data quality solutions offer advanced features, such as automated compliance monitoring and reporting, which help enterprises adhere to regulations like GDPR, HIPAA, and CCPA. This reduces the risk of penalties and enhances their reputation in the market.

By Industry Vertical

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position, capturing more than a 21.5% share in the AI in Data Quality Market. This significant dominance can be attributed to the sector’s increasing reliance on accurate and high-quality data for critical decision-making processes such as fraud detection, risk assessment, and compliance management.

With the rapid digitalization of financial operations, the BFSI industry has been inundated with massive data volumes from various sources like customer interactions, transactions, and regulatory reports. AI-powered data quality tools play a crucial role in cleansing, validating, and enriching this data to maintain operational efficiency and regulatory compliance, making it a necessity for financial institutions.

The growing emphasis on compliance with stringent regulations, such as GDPR, AML, and Basel III, further drives the adoption of AI-powered data quality solutions in the BFSI sector. Accurate and consistent data is essential for reporting and auditing, and AI solutions help streamline these processes by ensuring data accuracy, eliminating redundancies, and maintaining up-to-date records.

Financial institutions are also leveraging these tools to improve customer experience by personalizing services, reducing errors, and accelerating response times, further solidifying the demand for AI in data quality in the BFSI domain.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Other Industry Verticals

Driving Factors

Growing Demand for High-Quality Data to Support Decision-Making

In today’s data-driven economy, organizations are increasingly relying on high-quality data to make critical business decisions, which is driving the adoption of AI in data-quality solutions. Businesses across various sectors, including BFSI, healthcare, retail, and manufacturing, require accurate, reliable, and real-time data to optimize operations, enhance customer experience, and drive profitability.

Moreover, poor data quality costs companies an estimated $12.9 million annually, as reported by IBM. This has pushed enterprises to invest in AI tools that automatically clean, validate, and enrich datasets. For instance, in the BFSI sector, regulatory compliance requires financial institutions to handle vast amounts of sensitive data accurately. AI-powered data quality solutions help them meet these stringent requirements by ensuring data integrity, reducing redundancies, and automating compliance reporting.

Additionally, the rise of IoT and big data has amplified the volume and complexity of data being generated. A study from 2023 revealed that the global data volume reached 120 zettabytes and is expected to grow to 181 zettabytes by 2025. This exponential growth necessitates AI solutions to handle data inaccuracies, inconsistencies, and missing values effectively. By addressing these challenges, AI in data quality empowers organizations to improve operational efficiency, reduce errors, and gain competitive advantages.

Restraining Factors

High Implementation Costs of AI in Data Quality

Despite its benefits, the high implementation costs of AI-powered data quality solutions pose a significant barrier to adoption, especially for small and medium-sized enterprises (SMEs). Many organizations lack the financial resources to invest in these advanced tools, which often require significant upfront investments for hardware, software, and skilled personnel. According to a Deloitte study in 2023, approximately 45% of SMEs cited cost as the primary factor limiting their adoption of AI technologies.

Additionally, maintaining and scaling AI systems can incur ongoing costs, such as upgrades, cloud storage fees, and integration with existing systems. For example, cloud-based AI solutions charge subscription fees, which can accumulate over time and strain budgets, particularly for organizations with fluctuating data processing needs. These financial challenges discourage companies from fully leveraging AI in their data quality strategies.

Another aspect of this restraint is the lack of skilled personnel required to deploy and manage AI tools effectively. A McKinsey report in 2023 revealed that 43% of businesses face a talent gap in AI expertise, making it difficult to implement advanced AI solutions. The cost of hiring or upskilling employees further adds to the financial burden, especially in competitive job markets where AI specialists command high salaries.

Growth Opportunities

Increasing Adoption of Cloud-Based Data Quality Solutions

The rapid shift toward cloud-based technologies presents a lucrative growth opportunity for AI in data quality. Cloud-based solutions offer scalability, flexibility, and cost-efficiency, making them particularly attractive for businesses of all sizes.

Cloud-based AI in data quality solutions enables organizations to handle large datasets without investing in expensive on-premise infrastructure. This is especially beneficial for SMEs, which can leverage pay-as-you-go models to access advanced AI capabilities without incurring high upfront costs. For example, AWS and Microsoft Azure offer integrated AI tools for data quality, allowing businesses to improve data accuracy and consistency with minimal investment.

Another opportunity lies in the integration of AI-powered data quality solutions with other cloud-based enterprise tools, such as CRM and ERP systems. These integrations streamline workflows, enhance collaboration, and enable real-time insights. In 2024, Salesforce reported a 35% improvement in data accuracy for clients using its AI-driven data quality solution integrated with its CRM platform.

Challenging Factors

Ensuring Data Privacy and Security

One of the critical challenges facing AI in data quality is ensuring data privacy and security. As organizations increasingly rely on AI-powered tools to manage and process sensitive information, concerns over data breaches and compliance with privacy regulations have escalated. A 2023 IBM report revealed that the average cost of a data breach was $4.45 million, highlighting the risks associated with poor data security practices.

Data quality solutions often require access to vast amounts of organizational data, including customer information, financial records, and intellectual property. While AI algorithms improve data accuracy and reliability, they also introduce vulnerabilities if not implemented with robust security measures. For instance, data stored in cloud environments is susceptible to unauthorized access and cyberattacks, necessitating advanced encryption and multi-layered security protocols.

Another challenge is complying with global data privacy regulations, such as GDPR, CCPA, and HIPAA. These laws require organizations to ensure data accuracy while protecting sensitive information from misuse. Failure to meet these requirements can result in hefty fines and reputational damage. A 2023 survey by Deloitte found that 62% of businesses struggle to align their data quality initiatives with evolving privacy regulations, further complicating adoption.

Growth Factors

The growth of AI in data quality is primarily driven by the increasing volume of unstructured data generated globally. According to IDC, the total volume of data created worldwide is expected to grow to 175 zettabytes by 2025. Businesses are striving to extract actionable insights from this data, leading to the demand for advanced AI-powered tools that can process, analyze, and validate data efficiently.

Additionally, sectors like BFSI, healthcare, and retail are adopting AI for data accuracy to meet compliance requirements and enhance decision-making processes. The integration of AI into existing enterprise systems, such as CRM and ERP platforms, has also significantly fueled market growth.

Emerging Trends

The adoption of self-learning algorithms and natural language processing (NLP) is transforming data quality management. AI-driven tools now employ NLP to understand context, identify errors, and provide suggestions, significantly improving data accuracy. Another emerging trend is the use of real-time data quality monitoring powered by AI.

Businesses are now able to assess and fix data inconsistencies as they occur, reducing time delays. The rise of cloud-based AI solutions is another critical trend, enabling small and medium-sized enterprises (SMEs) to access high-quality tools without significant infrastructure investments.

Business Benefits

AI in data quality management offers several tangible benefits to businesses. First, it reduces operational costs by automating time-consuming tasks like data cleaning, validation, and deduplication. A recent McKinsey report revealed that companies using AI for data quality achieved up to 30% cost savings in data operations.

Second, improved data accuracy leads to better decision-making, enabling organizations to predict market trends, enhance customer satisfaction, and increase revenue. Lastly, AI solutions enhance regulatory compliance, helping businesses avoid hefty fines and maintain their reputation by ensuring data integrity and security.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 38.2% share, holding USD 0.34 billion in revenue. The region’s leadership in AI in the data quality market is attributed to the strong presence of key technology companies such as IBM, Microsoft, and Google.

These companies invest significantly in research and development of advanced AI-powered tools, ensuring the region remains at the forefront of innovation. Furthermore, North America’s early adoption of AI-driven solutions across sectors such as BFSI, healthcare, IT, and telecommunications has created a robust ecosystem for AI-based data quality solutions.

The region’s strong regulatory framework also plays a pivotal role in driving market growth. For instance, compliance requirements like the General Data Protection Regulation (GDPR) for data privacy and integrity have prompted companies to invest in advanced AI-powered data quality tools. In addition, the US and Canada have a high concentration of data-intensive industries that demand accuracy and reliability in data processing, further propelling the adoption of AI solutions.

Moreover, North America benefits from significant investments in cloud infrastructure, which complements the growth of cloud-based AI in data quality solutions. According to survey, cloud services spending in the US reached over USD 90 billion in 2023, enabling businesses to integrate AI-driven data management tools seamlessly. The region’s focus on digitization and big data analytics across enterprises further strengthens its market position.

Another contributing factor is the presence of a highly skilled workforce and advanced infrastructure, allowing businesses to implement AI solutions effectively. The growing adoption of AI in sectors like retail and e-commerce, where accurate data is crucial for enhancing customer experience, also bolsters market demand. As organizations increasingly rely on data for predictive analysis and decision-making, North America’s dominance in the AI data quality market is expected to remain steady in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In 2024, Microsoft expanded its Azure Purview platform by integrating AI-powered data quality solutions. These enhancements include intelligent data profiling, automated metadata tagging, and real-time validation tools designed for large-scale enterprises.

Microsoft has also been actively acquiring smaller AI startups, such as Nuance Communications, to strengthen its AI capabilities in data quality and governance. The company’s focus on innovation in the cloud-based segment continues to make Azure a preferred platform for businesses aiming to improve their data quality processes.

Informatica, a leader in data management, launched its AI-driven Intelligent Data Management Cloud (IDMC) in 2024, incorporating advanced machine learning algorithms for data quality. The company also partnered with Google Cloud to offer scalable AI solutions to global enterprises.

Focusing on real-time anomaly detection and predictive data cleansing. Informatica’s focus on hybrid cloud deployments and AI-driven automation has made it a top choice for industries such as BFSI and retail, where high-quality data is essential for decision-making.

SAP SE introduced its enhanced AI-driven Data Intelligence platform in early 2024. This update includes features such as automated error correction, machine learning-based data monitoring, and compliance tools tailored for regulated industries like healthcare and finance.

SAP also entered into a strategic partnership with AWS to integrate AI data quality tools into SAP’s existing ERP solutions. These advancements have strengthened SAP’s position as a market leader by enabling the seamless integration of data quality tools into enterprise workflows.

Top Key Players in the Market

- Microsoft Corporation

- Informatica Inc.

- SAP SE

- SAS Institute Inc.

- Qlik

- Ataccama

- Precisely

- Collibra

- Dataiku

- Alteryx, Inc.

- Other Key Players

Recent Developments

- In 2024: IBM announced the expansion of its AI-driven data quality platform, Watson Knowledge Catalog, to include enhanced automation features. This update integrates machine learning algorithms for real-time data validation and anomaly detection, improving data accuracy by over 40%.

- In 2024: Google Cloud introduced its advanced AI-powered Data Quality Insights tool within the BigQuery platform. The update has been designed for large enterprises handling extensive datasets, promising to cut data cleansing times by 25% while boosting decision-making accuracy by leveraging high-quality data.

Report Scope

Report Features Description Market Value (2023) USD 0.9 Bn Forecast Revenue (2033) USD 6.6 Bn CAGR (2024-2033) 22.10% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Healthcare, Retail and E-commerce, Manufacturing, Government and Public Sector, Other Industry Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Microsoft Corporation, Informatica Inc., SAP SE, SAS Institute Inc., Qlik, Ataccama, Precisely, Collibra, Dataiku, Alteryx, Inc., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Data Quality MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Data Quality MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Informatica Inc.

- SAP SE

- SAS Institute Inc.

- Qlik

- Ataccama

- Precisely

- Collibra

- Dataiku

- Alteryx, Inc.

- Other Key Players