Global Data Governance Market By Component (Solution, Services), By Application (Risk Management, Compliance Management), By Deployment (On-premises, Cloud), By Vertical (BFSI, Retail & Consumer, Government, Healthcare, Manufacturing, Telecom and IT, Transportation & Logistics, Other), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 116884

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Data Governance Software Market size is expected to be worth around USD 25.6 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 22% during the forecast period from 2024 to 2033.

Data governance software refers to tools and solutions designed to help organizations manage and govern their data assets effectively. In today’s data-driven world, businesses generate and collect vast amounts of data, making it crucial to have proper mechanisms in place to ensure data quality, integrity, security, and compliance.

The data governance software market has experienced significant growth in recent years as organizations recognize the importance of managing data as a strategic asset. With the increasing volume, variety, and velocity of data, businesses are seeking comprehensive solutions to address data governance challenges. The market offers a range of software options, including data cataloging tools, metadata management systems, data quality platforms, and data privacy and compliance solutions.

The adoption of data governance software can bring several benefits to organizations. It helps improve data accuracy and reliability, enhances decision-making processes, ensures regulatory compliance, and mitigates risks associated with data breaches or mishandling. Additionally, data governance software facilitates collaboration among different teams and departments, fostering a data-driven culture within the organization.

According to a report by UNCTAD, out of the 194 countries analyzed, 137 countries have implemented laws related to data protection and privacy. This indicates that a majority of countries recognize the significance of safeguarding personal information. Notably, strict regulations such as the General Data Protection Regulation (GDPR) in the US have the potential to impose fines on companies like Google, amounting to approximately 2% of their revenue.

Furthermore, the 2024 State of Data Security Report conducted by Immuta reveals that a significant 88% of data leaders anticipate an increased emphasis on data security by 2025, surpassing the priority given to artificial intelligence (AI). While AI remains popular among data professionals across diverse sectors, organizations are placing greater importance on security, trust, and compliance.

According to the International Association of Privacy Professionals, the adoption of data governance software to ensure compliance with data privacy regulations is expected to witness a significant increase of 45% between 2022 and 2024.

A study conducted by DataOps.live reveals that around 55% of organizations have plans to integrate their data governance software with cloud-based data management platforms by the end of 2024. This integration aims to enhance data governance capabilities and leverage the scalability and flexibility offered by cloud environments.

Moreover, the Data Management Association predicts a notable growth of 40% in the use of data governance software for managing data lineage and traceability between 2022 and 2024. This emphasizes the importance of maintaining a clear understanding of the origin, transformations, and movement of data within organizations.

Key Takeaways

- Data Governance Software Market size is expected to be worth around USD 25.6 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 22%

- In 2023, the Solution segment held a dominant position in the Data Governance Market, capturing more than a 55.0% share.

- In 2023, the Risk Management segment held a dominant market position in the Data Governance Market, capturing a significant share.

- In 2023, the On-premises segment held a dominant market position in the Data Governance Market, capturing a substantial share.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Data Governance Market, capturing more a substantial share.

- Over 60% of data governance software deployments are expected to be cloud-based or offered as software-as-a-service (SaaS).

- Approximately 50% of organizations intend to integrate their data governance software with data cataloging and metadata management tools by the end of 2024.

- It’s estimated that by 2024, over 70% of data governance software solutions will offer role-based access controls and data masking capabilities.

- The adoption of data governance software for managing data quality and data stewardship is projected to increase by 35% between 2022 and 2024.

- Approximately 45% of organizations plan to integrate their data governance software with data literacy and training platforms by the end of 2024.

- Approximately 40% of organizations plan to integrate their data governance software with data risk management and data protection tools by the end of 2024.

- By 2024, over 55% of data governance software implementations are expected to involve the use of data mesh architectures and distributed data management approaches.

Component Type Analysis

In 2023, the Solution segment held a dominant position in the Data Governance Market, capturing more than a 55.0% share. This prominence can be attributed to the increasing recognition of the need for data quality management and compliance with various regulatory standards across industries. Solutions in data governance ensure that data across organizations is accurate, accessible, secure, and manageable, which is critical in today’s data-driven business environment.

The growing emphasis on data security and privacy, spurred by regulations such as GDPR in Europe and CCPA in the United States, has compelled organizations to invest significantly in comprehensive data governance solutions. Moreover, these solutions facilitate better decision-making by providing business leaders and data stewards with enhanced tools for data quality management, data cataloging, and metadata management.

As businesses generate and handle vast amounts of data, the role of such solutions becomes indispensable to prevent data breaches and ensure the integrity of data. The advent of advanced technologies like AI and machine learning within data governance solutions further strengthens their market position by enabling more sophisticated data analytics and real-time data management capabilities.

The Services segment, while smaller, also plays a crucial role by supporting the implementation, operation, and maintenance of data governance frameworks. Services such as consulting, support, and maintenance are vital for organizations that lack the in-house expertise to manage complex data governance landscapes.

As organizations continue to realize the importance of data as a strategic asset, the demand for specialized services that can help in aligning data governance strategies with business objectives is expected to rise. Thus, while the Solution segment leads due to its direct impact on compliance and data management, the Services segment is integral to the sustained effectiveness and evolution of data governance strategies.

Application Analysis

In 2023, the Risk Management segment held a dominant market position in the Data Governance Market, capturing a significant share. This leadership is largely due to the escalating need for enterprises to mitigate risks associated with data breaches, cyber-attacks, and compliance failures. As organizations increasingly rely on digital platforms and data-driven decision-making, the potential risks related to data security and privacy have become more pronounced.

Risk management solutions within data governance frameworks help organizations identify, assess, and mitigate these risks, ensuring operational continuity and safeguarding sensitive information. Risk management strategies are further emphasized by the growing body of regulations and standards that require strict data handling procedures.

Tools and systems designed for risk management not only help in compliance but also enhance an organization’s ability to respond to potential threats swiftly and effectively. The implementation of risk management solutions is seen as a proactive measure to avoid substantial financial penalties and reputational damage that can arise from data mishandling or security breaches.

Furthermore, as the volume and variety of data that businesses process continue to grow, the complexity of managing this data securely increases. Risk management applications in data governance utilize advanced analytics and real-time monitoring to provide insights into potential vulnerabilities and anomalous activities within data environments. This capability not only protects the data but also reinforces the organization’s resilience against internal and external threats, thus explaining why the Risk Management segment commands such a substantial market share.

Deployment Analysis

In 2023, the On-premises segment held a dominant market position in the Data Governance Market, capturing a substantial share. This preference for on-premises deployment stems primarily from its inherent control and security benefits, which are highly valued in industries handling sensitive data, such as finance, healthcare, and government.

On-premises solutions provide organizations with full control over their data governance tools and systems, including how data is stored, accessed, and managed, which is crucial for complying with strict regulatory requirements and ensuring data privacy. Moreover, on-premises deployment is favored by organizations that are cautious about the vulnerability of cloud environments to cyber threats.

Despite the scalability and cost-effectiveness of cloud solutions, the perceived risks associated with data breaches and unauthorized access continue to drive demand for on-premises systems. These systems allow enterprises to maintain physical oversight of their data storage and management, significantly reducing the reliance on third-party service providers and thereby minimizing potential external threats.

Additionally, the on-premises model often aligns better with existing IT infrastructure in many large organizations that may have legacy systems in place. Integrating new data governance solutions with these systems can be more straightforward when managed on-site, allowing for customized adaptations and upgrades that meet specific organizational needs without the complexities of cloud integration.

Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Data Governance Market, capturing more a substantial share. This significant market share can be attributed to the stringent regulatory requirements and the critical need for data accuracy and security in financial transactions.

Financial institutions face an increasing need to manage vast amounts of data related to customer transactions, risk management, and compliance reporting. Effective data governance in this sector ensures integrity, confidentiality, and availability of data, which are paramount for maintaining trust and complying with regulations such as GDPR, SOX, and Basel III.

Moreover, the BFSI sector’s reliance on data governance is driven by the need to harness data for better customer insights and competitive advantage. As these institutions embrace digital transformation, they increasingly rely on data analytics for personalized services, risk assessment, and decision-making. The deployment of robust data governance frameworks supports these objectives by ensuring data is clean, well-documented, and readily available for analysis.

Furthermore, in an era marked by cyber threats and data breaches, BFSI institutions prioritize data governance to safeguard sensitive financial information against unauthorized access and cyber attacks. This focus on security is crucial not only for protecting client data but also for preserving institutional reputation and avoiding potential financial penalties for data breaches. Thus, the emphasis on comprehensive data governance solutions continues to drive the BFSI segment’s dominance in the market.

Key Market Segments

Component

- Services

- Solution

Application

- Compliance Management

- Risk Management

- Audit Management

- Incident Management

- Others

Deployment

- On-Premises

- Cloud

Vertical

- BFSI

- Retail & Consumer

- Government

- Healthcare

- Manufacturing

- Telecom and IT

- Transportation & Logistics

- Other

Driver

Regulatory and Compliance Mandates

One of the primary drivers of the Data Governance Market is the increasing regulatory and compliance mandates across various industries. Organizations are compelled to adhere to stringent data management standards due to regulations like GDPR in Europe and CCPA in California, which emphasize the protection of personal information and privacy.

This regulatory landscape has made it crucial for organizations to implement robust data governance frameworks to ensure compliance, avoid legal penalties, and maintain customer trust. As data becomes a critical asset, the demand for comprehensive data governance solutions that can handle compliance, risk management, and data security is growing significantly.

Restraint

High Initial Costs and Complexity of Implementation

A significant restraint in the Data Governance Market is the high initial costs associated with setting up on-premises data governance solutions, which include expenditures on hardware, software, and professional services for system installation and integration.

Additionally, the complexity of implementing these systems, particularly in organizations with extensive existing IT infrastructures, poses challenges. These factors can deter especially small and medium-sized enterprises from adopting on-premises data governance solutions despite the potential benefits.

Opportunity

Increasing Volume and Complexity of Data

The Data Governance Market sees a major opportunity in the increasing volume and complexity of data generated by organizations. This surge in data comes from various digital interactions and IoT devices across industries, requiring more sophisticated management tools to ensure data integrity and usefulness.

Data governance solutions that enhance data quality, compliance, and decision-making capabilities are in high demand, with organizations looking to leverage big data for strategic advantages. This trend is particularly strong in sectors such as healthcare, banking, and retail, where data is pivotal for operational efficiency and customer satisfaction.

Challenge

Varying Structures of Regulatory Policies

A critical challenge in the Data Governance Market is the varying structures of regulatory policies across different regions and sectors. These inconsistencies complicate the implementation of universal data governance systems that comply with all possible regulations.

Organizations often need to customize their data governance solutions to meet specific regional or industry-specific requirements, which can increase the complexity and cost of data governance initiatives. Keeping up with the evolving regulatory landscape and ensuring compliance while managing data effectively remains a daunting task for many organizations.

Growth Factors

- Regulatory and Compliance Demands: Increasing global regulatory pressures such as GDPR in Europe and CCPA in California drive the need for stringent data governance to ensure compliance, avoid penalties, and protect consumer privacy.

- Rise of Digital Transformations: As more organizations undergo digital transformations, the need for robust data governance to manage the vast amounts of generated data becomes crucial. This is particularly evident in sectors like banking, healthcare, and retail, where data integrity directly impacts operations.

- Advancements in Technology: The integration of AI and machine learning in data governance tools enhances their capability to manage data more efficiently, providing sophisticated analytics and automation that support better decision-making processes.

- Increasing Data Volume and Complexity: With the surge in data creation from digital interactions and IoT devices, organizations require advanced data governance solutions to handle the complexity and volume, ensuring data accuracy and usefulness.

- Growing Awareness of Data as a Strategic Asset: Across industries, there is a growing recognition of data as a critical asset that needs to be governed to unlock value, mitigate risks, and gain competitive advantage.

Emerging Trends

- Cloud-Based Data Governance Solutions: There’s a significant shift towards cloud deployments, which offer scalability, flexibility, and cost-effectiveness, appealing particularly to SMEs that require robust data governance without the heavy initial investment of on-premises solutions.

- Data Privacy and Security: With increasing cyber threats, data privacy and security remain a top priority in data governance strategies. This trend is particularly strong in industries handling sensitive information, such as BFSI and healthcare.

- Data Governance as a Service (DGaaS): As organizations seek more agile and less resource-intensive solutions, Data Governance as a Service emerges as a key trend, providing governance capabilities without the need for extensive in-house infrastructure.

- Increased Use of Data Governance for Compliance: Compliance management remains a critical function of data governance, driven by the need to adhere to various global and regional regulations. This ensures that organizations can avoid hefty fines and reputational damage due to non-compliance

- Enhanced Focus on Data Quality: There is an increased emphasis on improving data quality across business processes. Organizations are investing in technologies and strategies that enhance the accuracy, completeness, and reliability of their data, which is crucial for analytics and decision-making processes.

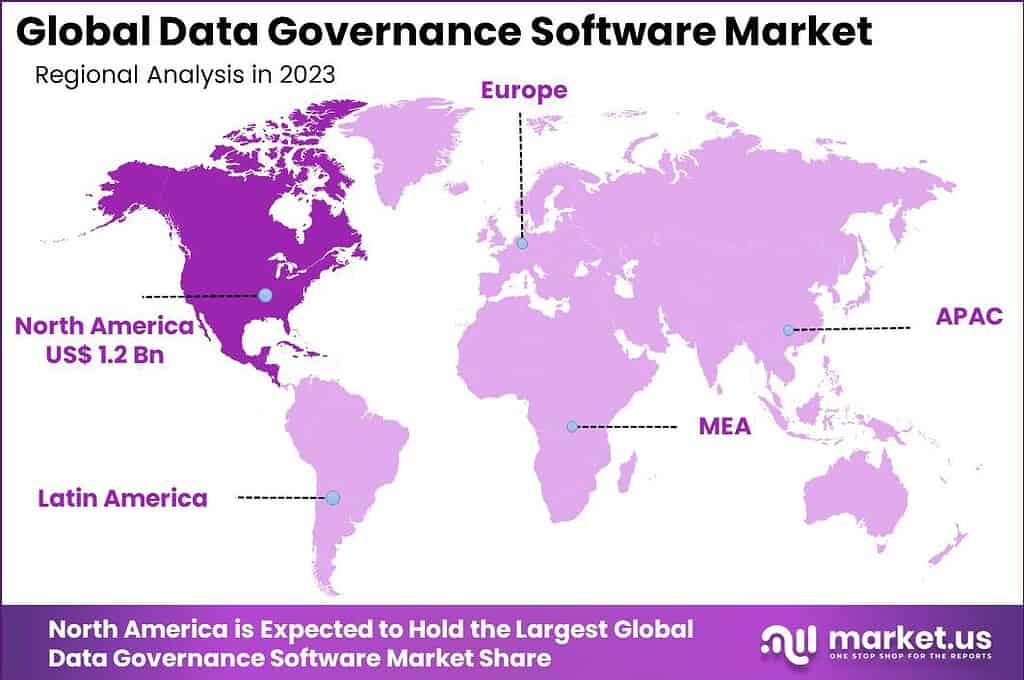

Regional Analysis

In 2023, North America held a dominant market position in the data governance market, capturing more than a 35.6% share. This region’s leadership can be attributed to several key factors. Predominantly, the stringent regulatory landscape concerning data protection and privacy, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), has propelled the adoption of robust data governance solutions.

The demand for Data Governance in North America was valued at US$ 1.2 billion in 2023 and is anticipated to grow significantly in the forecast period. Enterprises across the United States and Canada are increasingly aware of the significance of compliance with these regulations to avoid hefty penalties and reputational damage.

Additionally, North America is home to a high concentration of global technological innovators and a mature IT infrastructure, which facilitates the development and integration of advanced data governance technologies. The presence of major players in the data governance market, such as IBM, Oracle, and Microsoft, also plays a crucial role. These companies not only contribute to the regional market revenue but also drive innovation through significant investments in research and development.

The rise in data breaches and cyber-attacks has further emphasized the need for stringent data governance, pushing companies to adopt comprehensive data governance strategies that ensure data quality, security, and compliance. Europe follows North America in terms of market share in the data governance arena.

The enforcement of the General Data Protection Regulation (GDPR) has been a pivotal driver for the market in this region. GDPR’s strict mandates on data processing and storage have necessitated the adoption of advanced data governance solutions across European organizations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The data governance software market features several key players that are pivotal in shaping industry standards and driving innovation. Oracle, SAP, and IBM are leading giants known for their comprehensive data management solutions, catering to a wide range of industries globally. These companies offer robust platforms that integrate data governance with other functionalities like data security and business intelligence, making them popular choices among large enterprises.

SAS and Informatica also play significant roles, with SAS providing advanced analytics integrated with data governance tools, and Informatica focusing on cloud data management and integration services. Both companies are recognized for their ability to help organizations leverage data as a strategic asset.

Top Market Leaders

- Oracle

- SAP

- IBM

- SAS

- Informtica

- Talend

- Magnitude Software

- Infogix

- Zaloni

- Alex Solutions

Recent Developments

- In March 2024, SAS introduced enhancements to its Viya platform, specifically targeting data governance and analytics. The updates include new features for metadata management, data lineage tracking, and automated data quality assessments.

- In February 2024, IBM launched a new AI-driven data governance tool called IBM Data Governance and Compliance Hub. This tool integrates advanced AI capabilities to automate compliance checks and improve data quality across enterprise environments.

- In January 2024, SAP announced a new collaboration with Microsoft to enhance data integration and governance capabilities within SAP S/4HANA and Microsoft Azure. This partnership aims to streamline data management and improve compliance with regulatory standards across hybrid cloud environments. This integration is expected to help organizations better manage their data workflows and ensure data quality and compliance.

- In January 2024, Infogix launched Data360, an updated data governance platform that incorporates AI and machine learning to enhance data quality and compliance management. The platform offers new features for real-time data monitoring, automated data profiling, and enhanced metadata management, helping organizations maintain better control over their data environments

- In November 2023, Informatica launched the latest version of its Intelligent Data Management Cloud (IDMC), which includes new capabilities for data governance, privacy, and compliance. The updated platform offers enhanced data cataloging, automated data lineage, and improved integration with cloud-native environments, helping organizations manage their data more efficiently and securely

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 25.6 Bn CAGR (2024-2033) 22.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Application (Risk Management, Compliance Management), By Deployment (On-premises, Cloud), By Vertical (BFSI, Retail & Consumer, Government, Healthcare, Manufacturing, Telecom and IT, Transportation & Logistics, Other) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Oracle, SAP, IBM, SAS, Informtica, Talend, Magnitude Software, Infogix, Zaloni, Alex Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Data Governance Software?Data Governance Software refers to tools and platforms designed to manage, monitor, and enforce data governance policies within organizations. These software solutions help ensure that data is accurate, consistent, secure, and compliant with regulatory requirements.

How big is Data Governance Software Market?The Global Data Governance Software Market size is expected to be worth around USD 25.6 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 22% during the forecast period from 2024 to 2033.

What are the challenges associated with implementing Data Governance Software?Challenges may include:

- Complexity of data landscapes

- Data silos and integration issues

- Resistance to change within the organization

- Ensuring user adoption and engagement

- Keeping up with evolving regulatory requirements

What are the main drivers of the Data Governance market?Key drivers include the increasing volume and complexity of data, regulatory and compliance mandates (such as GDPR, CCPA, HIPAA), and the need for improved data quality and decision-making processes. The growth of cloud-based solutions and AI-powered applications also significantly propels market growth.

Which sectors are the largest adopters of data governance solutions?Major adopters include the healthcare sector (due to strict data privacy regulations), financial services (for risk management and regulatory compliance), IT and telecommunications, retail, and government sectors.

Which regions are leading in the Data Governance market?North America currently dominates the market due to stringent regulatory frameworks and the presence of major technology companies. The Asia-Pacific region is anticipated to be the fastest-growing market, driven by rapid digitization and increasing regulatory requirements.

Data Governance Software MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Data Governance Software MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle

- SAP

- IBM

- SAS

- Informtica

- Talend

- Magnitude Software

- Infogix

- Zaloni

- Alex Solutions