Global Data Center Interconnect Market Size, Share, Statistics Analysis Report By Component (Hardware, Software, Services), By Application (Disaster Recovery and Business Continuity, Shared Data & Resources, Workload and Data Mobility), By End-Use (Communications Service Providers (CSPs), Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs), Government/Research and Education (Government/R&E), Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135343

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

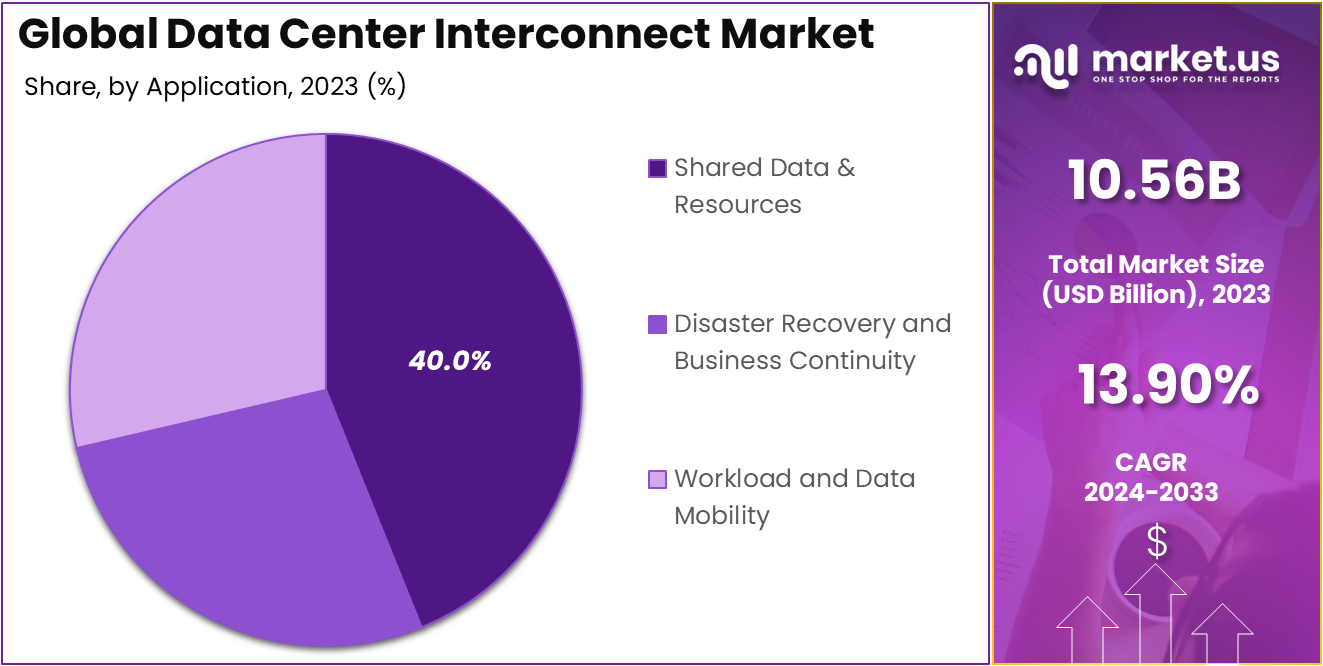

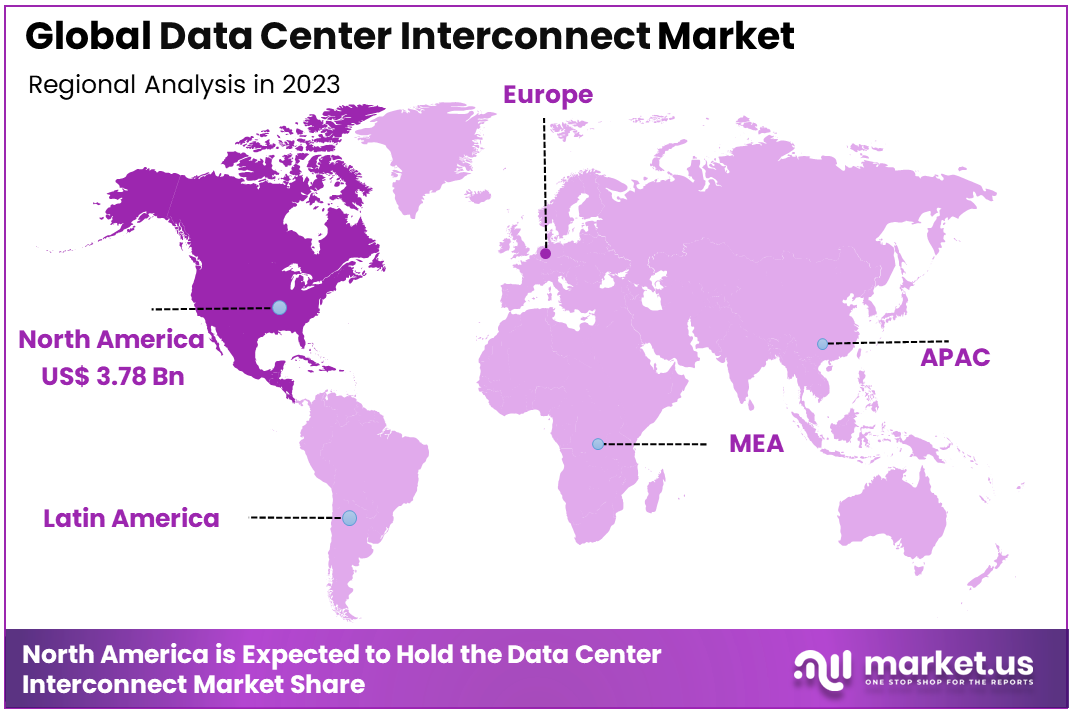

The Global Data Center Interconnect Market size is expected to be worth around USD 38.81 Billion By 2033, from USD 10.56 Billion in 2023, growing at a CAGR of 13.90% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.8% share, holding USD 3.78 Billion in revenue.

Data Center Interconnect (DCI) refers to the technology and infrastructure used to connect multiple data centers, allowing them to communicate and share resources seamlessly. DCI enables the transmission of large volumes of data across geographically dispersed data centers, ensuring high availability, redundancy, and scalability.

This is critical for businesses that need to handle vast amounts of data, such as cloud service providers, financial institutions, and telecom companies. By leveraging DCI, organizations can improve the speed and reliability of data transfer between locations, supporting applications like disaster recovery, backup solutions, and cloud computing services.

As companies increasingly adopt multi-cloud strategies, DCI is becoming a crucial component of modern data center architectures. The Data Center Interconnect market refers to the industry focused on providing the infrastructure and technologies necessary to interconnect data centers.

This market includes the deployment of both physical and virtual networking technologies, such as fiber optics, high-speed switches, and routing systems, along with software solutions for network management and monitoring.

As the demand for cloud computing and large-scale data storage grows, organizations require more efficient ways to connect their data centers to maintain business continuity, enhance performance, and scale operations. The DCI market is growing rapidly, driven by the surge in data traffic, the rise of hybrid and multi-cloud environments, and the increasing demand for seamless connectivity.

The major driving factors for the Data Center Interconnect (DCI) market include the increasing demand for cloud computing services, the growing volume of data traffic, and the need for efficient disaster recovery solutions.

As businesses move toward hybrid and multi-cloud environments, they require robust DCI solutions to ensure seamless connectivity between different cloud providers and on-premises data centers.

Additionally, the rise in e-commerce, digital media, and IoT is contributing to the exponential growth in data consumption, further driving the need for advanced DCI solutions. The growing focus on improving operational efficiency, reducing latency, and ensuring high availability also pushes organizations to adopt DCI technologies.

Ciena Corporation reports that the number of data centers worldwide has seen significant growth in recent years. Today, there are more than 7,500 data centers globally, with 2,600 of them located in the top 20 major cities alone. According to Huawei, the volume of global data generated annually is expected to reach a staggering 180 ZB by 2025.

Additionally, the share of unstructured data, which includes raw voice, video, and image files, is predicted to continue growing, potentially making up over 95% of all data shortly. This shift in data types is likely to further drive the expansion of data centers around the world, supporting the demand for more storage and processing capabilities.

The demand for Data Center Interconnect solutions is driven by the increasing need for high-speed, low-latency, and scalable connections between geographically distributed data centers. As organizations expand their digital presence globally, the ability to seamlessly interconnect data centers is critical for supporting applications such as cloud services, video streaming, big data analytics, and e-commerce.

The market is experiencing strong demand from industries like telecommunications, cloud service providers, and financial services. The shift to cloud-based infrastructures, as well as the growing adoption of AI, machine learning, and other data-heavy technologies, is also increasing the demand for high-bandwidth interconnect solutions that ensure reliable and fast data transfer across data center networks.

One of the key opportunities in the Data Center Interconnect market lies in the expansion of 5G networks and their integration with data center infrastructures. As 5G networks become more widely deployed, they are expected to drive greater data traffic, creating opportunities for DCI providers to offer high-speed, low-latency connectivity solutions tailored for 5G applications.

Additionally, the growing adoption of hybrid cloud models presents a significant opportunity for DCI providers to deliver solutions that help organizations seamlessly connect public and private clouds.

Furthermore, advancements in optical networking and software-defined networking (SDN) are enabling new levels of flexibility, scalability, and cost-efficiency in DCI solutions, opening up new market segments and driving further innovation in the field.

Technological advancements in optical networking, 5G, and software-defined networking (SDN) are transforming the Data Center Interconnect market. Optical fibers, which provide high-speed data transmission over long distances, are becoming the backbone of DCI solutions, offering improved bandwidth, lower latency, and higher scalability.

SDN technologies enable greater flexibility and automation in managing interconnects between data centers, allowing businesses to scale their networks more efficiently. Additionally, the rise of edge computing is creating new opportunities for DCI solutions to facilitate the distribution and processing of data at the network edge, closer to where it is generated. These technological innovations are helping data centers meet the increasing demands for faster, more reliable, and scalable interconnect solutions.

User data plays a crucial role in shaping the DCI landscape. As organizations increasingly rely on data-driven decision-making, the volume of data generated continues to rise dramatically. For instance, it is estimated that global data creation will reach 175 zettabytes by 2025, up from 59 zettabytes in 2020, representing an increase of approximately 196% over five years.

This surge in data necessitates robust interconnect solutions to facilitate efficient data transfer and storage across multiple locations. The regional dynamics show that North America holds the largest market share, accounting for over 38% of the DCI market in 2024, while Asia Pacific is recognized as the fastest-growing region during this period.

The DCI solutions are critical for enabling seamless data transfer and connectivity between geographically dispersed data centers, which is essential for supporting cloud services, big data analytics, and disaster recovery operations.

Overall, the DCI market’s growth trajectory is fueled by factors such as the exponential increase in data traffic driven by digital transformation initiatives and the rising adoption of cloud-based solutions. As organizations continue to generate and utilize vast amounts of user data—projected to exceed 40 trillion gigabytes annually by 2025—the demand for efficient and reliable DCI solutions will only intensify, making it a pivotal component of modern IT infrastructure.

Key Takeaways

- Market Value Growth: The Data Center Interconnect (DCI) market was valued at USD 10.56 Billion in 2023 and is projected to reach USD 38.81 Billion by 2033, growing at a CAGR of 13.90%.

- Dominant Component: Hardware accounts for the largest share, making up 52% of the market in 2023. This segment’s dominance is driven by the need for robust physical infrastructure such as fiber optic cables, routers, and switches for high-speed data transfer and low latency.

- Key Application: Shared Data & Resources is the leading application segment, capturing 40% of the market share in 2023. The growing demand for data sharing and collaboration across distributed data centers is fueling this trend.

- End-Use Industry: Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs) hold the largest share in the end-user segment, contributing to 38% of the market. This is due to the increasing demand from cloud providers and telecom firms for interconnecting data centers to ensure high availability and scalability.

- Regional Market Leader: North America leads the market with a share of 35.8% in 2023, owing to the presence of major internet content providers, cloud service providers, and advanced telecom infrastructure in the region.

By Component

In 2023, the Hardware segment held a dominant market position, capturing more than a 52% share in the Data Center Interconnect (DCI) market. The dominance of the Hardware segment can be attributed to the growing need for physical infrastructure that supports high-speed data transmission and connectivity across data centers.

Key hardware components, such as fiber optic cables, routers, switches, and optical transport systems, are essential to ensure the seamless and efficient transfer of large volumes of data. As data centers expand and become more interconnected, the demand for these physical components continues to rise.

One of the primary reasons for the continued growth of the Hardware segment is the increasing need for high-performance, low-latency solutions. Companies are relying heavily on hardware to ensure minimal downtime, scalability, and high-speed data exchange, especially in industries like cloud computing, telecom, and internet content providers.

The ability to transmit data quickly and efficiently across geographically dispersed data centers has become a core requirement for these businesses, pushing hardware demand even higher. Moreover, with the advancement of technologies like 5G and the growing volume of data being generated, the need for reliable, robust hardware has become more critical.

These technologies require ultra-fast interconnects between data centers to process and deliver data effectively, which is driving investments in next-gen hardware infrastructure. As the industry transitions towards more sophisticated data center architectures, hardware solutions will continue to play a pivotal role.

By Application

In 2023, the Shared Data & Resources segment held a dominant market position, capturing more than a 40% share in the Data Center Interconnect (DCI) market. This segment’s leadership can be attributed to the growing demand for real-time data access and collaborative environments across multiple data centers.

Shared data and resources enable enterprises to access and share vast amounts of data efficiently, creating a seamless experience for businesses that rely on distributed networks and cloud environments.

The rise of cloud computing and the shift toward digital transformation has significantly contributed to the dominance of this application, as organizations increasingly need to connect data centers and share resources to ensure business continuity and agility.

Shared Data & Resources are particularly critical for industries such as IT, telecommunications, and financial services, where access to large datasets across multiple locations is paramount. These industries require efficient interconnects to ensure that data stored across different centers is readily accessible in real time for analysis, decision-making, and customer service.

The ability to rapidly move data between locations without compromising speed or security has made this application a core focus for many organizations investing in DCI infrastructure. Additionally, with businesses expanding their digital footprint and embracing multi-cloud strategies, the need to share resources across a variety of platforms and services has intensified.

Shared resources, including storage, computing power, and network capacity, must be connected in a way that ensures high availability and low latency performance. As more companies migrate to hybrid or multi-cloud environments, this application continues to drive the adoption of DCI solutions, which allow businesses to optimize their infrastructure while ensuring scalability.

By End-Use

In 2023, the Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs) segment held a dominant market position, capturing more than a 38% share in the Data Center Interconnect (DCI) market. This segment’s leadership is primarily driven by the massive growth in data consumption and the ever-expanding digital ecosystems created by ICPs and CNPs.

These organizations, including tech giants like Google, Amazon, and Microsoft, are heavily reliant on DCI solutions to interconnect their global data centers. As demand for content delivery, cloud services, and digital media escalates, ICPs and CNPs continue to expand their infrastructure, requiring efficient, scalable, and high-performance interconnect solutions to support seamless operations across diverse geographical locations.

The growing dependence on cloud services, content distribution networks, and online services has been a key factor for ICPs/CNPs’ market dominance. These providers handle large volumes of data, demanding highly reliable, low-latency interconnects between data centers to ensure uninterrupted services to end-users.

ICPs and CNPs utilize DCI technologies to optimize their network performance, enhance resource sharing, and reduce operational costs by centralizing control over their infrastructure. Additionally, as the demand for high-speed internet, video streaming, and e-commerce continues to rise, ICPs and CNPs are focusing on building more interconnected and resilient networks.

Their ability to handle and deliver large volumes of content efficiently, without compromising on speed or quality, drives the need for robust interconnect solutions. The surge in edge computing, which reduces latency by processing data closer to the user, also adds to the increased demand for interconnect solutions by ICPs/CNPs, as they require seamless integration between distributed computing resources.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Disaster Recovery and Business Continuity

- Shared Data & Resources

- Workload and Data Mobility

By End-Use

- Communications Service Providers (CSPs)

- Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs)

- Government/Research and Education (Government/R&E)

- Others

Driving Factors

Increased Demand for High-Speed Data Transmission and Cloud Services

The growing demand for high-speed data transmission and cloud services is one of the key drivers of the Data Center Interconnect (DCI) market. With businesses and consumers increasingly shifting to digital platforms, there has been an unprecedented rise in the need for efficient, reliable, and fast data communication.

This demand is primarily fueled by the expansion of cloud services, video streaming, gaming, and e-commerce, all of which require high-performance data centers that are interconnected across vast geographical areas. Data centers must be capable of handling large volumes of traffic, ensuring low-latency communication, and providing continuous uptime, which has driven the adoption of DCI technologies.

Cloud service providers, in particular, are heavily reliant on robust interconnect solutions to facilitate seamless data flow between their global network of data centers. The need for faster data transfer speeds and the ability to share large datasets without compromising on performance or security has prompted organizations to invest heavily in DCI.

As cloud adoption continues to grow, particularly with the increasing use of hybrid and multi-cloud environments, the demand for advanced interconnection solutions is expected to rise significantly. Moreover, the rise in remote working, virtual collaboration, and digital transformation has further amplified the need for scalable, high-capacity data center interconnects.

This trend is particularly evident in industries like healthcare, finance, and education, where secure and high-speed data exchange is crucial for business operations. The ongoing investments in 5G infrastructure and other next-gen technologies are also playing a vital role in boosting the demand for DCI solutions, as they provide the required bandwidth and low latency needed for next-level digital experiences.

Restraining Factors

High Capital and Operational Costs

One of the major restraints on the growth of the Data Center Interconnect (DCI) market is the high capital and operational costs associated with establishing and maintaining interconnection infrastructure. DCI solutions typically require significant investment in hardware, software, and network infrastructure.

This includes the purchase of high-capacity fiber-optic cables, routers, switches, and other networking equipment, all of which can be prohibitively expensive for smaller businesses and organizations operating on tight budgets.

Additionally, the costs involved in maintaining a DCI network can be substantial. Data centers require ongoing power, cooling, and network management, all of which come with recurring expenses. For many organizations, the high costs of installation and maintenance of a reliable DCI network can be a significant barrier to entry, especially for those in developing markets with limited access to the latest technologies.

The complex nature of DCI technologies also means that organizations must employ highly skilled personnel to manage and maintain their interconnect solutions. This adds to the overall operational costs, as skilled IT professionals are often in high demand and command premium salaries. Furthermore, data centers must also meet stringent regulatory and compliance requirements, which often necessitate additional investment in security and data protection measures.

Growth Opportunities

Expansion of Edge Computing and IoT

The rise of edge computing and the growing deployment of Internet of Things (IoT) devices present a significant opportunity for the Data Center Interconnect (DCI) market. As more industries embrace edge computing to process data closer to the source, the need for high-performance DCI solutions to connect edge data centers with larger core data centers will become increasingly important.

Edge computing is revolutionizing sectors such as manufacturing, healthcare, and automotive by enabling real-time data processing, which is crucial for applications like autonomous vehicles, smart cities, and industrial IoT systems.

These technologies demand ultra-low latency and high-speed data transmission, which can only be supported by advanced DCI solutions. As edge computing becomes more widespread, DCI will play a vital role in connecting thousands of smaller edge nodes to centralized data centers, ensuring seamless data flow and analytics.

The expansion of the IoT ecosystem further strengthens this opportunity, as the proliferation of connected devices will generate vast amounts of data that must be transmitted and processed quickly and securely.

This data, often generated in remote locations, will require fast interconnect solutions to ensure that it reaches central data centers for analysis and decision-making. The ability to securely and efficiently manage the flow of IoT data between edge devices and data centers is a key challenge that DCI solutions are well-positioned to address.

Challenging Factors

Ensuring Security and Data Privacy

A major challenge facing the Data Center Interconnect (DCI) market is ensuring the security and privacy of data transmitted across interconnected data centers. With the increasing amount of sensitive data being exchanged between data centers, maintaining robust security protocols and mitigating cyber threats have become critical concerns for organizations.

Data center interconnects are vulnerable to various types of cyber-attacks, including data breaches, denial of service attacks, and man-in-the-middle attacks. As businesses rely more on cloud computing and interconnect their global data centers, the risk of security threats increases, especially if sensitive customer information or intellectual property is being transmitted. Therefore, DCI providers must implement strong encryption, access controls, and secure transmission protocols to safeguard the data being exchanged.

The rapid expansion of hybrid and multi-cloud environments adds another layer of complexity to data center interconnect security. Different clouds, edge devices, and on-premise systems often have varying security protocols, making it challenging to ensure a consistent and reliable security framework across all interconnections. This fragmentation of security standards increases the risk of potential vulnerabilities, making it imperative for organizations to adopt a unified and comprehensive security strategy.

Growth Factors

The Data Center Interconnect (DCI) market is driven by several key factors, notably the rise in cloud computing and the growing need for high-speed data transfer across geographically dispersed data centers. As enterprises increasingly migrate to hybrid and multi-cloud environments, the need for seamless, reliable interconnection between data centers becomes more critical.

Additionally, the surge in data consumption, fuelled by IoT devices, 5G rollouts, and high-definition video streaming, further amplifies the demand for DCI solutions. Businesses are investing in high-performance interconnect technologies to support these increased data flows and enhance network resilience.

Emerging Trends

A notable emerging trend is the shift towards software-defined networking (SDN) and optical interconnection technologies. SDN allows for more flexible, scalable, and programmable networking solutions that improve efficiency, while optical interconnects are becoming increasingly important due to their ability to support higher bandwidth at lower costs compared to traditional copper-based connections. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) for optimizing network performance and predictive maintenance is also gaining momentum in the DCI space.

Business Benefits

For businesses, adopting DCI solutions offers numerous benefits. By enabling high-speed, low-latency communication between data centers, DCI improves operational efficiency and ensures that critical business applications run smoothly across multiple locations.

Additionally, businesses can achieve greater flexibility in scaling their operations, reduce costs associated with network downtime, and enhance their disaster recovery capabilities by ensuring seamless data replication across interconnected sites. Furthermore, DCI enhances the customer experience by supporting faster data access, improving cloud service reliability, and enabling real-time data analytics, which is crucial for decision-making in a digital-first business environment.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 35.8% share, with USD 3.78 billion in revenue in the Data Center Interconnect (DCI) market. This region’s leadership can be attributed to its well-established technology infrastructure, the high concentration of major internet content providers (ICPs), cloud service providers, and large enterprises that drive demand for robust data interconnection solutions.

North America’s dominance is also supported by its advanced telecom networks, high adoption rates of cloud computing, and increasing investments in 5G and data centers. The increasing demand for high-speed data transfer, fueled by cloud computing and IoT technologies, is one of the primary drivers of the DCI market in North America.

Enterprises across industries in the region are leveraging DCI solutions to ensure efficient data transmission between geographically dispersed data centers, supporting hybrid and multi-cloud architectures. Moreover, the region’s strong data privacy and security regulations have led to greater emphasis on secure and reliable interconnects, further driving the need for advanced DCI technologies.

In addition, North America continues to lead in terms of innovation in networking technologies, with major players developing next-generation interconnect solutions based on software-defined networking (SDN), optical interconnection, and AI-driven management tools.

These advancements enable businesses to optimize data transfer, reduce latency, and ensure higher performance in their data-intensive operations. The expansion of hyperscale data centers and the rise of edge computing also contribute to the growing demand for efficient and high-capacity DCI solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Ciena Corporation, a leading player in the Data Center Interconnect (DCI) market, continues to strengthen its position through strategic acquisitions and product innovations. In recent years, the company has made significant strides in expanding its portfolio of optical networking solutions.

A notable acquisition was the purchase of Nail Communications, a software-driven networking solutions provider, in 2022. This acquisition bolstered Ciena’s capabilities in providing high-performance, scalable interconnect solutions, particularly for high-demand cloud and data center environments.

Cisco Systems is a dominant force in the global Data Center Interconnect market, with a continued focus on advancing its networking hardware and software solutions. Cisco’s Acacia Communications acquisition in 2020 was a pivotal moment, enabling the company to expand its optical interconnect technology capabilities.

Acacia’s innovations in optical transceivers and coherent optics have enabled Cisco to provide more reliable, high-performance interconnects for data centers. On the product launch front, Cisco has introduced Cisco 8000 Series routers, designed to enhance the efficiency and capacity of DCI solutions with advancements in both hardware and software.

Juniper Networks has been another key player shaping the Data Center Interconnect landscape, leveraging both product innovation and strategic partnerships. In 2022, Juniper expanded its Junos OS to deliver more robust and efficient DCI solutions, incorporating machine learning capabilities to automate network management.

The launch of its QFX series switches and PTX series routers has further solidified Juniper’s position in the market by delivering scalable and high-performing interconnection solutions that are ideal for both enterprises and service providers. Juniper has also emphasized the importance of AI-driven network automation, which enables seamless management of complex interconnects in large-scale data center environments.

Top Key Players in the Market

- Ciena Corp.

- Cisco Systems Inc.

- Juniper Networks Inc.

- Fujitsu Ltd.

- Microsemi Corp.

- Pluribus Networks Inc.

- Huawei Technologies Co. Ltd.

- ADVA Optical Networking SE

- Infinera Corp.

- Nokia Oyj

- Other Key Players

Recent Developments

- In 2023: Ciena Corporation introduced its WaveLogic 5 Extreme technology, a next-generation coherent optical platform that enhances the capacity and efficiency of data center interconnect solutions.

- In 2023: Cisco Systems continued to enhance its data center interconnect portfolio by expanding its optical network solutions with Acacia Communications, a company Cisco acquired in 2020.

Report Scope

Report Features Description Market Value (2023) USD 10.56 Bn Forecast Revenue (2033) USD 38.81 Bn CAGR (2024-2033) 13.90% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Disaster Recovery and Business Continuity, Shared Data & Resources, Workload and Data Mobility), By End-Use (Communications Service Providers (CSPs), Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs), Government/Research and Education (Government/R&E), Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Ciena Corp., Cisco Systems Inc., Juniper Networks Inc., Fujitsu Ltd., Microsemi Corp., Pluribus Networks Inc., Huawei Technologies Co. Ltd., ADVA Optical Networking SE, Infinera Corp., Nokia Oyj, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center Interconnect MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Interconnect MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ciena Corp.

- Cisco Systems Inc.

- Juniper Networks Inc.

- Fujitsu Ltd.

- Microsemi Corp.

- Pluribus Networks Inc.

- Huawei Technologies Co. Ltd.

- ADVA Optical Networking SE

- Infinera Corp.

- Nokia Oyj

- Other Key Players