Global Behavioral Health Market By Service Type (Outpatient Counselling, Emergency Mental Health Services, Home-Based Treatment Services, and Others), By Application (Depression & Anxiety Disorder, Substance Abuse Disorder, Post-Traumatic Stress Disorder, Eating Disorder, Bipolar Disorder, and Others), By End-User (Outpatient Clinics, Hospitals, Homecare Setting, and Rehabilitation Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 98340

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

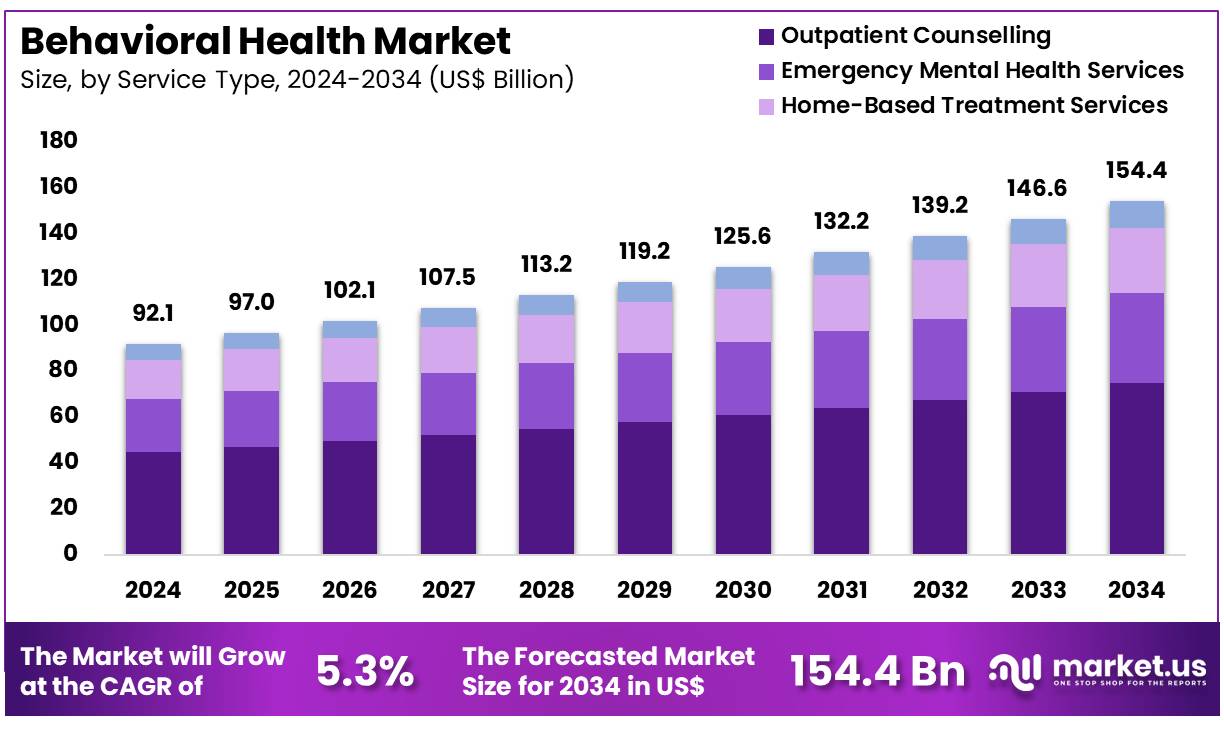

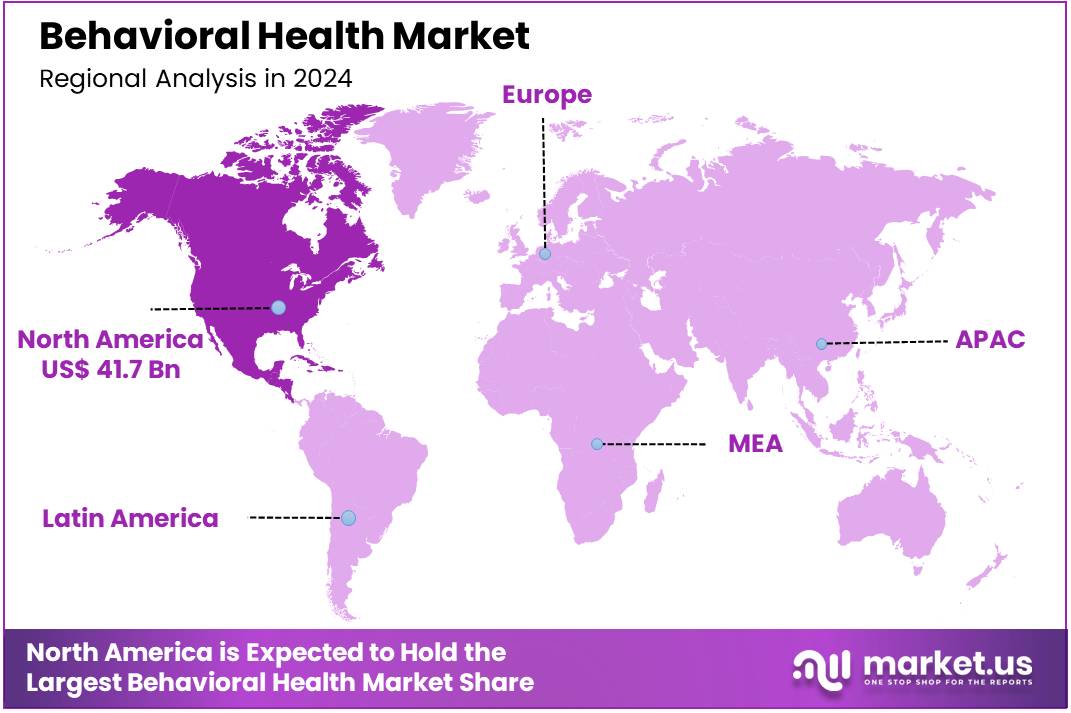

Global Behavioral Health Market size is expected to be worth around US$ 154.4 Billion by 2034 from US$ 92.1 Billion in 2024, growing at a CAGR of 5.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.3% share with a revenue of US$ 41.7 Billion.

Rising awareness of mental health issues and the increasing need for integrated healthcare solutions are driving the growth of the behavioral health market. Behavioral health encompasses a range of services designed to treat mental health disorders, substance abuse, and emotional well-being, with a focus on improving individuals’ overall quality of life. The growing prevalence of conditions such as depression, anxiety, substance use disorders, and stress-related illnesses has placed greater emphasis on the importance of accessible mental health care.

As stigma around mental health continues to decrease, more people are seeking help, which further drives demand for behavioral health services and interventions. Recent advancements in telehealth and digital health platforms have expanded access to behavioral health services, making therapy, counseling, and mental health monitoring more available and convenient for patients. In July 2024, NextGen Healthcare unveiled the first-ever Center of Innovation (COI) in collaboration with Mental Health Corporations of America.

The COI was established to foster best practices in behavioral healthcare and offer educational resources for professionals in the industry, demonstrating the growing focus on improving care delivery and workforce education. The market also benefits from increasing investments in research and technology, such as AI-driven tools for personalized mental health care, digital therapy programs, and wearable devices for real-time monitoring.

As the demand for mental health services grows, the behavioral health market presents significant opportunities to develop more efficient, accessible, and effective treatment models, improving care outcomes for a broader range of patients.

Key Takeaways

- In 2024, the market for behavioral health generated a revenue of US$ 92.1 billion, with a CAGR of 5.3%, and is expected to reach US$ 154.4 billion by the year 2034.

- The service type segment is divided into outpatient counselling, emergency mental health services, home-based treatment services, and others, with outpatient counselling taking the lead in 2024 with a market share of 48.5%.

- Considering application, the market is divided into depression & anxiety disorder, substance abuse disorder, post-traumatic stress disorder, eating disorder, bipolar disorder, and others. Among these, depression & anxiety disorder held a significant share of 40.3%.

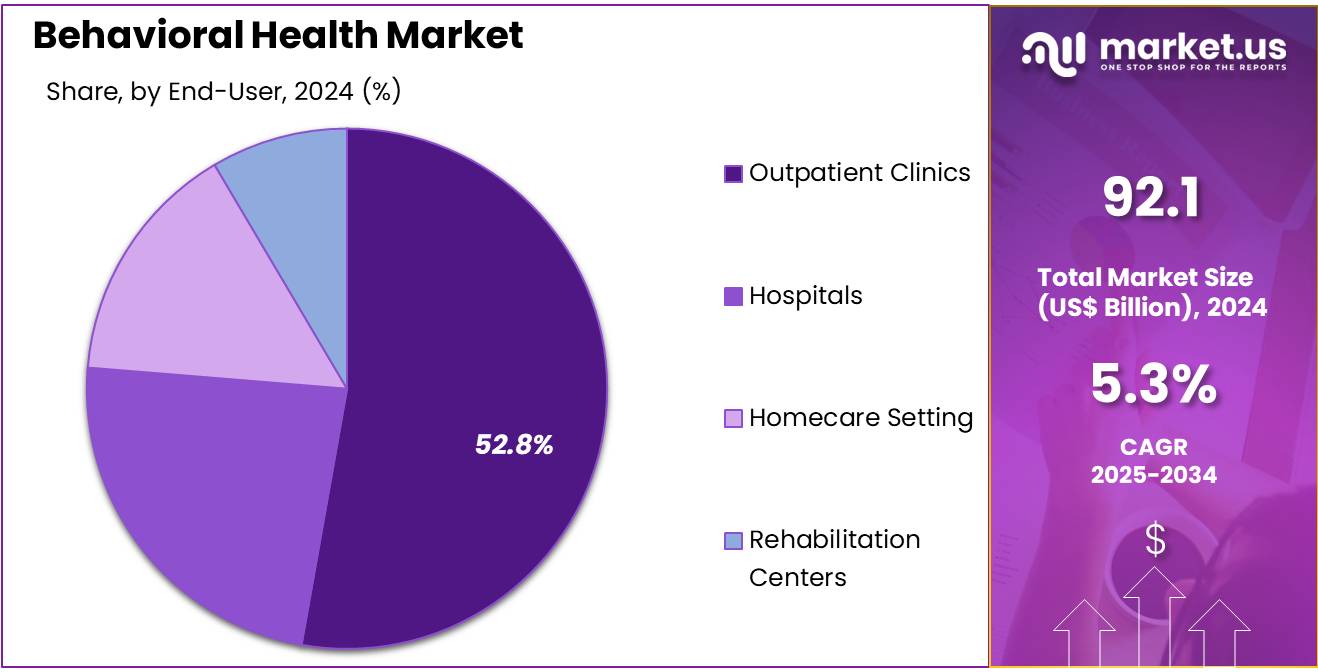

- Furthermore, concerning the end-user segment, the market is segregated into outpatient clinics, hospitals, homecare setting, and rehabilitation centers. The outpatient clinics sector stands out as the dominant player, holding the largest revenue share of 52.8% in the Behavioral Health market.

- North America led the market by securing a market share of 45.3% in 2024.

Service Type Analysis

Outpatient counselling is the dominant service type in the behavioral health market, holding 48.5% of the market share. This growth is expected to continue as outpatient counselling offers a flexible and cost-effective option for individuals seeking mental health treatment. The increasing prevalence of mental health conditions, such as depression and anxiety, combined with a growing emphasis on accessible, community-based mental health services, is driving the demand for outpatient counselling services.

Outpatient counselling is projected to grow as it provides patients with the ability to receive therapy without the need for hospitalization, which is often seen as a less intrusive and more comfortable option. Additionally, outpatient counselling has seen a rise in popularity due to telehealth services, which allow patients to access counselling from the comfort of their homes. The increasing focus on preventive mental health care and reducing the stigma around seeking therapy is expected to further expand this segment in the coming years.

Application Analysis

Depression and anxiety disorder is the leading application in the behavioral health market, holding 40.3% of the market share. This growth is expected to be driven by the increasing recognition of the high incidence and impact of mental health disorders globally. Depression and anxiety are among the most common mental health conditions, affecting millions of people worldwide. The rising awareness about mental health and the importance of early intervention is likely to drive demand for treatments focused on these disorders.

Furthermore, the growing availability of evidence-based therapies, including cognitive-behavioral therapy (CBT) and medication management, is expected to make treatment more effective and accessible. The shift toward destigmatizing mental health and providing more comprehensive treatment options is also expected to contribute to the growth of this segment. Additionally, the COVID-19 pandemic has heightened awareness of mental health challenges, particularly anxiety and depression, leading to increased demand for services and therapies designed to address these conditions.

End-User Analysis

Outpatient clinics dominate the end-user segment, holding 52.8% of the market share. This growth is expected to continue as outpatient clinics are often the first point of contact for individuals seeking mental health care, providing a wide range of services such as therapy, counseling, and psychiatric evaluations. The increasing demand for mental health services in community settings, coupled with the affordability and convenience of outpatient care, is driving the growth of this segment.

Outpatient clinics offer flexible scheduling, which is especially important for individuals with busy work or family schedules, and they can provide ongoing care without the need for overnight stays. The ability to provide mental health treatment in a less intimidating environment compared to hospitals is anticipated to further contribute to the expansion of outpatient clinics in the behavioral health market. Additionally, as the healthcare system continues to shift towards outpatient care and preventive services, outpatient clinics are expected to play an even larger role in the management of mental health conditions.

Key Market Segments

By Service Type

- Outpatient Counselling

- Emergency Mental Health Services

- Home-Based Treatment Services

- Others

By Application

- Depression & Anxiety Disorder

- Substance Abuse Disorder

- Post-Traumatic Stress Disorder

- Eating Disorder

- Bipolar Disorder

- Others

By End-User

- Outpatient Clinics

- Hospitals

- Homecare Setting

- Rehabilitation Centers

Drivers

Increasing Prevalence of Mental Health Disorders is Driving the Market

The escalating global prevalence of mental health disorders and substance use disorders is a significant driver propelling the behavioral health market. A growing awareness of these conditions, coupled with reduced stigma in many societies, is leading more individuals to seek diagnosis and treatment. This increased demand for services encompasses a wide range of needs, from psychotherapy and counseling to medication management and rehabilitation programs.

The Centers for Disease Control and Prevention (CDC) reported in May 2024 that in 2022, approximately 1 in 5 adults in the US (21.5%) experienced a mental illness, which equates to 57.8 million people. Furthermore, among young adults aged 18-25, the prevalence was even higher at 33.7%. These figures highlight a substantial portion of the population requiring behavioral health support.

The Substance Abuse and Mental Health Services Administration (SAMHSA) also reported in their 2023 National Survey on Drug Use and Health (NSDUH) that in 2022, 48.7 million people aged 12 or older in the US had a substance use disorder in the past year. This widespread and growing need for accessible, effective mental health and addiction treatment services continuously drives investment and expansion within the behavioral health sector.

Restraints

Shortage of Behavioral Health Professionals and Reimbursement Challenges are Restraining the Market

A significant shortage of qualified behavioral health professionals, coupled with persistent challenges in reimbursement models, represents a considerable restraint on the market. The demand for mental health and substance use disorder services often outstrips the available workforce of psychiatrists, psychologists, therapists, and social workers. This shortage leads to long wait times for appointments, limited access to specialized care, and increased burnout among existing providers.

The US Department of Health and Human Services (HHS) reported in June 2024 that as of March 2024, nearly 170 million people in the US live in a Mental Health Professional Shortage Area (HPSA). This figure indicates a widespread geographical deficit of practitioners. Furthermore, inadequate or complex reimbursement policies from both public and private payers can limit the financial viability of behavioral health practices, particularly for outpatient services.

Low reimbursement rates for certain therapies or extensive administrative burdens for billing can deter providers from accepting new patients or expanding their services. The American Medical Association (AMA) highlighted in a June 2024 report that administrative costs associated with prior authorizations and claims denials continue to burden healthcare providers, impacting their ability to deliver care efficiently. These workforce and financial hurdles collectively impede the full potential of the behavioral health market.

Opportunities

Expansion of Telehealth and Digital Mental Health Platforms is Creating Growth Opportunities

The rapid expansion of telehealth services and the increasing adoption of digital mental health platforms are creating significant growth opportunities in the behavioral health market. Telehealth removes geographical barriers, improves access to care in underserved areas, and offers greater convenience and privacy for patients seeking mental health support. Digital platforms, including mobile apps for therapy, remote monitoring tools, and AI-powered chatbots for mental well-being, provide scalable and accessible solutions for routine care, crisis intervention, and self-management.

The US Department of Health and Human Services (HHS) reported on June 18, 2024, that in 2022, telehealth visits accounted for 15% of all outpatient visits for mental health services among Medicare beneficiaries, marking a sustained high level of utilization after the pandemic surge. Furthermore, the Substance Abuse and Mental Health Services Administration (SAMHSA) indicated in its 2023 National Survey on Drug Use and Health (NSDUH) that in 2022, 37.5% of adults who received mental health services reported receiving services remotely via telehealth. This widespread acceptance and integration of virtual care models are revolutionizing service delivery, enabling providers to reach a larger patient base, improving engagement, and creating innovative avenues for delivering behavioral health interventions.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the prioritization of healthcare spending by governments, significantly influence the behavioral health market by affecting funding for programs and the affordability of services. Inflation can increase the operational costs for behavioral health providers, including salaries for professionals, technology infrastructure, and facility maintenance, potentially leading to higher service fees for patients or strained budgets for public programs. However, the increasing global recognition of mental health as a public health imperative often ensures a baseline level of investment, even during economic downturns.

The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries allocating over 10% of their GDP to health in 2023. For example, Canada’s health expenditure was 12.23% of GDP in 2022, and Australia’s was 10.51% in 2023, showcasing significant national commitments. Geopolitical stability also plays a role in fostering environments conducive to social support and mental well-being initiatives. Despite economic pressures, the profound societal impact of untreated mental health conditions ensures a sustained focus on and investment in the behavioral health sector, fostering resilience and continued growth.

Evolving US trade policies, including the imposition of tariffs on imported technology and medical devices, are shaping the behavioral health market by influencing the cost of digital health platforms and diagnostic tools. The increasing reliance on telehealth, digital mental health apps, and specialized diagnostic equipment in behavioral health means that tariffs on imported IT hardware, communication devices, or even some medical sensors can increase the operational costs for providers.

The US Bureau of Economic Analysis (BEA) reported in February 2025 that US imports of capital goods, which include various IT and medical equipment, increased by US$103.3 billion in 2024, highlighting the substantial volume of such imports that could be subject to tariffs. While specific tariffs on mental health software might not be direct, the underlying hardware infrastructure necessary for digital health delivery can face cost pressures.

These policies, while sometimes aiming to encourage domestic production, primarily create a more complex and potentially more expensive operational environment for technology-driven behavioral health services. However, the crucial role of technology in expanding access to care, particularly in a landscape with workforce shortages, ensures that the market will continue to adapt and seek cost-effective solutions for delivering behavioral health services.

Latest Trends

Increased Integration of Behavioral Health into Primary Care is a Recent Trend

A prominent recent trend shaping the behavioral health market in 2024 and continuing into 2025 is the intensified integration of behavioral health services into primary care settings. Recognizing that many mental health conditions are first identified in primary care, and that physical and mental health are intrinsically linked, healthcare systems are increasingly adopting collaborative care models. This approach involves embedding mental health professionals (e.g., psychologists, social workers) directly within primary care clinics or establishing seamless referral pathways, facilitating earlier intervention and coordinated care.

The Centers for Disease Control and Prevention (CDC) highlighted in a June 2024 update that integrating mental health care into primary care can improve access to services, reduce stigma, and address the whole person. Additionally, the US Health Resources and Services Administration (HRSA) has continuously funded initiatives supporting integrated behavioral health.

For instance, in fiscal year 2024, HRSA awarded approximately US$142 million to health centers to increase access to mental health and substance use care, with many focusing on integrated models. This trend enhances accessibility, reduces barriers to seeking care, and ensures that behavioral health needs are addressed as part of routine medical care, leading to more holistic and effective patient management.

Regional Analysis

North America is leading the Behavioral Health Market

The behavioral health market in North America, representing a substantial 45.3% share, experienced significant growth in 2024. This expansion was primarily driven by heightened awareness of mental health conditions and substance use disorders, reduced stigma, and improved access to care through various modalities. Data from the National Institute of Mental Health (NIMH) indicates that in 2022, an estimated 59.3 million adults aged 18 or older in the United States lived with a mental illness, representing 23.1% of the adult population. This widespread prevalence underscores the persistent need for comprehensive behavioral health services.

Government initiatives and funding have played a crucial role in expanding access, with the Substance Abuse and Mental Health Services Administration (SAMHSA) requesting a total of US$10.8 billion in its Fiscal Year 2024 President’s Budget to address the mental health and overdose crises. Telehealth services have also significantly broadened reach, with the US Department of Health and Human Services (HHS) permanently allowing Medicare patients to receive behavioral and mental telehealth services in their homes, effective from March 2025.

Leading providers in the sector have demonstrated strong financial performance, reflecting this growing demand. Universal Health Services, Inc. reported that net revenues generated from its behavioral health care services, on a same-facility basis, increased by 10.7% to US$3.2 billion in 2024, driven by robust demand and capacity expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The behavioral health market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is primarily fueled by increasing awareness of mental health issues, a reduction in societal stigma, and substantial government initiatives aimed at improving mental healthcare infrastructure and accessibility. Many countries in the region are recognizing the significant burden of mental and neurological conditions, which accounted for a quarter of the non-fatal disease burden in Asia Pacific in 2021, as reported by the OECD’s Health at a Glance: Asia/Pacific 2024. This recognition is prompting governments to prioritize mental health in their national healthcare agendas.

For example, the World Health Organization (WHO) South-East Asia Region adopted the Paro Declaration, committing to universal access to people-centered mental health services, and has seen 72.3 million more people gain access to newly available local services by the end of 2024 through its Special Initiative for Mental Health. Furthermore, the rising adoption of digital health solutions and telemedicine platforms is projected to bridge geographical gaps and increase the reach of mental health support. As healthcare systems mature and populations become more urbanized, the demand for diverse behavioral health services, including counseling, therapy, and specialized treatments, will likely continue to rise across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the behavioral health market are implementing a range of strategies to drive growth and improve patient care. They focus on expanding their services through acquisitions and partnerships to increase both geographic reach and service capacity. Investments in digital health solutions, such as telehealth platforms and AI-based diagnostic tools, enable providers to offer more personalized and accessible care.

Companies are also working to integrate behavioral health services into primary care settings, improving coordination and reducing stigma. Emphasis on staff training ensures high-quality care delivery, while operational efficiencies and streamlined administrative processes enhance overall performance. Additionally, many organizations advocate for policy changes and reimbursement reforms to expand access to services and improve financial stability.

Lifestance Health, a significant player in the US behavioral health market, exemplifies these growth strategies. Founded in 2015 and headquartered in Scottsdale, Arizona, Lifestance provides outpatient services, including therapy, psychiatry, and telehealth options. The company operates over 500 locations across 33 states and employs more than 7,400 licensed mental health clinicians. In 2024, Lifestance reported a revenue of $1.25 billion. Despite challenges such as a net loss in 2023, the company continues to expand its services and reach, aiming to improve access to mental health care across the nation.

Top Key Players

- Universal Health Services

- Surgo Health

- North Range Behavioral Health

- Epic Health Services

- CuraLinc Healthcare

- Behavioral Health Group, Inc.

- Arbital Health

- Acadia Healthcare

Recent Developments

- In December 2024, Surgo Health, in partnership with Melinda Gates’ Pivotal & SHOWTIME/MTV Entertainment Studios, introduced the Youth Mental Health Tracker. This platform serves as a comprehensive database focused on youth mental health and well-being in the United States.

- In October 2024, Arbital Health announced a long-term strategic partnership with Quartet Health to enhance Quartet’s mental health program. The initiative aims to lower costs and improve outcomes for patients diagnosed with serious mental health conditions.

Report Scope

Report Features Description Market Value (2024) US$ 92.1 Billion Forecast Revenue (2034) US$ 154.4 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Outpatient Counselling, Emergency Mental Health Services, Home-Based Treatment Services, and Others), By Application (Depression & Anxiety Disorder, Substance Abuse Disorder, Post-Traumatic Stress Disorder, Eating Disorder, Bipolar Disorder, and Others), By End-User (Outpatient Clinics, Hospitals, Homecare Setting, and Rehabilitation Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Universal Health Services, Surgo Health, North Range Behavioral Health, Epic Health Services, CuraLinc Healthcare, Behavioral Health Group, Inc., Arbital Health, and Acadia Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Universal Health Services

- Surgo Health

- North Range Behavioral Health

- Epic Health Services

- CuraLinc Healthcare

- Behavioral Health Group, Inc.

- Arbital Health

- Acadia Healthcare