Global Banana Milk Market Size, Share, And Industry Analysis Report By Nature (Organic, Conventional), By Flavor (Sweetened, Unsweetened), By Sales Channel (Direct, Indirect), By End Use (Milk and Milk Beverages, Dairy Products, Bakery and Confectionary, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170319

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

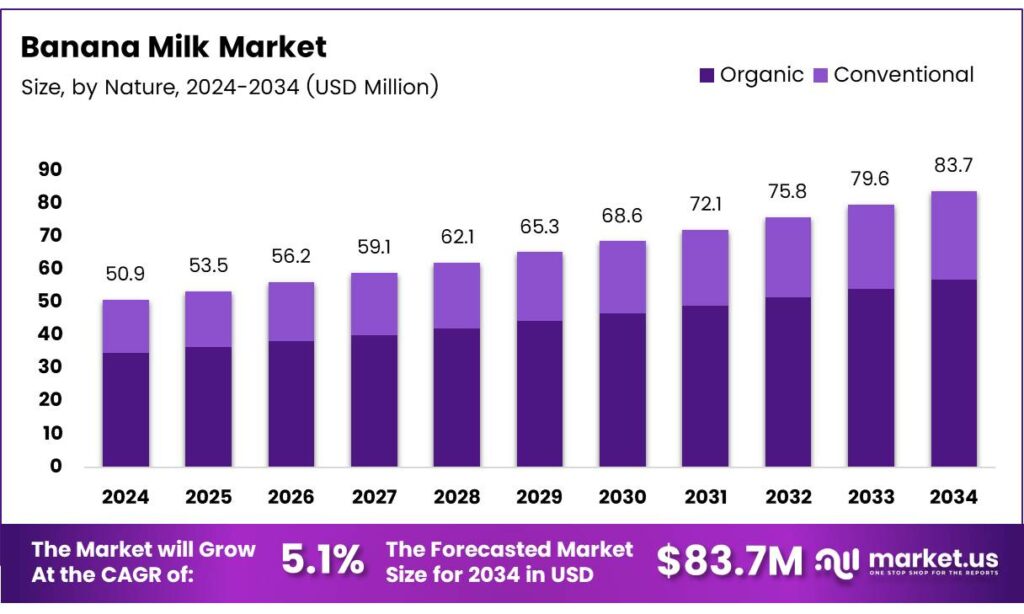

The Global Banana Milk Market size is expected to be worth around USD 83.7 million by 2034, from USD 50.9 million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Banana Milk Market refers to the commercial production and sale of beverages derived from bananas, dairy, or plant-based blends. It serves consumers seeking nutritious, flavored milk alternatives with familiar taste profiles. Increasingly, banana milk fits into functional beverages, vegan nutrition, and clean-label dairy categories, supporting both retail and foodservice demand.

As a beverage category, banana milk refers to ready-to-drink or prepared formulations combining banana fruit with dairy or plant-based milk. Importantly, it targets consumers seeking mild sweetness, natural nutrition, and easy digestion. Therefore, banana milk sits between flavored milk and plant-based functional beverages, supporting everyday consumption and specialized dietary needs.

- Nutritional research provides additional credibility to banana milk positioning. Organic banana milk prepared with sunflower seeds and cinnamon delivers only 60 calories per serving, with no added sugar, remaining vegan, gluten-free, and nut-free. The same study standardized a notional human dose using 50 g of banana and 50 mL of milk, forming a 100 g formulation, approximated to one banana’s weight.

Growth momentum is further supported by opportunities in fortified nutrition and value-added formulations. Producers can enrich banana milk with fibers, vitamins, or probiotics without complex processing. Additionally, its mild sweetness reduces dependence on added sugars, aligning with clean-label positioning and public health guidance on sugar reduction. Banana cultivation benefits from horticulture missions, cold-chain subsidies, and farmer income programs.

Key Takeaways

- The Global Banana Milk Market is projected to grow from USD 50.9 million in 2024 to USD 83.7 million by 2034, registering a CAGR of 5.1% during 2025–2034.

- Organic banana milk dominates the market with a share of 79.3%, driven by clean-label and plant-based nutrition demand.

- Sweetened banana milk leads with a market share of 67.1%, supported by strong taste preference and mass consumer acceptance.

- Indirect distribution holds a dominant share of 77.7%, backed by supermarkets, convenience stores, and foodservice reach.

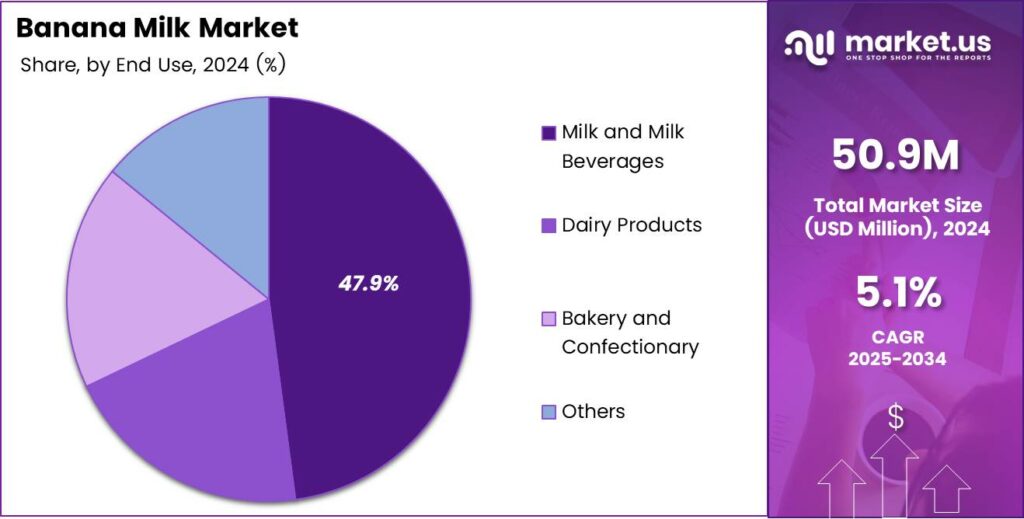

- Milk and Milk Beverages account for the largest share at 47.9%, reflecting daily consumption patterns.

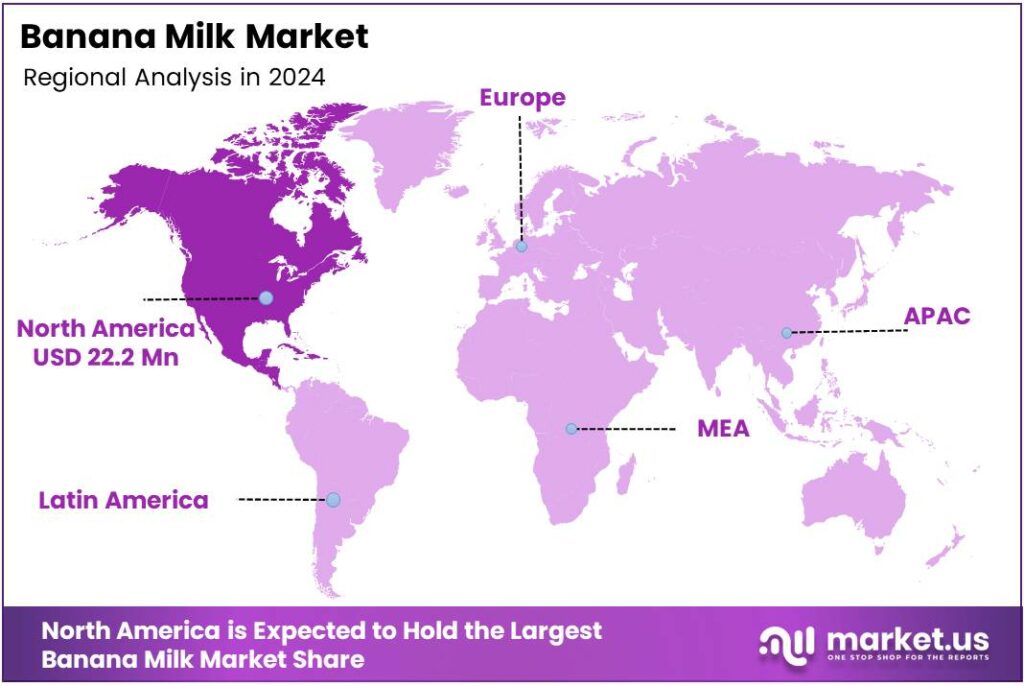

- North America is the leading region with a market share of 43.7%, valued at USD 22.2 million.

By Nature Analysis

Organic dominates with 79.3% due to rising preference for clean-label and plant-based nutrition.

In 2024, Organic held a dominant market position in the By Nature Analysis segment of the Banana Milk Market, with a 79.3% share. Consumers increasingly associate organic banana milk with natural sourcing, fewer additives, and better nutritional transparency. As a result, organic variants gain stronger trust across health-conscious households and premium retail formats.

Conventional banana milk continues to serve price-sensitive consumers and mass-market distribution. However, it faces growing scrutiny regarding additives and processing methods. While conventional products maintain steady demand in emerging markets, a gradual consumer shift toward perceived healthier options limits their growth pace compared to organic alternatives.

By Flavor Analysis

Sweetened dominates with 67.1% supported by taste familiarity and wider consumer acceptance.

In 2024, Sweetened held a dominant market position in the By Flavor Analysis segment of the Banana Milk Market, with a 67.1% share. Sweetened banana milk appeals strongly to children, young adults, and first-time buyers due to its dessert-like taste and ready-to-drink convenience, supporting repeat purchases across retail channels.

Unsweetened banana milk is gaining attention among diabetics, fitness-focused consumers, and clean-eating audiences. However, its comparatively neutral taste limits mass adoption. Growth remains gradual, driven mainly by specialty stores and consumers seeking sugar-controlled beverage alternatives.

By Sales Channel Analysis

Indirect dominates with 77.7% driven by strong retail and foodservice penetration.

In 2024, Indirect held a dominant market position in the By Sales Channel Analysis segment of the Banana Milk Market, with a 77.7% share. Supermarkets, convenience stores, and foodservice outlets ensure high product visibility, impulse buying, and easy accessibility, making indirect channels the primary volume drivers.

Direct sales channels, including brand websites and subscription models, support consumer engagement and premium positioning. However, limited reach and higher acquisition costs restrict their overall share, keeping them secondary to established retail-driven indirect distribution.

By End Use Analysis

Milk and Milk Beverages dominate with 47.9% due to daily consumption patterns.

In 2024, Milk and Milk Beverages held a dominant market position in the By End Use Analysis segment of the Banana Milk Market, with a 47.9% share. Banana milk is increasingly consumed as a standalone beverage, breakfast drink, or smoothie base, reinforcing its role in daily nutrition routines.

Dairy Products use banana milk as a flavor-enhancing and plant-based formulation ingredient. Adoption remains selective, mainly in yogurts and frozen desserts, where banana milk supports natural sweetness and texture improvement. Bakery and Confectionary applications use banana milk for flavor infusion and moisture retention.

However, limited formulation compatibility restrains large-scale adoption, keeping usage niche. Other end uses include ready meals and functional foods, where banana milk offers differentiation. Yet, experimental positioning keeps volumes comparatively low.

Key Market Segments

By Nature

- Organic

- Conventional

By Flavor

- Sweetened

- Unsweetened

By Sales Channel

- Direct

- Indirect

By End Use

- Milk and Milk Beverages

- Dairy Products

- Bakery and Confectionery

- Others

Emerging Trends

Clean-Label Trends and Flavor Experimentation Shape Market Direction

One key trending factor in the banana milk market is the clean-label movement. Consumers are carefully reading ingredient lists and preferring products with fewer additives. Banana milk made with simple, recognizable ingredients gains stronger trust and acceptance.

- Companies are blending banana with chocolate, strawberry, coffee, and spices to keep products exciting. According to the Food and Agriculture Organization (FAO), global banana production reached around 135 million metric tons, making bananas one of the most widely available fruits for beverage innovation. The USDA confirms that one medium banana provides about 422 mg of potassium, supporting muscle and nerve function.

Sustainability is influencing product positioning. Brands are highlighting eco-friendly packaging and responsible sourcing to appeal to environmentally conscious buyers. This trend is especially strong among younger consumers. Social media and influencer marketing also shape demand. Viral recipes and lifestyle content promote banana milk as a healthy, trendy drink.

Drivers

Rising Preference for Plant-Based and Dairy-Free Beverages Drives Banana Milk Demand

The banana milk market is mainly driven by the growing shift toward plant-based and dairy-free drinks. Consumers are actively reducing traditional dairy intake due to lactose intolerance, milk allergies, and digestive concerns. Banana milk offers a naturally creamy texture without using animal milk, making it attractive for a wide consumer base.

- The World Health Organization (WHO) recommends keeping free sugar intake below 10% of total daily energy, pushing beverage brands to reformulate flavored milk options. Banana milk benefits here because ripe bananas naturally provide sweetness, reducing the need for added sugar.

Health awareness is another strong driver supporting market growth. Banana milk is often perceived as a cleaner and lighter option compared to flavored dairy milk. It naturally contains potassium and carbohydrates, which appeal to people seeking everyday energy drinks. Parents also prefer banana milk for children due to its mild taste and familiar fruit profile.

Restraints

High Production Costs and Limited Shelf Stability Restrict Market Growth

One major restraint in the banana milk market is the higher production cost compared to conventional flavored milk. Processing bananas into a stable liquid form requires careful handling, blending, and preservation. These steps increase operational costs, which often lead to higher product prices for consumers.

- UNICEF states that 45 million children globally suffer from wasting, while balanced calorie and micronutrient intake remains a priority. Milk-based drinks blended with fruits like bananas help deliver energy, potassium, and calcium in an easy-to-consume form.

Shelf life remains another key challenge. Banana milk is sensitive to oxidation and natural browning, which affects color and taste. Without strong preservatives, maintaining freshness over long distances becomes difficult. This limits distribution in regions with weak cold-chain infrastructure.

Growth Factors

Product Innovation and Emerging Markets Create New Growth Opportunities

The banana milk market holds strong growth opportunities through product innovation. Brands are developing low-sugar, organic, and fortified variants to attract health-focused consumers. Adding protein, fiber, or vitamins allows banana milk to move into functional beverage categories.

Emerging markets present another major opportunity. Rising urbanization and changing food habits in developing regions are increasing the demand for packaged beverages. Banana is a familiar and widely accepted fruit in many countries, making banana milk easier to adopt than unfamiliar flavors.

Foodservice and café partnerships also open new channels. Banana milk is increasingly used in smoothies, shakes, and dessert drinks. This helps brands reach younger consumers who prefer customized beverages and café experiences. E-commerce growth supports direct-to-consumer sales.

Regional Analysis

North America Dominates the Banana Milk Market with a Market Share of 43.7%, Valued at USD 22.2 Million

North America leads the Banana Milk Market, holding a dominant share of 43.7% and reaching a valuation of USD 22.2 million. This leadership reflects strong consumer awareness of plant-based beverages and high acceptance of lactose-free milk alternatives. The region benefits from established cold-chain infrastructure and premium pricing potential. Consistent retail penetration further supports sustained market demand and volume stability.

Europe represents a steadily developing market for banana milk, supported by growing interest in dairy-free and vegan beverages. Consumers increasingly prefer clean-label and naturally flavored drinks, encouraging product experimentation. Retailers emphasize healthier alternatives, improving shelf visibility. Regulatory focus on food transparency also supports gradual market expansion across the region.

Asia Pacific shows promising growth potential driven by rising urbanization and evolving dietary preferences. Banana-based beverages align well with regional taste familiarity and fruit-based consumption habits. Expanding middle-income populations support packaged beverage demand. Innovation in flavored and functional drinks further strengthens regional market momentum.

The U.S. market reflects mature consumer acceptance of plant-based milk alternatives. Demand is supported by health-conscious buyers seeking allergen-free and low-sugar beverages. Banana milk benefits from innovation in formulations and packaging. Strong distribution networks aid consistent market penetration across channels.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Symrise AG plays a behind-the-scenes role in banana milk by supplying flavors and ingredient systems that help brands keep taste consistent across batches. In 2024, its strength is pairing banana notes with clean-label positioning, helping manufacturers reduce “artificial” perception while maintaining a familiar, creamy profile.

Döhler GmbH is well placed for banana milk growth because it supports beverage makers with natural ingredients, fruit-based solutions, and application know-how. Its analyst upside in 2024 is enabling faster product launches—especially for ready-to-drink formats—by helping customers balance sweetness, aroma stability, and shelf-life in plant-based matrices.

Paradise Ingredients fits the banana milk story through specialty ingredients that can improve mouthfeel and overall drinkability, particularly in non-dairy recipes. In 2024, the opportunity is to help smaller and mid-sized brands differentiate with “better texture” claims and smoother sensory performance without pushing costs too high.

Danone SA remains the most visible consumer-facing force among these players, with strong capabilities in dairy and plant-based beverages. From an analyst lens in 2024, Danone’s advantage is scale: it can test banana-flavored innovations across multiple channels and regions, then expand winning SKUs quickly through established distribution and brand trust.

Top Key Players in the Market

- Symrise AG

- Döhler GmbH

- Paradise Ingredients

- Danone SA

- Arla Foods

- Maeil Dairies Co., Ltd.

- Binggrae Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Meiji Holdings Co., Ltd.

- Yili Group

Recent Developments

- In 2024, Symrise completed major upgrades to its Pasaje facility in Ecuador, increasing production capacity for banana and tropical dry ingredients. This includes an innovation accelerator, workshop, and adherence to high food safety and anti-seismic standards to support global supply chains for banana-based products used in beverages and dairy alternatives.

- In 2024, Döhler continues to develop a diverse range of plant-based ingredients for dairy alternatives, including texturizing systems and protein blends for authentic-tasting milk drinks based on fruits like bananas. These are tested for sensory properties in almond, oat, and innovative fruit bases, supporting sustainable indulgence in non-dairy products.

Report Scope

Report Features Description Market Value (2024) USD 50.9 Million Forecast Revenue (2034) USD 83.7 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Flavor (Sweetened, Unsweetened), By Sales Channel (Direct, Indirect), By End Use (Milk and Milk Beverages, Dairy Products, Bakery and Confectionery, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Symrise AG, Döhler GmbH, Paradise Ingredients, Danone SA, Arla Foods, Maeil Dairies Co., Ltd., Binggrae Co., Ltd., Morinaga Milk Industry Co., Ltd., Meiji Holdings Co., Ltd., Yili Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Symrise AG

- Döhler GmbH

- Paradise Ingredients

- Danone SA

- Arla Foods

- Maeil Dairies Co., Ltd.

- Binggrae Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Meiji Holdings Co., Ltd.

- Yili Group