Global Bakeware Market By Product (Pans and Dishes, Tins and Trays, Cups, Molds, Rolling Pin, Others), By Material (Aluminum, Stainless Steel, Stoneware, Carbon Steel, Glass, Others), By End Use (Commercial, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139814

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

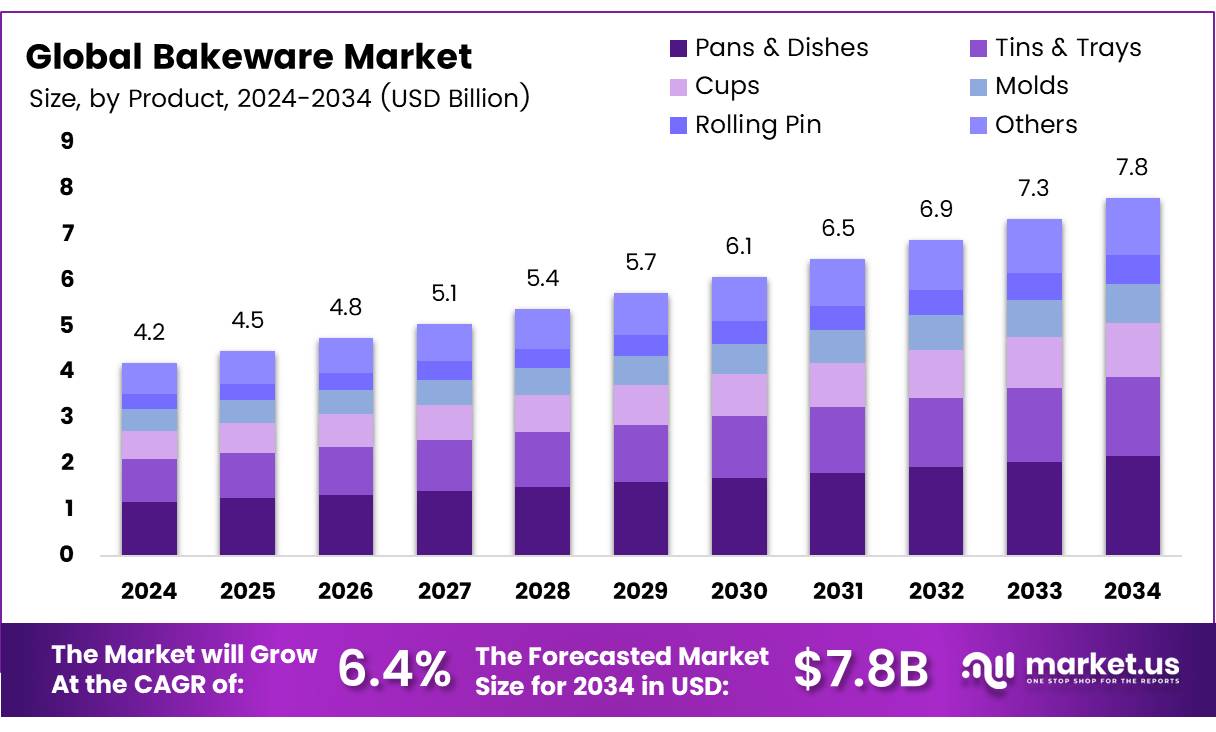

The Global Bakeware Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The bakeware market encompasses a wide range of kitchen products designed for baking purposes, including cake pans, cookie sheets, muffin tins, pie dishes, and various specialty pans. As consumer interest in home baking continues to rise, especially with the influence of food-centric media and social platforms, demand for bakeware has seen consistent growth.

Key players in the market manufacture these items using materials like metal, glass, and silicone, catering to both professional chefs and home bakers. The growth of online retailing has also played a pivotal role in the market expansion, allowing consumers to access a broader variety of bakeware products at competitive prices.

The bakeware market is experiencing strong growth driven by increased consumer interest in home baking. According to a survey, 60.1% of U.S. consumers would most likely purchase metal bakeware, reflecting a preference for durable and versatile products.

This insight reveals significant opportunities for companies focusing on high-quality metal bakeware options. Additionally, as the trend of home cooking and baking continues to gain momentum, driven by lifestyle influencers and social media, the market is expected to expand further.

Government investment in food safety and kitchen products has also played a role in driving the market forward. Stringent regulations in manufacturing and materials used for bakeware ensure that the products are safe for consumer use, especially when it comes to non-toxic coatings and sustainability practices. This is crucial in attracting consumers who are more mindful of health and environmental considerations.

As for market dynamics, mobile searches for bakeware have surged by over 210% in the past two years, according to Think With Google, underscoring the increasing interest in bakeware, particularly through digital channels. Furthermore, 21% of U.S. consumers are very likely to purchase bakeware within the next 12 months, according to Study, further highlighting the sustained demand for these products.

As companies continue to adapt to shifting consumer preferences and evolving regulations, opportunities for innovation in product design, material science, and sustainability remain abundant. Brands that stay ahead of these trends by offering high-quality, eco-friendly, and innovative bakeware solutions will likely continue to see strong growth in this competitive market.

Key Takeaways

- The global bakeware market is expected to grow from USD 4.2 billion in 2024 to USD 7.8 billion by 2034, with a CAGR of 6.4%.

- Pans & dishes dominate the bakeware market, holding a 38.6% share in 2024 due to their versatility in both home and professional baking.

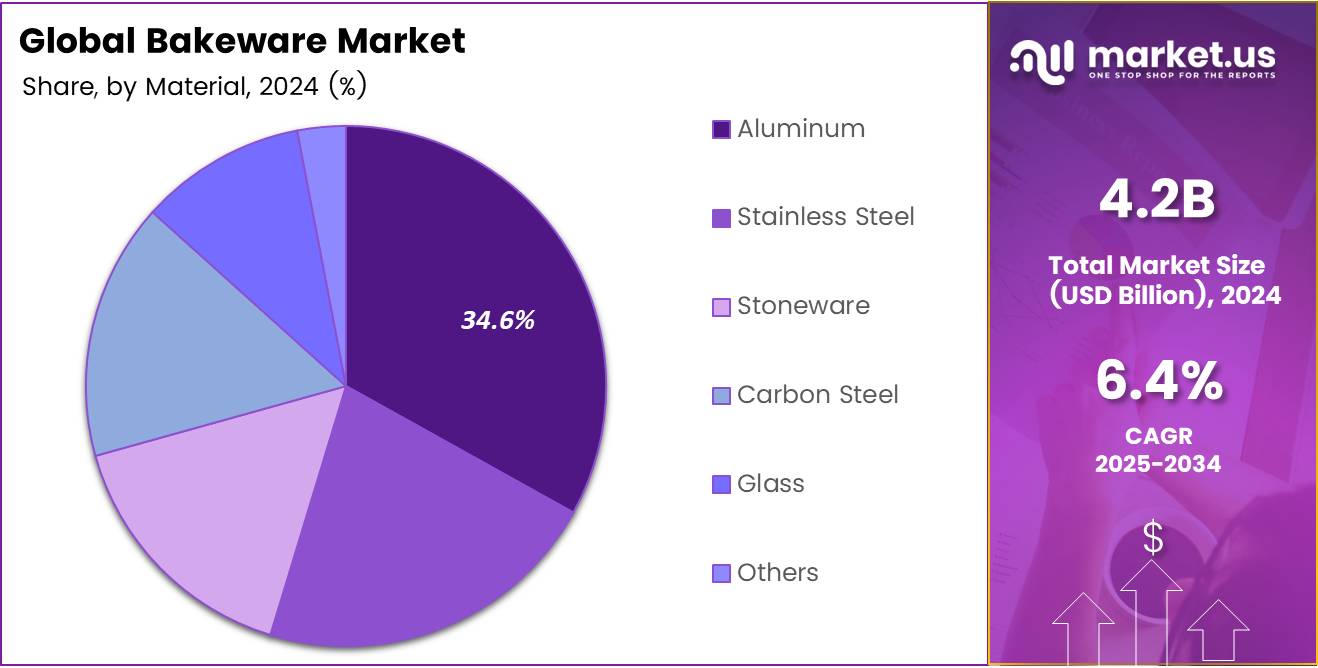

- Aluminum is the leading material in the market, with a 34.6% share in 2024, valued for its heat conductivity, light weight, and corrosion resistance.

- The commercial segment holds a 55.6% share in 2024, driven by high demand from bakeries, foodservice, and hospitality sectors.

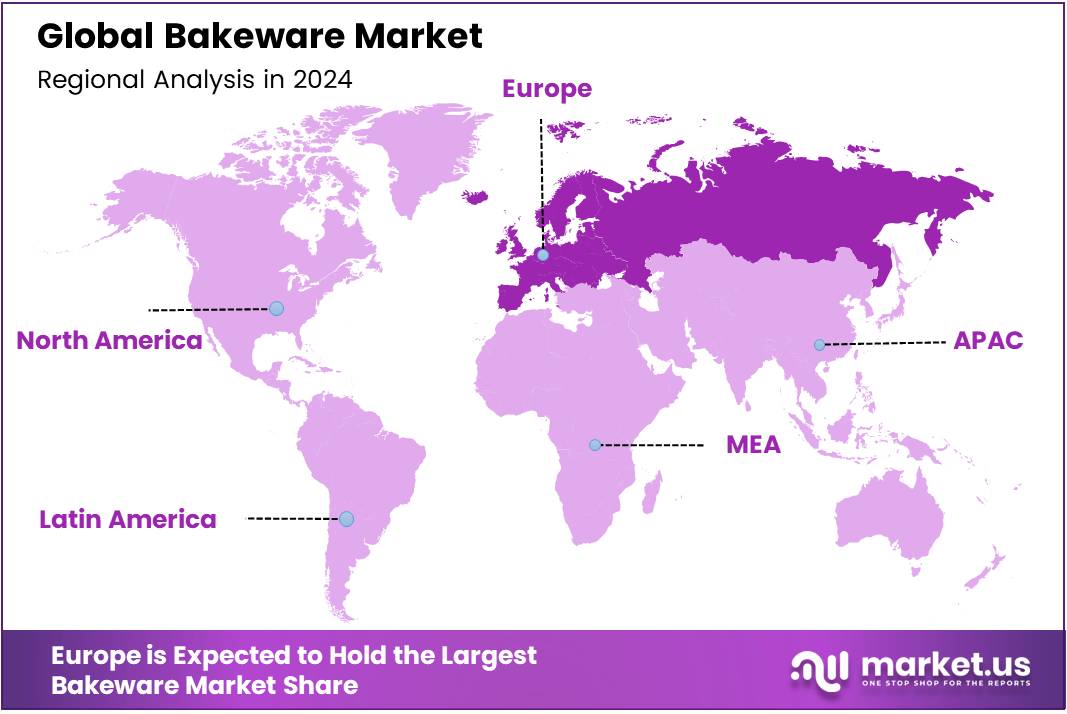

- Europe leads the global market with a 33.2% share, valued at USD 1.3 billion, fueled by strong home baking traditions in countries like the UK, Germany, and France.

Product Analysis

Pans & Dishes Lead the Bakeware Market with a 38.6% Share in 2024, Driven by Versatility and Popularity

In 2024, Pans & Dishes maintained a dominant position in the Bakeware Market, holding a significant 38.6% share within the By Product Analysis segment. Their popularity stems from their versatility in both home and professional baking environments, where they are essential for baking a wide variety of goods, from cakes to bread and pies. As consumers increasingly value multifunctional kitchen tools, the demand for pans and dishes continues to rise.

Tins & Trays followed closely, contributing a substantial portion of the market share due to their widespread use for pastries, muffins, and cookies. Molds and Cups also experienced growth, driven by specialty baking trends and the increasing popularity of custom-sized desserts, like cupcakes and individual servings.

Rolling Pins, though integral to the baking process, represent a smaller segment of the market. The Others category, which includes less common bakeware items like pastry brushes and dough scrapers, continues to show moderate but steady demand.

Overall, the bakeware market is characterized by a growing interest in convenience, functionality, and creativity, with Pans & Dishes leading the way as the go-to product for both amateur and professional bakers alike.

Material Analysis

Aluminum Leads the Bakeware Market with a 34.6% Share in 2024, Driven by Durability and Heat Conduction

In 2024, Aluminum held a dominant market position in the By Material Analysis segment of the Bakeware Market, with a 34.6% share. Its popularity can be attributed to several factors, including excellent heat conductivity, lightweight nature, and relatively low production cost.

Aluminum bakeware ensures even heat distribution, making it a preferred choice for both professional chefs and home bakers. Additionally, its resistance to rust and corrosion further contributes to its widespread usage.

Following aluminum, stainless steel holds a significant market share, appreciated for its durability, non-reactive properties, and aesthetic appeal. While more expensive than aluminum, stainless steel bakeware is often favored for its long-term reliability and ease of maintenance.

Stoneware, with its ability to retain heat, offers a more rustic aesthetic and is commonly used for baking dishes like bread and casseroles.

Carbon steel, while providing great heat conductivity and durability, is more prone to rusting and requires more maintenance. Glass bakeware is gaining traction for its versatility and ability to monitor food during baking. Other materials, including silicone and ceramic, hold smaller shares but cater to niche consumer preferences for specific uses or designs.

End Use Analysis

Commercial Segment Leads with 55.6% Share in Bakeware Market in 2024, Driven by Industry Demand and Large-Scale Operations

In 2024, the Commercial segment dominated the Bakeware Market under the By End Use Analysis category, accounting for a substantial 55.6% market share. This dominance is primarily attributed to the growing demand from large-scale bakeries, foodservice establishments, and hospitality sectors, which require durable and high-performance bakeware products for daily use.

The commercial segment benefits from economies of scale, allowing for bulk purchasing and long-term contracts, which in turn ensure cost-effectiveness and consistency in product supply.

Moreover, the expanding global demand for baked goods, including bread, pastries, and cakes, has led to increased investment in commercial-grade bakeware.

These products are designed for high-volume production and are engineered to withstand rigorous usage, providing excellent heat distribution and enhanced durability. Additionally, the rise of foodservice chains and online food delivery services has further bolstered the need for professional-grade bakeware.

On the other hand, the Household segment remains a significant contributor to the market, although it holds a smaller share compared to the Commercial sector. As consumer interest in home baking continues to rise, there is an increasing demand for premium bakeware items designed for everyday use. However, this segment’s growth is more gradual and less influenced by bulk purchasing trends.

Key Market Segments

By Product

- Pans & Dishes

- Tins & Trays

- Cups

- Molds

- Rolling Pin

- Others

By Material

- Aluminum

- Stainless Steel

- Stoneware

- Carbon Steel

- Glass

- Others

By End Use

- Commercial

- Household

Drivers

Increasing Interest in Home Baking Boosts Bakeware Market Demand

The bakeware market is experiencing significant growth due to several key factors. First, there’s a rising popularity of home baking, with more consumers seeking to try their hand at baking their favorite treats. This trend is fueled by the desire for fresh, homemade goods and the appeal of experimenting with new recipes.

In addition, rising disposable incomes, particularly in emerging markets, are allowing consumers to spend more on high-quality bakeware. As people can now afford better tools and equipment, they are investing in products that enhance their baking experience.

Social media also plays a crucial role, with platforms like Instagram and Pinterest showcasing visually appealing baked goods and recipes that inspire people to buy bakeware and try new techniques. The growing interest in healthy eating also contributes to market growth.

Many consumers are making healthier choices by baking at home to create gluten-free, low-sugar, or organic alternatives. As a result, there’s an increased need for specialized bakeware designed to meet these health-conscious preferences. Collectively, these factors create a strong demand for bakeware products, benefiting both established brands and emerging players in the market.

Restraints

High Costs and Intense Competition Limit Bakeware Market Growth

Despite the growing demand for bakeware, several restraints are hindering market expansion. One major challenge is the high cost of premium bakeware products, such as high-quality metal or ceramic items.

These premium products can be expensive, which may limit their accessibility for budget-conscious consumers. While many consumers desire durable and aesthetically pleasing bakeware, the price point can be a significant barrier, especially in price-sensitive markets.

Additionally, the bakeware market faces intense competition, particularly from low-cost, generic brands that flood the market with affordable alternatives. This saturation of budget-friendly options makes it difficult for premium brands to differentiate themselves and justify their higher prices.

As a result, many consumers may opt for less expensive bakeware options that still meet their basic needs, even if they lack the same quality and design features.

The combination of high product costs and strong competition from budget brands makes it challenging for premium bakeware companies to maintain a competitive edge and expand their customer base.

These factors can also limit profit margins and restrict the growth potential of established players, especially as consumers become more price-sensitive and selective about their purchases.

Growth Factors

Customization, Technology, and Sustainability Drive New Opportunities in the Bakeware Market

The bakeware market has several promising growth opportunities, driven by changing consumer preferences and technological advancements. One of the key opportunities is offering customized and personalized bakeware, such as cake pans or baking sets with unique designs or engraved names. This could attract consumers looking for one-of-a-kind products, allowing brands to stand out in a crowded market.

Another growth avenue is integrating smart technology into bakeware, such as temperature sensors or smart features that help users bake with precision. This trend could appeal to tech-savvy consumers who are looking for a more high-tech, efficient baking experience.

Additionally, as sustainability becomes a growing concern, there is increasing demand for eco-friendly bakeware made from materials like bamboo, recycled aluminum, and non-toxic coatings. This shift toward sustainable products presents a significant opportunity for companies to appeal to environmentally conscious consumers.

Finally, the expansion of commercial bakeware offers another lucrative opportunity. As the number of bakeries, cafes, and pastry shops grows, manufacturers can target the commercial sector with high-volume, durable bakeware designed for professional use.

By focusing on these areas customization, smart features, sustainability, and commercial expansion—bakeware companies can tap into emerging trends and diversify their product offerings to meet the evolving needs of both individual consumers and businesses.

Emerging Trends

Non-Stick, Ceramic, and Eco-Friendly Bakeware Trends Shape the Market

Several key trends are driving the bakeware market as consumer preferences evolve. One major trend is the growing demand for non-stick bakeware. Non-stick coatings make baking and cleaning easier, while ensuring that baked goods come out smoothly and evenly, leading to better results. Alongside this, ceramic bakeware continues to gain popularity due to its visual appeal and superior heat distribution.

Consumers appreciate its ability to create aesthetically pleasing presentations and evenly baked goods, making it a top choice for both functional and decorative purposes. Another significant trend is the increasing interest in eco-conscious materials.

As sustainability becomes more important to consumers, bakeware made from non-toxic, eco-friendly materials like silicone, bamboo, and recycled products is becoming highly sought after. This shift toward sustainable materials aligns with broader health and environmental concerns.

Additionally, multifunctional bakeware products are on the rise, as consumers look for versatile kitchen tools that can serve multiple purposes. Items like pie pans that can double as cake pans or loaf pans are appealing to those who want to maximize space and functionality in their kitchens.

These trends reflect the changing demands of consumers, who are increasingly focused on convenience, aesthetics, sustainability, and versatility in their bakeware purchases. As these trends continue to grow, bakeware manufacturers will need to adapt to meet the diverse needs of modern consumers.

Regional Analysis

Europe leads the bakeware market with 33.2% share valued at USD 1.3 billion

The global bakeware market exhibits varied dynamics across regions, with Europe holding the dominant share at 33.2%, valued at USD 1.3 billion. This dominance is driven by strong consumer demand for home baking, particularly in countries with well-established baking traditions such as the UK, Germany, and France.

The region’s high disposable income and robust retail infrastructure support the widespread use of bakeware, with both traditional and innovative products gaining popularity among consumers. Moreover, Europe’s significant presence of leading bakeware manufacturers and their continued innovation in non-stick, eco-friendly, and high-performance materials further strengthens the region’s market position.

Regional Mentions:

North America holds a significant share of the market, buoyed by a growing interest in home baking, especially in the United States and Canada. This is complemented by the rise of e-commerce platforms, which have made a wide range of bakeware products more accessible to consumers. The trend of baking as both a hobby and a therapeutic activity has led to increased demand for specialized products, further contributing to the market’s growth in this region.

In the Asia Pacific region, the market is expanding rapidly, fueled by changing lifestyles, rising disposable incomes, and growing interest in Western-style baking. Countries such as China, India, and Japan are witnessing a surge in consumer adoption of bakeware, particularly in urban centers, as baking becomes more integrated into local food cultures.

The Middle East & Africa and Latin America regions, while contributing to the global market, remain smaller in comparison. However, there is notable growth in these regions, driven by improving economic conditions and evolving consumer preferences for modern home baking practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global bakeware market remains highly competitive, with several key players driving growth through innovation, brand recognition, and product diversification. Groupe SEB, a dominant force in the industry, has strengthened its position through strategic acquisitions and expanding its product offerings. Known for its high-quality non-stick bakeware, Groupe SEB is poised to maintain its leadership, leveraging its strong distribution networks and consumer trust across multiple regions.

International Cookware, renowned for its Pyrex and Kitchenaid brands, continues to capitalize on its legacy of providing durable and reliable bakeware products. The company’s focus on innovation, particularly in glass and ceramic bakeware, aligns with consumer demand for eco-friendly and versatile kitchenware options.

Emile Henry, with its premium ceramic bakeware products, has carved a niche in the high-end market. The brand’s focus on craftsmanship and sustainability appeals to affluent consumers seeking durable and aesthetically pleasing bakeware.

Wilton Brands LLC, a leader in the cake decorating and baking accessory segments, remains a top player by offering a wide range of products that meet the needs of both amateur and professional bakers. Its strong presence in North America and commitment to innovation in baking tools support its continued growth.

Fackelmann GmbH, Nordic Ware, and USA Pan contribute to the market by consistently delivering quality products at competitive prices, ensuring accessibility across various market segments. Meanwhile, Le Creuset and Meyer Corporation U.S. dominate the premium category with high-quality offerings that blend functionality with luxury, particularly in cast iron and heavy-duty bakeware.

Overall, the bakeware market in 2024 is characterized by strong competition among these key players, with growth driven by technological innovation, sustainability trends, and evolving consumer preferences.

Top Key Players in the Market

- Groupe SEB

- International Cookware

- Emile Henry

- Wilton Brands LLC

- Fackelmann GmbH + Co. KG

- Nordic War

- Newell Brands Inc.

- USA Pan

- Le Creuset

- Meyer Corporation U.S.

Recent Developments

- In Feb 2024, consumer houseware startup Basil raised Rs 3.6 crore in seed funding to expand its innovative product range and strengthen its presence in the Indian market.

- In Jan 2025, Wonderchef Home Appliances Pvt Ltd. secured $50 million in funding, aiming to revolutionize the kitchenware industry through cutting-edge design and smart technology.

- In Aug 2024, Beco, a kitchen and personal care brand, raised $10 million in a pre-Series B round to accelerate growth and extend its eco-friendly product line.

- In Oct 2024, Clout Kitchen raised $4.45 million in a seed round to develop its next-generation kitchen appliances and build a strong digital presence. The funds will be directed towards R&D, product innovation, and expanding the brand’s footprint in the competitive kitchenware market.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 7.8 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pans and Dishes, Tins and Trays, Cups, Molds, Rolling Pin, Others), By Material (Aluminum, Stainless Steel, Stoneware, Carbon Steel, Glass, Others), By End Use (Commercial, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Groupe SEB, International Cookware, Emile Henry, Wilton Brands LLC, Fackelmann GmbH + Co. KG, Nordic War, Newell Brands Inc., USA Pan, Le Creuset, Meyer Corporation U.S. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Groupe SEB

- International Cookware

- Emile Henry

- Wilton Brands LLC

- Fackelmann GmbH + Co. KG

- Nordic War

- Newell Brands Inc.

- USA Pan

- Le Creuset

- Meyer Corporation U.S.