Global AI-enabled Kitchen Appliances Market By Type (Refrigerator, Ovens & Microwaves, Cooktops & Ranges, Dishwasher, Others), By End-User (Residential, Commercial), By Distribution Channel (Specialty Stores, Hypermarkets & Supermarkets, Online Stores), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan. 2025

- Report ID: 138506

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

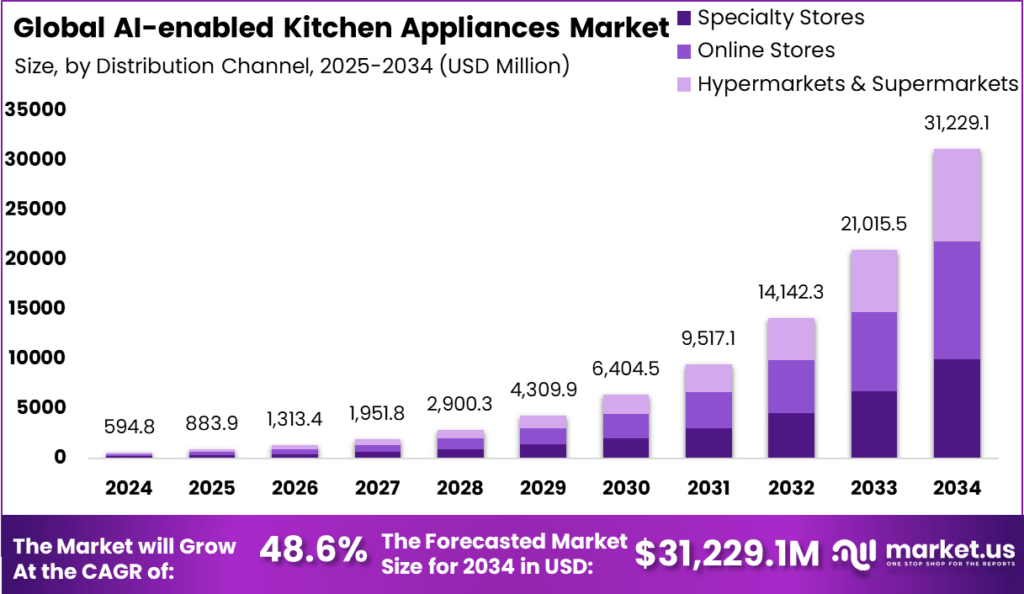

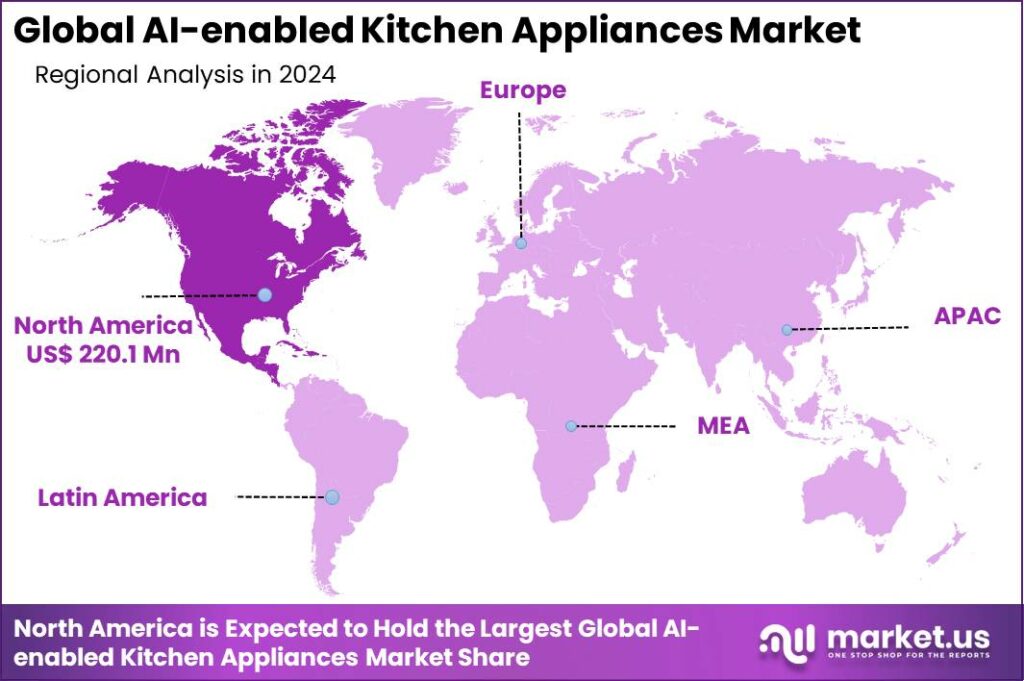

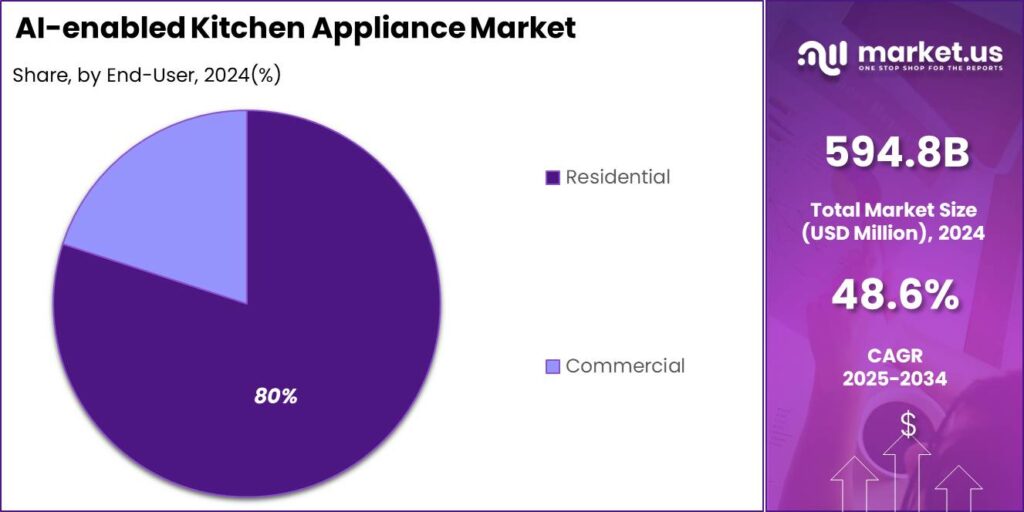

The Global AI-enabled Kitchen Appliances Market size is expected to be worth around USD 31,229.1 million by 2034, from USD 594.8 million in 2024, growing at a CAGR of 48.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37% share, holding USD 220.1 Million revenue.

AI-enabled kitchen appliances are the kitchen devices that utilize technology to communicate with the owners or with the other devices remotely using tablet or smartphone. These are equipped with advanced technology to gain knowledge about the precise requirement of owner such as off peak load period, reminder, automatic shutdown and others.

The market for AI-enabled kitchen appliances is growing driven by the expanding global working population in developing economies. For instance, according to World Bank, working population growth was 32 million with Asia Pacific more than 12 million. Moreover, the rising upgrades in AI based technology that assists in reducing repetitive tasks has also resulted in increased growth of the market.

The primary driving force behind the growth of AI-enabled kitchen appliances is the increasing working population and their demand for convenience and time-saving solutions. Technological advancements have also played a crucial role, as they allow for smarter and more efficient appliances that cater to the needs of fast-paced lifestyles. Another significant driver is the rising adoption of smart home technologies, which include AI-enabled appliances as a core component.

One of the prevailing trends in the AI-enabled kitchen appliances market is the incorporation of connectivity technologies like Wi-Fi, Bluetooth, and NFC. This connectivity facilitates seamless operation and control via smartphones and other devices, enhancing user convenience. There’s also a noticeable trend towards personalization, where appliances adjust their operations based on user preferences and patterns.

Market demand is increasing, particularly in regions with a high concentration of working professionals and in countries experiencing rapid urbanization and tech integration into daily life, such as in North America and Asia Pacific. The demand is supported by the growing middle class in these regions, who are the primary consumers of innovative and luxury appliance products.

Stakeholders, including manufacturers, retailers, and technology developers, benefit from the expanding market for AI-enabled kitchen appliances through increased sales opportunities and the potential to develop new revenue streams. Additionally, stakeholders can leverage these innovations to differentiate themselves in a competitive market and improve customer satisfaction through enhanced product offerings.

Key Takeaways:

- In 2024, the Refrigerator segment held a dominant market position, capturing more than a 36% share of theMarket.

- In 2024, the Residential segment held a dominant market position, capturing more than an 80% share of the Global AI-enabled Kitchen Appliances Market.

- In 2024, the Specialty Stores segment held a dominant market position, capturing more than a 28% share of the Global AI-enabled Kitchen Appliances Market.

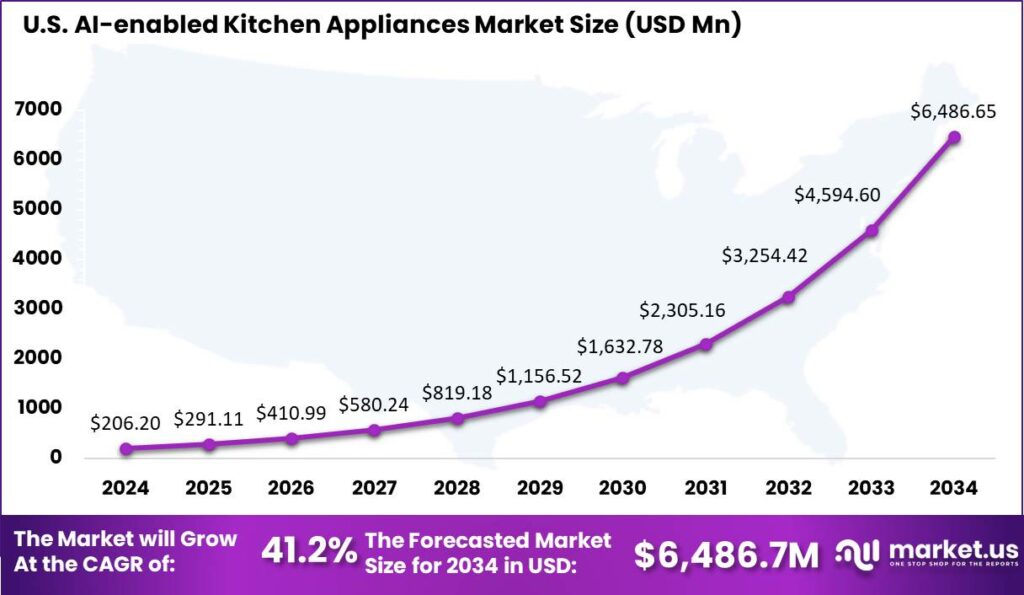

- The US AI-enabled Kitchen Appliances Market was valued at USD 206.2 million in 2024, with a robust CAGR of 18%.

- In 2024, North America held a dominant market position in the global AI-enabled Kitchen Appliances Market, capturing more than a 37% share.

- The US AI-enabled Kitchen Appliances Market size was exhibited at USD 206.2 Million in 2024 with CAGR of 41.18%.

- According to Federal Reserve Bank, AI usage at home was more prevalent than at work (32.6% versus 28.1%, respectively).

- According to UNECE, the primary concerns surrounding AI adoption are security and accuracy, with 66% and 61% of organizations, respectively, stating that these issues are of major concern

U.S. Market Size and Growth Analysis

The US AI-enabled Kitchen Appliances Market was valued at USD 206.2 million in 2024, with a robust CAGR of 41.18%. This is majorly due to the stronger consumer demand for smart home solutions in the U.S. People are increasingly looking for ways that aids in simplifying their lives and improve the efficiency of their daily routines. This need is being catered by AI enabled kitchen appliances as it offers features such as voice control, remote monitoring and automated functions.

U.S. has a robust e-commerce market where many consumers purchase appliances online. For instance, The Census Bureau of the Department of Commerce announced that the estimate of U.S. retail e-commerce sales for the third quarter of 2024, was $300.1 billion, an increase of 2.6 percent from the second quarter of 2024. This has also allowed the manufacturers to create awareness and make AI-based kitchen appliances easily accessible to the consumers.

In 2024, North America held a dominant market position in the global AI-enabled Kitchen Appliances Market, capturing more than a 37% share. This is majorly due to the growing disposable income of the consumers in the North American region, allowing them to invest in premium and high tech appliances.

For instance, according to the U.S Bureau of Labour Statistics, average annual expenditures for all consumer units in NA were $77,280. During the same period, the Consumer Price Index for All Urban Consumers (CPI-U) rose 4.1 percent, and average income before taxes increased 8.3 percent.

Moreover, the North American region has been the early adopter of technologies, with a numerous household already being equipped with the smart devices such as thermostats, lighting systems, and security cameras. The presence of required infrastructure makes it easier for the consumers to integrate AI enabled kitchen appliances into their homes.

Type Segment Analysis

In 2024, the Refrigerator segment held a dominant market position, capturing more than a 41% share of the Global AI-enabled Kitchen Appliances Market. refrigerators are essential household appliance, and consumers are more likely to invest in enhancing the functionality and convenience of the device, leading to the growth of the market.

AI based refrigerators offer advanced features such as inventory tracking, recipe suggestion based on the available ingredients and energy efficiency management. Moreover, refrigerator manufacturers have been quick to adopt AI technologies, due to its increasing awareness, and thus leading to a higher market penetration as compared to other kitchen appliances.

Additionally, refrigerators are often integrated into a broader smart home ecosystem, thus allowing for a seamless connectivity with other smart devices. this integration tends to enhance the overall user experience and convenience.

End User Analysis

In 2024, the Residential segment held a dominant market position, capturing more than an 80% share of the Global AI-enabled Kitchen Appliances Market. This is highly due to the increasing demand for simplifying the daily routines and improving the energy efficiency by house owners.

The growing trend of smart homes has also lead to an increased adoption of AI enabled kitchen appliances. Consumers are integrating these appliances into their smart home eco-systems for a seamless connectivity and enhanced functionality.

Moreover, the growing standard of living and change in lifestyle such as busier schedules, and a focus on healthy eating, has driven the demand for smart kitchen appliances. AI enabled appliances can assist consumers with meal planning, recipe suggestions and automated cooking, thus making it highly appealing to residential consumers.

Distribution Channel Analysis

In 2024, the Specialty Stores segment held a dominant position in the AI-enabled kitchen appliances market, capturing more than 28% share. This segment’s leadership can be attributed to several key factors.

Specialty stores offer a targeted selection of kitchen appliances and provide a high level of customer service and expert advice, which is particularly appealing for consumers looking to make informed decisions about technologically advanced products.

These stores typically feature a wide range of AI-enabled appliances that cater to the specific needs and preferences of consumers, allowing for demonstrations and detailed explanations of product features. This hands-on experience is invaluable for products that incorporate new technologies like AI, where consumers may require more information before making a purchase decision.

Moreover, specialty stores often have a strong reputation for after-sales services and support, which further attracts consumers who prioritize quality and reliability when investing in high-tech kitchen appliances. The personalized shopping experience, coupled with trust in expert recommendations, significantly influences consumer preferences towards specialty stores over other distribution channels like hypermarkets, supermarkets, or online stores.As the market continues to evolve, the specialty stores are expected to maintain their lead by adapting to new consumer trends and technologies, enhancing customer engagement, and expanding their offerings to include the latest innovations in AI-enabled kitchen appliances.

Key Market Segments

By Type

- Refrigerator

- Ovens & Microwaves

- Cooktops & Ranges

- Dishwasher

- Others

By End-User

- Residential

- Commercial

By Distribution Channel

- Specialty Stores

- Hypermarkets & Supermarkets

- Online Stores

Drivers

Rising adoption of IoT devices

The rising adoption of IoT devices is a significant driver for the AI enabled kitchen appliances market. IoT technology allows kitchen appliances to connect and communicate with each other as well as with the users. This creates a seamless and interconnected kitchen environment. This connectivity also enables a real time data sharing and analysis, allowing the appliances to make intelligent decisions and perform tasks automatically.

Moreover, IoT has also enabled higher personalization, convenience and automation of the AI based Kitchen appliances. Hence, there is a growing demand for smart home solutions that tend to offer higher convenience, personalization and automation.

Restraint

Complexity in usage

Consumers could face difficulties while operating AI based Kitchen appliances as it often comes with advanced features and functionalities that need users to learn new skills and habits, restricting the market growth.

Furthermore, complexities in user interface and intricate settings can also lead to a frustrating user experience. These complexities could be in navigating or operating the appliance, discouraging the users. Furthermore, these devices also need more frequent technical support and maintenance, adding to the challenge for the market.

Opportunities

Innovations in product features

Innovations in product features can lead to a more intuitive and user friendly interfaces, thus reducing the complexity and improving the overall user experience. This makes the AI enabled kitchen appliances more accessible to a broader audience.

Additional features such as voice control, remote monitoring, and automated cooking process can significantly enhance the functionality of kitchen appliances. For instance, the Amazon Echo Show is a smart display that integrates with Alexa, allowing users to control kitchen appliances with voice commands.

These advanced features enabled by AI leads to personalization such as personalized cooking recommendations inventory management and meal planning, catering to the individual user preferences and dietary needs, enhancing the value preposition for the consumers.

Challenges

Privacy and security concerns

Privacy and security concerns are a significant challenge for the AI enabled kitchen appliances market. AI enabled appliances often collect and store a vast amount of data, including the user habits, preferences and personal information. If this is not being protected adequately, it can be vulnerable to breaches and misuse.

As AI enabled appliances become more connected, they can be targets for cyberattacks. Hackers can potentially gain unauthorized access to these devices, leading to risks such as data theft, device manipulation data being compromised.

Growth Factors

As more consumers embrace the concept of smart homes, the demand for AI-enabled appliances that tends to offer convenience, efficiency and connectivity continues to grow. These appliances often come with advanced energy saving features, appealing to environmentally conscious consumers that seek to reduce their carbon footprints and utility bills.

Manufacturers are continuously innovating to introduce new and improved features that tends to attract the consumers and drive the market growth. the expansion of retail and e-commerce channels has also made AI enabled kitchen appliances more accessible to a broader audience, boosting sales and market penetration.

Latest Trends

There are various trends reshaping the global AI-enabled kitchen appliances market. devices like smart ovens and cooktops offer intelligence cooking assistance, adjusting cooking times and temperatures automatically, based on the type of food that is being prepared.

Integration of voice recognition and gesture control technologies allows the users to interact with their appliances more naturally and intuitively. Additionally, predictive maintenance features help the users identify potential issues before they become a major problem, extending the lifespan of appliances.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading player in the market is LG Electronics which has been at the forefront of integrating AI into their kitchen appliances, making them smarter and more user-friendly. LG Electronics has been at the forefront of integrating AI into their kitchen appliances, making them smarter and more user-friendly.

Top Key Players in the Market

- GE Appliances

- Whirlpool Corporation

- LG Electronics Inc.

- Robert Bosch GmbH

- Kenmore

- Samsung Electronics Co., Ltd.

- Electrolux AB

- June Life, Inc.

- Tovala

- Brava Home Inc.

- Anova Culinary

- SideChef Inc.

- Haier Group Corporation

- Panasonic Corporation

- Miele & Cie. KG

- Other Key Players

Recent Developments

- In December 2024, Samsung upgraded the kitchen experience by launching a refrigerator with a new 9” AI Home1 screen, and adding the 7” AI Home1 to the Wall Oven.

- In May 2024, Samsung Launches AI Fridge With 21.5” Display. This has added benefit of AI Vision that intelligently simplifies daily food management, allowing users to better manage their daily food needs. With their latest model owners have an internal camera that can actually identify certain fresh food items when they are put into or taken out of the refrigerator.

- In April 2024, Samsung Electronics America, Inc. has expanded its Bespoke kitchen appliance portfolio with new 4-Door Flex refrigerator models and a completely redesigned line of premium slide-in ranges, including a Bespoke Slide-in Induction Range – the most advanced induction range.

Report Scope

Report Features Description Market Value (2024) USD 594.8 Mn Forecast Revenue (2034) USD 31,229.1 Mn CAGR (2025-2034) 48.6% Dominating Region North America Holds 37% Share (USD 220.1 Mn) Leading Country US : USD 206.2 Mn, 41.18% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Segments Covered By Type (Refrigerator, Ovens & Microwaves, Cooktops & Ranges, Dishwasher, Others), By End-User (Residential, Commercial), By Distribution Channel (Specialty Stores, Hypermarkets & Supermarkets, Online Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Appliances, Whirlpool Corporation, LG Electronics Inc., Robert Bosch GmbH, Kenmore, Samsung Electronics Co., Ltd., Electrolux AB, June Life Inc., Tovala, Brava Home Inc., Anova Culinary, SideChef Inc., Haier Group Corporation, Panasonic Corporation, Miele & Cie. KG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-enabled Kitchen Appliances MarketPublished date: Jan. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-enabled Kitchen Appliances MarketPublished date: Jan. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Appliances

- Whirlpool Corporation

- LG Electronics Inc.

- Robert Bosch GmbH

- Kenmore

- Samsung Electronics Co., Ltd.

- Electrolux AB

- June Life, Inc.

- Tovala

- Brava Home Inc.

- Anova Culinary

- SideChef Inc.

- Haier Group Corporation

- Panasonic Corporation

- Miele & Cie. KG

- Other Key Players