Global Ayurveda Market By Product Type (Personal and Medical/Therapy), By Form (Herbal, Mineral, and Herbomineral), By Application (Skin/Hair, Respiratory System, Nervous System, Infectious Diseases, GI Tract, Cardiovascular System, and Others), By Distribution Channel (Direct Sales, E-sales, and Distance Correspondence), By End-user (Hospitals & Clinics and Academia & Research), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154278

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Form Analysis

- Application Analysis

- Distribution Channel Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

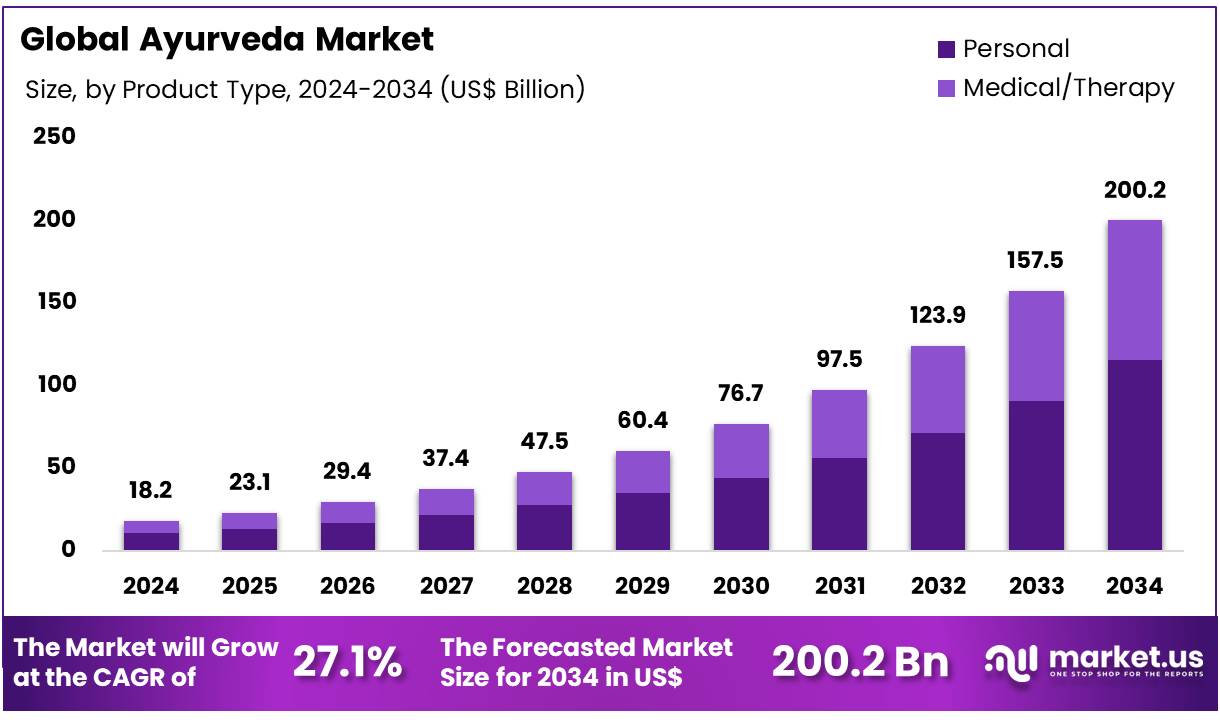

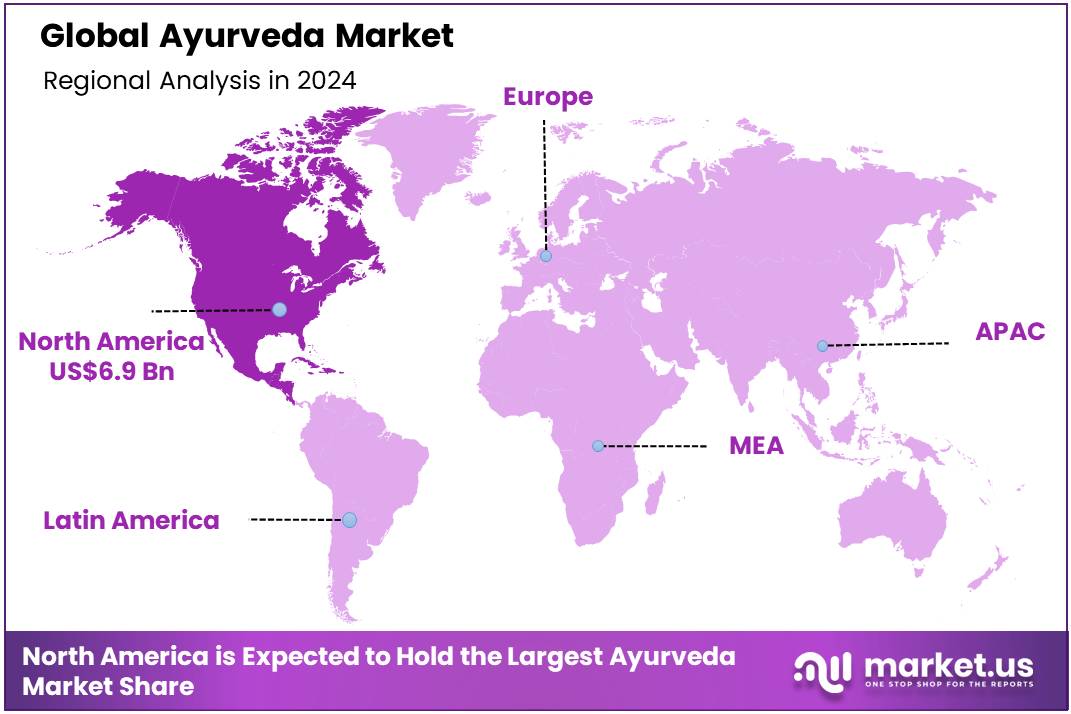

Global Ayurveda Market size is expected to be worth around US$ 200.2 Billion by 2034 from US$ 18.2 billion in 2024, growing at a CAGR of 27.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.8% share with a revenue of US$ 6.9 Billion.

Increasing awareness of natural and holistic healthcare solutions is driving the growth of the Ayurveda market. Ayurveda, a traditional system of medicine rooted in ancient India, emphasizes balancing the body, mind, and spirit to achieve overall well-being. Rising demand for natural, plant-based products and remedies in place of synthetic drugs is propelling Ayurveda’s popularity, as more individuals seek sustainable and organic health solutions. The growing focus on preventive healthcare, wellness, and lifestyle diseases, such as stress, obesity, and diabetes, has opened up new opportunities for Ayurvedic treatments and products.

Ayurveda offers various applications, including herbal medicines, dietary supplements, skin care products, and detoxification therapies, which align with the growing trend toward self-care and personalized health. In February 2024, the Traditional and Alternative Medicine Department of Thailand entered into a Memorandum of Understanding (MoU) with the National Institute of Ayurveda of India to collaborate academically on Ayurveda studies and research. This partnership highlights a recent trend toward increased recognition and institutional support for Ayurveda, facilitating research, development, and standardization of Ayurvedic practices globally.

Recent trends also show a rise in Ayurvedic-based wellness centers, spas, and retreats that offer personalized health treatments, attracting consumers looking for relaxation and holistic therapies. As Ayurveda continues to integrate with modern wellness trends and clinical practices, the market presents substantial growth opportunities, driven by increasing consumer interest in natural, effective, and personalized health solutions.

Key Takeaways

- In 2024, the market for ayurveda generated a revenue of US$ 18.2 billion, with a CAGR of 27.1%, and is expected to reach US$ 200.2 billion by the year 2034.

- The product type segment is divided into personal and medical/therapy, with personal taking the lead in 2024 with a market share of 57.8%.

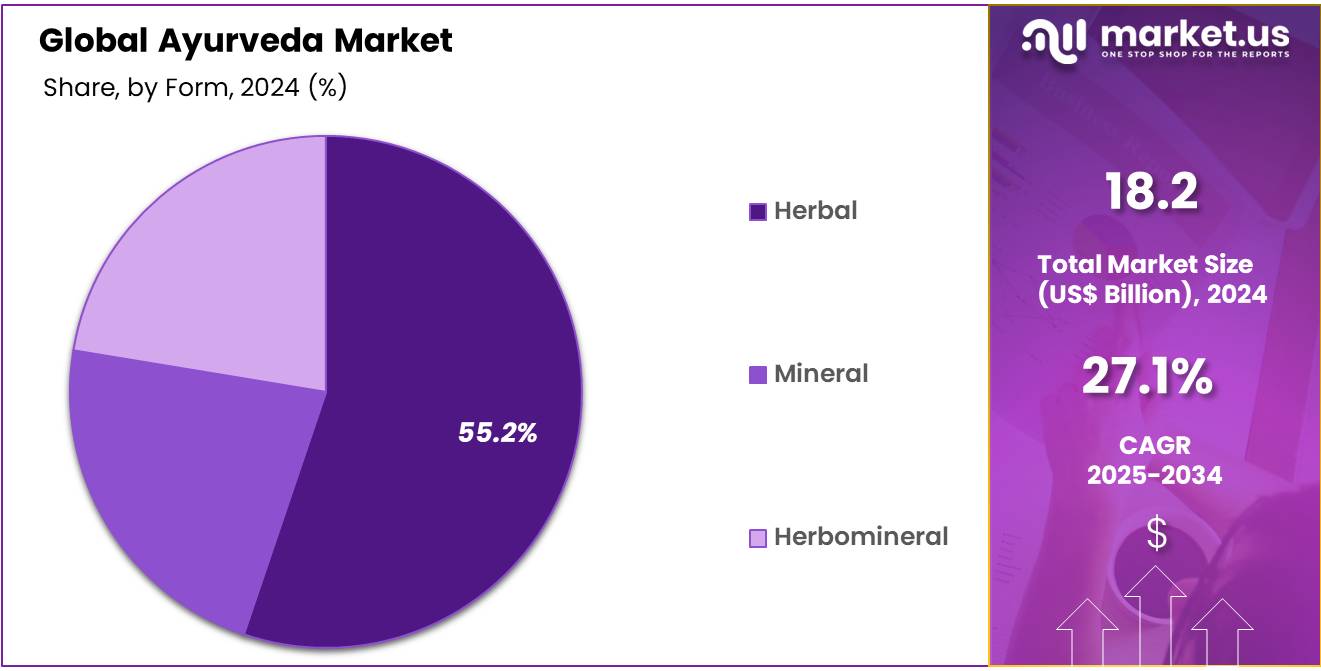

- Considering form, the market is divided into herbal, mineral, and herbomineral. Among these, herbal held a significant share of 55.2%.

- Furthermore, concerning the application segment, the market is segregated into skin/hair, respiratory system, nervous system, infectious diseases, GI tract, cardiovascular system, and others. The skin/hair sector stands out as the dominant player, holding the largest revenue share of 34.1% in the ayurveda market.

- The distribution channel segment is segregated into direct sales, e-sales, and distance correspondence, with the direct sales segment leading the market, holding a revenue share of 42.6%.

- Considering end-user, the market is divided into hospitals & clinics and academia & research. Among these, hospitals & clinics held a significant share of 54.5%.

- North America led the market by securing a market share of 37.8% in 2024.

Product Type Analysis

The personal segment, holding 57.8% of the market share in Ayurveda, is expected to grow significantly as more consumers seek natural, personalized wellness solutions tailored to their specific needs. Increasing awareness about the benefits of personalized care, driven by the desire for customized products, is likely to propel this segment forward. Consumers are shifting towards individualized wellness plans, incorporating Ayurveda-based skincare, haircare, and dietary products designed to address their unique body types and imbalances.

The rise of personalized health and beauty treatments, combined with an increasing focus on holistic, preventative care, is anticipated to drive demand for personal Ayurveda products. Additionally, as more people embrace lifestyle changes that prioritize self-care, the personal segment is projected to benefit from the growing popularity of Ayurveda in the wellness industry. The increasing availability of customized Ayurvedic solutions, such as herbal supplements and topical treatments, is also likely to contribute to the expansion of this segment.

Form Analysis

The herbal segment holds a dominant share of 55.2% in the Ayurveda market. This growth is expected to continue as more consumers turn to natural and plant-based products for health and wellness, driven by an increasing awareness of the benefits of traditional medicine. Herbal products, derived from plants, are projected to remain the primary form of Ayurveda due to their perceived safety, efficacy, and minimal side effects.

As the global demand for natural and organic alternatives to pharmaceutical drugs rises, herbal Ayurveda products are gaining popularity in skincare, digestion, immunity, and respiratory health. The increasing acceptance of holistic health practices, alongside growing interest in sustainable, eco-friendly products, is likely to propel the market for herbal Ayurvedic products. Moreover, the growing trend of self-care and natural beauty products, especially among the younger demographic, is expected to further strengthen the dominance of herbal Ayurveda products.

Application Analysis

Skin and hair care applications dominate the Ayurveda market with 34.1% of the share. This segment’s growth is anticipated to continue as Ayurveda increasingly becomes a preferred choice for consumers seeking natural and non-chemical-based solutions for skincare and hair health. Ayurvedic remedies, such as oils, powders, and pastes, are gaining popularity due to their gentle yet effective results in treating skin conditions like acne, eczema, and pigmentation, as well as promoting hair growth and reducing dandruff.

The growing focus on natural beauty and wellness, alongside rising concerns about the side effects of chemical-based products, is driving the demand for Ayurvedic skin and hair products. Additionally, Ayurveda’s emphasis on personalized treatment tailored to an individual’s body type and constitution adds to the appeal of these products in today’s market. With consumers shifting towards holistic and sustainable beauty alternatives, the skin/hair segment is likely to experience continued growth in the Ayurveda market.

Distribution Channel Analysis

Direct sales represent the largest distribution channel in the Ayurveda market, holding 42.6% of the share. This growth is primarily driven by the personal, face-to-face interaction between sellers and buyers, which builds trust in the efficacy of Ayurvedic products. Many consumers prefer purchasing Ayurveda products directly from local stores, health practitioners, or Ayurvedic centers where they can receive personalized advice. This method allows customers to explore the full range of products and get specific recommendations tailored to their individual needs.

Additionally, as the demand for holistic health solutions grows, direct sales through Ayurvedic practitioners and healthcare professionals are expected to rise, as consumers seek authentic, trusted guidance. The increasing popularity of wellness clinics and Ayurveda spas, which sell directly to customers, is likely to further boost the growth of this distribution channel.

End-User Analysis

Hospitals and clinics are the dominant end-user segment in the Ayurveda market, holding 54.5% of the share. This segment’s growth is expected to be driven by the increasing integration of Ayurvedic treatments into conventional healthcare settings. Hospitals and clinics are increasingly offering Ayurveda-based treatments alongside modern medical therapies, especially in areas like pain management, rehabilitation, and chronic disease management.

Ayurveda’s emphasis on holistic care, which includes diet, lifestyle, and mind-body balance, is anticipated to become more widely accepted as a complementary treatment in hospitals. Additionally, the rise in lifestyle diseases, such as diabetes and hypertension, where Ayurvedic treatments have shown promise, is likely to drive the demand for these services in healthcare settings. As more hospitals focus on providing integrative care, which combines conventional and alternative therapies, the demand for Ayurvedic treatments in hospitals and clinics is projected to grow significantly.

Key Market Segments

By Product Type

- Personal

- Medical/Therapy

By Form

- Herbal

- Mineral

- Herbomineral

By Application

- Skin/Hair

- Respiratory System

- Nervous System

- Infectious Diseases

- GI Tract

- Cardiovascular System

- Others

By Distribution Channel

- Direct Sales

- E-sales

- Distance Correspondence

By End-user

- Hospitals & Clinics

- Academia & Research

Drivers

Growing Consumer Preference for Natural and Holistic Healthcare is Driving the Market

The increasing global consumer preference for natural, preventive, and holistic healthcare approaches is a significant driver propelling the Ayurveda market. As people become more aware of the potential side effects of conventional medicine and seek long-term wellness solutions, there is a rising inclination towards traditional systems of medicine that focus on overall well-being, mind-body balance, and natural healing. This shift in consumer mindset is driving demand for Ayurvedic products, therapies, and wellness services.

The Ministry of Ayush, Government of India, conducted the first exclusive all-India survey on ‘Ayush’ systems from July 2022 to June 2023. This comprehensive survey revealed that approximately 46% of rural and 53% of urban individuals in India used Ayush systems for prevention or treatment of ailments within the past 365 days.

Among these systems, Ayurveda was the most commonly used across both rural (40.5%) and urban (45.5%) areas for treatment. This widespread adoption in its country of origin underscores the inherent trust and growing preference for this traditional healing system among a large population base. The emphasis on natural ingredients, personalized treatments, and lifestyle modifications resonates strongly with modern wellness trends, further solidifying its position in the healthcare landscape.

Restraints

Lack of Standardized Quality Control and Regulatory Frameworks is Restraining the Market

The absence of universally standardized quality control measures and harmonized regulatory frameworks across different regions represents a considerable restraint on the Ayurveda market. The inherent diversity in raw material sourcing, preparation methods, and formulation complexities for Ayurvedic products can lead to inconsistencies in product quality, purity, and efficacy. This lack of uniformity makes it challenging for international markets to accept and trust Ayurvedic products, often leading to concerns about heavy metal contamination or inaccurate labeling.

A review published in the Journal of Advanced Integrative Medicine Sciences in October 2023 highlighted that challenges in Ayurvedic drug dispensing include suboptimal hygienic conditions during preparation, lack of standardized dosing, and variability in raw material quality. While not a direct statistic, this scientific discussion points to the ongoing issues that impede broader acceptance.

Furthermore, different countries have varying regulations for herbal and traditional medicines, creating significant hurdles for manufacturers seeking to export and expand their reach globally. The diverse regulatory requirements for product registration, manufacturing practices, and clinical claims necessitate substantial investment and adaptation, often slowing market growth and limiting international trade opportunities for traditional medicinal products.

Opportunities

Increasing Scientific Validation and Research Initiatives are Creating Growth Opportunities

The growing emphasis on scientific validation of Ayurvedic principles and practices, coupled with increased research initiatives by government bodies and academic institutions, is creating significant growth opportunities in the market. As modern science begins to explore and validate the efficacy and safety of traditional remedies, it builds credibility and fosters greater acceptance among mainstream healthcare professionals and consumers. This scientific backing helps to demystify traditional medicine, allowing for its integration into evidence-based healthcare models.

The Ministry of Ayush, Government of India, has several schemes supporting research and innovation. For instance, the “AYURGYAN” Scheme, approved for the period from FY 2021-2022 to FY 2025-2026, aims to promote education, research, and innovation in Ayush systems through various academic activities, training, and capacity building.

Additionally, the Indian Council of Medical Research (ICMR) actively supports research on scientifically validating traditional medicines and practices from both codified and non-codified systems, helping to widen their acceptability worldwide. Such focused research and funding initiatives generate robust evidence for efficacy, identify active compounds, and help standardize product formulations, ultimately enhancing confidence in traditional medicine and opening new avenues for its integration into global health systems.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the prioritization of public health spending by governments, significantly influence the Ayurveda market by affecting affordability for consumers and investment in traditional medicine infrastructure. Inflation can increase the costs for cultivating medicinal herbs, manufacturing Ayurvedic products, and delivering services, potentially leading to higher prices for consumers. This might impact affordability, especially for those seeking long-term wellness solutions.

However, governments globally are increasingly recognizing the importance of holistic health and preventive care, often leading to sustained or increased funding for traditional medicine systems. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries allocating over 10% of their GDP to health in 2023.

For example, Brazil’s health expenditure was 10.22% of GDP in 2022, and Germany’s was 12.86% in 2023, showcasing substantial national commitments to healthcare systems that are increasingly open to integrated approaches. Geopolitical stability also plays a role in ensuring consistent supply chains for rare or exotic herbs. Despite economic pressures, the growing recognition of traditional medicine’s role in public health ensures a sustained focus on and investment in the traditional medicine sector, fostering resilience and continued growth.

Evolving US trade policies, including the imposition of tariffs and stringent import regulations on herbal products and traditional remedies, are shaping the Ayurveda market by influencing market accessibility and product costs for consumers. The US Food and Drug Administration (FDA) enforces strict regulations for imported dietary supplements and traditional medicines, requiring them to meet safety, labeling, and manufacturing quality standards that are comparable to domestic products. While specific tariffs on Ayurvedic products are not always directly itemized, broader trade policies affecting herbal supplements or certain botanical ingredients can increase import costs.

For example, the Johns Hopkins Bloomberg School of Public Health reported in June 2025 that US pharmaceutical imports, including certain active pharmaceutical ingredients derived from botanicals, more than doubled in value from US$73 billion in 2014 to over US$215 billion in 2024, indicating a vast import market potentially subject to evolving trade policies. Additionally, the US Customs and Border Protection (CBP) enforces FDA regulations, often leading to detentions or refusals of shipments that fail to meet compliance, causing delays and added costs for importers.

These policies, while aiming to ensure consumer safety and product quality, create a complex and potentially more expensive import environment for Ayurvedic products. However, the increasing consumer demand for natural health solutions incentivizes manufacturers and importers to navigate these regulatory landscapes, ensuring continued efforts to bring these products to the US market.

Latest Trends

Digital Transformation and Teleconsultation Platforms are a Recent Trend

A prominent recent trend shaping the Ayurveda market in 2024 and continuing into 2025 is the accelerated digital transformation, particularly through the proliferation of teleconsultation platforms and online availability of traditional medicinal products. This trend enhances accessibility to Ayurvedic practitioners and remedies, transcending geographical barriers and making traditional healthcare more convenient for consumers.

Digital platforms allow patients to consult with Ayurvedic doctors remotely, receive personalized wellness plans, and order authentic products from verified sources, thereby expanding the reach of traditional medicine significantly. The World Health Organization (WHO) announced a significant update to the International Classification of Diseases (ICD-11) in February 2025, introducing a pioneering new module dedicated to traditional medicine conditions. This update, following successful testing in 2024 for Ayurveda, Siddha, and Unani systems, enables systematic tracking and global integration of these healthcare practices, facilitating better data collection and evidence-based policymaking.

While not directly a statistic on digital platforms, this WHO initiative underscores the global movement towards integrating traditional medicine into mainstream digital health frameworks, validating its role and paving the way for more comprehensive digital solutions in the future. The convenience and broad reach offered by these digital avenues are fundamentally changing how people access and engage with traditional healthcare.

Regional Analysis

North America is leading the Ayurveda Market

The Ayurveda market in North America, holding a significant 37.8% share, experienced notable growth in 2024. This expansion was primarily driven by rising consumer interest in holistic health approaches, increasing awareness of natural and traditional remedies, and a growing demand for preventive healthcare solutions. The National Center for Complementary and Integrative Health (NCCIH), part of the US National Institutes of Health (NIH), indicates a substantial increase in the use of complementary health approaches among US adults, with traditional alternative medicine and botanicals dominating in the US. This trend reflects a shift towards natural products and ancient healing systems like Ayurveda.

Additionally, the increasing prevalence of chronic diseases and a desire for personalized wellness strategies have prompted consumers to explore Ayurvedic principles and products. While specific revenue figures for pure Ayurvedic products from government organizations or publicly traded companies solely focused on Ayurveda in North America are not readily available, the broader growth in complementary health approaches, coupled with the expanding product portfolios of companies like Himalaya Wellness Company and Dabur International offering Ayurvedic-inspired products in the region, underscores the upward trajectory of this market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Ayurveda market in Asia Pacific is expected to grow substantially during the forecast period. This anticipated expansion is fueled by the deep cultural roots of Ayurveda in countries like India, increasing government support, and the integration of traditional medicine into national healthcare systems, along with a growing consumer preference for natural and herbal products.

The Indian government’s Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homoeopathy) has significantly increased its budget, with allocations rising from Rs. 1,939.76 crores in 2019-20 to Rs. 3,647.50 crores (approximately US$437 million) in 2023-24, demonstrating a strong commitment to promoting and developing traditional Indian medicine. India’s pioneering efforts in integrating Artificial Intelligence (AI) with traditional medicine, including Ayurveda, as highlighted by the World Health Organization (WHO) in July 2025, are expected to enhance diagnostic accuracy and personalize preventive care, driving broader adoption.

Companies like Dabur India Ltd., a major player in Ayurvedic and natural healthcare, reported a full-year revenue of Rs. 12,563 crores (approximately US$1.5 billion) in 2024-25, up from Rs. 12,404 crores in the previous year, with its healthcare segment, including Ayurvedic products, being a key contributor. This growth, combined with rising health consciousness and expanding distribution networks for traditional products, indicates that the Ayurveda market in Asia Pacific will continue its robust upward trend.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Ayurveda market are employing various strategies to fuel growth and expand their reach. They focus on diversifying their product offerings, including herbal supplements, skincare, and personal care products, to cater to a wide range of consumer needs. Investment in research and development enables the creation of innovative formulations that combine traditional Ayurvedic practices with modern scientific advancements.

Strategic partnerships with international distributors help expand the global presence of Ayurvedic products, increasing their availability to a broader customer base. Companies also emphasize quality control and regulatory compliance to ensure product safety and efficacy, building consumer trust. Additionally, the use of digital platforms and e-commerce enhances customer engagement and optimizes distribution channels.

Patanjali Ayurved, founded in 2006 by Baba Ramdev and Acharya Balkrishna, exemplifies these strategies. Headquartered in Haridwar, India, Patanjali quickly expanded its product range to include a variety of Ayurvedic and FMCG products. The company focuses on using natural ingredients and traditional formulations, which appeal to consumers seeking holistic health solutions. Patanjali’s widespread distribution network, including both retail outlets and online platforms, has greatly contributed to its market penetration. Despite facing regulatory challenges, Patanjali remains a leading force in the Ayurveda market, reflecting the increasing consumer demand for natural products.

Top Key Players

- Vicco Laboratories

- Patanjali Ayurved Limited

- Kerry

- Kerala Ayurveda Ltd

- Himalaya Wellness Company

- EMAMI GROUP OF COMPANIES PVT LTD

- Dabur Ltd

- Baidyanath

Recent Developments

- In September 2023, Emami Ltd., a leading Indian company in personal care and healthcare, purchased a 26% stake in Axiom Ayurveda Pvt. Ltd. As part of this acquisition, Emami Ltd. also ventured into the juice market with its new brand, AloFrut, marketed by Axiom Ayurveda.

- In April 2022, Kerry, a nutrition-focused food company based in Ireland, acquired Natreon, an Ayurvedic extract company, to enhance its ProActive Health portfolio. This acquisition aims to leverage Natreon’s extensive research and development capabilities in Ayurvedic ingredients.

Report Scope

Report Features Description Market Value (2024) US$ 18.2 Billion Forecast Revenue (2034) US$ 200.2 Billion CAGR (2025-2034) 27.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Personal and Medical/Therapy), By Form (Herbal, Mineral, and Herbomineral), By Application (Skin/Hair, Respiratory System, Nervous System, Infectious Diseases, GI Tract, Cardiovascular System, and Others), By Distribution Channel (Direct Sales, E-sales, and Distance Correspondence), By End-user (Hospitals & Clinics and Academia & Research) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vicco Laboratories, Patanjali Ayurved Limited, Kerry, Kerala Ayurveda Ltd, Himalaya Wellness Company, EMAMI GROUP OF COMPANIES PVT LTD, Dabur Ltd, Baidyanath. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vicco Laboratories

- Patanjali Ayurved Limited

- Kerry

- Kerala Ayurveda Ltd

- Himalaya Wellness Company

- EMAMI GROUP OF COMPANIES PVT LTD

- Dabur Ltd

- Baidyanath