Global Cardiovascular Implants Market By Product Type (Prosthetic Heart Valve Devices, Coronary Stents, and Others), By Application (Arrhythmias, Heart Failure, and Others), By End-user (Cardiac Care Centers, Hospitals, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154257

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

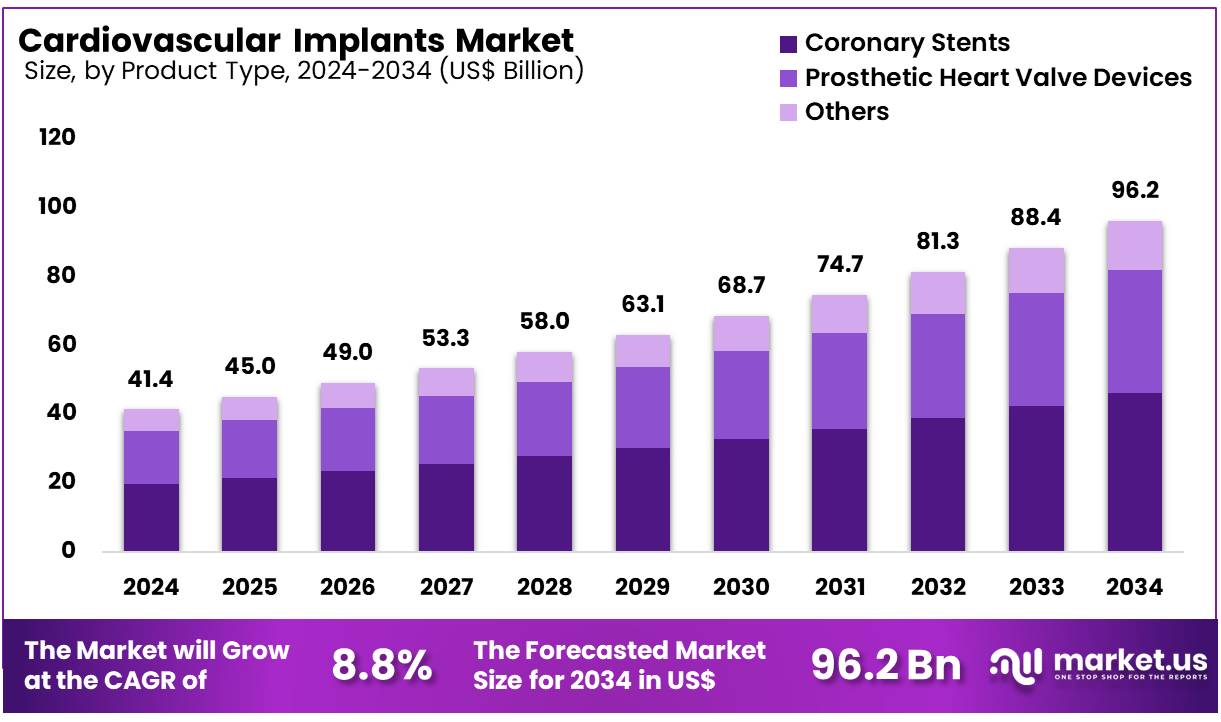

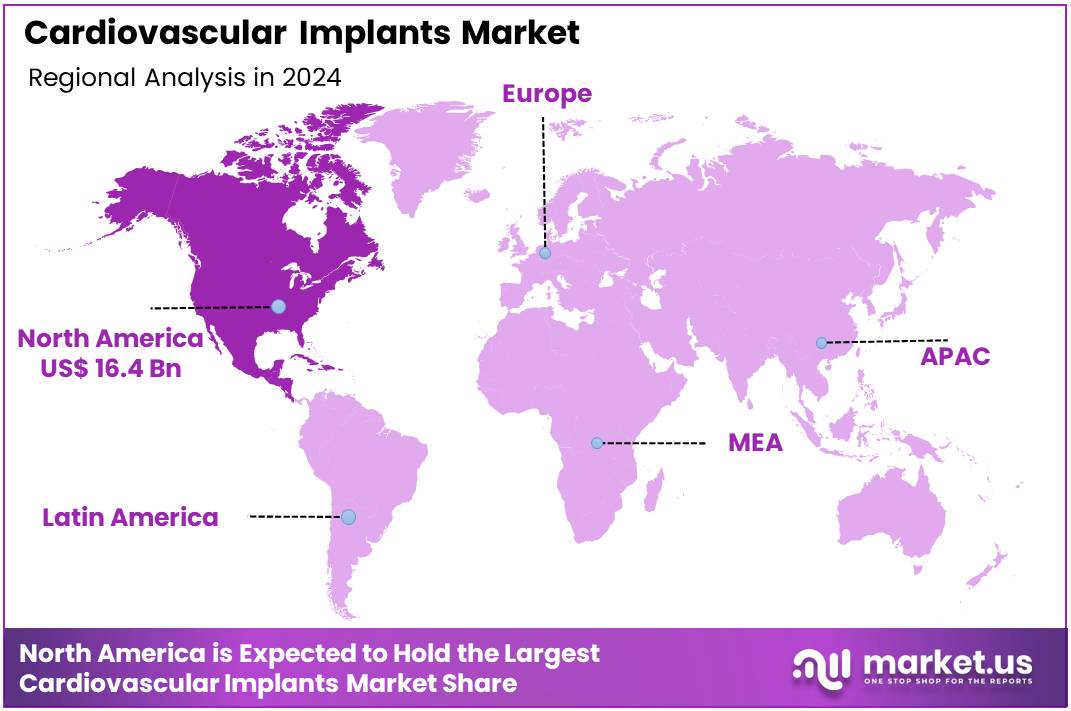

Global Cardiovascular Implants Market size is expected to be worth around US$ 96.2 Billion by 2034 from US$ 41.4 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 16.4 Billion.

Increasing prevalence of cardiovascular diseases and the growing demand for advanced treatment options are driving the expansion of the cardiovascular implants market. Cardiovascular implants, such as stents, pacemakers, heart valves, and implantable devices, play a critical role in the treatment and management of conditions like coronary artery disease, heart failure, and arrhythmias. The rise in lifestyle-related risk factors, including obesity, smoking, and physical inactivity, has led to an increase in cardiovascular conditions, further boosting the need for effective implant-based therapies.

As the population ages, the demand for cardiovascular implants continues to grow, offering opportunities for innovation in implant technology, particularly in minimally invasive procedures that reduce recovery times and complications. In February 2022, Abbott received approval from the US FDA for an expanded indication of the CardioMEMS HF System, enhancing its ability to assist more patients managing heart failure. This system features a small sensor, similar in size to a paperclip, which is implanted into the pulmonary artery using a catheter.

The approval highlights the trend toward remote patient monitoring and implantable devices that allow for continuous monitoring of heart health, reducing hospital readmissions and improving patient outcomes. Additionally, advancements in bioresorbable stents and heart valves, which eliminate the need for long-term implants, are gaining traction. The growing focus on personalized medicine and the integration of AI and robotics in cardiovascular surgeries present significant opportunities for the market, allowing for more precise, targeted treatments and improved surgical outcomes. As these innovations continue to evolve, the cardiovascular implants market is poised for significant growth, improving the quality of life for millions of patients worldwide.

Key Takeaways

- In 2024, the market for cardiovascular implants generated a revenue of US$ 41.4 billion, with a CAGR of 8.8%, and is expected to reach US$ 96.2 billion by the year 2034.

- The product type segment is divided into prosthetic heart valve devices, coronary stents, and others, with coronary stents taking the lead in 2024 with a market share of 47.9%.

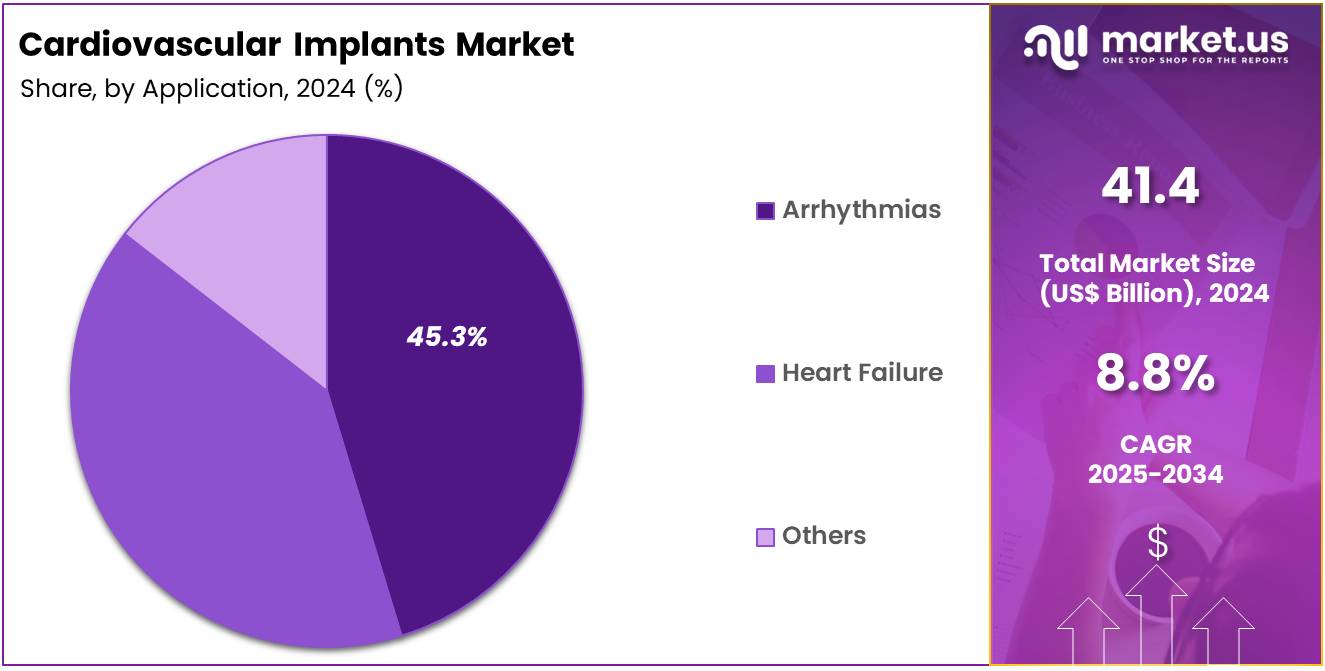

- Considering application, the market is divided into arrhythmias, heart failure, and others. Among these, arrhythmias held a significant share of 45.3%.

- Furthermore, concerning the end-user segment, the market is segregated into cardiac care centers, hospitals, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.7% in the cardiovascular implants market.

- North America led the market by securing a market share of 39.7% in 2024.

Product Type Analysis

Coronary stents hold a dominant share of 47.9% in the cardiovascular implants market. This growth is expected to continue as coronary artery disease (CAD) remains one of the leading causes of morbidity and mortality globally. Coronary stents are a key solution in percutaneous coronary interventions (PCI) to restore blood flow in blocked or narrowed coronary arteries. The increasing prevalence of risk factors such as high cholesterol, diabetes, and hypertension is driving the demand for coronary stents, particularly in aging populations.

Additionally, advancements in stent technology, including drug-eluting stents (DES) that help reduce restenosis rates, are anticipated to further fuel market growth. The continued focus on minimally invasive procedures and the increasing adoption of PCI over traditional bypass surgeries are likely to contribute to the growth of this segment. As healthcare systems prioritize cost-effective and efficient treatment options, coronary stents are projected to remain a critical component in the management of CAD, ensuring sustained demand in the market.

Application Analysis

Arrhythmias account for 45.3% of the application segment in the cardiovascular implants market. This growth is expected to be driven by the increasing incidence of heart rhythm disorders, such as atrial fibrillation (AF), which affect millions of people worldwide. Arrhythmias can lead to serious complications like stroke and heart failure, creating a strong demand for medical devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and catheter-based ablation therapies.

The rising prevalence of lifestyle-related conditions, such as obesity, smoking, and high blood pressure, is likely to increase the occurrence of arrhythmias, further driving the need for treatment options. Additionally, advancements in device technology, including smaller, more efficient, and longer-lasting devices, are projected to enhance the success rates of arrhythmia treatments. As healthcare providers focus on improving patient outcomes and quality of life, the demand for cardiovascular implants in arrhythmia management is expected to grow, ensuring this segment’s continued dominance.

End-User Analysis

Hospitals dominate the end-user segment of the cardiovascular implants market, holding 58.7% of the share. This growth is expected to continue as hospitals remain the primary healthcare settings for the treatment of cardiovascular diseases, including arrhythmias and coronary artery disease. With the increasing number of patients requiring complex cardiovascular interventions, hospitals are investing heavily in advanced implantable devices to provide effective treatments.

The integration of cardiovascular implants with advanced imaging and diagnostic systems in hospitals is likely to improve the precision and outcomes of procedures like PCI and arrhythmia management. Additionally, hospitals are expected to continue focusing on minimally invasive interventions, which offer quicker recovery times and reduced risks for patients, further driving the demand for cardiovascular implants. As the global burden of cardiovascular diseases rises and hospitals expand their cardiac care departments, the need for implants is projected to increase, solidifying hospitals’ position as the largest end-user segment in this market.

Key Market Segments

By Product Type

- Prosthetic Heart Valve Devices

- Coronary Stents

- Others

By Application

- Arrhythmias

- Heart Failure

- Others

By End-user

- Cardiac Care Centers

- Hospitals

- Others

Drivers

Increasing Prevalence of Cardiovascular Diseases is Driving the Market

The increasing prevalence of cardiovascular diseases is significantly driving the growth of the cardiovascular implants market. As the global incidence of conditions such as heart failure, arrhythmias, and valvular heart disease rises, many patients require implantable devices for treatment and management. With an aging global population and the rising burden of chronic diseases, there is an increasing demand for devices like pacemakers, implantable cardioverter-defibrillators (ICDs), heart valves, and vascular stents to restore cardiac function and enhance quality of life.

These devices are essential for addressing electrical irregularities, supporting weakened hearts, and repairing damaged valves and blood vessels. According to the American Heart Association’s “Heart Disease Mortality in the United States, 1970 to 2022” report, although the overall age-adjusted mortality from heart disease decreased by 66% between 1970 and 2022, mortality rates for certain heart conditions such as heart failure and arrhythmias saw an 81% increase during the same period.

Specifically, heart failure mortality rose from 13 to 32 per 100,000 individuals (a 146% increase), while arrhythmia mortality surged from 2 to 11 per 100,000 (a 450% rise). This highlights the growing number of patients who could benefit from implantable solutions, driving demand for advanced technologies that enhance patient outcomes and longevity.

Restraints

High Cost of Implantable Devices and Complex Reimbursement Policies are Restraining the Market

The substantial cost associated with advanced cardiovascular implantable devices and the complex, often challenging reimbursement policies in various healthcare systems represent a considerable restraint on the market. These sophisticated medical devices, such as transcatheter heart valves, ventricular assist devices, and advanced pacemakers, involve significant research, development, and manufacturing expenses, translating into high unit costs. Furthermore, obtaining favorable reimbursement rates from government payers and private insurers is a lengthy and intricate process, often varying by region and specific device type.

The American Hospital Association (AHA) in its “2024 Costs of Caring” report, published in April 2025, noted that medical device and equipment market prices contribute significantly to hospital expenses. For instance, a Cardiac Magnetic Resonance Imaging (cMRI) machine, often part of the diagnostic pathway leading to an implant, has an average list price of over US$3.2 million. While this is an imaging device, it reflects the high capital expenditure for cardiovascular care infrastructure, often influencing budgets for implantable technologies.

Additionally, the Centers for Medicare & Medicaid Services (CMS) continually updates its Physician Fee Schedule and Hospital Outpatient Prospective Payment System, and while cardiovascular services generally remain stable, changes in conversion factors can impact overall reimbursement. For example, the 2024 Physician Fee Schedule conversion factor was reduced by 3.37% from 2023. These financial barriers can limit hospitals’ ability to invest in the latest technologies and can increase out-of-pocket costs for patients, thereby slowing the broader adoption of cutting-edge implantable solutions.

Opportunities

Technological Advancements and Miniaturization are Creating Growth Opportunities

Ongoing technological advancements, including the miniaturization of implantable devices, improved battery life, enhanced connectivity, and the development of more biocompatible materials, are creating significant growth opportunities in the market. Innovations are leading to smaller, more sophisticated devices that are less invasive to implant and offer improved functionality and patient comfort. For example, leadless pacemakers and smaller, more durable ICDs are making procedures safer and recovery faster.

The US Food and Drug Administration (FDA) actively approves new and improved devices that leverage these advancements. Abbott Medical, a key player, received FDA approval for its Aveir DR Leadless System in June 2023, representing a significant advancement in leadless pacing technology. This dual-chamber leadless pacemaker eliminates the need for cardiac leads, which are often a source of complications.

Furthermore, in April 2024, Abbott also received FDA approval for its Esprit BTK Everolimus Eluting Resorbable Scaffold System, an absorbable scaffold for below-the-knee peripheral artery disease, highlighting the continuous innovation in resorbable and drug-eluting technologies. These advancements not only expand the treatable patient population by reducing invasiveness but also enhance the long-term efficacy and safety profiles of implants, fostering greater clinician confidence and patient acceptance. The continuous pursuit of less invasive and more effective solutions propels further adoption of these innovative devices.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall investment landscape within the healthcare sector, significantly influence the cardiovascular implants market by impacting manufacturing costs, healthcare expenditure, and patient affordability. Inflation can increase the expenses for producing sophisticated implantable devices, encompassing raw materials, specialized electronic components, and complex manufacturing processes, which might lead to higher product prices. This potentially strains hospital budgets and can affect the accessibility of these life-saving technologies.

However, governments and private entities globally recognize cardiovascular health as a crucial public health concern due to its significant contribution to mortality and healthcare burden, often leading to resilient investment in this vital area. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries consistently allocating a significant portion of their Gross Domestic Product (GDP) to health.

For instance, Australia’s health expenditure was 10.37% of GDP in 2022, and Canada’s was 12.23% in 2022, showcasing robust national commitments that underpin the continued acquisition of advanced medical implants. Geopolitical stability also plays a crucial role in maintaining robust and predictable supply chains for the complex and often globally sourced components required for these high-precision devices. Despite economic fluctuations, the fundamental imperative to treat life-threatening cardiovascular conditions ensures sustained investment in implantable technologies, fostering resilience and continued growth for the market.

Evolving US trade policies, including the imposition of tariffs on imported medical devices, electronic components, and advanced materials, are shaping the cardiovascular implants market by directly influencing manufacturing costs and recalibrating supply chain strategies for major players. Manufacturers of cardiovascular implants frequently rely on intricate global supply chains for highly specialized components such as advanced alloys, biocompatible polymers, and micro-electronic assemblies, many of which originate from international suppliers.

Tariffs on these specific imports directly increase the input costs for companies that either manufacture within the US or import finished components for assembly, potentially leading to higher prices for the final implantable devices sold to hospitals and healthcare providers. The US Bureau of Economic Analysis (BEA) reported in June 2024 that US imports of advanced technology products, a category that often includes high-value medical device components, increased by US$28 billion in 2023 compared to 2022, reaching significant overall values.

These policies, while sometimes aimed at encouraging domestic production and enhancing supply chain resilience, primarily create a more expensive and intricate operational environment for companies that design and produce essential medical implants. The critical need for life-saving cardiovascular implants, however, motivates manufacturers to strategically manage their supply chains and absorb some costs, ensuring continued access to essential components for patient care despite trade complexities.

Latest Trends

Growing Adoption of Remote Monitoring and Telehealth for Post-Implant Care is a Recent Trend

A prominent recent trend shaping the cardiovascular implants market in 2024 and continuing into 2025 is the increasing adoption of remote monitoring and telehealth solutions for post-implant patient care. This trend allows healthcare providers to continuously monitor the performance of implanted devices and the patient’s physiological parameters from a distance, facilitating early detection of issues, reducing the need for frequent in-person clinic visits, and improving patient adherence. Remote monitoring systems for pacemakers, ICDs, and heart failure monitors transmit critical data, enabling proactive management and reducing hospital readmissions.

A February 2025 review in the European Heart Journal Supplements discussed the significant potential of remote monitoring to improve clinical outcomes for heart failure patients, specifically mentioning implantable sensors like CardioMEMS™ and implantable monitors like pacemakers and ICDs. The review cited that Medicare data confirmed improved outcomes in real-world use for CardioMEMS, with a 48% reduction in heart failure hospitalizations after 6 months.

This widespread implementation of remote monitoring is driven by its proven benefits in enhancing patient safety, optimizing clinical workflows, and improving overall care efficiency. The continuous evolution of telehealth infrastructure and reimbursement models further supports the integration of these remote monitoring capabilities, making post-implant care more accessible and effective for a larger patient base.

Regional Analysis

North America is leading the Cardiovascular Implants Market

The cardiovascular implants market in North America, holding a significant 39.7% share, experienced substantial growth in 2024. This expansion was primarily driven by the persistent and evolving burden of cardiovascular diseases, an increasingly aging population requiring advanced interventions, and continuous technological innovations leading to more effective and durable implantable devices.

While age-adjusted mortality from ischemic heart disease decreased by 81% from 1970 to 2022 in the United States, mortality from other heart disease subtypes, including heart failure and arrhythmias, increased by 81% over the same period, according to a study published by the American Heart Association in June 2025, underscoring a shifting need for implantable solutions for these specific conditions. Advancements in transcatheter heart valves, implantable cardioverter-defibrillators (ICDs), and pacemakers have significantly improved patient outcomes and expanded treatment options.

Major medical technology companies providing these devices reported robust financial performance. Medtronic’s Cardiovascular portfolio generated US$11.831 billion in revenue in fiscal year 2024, representing a 2.7% increase, with strong performance in its Structural Heart & Aortic and Cardiac Rhythm & Heart Failure divisions.

Edwards Lifesciences, a leader in structural heart disease, reported total sales growth of 12% on a constant currency basis in 2023 compared to 2022, driven by its transcatheter aortic valve replacement (TAVR) and transcatheter mitral and tricuspid therapies. Abbott’s Medical Devices segment also contributed significantly, showing a 15.4% organic sales increase in the fourth quarter of 2023, reflecting strong demand for its cardiovascular products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The cardiovascular implants market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is fueled by the escalating prevalence of cardiovascular diseases, a rapidly expanding and aging population, and significant investments in healthcare infrastructure and access to advanced medical treatments across the region. The burden of cardiovascular diseases in Asia is projected to reach 729.5 million cases by 2050, a 109.0% increase from 2025, according to a forecast analysis in BMC Public Health in July 2024, indicating a massive future demand for interventional solutions.

Furthermore, increasing disposable incomes and a growing awareness of modern treatment options are prompting more individuals to seek advanced cardiac care. Governments in countries like China, India, and Japan are investing in upgrading hospital facilities and promoting the adoption of innovative medical technologies. Major global medical device manufacturers are strategically strengthening their presence and distribution networks in Asia Pacific to meet this rising demand.

Boston Scientific’s Asia-Pacific (APAC) region reported a 15.7% operational sales growth in 2024 compared to 2023, showcasing strong regional demand for its cardiovascular products. Medtronic and Edwards Lifesciences are also actively expanding their operations and introducing new implantable technologies designed for the diverse needs of the Asian market. These combined factors are likely to drive the significant growth of the market for cardiovascular implants throughout Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cardiovascular implants market employ several strategies to drive growth. These include investing in research and development to create innovative products, such as advanced pacemakers and stents, enhancing patient outcomes. Strategic mergers and acquisitions enable companies to expand their product portfolios and enter new markets. Collaborations with healthcare providers and research institutions facilitate the development of cutting-edge technologies and broaden market reach.

Geographic expansion into emerging markets allows companies to tap into new customer bases and increase revenue streams. Adherence to regulatory standards ensures product safety and efficacy, building trust with healthcare professionals and patients. Additionally, companies focus on marketing and educational initiatives to raise awareness about the benefits of cardiovascular implants, thereby driving demand.

Medtronic, a leading company in this sector, specializes in providing medical devices for various procedures, including cardiovascular implants. The company offers a comprehensive range of products designed to treat heart conditions, such as pacemakers, defibrillators, and heart valves. With a strong focus on expanding its product portfolio and leveraging advanced technologies, Medtronic aims to enhance patient outcomes and reduce healthcare costs. Through continuous innovation and strategic acquisitions, Medtronic strengthens its position in the cardiovascular implants market, meeting the growing demand for reliable and effective heart-related treatments.

Cardiovascular Implants Market

- Terumo Corporation

- Schiller AG

- Sahajanand Medical Technologies Pvt. Ltd

- Medtronic plc

- LivaNova PLC

- Japan Lifeline Co., Ltd

- Impulse Dynamics

- Edwards Lifesciences Corporation

- Braun Melsungen AG

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- Angel Medical Systems, Inc

- Abbott Laboratories

Recent Developments

- In April 2022, Impulse Dynamics introduced the Optimizer Smart Mini in the United States, following its FDA approval. The Optimizer Smart Mini is an implantable pulse generator (IPG) classified as a Class III medical device, aimed at treating moderate to severe heart failure.

- In July 2021, Angel Medical Systems, Inc. launched the Guardian System, its flagship product. This device is the first implantable cardiac monitoring system that provides real-time alerts for acute coronary syndrome (ACS) events, including silent heart attacks.

Report Scope

Report Features Description Market Value (2024) US$ 41.4 Billion Forecast Revenue (2034) US$ 96.2 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Implants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Implants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terumo Corporation

- Schiller AG

- Sahajanand Medical Technologies Pvt. Ltd

- Medtronic plc

- LivaNova PLC

- Japan Lifeline Co., Ltd

- Impulse Dynamics

- Edwards Lifesciences Corporation

- Braun Melsungen AG

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- Angel Medical Systems, Inc

- Abbott Laboratories