Automotive Electronics Market Size, Share, Growth Analysis By Type (EDU/DCU , Sensors , Power electronics), By Application (Body, Chassis, Powertrain, Infotainment, ADAS/AD), By Vehicle type (Passenger cars , Commercial cars), By Sales, By Propulsion, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 13890

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Automotive Electronics Market Key Takeaways

- Automotive Electronics Business Environment Analysis

- Regional Analysis of Automotive Electronics Market

- Type Analysis

- Application Analysis

- Vehicle Type Analysis

- Propulsion Analysis

- Sales Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Trending Factors

- Competitive Landscape of Automotive Electronics Market

- Recent News in Automotive Electronics Market

- Report Scope

Report Overview

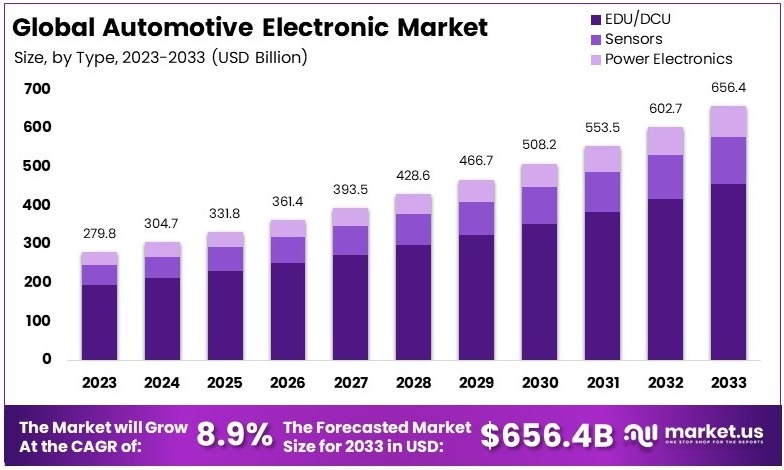

The Global Automotive Electronics Market size is expected to be worth around USD 656.4 Billion by 2033, from USD 279.8 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

The Automotive Electronics Market encompasses a broad spectrum of electronic components and systems integrated into vehicles to enhance performance, safety, and comfort. This market is pivotal for the modern automotive industry, playing a crucial role in the development of advanced driver-assistance systems (ADAS), infotainment systems, engine management, and vehicle safety features.

As vehicles evolve towards greater autonomy and connectivity, the demand for sophisticated electronics continues to surge, driving innovation and competition among manufacturers.

The automotive electronics market is witnessing remarkable growth, fueled by the increasing integration of smart technologies into vehicles. For example, the RAC predicts that by 2025, approximately 88% of new vehicles—or around 104 million units—will feature some form of connectivity. This reflects a growing consumer preference for enhanced vehicle functionality, ranging from infotainment systems to real-time navigation.

Moreover, advancements in autonomous vehicle technology contribute significantly to this expansion. Projections by the Insurance Institute for Highway Safety estimate that 3.5 million self-driving vehicles will be operational on U.S. roads by 2025, with the number rising to 4.5 million by 2030. Consequently, automakers are heavily investing in electronic systems that support autonomous driving, ensuring safer and more efficient transportation options.

Meanwhile, the shift toward vehicle electrification is evident, with the U.S. Energy Information Administration reporting that 16% of light-duty vehicle sales in Q2 2023 involved electric vehicles, a notable increase from 12.9% in 2022. This trend aligns with global sustainability goals and increasing regulatory mandates.

Additionally, partnerships such as Qualcomm’s collaboration with BMW and Mercedes, targeting $4 billion in automotive revenue by 2026, exemplify the growing focus on enhancing electronic content in vehicles. Qualcomm’s Snapdragon Automotive Cockpit Platforms are driving innovations in infotainment, highlighting the lucrative potential of in-car technologies.

On a global scale, government investments and regulations are shaping the market. Notably, the McKinsey Center for Future Mobility forecasts the commercialization of Level 4 robo-taxis by 2030, alongside fully autonomous trucking solutions shortly after. These advancements require robust electronic systems, prompting strategic developments and infrastructure upgrades.

Automotive Electronics Market Key Takeaways

- The Automotive Electronics Market is projected to reach USD 656.4 Billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033.

- EDU/DCU dominating at 69.3% in the type segment.

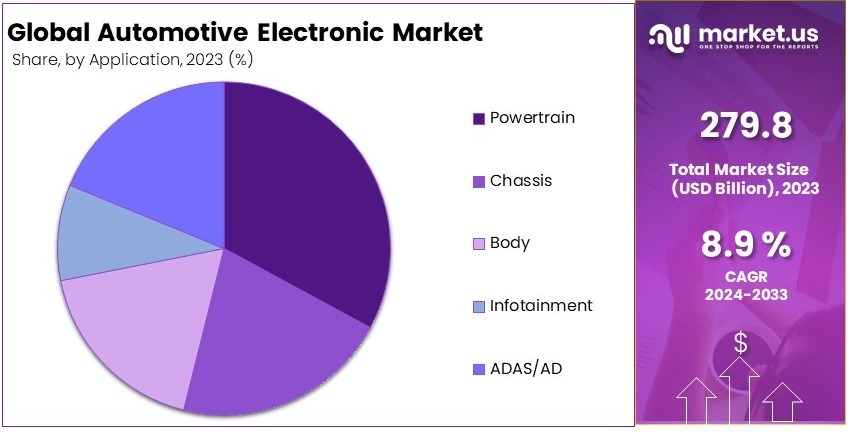

- Powertrain holds the largest market share at 32.9%, driven by the transition to electric and hybrid vehicles, while passenger cars lead with 74.6% market share in the vehicle type segment.

- Electric/Hybrid vehicles command 78.4% of the propulsion segment, reflecting the industry’s shift towards sustainable mobility solutions

- OEMs account for 60.9% of sales, emphasizing the importance of direct integration during vehicle manufacturing, while aftermarket solutions play a critical role in extending vehicle functionality and catering to retrofit demands.

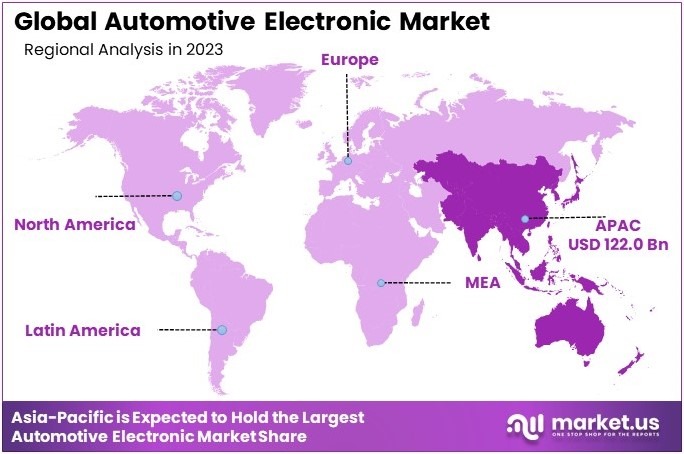

- Asia-Pacific region dominating with a 43.6% market share.

- Key players like Robert Bosch GmbH, Continental AG, and Denso Corporation drive innovation and market influence in automotive electronics solutions.

Automotive Electronics Business Environment Analysis

The automotive electronics market is approaching varying levels of saturation across regions. For instance, developed markets like Europe and the United States are near maturity, with high adoption rates of advanced systems. Conversely, emerging markets like Asia-Pacific continue to exhibit significant growth potential.

For Instance, According to CLEPA’s vision in October 2024, strengthening Europe’s semiconductor and automotive electronics ecosystem will be key to maintaining competitiveness, focusing on R&D advancements and industrial funding.

Demographics play a pivotal role in shaping demand. Millennials and Gen Z, accounting for 60% of connected and tech-enabled vehicle demand, prioritize modern features, while baby boomers, representing 25%, emphasize safety and comfort. High-income consumers, 30% of buyers, prefer premium solutions, while middle-income groups, constituting 50%, seek cost-effective options like ADAS and basic infotainment. These preferences create diverse market opportunities.

Product differentiation remains essential as consumer preferences vary. Deloitte’s survey in 2023 highlights that 67% of U.S. consumers still prefer gasoline/diesel engines, underscoring the importance of offering diverse powertrain options. Meanwhile, advanced infotainment systems and autonomous features are driving premium market growth, demanding continual innovation and technology integration.

The value chain of automotive electronics is transforming with investments like Flex’s €10 million in Hungary announced in May 2024. This expansion focuses on advanced production lines, strengthening supply chains while fostering regional hubs. Consequently, manufacturers gain better efficiency and scalability.

Investment opportunities are expanding, with strategic efforts like CLEPA’s emphasis in October 2024 on reducing energy costs and industrial funding. Moreover, robust growth in adjacent sectors, such as energy recovery systems, amplifies the impact of innovations in the automotive electronics domain.

Global trade dynamics reflect the market’s export-import interdependencies. In 2023, France traded automotive electronics worth €2.12 billion, while the global trade volume for automotive products in 2022 hit $1.6 trillion, with Germany and the U.S. leading exports and imports respectively. These figures highlight the globalized nature of the automotive electronics market.

Regional Analysis of Automotive Electronics Market

Asia-Pacific Dominates with 43.6% Market Share

Asia-Pacific leads the Automotive Electronics Market with 43.6% market share, valued at USD 122.0 billion. This dominance is driven by factors such as massive vehicle production in countries like China, Japan, and South Korea, alongside significant investments in advanced technologies, including ADAS and EV components. The region’s burgeoning middle class also drives demand for cost-effective and tech-enhanced vehicles.

The region benefits from an extensive supply chain, skilled labor, and government incentives promoting electrification and automation. Additionally, Asia-Pacific is home to some of the world’s largest automotive and electronics manufacturers, ensuring a consistent flow of innovations. Favorable trade policies and export opportunities further strengthen its position as a global leader in automotive electronics.

Looking ahead, Asia-Pacific’s influence will likely grow due to continued urbanization and a shift toward electric and autonomous vehicles. Countries in the region are expected to remain pivotal to global automotive trends, cementing their market share dominance over the next decade.

Regional Mentions:

- North America: North America accounts for a significant portion of the Automotive Electronics Market due to its robust innovation ecosystem and demand for advanced safety and infotainment systems. Regulatory mandates promoting vehicle safety enhance the market’s growth.

- Europe: Europe plays a key role, driven by stringent environmental regulations and a focus on electric vehicles. Germany leads with high investments in autonomous driving technologies and connected car infrastructure.

- Middle East & Africa: The region is gradually adopting automotive electronics, supported by investments in smart mobility projects and EV infrastructure. Rising urbanization and government initiatives boost market penetration.

- Latin America: Latin America is witnessing steady adoption of automotive electronics, particularly in Brazil and Mexico. The focus on vehicle efficiency and safety features drives the region’s progress, supported by growing local manufacturing capabilities.

Type Analysis

The Engine Control Units (ECU) and Drive Control Units (DCU) form the backbone of modern automotive electronics, commanding a dominant share of 69.3% in the market.

These units are pivotal in managing and optimizing the vehicle’s engine and transmission systems, directly influencing performance, fuel efficiency, and emissions.

The significant share held by EDU/DCU is attributed to the increasing complexity of automotive powertrains and the rising demand for more efficient, eco-friendly vehicles. As vehicles become more advanced, the role of ECUs and DCUs in managing electric powertrains, as well as integrating advanced driver-assistance systems (ADAS), becomes more critical, driving their market dominance.

Sensors play a crucial role in enhancing vehicle safety, efficiency, and connectivity. They are integral to the functioning of ADAS, providing the necessary data for systems like collision detection, lane departure warnings, and parking assistance. The proliferation of ADAS and the move towards autonomous vehicles are expected to drive the demand for sensors.

Power electronics are essential for managing the flow of electrical power in vehicles, especially in electric and hybrid vehicles. They convert and control the electric power to the drivetrain, battery charging, and other vehicle electronics. With the transition towards electrification, the importance of power electronics is set to increase, making it a key area for growth in the automotive electronics market.

Application Analysis

The Powertrain segment, accounting for 32.9% of the market, is fundamental to the operation of any vehicle.

It all components that generate power and deliver it to the road surface. This segment’s dominance is driven by the ongoing transition to electric and hybrid vehicles, which require sophisticated electronics for efficient power management, battery control, and energy recovery systems. Innovations in powertrain technology, aimed at improving fuel efficiency and reducing emissions, further bolster the demand for advanced electronics in this segment.

The body segment in electronics encompasses systems designed to enhance comfort and convenience, including automatic climate control, electric windows, and advanced lighting systems. Although these features are not as crucial as the powertrain, they significantly influence consumer purchasing decisions and contribute to vehicle differentiation.

In Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD), there is a notable evolution, with a heavy reliance on electronics for sensor processing, decision making, and vehicle control. This evolution is in response to tightening safety regulations and a rising consumer demand for safer vehicles, positioning the ADAS/AD segment for substantial growth.

The chassis segment comprises electronic systems that improve vehicle handling and stability, such as electronic stability control and anti-lock braking systems, which are vital for vehicle safety. This necessity drives the segment’s growth, paralleled by advancements in vehicle dynamics.

Vehicle Type Analysis

Passenger cars represent the largest segment in the Automotive Electronics Market, accounting for 74.6% of the market share.

This dominance is primarily driven by the increasing incorporation of advanced electronic systems in passenger vehicles, aimed at enhancing safety, efficiency, and comfort.

The demand for electronics in passenger cars is bolstered by consumer expectations for connectivity, infotainment, and advanced driver assistance systems (ADAS), alongside stringent regulatory standards for safety and emissions. The shift towards electric and hybrid vehicles further accentuates the need for sophisticated electronic control systems, battery management systems, and power electronics, contributing to the segment’s growth.

Commercial vehicles, while a smaller segment compared to passenger cars, are witnessing a growing integration of electronics for fleet management, cargo monitoring, and driver assistance systems. The adoption of telematics and ELD (Electronic Logging Devices) for regulatory compliance and operational efficiency is driving the demand within this segment.

As commercial vehicles increasingly adopt electric drivetrains and advanced safety features, the role of electronics in this segment is set to expand, contributing to overall market growth.

Propulsion Analysis

The propulsion segment is increasingly dominated by electric and hybrid vehicles, which currently represent 78.4% of the Automotive Electronics Market in this category.

This significant market share is a reflection of the global automotive industry’s shift towards sustainable mobility solutions. Electric and hybrid vehicles rely extensively on advanced electronic systems for propulsion, energy management, and battery monitoring, driving the demand for automotive electronics.

The push for electrification is further supported by governmental policies and incentives aimed at reducing carbon emissions, making electric and hybrid vehicles a key growth driver for the automotive electronics industry.

Despite the growing prominence of electric and hybrid vehicles, ICE vehicles continue to require electronic systems for engine management, emissions control, and fuel efficiency. While the share of ICE vehicles in the electronics market is diminishing in favor of electric and hybrid technologies, ongoing advancements in ICE technology and the integration of hybrid systems keep this segment relevant in the overall market landscape.

Sales Analysis

The Original Equipment Manufacturer (OEM) segment holds the majority of the market share in automotive electronics sales, accounting for 60.9%.

This dominance is attributed to the direct integration of electronic systems during vehicle manufacturing, ensuring compatibility and reliability.

OEMs are continuously innovating in electronic technologies to improve vehicle performance, safety, and user experience, driving the demand for advanced components. The collaboration between automotive manufacturers and technology providers is key to developing integrated electronic solutions that meet the evolving standards of connectivity, automation, and electrification.

The aftermarket segment, while smaller compared to OEM, plays a critical role in the Automotive Electronics Market by offering upgrades, replacements, and enhancements for existing vehicles. This segment caters to the demand for advanced infotainment systems, ADAS upgrades, and electric vehicle conversion kits, among others.

As vehicle owners seek to retrofit older vehicles with new technologies, the aftermarket provides an essential platform for extending the life and functionality of the automotive fleet, contributing to the overall growth of the automotive electronics market.

Key Market Segments

By Type

- EDU/DCU

- Sensors

- Power electronics

By Application

- Body

- Chassis

- Powertrain

- Infotainment

- ADAS/AD

By Vehicle type

- Passenger cars

- Commercial cars

By Propulsion

- ICE

- Electric/Hybrid

By Sales

- OEM

- Aftermarket

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Technological Advancements and Consumer Demand Drive Market Growth

The growth of the automotive electronics market is driven by several interconnected factors. Advancements in technology, such as the integration of artificial intelligence (AI), sensors, and Internet of Things (IoT) solutions, are revolutionizing vehicle functionalities. These technologies improve vehicle performance, safety, and connectivity, encouraging widespread adoption.

Additionally, increasing consumer demand for advanced driver-assistance systems (ADAS) and in-car infotainment is reshaping vehicle design and features. These systems enhance driving convenience and provide entertainment, which appeals to tech-savvy consumers.

Government regulations promoting vehicle safety also play a critical role, mandating the inclusion of electronic systems such as airbags, lane departure warnings, and collision avoidance systems. Furthermore, the rising trend of electric vehicles (EVs) is contributing significantly to market expansion. EVs rely heavily on advanced electronics for power management, battery monitoring, and autonomous driving capabilities

Restraining Factors

High Costs and Supply Chain Challenges Restrain Market Growth

The automotive electronics market faces growth restraints due to several critical challenges. High development and production costs of advanced electronic systems act as a barrier, particularly for mid-range and economy vehicle manufacturers. Additionally, the complexity of integrating electronics into traditional vehicle designs adds to engineering and manufacturing costs.

Supply chain disruptions also restrain growth, especially the ongoing shortage of semiconductors critical to electronic systems. Delays and bottlenecks in component availability have forced many automakers to scale back production, reducing market supply. Furthermore, cybersecurity risks associated with connected and autonomous vehicles raise concerns for consumers and manufacturers. Mitigating these risks requires significant investment in data protection and regulatory compliance, adding to overall costs.

Lastly, a lack of standardization in automotive electronics across regions creates challenges in designing universally compatible systems. This fragmentation complicates manufacturing processes and limits scalability, slowing the pace of innovation.

Growth Opportunities

Electrification and Smart Mobility Provide Opportunities

The automotive electronics market offers significant opportunities driven by the global shift toward electrification and smart mobility solutions. The rapid adoption of electric vehicles (EVs) presents a lucrative market for advanced electronics required in battery management, charging systems, and power distribution units.

As governments and industries invest heavily in EV infrastructure, companies can innovate in energy-efficient technologies to meet evolving standards. Additionally, the growing demand for smart and connected vehicles creates new avenues for developing advanced telematics, vehicle-to-everything (V2X) communication systems, and real-time data solutions.

Emerging markets in Asia-Pacific, Latin America, and the Middle East further amplify opportunities due to increasing vehicle ownership and infrastructure development. Players can tap into these regions with cost-effective and customized solutions tailored to local needs. Furthermore, the rise in subscription-based models for software-driven features, such as over-the-air updates and premium in-car services, enables sustained revenue streams.

Trending Factors

Autonomous Driving and AI Integration Are Latest Trending Factors

The automotive electronics market is witnessing significant growth due to trending factors like autonomous driving technologies and artificial intelligence (AI) integration. The demand for self-driving vehicles has accelerated the adoption of advanced sensors, LiDAR systems, and machine learning algorithms that enable vehicles to analyze and respond to their surroundings.

Moreover, AI-powered systems, such as predictive maintenance and personalized infotainment, are gaining traction. These technologies enhance vehicle efficiency, improve driver experiences, and reduce operational costs, making them essential for modern vehicles. The rise of shared mobility platforms, including ride-sharing and vehicle subscription models, further drives demand for connected and smart vehicle features.

Additionally, the increasing focus on sustainable transportation is pushing automakers to incorporate energy-efficient and lightweight electronic systems in vehicles. These systems are designed to enhance fuel efficiency and reduce emissions, aligning with global sustainability goals. The growing interest in vehicle electrification and digital transformation continues to amplify these trends, establishing a strong foundation for future advancements.

Competitive Landscape of Automotive Electronics Market

The automotive electronics market is dominated by leading Tier-1 suppliers, who drive innovation, supply cutting-edge technologies, and establish global partnerships with automakers. Key players include Robert Bosch GmbH, Continental AG, Denso Corporation, and ZF Friedrichshafen AG, which collectively shape market trends through technological advancements and strategic investments.

Robert Bosch GmbH leads with expertise in advanced driver-assistance systems (ADAS), powertrain solutions, and connected vehicle technologies. The company’s extensive R&D efforts and global manufacturing footprint allow it to deliver scalable and customized solutions, making it a preferred partner for automakers worldwide.

Continental AG focuses on safety systems, electrification, and autonomous driving technologies. The company is a pioneer in developing sensor-based solutions and software for connected vehicles, ensuring compliance with evolving safety regulations and consumer demand for smart mobility.

Denso Corporation excels in powertrain electrification, hybrid solutions, and thermal management systems. Its strong presence in the Asia-Pacific region, coupled with collaborations with major automakers, enables it to address the rising demand for energy-efficient and environmentally friendly technologies.

ZF Friedrichshafen AG specializes in drivetrain electrification and automation solutions. Its investments in intelligent systems and partnerships for autonomous vehicle development position the company as a leader in next-generation mobility solutions.

These companies act as Tier-1 suppliers, playing a critical role in integrating complex electronic systems into vehicles. They collaborate with Tier-2 and Tier-3 suppliers for components like semiconductors and sensors, ensuring a seamless value chain. Collectively, these players drive market innovation, enabling automakers to meet regulatory demands, sustainability goals, and evolving consumer preferences.

Market Key Players

- Xiling INC

- Visteon Corporation

- Hitachi Automotive Systems, ltd

- Valeo Inc

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Infineon Technologies

- Heela GmbH and Co kga

- Denso Corporation

- Continental AG

- Nvidia Corporation

- Philips N.V

Recent News in Automotive Electronics Market

- On January 2024, Diodes Incorporated has recently launched the AH371xQ series, an advanced Hall-effect latch designed specifically for automotive applications. This series features a Hall plate design, offering enhanced performance and versatility in automotive systems.

- In January 2024, Arrow Electronics, Inc. and its engineering services company, eInfochips, have expanded their Automotive Centre of Excellence (CoE) in Egypt to support the development of next-generation automotive products.

- On October 2023, Samsung Electronics unveiled its advanced and wide-ranging automotive process solutions at the Samsung Foundry Forum 2023 Europe. The company showcased its automotive process strategy, which includes solutions ranging from the most advanced 2-nanometer process to the 8-inch legacy process.

Report Scope

Report Features Description Market Value (2023) USD 279.8 Billion Forecast Revenue (2033) USD 656.4 Billion CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (EDU/DCU , Sensors , Power electronics), By Application (Body, Chassis, Powertrain, Infotainment, ADAS/AD), By Vehicle type (Passenger cars , Commercial cars), By Sales (OEM , Aftermarket), By Propulsion (ICE , Electric/Hybrid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xiling INC, Visteon Corporation, Hitachi Automotive Systems, ltd, Valeo Inc, ZF Friedrichshafen AG, Robert Bosch GmbH, Infineon Technologies, Heela GmbH and Co kga, Denso Corporation, Continental AG, Nvidia Corporation, Philips N.V Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Electronics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Electronics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Xiling INC

- Visteon Corporation

- Hitachi Automotive Systems, ltd

- Valeo Inc

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Infineon Technologies

- Heela GmbH and Co kga

- Denso Corporation

- Continental AG

- Nvidia Corporation

- Philips N.V