Global Automotive Battery Recycling Market Size, Share Analysis Report By Battery Type (Lead Acid Batteries, Lithium-Ion Batteries, Nickel-Metal Hydride (Nimh) Batteries, Others), By Recycling Process (Hydrometallurgical Process, Pyrometallurgical Process, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electic Vehicles (EV)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171703

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

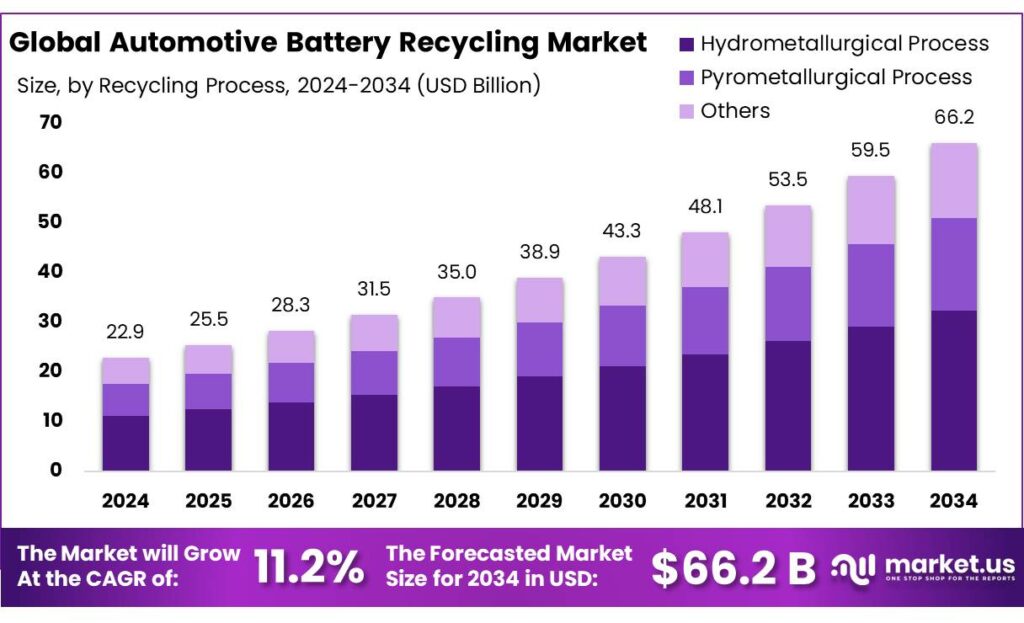

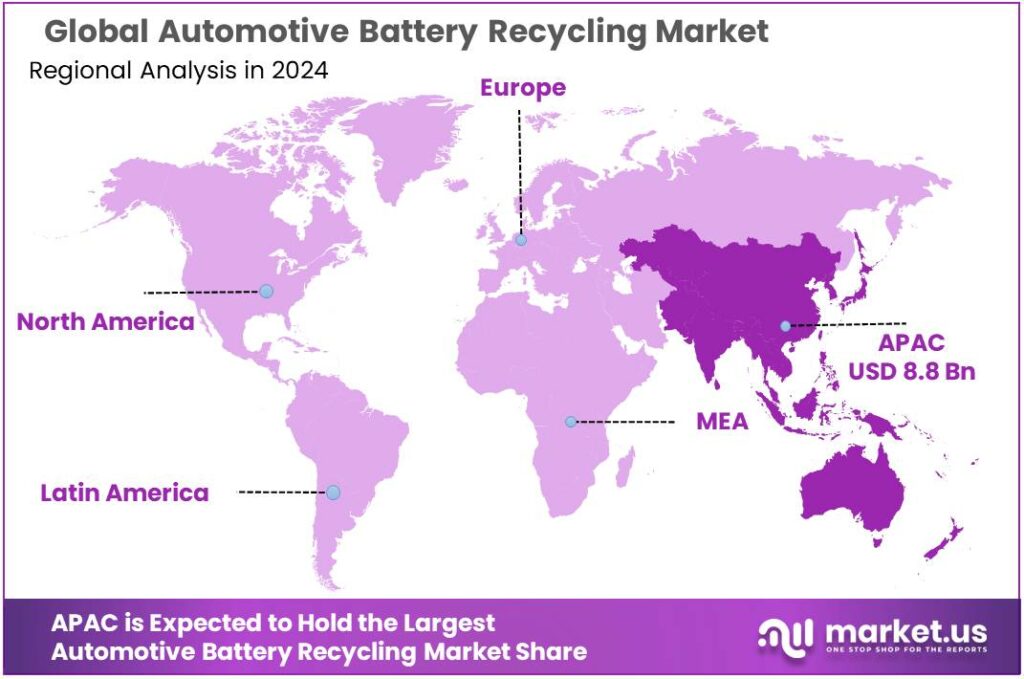

The Global Automotive Battery Recycling Market size is expected to be worth around USD 66.2 Billion by 2034, from USD 22.9 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.5% share, holding USD 8.8 Billion in revenue.

Automotive battery recycling is moving from a “waste-management” activity to a strategic industrial supply chain for metals, plastics, and battery-grade precursors. This shift is being driven by the rapid rise in electric vehicles and the need to reduce exposure to volatile, geopolitically concentrated raw-material markets. The International Energy Agency reports electric car sales exceeded 17 million globally in 2024, taking EV share to over 20% of total car sales. That scale means end-of-life batteries are no longer a niche stream—recycling is becoming part of mainstream automotive manufacturing planning.

Industrially, the sector now runs on two parallel tracks. First is the mature lead-acid battery loop used widely in conventional vehicles: the U.S. lead battery recycling rate is about 99%, and more than 160 million lead batteries are recycled in the U.S. each year; new U.S.-made lead-acid batteries typically contain over 80% recycled material.

Regulation is a major accelerator because it makes recycling measurable and bankable. In the EU, the Batteries Regulation sets minimum recycled-content requirements for new batteries, including 16% cobalt, 6% lithium, 6% nickel, and 85% lead by 2031, rising to 26% cobalt, 12% lithium, and 15% nickel by 2036. In India, Battery Waste Management Rules introduce rising recovery expectations for EV batteries, with targets starting at 70% in 2024–25, reinforcing extended producer responsibility across chemistries.

Public funding is also accelerating plant buildouts and process innovation. The U.S. Department of Energy’s Battery Materials Processing Grants program lists $3 billion in funding, with $600 million appropriated annually for fiscal years 2022–2026, supporting commercial-scale facilities and retrofits that can include recycling-linked processing capacity.

Government and trusted-industry funding is also shaping capacity and technology scaling. The U.S. Department of Energy notes it has awarded $1.82 billion to 14 projects under battery manufacturing and recycling-linked grants to expand commercial-scale facilities and demonstrate approaches using recycled materials. Separately, DOE’s EV battery recycling and second-life program awarded $74 million to 10 projects in its first phase, as part of a planned $200 million effort under the Infrastructure Investment and Jobs Act. These public signals reduce financing risk for recyclers and encourage automakers to sign longer-term offtake and closed-loop supply agreements.

Key Takeaways

- Automotive Battery Recycling Market size is expected to be worth around USD 66.2 Billion by 2034, from USD 22.9 Billion in 2024, growing at a CAGR of 11.2%.

- Lead Acid Batteries held a dominant market position, capturing more than a 69.8% share.

- Hydrometallurgical Process held a dominant market position, capturing more than a 48.9% share.

- Passenger Cars held a dominant market position, capturing more than a 61.2% share.

- Asia Pacific (APAC) region emerged as the dominant contributor to the Automotive Battery Recycling Market, accounting for approximately 38.5% of global revenue with an estimated market size of USD 8.8 billion.

By Battery Type Analysis

Lead Acid Batteries dominate with 69.8% due to high recyclability and strong recovery value.

In 2024, Lead Acid Batteries held a dominant market position, capturing more than a 69.8% share in the global automotive battery recycling market by battery type. This leadership was mainly supported by the well-established recycling ecosystem for lead acid batteries, where collection rates remained high due to regulatory mandates and attractive scrap value. The recycling process allowed recovery of a large portion of lead and plastic components, which were reused in new battery production, supporting circular economy practices. In 2025, demand for recycled lead continued to grow as automotive manufacturers and battery producers focused on cost control and raw material security.

By Recycling Process Analysis

Hydrometallurgical Process dominates with 48.9% due to its higher metal recovery rates and lower environmental impact.

In 2024, Hydrometallurgical Process held a dominant market position, capturing more than a 48.9% share in the Automotive Battery Recycling Market by recycling process. This leadership was mainly supported by its ability to recover valuable metals such as lithium, cobalt, nickel, and manganese with high purity using chemical solutions rather than high-temperature treatment. The process was widely preferred as it generated fewer emissions and allowed better control over material separation compared to conventional methods.

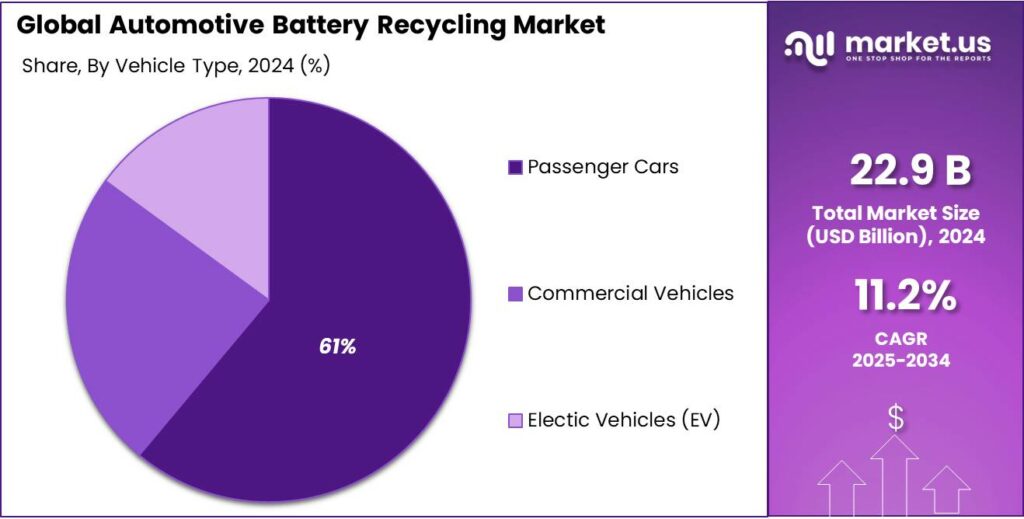

By Vehicle Type Analysis

Passenger Cars dominate with 61.2% due to higher vehicle population and frequent battery replacement cycles.

In 2024, Passenger Cars held a dominant market position, capturing more than a 61.2% share in the automotive battery recycling market by vehicle type. This leadership was driven by the large global fleet of passenger vehicles and regular battery replacements linked to daily usage patterns. The segment generated consistent end-of-life battery volumes, supporting stable recycling demand. In 2025, continued growth in vehicle ownership and aging car fleets sustained recycling activity, keeping passenger cars as the primary contributor to market volumes.

Key Market Segments

By Battery Type

- Lead Acid Batteries

- Lithium-Ion Batteries

- Nickel-Metal Hydride (Nimh) Batteries

- Others

By Recycling Process

- Hydrometallurgical Process

- Pyrometallurgical Process

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electic Vehicles (EV)

Emerging Trends

Battery Passport traceability is becoming the new normal

One major latest trend in automotive battery recycling is the move toward data-led recycling, where recyclers must prove what they recover, where it came from, and how it will be reused. This is being driven heavily by Europe’s new battery rules, which are turning traceability into a business requirement. The EU has set mandatory minimum recycled-content levels for industrial, SLI, and EV batteries—initially 16% cobalt, 85% lead, 6% lithium, and 6% nickel—and it also requires recycled content documentation.

That is why the Digital Battery Passport is shifting from “future concept” to “daily workflow.” Guidance linked to the EU regulation explains that an electronic record (battery passport) is mandated from 18 February 2027 for relevant batteries. In practical terms, this trend is changing how recycling plants prepare for incoming packs. If a recycler knows the battery’s chemistry, manufacturer, and key identifiers in advance, it can route the pack to the right line, reduce mis-sorting, and plan safer dismantling. This matters because EV batteries are not identical: different chemistries and pack designs can change the safest way to discharge, shred, and recover materials.

This trend is also happening because the volume behind it is growing quickly. The IEA reports electric car sales topped 17 million worldwide in 2024, rising by more than 25%, and reaching a sales share of more than 20% of new cars sold globally. As the number of batteries in use rises, the recycling system needs to handle more variety and more throughput. A passport-style data layer helps the industry scale with fewer mistakes, because operators can match batteries to the correct recycling route and compliance paperwork.

There’s a useful parallel in food systems, where tracking and measurement are also becoming central to cutting waste. UNEP estimates that in 2022 the world wasted 1.05 billion tonnes of food—about 19% of food available to consumers—with 631 million tonnes from households, 290 million tonnes from food service, and 131 million tonnes from retail. Food organizations emphasize measurement because it reveals where losses happen and where investments pay back fastest.

Drivers

Regulation-led recycled content demand is accelerating recycling

A major driving factor for automotive battery recycling is that governments are turning “recycling” into a measurable compliance requirement, not a voluntary promise. In the EU, the batteries regulation sets mandatory minimum recycled-content levels for batteries placed on the market—initially 16% cobalt, 85% lead, 6% lithium, and 6% nickel—and it also requires documentation to prove those claims. That single policy shift changes buyer behavior: automakers and cell makers now have to contract recycled materials early, because compliance is about verified inputs, not just end-of-life collection.

In the United States, policy is also tilting economics toward domestic circular supply chains. The federal Section 45X credit includes a benefit for battery cells equal to $35 per kWh of capacity, which is a meaningful support lever for local battery ecosystems that integrate recycling and material processing. When production incentives are this specific, companies work harder to secure reliable local feedstocks—especially when mined supply is exposed to geopolitical risk and price swings. Recycling becomes the practical “insurance policy” that keeps factories running when global supply tightens.

- Public funding programs reinforce the same direction. The U.S. Department of Energy’s Battery Materials Processing Grants program highlights $3 billion in funding, including $600 million appropriated annually for fiscal years 2022–2026, supporting commercial-scale facilities and retrofits for battery materials processing—an umbrella that can include recycling-linked capacity and upgrades. For recyclers, this matters because scaling safely is capital-heavy: emissions controls, fire protection, wastewater treatment, and lab QA are not optional, and grants can bridge early cost gaps.

The UN Environment Programme estimates 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, with 60% of that waste from households, 28% from food service, and 12% from retail. At the same time, FAO has long highlighted that roughly one-third of food produced for human consumption is lost or wasted globally—about 1.3 billion tonnes—showing how big the cold-chain and delivery challenge really is.

Restraints

High Cost and Complex Logistics Limit Battery Recycling Expansion

One major restraining factor slowing the growth of automotive battery recycling is the high cost of recycling paired with complex logistics. This issue isn’t just a technical problem; it affects real people — from workers handling hazardous battery packs to communities deciding whether to host recycling facilities. Unlike recycling simple materials like aluminum or paper, automotive lithium-ion batteries are made of many mixed materials — lithium, nickel, cobalt, manganese, copper, plastics, and adhesives — and they can still hold dangerous electrical charge. Safely collecting, transporting, disassembling, and processing these batteries takes specialized equipment, training, and strict safety controls, all of which add real costs that often outweigh the value of the recovered materials.

Government support is trying to help, but it doesn’t fully eliminate these barriers. For example, the U.S. Department of Energy’s Battery Materials Processing Grants program includes funding outlays — roughly $600 million per year from 2022 through 2026 — meant to help build processing and recycling capacity. While this support reduces upfront risk, it cannot completely offset the cost gap in most commercial settings. Developing a safe, compliant recycling line still demands millions in capital expenditure, environmental controls, skilled technicians, and ongoing operational costs.

The UN Environment Programme estimated that 1.05 billion tonnes of food were wasted in 2022, equivalent to 19% of food available to consumers, with a majority lost in households or retail environments. This loss represents not just wasted food, but wasted logistics, labor, packaging, transport energy, and storage infrastructure. Like battery recycling, fixing food waste requires investment — in proper cooling, tracking systems, handling protocols, and distribution networks — and those up-front costs make some actors hesitant to act quickly without clear economic return.

Opportunity

Closed-loop supply deals for EV makers and fleets

A major growth opportunity in automotive battery recycling is closed-loop supply—where recyclers don’t just “take waste,” they deliver battery-grade nickel, cobalt, and lithium back into new batteries under long-term contracts. This opportunity is getting bigger because the battery market is still expanding fast. The International Energy Agency (IEA) reports electric car sales topped 17 million in 2024, rising by more than 25%, and EVs reached more than 20% of new car sales worldwide.

Regulation is turning this into a “must-buy” market, not a “nice-to-have” market. In the EU, the batteries regulation sets mandatory minimum recycled-content levels for certain battery categories—initially 16% cobalt, 85% lead, 6% lithium, and 6% nickel—and requires recycled-content documentation. That creates a clear business opening: recyclers who can consistently produce verified battery-grade materials can become compliance partners to automakers and cell makers selling into Europe. It also rewards investments in traceability and quality testing, because the value is not only the metal—it is the proof that the metal qualifies.

In the United States, public funding and industrial policy are also pushing the same direction: build domestic, resilient supply chains that can use recycled inputs. The U.S. Department of Energy’s Battery Materials Processing Grants program shows $600 million appropriated annually for fiscal years 2022 through 2026 (available until expended), supporting demonstration projects and commercial-scale facilities for battery material processing. In addition, DOE notes it has awarded $1.82 billion to 14 projects under battery materials processing and manufacturing grant selections, including approaches that use recycled materials.

A second growth lane is serving electrified fleets that move essential goods—especially food. Food supply chains are under pressure to cut waste and improve delivery efficiency, and electrification is one of the tools being adopted in cities. UNEP estimates that in 2022 the world wasted 1.05 billion tonnes of food, equal to 19% of food available to consumers, including 631 million tonnes from households, 290 million tonnes from food service, and 131 million tonnes from retail.

Regional Insights

APAC leads with 38.50% share valued at USD 8.8 Bn, driven by strong automotive electrification and recycling initiatives.

In 2024, the Asia Pacific (APAC) region emerged as the dominant contributor to the Automotive Battery Recycling Market, accounting for approximately 38.5% of global revenue with an estimated market size of USD 8.8 billion. This leadership reflected the region’s strong automotive production base, rapid adoption of electric vehicles (EVs), and expanding recycling infrastructure that processed both conventional lead-acid and end-of-life lithium-ion batteries.

APAC’s share was supported by the sheer volume of vehicles in markets such as China, Japan, South Korea, and India, where electrification policies and regulatory mandates spurred the establishment of formal battery collection and recycling networks. Governments across the region introduced or strengthened policies requiring battery manufacturers to manage end-of-life flows and increase material recovery rates, which improved recycling economics and sustainability outcomes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Call2Recycle Inc. operates as a leading nonprofit battery recycling and stewardship program in the United States and Canada, facilitating end-of-life battery collection and material recovery across consumer and commercial applications. With more than 16,000 drop-off locations and ongoing partnerships with retailers and municipalities, the organization plays an important role in diverting spent batteries from landfill and recovering valuable components for reuse.

East Penn Manufacturing Co. Inc. is a U.S. battery producer with strong involvement in recycling lead-acid automotive batteries. Through participation in industry recycling initiatives, it supports domestic recycling capacity expansion and resource recovery, addressing North American demand for secondary lead materials and promoting responsible end-of-life management across conventional automotive battery types.

Top Key Players Outlook

- Accurec Recycling GmbH

- Call2Recycle Inc.

- Contemporary Amperex Technology Co. Ltd.

- Duesenfeld GmbH

- East Penn Manufacturing Co. Inc.

- Ecobat LLC

- ENGITEC TECHNOLOGIES SPA

- Exide Industries Ltd.

- Fortum Oyj

- Glencore Plc

Recent Industry Developments

In 2024, Accurec operated its lithium-ion recycling facility in Krefeld, Germany, processing about 4,000 tons of end-of-life batteries annually and recovering high-value metals such as lithium, nickel, and cobalt using its proprietary hydrometallurgical and mechanical processes that support circular supply chains and reduce resource dependency on mining.

In 2024, Call2Recycle Canada’s program reported that more than 6.8 million kg of used batteries were collected and recycled, marking a 17 % year-over-year increase and contributing to a cumulative total exceeding 50 million kg diverted since the organization’s inception.

Report Scope

Report Features Description Market Value (2024) USD 22.9 Bn Forecast Revenue (2034) USD 66.2 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lead Acid Batteries, Lithium-Ion Batteries, Nickel-Metal Hydride (Nimh) Batteries, Others), By Recycling Process (Hydrometallurgical Process, Pyrometallurgical Process, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electic Vehicles (EV)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Accurec Recycling GmbH, Call2Recycle Inc., Contemporary Amperex Technology Co. Ltd., Duesenfeld GmbH, East Penn Manufacturing Co. Inc., Ecobat LLC, ENGITEC TECHNOLOGIES SPA, Exide Industries Ltd., Fortum Oyj, Glencore Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Battery Recycling MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Battery Recycling MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accurec Recycling GmbH

- Call2Recycle Inc.

- Contemporary Amperex Technology Co. Ltd.

- Duesenfeld GmbH

- East Penn Manufacturing Co. Inc.

- Ecobat LLC

- ENGITEC TECHNOLOGIES SPA

- Exide Industries Ltd.

- Fortum Oyj

- Glencore Plc