Global Automotive Active Safety System Market Size, Share, Growth Analysis By Product Type (Anti-Lock Braking Systems, Electronic Stability Control, Adaptive Cruise Control, Lane Departure Warning Systems, Blind Spot Detection, Forward Collision Warning Systems, Tire Pressure Monitoring Systems, Others), By Technology (Radar-Based Systems, Camera-Based Systems, Lidar-Based Systems, Ultrasonic Sensors), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Propulsion Type (Internal Combustion Engine Vehicles, Electric Vehicles, Hybrid Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138157

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

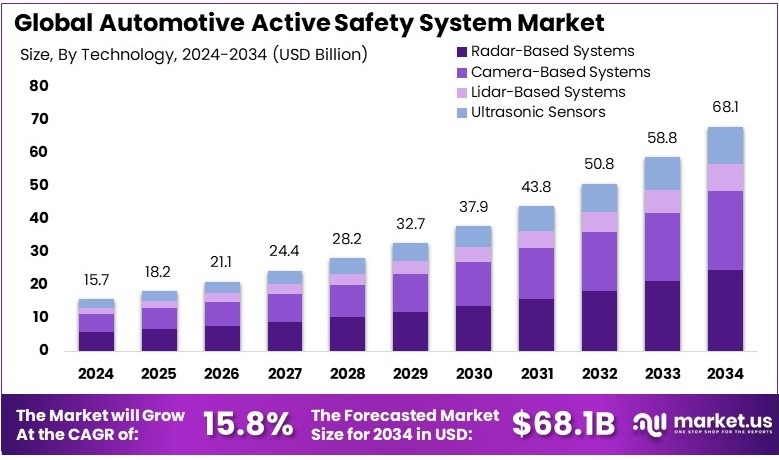

The Global Automotive Active Safety System Market size is expected to be worth around USD 68.1 Billion by 2034, from USD 15.7 Billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034.

An Automotive Active Safety System refers to technologies in vehicles designed to prevent accidents or reduce their severity. These systems include features like automatic emergency braking, lane-keeping assist, adaptive cruise control, and collision warning, aiming to improve driver safety and prevent accidents.

The Automotive Active Safety System Market involves the sale and development of active safety technologies in vehicles. It covers market trends, key players, product innovations, and regional demand for safety features in automobiles. The market includes systems such as automatic braking, lane departure warnings, and adaptive cruise control.

Automotive Active Safety Systems are designed to prevent accidents before they happen. These systems, including automatic emergency braking (AEB) and lane-keeping assist, help reduce crashes significantly. According to the Insurance Institute for Highway Safety (IIHS), AEB-equipped vehicles experience 50% fewer rear-end crashes. This proves their effectiveness in enhancing road safety.

The market for automotive active safety systems is expanding rapidly. With the increasing adoption of features like ADAS (Advanced Driver Assistance Systems), the demand for these systems is projected to grow. In fact, 60% of U.S. consumers would consider buying a car with ADAS, with safety concerns being a key motivator.

The growing demand for safety features in vehicles is a major factor driving the market’s growth. As consumer preferences shift toward safer cars, automakers are integrating more ADAS features. The market also benefits from the increasing regulatory push for safer road conditions. For example, new regulations are pushing manufacturers to adopt these systems faster.

The automotive active safety market is competitive but still has room for growth. Many players are entering the market, offering innovative solutions like LiDAR-based collision avoidance sensors. While some regions, such as Europe, are more saturated, emerging markets still present opportunities for expansion. Innovation is key for staying ahead.

Governments are increasingly investing in road safety, influencing the growth of active safety systems. New regulations are promoting the use of technologies like AEB and lane-assist. In some countries, these systems are even becoming mandatory in new vehicles, creating more opportunities for suppliers. This regulation push is driving investment into advanced safety solutions.

Key Takeaways

- The Automotive Active Safety System Market was valued at USD 15.7 billion in 2024 and is expected to reach USD 68.1 billion by 2034, with a CAGR of 15.8%.

- In 2024, Adaptive Cruise Control (ACC) dominates the product type segment with 27.4% due to its growing adoption in autonomous and semi-autonomous vehicles.

- In 2024, Radar-Based Systems lead the technology segment with 36.1%, driven by their precision and ability to function in various weather conditions.

- In 2024, Passenger Cars dominate the vehicle type segment with 31.3%, reflecting their widespread adoption of active safety systems for improved driving safety.

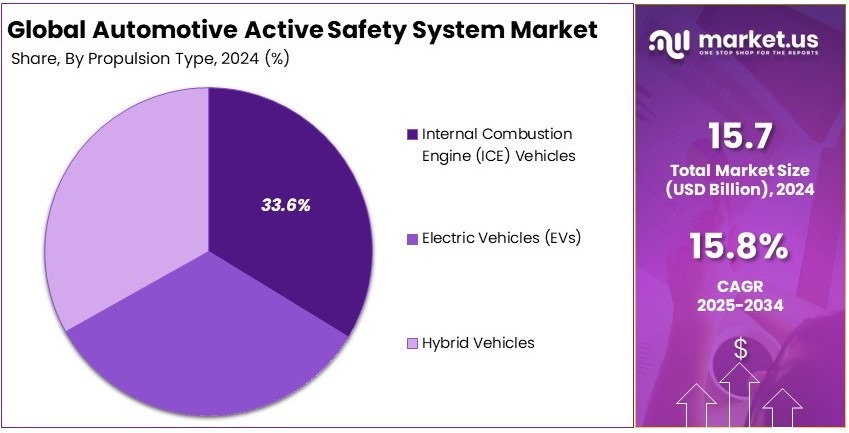

- In 2024, Internal Combustion Engine (ICE) Vehicles dominate the propulsion type segment with 33.6%, as they remain the primary vehicle type in most markets.

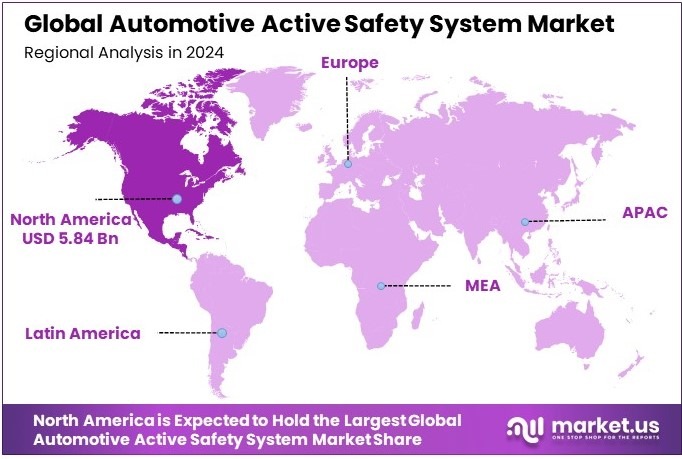

- In 2024, North America leads the regional market with 37.2% share, valued at USD 5.84 billion, due to strong automotive industry investments and high adoption of safety features.

Product Type Analysis

Adaptive Cruise Control dominates with 27.4% due to its growing popularity in improving driving convenience and safety.

The Automotive Active Safety System Market is experiencing significant growth in various product types. Among them, Adaptive Cruise Control (ACC) stands out, holding the largest market share of 27.4%. ACC is a system that automatically adjusts a vehicle’s speed to maintain a safe distance from the car ahead.

It is particularly popular because it enhances driving comfort, reduces fatigue, and increases safety. With growing consumer demand for autonomous driving features and enhanced safety systems, ACC is increasingly being installed in mid-range and high-end vehicles. In addition, advancements in sensor technology and data processing have made ACC systems more effective and affordable.

Other product types, including Anti-Lock Braking Systems (ABS), Electronic Stability Control (ESC), and Forward Collision Warning Systems (FCWS), also contribute to the market but to a lesser extent. ABS, which helps prevent wheel lock during braking, is one of the most common systems in vehicles today, improving overall safety.

ESC, another crucial system, helps maintain vehicle stability, reducing the risk of skidding and rollovers. Despite their importance, these systems do not have the same level of demand as ACC due to the growing preference for semi-autonomous features that ACC offers. Similarly, systems like Lane Departure Warning Systems (LDWS) and Blind Spot Detection (BSD) are vital for driving safety but have a smaller market share compared to ACC.

The remaining product types, such as Tire Pressure Monitoring Systems (TPMS) and other safety technologies, hold a smaller yet important role in the overall market growth. TPMS helps prevent tire blowouts, and other technologies aim to further enhance driver safety and vehicle control.

Technology Analysis

Radar-Based Systems dominate with 36.1% due to their superior reliability and performance in active safety applications.

Radar-based systems hold the largest share in the technology segment, accounting for 36.1% of the market. This technology plays a crucial role in detecting objects in the vehicle’s path, especially in poor weather conditions or low visibility. Radar systems are highly reliable for collision avoidance and adaptive cruise control features.

Their ability to operate under challenging conditions, such as rain, fog, or snow, makes them indispensable in active safety systems. Furthermore, radar technology is relatively cost-effective and less sensitive to lighting conditions, allowing it to be widely implemented in vehicles across different price segments.

Camera-based systems, while increasingly popular, hold a smaller share of the market compared to radar. These systems provide clear images of the vehicle’s surroundings, which helps in lane-keeping assistance and object recognition.

However, they are often limited by environmental factors like glare or darkness, reducing their effectiveness in some conditions. Lidar-based systems, known for their high precision, also contribute to the market but are not as widely used as radar. They are expensive and have yet to be adopted at the same scale as radar, especially in mass-market vehicles.

Ultrasonic sensors are another important technology, mainly used for parking assistance and close-range obstacle detection. While essential for certain functions, they are not as integral to active safety as radar-based systems.

Vehicle Type Analysis

Passenger Cars dominate with 31.3% due to their larger consumer base and broader adoption of safety features.

The vehicle type segment of the Automotive Active Safety System Market is largely led by passenger cars, which hold 31.3% of the market share. This dominance is due to the higher number of passenger cars on the road and the increasing demand for safety features in these vehicles.

With more consumers prioritizing vehicle safety, manufacturers are equipping passenger cars with advanced safety technologies such as Adaptive Cruise Control (ACC), Lane Departure Warning Systems (LDWS), and Blind Spot Detection (BSD). Additionally, government regulations and safety standards are pushing car manufacturers to include more active safety systems in passenger vehicles, further driving their market share.

Light Commercial Vehicles (LCVs) also play a significant role in the market, although they account for a smaller share compared to passenger cars. The adoption of safety technologies in LCVs is mainly driven by the growing focus on protecting drivers and cargo from road hazards, as well as regulatory pressure for safer commercial vehicles.

Heavy Commercial Vehicles (HCVs), which include large trucks and buses, are crucial in the market but represent a smaller percentage. The integration of active safety features in HCVs is essential due to the size and weight of these vehicles, which can make them more prone to accidents. However, the high cost of implementing advanced safety systems in such large vehicles limits their widespread adoption compared to passenger cars and LCVs.

Propulsion Type Analysis

ICE Vehicles dominate with 33.6% due to their established presence in the market and broader adoption of active safety systems.

Internal Combustion Engine (ICE) vehicles are the leading segment in the propulsion type category, with 33.6% market share. ICE vehicles have been the dominant type of vehicles on the road for decades, and their adoption of active safety systems is widespread.

As safety technologies become standard in ICE vehicles, manufacturers are increasingly integrating features like radar-based systems, adaptive cruise control, and lane-keeping assistance. ICE vehicles continue to hold the largest share in the market due to their established infrastructure, lower initial costs compared to electric or hybrid vehicles, and extensive consumer base.

Electric Vehicles (EVs), while growing rapidly, hold a smaller market share in the automotive safety systems market. EVs are attracting a larger consumer base due to their environmental benefits, lower operating costs, and advanced technologies.

Hybrid Vehicles, which combine both internal combustion and electric propulsion systems, also contribute to the market but hold a smaller share than both ICE and EVs. The hybrid vehicle market is expected to grow as consumers seek more fuel-efficient options, but the penetration of active safety systems in this segment is currently lower than in ICE vehicles.

Key Market Segments

By Product Type

- Anti-Lock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Adaptive Cruise Control (ACC)

- Lane Departure Warning Systems (LDWS)

- Blind Spot Detection (BSD)

- Forward Collision Warning Systems (FCWS)

- Tire Pressure Monitoring Systems (TPMS)

- Others

By Technology

- Radar-Based Systems

- Camera-Based Systems

- Lidar-Based Systems

- Ultrasonic Sensors

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

Driving Factors

Rising Demand for Advanced Driver Assistance Systems (ADAS) Drives Market Growth

The growing demand for Advanced Driver Assistance Systems (ADAS) is a major catalyst for the Automotive Active Safety System Market. ADAS technologies, such as lane-keeping assist, automatic emergency braking, adaptive cruise control, and collision avoidance, have become key selling points for automakers aiming to offer safer, more advanced vehicles.

Consumers are increasingly prioritizing safety features, leading to a surge in the adoption of vehicles equipped with these systems. This demand is further driven by government regulations worldwide that require automakers to incorporate specific safety features in new vehicles. For instance, the European Union and the United States have implemented strict regulations requiring systems like emergency braking and lane departure warning in all new cars.

These regulatory changes are creating a ripple effect across the global market, encouraging manufacturers to innovate and integrate ADAS technologies at an accelerated pace. The increasing public awareness about road safety and the potential to reduce accidents also helps drive the market.

Moreover, as ADAS technologies become more affordable, especially with advancements in sensors and artificial intelligence (AI), automakers can now offer these systems at lower prices, which helps further stimulate demand.

Restraining Factors

High Costs and Integration Challenges Restrain Market Growth

Despite the positive outlook for the Automotive Active Safety System Market, certain factors act as restraints, particularly high costs and integration complexities. Advanced safety technologies require sophisticated sensors, cameras, radar, and processing units, all of which contribute to a significant increase in vehicle costs.

In addition, the cost of maintaining and repairing these systems over the vehicle’s lifespan adds an additional financial burden for consumers. The complexity involved in integrating these systems into existing vehicle models is another major challenge.

Manufacturers face difficulties in ensuring that newer active safety technologies seamlessly integrate with older car models, which were not originally designed to accommodate such sophisticated systems.

This problem is particularly relevant in the case of aftermarket retrofitting, where additional costs and technical hurdles make the integration process less appealing for consumers. Furthermore, there is limited awareness about the benefits of active safety systems in emerging markets, where car buyers may not fully appreciate the value of these technologies.

Growth Opportunities

Rising Adoption of AI and Connected Car Technologies Provides Opportunities

The increasing use of Artificial Intelligence (AI) and connected car technologies presents significant opportunities for the growth of the Automotive Active Safety System Market. AI can enhance the functionality of active safety systems by enabling vehicles to learn and adapt to their surroundings in real-time.

These technologies improve a vehicle’s overall awareness, making it better equipped to respond to changing driving conditions and potential hazards. In parallel, the rise of connected car technologies, including Vehicle-to-Vehicle (V2V) communication, creates additional growth potential. V2V communication allows cars to exchange information, such as speed, direction, and traffic conditions, which can prevent accidents by alerting drivers about potential hazards they may not yet see.

As the adoption of smart cities and connected infrastructures grows, V2V communication will likely become an essential feature of future vehicles. Together, AI and connected car technologies can dramatically enhance the effectiveness of automotive active safety systems, providing manufacturers with opportunities to differentiate themselves in the market.

Emerging Trends

AI and V2V Communication Are Latest Trending Factors

The latest trends in the Automotive Active Safety System Market revolve around the adoption of Artificial Intelligence (AI) and Vehicle-to-Vehicle (V2V) communication systems, both of which are transforming the way cars perceive and respond to their environments.

AI, with its ability to analyze large datasets and make real-time decisions, enhances the performance of safety systems, such as adaptive cruise control and automatic emergency braking. AI-powered systems learn from previous experiences and continuously improve, making vehicles more intuitive and capable of avoiding accidents.

For example, AI can predict the likelihood of an obstacle in the vehicle’s path and take preemptive action, such as braking or steering away, to prevent a crash. Meanwhile, V2V communication is another emerging trend that enables cars to share information with one another to improve safety.

V2V communication also plays a critical role in enhancing situational awareness, especially in areas with high traffic congestion. The rapid growth of these technologies shows how the automotive industry is evolving towards creating smarter and safer vehicles.

Regional Analysis

North America Dominates with 37.2% Market Share

North America holds a dominant 37.2% share of the Automotive Active Safety System Market, valued at approximately USD 5.84 billion. This leadership position is driven by several key factors, including the region’s strong automotive industry, widespread adoption of advanced safety technologies, and high consumer demand for vehicle safety features. With major automotive manufacturers and tech companies investing heavily in safety innovations, North America continues to lead the charge.

The region’s technological advancements in active safety systems, such as automatic emergency braking, lane-keeping assist, and adaptive cruise control, are crucial drivers of its market share. The high penetration of electric and autonomous vehicles in North America also boosts the adoption of advanced safety systems, as these vehicles rely on these technologies for efficient operation.

Additionally, regulatory frameworks in the U.S. and Canada encourage automakers to meet stringent safety standards, further propelling market growth.

Regional Mentions:

- Europe: Europe, accounting for a significant share of the automotive market, focuses on high safety standards and technological advancements. Strict regulations, such as the European New Car Assessment Programme (Euro NCAP), promote the adoption of advanced safety systems across various vehicle types.

- Asia Pacific: Asia Pacific is expanding its footprint in the market, driven by strong automotive manufacturing hubs like China, Japan, and South Korea. Innovations in autonomous vehicles and the increasing adoption of advanced safety technologies in new models are key drivers of growth in the region.

- Middle East & Africa: The Middle East & Africa are seeing gradual market expansion, with the rising demand for luxury and high-performance vehicles equipped with active safety features. The region’s automotive market is also boosted by the growing focus on road safety and infrastructural improvements in urban areas.

- Latin America: Latin America is witnessing slow but steady growth in the adoption of active safety systems. Rising vehicle sales and consumer awareness about safety features, along with increasing regulatory standards, contribute to the expansion of active safety technology in this region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Automotive Active Safety System Market is characterized by the presence of several key players that are driving innovation and market growth. Among the top companies, Bosch Group, Denso Corporation, Autoliv Inc., and Delphi Technologies stand out due to their strong technological advancements, extensive product portfolios, and strategic partnerships.

Bosch Group is a leading player in the automotive safety systems market, offering a wide range of active safety solutions, including radar sensors, braking systems, and electronic stability control. The company’s strong research and development efforts allow it to stay at the forefront of active safety innovations, particularly in autonomous driving and driver assistance technologies.

Denso Corporation is another major player, known for its expertise in electronic systems and safety solutions. Denso provides active safety technologies such as advanced driver-assistance systems (ADAS), including collision detection and emergency braking. The company’s focus on integrating AI and sensor technologies into its products has helped it establish a strong presence in the global market.

Autoliv Inc. is a key supplier of safety systems, particularly in airbags, seatbelts, and active safety technologies. Autoliv’s active safety solutions include lane-keeping assistance, adaptive cruise control, and forward collision warning systems. The company has formed strategic partnerships with leading automakers to develop next-generation safety technologies aimed at reducing traffic-related fatalities.

Delphi Technologies, now part of BorgWarner, is recognized for its role in automotive active safety systems, particularly in vehicle control systems, sensors, and ADAS technologies. The company is focused on enhancing vehicle safety and efficiency through advanced safety technologies that are compatible with both traditional and electric vehicles.

These top players continue to lead the automotive active safety systems market, contributing to its growth through technological advancements, strategic collaborations, and a focus on providing safer, smarter driving experiences.

Major Companies in the Market

- Bosch Group

- Denso Corporation

- Autoliv Inc.

- Delphi Technologies

- Magna International Inc.

- Aptiv PLC

- TRW Automotive (ZF Friedrichshafen AG)

- Continental AG

- Valeo SA

- Harman International (Samsung Electronics)

- Mobileye (Intel Corporation)

- Visteon Corporation

- Honda Motor Co., Ltd.

Recent Developments

- Volvo Trucks: On October 2024, Volvo Trucks introduced two advanced safety systems aimed at protecting pedestrians and cyclists in urban traffic. The new Active Side Collision Avoidance Support and upgraded Collision Warning with Emergency Brake systems enhance truck safety and exceed upcoming European regulations, with availability starting November 2024 and 2025, respectively.

- ANCAP: On August 2024, ANCAP announced plans to quadruple the size of its safety testing facility in Cudal, NSW, with a $30 million investment from the NSW State Government. The expansion will allow for new highway speed and heavy vehicle testing, enhancing the facility’s capabilities to assess emerging technologies and further support ANCAP’s 2030 vision for vehicle safety.

Report Scope

Report Features Description Market Value (2024) USD 15.7 Billion Forecast Revenue (2034) USD 68.1 Billion CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Anti-Lock Braking Systems, Electronic Stability Control, Adaptive Cruise Control, Lane Departure Warning Systems, Blind Spot Detection, Forward Collision Warning Systems, Tire Pressure Monitoring Systems, Others), By Technology (Radar-Based Systems, Camera-Based Systems, Lidar-Based Systems, Ultrasonic Sensors), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Propulsion Type (Internal Combustion Engine Vehicles, Electric Vehicles, Hybrid Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Group, Denso Corporation, Autoliv Inc., Delphi Technologies, Magna International Inc., Aptiv PLC, TRW Automotive (ZF Friedrichshafen AG), Continental AG, Valeo SA, Harman International (Samsung Electronics), Mobileye (Intel Corporation), Visteon Corporation, Honda Motor Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Active Safety System MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Active Safety System MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch Group

- Denso Corporation

- Autoliv Inc.

- Delphi Technologies

- Magna International Inc.

- Aptiv PLC

- TRW Automotive (ZF Friedrichshafen AG)

- Continental AG

- Valeo SA

- Harman International (Samsung Electronics)

- Mobileye (Intel Corporation)

- Visteon Corporation

- Honda Motor Co., Ltd.