Global Vehicle-to-Vehicle Communication Market Size, Share, Growth Analysis By Type (Big Data Analytics, Smart Sensors), By Connectivity (Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N), Vehicle-to-Pedestrian (V2P), Others), By Device Type (OEMs Devices, Aftermarket Devices, Infrastructure-Based Devices), By Application (Traffic Safety, Emergency Vehicle Warning, Adaptive Cruise Control, Intersection Collision Avoidance, Grouptalk Service, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137231

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

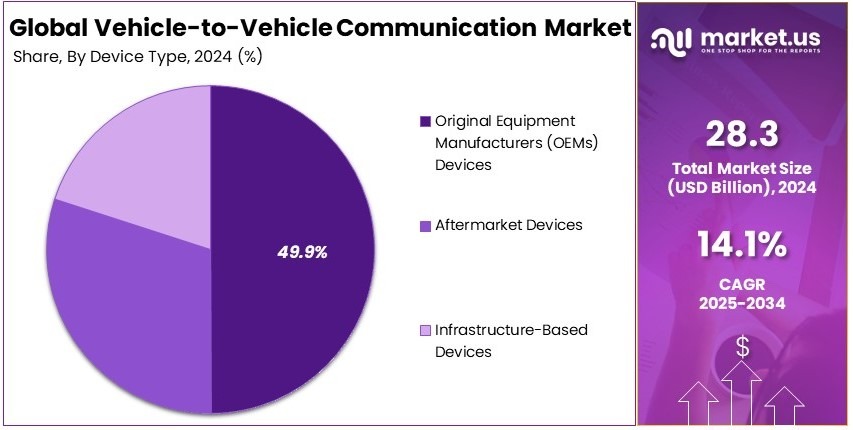

The Global Vehicle-to-Vehicle Communication Market size is expected to be worth around USD 105.8 Billion by 2034, from USD 28.3 Billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034.

Vehicle-to-vehicle communication refers to a wireless technology that allows cars to exchange information with each other. This communication helps in improving road safety by alerting drivers about potential hazards and optimizing traffic flow through real-time data sharing.

The vehicle-to-vehicle communication market involves the development, distribution, and integration of communication systems that enable vehicles to interact directly with each other. This market focuses on enhancing transportation safety and efficiency through advanced wireless communication technologies.

The Vehicle-to-Vehicle (V2V) communication market is expanding due to increasing concerns about road safety. Technologies enabling vehicles to share data aim to prevent accidents and improve traffic management. According to the World Health Organization (WHO), 1.19 million people die annually in road traffic crashes, highlighting the urgent need for such innovations.

Demand for V2V communication is accelerating as governments prioritize road safety. The U.S. Department of Transportation’s $1 billion allocation for road safety projects underlines this focus. Furthermore, advancements like Tesla’s Cybercab robotaxi and Mercedes-Benz Drive Pilot Level 3 system present opportunities to integrate V2V technologies into next-generation vehicles.

The market remains underpenetrated but highly competitive, offering substantial growth opportunities. For example, Pony.ai plans to expand its robotaxi fleet from 250 to over 1,000 vehicles by 2025, targeting major Chinese cities. This expansion reflects the integration of V2V systems in autonomous fleets, reshaping urban mobility.

On a global scale, V2V systems can reduce road accidents, ease congestion, and cut emissions. Locally, they improve urban traffic flow and lower collision risks in crowded areas. According to Mercedes-Benz, the adoption of its Drive Pilot system in Germany, California, and Nevada demonstrates how V2V is transforming regional transportation.

Government investments are crucial for V2V adoption. The U.S. Department of Transportation, supported by $1 billion in funding, is spearheading road safety improvements. Similarly, countries like China and Germany are promoting connected mobility through regulations and infrastructure enhancements.

The V2V communication market is set for robust growth, driven by safety priorities, technological advances, and government initiatives. Collaboration between public and private sectors will play a key role in shaping its impact on global transportation systems.

Key Takeaways

- The Vehicle-to-Vehicle Communication Market was valued at USD 28.3 billion in 2024 and is expected to reach USD 105.8 billion by 2034, with a CAGR of 14.1%.

- In 2024, Smart Sensors led the type segment with 57.3%, driven by advancements in sensor technologies for real-time communication.

- In 2024, Vehicle-to-Network (V2N) dominated the connectivity segment with 40.4%, enabling efficient data exchange between vehicles and networks.

- In 2024, OEMs Devices accounted for 49.9% of the device type segment, reflecting automaker-driven innovations in connected vehicles.

- In 2024, Traffic Safety led the application segment with 34.6%, emphasizing the role of V2V communication in accident prevention.

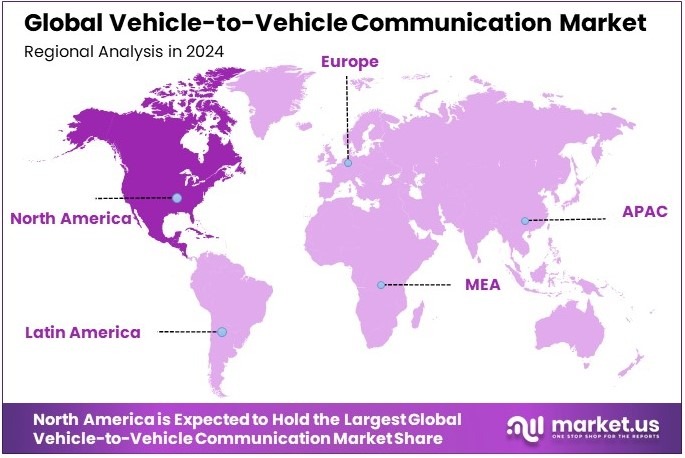

- In 2024, North America dominated the market, reflecting strong infrastructure development and early adoption of connected vehicle technologies.

Business Environment Analysis

The vehicle-to-vehicle (V2V) communication market exhibits moderate saturation in developed regions, while emerging markets offer significant growth opportunities.

Target demographics primarily include automakers and fleet management operators focused on enhancing safety and efficiency. Additionally, urban drivers benefit from reduced accident risks and better traffic management through V2V technology. This focus on safety and convenience continues to attract attention from both consumers and businesses.

Product differentiation in V2V communication revolves around latency, range, and integration with advanced driver-assistance systems (ADAS). Systems offering low-latency communication and seamless compatibility with existing vehicle platforms are gaining traction, especially as 5G infrastructure expands.

Value chain analysis reveals growth potential across hardware, software, and service components. Partnerships between automakers, telecom providers, and technology firms enhance system interoperability. Localizing production and ensuring compliance with regional safety standards further strengthens market competitiveness.

Investment opportunities are notable in infrastructure development and technology integration. Governments in Europe and North America have pledged funding for smart roadways, boosting the implementation of V2V technologies. For example, the European Commission allocated €3 billion in 2022 for connected and autonomous mobility projects.

Adjacent markets such as autonomous vehicles and intelligent traffic management systems closely align with V2V communication. These technologies complement one another, enabling safer and more efficient transportation networks. This synergy creates additional revenue streams and strengthens the overall ecosystem for connected mobility solutions.

Type Analysis

Smart Sensors dominate with 57.3% due to their crucial role in enabling real-time data exchange and enhanced vehicle safety.

In the Vehicle-to-Vehicle Communication Market, segmentation by type highlights two significant sub-segments: Smart Sensors and Big Data Analytics.

Smart Sensors lead the market with a 57.3% share, primarily due to their critical role in providing real-time data that facilitates effective vehicle communication. These sensors are essential for detecting immediate road conditions, vehicle behaviors, and obstacles, ensuring safety and efficient navigation. Their integration into vehicle systems supports collision avoidance, adaptive cruise control, and other advanced safety features, driving their dominance in the market.

Big Data Analytics, with a 42.7% share, plays a vital role in processing the vast amounts of data collected from various sensors and in-vehicle systems. This segment is pivotal in developing predictive models and intelligent transportation systems. By analyzing data trends, Big Data Analytics enhances traffic management, optimizes vehicle performance, and enables more reliable decision-making in diverse driving environments.

Connectivity Analysis

Vehicle-to-Network (V2N) leads with 40.4% due to its capacity to integrate with broader smart city infrastructure.

The Connectivity segment of the Vehicle-to-Vehicle Communication Market includes Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N), Vehicle-to-Pedestrian (V2P), and Others.

V2N stands out with a 40.4% market share, favored for its ability to connect vehicles directly with traffic management systems and other smart city elements. This connectivity is crucial for optimizing traffic flow and enhancing road safety by enabling vehicles to respond to city-wide traffic conditions and alerts.

V2I contributes 30.3% to the market and focuses on the direct communication between vehicles and road infrastructure like traffic lights and road signs, crucial for immediate responses to traffic changes. V2P, which holds 20.1% of the market, enhances pedestrian safety by allowing vehicles to communicate with pedestrian-carried devices. The Others segment, with a 9.2% share, includes emerging technologies that are expanding vehicle communication capabilities.

Device Type Analysis

OEMs Devices dominate with 49.9% due to manufacturer integration offering optimized and reliable communication systems.

Within the Device Type category, the Vehicle-to-Vehicle Communication Market is segmented into Original Equipment Manufacturers (OEMs) Devices, Aftermarket Devices, and Infrastructure-Based Devices.

OEMs Devices take the lead with a 49.9% share, as these are integrated by vehicle manufacturers, ensuring high compatibility and reliability. These devices are built directly into new vehicles, offering optimized communication capabilities that are tested and guaranteed by the manufacturers.

Aftermarket Devices account for 30.7% of the market, providing a flexible option for vehicle owners to upgrade their existing vehicles. Infrastructure-Based Devices make up 19.4%, critical for enhancing the existing road and traffic systems to support advanced vehicular communication technologies.

Application Analysis

Traffic Safety leads with 34.6% due to its direct impact on reducing accidents and enhancing road use efficiency.

The Application segment of the Vehicle-to-Vehicle Communication Market is essential for understanding its functional impacts, including Traffic Safety, Emergency Vehicle Warning, Adaptive Cruise Control, Intersection Collision Avoidance, Grouptalk Service, and Others. Traffic Safety is the most significant, holding a 34.6% share.

This application is pivotal as it directly contributes to reducing vehicular accidents and increasing the overall safety of road usage by enabling real-time communication between vehicles about road conditions and hazards.

Emergency Vehicle Warning has a 22.4% share, crucial for preempting other vehicles about emergency responses to clear the path and reduce response times. Adaptive Cruise Control captures 18.3%, enhancing driving comfort and fuel efficiency.

Intersection Collision Avoidance, with 12.1%, specifically targets accident reduction at intersections. Grouptalk Service and Others hold 6.2% and 6.4%, respectively, providing niche services that enhance group communication and other specialized functions in vehicle networks.

Key Market Segments

By Type

- Big Data Analytics

- Smart Sensors

By Connectivity

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Network (V2N)

- Vehicle-to-Pedestrian (V2P)

- Others

By Device Type

- Original Equipment Manufacturers (OEMs) Devices

- Aftermarket Devices

- Infrastructure-Based Devices

By Application

- Traffic Safety

- Emergency Vehicle Warning

- Adaptive Cruise Control

- Intersection Collision Avoidance

- Grouptalk Service

- Others

Driving Factors

Advanced Safety Integration Drives Market Growth

The Vehicle-to-Vehicle Communication Market is growing due to several important drivers. Rising demand for autonomous and connected vehicle technologies encourages innovation. Growing focus on road safety and accident prevention leads manufacturers to adopt communication solutions.

Increasing adoption of Advanced Driver Assistance Systems (ADAS) highlights safety and convenience. Government regulations mandating safety features in vehicles support market expansion.

For example, companies like Bosch and Continental are investing in V2V communication to meet these safety standards. These drivers create a strong foundation for growth. The emphasis on autonomous driving technology requires reliable communication between vehicles. Connected vehicles that can warn drivers of hazards reduce accidents on busy highways.

ADAS technologies use V2V data to enhance navigation and collision avoidance. Government mandates push automakers to upgrade their systems, similar to how emission standards have changed car designs. Public awareness of safety improvements also boosts demand.

Restraining Factors

High Costs and Security Concerns Restraint Market Growth

The growth of Vehicle-to-Vehicle Communication faces several restraints. High initial investment in communication infrastructure challenges smaller firms. Lack of standardization and interoperability between systems leads to technical hurdles, reminiscent of early mobile network issues. Privacy and data security concerns in vehicle-to-vehicle communication worry consumers. Regulatory challenges and uncertainty in implementation slow down progress.

For instance, a startup may hesitate to invest heavily without clear safety certification guidelines. High costs mean that new market entrants require significant funding. Privacy issues arise when sensitive data is shared between vehicles, causing reluctance among drivers. Uncertain regulations mean companies must navigate complex legal landscapes.

These factors slow infrastructure development and wider adoption. Investment risks rise because returns are not guaranteed. Technology providers face additional burdens to comply with varying standards across regions. Lack of clear regulations increases uncertainty. This environment requires careful planning and robust security measures.

Collaboration with regulators and standard bodies may help overcome these hurdles. Until these concerns are addressed, market growth may proceed cautiously, affecting stakeholders and delaying widespread implementation of V2V solutions.

Growth Opportunities

Low-Cost Solutions Provide Opportunities

The Vehicle-to-Vehicle Communication Market offers several growth opportunities. Expansion of Vehicle-to-Infrastructure (V2I) and Vehicle-to-Pedestrian (V2P) solutions broaden the use case. Development of low-cost communication systems for mass market adoption attracts a wider audience.

Increasing focus on software-defined networking for vehicle communication allows flexible solutions. Rise of Mobility-as-a-Service (MaaS) integrating vehicle-to-vehicle communication opens new business models.

For example, a car rental service might use V2V technology to coordinate fleets more efficiently. Low-cost solutions from companies like Savari enable broader market penetration. Partnerships between cities and tech firms can pilot V2I projects to improve traffic flow. Software-defined networks allow quick updates to communication protocols, similar to how mobile apps update automatically.

MaaS providers integrate V2V data to enhance ride-sharing safety and efficiency. These innovations reduce costs and simplify integration for manufacturers and service providers.

Emerging Trends

Real-Time Data Exchange Is Latest Trending Factor

The Vehicle-to-Vehicle Communication Market is trending towards real-time innovations. Increasing focus on V2V communication in autonomous driving drives this trend.

Integration of V2V communication with augmented reality dashboards enhances driver awareness. Growing popularity of over-the-air (OTA) updates for vehicle communication systems allows quick improvements. Rise of low-latency communication solutions ensures timely data exchange on busy roads.

These trends are shaping how vehicles interact on the road. For instance, a car with AR dashboards can display nearby hazards detected via V2V signals. OTA updates allow Tesla to improve software without dealership visits. Low-latency solutions, like 5G, support immediate response to sudden braking or obstacles. This real-time exchange improves safety and efficiency.

Traffic management systems benefit as vehicles share live data. Automakers like Audi and Volvo explore these trends to enhance user experience. Real-time capabilities mean smoother commutes and reduced accidents.

Regional Analysis

North America Dominates with Dominant Market Share

North America leads the Vehicle-to-Vehicle Communication Market with a significant share. This substantial market presence is bolstered by widespread adoption of advanced vehicle technologies, strong regulatory support for vehicle safety, and significant investments in connected vehicle infrastructure.

The region’s advanced technological infrastructure and robust automotive industry facilitate the development and integration of vehicle-to-vehicle communication systems. Moreover, initiatives by governments to implement V2V communication in new vehicles enhance safety and drive market growth.

The future influence of North America on the global Vehicle-to-Vehicle Communication Market looks promising. As regulations become stricter and technology adoption widens, North America is expected to maintain or even increase its market dominance. The push towards fully autonomous vehicles and smarter, safer roads will likely continue to propel the demand for vehicle-to-vehicle communication systems.

Regional Mentions:

- Europe: Europe is a strong player in the Vehicle-to-Vehicle Communication Market, backed by stringent safety regulations and high adoption rates of advanced vehicle technologies. The region focuses on integrating V2V systems to enhance traffic safety and reduce congestion.

- Asia Pacific: Asia Pacific is quickly advancing in the Vehicle-to-Vehicle Communication Market due to rapid technological advancements and large-scale implementation of smart transportation solutions, especially in countries like Japan and South Korea.

- Middle East & Africa: The Middle East and Africa are gradually exploring vehicle-to-vehicle communication technologies, with initiatives aimed at modernizing transportation infrastructure and improving road safety becoming more prevalent.

- Latin America: Latin America is emerging in the Vehicle-to-Vehicle Communication Market as the region begins to adopt more advanced transportation solutions to improve vehicle safety and manage traffic efficiently, especially in urban areas.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Vehicle-to-Vehicle (V2V) Communication Market, four major players stand out for their significant contributions and strategic advancements: General Motors Company, Mercedes-Benz Group AG, Toyota Motor Corporation, and Volkswagen Group.

General Motors Company is at the forefront of integrating V2V communication systems into its vehicles, enhancing road safety by enabling cars to communicate with each other to prevent accidents. GM’s commitment to innovation in this area is evident in its active participation in developing industry standards and protocols for V2V communications.

Mercedes-Benz Group AG is known for its emphasis on luxury and safety, and its approach to V2V communication is no different. Mercedes-Benz has been incorporating sophisticated V2V technologies that allow for real-time traffic and environmental condition updates, substantially improving driver awareness and vehicle safety.

Toyota Motor Corporation has been a pioneer in automotive technology, and its work in V2V communication is crucial. Toyota’s systems are designed to reduce traffic accidents and ease congestion by allowing vehicles to share information about their speed and position on the road, making it a leader in promoting collaborative safety technologies.

Volkswagen Group focuses on connectivity and intelligent transport systems, integrating V2V communication in its diverse lineup of vehicles. VW’s approach aims to enhance mobility and efficiency, using V2V to create a more interconnected and safer driving environment.

These companies are pushing the boundaries of what’s possible in automotive safety technologies. By leading the development and implementation of V2V communication systems, they not only improve individual vehicle safety but also contribute to a broader goal of smarter, safer roads. Their continued advancements in this field are crucial for the evolution of autonomous driving and connected vehicle ecosystems globally.

Major Companies in the Market

- General Motors Company

- Mercedes-Benz Group AG

- Toyota Motor Corporation

- Volkswagen Group

- Harman International Industries

- Mobileye Global Inc.

- Ford Motor Company

- Bayerische Motoren Werke AG (BMW)

- Audi AG

- Qualcomm Inc.

- Cisco Systems Inc.

- Autotalks Ltd.

- DENSO Corporation

Recent Developments

- NXP Semiconductors Acquires TTTech Auto: On January 2025, NXP Semiconductors N.V. announced the acquisition of TTTech Auto AG, an Austrian startup, for $625 million in cash. This acquisition strengthens NXP’s capabilities in advanced safety solutions for autonomous driving.

- AMD and StradVision Collaboration: On January 2025, AMD partnered with StradVision to enhance advanced driver-assistance systems (ADAS). This collaboration integrates high-performance perception solutions to improve vehicle safety and autonomous driving capabilities.

- FCC Advances C-V2X Technology: On November 2024, the Federal Communications Commission (FCC) finalized new spectrum rules to support cellular vehicle-to-everything (C-V2X) technology. This regulatory change aims to accelerate connected vehicle deployments and enhance road safety and traffic management.

Report Scope

Report Features Description Market Value (2024) USD 28.3 Billion Forecast Revenue (2034) USD 105.8 Billion CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Big Data Analytics, Smart Sensors), By Connectivity (Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N), Vehicle-to-Pedestrian (V2P), Others), By Device Type (OEMs Devices, Aftermarket Devices, Infrastructure-Based Devices), By Application (Traffic Safety, Emergency Vehicle Warning, Adaptive Cruise Control, Intersection Collision Avoidance, Grouptalk Service, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape General Motors Company, Mercedes-Benz Group AG, Toyota Motor Corporation, Volkswagen Group, Harman International Industries, Mobileye Global Inc., Ford Motor Company, Bayerische Motoren Werke AG (BMW), Audi AG, Qualcomm Inc., Cisco Systems Inc., Autotalks Ltd., DENSO Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vehicle-to-Vehicle Communication MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Vehicle-to-Vehicle Communication MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Motors Company

- Mercedes-Benz Group AG

- Toyota Motor Corporation

- Volkswagen Group

- Harman International Industries

- Mobileye Global Inc.

- Ford Motor Company

- Bayerische Motoren Werke AG (BMW)

- Audi AG

- Qualcomm Inc.

- Cisco Systems Inc.

- Autotalks Ltd.

- DENSO Corporation